Railway Bubble on:

[Wikipedia]

[Google]

[Amazon]

Railway Mania was a stock market bubble in the rail transportation industry of the

Railway Mania was a stock market bubble in the rail transportation industry of the

Magnates like

Magnates like

Report and Resolutions of a Public Meeting, Held at Glasgow, on Friday, 20 March 1846, in Support of Sir Robert Peel's Suggestions in Reference to Railways

ĆöPeel had commented upon the impolity and danger of allowing too much capital to be invested in railways in too short a period. The merchants of Glasgow evidently agreed in large numbers. From

RailwayMania.co.uk

ĆöNarrative of events and links to recent research

The Railway Mania: Not so Great Expectations

ĆöEconomic article which argues that during the British Railway Mania of the 1840s, railway shares were not obviously overpriced, even at the market peak, but prices still fell dramatically. *Odlyzko, Andrew

Collective hallucinations and inefficient markets: The British Railway Mania of the 1840s

2010. {{Financial bubbles 1840s in rail transport 1840s in the United Kingdom 1840s in economic history Economic bubbles History of rail transport in the United Kingdom Economic history of the United Kingdom Mania 19th-century fads and trends

Railway Mania was a stock market bubble in the rail transportation industry of the

Railway Mania was a stock market bubble in the rail transportation industry of the United Kingdom of Great Britain and Ireland

The United Kingdom of Great Britain and Ireland was the union of the Kingdom of Great Britain and the Kingdom of Ireland into one sovereign state, established by the Acts of Union 1800, Acts of Union in 1801. It continued in this form until ...

in the 1840s. It followed a common pattern: as the price of railway shares increased, speculators invested more money, which further increased the price of railway shares, until the share price collapsed. The mania reached its zenith in 1846, when 263 Acts of Parliament for setting up new railway companies were passed, with the proposed routes totalling . About a third of the railways authorised were never builtŌĆöthe companies either collapsed because of poor financial planning, were bought out by larger competitors before they could build their line, or turned out to be fraudulent enterprises to channel investors' money into other businesses.

