|

Bearer Bond

A bearer bond or bearer note is a bond or debt security issued by a government or a business entity such as a corporation. As a bearer instrument, it differs from the more common types of investment securities in that it is unregistered—no records are kept of the owner, or the transactions involving ownership. Whoever physically holds the paper on which the bond is issued is the presumptive owner of the instrument. This is useful for investors who wish to remain anonymous. Recovery of the value of a bearer bond in the event of its loss, theft, or destruction is usually impossible. Some relief is possible in the case of United States public debt. Furthermore, while all bond types state maturity dates and interest rates, bearer bond coupons for interest payments are physically attached to the security and must be submitted to an authorized agent in order to receive payment. Issuance of new bearer bonds has been effectively outlawed in the United States since the 1980s due ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Maturity (finance)

In finance, maturity or maturity date is the date on which the final payment is due on a loan or other financial instrument, such as a Bond (finance), bond or term deposit, at which point the Bond (finance)#Principal, principal (and all remaining interest) is due to be paid. Most instruments have a ''fixed maturity date'' which is a specific date on which the instrument matures. Such instruments include fixed interest and variable rate loans or debt instruments, however called, and other forms of security such as redeemable preference shares, provided their terms of issue specify a maturity date. It is similar in meaning to "redemption date". Some instruments have ''no fixed maturity date'' which continue indefinitely (unless repayment is agreed between the borrower and the lenders at some point) and may be known as "perpetual stocks". Some instruments have a range of possible maturity dates, and such stocks can usually be repaid at any time within that range, as chosen by the bor ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Stock Certificate

In company (law), corporate law, a stock certificate (also known as certificate of stock or share certificate) is a legal document that certifies the legal interest (a bundle of several legal rights) of ownership of a specific number of share (finance), shares (or, under Article 8 of the Uniform Commercial Code in the United States, a securities entitlement or pro rata share of a fungible bulk) or Share capital, stock in a corporation. History A stock certificate is a legal document that certifies the legal interest (a bundle of several legal rights) of ownership of a specific number of share (finance), shares (or, under Article 8 of the Uniform Commercial Code, a securities entitlement or pro rata share of a fungible bulk) or Share capital, stock in a corporation. The first such instruments were used in the Netherlands by 1606, and in the United States by the year 1800. Historically, certificates may have been required to evidence entitlement to dividends, with a receipt for t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

South Carolina V

South is one of the cardinal directions or compass points. The direction is the opposite of north and is perpendicular to both west and east. Etymology The word ''south'' comes from Old English ''sūþ'', from earlier Proto-Germanic ''*sunþaz'' ("south"), possibly related to the same Proto-Indo-European root that the word ''sun'' derived from. Some languages describe south in the same way, from the fact that it is the direction of the sun at noon (in the Northern Hemisphere), like Latin meridies 'noon, south' (from medius 'middle' + dies 'day', ), while others describe south as the right-hand side of the rising sun, like Biblical Hebrew תֵּימָן teiman 'south' from יָמִין yamin 'right', Aramaic תַּימנַא taymna from יָמִין yamin 'right' and Syriac ܬܰܝܡܢܳܐ taymna from ܝܰܡܝܺܢܳܐ yamina (hence the name of Yemen, the land to the south/right of the Levant). South is sometimes abbreviated as S. Navigation By convention, the ''bottom or down ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

US Supreme Court

The Supreme Court of the United States (SCOTUS) is the highest court in the federal judiciary of the United States. It has ultimate appellate jurisdiction over all Federal tribunals in the United States, U.S. federal court cases, and over State court (United States), state court cases that turn on questions of Constitution of the United States, U.S. constitutional or Law of the United States, federal law. It also has Original jurisdiction of the Supreme Court of the United States, original jurisdiction over a narrow range of cases, specifically "all Cases affecting Ambassadors, other public Ministers and Consuls, and those in which a State shall be Party." In 1803, the Court asserted itself the power of Judicial review in the United States, judicial review, the ability to invalidate a statute for violating a provision of the Constitution via the landmark case ''Marbury v. Madison''. It is also able to strike down presidential directives for violating either the Constitution or s ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

South Carolina

South Carolina ( ) is a U.S. state, state in the Southeastern United States, Southeastern region of the United States. It borders North Carolina to the north and northeast, the Atlantic Ocean to the southeast, and Georgia (U.S. state), Georgia to the west and south across the Savannah River. Along with North Carolina, it makes up the Carolinas region of the East Coast of the United States, East Coast. South Carolina is the List of U.S. states and territories by area, 11th-smallest and List of U.S. states and territories by population, 23rd-most populous U.S. state with a recorded population of 5,118,425 according to the 2020 United States census, 2020 census. In , its GDP was $213.45 billion. South Carolina is composed of List of counties in South Carolina, 46 counties. The capital is Columbia, South Carolina, Columbia with a population of 136,632 in 2020; while its List of municipalities in South Carolina, most populous city is Charleston, South Carolina, Charleston with ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Federal Deposit Insurance Corporation

