tax file number on:

[Wikipedia]

[Google]

[Amazon]

A tax file number (TFN) is a unique identifier issued by the

Under the later format, the TFN itself was either 8 or 9 digits, with a check digit. Individuals received a 9 digit TFN and non-individuals received an 8 digit TFN. The quote of the TFN was not obligatory when, for example, lodging a tax return, though failing to quote one may delay the processing of the tax return.

Under the later format, the TFN itself was either 8 or 9 digits, with a check digit. Individuals received a 9 digit TFN and non-individuals received an 8 digit TFN. The quote of the TFN was not obligatory when, for example, lodging a tax return, though failing to quote one may delay the processing of the tax return.

In May 1988, following the demise of the Australia Card scheme, the Treasurer

In May 1988, following the demise of the Australia Card scheme, the Treasurer

In 2014 the ATO conducted a second amnesty, known as Project DOIT (Disclose Offshore Income Today). The 2014 Amnesty was directed at income overseas. The 2014 Amnesty is said to be the ATO's last amnesty.

In 2014 the ATO conducted a second amnesty, known as Project DOIT (Disclose Offshore Income Today). The 2014 Amnesty was directed at income overseas. The 2014 Amnesty is said to be the ATO's last amnesty.

How to do TFN Field Validation in programs

{{National identification numbers Taxpayer identification numbers Taxation in Australia Identity documents of Australia

Australian Taxation Office

The Australian Taxation Office (ATO) is an Australian statutory agency and the principal revenue collection body for the Australian Government. The ATO has responsibility for administering the Taxation in Australia, Australian federal taxation ...

(ATO) to each taxpaying entity—an individual, company, superannuation fund, partnership, or trust. Not all individuals have a TFN, and a business has both a TFN and an Australian Business Number

The Australian Business Number (ABN) is a unique 11-digit identifier issued by the Australian Business Register (ABR) which is operated by the Australian Taxation Office (ATO). The ABN was introduced on 1 July 2000 by John Howard's Liberal gov ...

(ABN). If a business earns income as part of carrying on its business, it may quote its ABN instead of its TFN.

The TFN was introduced initially to facilitate file tracking at the ATO, but has since been expanded to encompass income and other data matching. The TFN consists of a nine digit number, usually presented in the format ''nnn nnn nnn''. Strict laws require that TFNs may be recorded or used only for specifically authorised tax-related purposes.

The TFN serves a purpose similar to the American Social Security number

In the United States, a Social Security number (SSN) is a nine-digit number issued to United States nationality law, U.S. citizens, Permanent residence (United States), permanent residents, and temporary (working) residents under section 205(c)(2 ...

, but its use is strictly limited by law to avoid the functionality creep which has affected the US counterpart. It also serves a similar function as national insurance in the UK.

History

TFNs have been used by the ATO since the 1930s. At some point in time between 1972 and 1983 the format of tax file numbers changed. The earlier format was still in use in 1972, and the later format was in use by 1983. Under the later format, the TFN itself was either 8 or 9 digits, with a check digit. Individuals received a 9 digit TFN and non-individuals received an 8 digit TFN. The quote of the TFN was not obligatory when, for example, lodging a tax return, though failing to quote one may delay the processing of the tax return.

Under the later format, the TFN itself was either 8 or 9 digits, with a check digit. Individuals received a 9 digit TFN and non-individuals received an 8 digit TFN. The quote of the TFN was not obligatory when, for example, lodging a tax return, though failing to quote one may delay the processing of the tax return.

In May 1988, following the demise of the Australia Card scheme, the Treasurer

In May 1988, following the demise of the Australia Card scheme, the Treasurer Paul Keating

Paul John Keating (born 18 January 1944) is an Australian former politician and trade unionist who served as the 24th prime minister of Australia from 1991 to 1996. He held office as the leader of the Labor Party (ALP), having previously ser ...

announced that the Government

A government is the system or group of people governing an organized community, generally a State (polity), state.

