fixed rate bond on:

[Wikipedia]

[Google]

[Amazon]

In

The

The

Bonds can be categorised in several ways, such as the type of issuer, the currency, the term of the bond (length of time to maturity) and the conditions applying to the bond. The following descriptions are not mutually exclusive, and more than one of them may apply to a particular bond:

Bonds can be categorised in several ways, such as the type of issuer, the currency, the term of the bond (length of time to maturity) and the conditions applying to the bond. The following descriptions are not mutually exclusive, and more than one of them may apply to a particular bond:

* A

* A

Estate planner victimized terminally ill

finance

Finance refers to monetary resources and to the study and Academic discipline, discipline of money, currency, assets and Liability (financial accounting), liabilities. As a subject of study, is a field of Business administration, Business Admin ...

, a bond is a type of security under which the issuer (debtor

A debtor or debitor is a legal entity (legal person) that owes a debt to another entity. The entity may be an individual, a firm, a government, a company or other legal person. The counterparty is called a creditor. When the counterpart of this ...

) owes the holder (creditor

A creditor or lender is a party (e.g., person, organization, company, or government) that has a claim on the services of a second party. It is a person or institution to whom money is owed. The first party, in general, has provided some propert ...

) a debt

Debt is an obligation that requires one party, the debtor, to pay money Loan, borrowed or otherwise withheld from another party, the creditor. Debt may be owed by a sovereign state or country, local government, company, or an individual. Co ...

, and is obliged – depending on the terms – to provide cash flow

Cash flow, in general, refers to payments made into or out of a business, project, or financial product. It can also refer more specifically to a real or virtual movement of money.

*Cash flow, in its narrow sense, is a payment (in a currency), es ...

to the creditor (e.g. repay the principal (i.e. amount borrowed) of the bond at the maturity date and interest

In finance and economics, interest is payment from a debtor or deposit-taking financial institution to a lender or depositor of an amount above repayment of the principal sum (that is, the amount borrowed), at a particular rate. It is distinct f ...

(called the coupon

In marketing, a coupon is a ticket or document that can be redeemed for a financial discount or rebate when purchasing a product.

Customarily, coupons are issued by manufacturers of consumer packaged goods

or by retailers, to be used in ...

) over a specified amount of time.) The timing and the amount of cash flow provided varies, depending on the economic value that is emphasized upon, thus giving rise to different types of bonds. The interest is usually payable at fixed intervals: semiannual, annual, and less often at other periods. Thus, a bond is a form of loan

In finance, a loan is the tender of money by one party to another with an agreement to pay it back. The recipient, or borrower, incurs a debt and is usually required to pay interest for the use of the money.

The document evidencing the deb ...

or IOU

An IOU (Abbreviation, abbreviated from the phrase "I owe you") is usually an informal document acknowledging debt. An IOU differs from a promissory note in that an IOU is not a negotiable instrument and does not specify repayment terms such as th ...

. Bonds provide the borrower with external funds to finance long-term investments or, in the case of government bond

A government bond or sovereign bond is a form of Bond (finance), bond issued by a government to support government spending, public spending. It generally includes a commitment to pay periodic interest, called Coupon (finance), coupon payments' ...

s, to finance current expenditure.

Bonds and stock

Stocks (also capital stock, or sometimes interchangeably, shares) consist of all the Share (finance), shares by which ownership of a corporation or company is divided. A single share of the stock means fractional ownership of the corporatio ...

s are both securities

A security is a tradable financial asset. The term commonly refers to any form of financial instrument, but its legal definition varies by jurisdiction. In some countries and languages people commonly use the term "security" to refer to any for ...

, but the major difference between the two is that (capital) stockholders have an equity stake in a company (i.e. they are owners), whereas bondholders have a creditor stake in a company (i.e. they are lenders). As creditors, bondholders have priority over stockholders. This means they will be repaid in advance of stockholders, but will rank behind secured creditor

A secured creditor is a creditor with the benefit of a security interest over some or all of the assets of the debtor.

In the event of the bankruptcy of the debtor, the secured creditor can enforce security against the assets of the debtor and avo ...

s, in the event of bankruptcy. Another difference is that bonds usually have a defined term, or maturity, after which the bond is redeemed, whereas stocks typically remain outstanding indefinitely. An exception is an irredeemable bond, which is a perpetuity

In finance, a perpetuity is an annuity that has no end, or a stream of cash payments that continues forever. There are few actual perpetuities in existence. For example, the United Kingdom (UK) government issued them in the past; these were kno ...

, that is, a bond with no maturity. Certificates of deposit (CDs) or short-term commercial paper

Commercial paper, in the global financial market, is an Unsecured debt, unsecured promissory note with a fixed Maturity (finance), maturity of usually less than 270 days. In layperson terms, it is like an "IOU" but can be bought and sold becaus ...

are classified as money market

The money market is a component of the economy that provides short-term funds. The money market deals in short-term loans, generally for a period of a year or less.

As short-term securities became a commodity, the money market became a compo ...

instruments and not bonds: the main difference is the length of the term of the instrument.

The most common forms include municipal, corporate

A corporation or body corporate is an individual or a group of people, such as an association or company, that has been authorized by the state to act as a single entity (a legal entity recognized by private and public law as "born out of s ...

, and government bond

A government bond or sovereign bond is a form of Bond (finance), bond issued by a government to support government spending, public spending. It generally includes a commitment to pay periodic interest, called Coupon (finance), coupon payments' ...

s. Very often the bond is negotiable, that is, the ownership of the instrument can be transferred in the secondary market

The secondary market, also called the aftermarket and follow on public offering, is the financial market in which previously issued financial instruments such as stock, bonds, options, and futures are bought and sold. The initial sale of ...

. This means that once the transfer agents at the bank medallion-stamp the bond, it is highly liquid

Liquid is a state of matter with a definite volume but no fixed shape. Liquids adapt to the shape of their container and are nearly incompressible, maintaining their volume even under pressure. The density of a liquid is usually close to th ...

on the secondary market. The price of a bond in the secondary market may differ substantially from the principal due to various factors in bond valuation

Bond valuation is the process by which an investor arrives at an estimate of the theoretical fair value, or intrinsic worth, of a bond. As with any security or capital investment, the theoretical fair value of a bond is the present value of the s ...

.

Bonds are often identified by their international securities identification number, or ISIN, which is a 12-digit alphanumeric code that uniquely identifies debt securities.

Etymology

In English, the word "" relates to the etymology of "bind". The use of the word "bond" in this sense of an "instrument binding one to pay a sum to another" dates from at least the 1590s.Issuance

Bonds are issued by public authorities, credit institutions, companies and supranational institutions in the primary markets. The most common process for issuing bonds is through underwriting. When a bond issue is underwritten, one or more securities firms or banks, forming asyndicate

A syndicate is a self-organizing group of individuals, companies, corporations or entities formed to transact some specific business, to pursue or promote a shared interest.

Etymology

The word ''syndicate'' comes from the French word ''syndic ...

, buy the entire issue of bonds from the issuer and resell them to investors. The security firm takes the risk of being unable to sell on the issue to end investors. Primary issuance is arranged by '' bookrunners'' who arrange the bond issue, have direct contact with investors and act as advisers to the bond issuer in terms of timing and price of the bond issue. The bookrunner is listed first among all underwriters participating in the issuance in the tombstone ads commonly used to announce bonds to the public. The bookrunners' willingness to underwrite must be discussed prior to any decision on the terms of the bond issue as there may be limited demand for the bonds.

In contrast, government bonds are usually issued in an auction. In some cases, both members of the public and banks may bid for bonds. In other cases, only market makers may bid for bonds. The overall rate of return on the bond depends on both the terms of the bond and the price paid. The terms of the bond, such as the coupon, are fixed in advance and the price is determined by the market.

