Merrion v. Jicarilla Apache Tribe on:

[Wikipedia]

[Google]

[Amazon]

''Merrion v. Jicarilla Apache Tribe'', 455 U.S. 130 (1982), was a case in which the

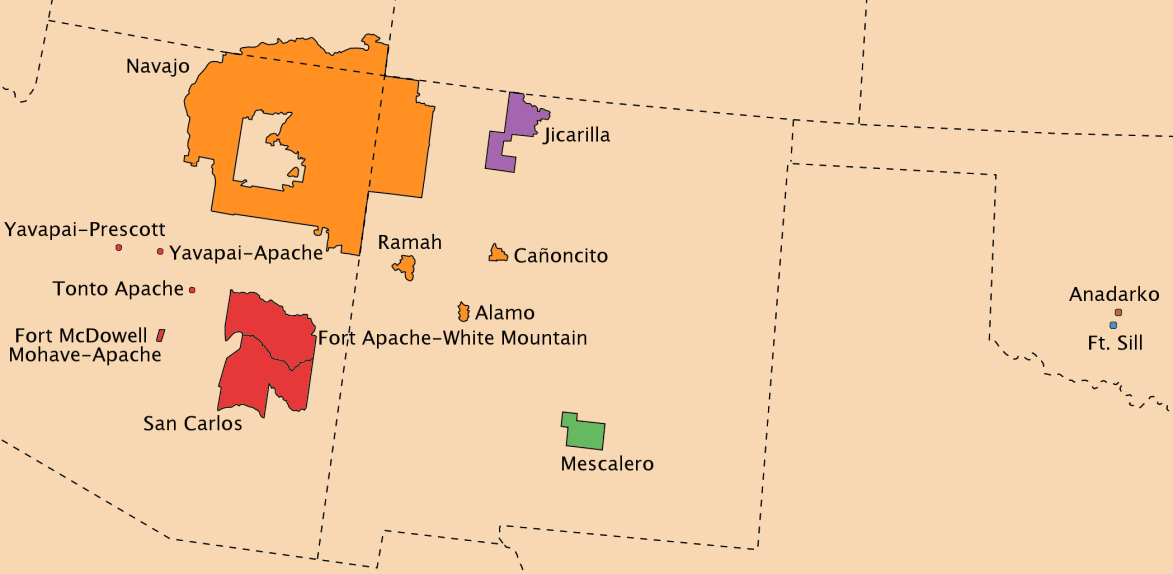

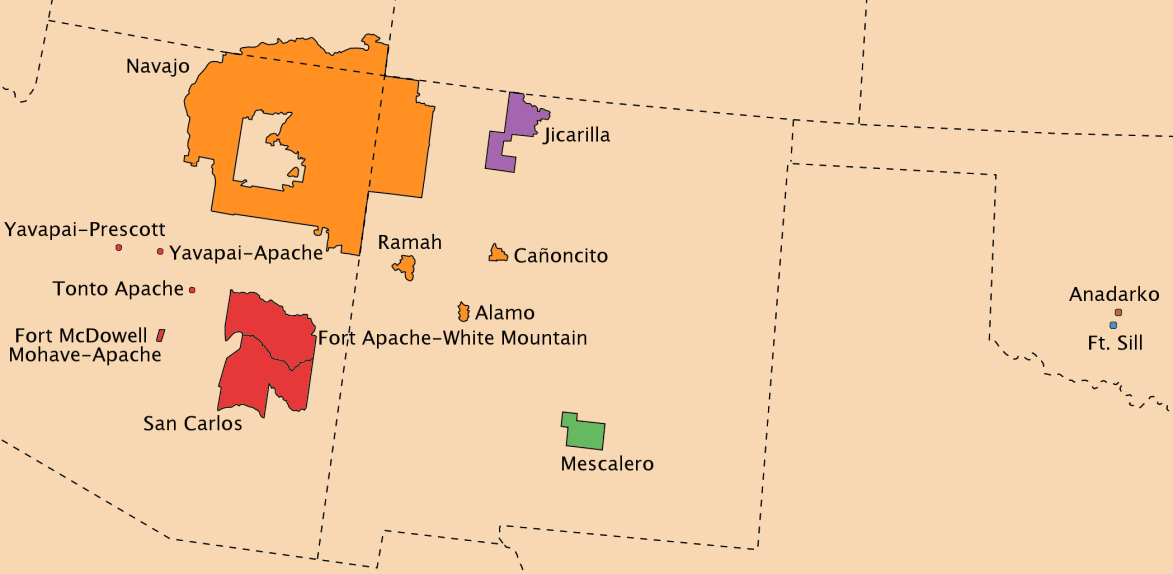

The Jicarilla Apache Tribe is a Native American (Indian) tribe in northwestern

The Jicarilla Apache Tribe is a Native American (Indian) tribe in northwestern

Justice Thurgood Marshall delivered the opinion of the court. Marshall noted that the tribe had a properly formed constitution, approved by the Secretary of the Interior, and that it included that the tribal council may impose taxes on non-members doing business on the reservation. He noted that the tribe had executed oil and gas leases for about 69% of the reservation and that the leases provided for royalties to be paid to the tribe. Marshall further noted that the tribe followed the proper process to enact a severance tax, obtaining the approval of the BIA as part of the process. The first argument of the oil companies that the power to tax only arose from the power of the tribe to exclude persons from the reservation. Marshall disagreed, stating that the power to tax is an inherent attribute of a tribe's sovereignty. Tribal government includes the need to provide for services, not only to the tribe, but to anyone doing business on the reservation. He noted that the oil companies benefited from police protection and other governmental services. Citing ''Colville'', he stated that the tribe's interest in raising "revenues for essential governmental programs . . . is strongest when the revenues are derived from value generated on the reservation by activities involving the Tribes and when the taxpayer is the recipient of tribal services." Marshall noted that Congress was able to remove this power, but had not done so, and had acknowledged in 1879 the power of the