The Federal Deposit Insurance Corporation (FDIC) is a State-owned enterprises of the United States, United States government corporation supplying deposit insurance to depositors in American commercial banks and savings banks. The FDIC was created by the Banking Act of 1933, enacted during the Great Depression to restore trust in the American banking system. More than one-third of banks failed in the years before the FDIC's creation, and bank runs were common. The insurance limit was initially US$2,500 per ownership category, and this has been increased several times over the years. Since the enactment of the Dodd–Frank Wall Street Reform and Consumer Protection Act in 2010, the FDIC insures deposits in member banks up to $250,000 per ownership category. FDIC insurance is backed by the full faith and credit of the government of the United States, and according to the FDIC, "since its start in 1933 no depositor has ever lost a penny of FDIC-insured funds". Deposits placed wit ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Equity And Fiscal Responsibility Act Of 1982

The Tax Equity and Fiscal Responsibility Act of 1982 (), also known as TEFRA, is a United States federal law that rescinded some of the effects of the Kemp-Roth Act passed the year before. Between summer 1981 and summer 1982, tax revenue fell by about 6% in real terms, caused by the dual effects of the economy dipping back into recession (the second dip of the "double dip recession") and Kemp-Roth's reduction in tax rates, and the deficit was likewise rising rapidly because of the fall in revenue and the rise in government expenditures. The rapid rise in the budget deficit created concern among many in Congress. TEFRA was created to reduce the budget gap by generating revenue through closure of tax loopholes; introduction of tougher enforcement of tax rules; rescinding some of Kemp-Roth's reductions in marginal personal income tax rates that had not yet gone into effect; and raising some rates, especially corporate rates. TEFRA was introduced November 13, 1981 and was sponsored ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Chiasso Financial Smuggling Case

The Chiasso financial smuggling case began on June 3, 2009, near Chiasso, Switzerland (near the Swiss/Italian border), when Sezione Operativa Territoriale di Chiasso in collaboration with officers of Italian customs/financial military police (Guardia di Finanza) detained two suspects (who appeared to be Japanese nationals in their 50s) who had attempted to enter Switzerland with a suitcase in their possession with a false bottom containing what at first appeared to be U.S. Treasury Bonds worth $134.5 billion. The two possessed 249 U.S. bonds worth $500 million each (among other securities, they also had 10 "Kennedy bonds" denominated at $1 billion each). The large denominations of the securities, along with accompanying bank documentation, was what attracted the Italian police's attention. Large denominations are not available to the general public; only nation-states handle such amounts of money. Investigation and determination Assessment as to the authenticity of the bonds beg ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Evasion

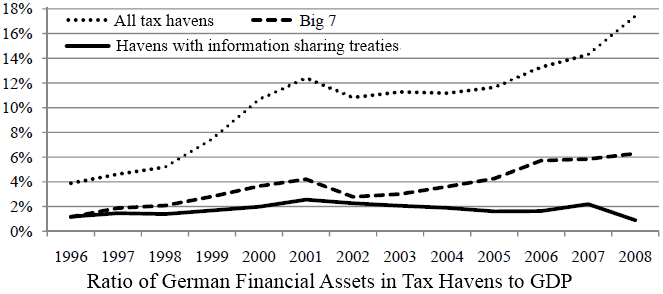

Tax evasion or tax fraud is an illegal attempt to defeat the imposition of taxes by individuals, corporations, trusts, and others. Tax evasion often entails the deliberate misrepresentation of the taxpayer's affairs to the tax authorities to reduce the taxpayer's tax liability, and it includes dishonest tax reporting, declaring less income, profits or gains than the amounts actually earned, overstating deductions, bribing authorities and hiding money in secret locations. Tax evasion is an activity commonly associated with the informal economy. One measure of the extent of tax evasion (the "tax gap") is the amount of unreported income, which is the difference between the amount of income that the tax authority requests be reported and the actual amount reported. In contrast, tax avoidance is the legal use of tax laws to reduce one's tax burden. Both tax evasion and tax avoidance can be viewed as forms of tax noncompliance, as they describe a range of activities that intend to ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bond (finance)

In finance, a bond is a type of Security (finance), security under which the issuer (debtor) owes the holder (creditor) a debt, and is obliged – depending on the terms – to provide cash flow to the creditor (e.g. repay the principal (i.e. amount borrowed) of the bond at the Maturity (finance), maturity date and interest (called the coupon (bond), coupon) over a specified amount of time.) The timing and the amount of cash flow provided varies, depending on the economic value that is emphasized upon, thus giving rise to different types of bonds. The interest is usually payable at fixed intervals: semiannual, annual, and less often at other periods. Thus, a bond is a form of loan or IOU. Bonds provide the borrower with external funds to finance long-term investments or, in the case of government bonds, to finance current expenditure. Bonds and Share capital, stocks are both Security (finance), securities, but the major difference between the two is that (capital) stockholders h ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Money Laundering

Money laundering is the process of illegally concealing the origin of money obtained from illicit activities (often known as dirty money) such as drug trafficking, sex work, terrorism, corruption, and embezzlement, and converting the funds into a seemingly legitimate source, usually through a front organization. Money laundering is illegal; the acts generating the money almost always are themselves criminal in some way (for if not, the money would not need to be laundered). As financial crime has become more complex and financial intelligence is more important in combating international crime and terrorism, money laundering has become a prominent political, economic, and legal debate. Most countries implement some anti-money-laundering measures. In the past, the term "money laundering" was applied only to financial transactions related to organized crime. Today its definition is often expanded by government and international regulators such as the US Office of the Comp ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |