Behavioral economics studies the effects of

psychological

Psychology is the scientific study of mind and behavior. Psychology includes the study of conscious and unconscious phenomena, including feelings and thoughts. It is an academic discipline of immense scope, crossing the boundaries between t ...

,

cognitive

Cognition refers to "the mental action or process of acquiring knowledge and understanding through thought, experience, and the senses". It encompasses all aspects of intellectual functions and processes such as: perception, attention, thought, ...

, emotional, cultural and social factors on the

decisions of individuals or institutions, such as how those decisions vary from those implied by

classical economic theory.

Behavioral economics is primarily concerned with the

bounds of

rationality

Rationality is the quality of being guided by or based on reasons. In this regard, a person acts rationally if they have a good reason for what they do or a belief is rational if it is based on strong evidence. This quality can apply to an abil ...

of

economic agents. Behavioral models typically integrate insights from psychology,

neuroscience and

microeconomic theory.

The study of behavioral economics includes how

market decisions are made and the mechanisms that drive public opinion.

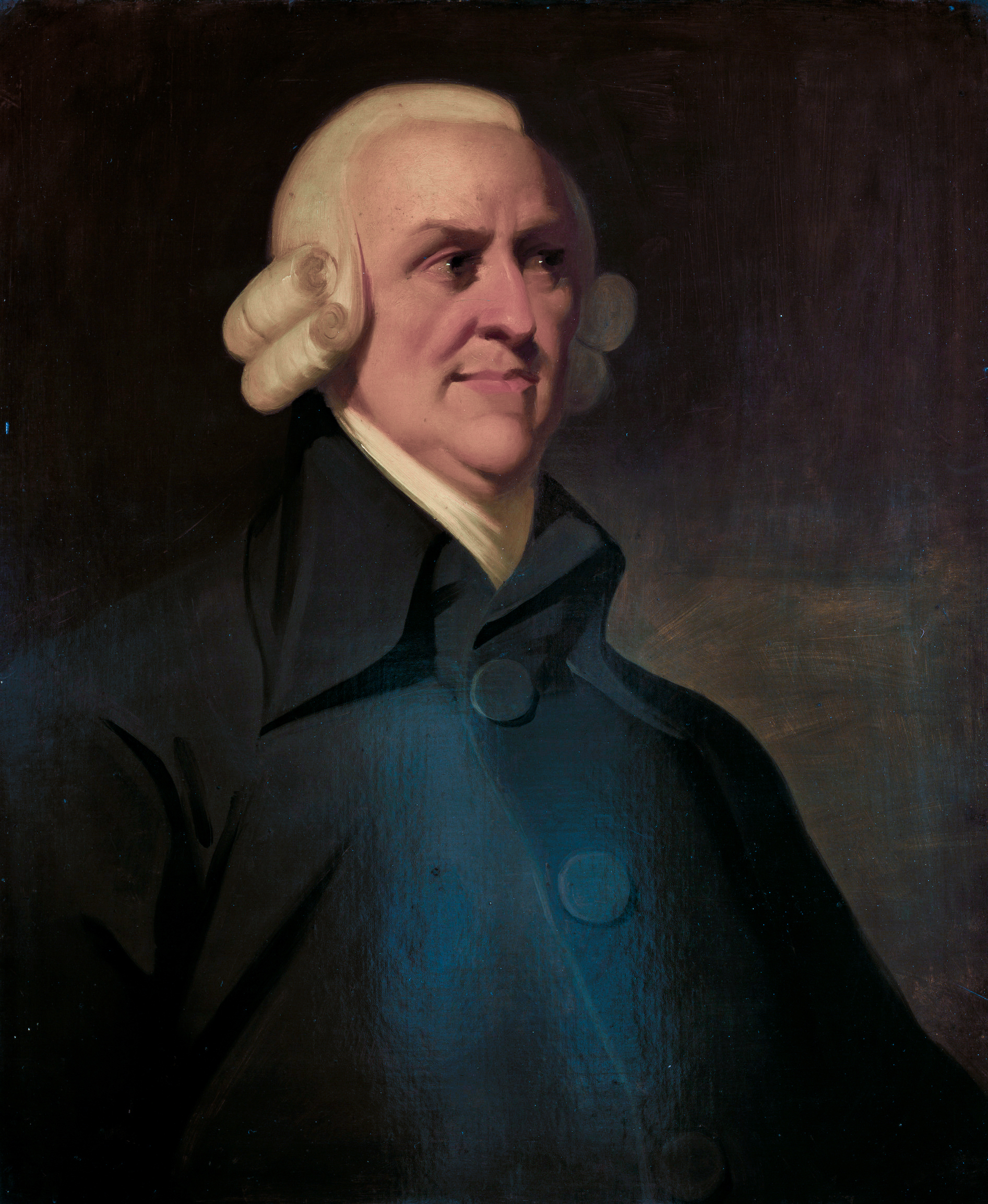

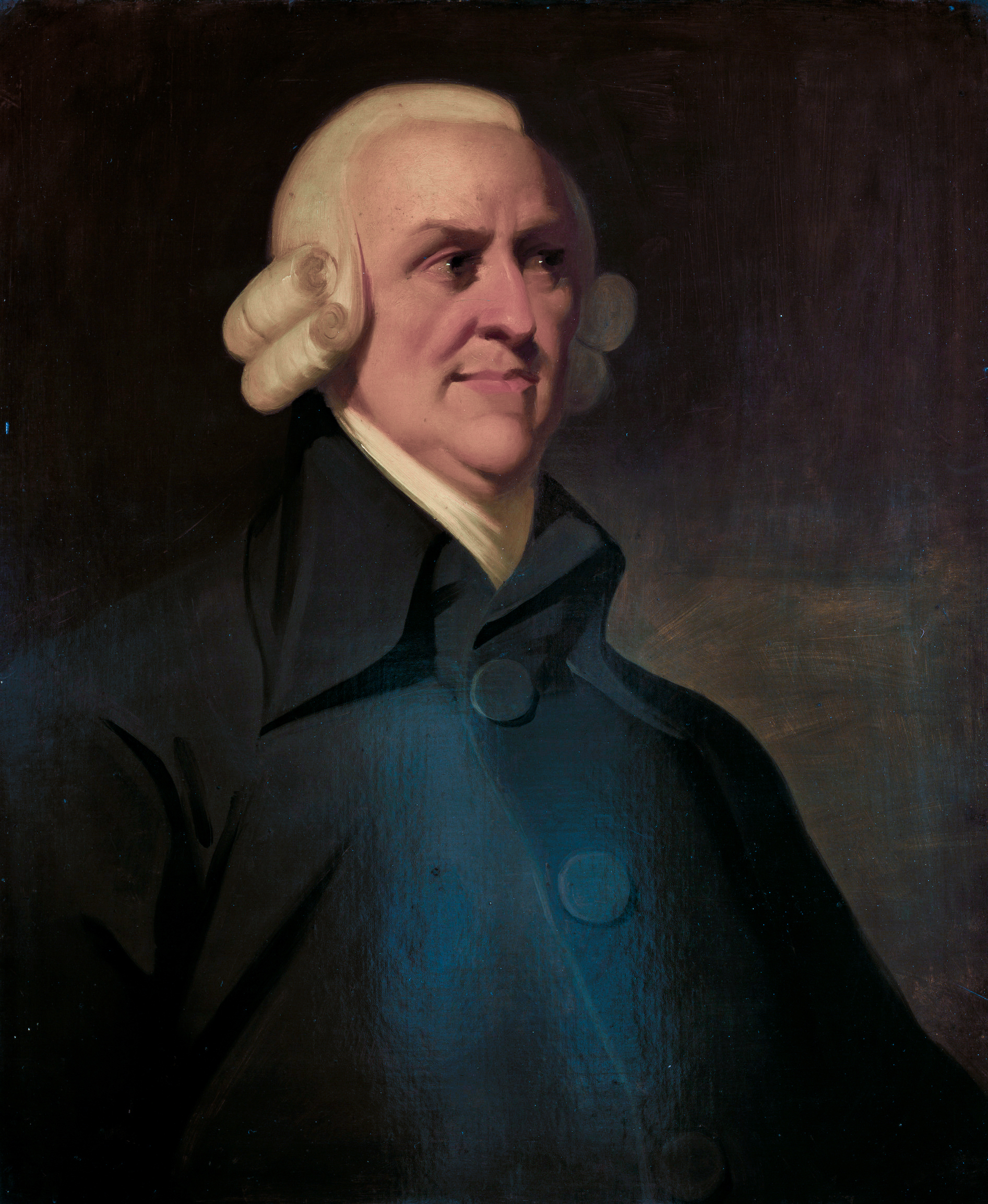

The concepts used in behavioral economics today can be traced back to 18th-century economists, such as Adam Smith, who deliberated how the economic behavior of individuals could be influenced by their desires.