In the case of an underwritten bond, the underwriters will charge a fee for underwriting. An alternative process for bond issuance, which is commonly used for smaller issues and avoids this cost, is the private placement bond. Bonds sold directly to buyers may not be tradeable in the bond market.

Historically, an alternative practice of issuance was for the borrowing government authority to issue bonds over a period of time, usually at a fixed price, with volumes sold on a particular day dependent on market conditions. This was called a ''tap issue'' or ''bond tap''.

Features

Principal

Nominal, principal, par, or face amount is the amount on which the issuer pays interest, and which, most commonly, has to be repaid at the end of the term. Some structured bonds can have a redemption amount which is different from the face amount and can be linked to the performance of particular assets.Maturity

The issuer is obligated to repay the nominal amount on the maturity date. As long as all due payments have been made, the issuer has no further obligations to the bond holders after the maturity date. The length of time until the maturity date is often referred to as the term or tenor or maturity of a bond. The maturity can be any length of time, although debt securities with a term of less than one year are generally designated money market instruments rather than bonds. Most bonds have a term shorter than 30 years. Some bonds have been issued with terms of 50 years or more, and historically there have been some issues with no maturity date (irredeemable). In the market for United States Treasury securities, there are four categories of bond maturities: * short term (bills): maturities under one year; * medium term (notes): maturities between one and ten years; * long term (bonds): maturities between ten and thirty years; * perpetual: no maturity period.Coupon

The

The coupon

In marketing, a coupon is a ticket or document that can be redeemed for a financial discount or rebate when purchasing a product.

Customarily, coupons are issued by manufacturers of consumer packaged goods

or by retailers, to be used in ...

is the interest rate that the issuer pays to the holder. For fixed rate bonds, the coupon is fixed throughout the life of the bond. For floating rate note

Floating rate notes (FRNs) are bonds that have a variable coupon, equal to a money market reference rate, like SOFR or federal funds rate, plus a quoted spread (also known as quoted margin). The spread is a rate that remains constant. Almost a ...

s, the coupon varies throughout the life of the bond and is based on the movement of a money market

The money market is a component of the economy that provides short-term funds. The money market deals in short-term loans, generally for a period of a year or less.

As short-term securities became a commodity, the money market became a compo ...

reference rate (historically this was generally LIBOR, but with its discontinuation the market reference rate has transitioned to SOFR).

