Scottish Widows on:

[Wikipedia]

[Google]

[Amazon]

Scottish Widows Limited is a life insurance, pensions and investment company based in

In March 1812, a number of prominent Scotsmen gathered in the Royal Exchange Coffee Rooms in Edinburgh. They were there to discuss setting up 'a general fund for securing provisions to widows, sisters and other female relatives' of fundholders so that they would not be plunged into poverty on the death of the fundholder during and after the

In March 1812, a number of prominent Scotsmen gathered in the Royal Exchange Coffee Rooms in Edinburgh. They were there to discuss setting up 'a general fund for securing provisions to widows, sisters and other female relatives' of fundholders so that they would not be plunged into poverty on the death of the fundholder during and after the

Edinburgh

Edinburgh is the capital city of Scotland and one of its 32 Council areas of Scotland, council areas. The city is located in southeast Scotland and is bounded to the north by the Firth of Forth and to the south by the Pentland Hills. Edinburgh ...

, Scotland, and is a part of Lloyds Banking Group

Lloyds Banking Group plc is a British financial institution formed through the acquisition of HBOS by Lloyds TSB in 2009. It is one of the UK's largest financial services organisations, with 30 million customers and 65,000 employees. Lloyds B ...

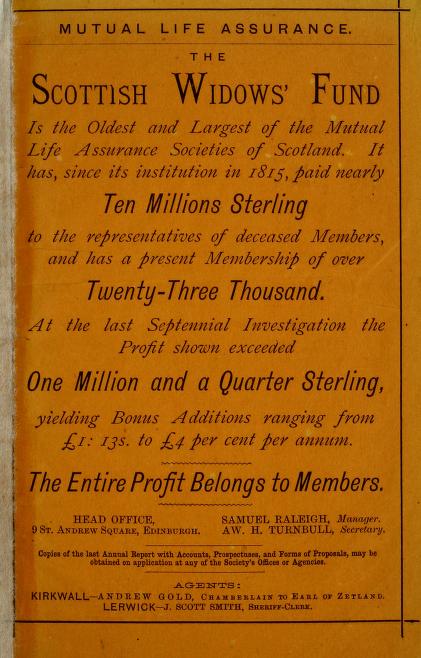

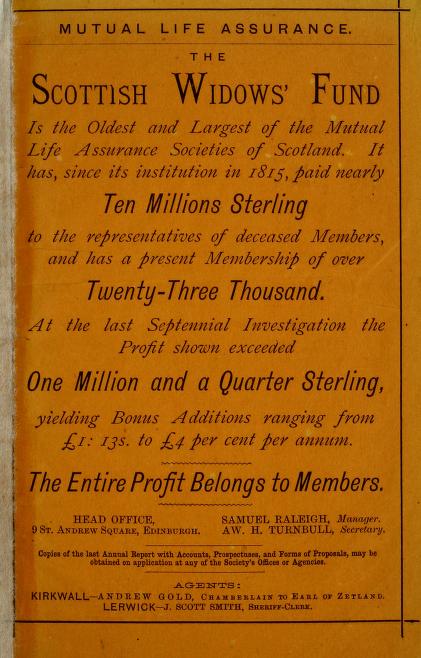

. The company has been providing financial services to the UK market since 1815 and its product range includes workplace and individual pensions, annuities, life cover, critical illness and income protection, as well as savings and investments.

More than 200 years on, Scottish Widows has £232bn assets under administration and looks after 10 million customers across the UK. In addition, more than 23,000 advisers and advice firms support clients with their pensions and investments through the Scottish Widows Platform.

Awards and ratings

Scottish Widows has received notable recognition for its pension and protection products and services. In 2025, the company earned a 4.4 Trust Pilot rating from its customers and multiple Defaqto 5 Star ratings, including for its Group Personal Pension, Group SIPP Retirement Saver, and Retirement Account in both Drawdown and Personal Pension categories. Additionally, Scottish Widows’ critical illness and life assurance products also received 5 Star ratings, highlighting their comprehensive coverage and reliability. The company’s commitment to quality service is further evidenced by Defaqto Gold Ratings for both Pension and Protection Services. In the 2024 Investment Life & Pensions Moneyfacts Awards, Scottish Widows was honoured as the Best Personal Pension Provider and Best Critical Illness Provider. These accolades underscore the company’s dedication to delivering top-tier financial products and services, reinforcing its reputation as a trusted provider in the industry.History

In March 1812, a number of prominent Scotsmen gathered in the Royal Exchange Coffee Rooms in Edinburgh. They were there to discuss setting up 'a general fund for securing provisions to widows, sisters and other female relatives' of fundholders so that they would not be plunged into poverty on the death of the fundholder during and after the

In March 1812, a number of prominent Scotsmen gathered in the Royal Exchange Coffee Rooms in Edinburgh. They were there to discuss setting up 'a general fund for securing provisions to widows, sisters and other female relatives' of fundholders so that they would not be plunged into poverty on the death of the fundholder during and after the Napoleonic Wars

{{Infobox military conflict

, conflict = Napoleonic Wars

, partof = the French Revolutionary and Napoleonic Wars

, image = Napoleonic Wars (revision).jpg

, caption = Left to right, top to bottom:Battl ...

