Tax Revolt on:

[Wikipedia]

[Google]

[Amazon]

Tax resistance is the refusal to pay

Tax resistance is the refusal to pay

The earliest and most widespread forms of taxation were the

The earliest and most widespread forms of taxation were the  Because taxation is often oppressive, governments have always struggled with

Because taxation is often oppressive, governments have always struggled with

Other tax resisters change their lifestyles so that they owe less tax. For instance; to avoid

Other tax resisters change their lifestyles so that they owe less tax. For instance; to avoid

Climate change and my tax returnConscience Canada

*

Death and Taxes

' - NWTRCC film about war tax resisters and their motivations

History of War Tax Resistance

by Peace Tax Seven (U.S./UK focus)

Resistance to Civil Government

by

Silence and Courage: Income Taxes, War and Mennonites 1940-1993

— tax resistance in the women's suffrage movement

by Lawrence Rosenwald {{Types of justice Civil disobedience Community organizing Protest tactics Anarchist theory Libertarian theory Tax noncompliance

Tax resistance is the refusal to pay

Tax resistance is the refusal to pay tax

A tax is a mandatory financial charge or levy imposed on an individual or legal entity by a governmental organization to support government spending and public expenditures collectively or to regulate and reduce negative externalities. Tax co ...

because of opposition to the government that is imposing the tax, or to government policy, or as opposition to taxation in itself. Tax resistance is a form of direct action

Direct action is a term for economic and political behavior in which participants use agency—for example economic or physical power—to achieve their goals. The aim of direct action is to either obstruct a certain practice (such as a governm ...

and, if in violation of the tax regulations, also a form of civil disobedience

Civil disobedience is the active and professed refusal of a citizenship, citizen to obey certain laws, demands, orders, or commands of a government (or any other authority). By some definitions, civil disobedience has to be nonviolent to be cal ...

. Tax resisters are distinct from " tax protesters", who deny that the legal obligation to pay taxes exists or applies to them. Tax resisters may accept that some law commands them to pay taxes but they still choose to resist taxation.

Examples of tax resistance campaigns include those advocating home rule

Home rule is the government of a colony, dependent country, or region by its own citizens. It is thus the power of a part (administrative division) of a state or an external dependent country to exercise such of the state's powers of governan ...

, such as the Salt March

The Salt march, also known as the Salt Satyagraha, Dandi March, and the Dandi Satyagraha, was an act of Non violence, non violent civil disobedience in British Raj, colonial India, led by Mahatma Gandhi. The 24-day march lasted from 12 March 19 ...

led by Mahatma Gandhi

Mohandas Karamchand Gandhi (2October 186930January 1948) was an Indian lawyer, anti-colonial nationalism, anti-colonial nationalist, and political ethics, political ethicist who employed nonviolent resistance to lead the successful Indian ...

, and those promoting women's suffrage

Women's suffrage is the women's rights, right of women to Suffrage, vote in elections. Several instances occurred in recent centuries where women were selectively given, then stripped of, the right to vote. In Sweden, conditional women's suffra ...

, such as the Women's Tax Resistance League. War tax resistance is the refusal to pay some or all taxes that pay for war

War is an armed conflict between the armed forces of states, or between governmental forces and armed groups that are organized under a certain command structure and have the capacity to sustain military operations, or between such organi ...

and may be practiced by conscientious objector

A conscientious objector is an "individual who has claimed the right to refuse to perform military service" on the grounds of freedom of conscience or religion. The term has also been extended to objecting to working for the military–indu ...

s, pacifists

Pacifism is the opposition to war or violence. The word ''pacifism'' was coined by the French peace campaigner Émile Arnaud and adopted by other peace activists at the tenth Universal Peace Congress in Glasgow in 1901. A related term is ''a ...

, or those protesting against a particular war.