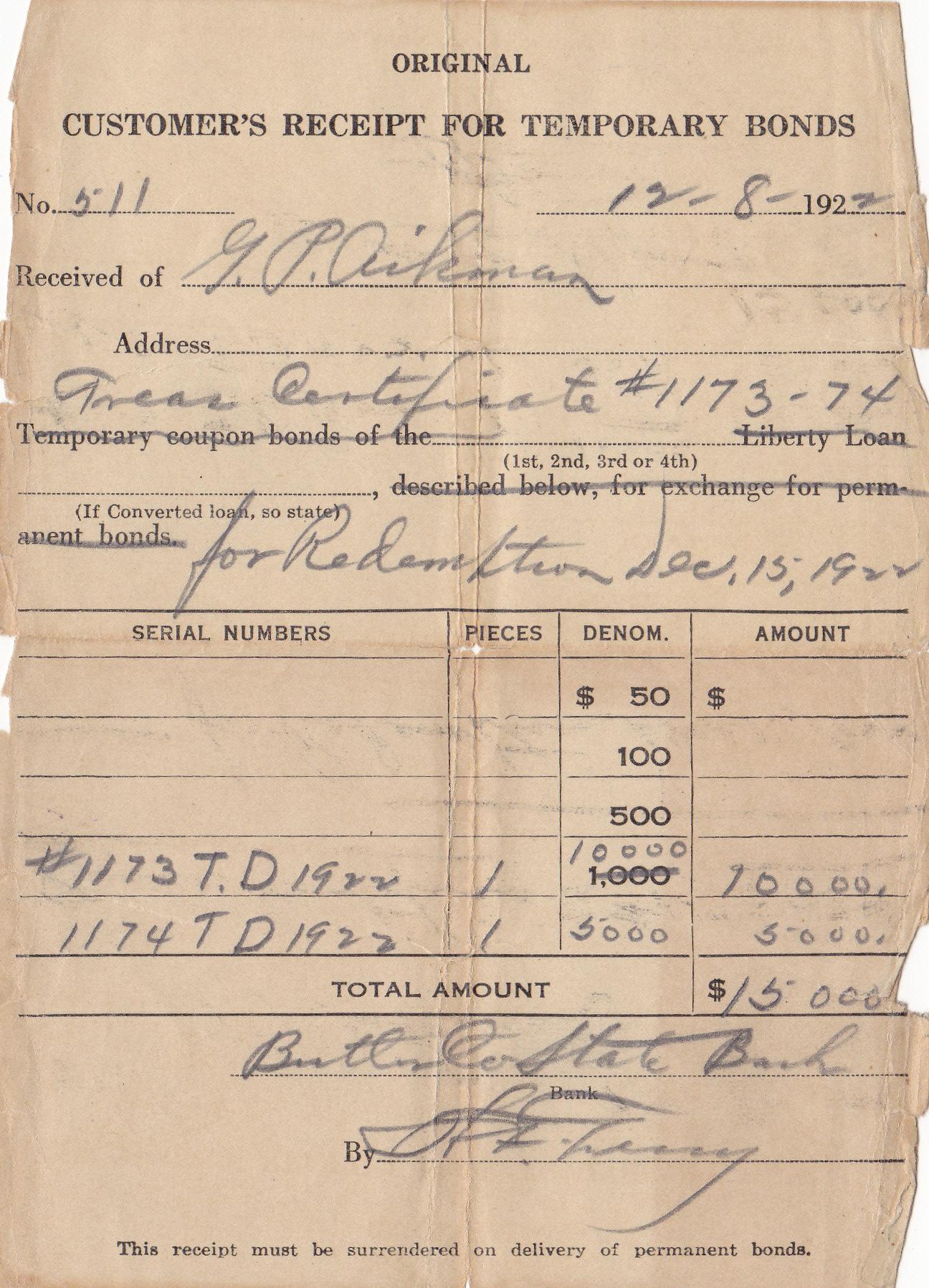

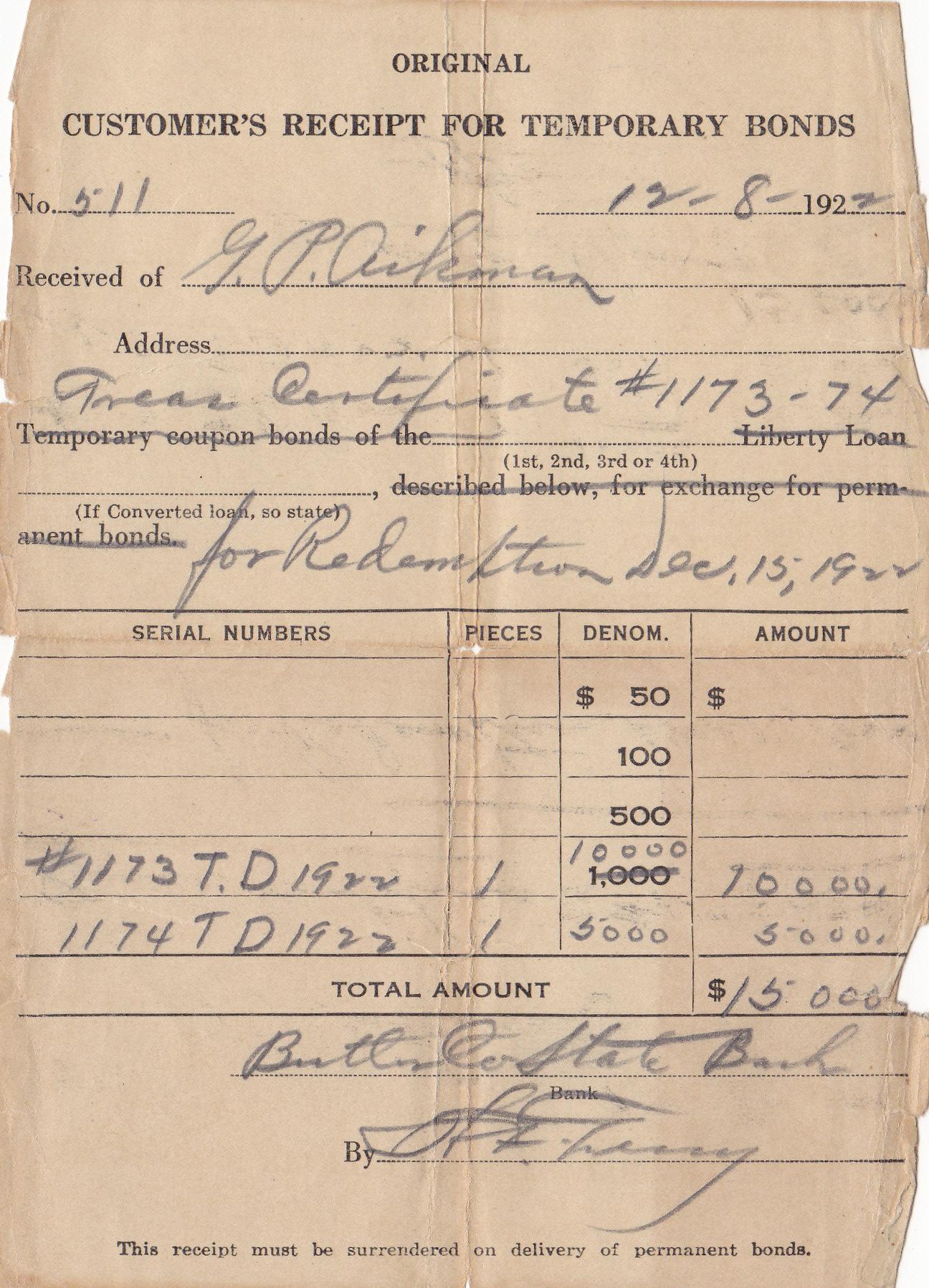

Historically, coupons were physical attachments to the paper bond certificates, with each coupon representing an interest payment. On the interest due date, the bondholder would hand in the coupon to a bank in exchange for the interest payment. Today, interest payments are almost always paid electronically. Interest can be paid at different frequencies: generally semi-annual (every six months) or annual.

Yield

The yield is the rate of return received from investing in the bond. It usually refers to one of the following: * The current yield, or running yield: the annual interest payment divided by the current market price of the bond (often the clean price). * Theyield to maturity

The yield to maturity (YTM), book yield or redemption yield of a fixed-interest security is an estimate of the total rate of return anticipated to be earned by an investor who buys it at a given market price, holds it to maturity, and receives ...

(or redemption yield, as it is termed in the United Kingdom) is an estimate of the total rate of return anticipated to be earned by an investor who buys a bond at a given market price, holds it to maturity, and receives all interest payments and the capital redemption on schedule. It is a more useful measure of the return on a bond than current yield because it takes into account the present value

In economics and finance, present value (PV), also known as present discounted value (PDV), is the value of an expected income stream determined as of the date of valuation. The present value is usually less than the future value because money ha ...

of future interest payments and principal repaid at maturity. The yield to maturity or redemption yield calculated at the time of purchase is not necessarily the return the investor will actually earn, as finance scholars Dr. Annette Thau and Dr. Frank Fabozzi have noted. The yield to maturity will be realized only under certain conditions, including 1) all interest payments are reinvested rather than spent, and 2) all interest payments are reinvested at the yield to maturity calculated at the time the bond is purchased. This distinction may not be a concern to bond buyers who intend to spend rather than reinvest the coupon payments, such as those practicing asset/liability matching strategies.

Credit quality

The quality of the issue refers to the probability that the bondholders will receive the amounts promised at the due dates. In other words, credit quality tells investors how likely the borrower is going to default. This will depend on a wide range of factors. High-yield bonds are bonds that are rated below investment grade by thecredit rating agencies

A credit rating agency (CRA, also called a ratings service) is a company that assigns credit ratings, which rate a debtor's ability to pay back debt by making timely principal and interest payments and the likelihood of default. An agency may r ...

. As these bonds are riskier than investment grade bonds, investors expect to earn a higher yield. These bonds are also called ''junk bonds''.

Market price

The market price of a tradable bond will be influenced, among other factors, by the amounts, currency and timing of the interest payments and capital repayment due, the quality of the bond, and the available redemption yield of other comparable bonds which can be traded in the markets. The price can be quoted as clean or dirty. "Dirty" includes the present value of all future cash flows, including accrued interest, and is most often used in Europe. "Clean" does not include accrued interest, and is most often used in the U.S. The issue price at which investors buy the bonds when they are first issued will typically be approximately equal to the nominal amount. The net proceeds that the issuer receives are thus the issue price, less issuance fees. The market price of the bond will vary over its life: it may trade at a premium (above par, usually because market interest rates have fallen since issue), or at a discount (price below par, if market rates have risen or there is a high probability of default on the bond).Others

* Indentures and Covenants—Anindenture

An indenture is a legal contract that reflects an agreement between two parties. Although the term is most familiarly used to refer to a labor contract between an employer and a laborer with an indentured servant status, historically indentures we ...

is a formal debt agreement that establishes the terms of a bond issue, while covenants are the clauses of such an agreement. Covenants specify the rights of bondholders and the duties of issuers, such as actions that the issuer is obligated to perform or is prohibited from performing. In the U.S., federal and state securities and commercial laws apply to the enforcement of these agreements, which are construed by courts as contracts between issuers and bondholders. The terms may be changed only with great difficulty while the bonds are outstanding, with amendments to the governing document generally requiring approval by a majority

A majority is more than half of a total; however, the term is commonly used with other meanings, as explained in the "#Related terms, Related terms" section below.

It is a subset of a Set (mathematics), set consisting of more than half of the se ...

(or super-majority) vote of the bondholders.

* Optionality: Occasionally a bond may contain an embedded option

An embedded option

is a component of a financial bond or other security, which provides the bondholder or the issuer the right to take some action against the other party. There are several types of options that can be embedded into a bond; comm ...

; that is, it grants option-like features to the holder or the issuer:

** Callability—Some bonds give the issuer the right to repay the bond before the maturity date on the call dates; see call option

In finance, a call option, often simply labeled a "call", is a contract between the buyer and the seller of the call Option (finance), option to exchange a Security (finance), security at a set price. The buyer of the call option has the righ ...

. These bonds are referred to as callable bond

A callable bond (also called redeemable bond) is a type of bond ( debt security) that allows the issuer of the bond to retain the privilege of redeeming the bond at some point before the bond reaches its date of maturity. In other words, on the c ...

s. Most callable bonds allow the issuer to repay the bond at par. With some bonds, the issuer has to pay a premium, the so-called call premium. This is mainly the case for high-yield bonds. These have very strict covenants, restricting the issuer in its operations. To be free from these covenants, the issuer can repay the bonds early, but only at a high cost.

** Puttability—Some bonds give the holder the right to force the issuer to repay the bond before the maturity date on the put dates; see put option

In finance, a put or put option is a derivative instrument in financial markets that gives the holder (i.e. the purchaser of the put option) the right to sell an asset (the ''underlying''), at a specified price (the ''strike''), by (or on) a ...

. These are referred to as retractable or putable bonds.

** Call dates and put dates—the dates on which callable and putable bonds can be redeemed early. There are four main categories:

*** A Bermudan callable has several call dates, usually coinciding with coupon dates.

*** A European callable has only one call date. This is a special case of a Bermudan callable.

*** An American callable can be called at any time until the maturity date.

*** A death put is an optional redemption feature on a debt instrument allowing the beneficiary of the estate of a deceased bondholder to put (sell) the bond back to the issuer at face value in the event of the bondholder's death or legal incapacitation. This is also known as a "survivor's option".

