A value-added tax (VAT or goods and services tax (GST), general consumption tax (GCT)) is a consumption tax that is levied on the value added at each stage of a product's production and distribution. VAT is similar to, and is often compared with, a

sales tax

A sales tax is a tax paid to a governing body for the sales of certain goods and services. Usually laws allow the seller to collect funds for the tax from the consumer at the point of purchase. When a tax on goods or services is paid to a govern ...

. VAT is an

indirect tax

An indirect tax (such as a sales tax, per unit tax, value-added tax (VAT), excise tax, consumption tax, or tariff) is a tax that is levied upon goods and services before they reach the customer who ultimately pays the indirect tax as a part of ...

, because the consumer who ultimately bears the burden of the tax is not the entity that pays it. Specific goods and services are typically exempted in various jurisdictions.

Products exported to other countries are typically exempted from the tax, typically via a rebate to the exporter. VAT is usually implemented as a destination-based tax, where the tax rate is based on the location of the customer. VAT raises about a fifth of total tax revenues worldwide and among the members of the

Organisation for Economic Co-operation and Development

The Organisation for Economic Co-operation and Development (OECD; , OCDE) is an international organization, intergovernmental organization with 38 member countries, founded in 1961 to stimulate economic progress and international trade, wor ...

(OECD).

As of January 2025, 175 of the

193 countries with UN membership employ a VAT, including all OECD members except the

United States

The United States of America (USA), also known as the United States (U.S.) or America, is a country primarily located in North America. It is a federal republic of 50 U.S. state, states and a federal capital district, Washington, D.C. The 48 ...

.

History

German industrialist

Wilhelm von Siemens proposed the concept of a value-added tax in 1918 to replace the German

turnover tax

A turnover tax is similar to VAT, with the difference that it taxes intermediate and possibly capital goods. It is an indirect tax, typically on an ad valorem basis, applicable to a production process or stage. For example, when manufacturing a ...

. However, the turnover tax was not replaced until 1968.

The modern variation of VAT was first implemented by

Maurice Lauré, joint director of the French tax authority, who implemented VAT on 10 April 1954 in France's

Ivory Coast

Ivory Coast, also known as Côte d'Ivoire and officially the Republic of Côte d'Ivoire, is a country on the southern coast of West Africa. Its capital city of Yamoussoukro is located in the centre of the country, while its largest List of ci ...

colony. Assessing the experiment as successful, France introduced it domestically in 1958.

Initially directed at large businesses, it was extended over time to include all business sectors. In France it is the largest source of state finance, accounting for nearly 50% of state revenues.

Following creation of the

European Economic Community

The European Economic Community (EEC) was a regional organisation created by the Treaty of Rome of 1957,Today the largely rewritten treaty continues in force as the ''Treaty on the functioning of the European Union'', as renamed by the Lisbo ...

in 1957, the Fiscal and Financial Committee set up by the

European Commission

The European Commission (EC) is the primary Executive (government), executive arm of the European Union (EU). It operates as a cabinet government, with a number of European Commissioner, members of the Commission (directorial system, informall ...

in 1960 under the chairmanship of Professor

Fritz Neumark made its priority objective the elimination of distortions to competition caused by disparities in national indirect tax systems.

The Neumark Report published in 1962 concluded that France's VAT model would be the simplest and most effective indirect tax system. This led to the EEC issuing two VAT directives, adopted in April 1967, providing a blueprint for introducing VAT across the EEC, following which, other member states (initially Belgium, Italy, Luxembourg, the Netherlands and West Germany) introduced VAT.

[

As of 2020, more than 160 countries collect VAT.]

Implementation

VAT can be accounts-based or invoice-based. All VAT-collecting countries except Japan use the invoice method.

Incentives

VAT provides an incentive for businesses to register and keep invoices, and it does this in the form of zero-rated goods and VAT exemption on goods not resold. Through registration, a business documents its purchases, making them eligible for a VAT credit.

The main benefits of VAT are that in relation to many other forms of taxation, it does not distort firms' production decisions, it is difficult to evade, and it generates a substantial amount of revenue.

Comparison with sales tax

VAT has no effect on how businesses organize, because the same amount of tax is collected regardless of how many times goods change hands before arriving at the ultimate consumer. By contrast, sales taxes are collected on each transaction, encouraging businesses to vertically integrate to reduce the number of transactions and thereby reduce the amount of tax. For this reason, VAT has been gaining favor over traditional sales taxes.

Another difference is that VAT is collected at the national level, while in countries such as India and the US, sales tax is collected at the point of sale by the local jurisdiction, leading them to prefer the latter method.

The main disadvantage of VAT is the extra accounting required by those in the supply chain. However, payment of VAT is made simpler when the VAT system has few, if any, exemptions (such as with GST in New Zealand).

Untaxed

* A widget manufacturer, for example, spends $1.00 on

* A widget manufacturer, for example, spends $1.00 on raw material

A raw material, also known as a feedstock, unprocessed material, or primary commodity, is a basic material that is used to produce goods, finished goods, energy, or intermediate materials/Intermediate goods that are feedstock for future finished ...

s and uses them to make a widget.

* The widget is sold wholesale to a widget retailer for $1.20, at a gross margin of $0.20.

* The widget retailer then sells the widget to a widget consumer for $1.50, at a gross margin of $0.30.