Justice Thurgood Marshall delivered the opinion of the court. Marshall noted that the tribe had a properly formed constitution, approved by the Secretary of the Interior, and that it included that the tribal council may impose taxes on non-members doing business on the reservation. He noted that the tribe had executed oil and gas leases for about 69% of the reservation and that the leases provided for royalties to be paid to the tribe. Marshall further noted that the tribe followed the proper process to enact a severance tax, obtaining the approval of the BIA as part of the process. The first argument of the oil companies that the power to tax only arose from the power of the tribe to exclude persons from the reservation. Marshall disagreed, stating that the power to tax is an inherent attribute of a tribe's sovereignty. Tribal government includes the need to provide for services, not only to the tribe, but to anyone doing business on the reservation. He noted that the oil companies benefited from police protection and other governmental services. Citing ''Colville'', he stated that the tribe's interest in raising "revenues for essential governmental programs . . . is strongest when the revenues are derived from value generated on the reservation by activities involving the Tribes and when the taxpayer is the recipient of tribal services." Marshall noted that Congress was able to remove this power, but had not done so, and had acknowledged in 1879 the power of the

Justice John Paul Stevens, joined by Chief Justice Burger and Justice Rehnquist, dissented from the majority opinion. Stevens noted that over its own members, a tribe has virtually unlimited sovereignty. Over non-Indians, a tribe had no power, but many tribes were granted the authority to exclude non-Indians from their reservations. Stevens also noted that the various statutes that were passed in regards to mineral rights and leases were silent as to the authority of a tribe to impose taxes. Therefore, authority must come from one of three sources, federal statutes, treaties, and inherent tribal sovereignty. He noted that in matters involving their own members, the tribe could act in manners that the federal government could not, such as discriminating against females in citizenship cases (citing '' Santa Clara Pueblo v. Martinez'', ).'' Santa Clara Pueblo v. Martinez'', Tribal authority over non-members was always severely limited, in both a civil and criminal context, and he viewed both ''Oliphant'' and ''Montana'' as controlling in this area also. He viewed the authority to tax as merely an adjunct to the tribe's right to exclude individuals from the reservation. Since the leases were entered into by the tribe voluntarily, the tribe cannot enact later taxes without the consent of the oil companies. Stevens would have reversed the Circuit Court.

Justice John Paul Stevens, joined by Chief Justice Burger and Justice Rehnquist, dissented from the majority opinion. Stevens noted that over its own members, a tribe has virtually unlimited sovereignty. Over non-Indians, a tribe had no power, but many tribes were granted the authority to exclude non-Indians from their reservations. Stevens also noted that the various statutes that were passed in regards to mineral rights and leases were silent as to the authority of a tribe to impose taxes. Therefore, authority must come from one of three sources, federal statutes, treaties, and inherent tribal sovereignty. He noted that in matters involving their own members, the tribe could act in manners that the federal government could not, such as discriminating against females in citizenship cases (citing '' Santa Clara Pueblo v. Martinez'', ).'' Santa Clara Pueblo v. Martinez'', Tribal authority over non-members was always severely limited, in both a civil and criminal context, and he viewed both ''Oliphant'' and ''Montana'' as controlling in this area also. He viewed the authority to tax as merely an adjunct to the tribe's right to exclude individuals from the reservation. Since the leases were entered into by the tribe voluntarily, the tribe cannot enact later taxes without the consent of the oil companies. Stevens would have reversed the Circuit Court.

Supreme Court of the United States

The Supreme Court of the United States (SCOTUS) is the highest court in the federal judiciary of the United States. It has ultimate appellate jurisdiction over all Federal tribunals in the United States, U.S. federal court cases, and over Stat ...

holding that an Indian tribe has the authority to impose taxes on non-Indians that are conducting business on the reservation as an inherent power under their tribal sovereignty.. Nordhaus, Robert, Hall, G. Emlen and Rudio, Anne Alise (2003), Revisiting ''Merrion v. Jicarilla Apache Tribe'': Robert Nordhaus and Sovereign Indian Control over Natural Resources on Reservations, 43 Nat. Resources J. 223

Background

History

The Jicarilla Apache Tribe is a Native American (Indian) tribe in northwestern

The Jicarilla Apache Tribe is a Native American (Indian) tribe in northwestern New Mexico

New Mexico is a state in the Southwestern United States, Southwestern region of the United States. It is one of the Mountain States of the southern Rocky Mountains, sharing the Four Corners region with Utah, Colorado, and Arizona. It also ...

on a reservation of . The reservation was established by an Executive Order

In the United States, an executive order is a directive by the president of the United States that manages operations of the federal government. The legal or constitutional basis for executive orders has multiple sources. Article Two of the ...

of President

President most commonly refers to:

*President (corporate title)

* President (education), a leader of a college or university

*President (government title)

President may also refer to:

Arts and entertainment Film and television

*'' Præsident ...