The status of behavioral economics as a subfield of economics is a fairly recent development; the breakthroughs that laid the foundation for it were published through the last three decades of the 20th century.

Behavioral economics is still growing as a field, being used increasingly in research and in teaching.

History

Early

Neoclassical economists included psychological reasoning in much of their writing, though psychology at the time was not a recognized field of study.

In ''

The Theory of Moral Sentiments,'' Adam Smith wrote on concepts later popularized by modern Behavioral Economic theory, such as

loss aversion.

, another Neoclassical economist in the 1700s conceptualized

utility as a product of psychology.

Other Neoclassical economists who incorporated psychological explanations in their works included

Francis Edgeworth,

Vilfredo Pareto and

Irving Fisher

Irving Fisher (February 27, 1867 – April 29, 1947) was an American economist, statistician, inventor, eugenicist and progressive social campaigner. He was one of the earliest American neoclassical economists, though his later work on debt def ...

.

A rejection and elimination of psychology from economics by the Neoclassical school in the early 1900s brought on a period defined by a reliance on empiricism.

There was a lack of confidence in

hedonic theories, which saw pursuance of maximum benefit as an essential aspect in understanding human economic behavior.

Hedonic analysis had shown little success in predicting human behavior, leading many to question its accuracy.

There was also a fear among economists that the involvement of psychology in shaping economic models was inordinate and a departure from contemporary Neoclassical principles.

They feared that an increased emphasis on psychology would undermine the mathematic components of the field. William Peter Hamilton, ''Wall Street Journal'' editor from 1907 to 1929, wrote in ''The Stock Market Barometer:'' "We have meddled so disastrously with the law of

supply and demand

In microeconomics, supply and demand is an economic model of price determination in a Market (economics), market. It postulates that, Ceteris paribus, holding all else equal, in a perfect competition, competitive market, the unit price for a ...

that we cannot bring ourselves to the radical step of letting it alone."

To boost the ability of economics to predict accurately, economists started looking to tangible phenomena rather than theories based on human psychology.

Psychology was seen as unreliable to many of these economists as it was a new field, not regarded as sufficiently scientific.

Though a number of scholars expressed concern towards the

positivism

Positivism is an empiricist philosophical theory that holds that all genuine knowledge is either true by definition or positive—meaning ''a posteriori'' facts derived by reason and logic from sensory experience.John J. Macionis, Linda M. G ...

within economics, models of study dependent on psychological insights became rare.

Economists instead conceptualized humans as purely rational and self-interested decision makers, illustrated in the concept of ''

homo economicus.''

The re-emergence of psychology within economics that allowed for the spread of behavioral economics has been associated with the

cognitive revolution.

In the 1960s,

cognitive psychology

Cognitive psychology is the scientific study of mental processes such as attention, language use, memory, perception, problem solving, creativity, and reasoning.

Cognitive psychology originated in the 1960s in a break from behaviorism, which ...

began to shed more light on the brain as an information processing device (in contrast to

behaviorist models). Psychologists in this field, such as Ward Edwards,

Amos Tversky

Amos Nathan Tversky ( he, עמוס טברסקי; March 16, 1937 – June 2, 1996) was an Israeli cognitive and mathematical psychologist and a key figure in the discovery of systematic human cognitive bias and handling of risk.

Much of his ...

and

Daniel Kahneman

Daniel Kahneman (; he, דניאל כהנמן; born March 5, 1934) is an Israeli-American psychologist and economist notable for his work on the psychology of judgment and decision-making, as well as behavioral economics, for which he was award ...

began to compare their cognitive models of decision-making under risk and uncertainty to economic models of rational behavior. These developments spurred economists to reconsider how psychology could be applied to economic models and theories.

Concurrently, the

Expected utility hypothesis and

discounted utility models began to gain acceptance. In challenging the accuracy of generic utility, these concepts established a practice foundational in behavioral economics: Building on standard models by applying psychological knowledge.

reflects a longstanding interest in preference transitivity and the measurement of utility.