Causes

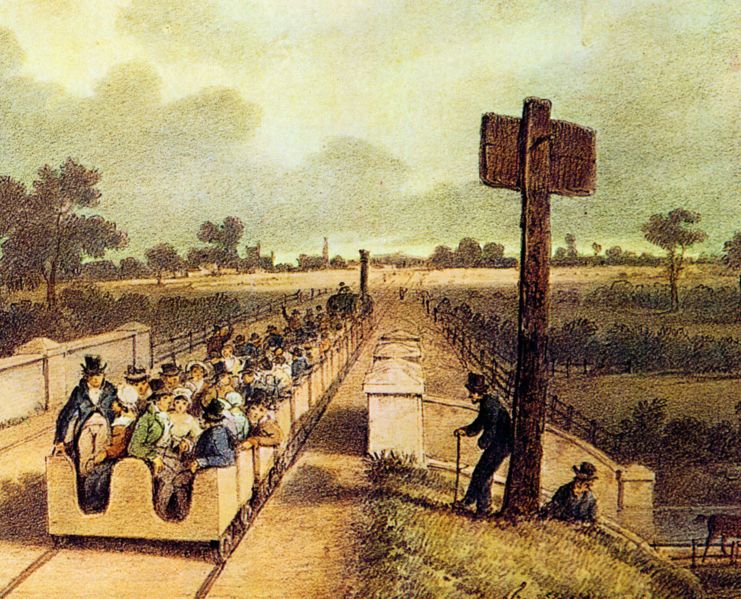

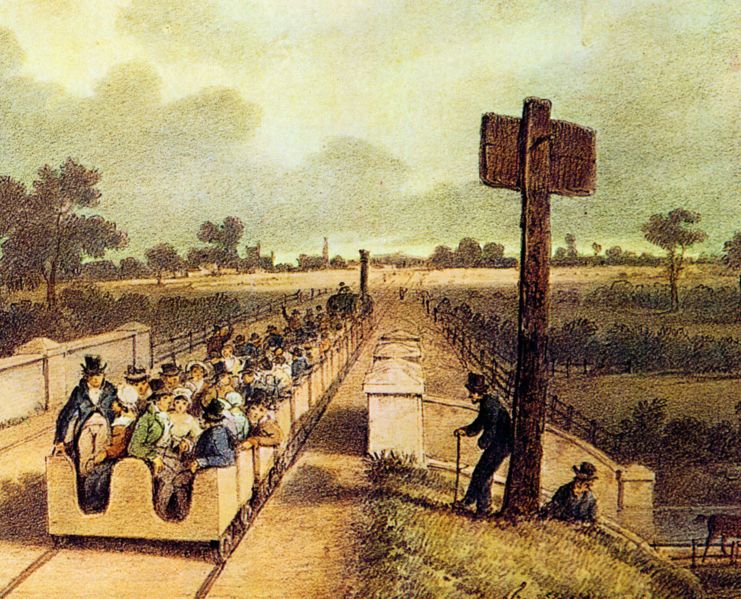

The world's first recognizably modern inter-city railway, theLiverpool and Manchester Railway

The Liverpool and Manchester Railway (L&MR) was the first inter-city railway in the world. It Opening of the Liverpool and Manchester Railway, opened on 15 September 1830 between the Lancashire towns of Liverpool and Manchester in England. It ...

(the L&M), opened in 1830 and proved to be successful for transporting both passengers and freight. In the late 1830s and early 1840s, the British economy slowed. Interest rate

An interest rate is the amount of interest due per period, as a proportion of the amount lent, deposited, or borrowed (called the principal sum). The total interest on an amount lent or borrowed depends on the principal sum, the interest rate, ...

s rose, making it more attractive to invest money in government bondsŌĆöthe main source of investment at the timeŌĆöand political and social unrest deterred banks and businesses from investing the huge sums of money required to build railways; the L&M cost ┬Ż637,000 (┬Ż adjusted for 2015).

By the mid-1840s, the economy was improving and the manufacturing industries were once again growing. The Bank of England

The Bank of England is the central bank of the United Kingdom and the model on which most modern central banks have been based. Established in 1694 to act as the Kingdom of England, English Government's banker and debt manager, and still one ...

cut interest rates, making government bonds less attractive investments, and existing railway companies' shares began to boom as they moved ever-increasing amounts of cargo and people, making people willing to invest in new railways.

Crucially, there were more investors in British business. The Industrial Revolution

The Industrial Revolution, sometimes divided into the First Industrial Revolution and Second Industrial Revolution, was a transitional period of the global economy toward more widespread, efficient and stable manufacturing processes, succee ...

was creating a new, increasingly affluent middle class

The middle class refers to a class of people in the middle of a social hierarchy, often defined by occupation, income, education, or social status. The term has historically been associated with modernity, capitalism and political debate. C ...

. While earlier business ventures had relied on a small number of bank

A bank is a financial institution that accepts Deposit account, deposits from the public and creates a demand deposit while simultaneously making loans. Lending activities can be directly performed by the bank or indirectly through capital m ...

s, businessmen and wealthy aristocrat

The aristocracy (''from Greek'' ''ß╝ĆŽü╬╣ŽāŽä╬┐╬║Žü╬▒Žä╬»╬▒'' ''aristokrat├Ła'', "rule of the best"; ''Latin: aristocratia'') is historically associated with a "hereditary" or a "ruling" social class. In many states, the aristocracy included the ...

s for investment, a prospective railway company also had a large, literate section of population with savings to invest. In 1825 the government had repealed the Bubble Act, brought in during the near-disastrous South Sea Bubble

South is one of the cardinal directions or compass points. The direction is the opposite of north and is perpendicular to both west and east.

Etymology

The word ''south'' comes from Old English ''s┼½├Š'', from earlier Proto-Germanic ''*sun├Ša ...

of 1720, which had put close limits on the formation of new business ventures and, importantly, had limited joint stock companies to a maximum of five separate investors. With these limits removed, anyone could invest money (and hopefully earn a return) on a new company, and railways were heavily promoted as a foolproof venture. New media such as newspaper

A newspaper is a Periodical literature, periodical publication containing written News, information about current events and is often typed in black ink with a white or gray background. Newspapers can cover a wide variety of fields such as poli ...

s and the emergence of the modern international financial and trade

Trade involves the transfer of goods and services from one person or entity to another, often in exchange for money. Economists refer to a system or network that allows trade as a market.