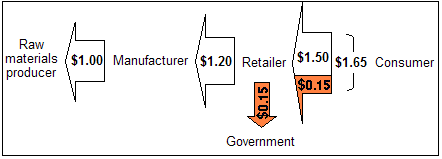

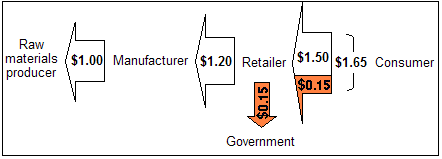

Sales tax

10% sales tax:

* The manufacturer spends $1.00 for the raw materials, certifying it is not a final consumer.

* The manufacturer charges the retailer $1.20, checking that the retailer is not a consumer, leaving the same gross margin of $0.20.

* The retailer charges the consumer ($1.50 × 1.10) = $1.65 and pays the government $0.15, leaving the gross margin of $0.30.

So, the consumer pays 10% ($0.15) extra, compared to the no taxation scheme, and the government collects this amount. The retailers pay no tax directly, but the retailer has to do the tax-related paperwork. Suppliers and manufacturers have the administrative burden of supplying correct state exemption certifications that the retailer must verify and maintain.

The manufacturer is responsible for ensuring that their customers (retailers) are only intermediates and not end consumers (otherwise the manufacturer charges the tax). In addition, the retailer tracks what is taxable and what is not, along with the various tax rates in each city where it operates.

* The manufacturer spends $1.00 for the raw materials, certifying it is not a final consumer.

* The manufacturer charges the retailer $1.20, checking that the retailer is not a consumer, leaving the same gross margin of $0.20.

* The retailer charges the consumer ($1.50 × 1.10) = $1.65 and pays the government $0.15, leaving the gross margin of $0.30.

So, the consumer pays 10% ($0.15) extra, compared to the no taxation scheme, and the government collects this amount. The retailers pay no tax directly, but the retailer has to do the tax-related paperwork. Suppliers and manufacturers have the administrative burden of supplying correct state exemption certifications that the retailer must verify and maintain.

The manufacturer is responsible for ensuring that their customers (retailers) are only intermediates and not end consumers (otherwise the manufacturer charges the tax). In addition, the retailer tracks what is taxable and what is not, along with the various tax rates in each city where it operates.

Value-added tax

10% VAT:

* The manufacturer spends ($1 × 1.10) = $1.10 to buy raw materials, and the seller of the raw materials pays the government $0.10.

* The manufacturer charges the retailer ($1.20 × 1.10) = $1.32 and pays the government ($0.12 ''minus'' $0.10) = $0.02, leaving the same gross margin of ($1.32 – $1.10 – $0.02) = $0.20.

* The retailer charges the consumer ($1.50 × 1.10) = $1.65 and pays the government ($0.15 ''minus'' $0.12) = $0.03, leaving the same gross margin of ($1.65 – $1.32 – $0.03) = $0.30.

* Manufacturer and retailer gross margins are a smaller percent of the total perspective. If the cost of raw material production were shown, this would also be true of the raw material supplier's gross margin on a percentage basis.

* Note that the taxes paid by both the manufacturer and the retailer to the government are 10% of the ''values added'' by their respective business practices (e.g. the ''value added'' by the manufacturer is $1.20 minus $1.00, thus the tax payable by the manufacturer is ($1.20 – $1.00) × 10% = $0.02).

In the VAT example above, the consumer has paid, and the government received, the same dollar amount as with a sales tax. At each stage of production, the seller collects a tax and the buyer pays that tax. The buyer can then be reimbursed for paying the tax, but only by successfully selling the value-added product to the buyer at the next stage. In the previous examples, if the retailer fails to sell some of its inventory, it suffers a greater financial loss in the VAT scheme, in comparison to the sales tax regulatory system, by having paid a higher wholesale price on the product it wants to sell.

Each business is responsible for handling the necessary tax paperwork. However, businesses have no obligation to request certifications from purchasers who are not end users, or of providing such certifications to their suppliers, but they incur increased accounting costs for collecting the tax.

* The manufacturer spends ($1 × 1.10) = $1.10 to buy raw materials, and the seller of the raw materials pays the government $0.10.

* The manufacturer charges the retailer ($1.20 × 1.10) = $1.32 and pays the government ($0.12 ''minus'' $0.10) = $0.02, leaving the same gross margin of ($1.32 – $1.10 – $0.02) = $0.20.

* The retailer charges the consumer ($1.50 × 1.10) = $1.65 and pays the government ($0.15 ''minus'' $0.12) = $0.03, leaving the same gross margin of ($1.65 – $1.32 – $0.03) = $0.30.

* Manufacturer and retailer gross margins are a smaller percent of the total perspective. If the cost of raw material production were shown, this would also be true of the raw material supplier's gross margin on a percentage basis.

* Note that the taxes paid by both the manufacturer and the retailer to the government are 10% of the ''values added'' by their respective business practices (e.g. the ''value added'' by the manufacturer is $1.20 minus $1.00, thus the tax payable by the manufacturer is ($1.20 – $1.00) × 10% = $0.02).

In the VAT example above, the consumer has paid, and the government received, the same dollar amount as with a sales tax. At each stage of production, the seller collects a tax and the buyer pays that tax. The buyer can then be reimbursed for paying the tax, but only by successfully selling the value-added product to the buyer at the next stage. In the previous examples, if the retailer fails to sell some of its inventory, it suffers a greater financial loss in the VAT scheme, in comparison to the sales tax regulatory system, by having paid a higher wholesale price on the product it wants to sell.