** Sinking fund provision of the corporate bond indenture requires a certain portion of the issue to be retired periodically. The entire bond issue can be liquidated by the maturity date; if not, the remainder is called balloon maturity. Issuers may either pay to trustees, which in turn call randomly selected bonds in the issue, or, alternatively, purchase bonds in the open market, then return them to trustees.

Types

Bonds can be categorised in several ways, such as the type of issuer, the currency, the term of the bond (length of time to maturity) and the conditions applying to the bond. The following descriptions are not mutually exclusive, and more than one of them may apply to a particular bond:

Bonds can be categorised in several ways, such as the type of issuer, the currency, the term of the bond (length of time to maturity) and the conditions applying to the bond. The following descriptions are not mutually exclusive, and more than one of them may apply to a particular bond:

The nature of the issuer and the security offered

The nature of the issuer will affect the security (certainty of receiving the contracted payments) offered by the bond, and sometimes the tax treatment. *Government bond

A government bond or sovereign bond is a form of Bond (finance), bond issued by a government to support government spending, public spending. It generally includes a commitment to pay periodic interest, called Coupon (finance), coupon payments' ...

s, often also called treasury bonds, are issued by a sovereign

''Sovereign'' is a title that can be applied to the highest leader in various categories. The word is borrowed from Old French , which is ultimately derived from the Latin">-4; we might wonder whether there's a point at which it's appropriate to ...

national government. Some countries have repeatedly defaulted on their government bonds, while some other treasury bonds have been treated as risk-free and not exposed to default risk. Risk-free bonds are the safest bonds, with the lowest interest rate. A Treasury bond is backed by the "full faith and credit" of the relevant government. However, in reality most or all government bonds do carry some residual risk. This is indicated by

**the award by rating agencies

A credit rating agency (CRA, also called a ratings service) is a company that assigns credit ratings, which rate a debtor's ability to pay back debt by making timely principal and interest payments and the likelihood of default. An agency may r ...

of a rating below the top rating,

**bonds issued by different national governments, such as various member states of the European Union, all denominated in Euros, offering different market yields reflecting their different risks.

* A supranational bond, also known as a "supra", is issued by a supranational organisation like the World Bank

The World Bank is an international financial institution that provides loans and Grant (money), grants to the governments of Least developed countries, low- and Developing country, middle-income countries for the purposes of economic development ...

. They have a very good credit rating, similar to that on national government bonds.

* A municipal bond

A municipal bond, commonly known as a muni, is a bond issued by state or local governments, or entities they create such as authorities and special districts. In the United States, interest income received by holders of municipal bonds is often ...

issued by a local authority or subdivision within a country, for example a city or a federal state. These will to varying degrees carry the backing of the national government. In the United States, such bonds are exempt from certain taxes. For example, Build America Bonds (BABs) are a form of municipal bond authorized by the American Recovery and Reinvestment Act of 2009

The American Recovery and Reinvestment Act of 2009 (ARRA) (), nicknamed the Recovery Act, was a Stimulus (economics), stimulus package enacted by the 111th U.S. Congress and signed into law by President Barack Obama in February 2009. Developed ...

. Unlike traditional US municipal bonds, which are usually tax exempt, interest received on BABs is subject to federal taxation. However, as with municipal bonds, the bond is tax-exempt within the US state where it is issued. Generally, BABs offer significantly higher yields than standard municipal bonds.

** A revenue bond

A revenue bond is a special type of municipal bond distinguished by its guarantee of repayment solely from revenues generated by a specified revenue-generating entity associated with the purpose of the bonds, rather than from a tax. Unlike gener ...

is a special type of municipal bond distinguished by its guarantee of repayment solely from revenues generated by a specified revenue-generating entity associated with the purpose of the bonds. Revenue bonds are typically "non-recourse", meaning that in the event of default, the bond holder has no recourse to other governmental assets or revenues.

* A War bond

War bonds (sometimes referred to as victory bonds, particularly in propaganda) are Security (finance)#Debt, debt securities issued by a government to finance military operations and other expenditure in times of war without raising taxes to an un ...

is a bond issued by a government to fund military operations and other expenditure during wartime. It will often have a low return rate, and so can be bought due a lack of opportunities or patriotism

Patriotism is the feeling of love, devotion, and a sense of attachment to one's country or state. This attachment can be a combination of different feelings for things such as the language of one's homeland, and its ethnic, cultural, politic ...

.

* Corporate bond

A corporate bond is a bond issued by a corporation in order to raise financing for a variety of reasons such as to ongoing operations, mergers & acquisitions, or to expand business. It is a longer-term debt instrument indicating that a corpo ...

s are issued by corporations.

* High-yield bonds (junk bonds) are bonds that are rated below investment grade by the credit rating agencies

A credit rating agency (CRA, also called a ratings service) is a company that assigns credit ratings, which rate a debtor's ability to pay back debt by making timely principal and interest payments and the likelihood of default. An agency may r ...

, because they are uncertain that the issuer will be able or willing to pay the scheduled interest payments and/or redeem the bond at maturity. As these bonds are much riskier than investment grade bonds, investors expect to earn a much higher yield.

* A Climate bond

A green bond is a fixed-income financial instrument ( bond) which is used to fund projects that have positive environmental benefits. When referring to climate change mitigation projects they are also known as ''climate bonds''. Green bonds follo ...

is a bond issued by a government or corporate entity in order to raise finance for climate change mitigation- or adaptation-related projects or programmes. For example, in 2021 the UK government started to issue "green bonds".

* Asset-backed securities are bonds whose interest and principal payments are backed by underlying cash flows from other assets. Examples of asset-backed securities are mortgage-backed securities

A mortgage-backed security (MBS) is a type of asset-backed security (an "Financial instrument, instrument") which is secured by a mortgage loan, mortgage or collection of mortgages. The mortgages are aggregated and sold to a group of individuals ( ...

(MBSs), collateralized mortgage obligation

A collateralized mortgage obligation (CMO) is a type of complex debt security that repackages and directs the payments of principal and interest from a collateral pool to different types and maturities of securities, thereby meeting investor need ...

s (CMOs), and collateralized debt obligation

A collateralized debt obligation (CDO) is a type of structured finance, structured asset-backed security (ABS). Originally developed as instruments for the corporate debt markets, after 2002 CDOs became vehicles for refinancing Mortgage-backed se ...

s (CDOs).

* Covered bonds are backed by cash flows from mortgages or public sector assets. Unlike asset-backed securities, the assets for such bonds remain on the issuer's balance sheet.

* Subordinated bonds are those that have a lower priority than other bonds of the issuer in case of liquidation

Liquidation is the process in accounting by which a Company (law), company is brought to an end. The assets and property of the business are redistributed. When a firm has been liquidated, it is sometimes referred to as :wikt:wind up#Noun, w ...

. In case of bankruptcy, there is a hierarchy of creditors. First the liquidator is paid, then government taxes, etc. The first bond holders in line to be paid are those holding what are called senior bonds. After they have been paid, the subordinated bond holders are paid. As a result, the risk is higher. Therefore, subordinated bonds usually have a lower credit rating than senior bonds. The main examples of subordinated bonds can be found in bonds issued by banks and asset-backed securities. The latter are often issued in tranche

In structured finance, a tranche () is one of a number of related securities offered as part of the same transaction. In the financial sense of the word, each bond is a different slice of the deal's risk. Transaction documentation (see indent ...

s. The senior tranches get paid back first, the subordinated tranches later.

* Social impact bond

A social impact bond (SIB), also known as pay-for-success financing, pay-for-success bond (US), social benefit bond (Australia), pay-for-benefit bond (Australia), social outcomes contract (UK), social impact partnership (Europe), social impact ...

s are an agreement for public sector entities to pay back private investors after meeting verified improved social outcome goals that result in public sector savings from innovative social program pilot projects.

