GCash on:

[Wikipedia]

[Google]

[Amazon]

GCash is a Philippine

mobile payment

Mobile payment, also referred to as mobile money, mobile money transfer and mobile wallet, is any of various payment processing services operated under financial regulations and performed from or via a mobile device. Instead of paying with cas ...

s service owned by Globe Fintech Innovations, Inc. (doing business as Mynt), and operated by its wholly-owned subsidiary, G-Xchange, Inc.

Mynt is a joint venture between Ant Group, an affiliate company of the Alibaba Group

Alibaba Group Holding Limited, branded as Alibaba (), is a Chinese Multinational corporation, multinational technology company specializing in E-commerce in China, e-commerce, retail, Internet, and technology. Founded on 28 June 1999 in Hangzho ...

who operates Alipay

Alipay () is a third-party mobile and online payment platform, established in Hangzhou, China in February 2004 by Alibaba Group and its founder Jack Ma. In 2015, Alipay moved its headquarters to Pudong, Shanghai, although its parent company ...

, the world's leading mobile and online payment

An e-commerce payment system (or an electronic payment system) facilitates the acceptance of electronic payment for offline transfer, also known as a subcomponent of electronic data interchange (EDI), e-commerce payment systems have become increa ...

s platform; Ayala Corporation

Ayala Corporation (, formerly ''Ayala y Compañía''; ) is the publicly listed holding company for the diversified interests of the Ayala Group. Founded in the Philippines by Domingo Róxas and Antonio de Ayala during Spanish colonial rule, ...

, one of the Philippines' largest and oldest business conglomerates; and telco giant Globe Telecom, through its corporate venture builder, 917Ventures.

As of May 2023, GCash claims to have 81 million active users and 2.5 million sellers and merchants across the Philippines.

Since GCash does not have bank status, the protection of funds deposited in a bank by the Philippine Deposit Insurance Corporation is not available for e-money issuers.

History

GCash was launched in October 2004 as an SMS-based money to transfer service. It was Globe Telecom's answer toSmart Communications

Smart Communications Inc., commonly referred to as Smart, is a wholly owned wireless communications and digital services subsidiary of PLDT Inc., a telecommunications and digital services provider based in the Philippines. As of November ...

' Smart Padala which aimed to serve the majority of Filipinos who lacked access to formal banking services at the time. Users could convert their cash to e-money through cash-in and cash-out outlets like sari-sari stores with a transaction fee of .

GCash launched its mobile application in 2012 to shift from physical outlets to a digital cashless system. In 2017, GCash and its rival mobile wallet PayMaya, partnered with Facebook

Facebook is a social media and social networking service owned by the American technology conglomerate Meta Platforms, Meta. Created in 2004 by Mark Zuckerberg with four other Harvard College students and roommates, Eduardo Saverin, Andre ...

to offer its services within Facebook Messenger, but this partnership wouldn't last due to changes in Facebook's fintech strategy. GCash is still widely used payment method for physical outlet and offline-related services in the Philippines, particularly retail and events. As of 2022, there were an estimated 58 million active e-wallet users in the Philippines.