Each business is responsible for handling the necessary tax paperwork. However, businesses have no obligation to request certifications from purchasers who are not end users, or of providing such certifications to their suppliers, but they incur increased accounting costs for collecting the tax.

Limitations

The simplified examples assume incorrectly that taxes are non-distortionary: the same number of widgets were made and sold both before and after the introduction of the tax. However, the supply and demand

In microeconomics, supply and demand is an economic model of price determination in a Market (economics), market. It postulates that, Ceteris_paribus#Applications, holding all else equal, the unit price for a particular Good (economics), good ...

economic model

An economic model is a theoretical construct representing economic processes by a set of variables and a set of logical and/or quantitative relationships between them. The economic model is a simplified, often mathematical, framework designed ...

suggests that any tax raises the cost of the product for someone. In raising the cost, the supply curve shifts leftward. Consequently, the quantity of a good purchased decreases, and/or the price at which it is sold increases.

Criticism

Regressivity

VAT has been criticized by opponents as a regressive tax, meaning that the poor pay more, as a percentage of their income, relative to the wealthier individuals, given the higher marginal propensity to consume

In economics, the marginal propensity to consume (MPC) is a metric that quantifies induced consumption, the concept that the increase in personal consumer spending ( consumption) occurs with an increase in disposable income (income after taxes a ...

among the poor.OECD

The Organisation for Economic Co-operation and Development (OECD; , OCDE) is an international organization, intergovernmental organization with 38 member countries, founded in 1961 to stimulate economic progress and international trade, wor ...

study found that VAT could even be slightly progressive.

Deadweight loss

The incidence of VAT may not fall entirely on consumers as traders tend to absorb VAT so as to maintain sales volumes. Conversely, not all cuts in VAT are passed on in lower prices. VAT consequently leads to a deadweight loss if cutting prices pushes a business below the margin of profitability. The effect can be seen when VAT is cut or abolished. Sweden reduced VAT on restaurant meals from 25% to 12%, creating 11,000 additional jobs.

Churning

Because VAT is included in the price index to which state benefits such as pensions and welfare payments are linked in some countries, as well as public sector pay, some of the apparent revenue is churned – i.e. taxpayers are given the money to pay the tax, reducing net revenue.

Business cashflow

Refund delays by the tax administration can damage businesses.

Compliance costs

Compliance costs are seen as a burden on business. In the UK, compliance costs for VAT have been estimated to be about 4% of the yield, with greater impacts on smaller businesses.

Under a sales tax system, only businesses selling to the end-user are required to collect tax and bear the accounting cost of collecting the tax. Under VAT, manufacturers and wholesale companies also incur accounting expenses to handle the additional paperwork required for collecting VAT, increasing overhead costs and prices.

Fraud

VAT offers distinctive opportunities for evasion and fraud, especially through abuse of the credit and refund mechanism. VAT overclaim fraud reached as high as 34% in Romania.

Exports are generally zero-rated, creating opportunity for fraud. In Europe, the main source of problems is carousel fraud. This fraud originated in the 1970s in the Benelux

The Benelux Union (; ; ; ) or Benelux is a politico-economic union, alliance and formal international intergovernmental cooperation of three neighbouring states in Western Europe: Belgium, the Netherlands, and Luxembourg. The name is a portma ...

countries. VAT fraud then became a major problem in the UK. Similar fraud possibilities exist inside a country. To avoid this, countries such as Sweden hold the major owner of a limited company personally responsible.

Trade criticism

Increased VAT rebates on exports can increase the exports of goods.

Increased VAT rebates on exports can increase the exports of goods.

Around the world

Armenia

The VAT rate is 20%. However, the expanded application is zero VAT for many operations and transactions. That zero VAT is the source of controversies between its trading partners, mainly Russia, which is against the zero VAT and promotes wider use of tax credits. VAT is replaced with fixed payments, which are utilized for many taxpayers, operations, and transactions. Legislation is based largely on the EU VAT Directive's principles.

Australia

The goods and services tax (GST) is a VAT introduced in Australia in 2000. Revenue is redistributed to the states and territories via the Commonwealth Grants Commission process. This works as a program of horizontal fiscal equalisation. The rate is set at 10%, although many domestically consumed items are effectively zero-rated (GST-free) such as fresh food, education, health services, certain medical products, as well as government charges and fees that are effectively taxes.

Bangladesh

VAT was introduced in 1991, replacing sales tax and most excise duties. The Value Added Tax Act, 1991 triggered VAT starting on 10 July 1991, which is observed as National VAT Day.

Barbados

VAT was introduced on 1 January 1997 and replaced 11 other taxes. The original rate of 15% was increased to 17.5% in 2011. The rate on restaurant and hotel accommodations is between 10% and 15% while certain foods and goods are zero-rated. The revenue is collected by the Barbados Revenue Authority.

Bulgaria

VAT was 20% as of 2023. A reduced rate of 9% applies to baby foods and hygiene products, as well as on books. A permanent rate of 9% applies to physical or electronic periodicals, such as newspapers and magazines.

Canada

Goods and Services Tax (GST) is a national sales tax introduced in 1991 at a rate of 7%, later reduced to 5%. A Harmonized Sales Tax

The harmonized sales tax (HST) is a consumption tax in Canada. It is used in provinces where both the federal goods and services tax (GST) and the regional provincial sales tax (PST) have been combined into a single value-added tax.