The term of the bond

* Most bonds are structured to mature on a stated date, when the principal is due to be repaid, and interest payments cease. Typically, a bond with term to maturity of under five years would be called a short bond; 5 to 15 years would be "medium", and over 15 years would be "long"; but the numbers may vary in different markets. *Perpetual bond A perpetual bond, also known colloquially as a perpetual or perp, is a bond with no maturity date, therefore allowing it to be treated as equity, not as debt. Issuers pay coupons on perpetual bonds forever, and they do not have to redeem the pri ...

s are also often called perpetuities or 'Perps'. They have no maturity date. Historically the most famous of these were the UK Consols (there were also some other perpetual UK government bonds, such as War Loan, Treasury Annuities and undated Treasuries). Some of these were issued back in 1888 or earlier. There had been insignificant quantities of these outstanding for decades, and they have now been fully repaid. Some ultra-long-term bonds (sometimes a bond can last centuries: West Shore Railroad issued a bond which matures in 2361 (i.e. 24th century)) are virtually perpetuities from a financial point of view, with the current value of principal near zero.

* The ''Methuselah'' is a type of bond with a maturity of 50 years or longer. The term is a reference to Methuselah, the oldest person whose age is mentioned in the Hebrew Bible

The Hebrew Bible or Tanakh (;"Tanach"

. '' pension A pension (; ) is a fund into which amounts are paid regularly during an individual's working career, and from which periodic payments are made to support the person's retirement from work. A pension may be either a " defined benefit plan", wh ...

plans, particularly in . '' pension A pension (; ) is a fund into which amounts are paid regularly during an individual's working career, and from which periodic payments are made to support the person's retirement from work. A pension may be either a " defined benefit plan", wh ...

France

France, officially the French Republic, is a country located primarily in Western Europe. Overseas France, Its overseas regions and territories include French Guiana in South America, Saint Pierre and Miquelon in the Atlantic Ocean#North Atlan ...

and the United Kingdom

The United Kingdom of Great Britain and Northern Ireland, commonly known as the United Kingdom (UK) or Britain, is a country in Northwestern Europe, off the coast of European mainland, the continental mainland. It comprises England, Scotlan ...

. Issuance of Methuselahs in the United States

The United States of America (USA), also known as the United States (U.S.) or America, is a country primarily located in North America. It is a federal republic of 50 U.S. state, states and a federal capital district, Washington, D.C. The 48 ...

has been limited, however: the U.S. Treasury does not currently issue Treasuries with maturities beyond 30 years, which would serve as a reference level for any corporate

A corporation or body corporate is an individual or a group of people, such as an association or company, that has been authorized by the state to act as a single entity (a legal entity recognized by private and public law as "born out of s ...

issuance.

* A Serial bond is a bond that matures in installments over a period of time. For example, a $100,000, 5-year serial bond might pay $20,000 per year.

The conditions applying to the bond

* Fixed rate bonds have interest payments ("coupon"), usually semi-annual, that remains constant throughout the life of the bond. Other variations include stepped-coupon bonds, whose coupon increases during the life of the bond. *Floating rate note

Floating rate notes (FRNs) are bonds that have a variable coupon, equal to a money market reference rate, like SOFR or federal funds rate, plus a quoted spread (also known as quoted margin). The spread is a rate that remains constant. Almost a ...

s (FRNs, floaters) have a variable coupon that is linked to a reference rate of interest, such as Libor

The London Inter-Bank Offered Rate (Libor ) was an interest rate average calculated from estimates submitted by the leading Bank, banks in London. Each bank estimated what it would be charged were it to borrow from other banks. It was the prim ...

or Euribor

The Euro Interbank Offered Rate (Euribor) is a daily reference rate, published by the European Money Markets Institute, based on the averaged interest rates at which Eurozone banks borrow unsecured funds from counterparties in the euro wholes ...

. For example, the coupon may be defined as three-month USD LIBOR + 0.20%. The coupon rate is recalculated periodically, typically every one or three months.

* Zero-coupon bond

A zero-coupon bond (also discount bond or deep discount bond) is a bond in which the face value is repaid at the time of maturity. Unlike regular bonds, it does not make periodic interest payments or have so-called coupons, hence the term zer ...

s (zeros) pay no regular interest. They are issued at a substantial discount to par value

In finance and accounting, par value means stated value or face value of a financial instrument. Expressions derived from this term include at par (at the par value), over par (over par value) and under par (under par value).

Bonds

A bond selli ...

, so that the interest is effectively rolled up to maturity (and usually taxed as such). The bondholder receives the full principal amount on the redemption date. An example of zero coupon bonds is Series E savings bonds issued by the U.S. government. Zero-coupon bond

A zero-coupon bond (also discount bond or deep discount bond) is a bond in which the face value is repaid at the time of maturity. Unlike regular bonds, it does not make periodic interest payments or have so-called coupons, hence the term zer ...

s may be created from fixed rate bonds by a financial institution separating ("stripping off") the coupons from the principal. This can create a "Principal Only" zero-coupon bond and an "Interest Only" (IO) strip bond

A zero-coupon bond (also discount bond or deep discount bond) is a bond in which the face value is repaid at the time of maturity. Unlike regular bonds, it does not make periodic interest payments or have so-called coupons, hence the term zer ...

from the original fixed income bond.

* Inflation-indexed bond

Daily inflation-indexed bonds (also known as inflation-linked bonds or colloquially as linkers) are bonds where the principal is indexed to inflation or deflation on a daily basis. They are thus designed to hedge the inflation risk of a bond. T ...

s (linkers) (US) or index-linked bonds (UK), in which the principal amount and the interest payments are indexed to the level of consumer prices. The interest rate is normally lower than for fixed rate bonds with a comparable maturity (this relationship briefly reversed for short-term UK bonds in December 2008). Higher inflation rates increase the nominal principal and coupon amounts paid on these bonds. The United Kingdom

The United Kingdom of Great Britain and Northern Ireland, commonly known as the United Kingdom (UK) or Britain, is a country in Northwestern Europe, off the coast of European mainland, the continental mainland. It comprises England, Scotlan ...

was the first sovereign issuer to issue inflation-linked gilts

Gilt-edged securities, also referred to as gilts, are bonds issued by the UK Government. The term is of British origin, and referred to the debt securities issued by the Bank of England on behalf of His Majesty's Treasury, whose paper certific ...

in the 1980s. Treasury Inflation-Protected Securities

United States Treasury securities, also called Treasuries or Treasurys, are government debt instruments issued by the United States Department of the Treasury to finance government spending as a supplement to taxation. Since 2012, the U.S. ...

(TIPS) and I-bonds are examples of inflation-linked bonds issued by the U.S. government.

* Other indexed bonds, for example equity-linked note

An equity-linked note (ELN) is a debt instrument, usually a bond issued by a financial institution such as an investment bank or a subsidiary of a commercial bank. ELNs are liabilities of the issuer, but the final payout to the investor is based o ...

s and bonds indexed on a business indicator (income, added value) or on a country's GDP.

* Lottery bonds are issued by European and other states. Interest is paid as on a traditional fixed rate bond, but the issuer will redeem randomly selected individual bonds within the issue according to a schedule. Some of these redemptions will be for a higher value than the face value of the bond.

Bonds with embedded options for the holder

*Convertible bond

In finance, a convertible bond, convertible note, or convertible debt (or a convertible debenture if it has a maturity of greater than 10 years) is a type of bond that the holder can convert into a specified number of shares of common stock in ...

s let a bondholder exchange a bond to a number of shares of the issuer's common stock. These are known as hybrid securities, because they combine equity and debt

Debt is an obligation that requires one party, the debtor, to pay money Loan, borrowed or otherwise withheld from another party, the creditor. Debt may be owed by a sovereign state or country, local government, company, or an individual. Co ...

features.