Development of Behavioral Economics

In 2017, Niels Geiger, a lecturer in economics at the

University of Hohenheim conducted an investigation into the proliferation of behavioral economics.

Geiger's research looked at studies that had quantified the frequency of references to terms specific to behavioral economics, and how often influential papers in behavioral economics were cited in journals on economics.

The quantitative study found that there was a significant spread in behavioral economics after Kahneman and Tversky's work in the 1990s and into the 2000s.

Bounded rationality

Bounded rationality

Bounded rationality is the idea that rationality is limited when individuals make decisions, and under these limitations, rational individuals will select a decision that is satisfactory rather than optimal.

Limitations include the difficulty of ...

is the idea that when individuals make decisions, their

rationality

Rationality is the quality of being guided by or based on reasons. In this regard, a person acts rationally if they have a good reason for what they do or a belief is rational if it is based on strong evidence. This quality can apply to an abil ...

is limited by the tractability of the decision problem, their cognitive limitations and the time available. Decision-makers in this view act as

satisficers, seeking a satisfactory solution rather than an optimal one.

Herbert A. Simon proposed bounded rationality as an alternative basis for the mathematical modeling of

decision-making

In psychology, decision-making (also spelled decision making and decisionmaking) is regarded as the Cognition, cognitive process resulting in the selection of a belief or a course of action among several possible alternative options. It could be ...

. It complements "rationality as optimization", which views decision-making as a fully rational process of finding an optimal choice given the information available.

Simon used the analogy of a pair of scissors, where one blade represents human cognitive limitations and the other the "structures of the environment", illustrating how minds compensate for limited resources by exploiting known structural regularity in the environment.

Bounded rationality implicates the idea that humans take shortcuts that may lead to suboptimal decision-making. Behavioral economists engage in mapping the decision shortcuts that agents use in order to help increase the effectiveness of human decision-making. Bounded rationality finds that actors do not assess all available options appropriately, in order to save on search and deliberation costs. As such decisions are not always made in the sense of greatest self-reward as limited information is available. Instead agents shall choose to settle for an acceptable solution. One treatment of this idea comes from

Cass Sunstein

Cass Robert Sunstein (born September 21, 1954) is an American legal scholar known for his studies of constitutional law, administrative law, environmental law, law and behavioral economics. He is also ''The New York Times'' best-selling author of ...

and

Richard Thaler's ''

Nudge''.

Sunstein and Thaler recommend that choice architectures are modified in light of human agents' bounded rationality. A widely cited proposal from Sunstein and Thaler urges that healthier food be placed at sight level in order to increase the likelihood that a person will opt for that choice instead of less healthy option. Some critics of ''Nudge'' have lodged attacks that modifying choice architectures will lead to people becoming worse decision-makers.

Prospect theory

In 1979, Kahneman and Tversky published ''

Prospect Theory: An Analysis of Decision Under Risk'', that used cognitive psychology to explain various divergences of economic decision making from neo-classical theory. Kahneman and Tversky utilising prospect theory determined three generalisations; gains are treated differently than losses, outcomes received with certainty are overweighed relative to uncertain outcomes and the structure of the problem may affect choices. These arguments were proven in part by altering a survey question so that it was no longer a case of achieving gains but averting losses and the majority of respondents altered their answers accordingly. In essence proving that emotions such as fear of loss, or greed can alter decisions, indicating the presence of an irrational decision-making process. Prospect theory has two stages: an editing stage and an evaluation stage. In the editing stage, risky situations are simplified using various

heuristics. In the evaluation phase, risky alternatives are evaluated using various psychological principles that include:

*

Reference dependence: When evaluating outcomes, the decision maker considers a "reference level". Outcomes are then compared to the reference point and classified as "gains" if greater than the reference point and "losses" if less than the reference point.

*

Loss aversion: Losses are avoided more than equivalent gains are sought. In their 1992 paper, Kahneman and Tversky found the median coefficient of loss aversion to be about 2.25, i.e., losses hurt about 2.25 times more than equivalent gains reward.

[Abstract.](_blank)

/ref>

* Non-linear probability weighting: Decision makers overweigh small probabilities and underweigh large probabilities—this gives rise to the inverse-S shaped "probability weighting function".