Jurisdict ...

(HST) that combines the GST and provincial sales tax, is collected in New Brunswick

New Brunswick is a Provinces and Territories of Canada, province of Canada, bordering Quebec to the north, Nova Scotia to the east, the Gulf of Saint Lawrence to the northeast, the Bay of Fundy to the southeast, and the U.S. state of Maine to ...

(15%), Newfoundland

Newfoundland and Labrador is the easternmost province of Canada, in the country's Atlantic region. The province comprises the island of Newfoundland and the continental region of Labrador, having a total size of . As of 2025 the population ...

(15%), Nova Scotia

Nova Scotia is a Provinces and territories of Canada, province of Canada, located on its east coast. It is one of the three Maritime Canada, Maritime provinces and Population of Canada by province and territory, most populous province in Atlan ...

(15%), Ontario

Ontario is the southernmost Provinces and territories of Canada, province of Canada. Located in Central Canada, Ontario is the Population of Canada by province and territory, country's most populous province. As of the 2021 Canadian census, it ...

(13%) and Prince Edward Island

Prince Edward Island is an island Provinces and territories of Canada, province of Canada. While it is the smallest province by land area and population, it is the most densely populated. The island has several nicknames: "Garden of the Gulf", ...

(15%), while British Columbia

British Columbia is the westernmost Provinces and territories of Canada, province of Canada. Situated in the Pacific Northwest between the Pacific Ocean and the Rocky Mountains, the province has a diverse geography, with rugged landscapes that ...

had a 12% HST until 2013. Quebec

Quebec is Canada's List of Canadian provinces and territories by area, largest province by area. Located in Central Canada, the province shares borders with the provinces of Ontario to the west, Newfoundland and Labrador to the northeast, ...

has a de facto 14.975% HST: it follows the same rules as the GST, and both are collected by Revenu Québec.

Advertised and posted prices generally exclude taxes, which are calculated at the time of payment; common exceptions are motor fuels, the posted prices for which include sales and excise taxes, and items in vending machines as well as alcohol in monopoly stores. Basic groceries, prescription drugs, inward/outbound transportation and medical devices are zero-rated. Other provinces that do not have a HST may have a Provincial Sales Tax (PST), which are collected in British Columbia (7%), Manitoba

Manitoba is a Provinces and territories of Canada, province of Canada at the Centre of Canada, longitudinal centre of the country. It is Canada's Population of Canada by province and territory, fifth-most populous province, with a population ...

(7%) and Saskatchewan

Saskatchewan is a Provinces and territories of Canada, province in Western Canada. It is bordered on the west by Alberta, on the north by the Northwest Territories, on the east by Manitoba, to the northeast by Nunavut, and to the south by the ...

(6%). Alberta

Alberta is a Provinces and territories of Canada, province in Canada. It is a part of Western Canada and is one of the three Canadian Prairies, prairie provinces. Alberta is bordered by British Columbia to its west, Saskatchewan to its east, t ...

and all three territories do not collect either a HST or PST.

Chile

VAT was introduced in Chile in 1974 under Decreto Ley 825. From 1998 there was implemented a 18% tax. Since October 2003, the standard VAT rate has been 19%, applying to the majority of goods and some services. However certain items have been subjected to additional tax, for instance, alcoholic beverages (between 20.5= – 31.5% for fermented to distilled products), jewellery (15%), pyrotechnic items (50% or more for the first sale or import) or soft drinks with high sugar (18%). AS of 2023, the VAT tax includes majority of services excluding Education, Health and Transport, as well as taxpayers issuing fee receipts. This tax makes the 41.2% of the total revenue of the country.

China

VAT produces the largest share of China's tax revenue.

Czech Republic

In 1993, a standard rate of 23% and a reduced rate of 5% for non-alcoholic beverages, sewerage, heat, and public transport was introduced. In 2015, rates were revised to 21% for the standard rate, and 15% and 10% reduced rates. The lowest reduced rate primarily targeted baby food, medicines, vaccines, books, and music shops, while maintaining a similar redistribution of goods and services for the other rates.

In 2024, a law aimed at reducing the national debt featured return to two rates: a standard rate of 21% and a reduced rate of 12%. Goods and services were redistributed among different tax rates.

There was only one services that shifted from the standard rate to the reduced rate and that were non-regular land passenger bus services. These are not taxi services, which apply a VAT rate of 21%. Books and printed materials, including electronic books, were zero rated.

Several services were moved from reduced rates to the standard rate. Examples include hairdressers and barbers, bicycle repairs, footwear and clothing repairs, freelance journalists and models, cleaning services, and municipal waste.

European Union

The European Union VAT is mandatory for member states of the European Union

The European Union (EU) is a political and economic union of 27 member states that are party to the EU's founding treaties, and thereby subject to the privileges and obligations of membership. They have agreed by the treaties to share their o ...

. The EU VAT asks where supply and consumption occurs, which determines which state collects VAT and at what rate.

Each state must comply with EU VAT law, which requires a minimum standard rate of 15% and one or two reduced rates not to be below 5%. Some EU members have a 0% VAT rate on certain items; these states agreed this as part of their accession (for example, newspapers and certain magazines in Belgium). Certain goods and services must be exempt from VAT (for example, postal services, medical care, lending, insurance, betting), and certain other items are exempt from VAT by default, but states may opt to charge VAT on them (such as land and certain financial services). Luxembourg charges the lowest rate, 17%, and Hungary charges the highest rate, 27%. Only Denmark has no reduced rate.