* Exchangeable bond

Exchangeable bond (or XB) is a type of hybrid security consisting of a straight bond and an embedded option to exchange the bond for the stock of a company other than the issuer (usually a subsidiary or company in which the issuer owns a stake) a ...

s allows for exchange to shares of a corporation other than the issuer.

Documentation and evidence of title

* A

* A bearer bond

A bearer bond or bearer note is a bond or debt security issued by a government or a business entity such as a corporation. As a bearer instrument, it differs from the more common types of investment securities in that it is unregistered—no ...

is an official certificate issued without a named holder. In other words, the person who has the paper certificate can claim the value of the bond. Often they are registered by a number to prevent counterfeiting, but may be traded like cash. Bearer bonds are very risky because they can be lost or stolen, due to the fact that they can be claimed by whoever is in possession of them. In some countries they were historically popular because the owner could not be traced by the tax authorities. For example, after federal income tax began in the United States, bearer bonds were seen as an opportunity to conceal income or assets. U.S. corporations stopped issuing bearer bonds in the 1960s, the U.S. Treasury stopped in 1982, and state and local tax-exempt bearer bonds were prohibited in 1983.

* A registered bond is a bond whose ownership (and any subsequent purchaser) is recorded by the issuer, or by a transfer agent. Interest payments and the principal upon maturity are sent to the registered owner. The owner can continue to receive interest with a duplicated bond in case of a loss. However, the bond is not easily transferable to other people. Registered bonds seldom appeared in the market for trading. The traceability of the bonds means it has a minor effect on bond prices. Once a new owner acquired the bond, the old bond must be sent to the corporation or agent for cancellation and for issuance of a new bond. It is the opposite of a bearer bond

A bearer bond or bearer note is a bond or debt security issued by a government or a business entity such as a corporation. As a bearer instrument, it differs from the more common types of investment securities in that it is unregistered—no ...

.

* A book-entry bond is a bond that does not have a paper certificate. As physically processing paper bonds and interest coupons became more expensive, issuers (and banks that used to collect coupon interest for depositors) have tried to discourage their use. Some book-entry bond issues do not offer the option of a paper certificate, even to investors who prefer them.

Retail bonds

* Retail bonds are a type of corporate bond mostly designed for ordinary investors.Foreign currencies

Some companies, banks, governments, and other sovereign entities may decide to issue bonds in foreign currencies as the foreign currency may appear to potential investors to be more stable and predictable than their domestic currency. Issuing bonds denominated in foreign currencies also gives issuers the ability to access investment capital available in foreign markets. A downside is that the government loses the option to reduce its bond liabilities by inflating its domestic currency. The proceeds from the issuance of these bonds can be used by companies to break into foreign markets, or can be converted into the issuing company's local currency to be used on existing operations through the use of foreign exchange swap hedges. Foreign issuer bonds can also be used to hedge foreign exchange rate risk. Some foreign issuer bonds are called by their nicknames, such as the "samurai bond". These can be issued by foreign issuers looking to diversify their investor base away from domestic markets. These bond issues are generally governed by the law of the market of issuance, e.g., a samurai bond, issued by an investor based in Europe, will be governed by Japanese law. Not all of the following bonds are restricted for purchase by investors in the market of issuance.Bond valuation

The market price of a bond is thepresent value

In economics and finance, present value (PV), also known as present discounted value (PDV), is the value of an expected income stream determined as of the date of valuation. The present value is usually less than the future value because money ha ...

of all expected future interest

In property law and real estate, a future interest is a legal right to property ownership that does not include the right to present possession or enjoyment of the property. Future interests are created on the formation of a defeasible estate; t ...

and principal payments of the bond, here discounted at the bond's yield to maturity

The yield to maturity (YTM), book yield or redemption yield of a fixed-interest security is an estimate of the total rate of return anticipated to be earned by an investor who buys it at a given market price, holds it to maturity, and receives ...

(i.e. rate of return

In finance, return is a profit on an investment. It comprises any change in value of the investment, and/or cash flows (or securities, or other investments) which the investor receives from that investment over a specified time period, such as i ...

). That relationship is the definition of the redemption yield on the bond, which is likely to be close to the current market interest rate for other bonds with similar characteristics, as otherwise there would be arbitrage

Arbitrage (, ) is the practice of taking advantage of a difference in prices in two or more marketsstriking a combination of matching deals to capitalize on the difference, the profit being the difference between the market prices at which th ...

opportunities. The yield and price of a bond are inversely related so that when market interest rates rise, bond prices fall and vice versa. For a discussion of the mathematics see Bond valuation

Bond valuation is the process by which an investor arrives at an estimate of the theoretical fair value, or intrinsic worth, of a bond. As with any security or capital investment, the theoretical fair value of a bond is the present value of the s ...

.

The bond's market price is usually expressed as a percentage of nominal value: 100% of face value, "at par", corresponds to a price of 100; prices can be above par (bond is priced at greater than 100), which is called trading at a premium, or below par (bond is priced at less than 100), which is called trading at a discount. The market price

A price is the (usually not negative) quantity of payment or compensation expected, required, or given by one party to another in return for goods or services. In some situations, especially when the product is a service rather than a phy ...

of a bond may be quoted including the accrued interest

In finance, accrued interest is the interest on a bond or loan that has accumulated since the principal investment, or since the previous coupon payment if there has been one already.

For a type of obligation such as a bond, interest is cal ...

since the last coupon date. (Some bond markets include accrued interest in the trading price and others add it on separately when settlement is made.) The price including accrued interest is known as the "full" or " dirty price". (''See also'' Accrual bond.) The price excluding accrued interest is known as the "flat" or " clean price".

Most government bonds are denominated in units of $1000 in the United States

The United States of America (USA), also known as the United States (U.S.) or America, is a country primarily located in North America. It is a federal republic of 50 U.S. state, states and a federal capital district, Washington, D.C. The 48 ...

, or in units of £100 in the United Kingdom

The United Kingdom of Great Britain and Northern Ireland, commonly known as the United Kingdom (UK) or Britain, is a country in Northwestern Europe, off the coast of European mainland, the continental mainland. It comprises England, Scotlan ...

. Hence, a deep discount US bond, selling at a price of 75.26, indicates a selling price of $752.60 per bond sold. (Often, in the US, bond prices are quoted in points and thirty-seconds of a point, rather than in decimal form.) Some short-term bonds, such as the U.S. Treasury bill, are always issued at a discount, and pay par amount at maturity rather than paying coupons. This is called a discount bond.

Although bonds are not necessarily issued at par (100% of face value, corresponding to a price of 100), their prices will move towards par as they approach maturity (if the market expects the maturity payment to be made in full and on time) as this is the price the issuer will pay to redeem the bond. This is referred to as "pull to par

Pull to Par is the effect in which the price of a bond converges to par value as time passes. At maturity the price of a debt instrument in good standing should equal its par (or face value).

Another name for this effect is reduction of matur ...

". At the time of issue of the bond, the coupon paid, and other conditions of the bond, will have been influenced by a variety of factors, such as current market interest rates, the length of the term and the creditworthiness of the issuer. These factors are likely to change over time, so the market price of a bond will vary after it is issued. (The position is a bit more complicated for inflation-linked bonds.)

The interest payment ("coupon payment") divided by the current price of the bond is called the current yield (this is the nominal yield The coupon rate (nominal rate, or nominal yield) of a fixed income security is the interest rate that the issuer agrees to pay to the security holder each year, expressed as a percentage of the security's principal amount or par value. The coupon ...

multiplied by the par value and divided by the price). There are other yield measures that exist such as the yield to first call, yield to worst, yield to first par call, yield to put, cash flow yield and yield to maturity. The relationship between yield and term to maturity (or alternatively between yield and the weighted mean term allowing for both interest and capital repayment) for otherwise identical bonds derives the yield curve

In finance, the yield curve is a graph which depicts how the Yield to maturity, yields on debt instruments – such as bonds – vary as a function of their years remaining to Maturity (finance), maturity. Typically, the graph's horizontal ...