* Diminishing sensitivity to gains and losses: As the size of the gains and losses relative to the reference point increase in absolute value, the marginal effect on the decision maker's utility or satisfaction falls.

Prospect theory is able to explain everything that the two main existing decision theories— expected utility theory and rank dependent utility theory—can explain. Further, prospect theory has been used to explain phenomena that existing decision theories have great difficulty in explaining. These include backward bending labor supply curves, asymmetric price elasticities, tax evasion and co-movement of stock prices and consumption.

In 1992, in the ''Journal of Risk and Uncertainty'', Kahneman and Tversky gave a revised account of prospect theory that they called cumulative prospect theory.overconfidence

Confidence is a state of being clear-headed either that a hypothesis or prediction is correct or that a chosen course of action is the best or most effective. Confidence comes from a Latin word 'fidere' which means "to trust"; therefore, having ...

, projection bias, and the effects of limited attention are now part of the theory. Other developments include a conference at the University of Chicago, a special behavioral economics edition of the '' Quarterly Journal of Economics'' ("In Memory of Amos Tversky"), and Kahneman's 2002 Nobel Prize for having "integrated insights from psychological research into economic science, especially concerning human judgment and decision-making under uncertainty."Daniel Kahneman

Daniel Kahneman (; he, דניאל כהנמן; born March 5, 1934) is an Israeli-American psychologist and economist notable for his work on the psychology of judgment and decision-making, as well as behavioral economics, for which he was award ...

further expanded upon the effect cognitive ability and processes have on decision making in his book Thinking, Fast and Slow Kahneman delved into two forms of thought, fast thinking which he considered "operates automatically and quickly, with little or no effort and no sense of voluntary control". Conversely, slow thinking is the allocation of cognitive ability, choice and concentration. Fast thinking utilises heuristics, which is a decision-making process that undertakes shortcuts, and rules of thumb to provide an immediate but often irrational and imperfect solution. Kahneman proposed that the result of the shortcuts is the occurrence of a number of biases such as hindsight bias, confirmation bias and outcome bias among others. A key example of fast thinking and the resultant irrational decisions is the 2008 financial crisis.

Nudge theory

Nudge is a concept in behavioral science, political theory

Political philosophy or political theory is the philosophical study of government, addressing questions about the nature, scope, and legitimacy of public agents and institutions and the relationships between them. Its topics include politics, l ...

and economics which proposes positive reinforcement and indirect suggestions as ways to influence the behavior and decision making

In psychology, decision-making (also spelled decision making and decisionmaking) is regarded as the cognitive process resulting in the selection of a belief or a course of action among several possible alternative options. It could be either rati ...

of groups or individuals—in other words, it's "a way to manipulate people's choices to lead them to make specific decisions".cybernetics

Cybernetics is a wide-ranging field concerned with circular causality, such as feedback, in regulatory and purposive systems. Cybernetics is named after an example of circular causal feedback, that of steering a ship, where the helmsperson m ...

by James Wilk before 1995 and described by Brunel University academic D. J. Stewart as "the art of the nudge" (sometimes referred to as micronudges). It also drew on methodological influences from clinical psychotherapy

Psychotherapy (also psychological therapy, talk therapy, or talking therapy) is the use of psychological methods, particularly when based on regular personal interaction, to help a person change behavior, increase happiness, and overcome pro ...

tracing back to Gregory Bateson

Gregory Bateson (9 May 1904 – 4 July 1980) was an English anthropologist, social scientist, linguist, visual anthropologist, semiotician, and cyberneticist whose work intersected that of many other fields. His writings include '' Steps to an ...

, including contributions from Milton Erickson, Watzlawick, Weakland and Fisch, and Bill O'Hanlon. In this variant, the nudge is a microtargeted design geared towards a specific group of people, irrespective of the scale of intended intervention.

In 2008, Richard Thaler and Cass Sunstein

Cass Robert Sunstein (born September 21, 1954) is an American legal scholar known for his studies of constitutional law, administrative law, environmental law, law and behavioral economics. He is also ''The New York Times'' best-selling author of ...

's book '' Nudge: Improving Decisions About Health, Wealth, and Happiness'' brought nudge theory to prominence.Office of Information and Regulatory Affairs

The Office of Information and Regulatory Affairs (OIRA ) is a Division within the Office of Management and Budget (OMB), which in turn, is within the Executive Office of the President. OIRA oversees the implementation of government-wide policie ...