Grover Cleveland

Stephen Grover Cleveland (March 18, 1837June 24, 1908) was the 22nd and 24th president of the United States, serving from 1885 to 1889 and from 1893 to 1897. He was the first U.S. president to serve nonconsecutive terms and the first Hist ...

in 1887 and clarified by the Executive Orders of Presidents Theodore Roosevelt

Theodore Roosevelt Jr. (October 27, 1858 – January 6, 1919), also known as Teddy or T.R., was the 26th president of the United States, serving from 1901 to 1909. Roosevelt previously was involved in New York (state), New York politics, incl ...

in 1907 and William Howard Taft

William Howard Taft (September 15, 1857March 8, 1930) served as the 27th president of the United States from 1909 to 1913 and the tenth chief justice of the United States from 1921 to 1930. He is the only person to have held both offices. ...

in 1912. The tribe adopted a formal constitution under the provisions of the Indian Reorganization Act

The Indian Reorganization Act (IRA) of June 18, 1934, or the Wheeler–Howard Act, was U.S. federal legislation that dealt with the status of American Indians in the United States. It was the centerpiece of what has been often called the "Indian ...

, ''et seq.'' that provided for the taxation of members of the tribe and non-members of the tribe doing business on the reservation. If the tribe enacted a such tax ordinance on non-members, the ordinance had to be approved by the Secretary of the Interior.

Beginning in 1953, the tribe entered into agreements with oil companies, including the plaintiffs Merrion and Bayless, to provide oil and gas leases. The leases were approved by the Commissioner of Indian Affairs (now the Bureau of Indian Affairs

The Bureau of Indian Affairs (BIA), also known as Indian Affairs (IA), is a United States List of United States federal agencies, federal agency within the U.S. Department of the Interior, Department of the Interior. It is responsible for im ...

, or BIA) in accordance with . As was the usual practice at the time, the oil companies negotiated directly with BIA, who then presented the contracts to the tribal council. While the oil and gas was from reservation land, Merrion paid severance taxes to the state of New Mexico

New Mexico is a state in the Southwestern United States, Southwestern region of the United States. It is one of the Mountain States of the southern Rocky Mountains, sharing the Four Corners region with Utah, Colorado, and Arizona. It also ...

under the provisions of , where Congress

A congress is a formal meeting of the representatives of different countries, constituent states, organizations, trade unions, political parties, or other groups. The term originated in Late Middle English to denote an encounter (meeting of ...

had authorized such taxation in 1927. The leases provided for royalties to be paid to the tribe, but the BIA was lax in collecting them. In 1973, tribal attorneys wrote to the BIA to demand the collection of royalties, and after a year delay, the BIA would only state that they were "looking into it." In 1976, the BIA approved a tribal ordinance that also provided for a severance tax. This tax was set at 29 cents (U.S.) per barrel of oil and at 5 cents per million British thermal unit

The British thermal unit (Btu) is a measure of heat, which is a form of energy. It was originally defined as the amount of heat required to raise the temperature of one pound of water by one degree Fahrenheit. It is also part of the United Stat ...

s (BTU) for natural gas

Natural gas (also fossil gas, methane gas, and gas) is a naturally occurring compound of gaseous hydrocarbons, primarily methane (95%), small amounts of higher alkanes, and traces of carbon dioxide and nitrogen, hydrogen sulfide and helium ...

.

District court

Merrion did not want to pay a severance tax to both New Mexico and the tribe, and filed suit in theUnited States District Court

The United States district courts are the trial courts of the United States federal judiciary, U.S. federal judiciary. There is one district court for each United States federal judicial district, federal judicial district. Each district cov ...

for the District of New Mexico, along with such major companies as Atlantic Richfield (now part of BP), Getty Oil

Getty Oil Company was an American oil marketing company with its origins as part of the large integrated oil company founded by J. Paul Getty. They went defunct in 2012.

History

J. Paul Getty incorporated Getty Oil in 1942. He had previously ...

, Gulf Oil

Gulf Oil was a major global oil company in operation from 1901 to 1985. The eighth-largest American manufacturing company in 1941 and the ninth largest in 1979, Gulf Oil was one of the Seven Sisters (oil companies), Seven Sisters oil companies. ...

, and Phillips Petroleum

Phillips Petroleum Company was an American oil company incorporated in 1917 that expanded into petroleum refining, marketing and transportation, natural gas gathering and the chemicals sectors. It was Phillips Petroleum that first found oil in th ...

(now ConocoPhillips), among others. The case was not filed until 15 days before the severance tax was due. In the hearing on the temporary injunction on June 17, 1977, Merrion argued that the tribe's severance tax was unconstitutional, violating both the Commerce clause

The Commerce Clause describes an enumerated power listed in the United States Constitution ( Article I, Section 8, Clause 3). The clause states that the United States Congress shall have power "to regulate Commerce with foreign Nations, and amon ...

and Equal protection clause

The Equal Protection Clause is part of the first section of the Fourteenth Amendment to the United States Constitution. The clause, which took effect in 1868, provides "nor shall any State... deny to any person within its jurisdiction the equal pr ...

, and that it was both taxation without representation and double taxation. In addition, the plaintiffs argued against the entire concept of tribal sovereignty

The term tribe is used in many different contexts to refer to a category of human social group. The predominant worldwide use of the term in English is in the discipline of anthropology. The definition is contested, in part due to conflict ...

, stating that it had been a "legal fiction for decades." U.S. District Judge H. Vearle Payne granted the temporary injunction and set the hearing on the permanent injunction for August 29, 1977. The oil companies showed up with approximately 40-50 attorneys, compared to 2 or 3 lawyers for the tribe. Both sides made essentially the same arguments as for the temporary injunction. Following the hearing, District court ruled that the tribe's tax violated the Commerce clause of the Constitution

A constitution is the aggregate of fundamental principles or established precedents that constitute the legal basis of a polity, organization or other type of entity, and commonly determines how that entity is to be governed.