Gulf Cooperation Council

The United Arab Emirates

The United Arab Emirates (UAE), or simply the Emirates, is a country in West Asia, in the Middle East, at the eastern end of the Arabian Peninsula. It is a Federal monarchy, federal elective monarchy made up of Emirates of the United Arab E ...

(UAE) on 1 January 2018 implemented VAT. For companies whose annual revenues exceed $102,000 (Dhs 375,000), registration is mandatory. GCC countries agreed to an introductory rate of 5%. Saudi Arabia

Saudi Arabia, officially the Kingdom of Saudi Arabia (KSA), is a country in West Asia. Located in the centre of the Middle East, it covers the bulk of the Arabian Peninsula and has a land area of about , making it the List of Asian countries ...

's VAT system uses a 15% rate.

India

VAT was introduced on 1 April 2005. Of the then 28 states, eight did not immediately introduce VAT. Rates were 5% and 14.5%. Tamil Nadu

Tamil Nadu (; , TN) is the southernmost States and union territories of India, state of India. The List of states and union territories of India by area, tenth largest Indian state by area and the List of states and union territories of Indi ...

introduced VAT on 1 January 2007. Under the BJP government, it was replaced by a national Goods and Services Tax (GST) according to the One Hundred and First Amendment of the Constitution of India.

Indonesia

Italy

Israel

Japan

VAT was implemented in Japan in 1989.

Malaysia

Mexico

The existing sales tax () was replaced by VAT (, IVA) on 1 January 1980. As of 2010, the general VAT rate was 16%. This rate was applied all over Mexico except for border regions (i.e. the United States border, or Belize and Guatemala), where the rate was 11%. Books, food, and medicines are zero-rated. Some services such as medical care are zero-rated. In 2014 the favorable tax rate for border regions was eliminated and the rate increased to 16% across the country.

Nepal

New Zealand

Nordic countries

MOMS (, formerly ), (bokmål

Bokmål () (, ; ) is one of the official written standards for the Norwegian language, alongside Nynorsk. Bokmål is by far the most used written form of Norwegian today, as it is adopted by 85% to 90% of the population in Norway. There is no cou ...

) or (nynorsk

Nynorsk (; ) is one of the two official written standards of the Norwegian language, the other being Bokmål. From 12 May 1885, it became the state-sanctioned version of Ivar Aasen's standard Norwegian language (''Landsmål''), parallel to the Da ...

) (abbreviated ''MVA''), (until the early 1970s labeled as OMS only), (abbreviated ''VSK''), (abbreviated ''MVG'') or Finnish: (abbreviated ''ALV'') are the Nordic terms for VAT. Like other countries' sales and VAT, it is an indirect tax

An indirect tax (such as a sales tax, per unit tax, value-added tax (VAT), excise tax, consumption tax, or tariff) is a tax that is levied upon goods and services before they reach the customer who ultimately pays the indirect tax as a part of ...

.

Denmark has the highest VAT, alongside Norway, Sweden, and Croatia. VAT is generally applied at one rate, 25%, with few exceptions. Services such as public transport, health care, newspapers, rent (the lessor can voluntarily register as a VAT payer, except for residential premises), and travel agencies.

In Finland, the standard rate is 25.5%. A 14% rate is applied on groceries, animal feed, and restaurant and catering services. A 10% rate is applied on books, newspapers and magazines, pharmaceutical products,

sports and fitness services, entrance fees to cultural, entertainment and sporting events,

passenger transport services, accommodation services, and royalties for television and public radio activities. Åland

Åland ( , ; ) is an Federacy, autonomous and Demilitarized zone, demilitarised region of Finland. Receiving its autonomy by a 1920 decision of the League of Nations, it is the smallest region of Finland by both area () and population (30,54 ...

, an autonomous area, is considered to be outside the EU VAT area, although its VAT rate is the same as for Finland. Goods brought from Åland to Finland or other EU countries are considered to be imports. This enables tax-free sales onboard passenger ships.

In Iceland, VAT is 24% for most goods and services. An 11% rate is applied for hotel and guesthouse stays, licence fees for radio stations (namely RÚV

Ríkisútvarpið (, ; abbr. RÚV ) is Iceland's national public broadcasting, public-service broadcasting organization.

Founded in 1930, it operates from studios in the country's capital, Reykjavík, as well as regional centres around the count ...

), newspapers and magazines, books; hot water, electricity and oil for heating houses, food for human consumption (but not alcoholic beverages), access to toll road

A toll road, also known as a turnpike or tollway, is a public or private road for which a fee (or ''Toll (fee), toll'') is assessed for passage. It is a form of road pricing typically implemented to help recoup the costs of road construction and ...

s and music.

In Norway, the general rate is 25%, 15% on foodstuffs, and 12% on hotels and holiday homes, on some transport services, cinemas. Financial services, health services, social services and educational services, newspapers, books and periodicals are zero-rated. Svalbard

Svalbard ( , ), previously known as Spitsbergen or Spitzbergen, is a Norway, Norwegian archipelago that lies at the convergence of the Arctic Ocean with the Atlantic Ocean. North of continental Europe, mainland Europe, it lies about midway be ...

has no VAT because of a clause in the Svalbard Treaty

The Svalbard Treaty (originally the Spitsbergen Treaty) recognises the sovereignty of Norway over the Arctic archipelago of Svalbard, at the time called Spitsbergen. The exercise of sovereignty is, however, subject to certain stipulations, and no ...

.

In Sweden, VAT is 25% for most goods and services, 12% for foods including restaurants, and hotels. It is 6% for printed matter, cultural services, and transport of private persons. Zero-rated services including public (but not private) education, health, dental care. Dance event tickets are 25%, concerts and stage shows are 6%, while some types of cultural events are 0%.

MOMS replaced OMS (Danish , Swedish ) in 1967, which was a tax applied exclusively for retailers.

Philippines

The VAT rate is 12%. Senior citizens are exempted from paying VAT for most goods and some services for personal consumption.

Poland

VAT was introduced in 1993. The standard rate is 23%. Items and services eligible for an 8% include certain food products, newspapers, goods and services related to agriculture, medicine, sport, and culture. The complete list is in Annex 3 to the VAT Act. A 5% applies to basic food items (such as meat, fruits, vegetables, dairy and bakery products), children's items, hygiene products, and books. Exported goods, international transport services, supply of specific computer hardware to educational institutions, vessels, and air transport are zero rated. Taxi services have flat-rate tax of 4%. Flat-rate farmers supplying agricultural goods to VAT taxable entities are eligible for a 7% refund.

Russia

The VAT rate is 20% with exemptions for some services (for example, medical care). VAT payers include organizations (industrial and financial, state and municipal enterprises, institutions, business partnerships, insurance companies and banks), enterprises with foreign investments, individual entrepreneurs, international associations, and foreign entities with operations in the Russian Federation, non-commercial organizations that conduct commercial activities, and those who move goods across the border of the Customs Union.

Singapore

Slovakia

The standard rate is 23%. A 5% rate primarily applies to essential goods such as (healthy) food, medicine, and books.

Spain

South Africa

South Africa applies a standard VAT rate of 15%, with specific zero-rated and exempt items; recent case law has clarified the treatment of certain entertainment expenses for VAT input claims.

Switzerland and Liechtenstein

Taiwan

VAT in Taiwan is 5%. It is levied on all goods and services. Exceptions include exports, vessels, aircraft used in international transportation, and deep-sea fishing boats.

Trinidad and Tobago

VAT is 12.5%.

Ukraine

United Kingdom

The United Kingdom introduced VAT in 1973 after joining the EEC.[ The current standard rate for VAT in the United Kingdom since 2011 is 20%. Some goods and services have a reduced rate of 5% or are zero-rated (0%). Others may be exempt.

]

United States

In the United States no federal VAT is in effect. Instead, sales and use taxes are used in most states.

Puerto Rico

; abbreviated PR), officially the Commonwealth of Puerto Rico, is a Government of Puerto Rico, self-governing Caribbean Geography of Puerto Rico, archipelago and island organized as an Territories of the United States, unincorporated territo ...

replaced its 6% sales tax with a 10.5% VAT beginning 1 April 2016, leaving in place its 1% municipal sales and use tax. Materials imported for manufacturing are exempt.Michigan

Michigan ( ) is a peninsular U.S. state, state in the Great Lakes region, Great Lakes region of the Upper Midwest, Upper Midwestern United States. It shares water and land boundaries with Minnesota to the northwest, Wisconsin to the west, ...

used a form of VAT known as the "Single Business Tax" (SBT) from 1975 until voter-initiated legislation repealed it, replaced by the Michigan Business Tax in 2008.

Hawaii

Hawaii ( ; ) is an island U.S. state, state of the United States, in the Pacific Ocean about southwest of the U.S. mainland. One of the two Non-contiguous United States, non-contiguous U.S. states (along with Alaska), it is the only sta ...

has a 4% General Excise Tax (GET) that is charged on gross business income. Individual counties add a .5% surcharge. Unlike a VAT, rebates are not available, such that items incur the tax each time they are (re)sold.

Discussions about a federal VAT

Former 2020 Democratic presidential candidate Andrew Yang advocated for a national VAT in order to pay for his universal basic income

Universal basic income (UBI) is a social welfare proposal in which all citizens of a given population regularly receive a minimum income in the form of an unconditional transfer payment, i.e., without a means test or need to perform Work (hu ...

proposal. A national subtraction-method VAT, often referred to as a "flat tax", has been repeatedly proposed as a replacement of the corporate income tax.

Vietnam

All organizations and individuals producing and trading VAT taxable goods and services pay VAT, regardless of whether they have Vietnam-resident establishments.

Vietnam has three VAT rates: 0 percent, 5 percent and 10 percent. 10 percent is the standard rate.

A variety of goods and service transactions qualify for VAT exemption.

Tax rates

Examples by continent

European Union countries

Non-European Union countries

VAT-free countries and territories

As of January 2022, the countries and territories listed remained VAT-free.

See also

* Excise

* Flat tax

A flat tax (short for flat-rate tax) is a tax with a single rate on the taxable amount, after accounting for any deductions or exemptions from the tax base. It is not necessarily a fully proportional tax. Implementations are often progressi ...

* Georgism

* Gross receipts tax

A gross receipts tax or gross excise tax is a tax on the total gross revenues of a company, regardless of their source. A gross receipts tax is often compared to a sales tax; the difference is that a gross receipts tax is levied upon the seller o ...

* Henry George

Henry George (September 2, 1839 – October 29, 1897) was an American political economist, Social philosophy, social philosopher and journalist. His writing was immensely popular in 19th-century America and sparked several reform movements of ...

* Import One-Stop Shop (IOSS)

* Income tax

An income tax is a tax imposed on individuals or entities (taxpayers) in respect of the income or profits earned by them (commonly called taxable income). Income tax generally is computed as the product of a tax rate times the taxable income. Tax ...

* Land value tax

* Missing Trader Fraud (Carousel VAT Fraud)

* Progressive tax

A progressive tax is a tax in which the tax rate increases as the taxable amount increases. The term ''progressive'' refers to the way the tax rate progresses from low to high, with the result that a taxpayer's average tax rate is less than the ...

* Single tax

A single tax is a system of taxation based mainly or exclusively on one tax, typically chosen for its special properties, often being a tax on land value.

Pierre Le Pesant, sieur de Boisguilbert and Sébastien Le Prestre de Vauban were ear ...

* X tax

General:

* List of tax rates around the world

References

Scholarly sources

*

* Ahmed, Ehtisham and Nicholas Stern. 1991. The Theory and Practice of Tax Reform in Developing Countries (Cambridge University Press).

* Bird, Richard M. and P.-P. Gendron .1998. "Dual VATs and Cross-border Trade: Two Problems, One Solution?" International Tax and Public Finance, 5: 429–42.

* Bird, Richard M. and P.-P. Gendron .2000. "CVAT, VIVAT and Dual VAT; Vertical 'Sharing' and Interstate Trade", International Tax and Public Finance, 7: 753–61.

* Keen, Michael and S. Smith .2000. "Viva VIVAT!" International Tax and Public Finance, 7: 741–51.

* Keen, Michael and S. Smith .1996. "The Future of Value-added Tax in the European Union", Economic Policy, 23: 375–411.

* McLure, Charles E. (1993) "The Brazilian Tax Assignment Problem: Ends, Means, and Constraints", in A Reforma Fiscal no Brasil (São Paulo: Fundaçäo Instituto de Pesquisas Econômicas).

* McLure, Charles E. 2000. "Implementing Subnational VATs on Internal Trade: The Compensating VAT (CVAT)", International Tax and Public Finance, 7: 723–40.

* Muller, Nichole. 2007. Indisches Recht mit Schwerpunkt auf gewerblichem Rechtsschutz im Rahmen eines Projektgeschäfts in Indien, ''IBL Review'', VOL. 12, Institute of International Business and law, Germany

Law-and-business.de

* Muller, Nichole. 2007. Indian law with emphasis on commercial legal insurance within the scope of a project business in India. ''IBL Review'', VOL. 12, Institute of International Business and law, Germany.

* MOMS, Politikens Nudansk Leksikon 2002, .

* OECD. 2008. ''Consumption Tax Trends 2008: VAT/GST and Excise Rates, Trends and Administration Issues''. Paris: OECD.

* Serra, J. and J. Afonso. 1999. "Fiscal Federalism Brazilian Style: Some Reflections", Paper presented to Forum of Federations, Mont Tremblant, Canada, October 1999.

* Shome, Parthasarathi and Paul Bernd Spahn (1996) "Brazil: Fiscal Federalism and Value Added Tax Reform", Working Paper No. 11, National Institute of Public Finance and Policy, New Delhi

* Silvani, Carlos and Paulo dos Santos (1996) "Administrative Aspects of Brazil's Consumption Tax Reform", International VAT Monitor, 7: 123–32.

* Tait, Alan A. (1988) Value Added Tax: International Practice and Problems (Washington: International Monetary Fund).

Saudi Arabia Increases Value Added Tax (VAT) will be increase to 15% from 5% as of July 2020.

External links

*

*

{{DEFAULTSORT:Value Added Tax

Tax terms

Following creation of the

Following creation of the  * A widget manufacturer, for example, spends $1.00 on

* A widget manufacturer, for example, spends $1.00 on  * The manufacturer spends $1.00 for the raw materials, certifying it is not a final consumer.

* The manufacturer charges the retailer $1.20, checking that the retailer is not a consumer, leaving the same gross margin of $0.20.

* The retailer charges the consumer ($1.50 × 1.10) = $1.65 and pays the government $0.15, leaving the gross margin of $0.30.

So, the consumer pays 10% ($0.15) extra, compared to the no taxation scheme, and the government collects this amount. The retailers pay no tax directly, but the retailer has to do the tax-related paperwork. Suppliers and manufacturers have the administrative burden of supplying correct state exemption certifications that the retailer must verify and maintain.

The manufacturer is responsible for ensuring that their customers (retailers) are only intermediates and not end consumers (otherwise the manufacturer charges the tax). In addition, the retailer tracks what is taxable and what is not, along with the various tax rates in each city where it operates.

* The manufacturer spends $1.00 for the raw materials, certifying it is not a final consumer.

* The manufacturer charges the retailer $1.20, checking that the retailer is not a consumer, leaving the same gross margin of $0.20.

* The retailer charges the consumer ($1.50 × 1.10) = $1.65 and pays the government $0.15, leaving the gross margin of $0.30.

So, the consumer pays 10% ($0.15) extra, compared to the no taxation scheme, and the government collects this amount. The retailers pay no tax directly, but the retailer has to do the tax-related paperwork. Suppliers and manufacturers have the administrative burden of supplying correct state exemption certifications that the retailer must verify and maintain.

The manufacturer is responsible for ensuring that their customers (retailers) are only intermediates and not end consumers (otherwise the manufacturer charges the tax). In addition, the retailer tracks what is taxable and what is not, along with the various tax rates in each city where it operates.