In the case of its broad associative definition, government normally consists of legislature, executive (government), execu ...

intended to introduce an enhanced TFN scheme, and legislation establishing the scheme was passed that year.

When the legislation was introduced in 1988 the 8 and 9 digit TFN scheme still applied. However, as the 8 digit TFNs were becoming exhausted, all new taxpayers are issued 9 digit TFNs. The numbers now do not have any embedded meaning.

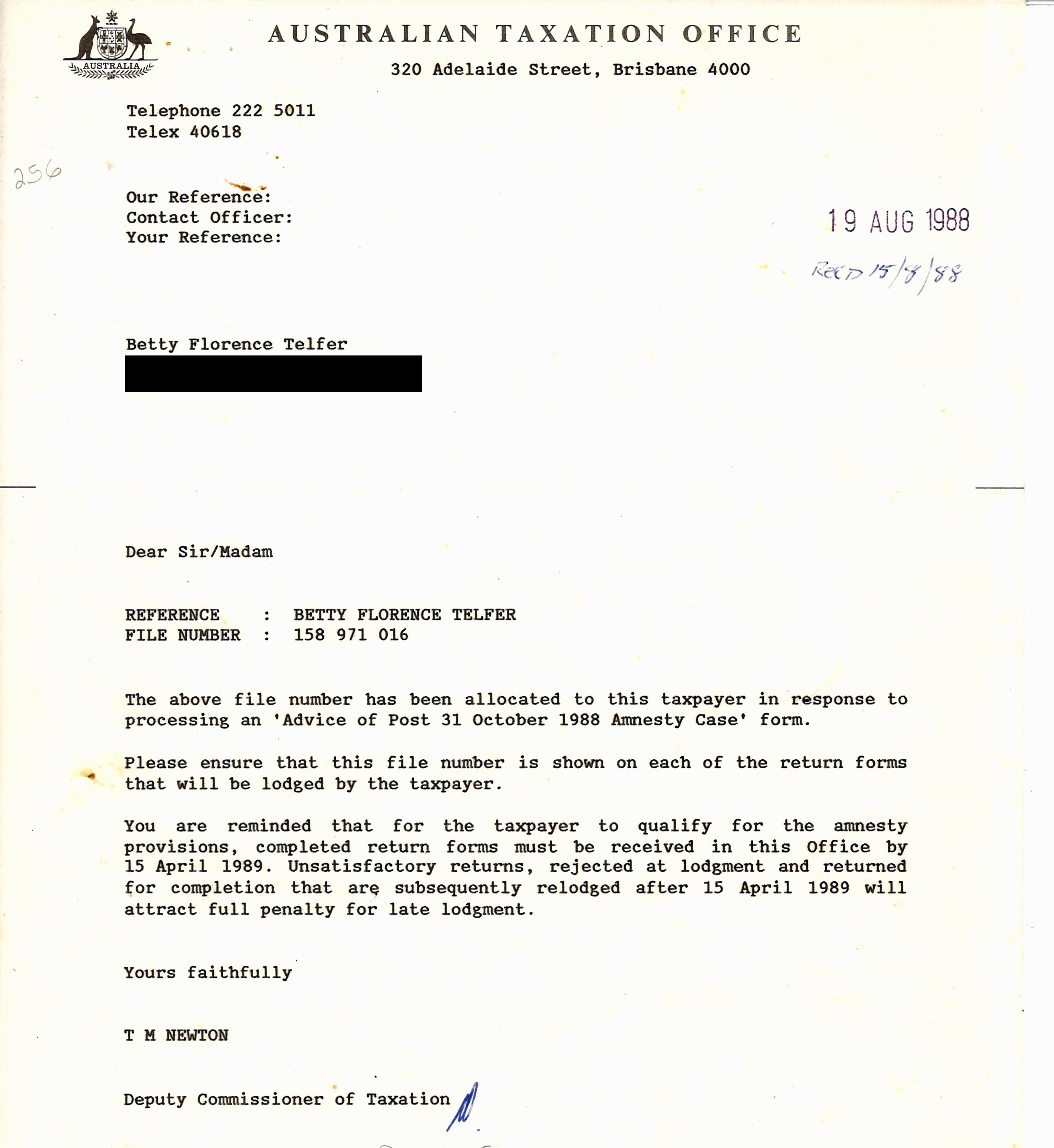

Amnesty 1988

One implication of the enhanced system using TFNs to match interest and dividend income with tax file numbers and their corresponding entities – or absence of TFNs/corresponding entities as the case may be – was that it would be increasingly difficult to hide such income from the ATO. There was also a risk that in cases where the undisclosed past tax liabilities were large, offenders could be identified and pursued for arrears plus severe penalties (a percentage of the arrears, plus interest on the arrears). In view of the new legislation, the ATO offered an amnesty from these penalties as incentive for affected persons to amend their returns for preceding years – by including previously undeclared interest income – pay their outstanding tax – without the available penalties being imposed on the increased tax liabilities. Between May 1988 and October 31 1988 the ATO conducted this amnesty so that taxpayers who had previously failed to fully declare passive income such as bank interest, share dividends and so forth and other non-taxpayer persons who had failed to submit income tax returns in previous years could lodge retrospective amendments to returns or lodge retrospective returns. In such cases, persons claiming relief under the amnesty became liable for outstanding income tax, but were generally excused from fines and penalties that would have been imposed in the absence of the amnesty. The amnesty was subsequently extended beyond October 31 1988, with late enrolled amnesty participants being given until April 15 1989 to lodge amended tax returns or lodge formerly missing returns disclosing additional previously undeclared income. In 2014 the ATO conducted a second amnesty, known as Project DOIT (Disclose Offshore Income Today). The 2014 Amnesty was directed at income overseas. The 2014 Amnesty is said to be the ATO's last amnesty.

In 2014 the ATO conducted a second amnesty, known as Project DOIT (Disclose Offshore Income Today). The 2014 Amnesty was directed at income overseas. The 2014 Amnesty is said to be the ATO's last amnesty.

