|

Baseline (budgeting)

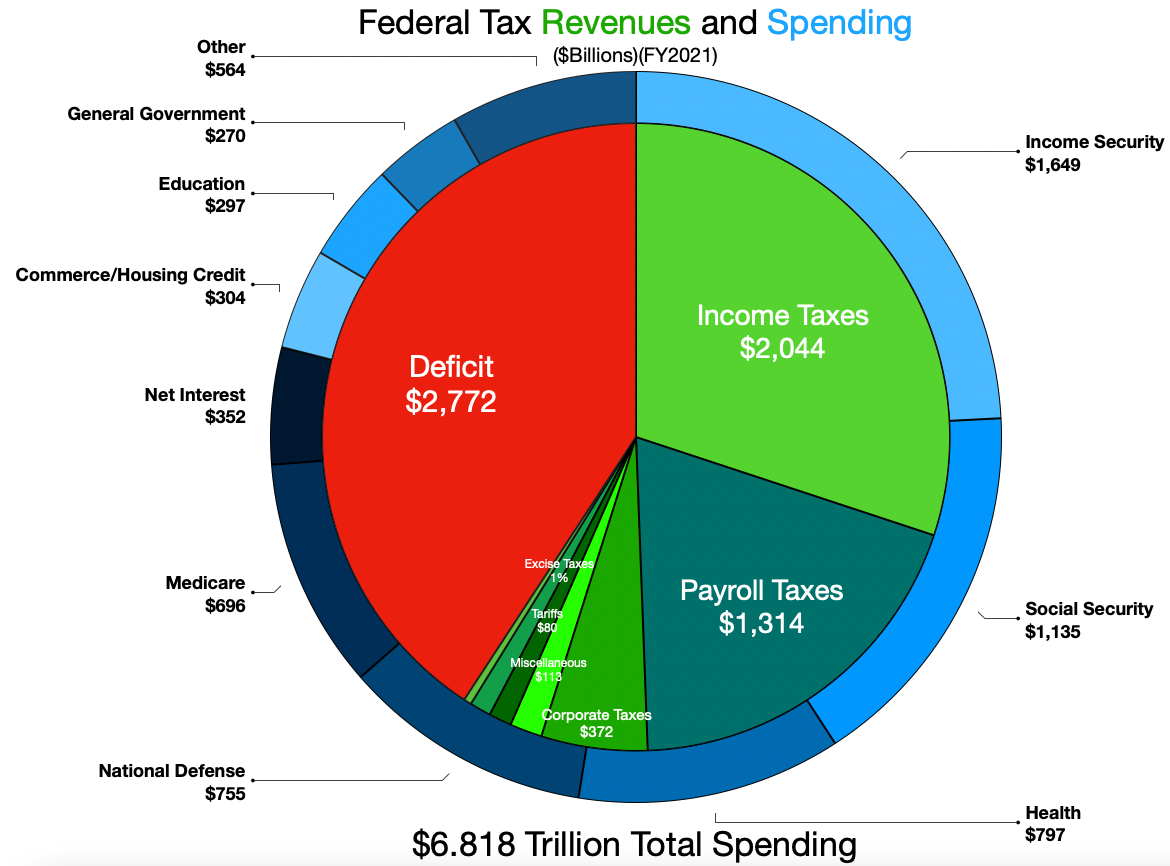

Baseline budgeting is an accounting method the United States Federal Government uses to develop a budget for future years. Baseline budgeting uses current spending levels as the "baseline" for establishing future funding requirements and assumes future budgets will equal the current budget times the inflation rate times the population growth rate. Twice a year—generally in January and August—CBO prepares baseline projections of federal revenues, outlays, and the surplus or deficit. Those projections are designed to show what would happen if current budgetary policies were continued as is—that is, they serve as a benchmark for assessing possible changes in policy. They are not forecasts of actual budget outcomes, since the Congress will undoubtedly enact legislation that will change revenues and outlays. Similarly, they are not intended to represent the appropriate or desirable levels of federal taxes and spending.See Statement of Paul N. Van de Water cited above Baseline Acco ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Accounting