, a graph plotting this relationship.

If the bond includes embedded option

An embedded option

is a component of a financial bond or other security, which provides the bondholder or the issuer the right to take some action against the other party. There are several types of options that can be embedded into a bond; comm ...

s, the valuation is more difficult and combines option pricing

In finance, a price (premium) is paid or received for purchasing or selling options.

The calculation of this premium will require sophisticated mathematics.

Premium components

This price can be split into two components: intrinsic value, and ...

with discounting. Depending on the type of option, the option price as calculated is either added to or subtracted from the price of the "straight" portion. See further under . This total is then the value of the bond. More sophisticated lattice- or simulation-based techniques may (also) be employed.

Bond markets, unlike stock or share markets, sometimes do not have a centralized exchange or trading system. Rather, in most developed bond markets such as the U.S., Japan and western Europe, bonds trade in decentralized, dealer-based over-the-counter

Over-the-counter (OTC) drugs are medicines sold directly to a consumer without a requirement for a prescription from a healthcare professional, as opposed to prescription drugs, which may be supplied only to consumers possessing a valid pres ...

markets. In such a market, liquidity is provided by dealers and other market participants committing risk capital to trading activity. In the bond market, when an investor buys or sells a bond, the counterparty

A counterparty (sometimes contraparty) is a Juristic person, legal entity, unincorporated entity, or collection of entities to which an exposure of financial risk may exist. The word became widely used in the 1980s, particularly at the time of the ...

to the trade is almost always a bank or securities firm acting as a dealer. In some cases, when a dealer buys a bond from an investor, the dealer carries the bond "in inventory", i.e. holds it for their own account. The dealer is then subject to risks of price fluctuation. In other cases, the dealer immediately resells the bond to another investor.

Investing in bonds

Bonds are bought and traded mostly by institutions likecentral bank

A central bank, reserve bank, national bank, or monetary authority is an institution that manages the monetary policy of a country or monetary union. In contrast to a commercial bank, a central bank possesses a monopoly on increasing the mo ...

s, sovereign wealth fund

A sovereign wealth fund (SWF), or sovereign investment fund, is a state-owned investment fund that invests in real and financial assets such as stocks, Bond (finance), bonds, real estate, precious metals, or in alternative investments such as ...

s, pension fund

A pension fund, also known as a superannuation fund in some countries, is any program, fund, or scheme which provides pension, retirement income. The U.S. Government's Social Security Trust Fund, which oversees $2.57 trillion in assets, is the ...

s, insurance companies

Insurance is a means of protection from financial loss in which, in exchange for a fee, a party agrees to compensate another party in the event of a certain loss, damage, or injury. It is a form of risk management, primarily used to protect ...

, hedge fund

A hedge fund is a Pooling (resource management), pooled investment fund that holds Market liquidity, liquid assets and that makes use of complex trader (finance), trading and risk management techniques to aim to improve investment performance and ...

s, and bank

A bank is a financial institution that accepts Deposit account, deposits from the public and creates a demand deposit while simultaneously making loans. Lending activities can be directly performed by the bank or indirectly through capital m ...

s. Insurance companies and pension funds have liabilities which essentially include fixed amounts payable on predetermined dates. They buy the bonds to match their liabilities, and may be compelled by law to do this. Most individuals who want to own bonds do so through bond fund

A bond fund or debt fund is a fund that invests in bonds, or other debt securities. Bond funds can be contrasted with stock funds and money funds. Bond funds typically pay periodic dividends that include interest payments on the fund's underlyi ...

s. Still, in the U.S., nearly 10% of all bonds outstanding are held directly by households.

The volatility of bonds (especially short and medium dated bonds) is lower than that of equities (stocks). Thus, bonds are generally viewed as safer investments than equities, but this perception is only partially correct. Bonds do suffer from less day-to-day volatility than stocks, and bonds' interest payments are sometimes higher than the general level of dividend

A dividend is a distribution of profits by a corporation to its shareholders, after which the stock exchange decreases the price of the stock by the dividend to remove volatility. The market has no control over the stock price on open on the ex ...

payments. Bonds are often liquid – it is often fairly easy for an institution to sell a large quantity of bonds without affecting the price much, which may be more difficult for equities – and the comparative certainty of a fixed interest payment twice a year and a fixed lump sum at maturity is attractive. Bondholders also enjoy a measure of legal protection: under the law of most countries, if a company goes bankrupt

Bankruptcy is a legal process through which people or other entities who cannot repay debts to creditors may seek relief from some or all of their debts. In most jurisdictions, bankruptcy is imposed by a court order, often initiated by the de ...

, its bondholders will often receive some money back (the recovery amount), whereas the company's equity stock often ends up valueless. However, bonds can also be risky but less risky than stocks:

* Fixed rate bonds are subject to ''interest rate risk

Interest rate risk is the risk that arises for bond owners from fluctuating interest rate

An interest rate is the amount of interest due per period, as a proportion of the amount lent, deposited, or borrowed (called the principal sum). The ...

'', meaning that their market prices will decrease in value when the generally prevailing interest rates rise. Since the payments are fixed, a decrease in the market price of the bond means an increase in its yield. When the market interest rate rises, the market price

A price is the (usually not negative) quantity of payment or compensation expected, required, or given by one party to another in return for goods or services. In some situations, especially when the product is a service rather than a phy ...

of bonds will fall, reflecting investors' ability to get a higher interest rate on their money elsewhere—perhaps by purchasing a newly issued bond that already features the newly higher interest rate. This does not affect the interest payments to the bondholder, so long-term investors who want a specific amount at the maturity date do not need to worry about price swings in their bonds and do not suffer from interest rate risk.

Bonds are also subject to various other risks such as call and prepayment risk, credit risk

Credit risk is the chance that a borrower does not repay a loan

In finance, a loan is the tender of money by one party to another with an agreement to pay it back. The recipient, or borrower, incurs a debt and is usually required to pay ...

, reinvestment risk

Reinvestment risk is a form of financial risk. It is primarily associated with fixed income securities (including bonds), in the form of early redemption risk and coupon reinvestment risk.

Early redemption

One form of reinvestment risk is t ...

, liquidity risk

Liquidity risk is a financial risk that for a certain period of time a given financial asset, security or commodity cannot be traded quickly enough in the market without impacting the market price.

Types

Market liquidity – An asset cannot be ...

, event risk, exchange rate risk, volatility risk

Volatility risk is the risk of an adverse change of price, due to changes in the volatility of a factor affecting that price. It usually applies to derivative instruments, and their portfolios, where the volatility of the underlying asset is a ...

, inflation risk, sovereign risk and yield curve risk. Again, some of these will only affect certain classes of investors.

Price changes in a bond will immediately affect mutual fund

A mutual fund is an investment fund that pools money from many investors to purchase Security (finance), securities. The term is typically used in the United States, Canada, and India, while similar structures across the globe include the SICAV in ...

s that hold these bonds. If the value of the bonds in their trading portfolio

Portfolio may refer to:

Objects

* Portfolio (briefcase), a type of briefcase

Collections

* Portfolio (finance), a collection of assets held by an institution or a private individual

* Artist's portfolio, a sample of an artist's work or a ...

falls, the value of the portfolio also falls. This can be damaging for professional investors such as banks, insurance companies, pension funds and asset managers (irrespective of whether the value is immediately "marked to market

Mark-to-market (MTM or M2M) or fair value accounting is accounting for the "fair value" of an asset or liability based on the current market price, or the price for similar assets and liabilities, or based on another objectively assessed "fair" ...

" or not).