Data matching

The primary purpose of the enhanced TFN system is to allow the ATO to collect income and other information for taxpayers (officially known as "data matching"). This is done by the ATO requiring paying entities (e.g., banks, employers, public companies, superannuation funds, Centrelink and others) to electronically provide the ATO with information of certain types of payments made by them, together with the associated TFN of the recipient. When taxpayers file their income tax returns at the end of the financial year, the ATO can electronically match the income reported by the taxpayer against the payments reported by the paying entities. The types of income payments covered by the TFN data matching rules include: * Wages and salaries from employers (see PAYG), including fringe benefit and superannuation information *Interest

In finance and economics, interest is payment from a debtor or deposit-taking financial institution to a lender or depositor of an amount above repayment of the principal sum (that is, the amount borrowed), at a particular rate. It is distinct f ...

from bank

A bank is a financial institution that accepts Deposit account, deposits from the public and creates a demand deposit while simultaneously making loans. Lending activities can be directly performed by the bank or indirectly through capital m ...

s and similar institutions, from all account types, including term deposits

* Interest

In finance and economics, interest is payment from a debtor or deposit-taking financial institution to a lender or depositor of an amount above repayment of the principal sum (that is, the amount borrowed), at a particular rate. It is distinct f ...

from bonds and debentures

* Dividend

A dividend is a distribution of profits by a corporation to its shareholders, after which the stock exchange decreases the price of the stock by the dividend to remove volatility. The market has no control over the stock price on open on the ex ...

s from public companies

* Distributions from unit trust

A unit trust is a form of collective investment constituted under a trust deed.

A unit trust pools investors' money into a single fund, which is managed by a fund manager. Unit trusts offer access to a wide range of investments, and depending on ...

s, including cash management trusts

* Superannuation payments (amounts paid out to a beneficiary)

* Some government benefits, in particular unemployment benefits.

Other information provided to the ATO using the TFN includes health insurance information, as well as the purchase and sale of property, such as real estate and shares.

Because of the community backlash against the aborted Australia Card scheme, the expanded TFN rules are technically optional. The taxpayer entitled to such income payments has a choice between quoting the TFN, or not doing so. As a general rule taxpayers quote their TFN. Institutions usually help by reminding or inviting clients to do so on any new source of income (e.g., new accounts, new debentures, new shareholdings). Forms for quoting include a reminder of the key provisions of the system, for example from Computershare

Computershare Limited is an Australian stock transfer company that provides corporate trust, stock transfer, and employee share plan services in many countries.

The company currently has offices in 20 countries, including Australia, the U ...

:

: ''It is not an offence to withhold your TFN or, where the securities are held for a business purpose, your ABN. However, if you do not provide your TFN or ABN, tax may be deducted from payments of interest and the unfranked portion of dividends and distributions at the highest marginal rate.''

If an account is held in the names of multiple investors, each may choose whether to quote or not, but tax is withheld unless at least two have done so.

TFN withholding tax

In the few cases that a payee has not supplied the paying entity with their TFN by the time payment is to be made, unless if the payment is exempt, the paying entity is legally required to withhold a TFN withholding tax amount at the highest marginal tax rate (currently 47%) from the payment the paying entity is about to make. Similar but stricter rules apply to businesses which do not supply their customers with an ABN. The paying entity would report the TFN and ABN withheld amounts on its next Business Activity Statement (BAS) and add the withheld amounts to the payment it needs to make to the ATO. The paying entity would also advise the recipient of the TFN withheld amount. The TFN withheld amount becomes a prepayment of tax by the taxpayer whose funds have been withheld. When the taxpayer files an income tax return he or she would need to claim the so-called "TFN amounts" against his or her final tax liability, and any excess is refunded. The taxpayer needs to file an income tax return to get back the excess of tax.Exemptions

Some people and organisations are exempt from TFN withholding; they may state their exemption category instead of quoting a TFN. This includes: * Income tax exempt organisations (e.g.,school

A school is the educational institution (and, in the case of in-person learning, the Educational architecture, building) designed to provide learning environments for the teaching of students, usually under the direction of teachers. Most co ...

s, museum

A museum is an institution dedicated to displaying or Preservation (library and archive), preserving culturally or scientifically significant objects. Many museums have exhibitions of these objects on public display, and some have private colle ...

s).

* Non-profit organisation

A nonprofit organization (NPO), also known as a nonbusiness entity, nonprofit institution, not-for-profit organization, or simply a nonprofit, is a non-governmental (private) legal entity organized and operated for a collective, public, or so ...

s.

* Recipients of government pensions who are 80 years and older.

* Children

A child () is a human being between the stages of childbirth, birth and puberty, or between the Development of the human body, developmental period of infancy and puberty. The term may also refer to an unborn human being. In English-speaking ...

under 16 (earning up to $420 per year of interest, in 2005).

* Foreign residents for interest

In finance and economics, interest is payment from a debtor or deposit-taking financial institution to a lender or depositor of an amount above repayment of the principal sum (that is, the amount borrowed), at a particular rate. It is distinct f ...

and dividend

A dividend is a distribution of profits by a corporation to its shareholders, after which the stock exchange decreases the price of the stock by the dividend to remove volatility. The market has no control over the stock price on open on the ex ...

s (they are subject to non-resident withholding tax instead).

People and organisations in these categories may still need to submit a tax return, but generally speaking these exemptions mean those not needing to submit a tax return don't need to get a tax file number.

The exemption for children

A child () is a human being between the stages of childbirth, birth and puberty, or between the Development of the human body, developmental period of infancy and puberty. The term may also refer to an unborn human being. In English-speaking ...

does not apply to company dividends, and if a bank account

A bank account is a financial account maintained by a bank or other financial institution in which the financial transaction

A financial transaction is an Contract, agreement, or communication, between a buyer and seller to exchange goods, ...

is held in more than one name, it is only exempt if all account holders are under 16. Children can apply for a TFN and quote it in the same way as anyone else, if they wish.