History

The earliest and most widespread forms of taxation were the

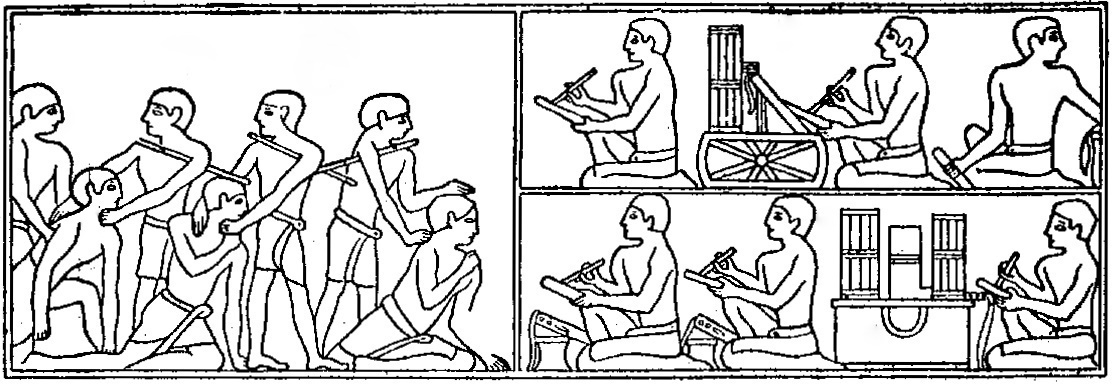

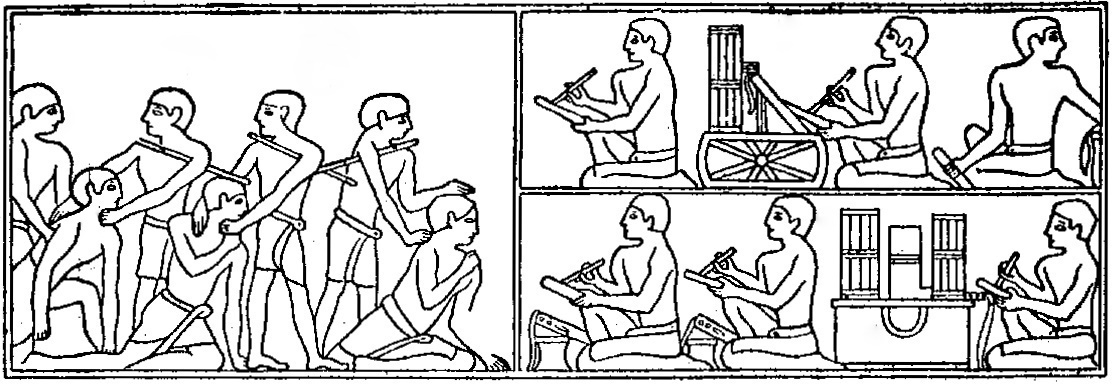

The earliest and most widespread forms of taxation were the corvée

Corvée () is a form of unpaid forced labour that is intermittent in nature, lasting for limited periods of time, typically only a certain number of days' work each year. Statute labour is a corvée imposed by a state (polity), state for the ...

and tithe

A tithe (; from Old English: ''teogoþa'' "tenth") is a one-tenth part of something, paid as a contribution to a religious organization or compulsory tax to government. Modern tithes are normally voluntary and paid in money, cash, cheques or v ...

, both of which can be traced back to the beginning of civilization

A civilization (also spelled civilisation in British English) is any complex society characterized by the development of state (polity), the state, social stratification, urban area, urbanization, and symbolic systems of communication beyon ...

. The corvée was state-imposed forced labour

Forced labour, or unfree labour, is any work relation, especially in modern or early modern history, in which people are employed against their will with the threat of destitution, detention, or violence, including death or other forms of ...

on peasant

A peasant is a pre-industrial agricultural laborer or a farmer with limited land-ownership, especially one living in the Middle Ages under feudalism and paying rent, tax, fees, or services to a landlord. In Europe, three classes of peasan ...

s too poor to pay other forms of taxation (''labour'' in ancient Egyptian

Ancient Egypt () was a cradle of civilization concentrated along the lower reaches of the Nile River in Northeast Africa. It emerged from prehistoric Egypt around 3150BC (according to conventional Egyptian chronology), when Upper and Lower E ...

is a synonym for taxes). Low taxes helped the Roman aristocracy increase their wealth, which equalled or exceeded the revenues of the central government. An emperor sometimes replenished his treasury by confiscating the estates of the "super-rich", but in the later period, the resistance of the wealthy to paying taxes was one of the factors contributing to the collapse of the Empire. Morris, p. 184.

Because taxation is often oppressive, governments have always struggled with

Because taxation is often oppressive, governments have always struggled with tax noncompliance

Tax noncompliance is a range of activities that are unfavorable to a government's tax system. This may include tax avoidance, which is tax reduction by legal means, and tax evasion which is the illegal non-payment of tax liabilities. The use of th ...

and resistance. It has been suggested that tax resistance played a significant role in the collapse of several empire

An empire is a political unit made up of several territories, military outpost (military), outposts, and peoples, "usually created by conquest, and divided between a hegemony, dominant center and subordinate peripheries". The center of the ...

s, including the Egyptian

''Egyptian'' describes something of, from, or related to Egypt.

Egyptian or Egyptians may refer to:

Nations and ethnic groups

* Egyptians, a national group in North Africa

** Egyptian culture, a complex and stable culture with thousands of year ...

, Roman

Roman or Romans most often refers to:

*Rome, the capital city of Italy

*Ancient Rome, Roman civilization from 8th century BC to 5th century AD

*Roman people, the people of Roman civilization

*Epistle to the Romans, shortened to Romans, a letter w ...

, Spanish, and Aztec

The Aztecs ( ) were a Mesoamerican civilization that flourished in central Mexico in the Post-Classic stage, post-classic period from 1300 to 1521. The Aztec people included different Indigenous peoples of Mexico, ethnic groups of central ...

. Reports of collective tax refusal include Zealot

The Zealots were members of a Jewish political movement during the Second Temple period who sought to incite the people of Judaea to rebel against the Roman Empire and expel it from the Land of Israel by force of arms, most notably during the ...

s resisting the Roman poll tax

A poll tax, also known as head tax or capitation, is a tax levied as a fixed sum on every liable individual (typically every adult), without reference to income or resources. ''Poll'' is an archaic term for "head" or "top of the head". The sen ...

during the 1st century CE, culminating in the First Jewish–Roman War

The First Jewish–Roman War (66–74 CE), also known as the Great Jewish Revolt, the First Jewish Revolt, the War of Destruction, or the Jewish War, was the first of three major Jewish rebellions against the Roman Empire. Fought in the prov ...

. Other historic events that originated as tax revolts include Magna Carta

(Medieval Latin for "Great Charter"), sometimes spelled Magna Charta, is a royal charter of rights agreed to by King John of England at Runnymede, near Windsor, on 15 June 1215. First drafted by the Archbishop of Canterbury, Cardin ...

, the American Revolution

The American Revolution (1765–1783) was a colonial rebellion and war of independence in which the Thirteen Colonies broke from British America, British rule to form the United States of America. The revolution culminated in the American ...

and the French Revolution.

War tax resisters often highlight the relationship between income tax

An income tax is a tax imposed on individuals or entities (taxpayers) in respect of the income or profits earned by them (commonly called taxable income). Income tax generally is computed as the product of a tax rate times the taxable income. Tax ...

and war. In Britain

Britain most often refers to:

* Great Britain, a large island comprising the countries of England, Scotland and Wales

* The United Kingdom of Great Britain and Northern Ireland, a sovereign state in Europe comprising Great Britain and the north-eas ...

income tax was introduced in 1799, to pay for weapons and equipment in preparation for the Napoleonic wars

{{Infobox military conflict

, conflict = Napoleonic Wars

, partof = the French Revolutionary and Napoleonic Wars

, image = Napoleonic Wars (revision).jpg

, caption = Left to right, top to bottom:Battl ...

, whilst the US federal government

The Federal Government of the United States of America (U.S. federal government or U.S. government) is the national government of the United States.

The U.S. federal government is composed of three distinct branches: legislative, execut ...

imposed their first income tax in the Revenue Act of 1861 to help pay for the American Civil War

The American Civil War (April 12, 1861May 26, 1865; also known by Names of the American Civil War, other names) was a civil war in the United States between the Union (American Civil War), Union ("the North") and the Confederate States of A ...

.

Views and aims

Tax resisters

Tax resistance is the refusal to pay tax because of opposition to the government that is imposing the tax, or to government policy, or as Taxation as theft, opposition to taxation in itself. Tax resistance is a form of direct action and, if in v ...

come from a wide range of backgrounds with diverse ideologies

An ideology is a set of beliefs or values attributed to a person or group of persons, especially those held for reasons that are not purely about belief in certain knowledge, in which "practical elements are as prominent as theoretical ones". Form ...

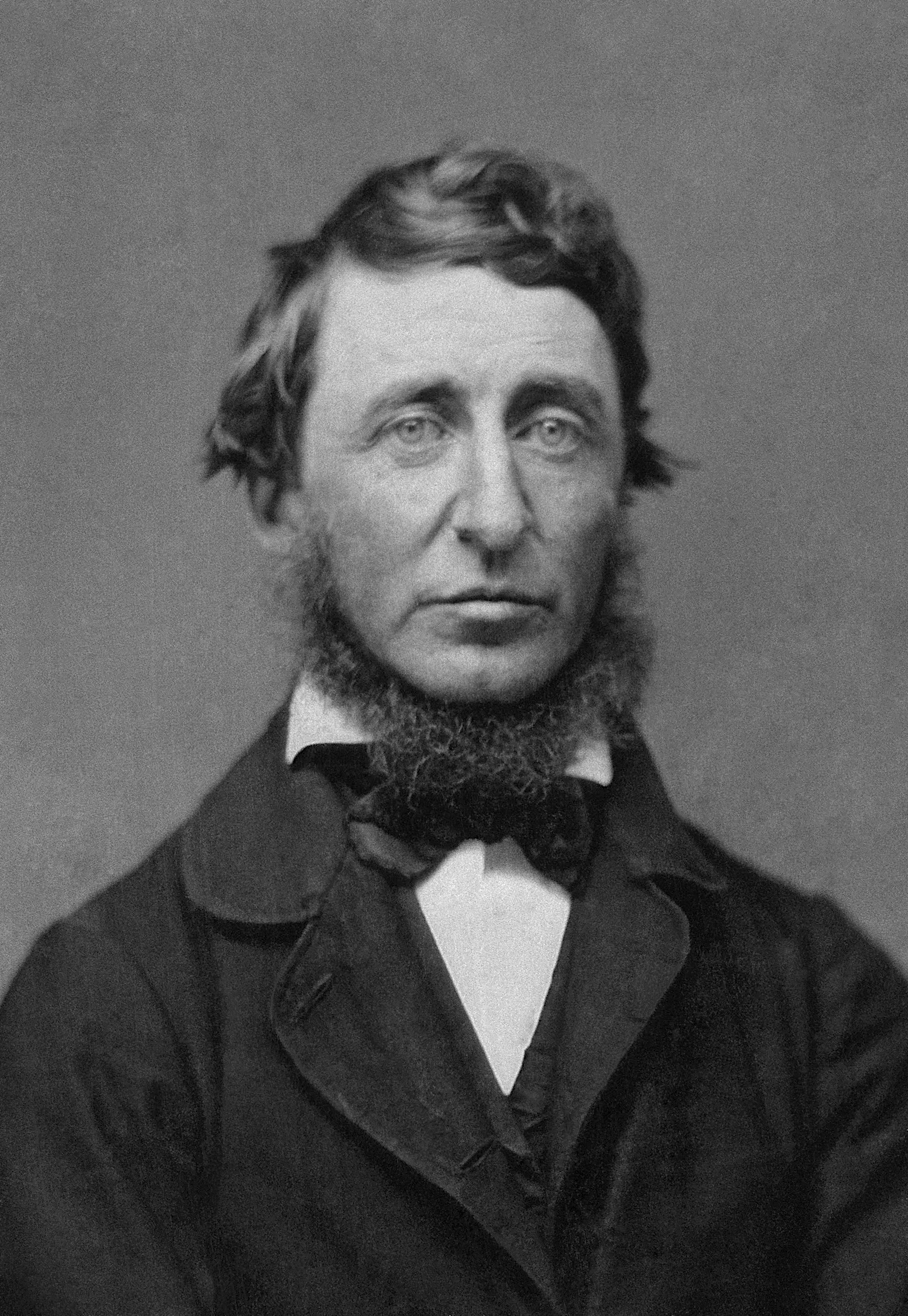

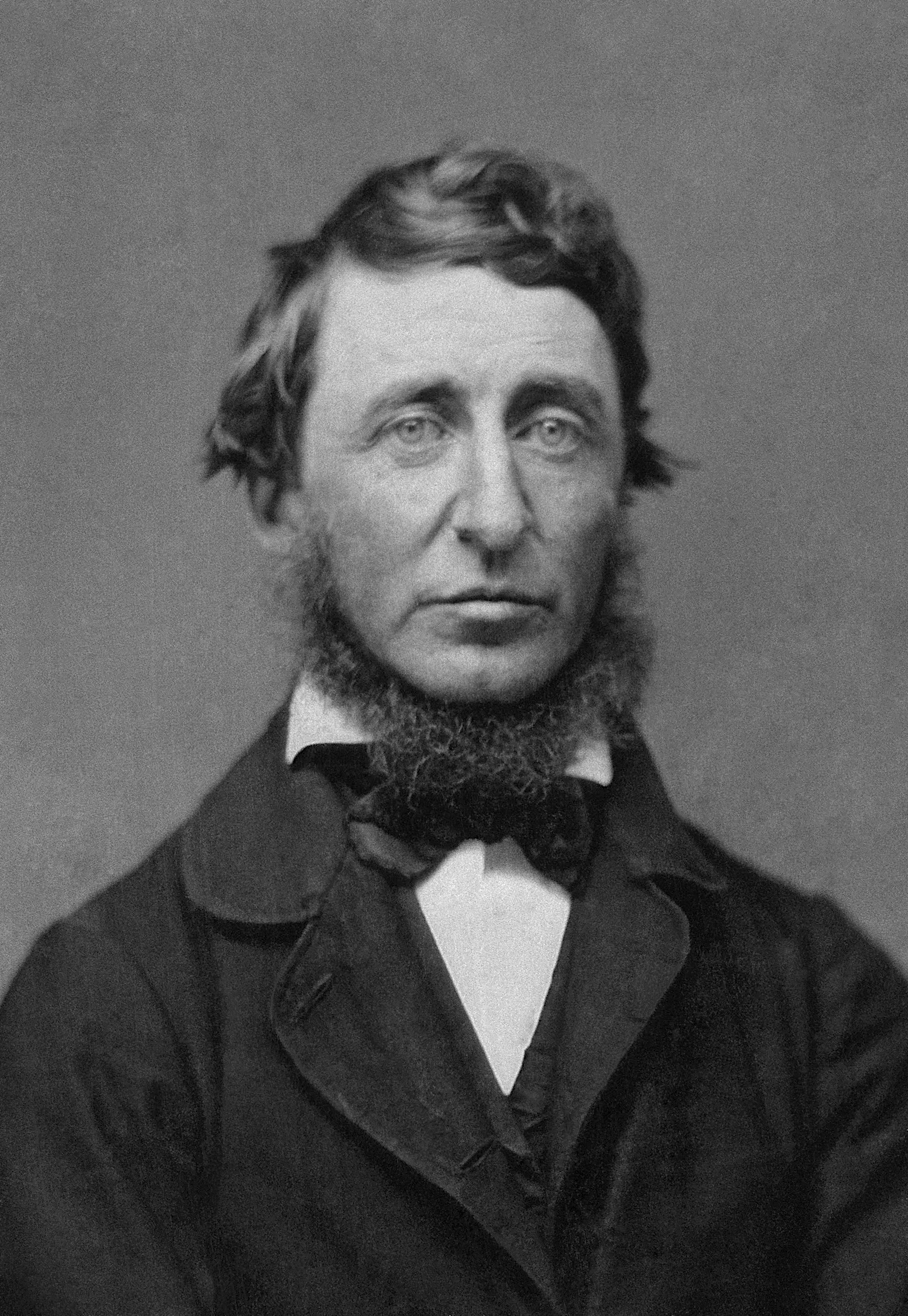

and aims. For example, Henry David Thoreau

Henry David Thoreau (born David Henry Thoreau; July 12, 1817May 6, 1862) was an American naturalist, essayist, poet, and philosopher. A leading Transcendentalism, transcendentalist, he is best known for his book ''Walden'', a reflection upon sim ...

and William Lloyd Garrison

William Lloyd Garrison (December , 1805 – May 24, 1879) was an Abolitionism in the United States, American abolitionist, journalist, and reformism (historical), social reformer. He is best known for his widely read anti-slavery newspaper ''The ...

drew inspiration from the American Revolution and the stubborn pacifism of the Quakers

Quakers are people who belong to the Religious Society of Friends, a historically Protestantism, Protestant Christian set of Christian denomination, denominations. Members refer to each other as Friends after in the Bible, and originally ...

. Some tax resisters refuse to pay tax because their conscience will not allow them to fund war, whilst others resist tax as part of a campaign to overthrow the government.

Tax resisters have been violent revolutionaries like John Adams

John Adams (October 30, 1735 – July 4, 1826) was a Founding Fathers of the United States, Founding Father and the second president of the United States from 1797 to 1801. Before Presidency of John Adams, his presidency, he was a leader of ...

and pacifist nonresistants like John Woolman; communists like Karl Marx

Karl Marx (; 5 May 1818 – 14 March 1883) was a German philosopher, political theorist, economist, journalist, and revolutionary socialist. He is best-known for the 1848 pamphlet '' The Communist Manifesto'' (written with Friedrich Engels) ...

and capitalists like Vivien Kellems; solitary anti-war

An anti-war movement is a social movement in opposition to one or more nations' decision to start or carry on an armed conflict. The term ''anti-war'' can also refer to pacifism, which is the opposition to all use of military force during conf ...

activists like Ammon Hennacy and leaders of independence movements like Mahatma Gandhi. Leo Tolstoy

Count Lev Nikolayevich Tolstoy Tolstoy pronounced his first name as , which corresponds to the romanization ''Lyov''. () (; ,Throughout Tolstoy's whole life, his name was written as using Reforms of Russian orthography#The post-revolution re ...

, a Christian anarchist, urged government leaders to change their attitude to war and citizens to taxes:

Methods

As an example of the numerous tax resistance methods, below are some of the legal and illegal techniques used by war tax resisters:Legal

Avoidance

A resister may lower their tax payments by using legaltax avoidance

Tax avoidance is the legal usage of the tax regime in a single territory to one's own advantage to reduce the amount of tax that is payable. A tax shelter is one type of tax avoidance, and tax havens are jurisdictions that facilitate reduced taxe ...

techniques.

Paying under protest

Some taxpayers pay their taxes, but include protest letters along with their tax forms. Others pay in a protesting form—for instance, by writing their cheque on atoilet seat

A toilet seat is a hinged unit consisting of a round or oval open seat, and usually a lid, which is bolted onto the bowl of a toilet used in a sitting position (as opposed to a squat toilet). The seat can be either for a flush toilet or a dry ...

or a mock-up of a missile. Others pay in a way that creates inconvenience for the collector—for instance, by paying the entire amount in low-denomination coins. This last method is less effective in countries where small coins are legal tender

Legal tender is a form of money that Standard of deferred payment, courts of law are required to recognize as satisfactory payment in court for any monetary debt. Each jurisdiction determines what is legal tender, but essentially it is anything ...

only in limited amounts, allowing the tax authority legally to reject such payments; for example in England and Wales, 1p coins are legal tender only in amounts up to 20p.

Reducing taxable income and consumption

Other tax resisters change their lifestyles so that they owe less tax. For instance; to avoid

Other tax resisters change their lifestyles so that they owe less tax. For instance; to avoid consumption tax

A consumption tax is a tax levied on consumption spending on goods and services. The tax base of such a tax is the money spent on Consumption (economics), consumption. Consumption taxes are usually indirect, such as a sales tax or a value-added ta ...

es on alcohol, a resister might home-brew beer; to avoid excise taxes on gasoline, a resister might take up cycling

Cycling, also known as bicycling or biking, is the activity of riding a bicycle or other types of pedal-driven human-powered vehicles such as balance bikes, unicycles, tricycles, and quadricycles. Cycling is practised around the world fo ...

; to avoid income tax, a resister may reduce their income below the tax threshold by embracing simple living or a freegan lifestyle. For example, British citizens pay no income tax if their income is below the personal allowance

In the UK tax system, personal allowance is the threshold above which income tax is levied on an individual's income. A person who receives less than their own personal allowance in taxable income (such as earnings and some benefits) in a giv ...

. In the US the equivalent tax-free annual income is the standard deduction

Under United States tax law, the standard deduction is a dollar amount that non- itemizers may subtract from their income before income tax (but not other kinds of tax, such as payroll tax) is applied. Taxpayers may choose either itemized deduc ...

, though many deductions and credits allow people to earn much more than this and still avoid income tax.

Opposition to war has led some, such as Ammon Hennacy and Ellen Thomas, to a form of tax resistance in which they reduce their income below the tax threshold by taking up a simple living

Simple living refers to practices that promote simplicity in one's lifestyle. Common practices of simple living include reducing the number of possessions one owns, depending less on technology and services, and spending less money. In addition t ...

lifestyle. These individuals believe that their government is engaged in immoral, unethical or destructive activities such as war, and that paying taxes inevitably funds these activities. These methods differ from tax evasion

Tax evasion or tax fraud is an illegal attempt to defeat the imposition of taxes by individuals, corporations, trusts, and others. Tax evasion often entails the deliberate misrepresentation of the taxpayer's affairs to the tax authorities to red ...

in that they stay within the tax laws, and they differ from tax avoidance in that the goal is to pay as little tax as possible rather than to keep as much post-tax income as possible.

Illegal

Evasion

A resister may decide to reduce their tax paid through illegal tax evasion. For instance, one way to evade income tax is to only work for cash-in-hand, therefore circumventingwithholding tax

Tax withholding, also known as tax retention, pay-as-you-earn tax or tax deduction at source, is income tax paid to the government by the payer of the income rather than by the recipient of the income. The tax is thus withheld or deducted from the ...

.

Redirection

Some tax resisters refuse to pay all or a portion of the taxes due but then make an equivalent donation to charity. In this way, they demonstrate that the intent of their resistance is not selfish and that they want to use a portion of their earnings to contribute to the common good. For instance, Julia Butterfly Hill resisted about $150,000 in federal taxes, and donated that money to after school programs, arts and cultural programs, community gardens, programs for Native Americans, alternatives to incarceration, and environmental protection programs. She said:I actually take the money that theIRS The Internal Revenue Service (IRS) is the revenue service for the Federal government of the United States, United States federal government, which is responsible for collecting Taxation in the United States, U.S. federal taxes and administerin ...says goes to them and I give it to the places where our taxes ''should'' be going. And in my letter to the IRS I said: "I'm not refusing to pay my taxes. I'm actually paying them but I'm paying them where they belong because you refuse to do so."

Refusing specific taxes

Some resisters refuse to willingly pay only certain taxes, either because those taxes are especially noxious to them, or because they present a useful symbolic target, or because they are more easily resisted. For instance, in the United States, many tax resisters resist the telephone federal excise tax. The tax was initiated to pay for theSpanish–American War

The Spanish–American War (April 21 – August 13, 1898) was fought between Restoration (Spain), Spain and the United States in 1898. It began with the sinking of the USS Maine (1889), USS ''Maine'' in Havana Harbor in Cuba, and resulted in the ...

and has frequently been raised or extended by the government during times of war. This made it an attractive symbolic target as a " war tax". Such refusal is relatively safe: because this tax is typically small, resistance very rarely triggers significant government retaliation. Phone companies will cooperate with such resisters by removing the excise tax from their phone bills and reporting their resistance to the government.

Refusing to pay

The most dramatic and characteristic method of tax resistance is to refuse to pay a tax – either by quietly ignoring the tax bill or by openly declaring the refusal to pay. Some tax resisters resist only a portion of the taxes due. For instance, some war tax resisters refuse to pay a percentage of their taxes equivalent to the military percentage of the government's budget.See also

* Draft resistance *Tax choice

In public choice theory, tax choice (sometimes called taxpayer sovereignty, earmarking, participatory taxation or fiscal subsidiarity) is an emerging type of citizen sourcing in which individuals or groups of taxpayers decide how to allocate par ...

* Taxation as theft

The position that taxation is theft, and therefore immoral, is found in a number of political philosophies. Its popularization marks a significant departure from conservatism and classical liberalism, and has been considered radical by many ...

References

Further reading

* War Resisters League (2003) ''War Tax Resistance: A Guide To Withholding Your Support from the Military''. * Donald D. Kaufman (2006) ''What Belongs to Caesar?: A Discussion on the Christian's Response to Payment of War Taxes''. * Donald D. Kaufman (2006) ''The Tax Dilemma: Praying for Peace, Paying for War''. * David M. Gross (2008) ''We Won't Pay: A Tax Resistance Reader''. * David M. Gross (2009) ''Against War and War Taxes: Quaker Arguments for War Tax Refusal''. * Marian Franz (2009) ''Persistent Voice: Marian Franz and Conscientious Objection to Military Taxation''. * David M. Gross (2011) ''American Quaker War Tax Resistance''. *External links

Climate change and my tax return

*

Death and Taxes

' - NWTRCC film about war tax resisters and their motivations

History of War Tax Resistance

by Peace Tax Seven (U.S./UK focus)

Resistance to Civil Government

by

Henry David Thoreau

Henry David Thoreau (born David Henry Thoreau; July 12, 1817May 6, 1862) was an American naturalist, essayist, poet, and philosopher. A leading Transcendentalism, transcendentalist, he is best known for his book ''Walden'', a reflection upon sim ...

Silence and Courage: Income Taxes, War and Mennonites 1940-1993

— tax resistance in the women's suffrage movement

by Lawrence Rosenwald {{Types of justice Civil disobedience Community organizing Protest tactics Anarchist theory Libertarian theory Tax noncompliance