. Scottish Widows' Fund and Life Assurance Society opened in 1815 as Scotland's first mutual life office.

Regulations made in 1811 showed its focus on providing annuities for dependants, but this quickly became only a small part of the company's business. They also set eligibility requirements; for example, those over fifty years old or those with a wife more than twenty years younger than himself could not apply.Wall text for ''Buying Security - Life Assurance,'' Museum on the Mound, Edinburgh.

Scottish Widows granted just 10 policies to female customers in the first four years, as applications from women were rare at the time. One example is Catherine Drummond in 1818, who as an unmarried woman requested annuity of £50 (£ in ) once turning sixty years old.

In 1999, Lloyds TSB agreed to buy the society for £7 billion. The society demutualised on 3 March 2000 as part of the acquisition. Scottish Widows became part of Lloyds Banking Group in January 2009 and in November 2013, Lloyds Banking Group sold its asset management division, Scottish Widows Investment Partnership (SWIP) to Aberdeen Asset Management in a £660m deal.

In July 2021 Lloyds Banking Group announced its intention to acquire Embark Group, a fast-growing investment and retirement platform business. Following the deal, the Embark Platform was rebranded as the Scottish Widows Platform and the business announced significant investment plans to make improvements to payment functionality, charging capability and new investment solutions for financial advisers.

Emblems and advertising

In 1818, Scottish Widows adopted an emblem created by William Home Lizars, which features the Roman goddess Ceres (Plenty) holding acornucopia

In classical antiquity, the cornucopia (; ), also called the horn of plenty, was a symbol of abundance and nourishment, commonly a large horn-shaped container overflowing with produce, flowers, or nuts. In Greek, it was called the " horn of ...

and accompanied by cherub

A cherub (; : cherubim; ''kərūḇ'', pl. ''kərūḇīm'') is one type of supernatural being in the Abrahamic religions. The numerous depictions of cherubim assign to them many different roles, such as protecting the entrance of the Garden of ...

s. A tombstone is seen on her left and a widow kneels on her right with her daughters. This imagery represented the company's goal to support female dependants facing financial loss. The emblem was not only used as the company arms, but also in its policy documents.

In 1832, Sir John Steell was inspired by the 1818 emblem to sculpture figures of a widow, her children, and Ceres into the ornamentation of the company's building in 5 St Andrew Square.

The emblem on the cover of the 1914 Scottish Widows annual report was designed by Walter Crane

Walter Crane (15 August 184514 March 1915) was an English artist and book illustrator. He is considered to be the most influential, and among the most prolific, children's book creators of his generation and, along with Randolph Caldecott and Ka ...

in 1888. It featured Perseus

In Greek mythology, Perseus (, ; Greek language, Greek: Περσεύς, Romanization of Greek, translit. Perseús) is the legendary founder of the Perseid dynasty. He was, alongside Cadmus and Bellerophon, the greatest Greek hero and slayer of ...

and Pegasus

Pegasus (; ) is a winged horse in Greek mythology, usually depicted as a white stallion. He was sired by Poseidon, in his role as horse-god, and foaled by the Gorgon Medusa. Pegasus was the brother of Chrysaor, both born from Medusa's blood w ...

, a symbol of immortality.

In 1986 the first Scottish Widow appeared in a television advert directed by David Bailey in 1986. Since then, Scottish Widows has made 10 adverts featuring the Scottish Widow.

Four models have portrayed the Scottish Widow, a hooded character featured in the company's advertising. The original Widow, chosen to portray the company's brand values in the 'Looking Good' commercial in 1986, was Deborah Moore, daughter of actor Roger Moore

Sir Roger George Moore (14 October 192723 May 2017) was an English actor. He was the actor to portray Ian Fleming's fictional secret agent James Bond (literary character), James Bond in the Eon Productions/MGM Studios film series, playing the ...

. In 1994, Amanda Lamb took over the role. Hayley Hunt became the third Scottish Widow in 2005. In 2014, the company announced that the fourth Scottish Widow would be Amber Martinez.

Scottish Widows is well-known for its iconic advertising campaigns featuring the “living logo” of a widow in a black hood and cape. This symbol has been a staple of the company’s branding for decades.

In 2024, Scottish Widows began a rebranding initiative to modernise its image, introducing a contemporary logo while maintaining its traditional elements. The rebrand includes updates to digital platforms and advertising materials, ensuring a fresh and modern look for the company.

References

{{Use dmy dates, date=September 2019 Financial services companies established in 1815 Companies based in Edinburgh British companies established in 1815 Insurance companies of Scotland Former mutual insurance companies Lloyds Banking Group Life insurance companies of the United Kingdom Scottish brands 1815 establishments in Scotland Widowhood in the United Kingdom 2000 mergers and acquisitions Asset management companies