For some forms of income, small earnings are exempt from TFN withholding for any account holder. For example, bank interest up to $120 per year is exempt. (However such amounts are still taxable income.)

Issuing

TFNs are issued by the Australian Taxation Office. A new taxpayer receives a tax file number within about a month of making an application and providingproof of identity

An identity document (abbreviated as ID) is a documentation, document proving a person's Identity (social science), identity.

If the identity document is a plastic card it is called an ''identity card'' (abbreviated as ''IC'' or ''ID card''). ...

.

Centrelink helps those applying for certain benefits to apply for a TFN at the same time, if they do not already have one. For example, unemployment benefits are subject to the TFN withholding rules if a TFN is not quoted. A young person applying for such a benefit for the first time may have never previously needed a TFN.

Foreigners in Australia whose visas permit them to work can apply for a TFN online, using their passport number and visa number. Proof of identity is established by the ATO confirming those numbers with the Department of Immigration.

Check digit

As is the case with many identification numbers, the TFN includes acheck digit

A check digit is a form of redundancy check used for Error detection and correction, error detection on identification numbers, such as bank account numbers, which are used in an application where they will at least sometimes be input manually. It ...

for detecting erroneous numbers. The algorithm is based on simple modulo

In computing and mathematics, the modulo operation returns the remainder or signed remainder of a division, after one number is divided by another, the latter being called the '' modulus'' of the operation.

Given two positive numbers and , mo ...

11 arithmetic per many other digit checksum schemes.

Example

The validity of the example TFN '123456782' can be checked by the following process The sum of the numbers is 253 (1 + 8 + 9 + 28 + 25 + 48 + 42 + 72 + 20 = 253). 253 is a multiple of 11 (11 × 23 = 253). Therefore, the number is valid.See also

* IRD number (a similar number inNew Zealand

New Zealand () is an island country in the southwestern Pacific Ocean. It consists of two main landmasses—the North Island () and the South Island ()—and List of islands of New Zealand, over 600 smaller islands. It is the List of isla ...

)

* National Insurance number

The National Insurance number is a number used in the United Kingdom in the administration of the National Insurance or social security system. It is also used as a ''de facto'' national identification number in the UK, including in the HM Reven ...

(a similar number in the United Kingdom

The United Kingdom of Great Britain and Northern Ireland, commonly known as the United Kingdom (UK) or Britain, is a country in Northwestern Europe, off the coast of European mainland, the continental mainland. It comprises England, Scotlan ...

)

* PPS number (a similar number in Ireland

Ireland (, ; ; Ulster Scots dialect, Ulster-Scots: ) is an island in the North Atlantic Ocean, in Northwestern Europe. Geopolitically, the island is divided between the Republic of Ireland (officially Names of the Irish state, named Irelan ...

)

* Social insurance number (a similar number in Canada

Canada is a country in North America. Its Provinces and territories of Canada, ten provinces and three territories extend from the Atlantic Ocean to the Pacific Ocean and northward into the Arctic Ocean, making it the world's List of coun ...

)

* Social Security number

In the United States, a Social Security number (SSN) is a nine-digit number issued to United States nationality law, U.S. citizens, Permanent residence (United States), permanent residents, and temporary (working) residents under section 205(c)(2 ...

(a similar number in the United States

The United States of America (USA), also known as the United States (U.S.) or America, is a country primarily located in North America. It is a federal republic of 50 U.S. state, states and a federal capital district, Washington, D.C. The 48 ...

)

* Taxation in Australia

Income taxes are the most significant form of taxation in Australia, and collected by the federal government through the Australian Taxation Office (ATO). Australian GST revenue is collected by the Federal government, and then paid to the sta ...

References

External links

How to do TFN Field Validation in programs

{{National identification numbers Taxpayer identification numbers Taxation in Australia Identity documents of Australia