Accounting, also known as accountancy, is the measurement, processing, and communication of financial and non financial information about economic entities such as businesses and corporations. Accounting, which has been called the "language of business", measures the results of an organization's economic activities and conveys this information to a variety of stakeholders, including investors, creditors, management, and regulators. Practitioners of accounting are known as accountants. The terms "accounting" and " financial reporting" are often used as synonyms. Accounting can be divided into several fields including financial accounting, management accounting, tax accounting and cost accounting. Financial accounting focuses on the reporting of an organization's financial information, including the preparation of financial statements, to the external users of the information, such as investors, regulators and suppliers; and management accounting focuses on the mea ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

United States Federal Government

The federal government of the United States (U.S. federal government or U.S. government) is the national government of the United States, a federal republic located primarily in North America, composed of 50 states, a city within a federal district (the city of Washington in the District of Columbia, where most of the federal government is based), five major self-governing territories and several island possessions. The federal government, sometimes simply referred to as Washington, is composed of three distinct branches: legislative, executive, and judicial, whose powers are vested by the U.S. Constitution in the Congress, the president and the federal courts, respectively. The powers and duties of these branches are further defined by acts of Congress, including the creation of executive departments and courts inferior to the Supreme Court. Naming The full name of the republic is "United States of America". No other name appears in the Constitution, and th ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Budget

A budget is a calculation play, usually but not always financial, for a defined period, often one year or a month. A budget may include anticipated sales volumes and revenues, resource quantities including time, costs and expenses, environmental impacts such as greenhouse gas emissions, other impacts, assets, liabilities and cash flows. Companies, governments, families, and other organizations use budgets to express strategic plans of activities in measurable terms. A budget expresses intended expenditures along with proposals for how to meet them with resources. A budget may express a surplus, providing resources for use at a future time, or a deficit in which expenditures exceed income or other resources. Government The budget of a government is a summary or plan of the anticipated resources (often but not always from taxes) and expenditures of that government. There are three types of government budget: the operating or current budget, the capital or investment budge ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Inflation Rate

In economics, inflation is an increase in the general price level of goods and services in an economy. When the general price level rises, each unit of currency buys fewer goods and services; consequently, inflation corresponds to a reduction in the purchasing power of money. The opposite of inflation is deflation, a sustained decrease in the general price level of goods and services. The common measure of inflation is the inflation rate, the annualized percentage change in a general price index. As prices do not all increase at the same rate, the consumer price index (CPI) is often used for this purpose. The employment cost index is also used for wages in the United States. Most economists agree that high levels of inflation as well as hyperinflation—which have severely disruptive effects on the real economy—are caused by persistent excessive growth in the money supply. Views on low to moderate rates of inflation are more varied. Low or moderate inflation may be attr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Population

Population typically refers to the number of people in a single area, whether it be a city or town, region, country, continent, or the world. Governments typically quantify the size of the resident population within their jurisdiction using a census, a process of collecting, analysing, compiling, and publishing data regarding a population. Perspectives of various disciplines Social sciences In sociology and population geography, population refers to a group of human beings with some predefined criterion in common, such as location, race, ethnicity, nationality, or religion. Demography is a social science which entails the statistical study of populations. Ecology In ecology, a population is a group of organisms of the same species who inhabit the same particular geographical area and are capable of interbreeding. The area of a sexual population is the area where inter-breeding is possible between any pair within the area and more probable than cro ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Government Accountability Office

The U.S. Government Accountability Office (GAO) is a legislative branch government agency that provides auditing, evaluative, and investigative services for the United States Congress. It is the supreme audit institution of the federal government of the United States. It identifies its core "mission values" as: accountability, integrity, and reliability. It is also known as the "congressional watchdog". Powers of GAO The work of the GAO is done at the request of congressional committees or subcommittees or is mandated by public laws or committee reports. It also undertakes research under the authority of the Comptroller General. It supports congressional oversight by: * auditing agency operations to determine whether federal funds are being spent efficiently and effectively; * investigating allegations of illegal and improper activities; * reporting on how well government programs and policies are meeting their objectives; * performing policy analyses and outlining options f ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Congressional Budget Act Of 1974

The Congressional Budget and Impoundment Control Act of 1974 (, , ) is a United States federal law that governs the role of the Congress in the United States budget process. The Congressional budget process Titles I through IX of the law are also known as the Congressional Budget Act of 1974. Title II created the Congressional Budget Office. Title III governs the procedures by which Congress annually adopts a budget resolution, a concurrent resolution that is not signed by the President, which sets fiscal policy for the Congress. This budget resolution sets limits on revenues and spending that may be enforced in Congress through procedural objections called points of order. The budget resolution can also specify that a budget reconciliation bill be written, which the Congress will then consider under expedited procedures. Later amendments The act has been amended several times, including provisions in the Balanced Budget and Emergency Deficit Control Act of 1985, the Budget ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Office Of Management And Budget

