Hanging man (candlestick pattern) on:

[Wikipedia]

[Google]

[Amazon]

A hanging man is a type of

A hanging man is a type of

Video and chart examples of hanging man pattern

at onlinetradingconcepts.com

Hanging man definition

at investopedia.com

Hanging Man Information

at candlecharts.com Candlestick patterns {{econ-stub

A hanging man is a type of

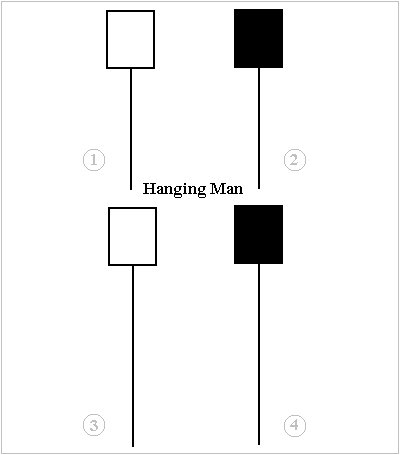

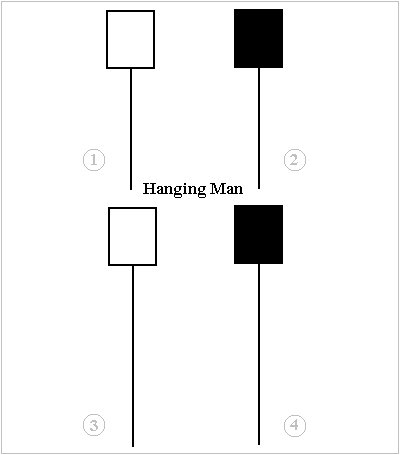

A hanging man is a type of candlestick pattern In financial technical analysis, a candlestick pattern is a movement in prices shown graphically on a candlestick chart that some believe can predict a particular market movement. The recognition of the pattern is subjective and programs that are ...

in financial technical analysis

In finance, technical analysis is an analysis methodology for analysing and forecasting the direction of prices through the study of past market data, primarily price and volume. Behavioral economics and quantitative analysis use many of the sa ...

. It is a bearish reversal pattern made up of just one candle. It has a long lower wick and a short body at the top of the candlestick with little or no upper wick. In order for a candle to be a valid hanging man most traders say the lower wick must be two times greater than the size of the body portion of the candle, and the body of the candle must be at the upper end of the trading range.

See also

*Hammer

A hammer is a tool, most often a hand tool, consisting of a weighted "head" fixed to a long handle that is swung to deliver an impact to a small area of an object. This can be, for example, to drive nails into wood, to shape metal (as ...

— Hanging man pattern found in a downtrend

External links

Video and chart examples of hanging man pattern

at onlinetradingconcepts.com

Hanging man definition

at investopedia.com

Hanging Man Information

at candlecharts.com Candlestick patterns {{econ-stub