Traders generally negotiate through a medium of cr ...

markets made it easy for companies to promote themselves and provide the means for the general public to invest. Shares could be purchased for a 10% deposit, with the railway company holding the right to call in the remainder at any time. The railways were so heavily promoted as a foolproof venture that thousands of investors on modest incomes bought large numbers of shares, whilst only being able to afford the deposit. Many families invested their entire savings in prospective railway companiesŌĆöand many of those lost everything when the bubble collapsed and the companies called in the remainder of their due payments.

The British government promoted an almost totally 'laissez-faire

''Laissez-faire'' ( , from , ) is a type of economic system in which transactions between private groups of people are free from any form of economic interventionism (such as subsidies or regulations). As a system of thought, ''laissez-faire'' ...

' system of non-regulation in the railways. Companies had to submit a bill to Parliament to gain the right to acquire land for the line, which required the route of the proposed railway to be approved, but there were no limits on the number of companies and no real checks on the financial viability of a line. Anyone could form a company, gain investment and submit a bill to Parliament. Since many Members of Parliament (MPs) were heavy investors in such schemes, it was rare for a bill to not pass during the peak of the mania in 1846, although Parliament did reject schemes that were blatantly misleading or impossible to construct.

Magnates like

Magnates like George Hudson

George Hudson (probably 10 March 1800 ŌĆō 14 December 1871) was an English railway financier and politician who, because he controlled a significant part of the Railway Mania, railway network in the 1840s, became known as "The Railway King"ŌĆöa ...

developed routes in the North and Midlands by amalgamating small railway companies and rationalising routes. He was also an MP, but ultimately failed because of his fraudulent practices of, for example, paying dividend

A dividend is a distribution of profits by a corporation to its shareholders, after which the stock exchange decreases the price of the stock by the dividend to remove volatility. The market has no control over the stock price on open on the ex ...

s from capital.

The end of the mania

As with other bubbles, the Railway Mania became a self-promoting cycle based purely on over-optimistic speculation. As the dozens of companies formed began to operate and the simple unviability of many of them became clear, investors began to realise that railways were not all as lucrative and as easy to build as they had been led to believe. Coupled to this, in late 1845 the Bank of England increased interest rates. As banks began to re-invest in bonds, the money began to flow out of railways, undercutting the boom. The share prices of railways slowed in their rise, then leveled out. As they began to fall, investment stopped virtually overnight, leaving numerous companies without funding and numerous investors with no prospect of any return on their investment. The larger railway companies such as theGreat Western Railway

The Great Western Railway (GWR) was a History of rail transport in Great Britain, British railway company that linked London with the southwest, west and West Midlands (region), West Midlands of England and most of Wales. It was founded in 1833, ...

and the nascent Midland began to buy up strategic failed lines to expand their network. These lines could be purchased at a fraction of their real value as given a choice between a below-value offer for their shares or the total loss of their investment, shareholders naturally chose the former. Many middle-class families on modest incomes had sunk their entire savings into new companies during the mania, and they lost everything when the speculation collapsed.

The boom-and-bust cycle of early-industrial Britain was still in effect, and the boom that had created the conditions for Railway Mania began to cool and then a decline set in. The number of new railway companies fell away to almost nothing in the late 1840s and early 1850s, with the only new lines constructed being by the large companies. Economic upturns in the 1850s and 1860s saw smaller booms in railway construction, but these never reached anywhere near the scale of the maniaŌĆöpartly because of more thoughtful (if still very limited) government control, partly because of more cautious investors and partly because the UK railway network was approaching maturity, with none of the 'blank canvas' available to numerous companies as in the 1840s.

Results

Unlike some stock market bubbles, there was a net tangible result from all the investment: a vast expansion of the British railway system, though perhaps at an inflated cost. Amongst the high number of impractical, overambitious and downright fraudulent schemes promoted during the mania were a good number of practical trunk routes (most notably the initial part of the Great Northern Railway and the trans-Pennine Woodhead route) and important freight lines (such as large parts of what would become the North Eastern Railway). These projects all required vast amounts of capital, all of which had to be raised from private enterprise. The speculative frenzy of the mania made people much more willing to invest the large sums required for railway construction than they had been previously or would be in later years. Even many of the routes that failed when the mania collapsed became viable (if not lucrative) when each was in the hands of the larger company that had purchased it. A total of of railway line were built as a result of projects authorised between 1844 and 1846ŌĆöby comparison, the total route mileage of the modern UK railway network is around .Comparisons