When these pri ...

and that only state and local authorities had the ability to tax mineral rights on Indian reservations. The court then issued a permanent injunction

An injunction is an equitable remedy in the form of a special court order compelling a party to do or refrain from doing certain acts. It was developed by the English courts of equity but its origins go back to Roman law and the equitable rem ...

prohibiting the collection of the tax by the tribe.

Circuit court

The case then went to the Tenth Circuit Court of Appeals. The western states ofUtah

Utah is a landlocked state in the Mountain states, Mountain West subregion of the Western United States. It is one of the Four Corners states, sharing a border with Arizona, Colorado, and New Mexico. It also borders Wyoming to the northea ...

, New Mexico

New Mexico is a state in the Southwestern United States, Southwestern region of the United States. It is one of the Mountain States of the southern Rocky Mountains, sharing the Four Corners region with Utah, Colorado, and Arizona. It also ...

, Montana

Montana ( ) is a landlocked U.S. state, state in the Mountain states, Mountain West subregion of the Western United States. It is bordered by Idaho to the west, North Dakota to the east, South Dakota to the southeast, Wyoming to the south, an ...

, North Dakota

North Dakota ( ) is a U.S. state in the Upper Midwest, named after the indigenous Dakota people, Dakota and Sioux peoples. It is bordered by the Canadian provinces of Saskatchewan and Manitoba to the north and by the U.S. states of Minneso ...

and Wyoming

Wyoming ( ) is a landlocked U.S. state, state in the Mountain states, Mountain West subregion of the Western United States, Western United States. It borders Montana to the north and northwest, South Dakota and Nebraska to the east, Idaho t ...

filed ''amici curiae

An amicus curiae (; ) is an individual or organization that is not a party to a legal case, but that is permitted to assist a court by offering information, expertise, or insight that has a bearing on the issues in the case. Whether an ''amicu ...

'' briefs in support of the oil companies, while the Navajo Nation

The Navajo Nation (), also known as Navajoland, is an Indian reservation of Navajo people in the United States. It occupies portions of northeastern Arizona, northwestern New Mexico, and southeastern Utah. The seat of government is located in ...

, the Arapahoe Nation, the Shoshone Indian Tribe, the Assiniboine and Sioux Tribes, the Three Affiliated Tribes of the Fort Berthold Reservation, and the National Congress of American Indians

The National Congress of American Indians (NCAI) is an Indigenous peoples of the Americas, American Indian and Alaska Natives, Alaska Native Indigenous rights, rights organization. It was founded in 1944 to represent the tribes and resist U.S. ...

all filed briefs in support of the Jacrilla tribe. The case was heard on May 29, 1979 by a three-judge panel consisting of Chief Judge Oliver Seth and Circuit Judges William Holloway, Jr. and Monroe G. McKay. The arguments were the same as at the district court level, with the oil companies stating that tribal sovereignty did not apply to taxation of non-Indians conducting business on the reservation. In an unusual move, no written decision was issued, and the attorneys were told to reargue the case ''en banc

In law, an ''en banc'' (; alternatively ''in banc'', ''in banco'' or ''in bank''; ) session is when all the judges of a court sit to hear a case, not just one judge or a smaller panel of judges.

For courts like the United States Courts of Appeal ...

.'' McKay stated that as he recalls, he and Holloway were in disagreement with Seth, who favored a limited view of the tribe's authority to tax the oil companies.

On September 12, 1979, the case was reheard before the entire panel. Following that hearing, in a 5-2 decision, the Tenth Circuit reversed the District Court, holding that the tribe had the inherent power under their tribal sovereignty

The term tribe is used in many different contexts to refer to a category of human social group. The predominant worldwide use of the term in English is in the discipline of anthropology. The definition is contested, in part due to conflict ...

to impose taxes on the reservation. The court also held that the tax did not violate the Commerce Clause nor place an undue burden on the oil companies.

Opinion of the Court

Initial arguments

The oil companies immediately appealed and theUnited States Supreme Court

The Supreme Court of the United States (SCOTUS) is the highest court in the federal judiciary of the United States. It has ultimate appellate jurisdiction over all U.S. federal court cases, and over state court cases that turn on question ...

granted ''certiorari

In law, ''certiorari'' is a court process to seek judicial review of a decision of a lower court or government agency. ''Certiorari'' comes from the name of a prerogative writ in England, issued by a superior court to direct that the recor ...

'' to hear the case. This appeal came shortly after the Supreme Court had decided '' Oliphant v. Suquamish Indian Tribe'', , which had stated that an Indian tribe did not have the authority to try a non-Indian for a crime committed on the reservation.'' Oliphant v. Suquamish Indian Tribe'', The ''Oliphant'' case was a major blow against tribal sovereignty, and was a case used by the oil companies in their briefs. The oil companies argued that ''Oliphant'', currently limited to criminal cases, should be expanded to civil matters as well. The attorneys for the tribe argued that this case was no different than '' Washington v. Confederated Tribes of Colville Indian Reservation'', , which stated that tribes had the authority to impose a cigarette tax on both tribal members and non-Indians alike.'' Washington v. Confederated Tribes of Colville Indian Reservation'', ''Amici'' briefs were filed by Montana, North Dakota, Utah, Wyoming, New Mexico, Washington (state)

Washington, officially the State of Washington, is a U.S. state, state in the Pacific Northwest region of the United States. It is often referred to as Washington State to distinguish it from Washington, D.C., the national capital, both n ...

, the Mountain States Legal Foundation, the Salt River Project Agricultural Improvement and Power District, Shell Oil

Shell plc is a British multinational oil and gas company, headquartered in London, England. Shell is a public limited company with a primary listing on the London Stock Exchange (LSE) and secondary listings on Euronext Amsterdam and the New Y ...