* The manufacturer spends ($1 × 1.10) = $1.10 to buy raw materials, and the seller of the raw materials pays the government $0.10.

* The manufacturer charges the retailer ($1.20 × 1.10) = $1.32 and pays the government ($0.12 ''minus'' $0.10) = $0.02, leaving the same gross margin of ($1.32 – $1.10 – $0.02) = $0.20.

* The retailer charges the consumer ($1.50 × 1.10) = $1.65 and pays the government ($0.15 ''minus'' $0.12) = $0.03, leaving the same gross margin of ($1.65 – $1.32 – $0.03) = $0.30.

* Manufacturer and retailer gross margins are a smaller percent of the total perspective. If the cost of raw material production were shown, this would also be true of the raw material supplier's gross margin on a percentage basis.

* Note that the taxes paid by both the manufacturer and the retailer to the government are 10% of the ''values added'' by their respective business practices (e.g. the ''value added'' by the manufacturer is $1.20 minus $1.00, thus the tax payable by the manufacturer is ($1.20 – $1.00) × 10% = $0.02).

In the VAT example above, the consumer has paid, and the government received, the same dollar amount as with a sales tax. At each stage of production, the seller collects a tax and the buyer pays that tax. The buyer can then be reimbursed for paying the tax, but only by successfully selling the value-added product to the buyer at the next stage. In the previous examples, if the retailer fails to sell some of its inventory, it suffers a greater financial loss in the VAT scheme, in comparison to the sales tax regulatory system, by having paid a higher wholesale price on the product it wants to sell.

Each business is responsible for handling the necessary tax paperwork. However, businesses have no obligation to request certifications from purchasers who are not end users, or of providing such certifications to their suppliers, but they incur increased accounting costs for collecting the tax.

* The manufacturer spends ($1 × 1.10) = $1.10 to buy raw materials, and the seller of the raw materials pays the government $0.10.

* The manufacturer charges the retailer ($1.20 × 1.10) = $1.32 and pays the government ($0.12 ''minus'' $0.10) = $0.02, leaving the same gross margin of ($1.32 – $1.10 – $0.02) = $0.20.

* The retailer charges the consumer ($1.50 × 1.10) = $1.65 and pays the government ($0.15 ''minus'' $0.12) = $0.03, leaving the same gross margin of ($1.65 – $1.32 – $0.03) = $0.30.

* Manufacturer and retailer gross margins are a smaller percent of the total perspective. If the cost of raw material production were shown, this would also be true of the raw material supplier's gross margin on a percentage basis.

* Note that the taxes paid by both the manufacturer and the retailer to the government are 10% of the ''values added'' by their respective business practices (e.g. the ''value added'' by the manufacturer is $1.20 minus $1.00, thus the tax payable by the manufacturer is ($1.20 – $1.00) × 10% = $0.02).

In the VAT example above, the consumer has paid, and the government received, the same dollar amount as with a sales tax. At each stage of production, the seller collects a tax and the buyer pays that tax. The buyer can then be reimbursed for paying the tax, but only by successfully selling the value-added product to the buyer at the next stage. In the previous examples, if the retailer fails to sell some of its inventory, it suffers a greater financial loss in the VAT scheme, in comparison to the sales tax regulatory system, by having paid a higher wholesale price on the product it wants to sell.

Each business is responsible for handling the necessary tax paperwork. However, businesses have no obligation to request certifications from purchasers who are not end users, or of providing such certifications to their suppliers, but they incur increased accounting costs for collecting the tax.

Increased VAT rebates on exports can increase the exports of goods. The American Manufacturing Trade Action Coalition in the United States consider VAT charges on US products and rebates for products from other countries to be an unfair trade practice. AMTAC claims that so-called "border tax disadvantage" is the greatest contributing factor to the US current account deficit, and estimated this disadvantage to US producers and service providers to be $518 billion in 2008 alone. US politicians such as congressman Bill Pascrell, advocate either changing WTO rules relating to VAT or rebating VAT charged on US exporters. A business tax rebate for exports was proposed in the 2016 GOP tax reform policy paper. The assertion that this "border adjustment" would be compatible with the rules of the WTO is controversial; it was alleged that the proposed tax would favour domestically produced goods as they would be taxed less than imports, to a degree varying across sectors. For example, the wage component of the cost of domestically produced goods would not be taxed.

A 2021 study reported that value-added taxes within the EU were unlikely to distort trade flows.

Increased VAT rebates on exports can increase the exports of goods. The American Manufacturing Trade Action Coalition in the United States consider VAT charges on US products and rebates for products from other countries to be an unfair trade practice. AMTAC claims that so-called "border tax disadvantage" is the greatest contributing factor to the US current account deficit, and estimated this disadvantage to US producers and service providers to be $518 billion in 2008 alone. US politicians such as congressman Bill Pascrell, advocate either changing WTO rules relating to VAT or rebating VAT charged on US exporters. A business tax rebate for exports was proposed in the 2016 GOP tax reform policy paper. The assertion that this "border adjustment" would be compatible with the rules of the WTO is controversial; it was alleged that the proposed tax would favour domestically produced goods as they would be taxed less than imports, to a degree varying across sectors. For example, the wage component of the cost of domestically produced goods would not be taxed.

A 2021 study reported that value-added taxes within the EU were unlikely to distort trade flows.