If there is any chance a holder of individual bonds may need to sell their bonds and "cash out", interest rate risk

Interest rate risk is the risk that arises for bond owners from fluctuating interest rate

An interest rate is the amount of interest due per period, as a proportion of the amount lent, deposited, or borrowed (called the principal sum). The ...

could become a real problem, conversely, bonds' market prices would increase if the prevailing interest rate were to drop, as it did from 2001 through 2003. One way to quantify the interest rate risk on a bond is in terms of its duration. Efforts to control this risk are called immunization

Immunization, or immunisation, is the process by which an individual's immune system becomes fortified against an infectious agent (known as the antigen, immunogen). When this system is exposed to molecules that are foreign to the body, called ' ...

or hedging.

* Bond prices can become volatile depending on the credit rating of the issuer – for instance if the credit rating agencies

A credit rating agency (CRA, also called a ratings service) is a company that assigns credit ratings, which rate a debtor's ability to pay back debt by making timely principal and interest payments and the likelihood of default. An agency may r ...

like Standard & Poor's

S&P Global Ratings (previously Standard & Poor's and informally known as S&P) is an American credit rating agency (CRA) and a division of S&P Global that publishes financial research and analysis on stocks, bonds, and commodities. S&P is co ...

and Moody's

Moody's Ratings, previously and still legally known as Moody's Investors Service and often referred to as Moody's, is the bond credit rating business of Moody's Corporation, representing the company's traditional line of business and its histo ...

upgrade or downgrade the credit rating of the issuer. An unanticipated downgrade will cause the market price of the bond to fall. As with interest rate risk, this risk does not affect the bond's interest payments (provided the issuer does not actually default), but puts at risk the market price, which affects mutual funds holding these bonds, and holders of individual bonds who may have to sell them.

* A company's bondholders may lose much or all their money if the company goes bankrupt

Bankruptcy is a legal process through which people or other entities who cannot repay debts to creditors may seek relief from some or all of their debts. In most jurisdictions, bankruptcy is imposed by a court order, often initiated by the de ...

. Under the laws of many countries (including the United States and Canada), bondholders are in line to receive the proceeds of the sale of the assets of a liquidated company ahead of some other creditors. Bank lenders, deposit holders (in the case of a deposit taking institution such as a bank) and trade creditors may take precedence.

There is no guarantee of how much money will remain to repay bondholders. As an example, after an accounting scandal and a Chapter 11

Chapter 11 of the United States Bankruptcy Code ( Title 11 of the United States Code) permits reorganization under the bankruptcy laws of the United States. Such reorganization, known as Chapter 11 bankruptcy, is available to every business, w ...

bankruptcy at the giant telecommunications company Worldcom

MCI, Inc. (formerly WorldCom and MCI WorldCom) was a telecommunications company. For a time, it was the second-largest long-distance telephone company in the United States, after AT&T. WorldCom grew largely by acquiring other telecommunicatio ...

, in 2004 its bondholders ended up being paid 35.7 cents on the dollar. In a bankruptcy involving reorganization or recapitalization, as opposed to liquidation, bondholders may end up having the value of their bonds reduced, often through an exchange for a smaller number of newly issued bonds.

* Some bonds are callable, meaning that even though the company has agreed to make payments plus interest towards the debt for a certain period of time, the company can choose to pay off the bond early. This creates reinvestment risk

Reinvestment risk is a form of financial risk. It is primarily associated with fixed income securities (including bonds), in the form of early redemption risk and coupon reinvestment risk.

Early redemption

One form of reinvestment risk is t ...

, meaning the investor is forced to find a new place for their money, and the investor might not be able to find as good a deal, especially because this usually happens when interest rates are falling.

Bond indices

A number of bond indices exist for the purposes of managing portfolios and measuring performance, similar to theS&P 500

The Standard and Poor's 500, or simply the S&P 500, is a stock market index tracking the stock performance of 500 leading companies listed on stock exchanges in the United States. It is one of the most commonly followed equity indices and in ...

or Russell Indexes

Russell indexes are a family of global stock market indices from FTSE Russell that allow investors to track the performance of distinct market segments worldwide. Many investors use mutual funds or exchange-traded funds based on the FTSE Russell In ...

for companies' shares. The most common American benchmarks are the Bloomberg Barclays US Aggregate (ex Lehman Aggregate), Citigroup BIG The Salomon Broad Investment Grade Index (known as the Salomon BIG or Citigroup BIG) is a common American Bond index, akin to the S&P 500 for stocks, originally owned by Salomon Brothers, run by its successor, Citigroup and now by FTSE Russell. Th ...

and Merrill Lynch Domestic Master. Most indices are parts of families of broader indices that can be used to measure global bond portfolios, or may be further subdivided by maturity or sector for managing specialized portfolios.

See also

*Bond credit rating

In investment, the bond credit rating represents the credit worthiness of corporate or government bonds. The ratings are published by credit rating agencies and used by investment professionals to assess the likelihood the debt will be repaid.

C ...

* Collective action clause A collective action clause (CAC) allows a supermajority of bondholders to agree to a debt restructuring that is legally binding on all holders of the bond, including those who vote against the restructuring. Bondholders generally opposed such cla ...

* Debenture

In corporate finance, a debenture is a medium- to long-term debt instrument used by large companies to borrow money, at a fixed rate of interest. The legal term "debenture" originally referred to a document that either creates a debt or acknowle ...

* Deferred financing costs

Deferred financing costs or debt issuance costs is an accounting concept meaning costs associated with issuing debt (loans and bonds), such as various fees and commissions paid to investment banks, law firms, auditors, regulators, and so on. Since ...

* GDP-linked bond

* Government bond

A government bond or sovereign bond is a form of Bond (finance), bond issued by a government to support government spending, public spending. It generally includes a commitment to pay periodic interest, called Coupon (finance), coupon payments' ...

/ Sovereign bonds

* Immunization (finance)

In finance, interest rate immunization is a portfolio management strategy designed to take advantage of the offsetting effects of interest rate risk and reinvestment risk.

In theory, immunization can be used to ensure that the value of a por ...

* Promissory note

A promissory note, sometimes referred to as a note payable, is a legal instrument (more particularly, a financing instrument and a debt instrument), in which one party (the ''maker'' or ''issuer'') promises in writing to pay a determinate sum of ...

* Short-rate model

A short-rate model, in the context of interest rate derivatives, is a mathematical model that describes the future evolution of interest rates by describing the future evolution of the short rate, usually written r_t \,.

The short rate

Under a sh ...

* Penal bond

* Structured note

A structured note is an over the counter derivative with hybrid security features which combine payoffs from multiple ordinary securities, typically a stock or bond plus a derivative.

When the product depends on a credit payoff, it is calle ...

* Syndicated lending

Market specific

* Brady Bonds

Brady bonds are United States dollar, dollar-denominated Bond (finance), bonds, issued mostly by Latin American countries in the late 1980s. The bonds were named after United States Secretary of the Treasury Nicholas F. Brady, who proposed a nov ...

* Build America Bonds

* Eurobond

General

* Fixed income

Fixed income refers to any type of investment under which the borrower or issuer is obliged to make payments of a fixed amount on a fixed schedule. For example, the borrower may have to pay interest at a fixed rate once a year and repay the pr ...

* List of accounting topics

This page is an index of accounting topics.

{{AlphanumericTOC,

align=center,

nobreak=,

numbers=,

references=,

externallinks=,

top=}

A

Accounting ethics - Accounting information system - Accounting research - Activity-Based Costing ...

* List of economics topics

* List of finance topics

A list is a set of discrete items of information collected and set forth in some format for utility, entertainment, or other purposes. A list may be memorialized in any number of ways, including existing only in the mind of the list-maker, but ...

References

External links

Estate planner victimized terminally ill

FBI

The Federal Bureau of Investigation (FBI) is the domestic Intelligence agency, intelligence and Security agency, security service of the United States and Federal law enforcement in the United States, its principal federal law enforcement ag ...

{{DEFAULTSORT:Bond (Finance)