, and Westmoreland Resources in support of the oil companies. The Council of Energy Resource Tribes and the Navajo Nation

The Navajo Nation (), also known as Navajoland, is an Indian reservation of Navajo people in the United States. It occupies portions of northeastern Arizona, northwestern New Mexico, and southeastern Utah. The seat of government is located in ...

filed briefs supporting the tribe.

Arguing for Mellion and Bayless was Jason W. Kellahin, for Amoco

Amoco ( ) is a brand of filling station, fuel stations operating in the United States and owned by British conglomerate BP since 1998. The Amoco Corporation was an American chemical and petroleum, oil company, founded by Standard Oil Company i ...

and Marathon Oil

Marathon Oil Corporation was an American company engaged in hydrocarbon exploration. In November 2024, it was acquired by ConocoPhillips and absorbed into the company.

Marathon was founded in Lima, Ohio, as the Ohio Oil Company. In 1899, the ...

was John R. Cooney (originally a separate case, but which was consolidated with this case), for the tribe was Robert J. Nordhaus, and on behalf of the tribe for the Solicitor General

A solicitor general is a government official who serves as the chief representative of the government in courtroom proceedings. In systems based on the English common law that have an attorney general or equivalent position, the solicitor general ...

was Louis F. Claiborne. Kellahin argued that tribal sovereignty only extended to members of the tribe, citing both ''Oliphant'' and '' Montana v. United States'', ,'' Montana v. United States'', both cases involving the jurisdiction of a tribal court over non-Indians. Kellahin stated that those cases that allowed a tribe to tax non-Indians were not due to tribal sovereignty, but were connected with the authority of the tribe to regulate who could enter the reservation, in the same manner as a landlord controlled their property. Cooney argued that the tax was a violation of the Commerce Clause, in that Congress

A congress is a formal meeting of the representatives of different countries, constituent states, organizations, trade unions, political parties, or other groups. The term originated in Late Middle English to denote an encounter (meeting of ...

divested the tribes of that authority when they enacted granting the states the right to impose a severance tax on reservation lands. Nordhaus, in arguing for the tribe, pointed out that there was first, no Congressional preemption of the tribal authority to tax, and that second, taxation was an inherent power of tribal sovereignty. Claiborne first distinguished ''Montana'', noting that it dealt with non-Indians on fee land owned by non-Indians that happened to be within the boundaries of the reservation, something that was completely unrelated to the current case.

Re-argument

Following theoral argument

Oral arguments are spoken presentations to a judge or appellate court by a lawyer (or parties when representing themselves) of the legal reasons why they should prevail. Oral argument at the appellate level accompanies written briefs, which also ...