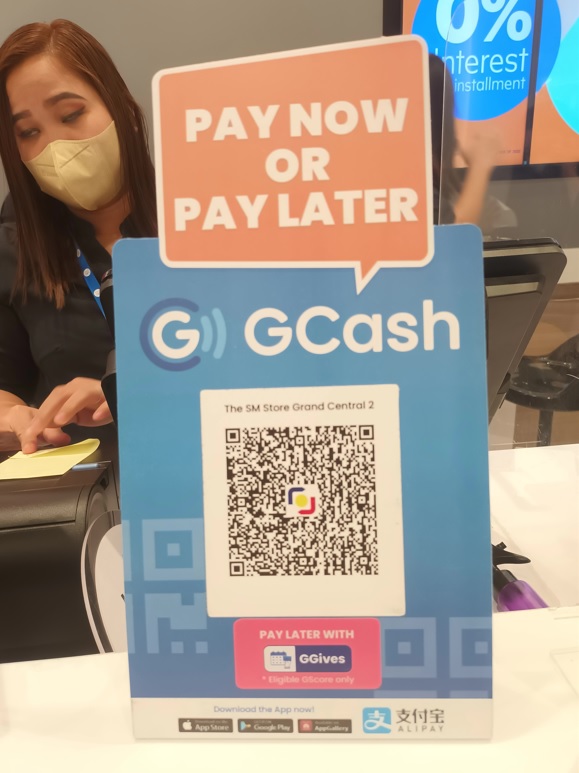

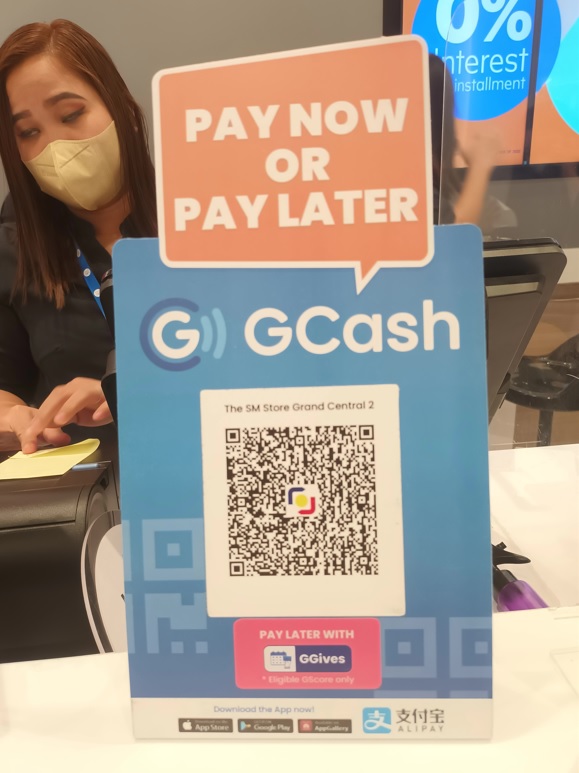

From 2013 to 2020, GCash focused on bringing new features to its app including QR-based payments, mobile and gaming credit purchases, online checkout, barcode cash-in, bills payment, and the support for InstaPay which enabled interbank transfers. GCash also partnered with CIMB Bank Philippines for the pilot of GSave, a high-yield savings account. GSave would later evolve into GSave Marketplace with options between CIMB Bank Philippines, BPI, and Maybank

Malayan Banking Berhad (doing business as Maybank) is a Malaysian universal bank, with key operating "home markets" of Malaysia, Singapore, and Indonesia. According to the 2020 Brand Finance report, Maybank is Malaysia's most valuable bank b ...

Philippines.

In 2021, GCredit, a revolving mobile credit line initially powered by Fuse Lending was also transferred to CIMB Bank. GCash also revived its remittance service, now called GCash Padala, and made it available to non-app users through its 2,000 partner outlets nationwide.

GCash's parent company, Mynt, made history as the Philippine's first double unicorn

The unicorn is a legendary creature that has been described since Classical antiquity, antiquity as a beast with a single large, pointed, spiraling horn (anatomy), horn projecting from its forehead.

In European literature and art, the unico ...

when it announced that it raised $300M in funding last November 2021 at a $2B valuation. In an effort to further increase its footprint, GCash Jr., designed for users aged 7 to 17, was launched in 2022.

In August 2024, GCash secured additional funding from Ayala Corporation

Ayala Corporation (, formerly ''Ayala y Compañía''; ) is the publicly listed holding company for the diversified interests of the Ayala Group. Founded in the Philippines by Domingo Róxas and Antonio de Ayala during Spanish colonial rule, ...

and Mitsubishi UFJ Financial Group

is a Japanese bank holding and financial services company headquartered in Chiyoda, Tokyo, Japan. MUFG was created in 2005 by merger between and UFJ Holdings (株式会社UFJホールディングス; ''kabushikigaisha yūefujei hōrudingusu'' ...

, increasing its valuation to $5B.

Issues

Service interruptions

During its surge of popularity from 2017 to 2020, GCash experienced multiple service interruptions lasting between one and eight hours. There have also been reports of fraud and scams that specifically targeted GCash users, most notably involving phishing activities. In response, GCash launched "Double Safe" in 2023 which requires facial identification from customers.2023 unauthorized transactions

On May 8, 2023, when hundreds of users, reported missing funds from unauthorized bank transfers. By midnight of May 9, the GCash app had shut down and a full-banner error message that read "We're just working on improving your experience. Rest assured that your funds are safe" was displayed. Around 300 victims formed a group chat and alleged hacking, but GCash denied that such an incident occurred and stuck to the same messaging that all funds were secure, even after its own admission that sums of money were funneled by an undisclosed malicious actor to two accounts in EastWest Bank and Asia United Bank without customer permission. In a statement, GCash wrote:Some customers may have experienced a deduction in their GCash accounts. We extended our scheduled maintenance to investigate and determined that no hacking occurred.As of 4:00 pm PHT of May 9, GCash said it has already adjusted the balance of affected users, and added that the app is operational again after an hours-long downtime. Users and government regulators remained unhappy without the public disclosure of a comprehensive investigation's findings. House Deputy Minority Leader Bernadette Herrera-Dy of Bagong Henerasyon filed House Resolution No. 963 which seeks for a congress-led probe because she was not satisfied with GCash's non-explanation of what caused the anomalous transactions. The Cybercrime Investigation and Coordinating Center, an attached agency of the Department of Information and Communication Technology, probed the incident and requested a meeting with executives from the mobile wallet's operator. The National Privacy Commission mentioned that they, too, will be conducting an independent assessment to determine a potential data breach that may have resulted to unauthorized fund transfers. On May 24, 2023, the National Privacy Commission concluded its extensive investigation into the reported unauthorized transactions involving multiple GCash accounts. After examination and independent verification of the incident, the NPC confirmed that the security breach resulted from the utilization of phishing attacks. According to the Privacy Commissioner, John Henry Du Naga, "Unknown threat actors took advantage of vulnerable GCash users, triggering the phishing scheme through online gambling websites such as 'Philwin' and 'tapwin1.com'".

References

External links

* {{Digital payment providers Products introduced in 2004 Internet properties established in 2004 2004 establishments in the Philippines Alibaba Group Ayala Corporation subsidiaries Mobile payments in the Philippines Payment service providers Philippine brands