The Office of Management and Budget (OMB) is the largest office within the Executive Office of the President of the United States (EOP). OMB's most prominent function is to produce the president's budget, but it also examines agency programs, policies, and procedures to see whether they comply with the president's policies and coordinates inter-agency policy initiatives. Shalanda Young became OMB's acting director in March 2021, and was confirmed by the Senate in March 2022. History The Bureau of the Budget, OMB's predecessor, was established in 1921 as a part of the Department of the Treasury by the Budget and Accounting Act of 1921, which President Warren G. Harding signed into law. The Bureau of the Budget was moved to the Executive Office of the President in 1939 and was run by Harold D. Smith during the government's rapid expansion of spending during World War II. James L. Sundquist, a staffer at the Bureau of the Budget, called the relationship between the president an ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Fiscal Year

A fiscal year (or financial year, or sometimes budget year) is used in government accounting, which varies between countries, and for budget purposes. It is also used for financial reporting by businesses and other organizations. Laws in many jurisdictions require company financial reports to be prepared and published on an annual basis but generally not the reporting period to align with the calendar year (1 January to 31 December). Taxation laws generally require accounting records to be maintained and taxes calculated on an annual basis, which usually corresponds to the fiscal year used for government purposes. The calculation of tax on an annual basis is especially relevant for direct taxes, such as income tax. Many annual government fees—such as council tax and license fees, are also levied on a fiscal year basis, but others are charged on an anniversary basis. Some companies, such as Cisco Systems, end their fiscal year on the same day of the week each year: the day ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Congressional Budget Office

The Congressional Budget Office (CBO) is a List of United States federal agencies, federal agency within the United States Congress, legislative branch of the United States government that provides budget and economic information to Congress. Inspired by California's California Legislative Analyst's Office, Legislative Analyst's Office that manages the state budget in a strictly nonpartisan fashion, the CBO was created as a nonpartisan agency by the Congressional Budget and Impoundment Control Act of 1974. Whereas politicians on both sides of the aisle have criticized the CBO when its estimates have been politically inconvenient, economists and other academics overwhelmingly reject that the CBO is partisan or that it fails to produce credible forecasts. There is a consensus among economists that "adjusting for legal restrictions on what the CBO can assume about future legislation and events, the CBO has historically issued credible forecasts of the effects of both Democratic and R ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Balanced Budget And Emergency Deficit Control Act Of 1985

In telecommunications and professional audio, a balanced line or balanced signal pair is a circuit consisting of two conductors of the same type, both of which have equal impedances along their lengths and equal impedances to ground and to other circuits. The chief advantage of the balanced line format is good rejection of common-mode noise and interference when fed to a differential device such as a transformer or differential amplifier.G. Ballou, ''Handbook for Sound Engineers'', Fifth Edition, Taylor & Francis, 2015, p. 1267–1268. As prevalent in sound recording and reproduction, balanced lines are referred to as balanced audio. Common forms of balanced line are twin-lead, used for radio frequency signals and twisted pair, used for lower frequencies. They are to be contrasted to unbalanced lines, such as coaxial cable, which is designed to have its return conductor connected to ground, or circuits whose return conductor actually is ground (see earth-return telegraph). Ba ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Debt Limit

A debt limit or debt ceiling is a legislative mechanism restricting the total amount that a country can borrow or how much debt it can be permitted to take on. Several countries have debt limitation restrictions. Description A debt limit is a legislative mechanism restricting the total amount that a country can borrow or how much debt it can be permitted to take on. Usually this is measured as percentage of GDP. Use Several countries have debt limitation laws in place, including the United States debt ceiling. Poland is the only nation with a constitutional limit on public debt, set at 60% of GDP; by law, a budget cannot pass with a breach in place. Between 2007 and 2013, Australia had debt ceiling, which limited how much the Australian government could borrow. The debt ceiling was contained in section 5(1) of the ''Commonwealth Inscribed Stock Act 1911'' until its repeal on 10 December 2013. The statutory limit was created in 2007 by the Rudd Government and set at $75&nbs ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.jpg)