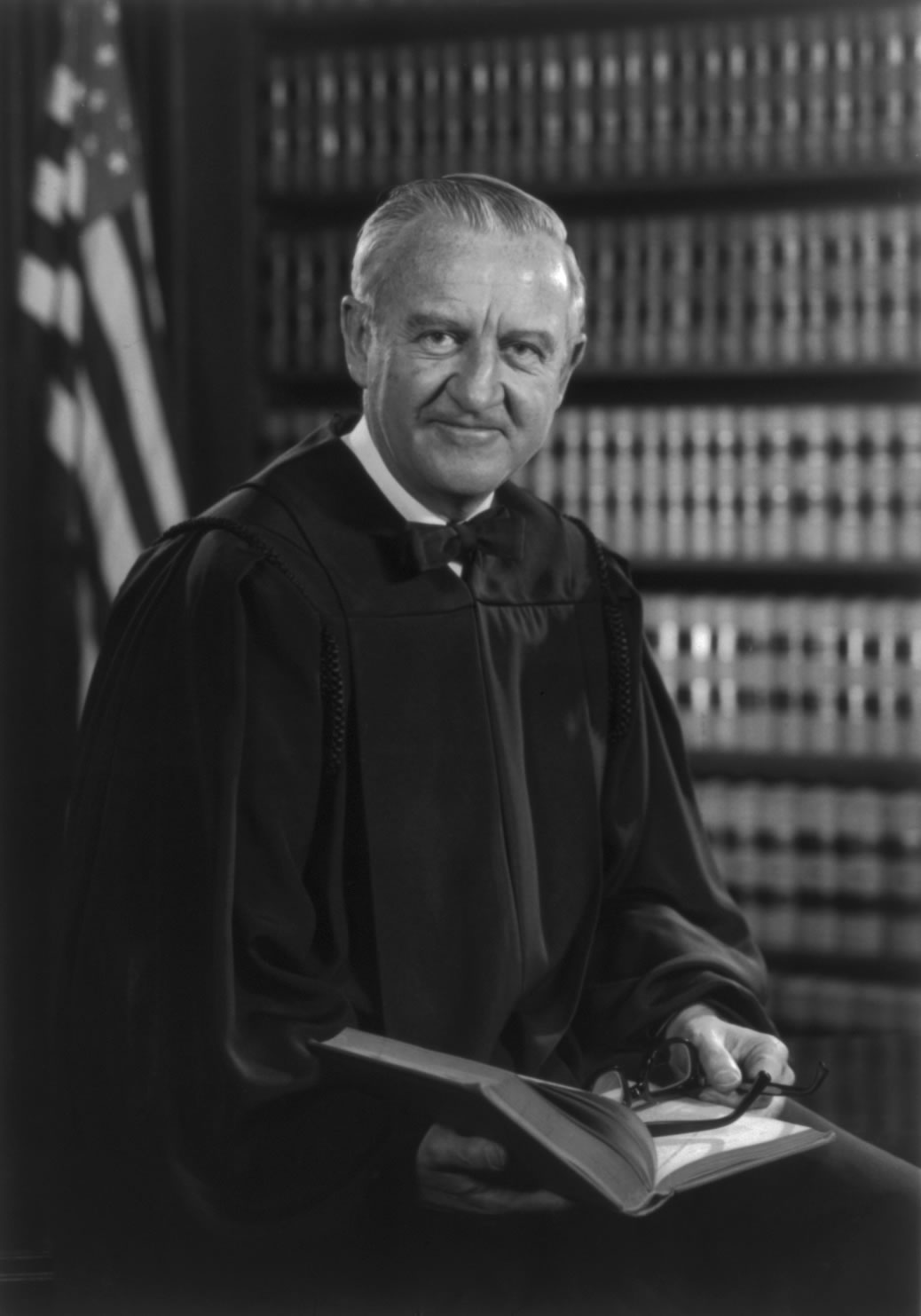

, the Chief Justice assigned Justice John Paul Stevens

John Paul Stevens (April 20, 1920 – July 16, 2019) was an American lawyer and jurist who served as an associate justice of the Supreme Court of the United States from 1975 to 2010. At the time of his retirement, he was the second-oldes ...

to write the majority opinion

In law, a majority opinion is a judicial opinion agreed to by more than half of the members of a court. A majority opinion sets forth the decision of the court and an explanation of the rationale behind the court's decision.

Not all cases hav ...

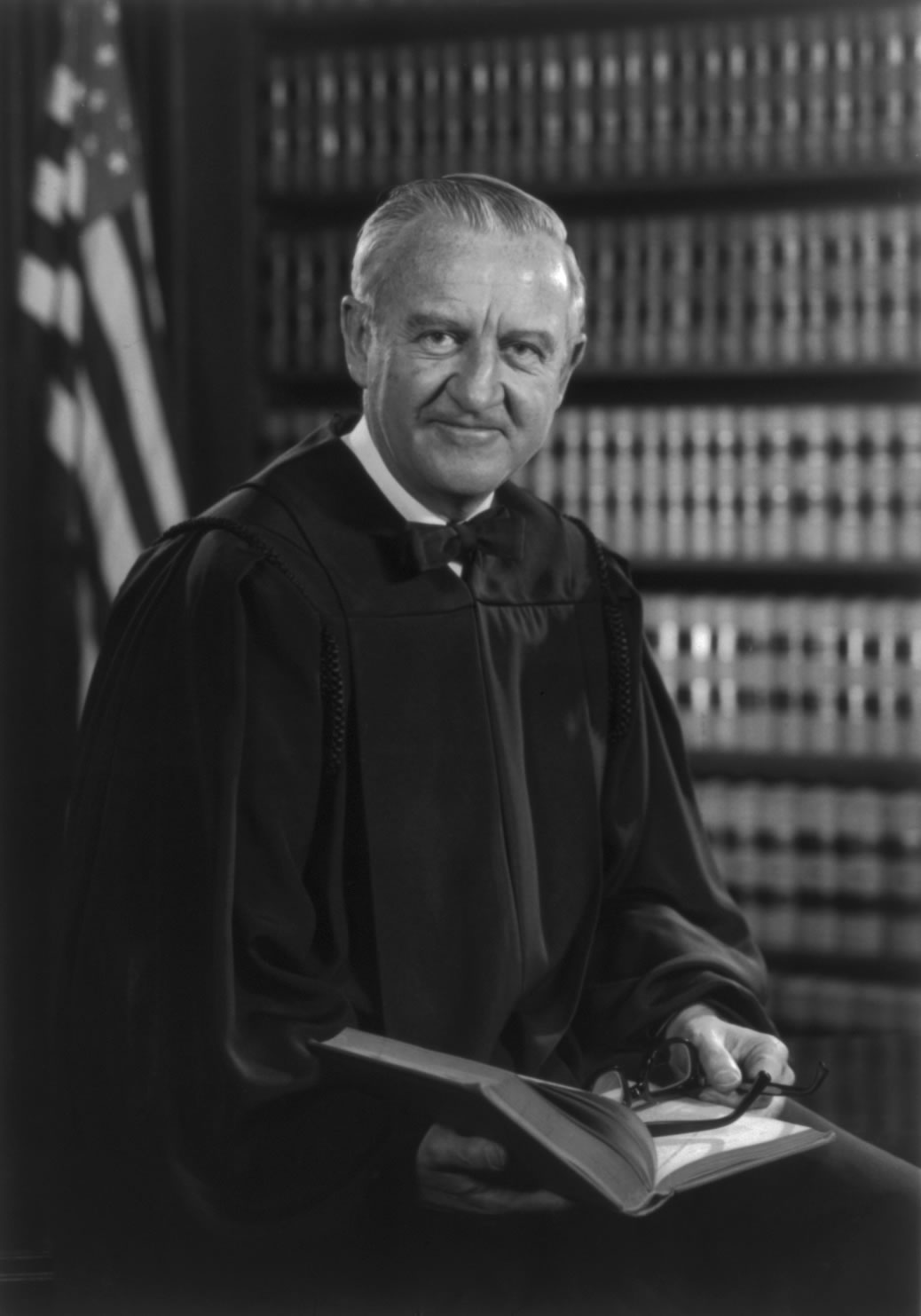

and Justice William J. Brennan, Jr. asked Justice Thurgood Marshall

Thoroughgood "Thurgood" Marshall (July 2, 1908 – January 24, 1993) was an American civil rights lawyer and jurist who served as an associate justice of the Supreme Court of the United States from 1967 until 1991. He was the Supreme C ...

to write the minority or dissenting opinion

A dissenting opinion (or dissent) is an Legal opinion, opinion in a legal case in certain legal systems written by one or more judges expressing disagreement with the majority opinion of the court which gives rise to its judgment.