Railway and Canal Mania can be compared with a similar mania in the 1990s in the stock of telecom companies. The telecom mania resulted in the installation and deployment of a vast amount of fibre-optic telecommunications infrastructure, spurred on from the realisation that the same railway rights-of-way could make affordable conduits for fibre optics. Yet another boom occurred in the period 1995ŌĆō2000, during the development of theInternet

The Internet (or internet) is the Global network, global system of interconnected computer networks that uses the Internet protocol suite (TCP/IP) to communicate between networks and devices. It is a internetworking, network of networks ...

, when many companies were established to promote new services on the growing network. The dot-com bubble

The dot-com bubble (or dot-com boom) was a stock market bubble that ballooned during the late-1990s and peaked on Friday, March 10, 2000. This period of market growth coincided with the widespread adoption of the World Wide Web and the Interne ...

collapsed in 2000, and the much more extensive telecoms bubble in 2002 with the bankruptcies of Enron

Enron Corporation was an American Energy development, energy, Commodity, commodities, and services company based in Houston, Texas. It was led by Kenneth Lay and developed in 1985 via a merger between Houston Natural Gas and InterNorth, both re ...

, WorldCom

MCI, Inc. (formerly WorldCom and MCI WorldCom) was a telecommunications company. For a time, it was the second-largest long-distance telephone company in the United States, after AT&T. WorldCom grew largely by acquiring other telecommunicatio ...

, Global Crossing

Global Crossing Limited was a telecommunications company that provided computer networking services and operated a tier 1 carrier. It maintained a large backbone network and offered peering, virtual private networks, leased lines, audio and vid ...

and QWest, although some platform companies such as Google

Google LLC (, ) is an American multinational corporation and technology company focusing on online advertising, search engine technology, cloud computing, computer software, quantum computing, e-commerce, consumer electronics, and artificial ...

and Amazon

Amazon most often refers to:

* Amazon River, in South America

* Amazon rainforest, a rainforest covering most of the Amazon basin

* Amazon (company), an American multinational technology company

* Amazons, a tribe of female warriors in Greek myth ...

grew and prospered, diversifying into backbone fibre networks and cloud computing

Cloud computing is "a paradigm for enabling network access to a scalable and elastic pool of shareable physical or virtual resources with self-service provisioning and administration on-demand," according to International Organization for ...

services.

See also

*History of rail transport in Great Britain

The Rail transport in Great Britain, railway system of Great Britain started with the building of local isolated wooden wagonways starting in the 1560s. A patchwork of local rail links operated by small private railway companies developed in t ...

* List of early British railway companies

* Balloonomania

* Bike boom

The bike boom or bicycle craze is any of several specific historic periods marked by increased bicycle enthusiasm, popularity, and sales.

Prominent examples include 1819 and 1868, as well as the decades of the 1890s and 1970sthe latter espec ...

* Timeline of transportation technology

References

Bibliography

*Wolmar, C, 2007, ''Fire & Steam: A History of the Railways in Britain'', Atlantic Book (London)External links

Report and Resolutions of a Public Meeting, Held at Glasgow, on Friday, 20 March 1846, in Support of Sir Robert Peel's Suggestions in Reference to Railways

ĆöPeel had commented upon the impolity and danger of allowing too much capital to be invested in railways in too short a period. The merchants of Glasgow evidently agreed in large numbers. From

Google Book Search

Google Books (previously known as Google Book Search, Google Print, and by its code-name Project Ocean) is a service from Google that searches the full text of books and magazines that Google has scanned, converted to text using optical charac ...

RailwayMania.co.uk

ĆöNarrative of events and links to recent research

The Railway Mania: Not so Great Expectations

ĆöEconomic article which argues that during the British Railway Mania of the 1840s, railway shares were not obviously overpriced, even at the market peak, but prices still fell dramatically. *Odlyzko, Andrew

Collective hallucinations and inefficient markets: The British Railway Mania of the 1840s

2010. {{Financial bubbles 1840s in rail transport 1840s in the United Kingdom 1840s in economic history Economic bubbles History of rail transport in the United Kingdom Economic history of the United Kingdom Mania 19th-century fads and trends