Dissenting opi ...

, based on the initial count of the justices' views. Since Justice Potter Stewart

Potter Stewart (January 23, 1915 – December 7, 1985) was an American lawyer and judge who was an associate justice of the United States Supreme Court from 1958 to 1981. During his tenure, he made major contributions to criminal justice reform ...

did not participate in the case, it would take a 5-3 vote to overturn the decision of the Circuit Court. Stevens circulated a memorandum stating that his decision would be to invalidate the tax - Chief Justice Warren Burger

Warren Earl Burger (September 17, 1907 – June 25, 1995) was an American attorney who served as the 15th chief justice of the United States from 1969 to 1986.

Born in Saint Paul, Minnesota, Burger graduated from the St. Paul College of Law i ...

and Justice William Rehnquist

William Hubbs Rehnquist (October 1, 1924 – September 3, 2005) was an American attorney who served as the 16th chief justice of the United States from 1986 until his death in 2005, having previously been an associate justice from 1972 to 1986. ...

immediately stated they would join his opinion. Justice Byron White

Byron Raymond "Whizzer" White (June 8, 1917 – April 15, 2002) was an American lawyer, jurist, and professional American football, football player who served as an Associate Justice of the U.S. Supreme Court, associate justice of the Supreme ...

stated that he would wait and see what the dissent said, and then indicated he would join the dissent in part. It also appeared that Justice Harry Blackmun was also going to write a separate dissent, but he also stated that he would wait to see Marshall's opinion. At this point, the tribe had the votes to win on a 4-4 vote, but the Court was close to being adjourned for the summer recess. On July 3, 1981, the Court notified the parties to reargue the case on November 4, 1981.

In the meantime, the Court had changed. Justice Stewart retired, and President

President most commonly refers to:

*President (corporate title)

* President (education), a leader of a college or university

*President (government title)

President may also refer to:

Arts and entertainment Film and television

*'' Præsident ...

Ronald Reagan

Ronald Wilson Reagan (February 6, 1911 – June 5, 2004) was an American politician and actor who served as the 40th president of the United States from 1981 to 1989. He was a member of the Republican Party (United States), Republican Party a ...

had appointed Sandra Day O'Connor

Sandra Day O'Connor (March 26, 1930 – December 1, 2023) was an American attorney, politician, and jurist who served as an associate justice of the Supreme Court of the United States from 1981 to 2006. Nominated by President Ronald Reagan, O' ...

to replace him. During the re-argument, Kellahin began with the fact the New Mexico was acquired via the Treaty of Guadalupe Hildalgo and that neither Spain

Spain, or the Kingdom of Spain, is a country in Southern Europe, Southern and Western Europe with territories in North Africa. Featuring the Punta de Tarifa, southernmost point of continental Europe, it is the largest country in Southern Eur ...

or Mexico

Mexico, officially the United Mexican States, is a country in North America. It is the northernmost country in Latin America, and borders the United States to the north, and Guatemala and Belize to the southeast; while having maritime boundar ...

recognized Indian title and claimed that the tax was a veiled attempt to increase royalty payments. Cooney argued that there was no authority in statute for the Secretary of the Interior to approve a tribal tax and that the 1927 statute preempted the tribes authority in favor of the states being empowered to apply a severance tax on reservations. Nordhaus stated that the argument about the Treaty of Guadalupe Hildalgo did not apply, since no branch of the federal government had ever differentiated between these tribes and other tribes. The case was then submitted to the court.

Majority opinion

Justice Thurgood Marshall delivered the opinion of the court. Marshall noted that the tribe had a properly formed constitution, approved by the Secretary of the Interior, and that it included that the tribal council may impose taxes on non-members doing business on the reservation. He noted that the tribe had executed oil and gas leases for about 69% of the reservation and that the leases provided for royalties to be paid to the tribe. Marshall further noted that the tribe followed the proper process to enact a severance tax, obtaining the approval of the BIA as part of the process. The first argument of the oil companies that the power to tax only arose from the power of the tribe to exclude persons from the reservation. Marshall disagreed, stating that the power to tax is an inherent attribute of a tribe's sovereignty. Tribal government includes the need to provide for services, not only to the tribe, but to anyone doing business on the reservation. He noted that the oil companies benefited from police protection and other governmental services. Citing ''Colville'', he stated that the tribe's interest in raising "revenues for essential governmental programs . . . is strongest when the revenues are derived from value generated on the reservation by activities involving the Tribes and when the taxpayer is the recipient of tribal services." Marshall noted that Congress was able to remove this power, but had not done so, and had acknowledged in 1879 the power of the

Justice Thurgood Marshall delivered the opinion of the court. Marshall noted that the tribe had a properly formed constitution, approved by the Secretary of the Interior, and that it included that the tribal council may impose taxes on non-members doing business on the reservation. He noted that the tribe had executed oil and gas leases for about 69% of the reservation and that the leases provided for royalties to be paid to the tribe. Marshall further noted that the tribe followed the proper process to enact a severance tax, obtaining the approval of the BIA as part of the process. The first argument of the oil companies that the power to tax only arose from the power of the tribe to exclude persons from the reservation. Marshall disagreed, stating that the power to tax is an inherent attribute of a tribe's sovereignty. Tribal government includes the need to provide for services, not only to the tribe, but to anyone doing business on the reservation. He noted that the oil companies benefited from police protection and other governmental services. Citing ''Colville'', he stated that the tribe's interest in raising "revenues for essential governmental programs . . . is strongest when the revenues are derived from value generated on the reservation by activities involving the Tribes and when the taxpayer is the recipient of tribal services." Marshall noted that Congress was able to remove this power, but had not done so, and had acknowledged in 1879 the power of the Cherokee Nation

The Cherokee Nation ( or ) is the largest of three list of federally recognized tribes, federally recognized tribes of Cherokees in the United States. It includes people descended from members of the Cherokee Nation (1794–1907), Old Cheroke ...

to tax non-Indians.

Marshall further noted the oil companies' arguments that a lease would prevent a governmental body from later imposing a tax would denigrate tribal sovereignty, and that tribal sovereignty was not limited by contractual arrangements. Only the Federal government has the authority to limit the powers of a tribal government, and a non-Indian's consent is not needed (by contract or otherwise) to exercise its sovereignty, to the contrary, the tribe may set conditions and limits on the non-Indian as a matter of right. "To presume that a sovereign forever waives the right to exercise one of its sovereign powers unless it expressly reserves the right to exercise that power in a commercial agreement turns the concept of sovereignty on its head."

Marshall then addressed the Commerce Clause issues, and the argument of the Solicitor General that the section of the Commerce Clause that dealt directly with Indians applied rather than the argument of the oil companies that the section dealing with interstate commerce applied. First, Marshall noted that the case history of the Indian Commerce Clause was to protect the tribes from state infringement, not to approve of Indian trade without constitutional restraint. He saw of no reason to begin now, especially since he did not find that the tribe's severance tax did not have negative implications on interstate commerce. In a 6–3 decision, Marshall found that the tribe had the right to impose such a tax on non-Indians.

Dissent

Justice John Paul Stevens, joined by Chief Justice Burger and Justice Rehnquist, dissented from the majority opinion. Stevens noted that over its own members, a tribe has virtually unlimited sovereignty. Over non-Indians, a tribe had no power, but many tribes were granted the authority to exclude non-Indians from their reservations. Stevens also noted that the various statutes that were passed in regards to mineral rights and leases were silent as to the authority of a tribe to impose taxes. Therefore, authority must come from one of three sources, federal statutes, treaties, and inherent tribal sovereignty. He noted that in matters involving their own members, the tribe could act in manners that the federal government could not, such as discriminating against females in citizenship cases (citing '' Santa Clara Pueblo v. Martinez'', ).'' Santa Clara Pueblo v. Martinez'', Tribal authority over non-members was always severely limited, in both a civil and criminal context, and he viewed both ''Oliphant'' and ''Montana'' as controlling in this area also. He viewed the authority to tax as merely an adjunct to the tribe's right to exclude individuals from the reservation. Since the leases were entered into by the tribe voluntarily, the tribe cannot enact later taxes without the consent of the oil companies. Stevens would have reversed the Circuit Court.

Justice John Paul Stevens, joined by Chief Justice Burger and Justice Rehnquist, dissented from the majority opinion. Stevens noted that over its own members, a tribe has virtually unlimited sovereignty. Over non-Indians, a tribe had no power, but many tribes were granted the authority to exclude non-Indians from their reservations. Stevens also noted that the various statutes that were passed in regards to mineral rights and leases were silent as to the authority of a tribe to impose taxes. Therefore, authority must come from one of three sources, federal statutes, treaties, and inherent tribal sovereignty. He noted that in matters involving their own members, the tribe could act in manners that the federal government could not, such as discriminating against females in citizenship cases (citing '' Santa Clara Pueblo v. Martinez'', ).'' Santa Clara Pueblo v. Martinez'', Tribal authority over non-members was always severely limited, in both a civil and criminal context, and he viewed both ''Oliphant'' and ''Montana'' as controlling in this area also. He viewed the authority to tax as merely an adjunct to the tribe's right to exclude individuals from the reservation. Since the leases were entered into by the tribe voluntarily, the tribe cannot enact later taxes without the consent of the oil companies. Stevens would have reversed the Circuit Court.

Subsequent developments

Almost immediately after the decision, the BIA, on directions from Assistant Secretary of the Interior Kenneth Smith, proposed federal regulations that would have severely limited the ability of the tribes to impose severance taxes. Following numerous complaints from the tribes, the BIA abandoned that plan. The Jicarilla tribe has also purchased the Palmer Oil Company, becoming the first Indian tribe to have 100% ownership of an oil production firm. The case is a landmark case in Native American case law, having been cited in approximately 400law review

A law review or law journal is a scholarly journal or publication that focuses on legal issues. A law review is a type of legal periodical. Law reviews are a source of research, imbedded with analyzed and referenced legal topics; they also provide ...

articles as of July 2010. Almost all tribes that have mineral deposits now impose a severance tax, based on the ''Merrion'' decision and has been used as the basis for subsequent decisions supporting tribal taxing authority. Numerous books also mention the case, whether in regards to tribal sovereignty or taxation.

See also

* '' Cotton Petroleum Corp. v. New Mexico'' (1989)References

External links

* * * {{DEFAULTSORT:Merrion V. Jicarilla Apache Tribe 1982 in United States case law United States Supreme Court cases United States Native American tax case law Jicarilla Apache Nation History of the petroleum industry in the United States Energy in New Mexico United States Supreme Court cases of the Burger Court Severance taxes Taxation in New Mexico Native American history of New Mexico