.Cabinet Office

The Cabinet Office is a department of His Majesty's Government responsible for supporting the prime minister and Cabinet. It is composed of various units that support Cabinet committees and which co-ordinate the delivery of government objecti ...

, headed by David Halpern. In addition, th

Penn Medicine Nudge Unit

is the world's first behavioral design team embedded within a health system.

Both Prime Minister David Cameron

David William Donald Cameron (born 9 October 1966) is a British former politician who served as Prime Minister of the United Kingdom from 2010 to 2016 and Leader of the Conservative Party from 2005 to 2016. He previously served as Leader o ...

and President Barack Obama sought to employ nudge theory to advance domestic policy goals during their terms.

In Australia, the government of New South Wales established a Behavioural Insights community of practice.

Nudge theory has also been applied to business management and corporate culture, such as in relation to health, safety and environment (HSE) and human resources. Regarding its application to HSE, one of the primary goals of nudge is to achieve a "zero accident culture".

Leading Silicon Valley companies are forerunners in applying nudge theory in a corporate setting. These companies are using nudges in various forms to increase the productivity and happiness of employees. Recently, further companies are gaining interest in using what is called "nudge management" to improve the productivity of their white-collar workers.

Behavioral insights and nudges are currently used in many countries around the world.

Criticisms

Citing the example of restaurant hygiene ratings to 'nudge' consumers towards food safety, it has been argued that mere public disclosure of ratings is not always sufficient to ensure public health safety, with strong variance in effectiveness from country to country.

Tammy Boyce, from public health foundation The King's Fund, has said: "We need to move away from short-term, politically motivated initiatives such as the 'nudging people' idea, which is not based on any good evidence and doesn't help people make long-term behaviour changes."

Cass Sunstein has responded to critiques at length in his ''The Ethics of Influence'' making the case in favor of nudging against charges that nudges diminish autonomy, threaten dignity, violate liberties, or reduce welfare. Ethicists have debated this rigorously. These charges have been made by various participants in the debate from Bovens to Goodwin. Wilkinson for example charges nudges for being manipulative, while others such as Yeung question their scientific credibility.

Some, such as Hausman & Welch have inquired whether nudging should be permissible on grounds of ( distributive) justice; Lepenies & Malecka have questioned whether nudges are compatible with the rule of law. Similarly, legal scholars have discussed the role of nudges and the law.

Behavioral economists such as Bob Sugden have pointed out that the underlying normative benchmark of nudging is still homo economicus, despite the proponents' claim to the contrary.

It has been remarked that nudging is also a euphemism

A euphemism () is an innocuous word or expression used in place of one that is deemed offensive or suggests something unpleasant. Some euphemisms are intended to amuse, while others use bland, inoffensive terms for concepts that the user wishes ...

for psychological manipulation as practiced in social engineering Social engineering may refer to:

* Social engineering (political science), a means of influencing particular attitudes and social behaviors on a large scale

* Social engineering (security), obtaining confidential information by manipulating and/or ...

.

There exists an anticipation and, simultaneously, implicit criticism of the nudge theory in works of Hungarian social psychologists who emphasize the active participation in the nudge of its target (Ferenc Merei and Laszlo Garai

Behavioral economics concepts

Conventional economics assumes that all people are both rational and selfish. In practice, this is often not the case, which leads to the failure of traditional models. Behavioral economics studies the biases, tendencies and heuristics that affect the decisions that people make to improve, tweak or overhaul traditional economic theory. It aids in determining whether people make good or bad choices and whether they could be helped to make better choices. It can be applied both before and after a decision is made.

Search heuristics

Before a decision is made, there needs to be a minimum of two options. Behavioral economics employs search heuristics to explain how a person may evaluate their options. Search heuristics is a school of thought that suggests that when making a choice, it is costly to gain information about options and that methods exist to maximise the utility that one might get from searching for information. While each heuristic is not wholistic in its explanation of the search process alone, a combination of these heuristics may be used in the decision-making process. There are three primary search heuristics.

Satisficing

Satisficing is the idea that there is some minimum requirement from the search and once that has been met, stop searching. Following the satisficing heuristic a person may not necessarily acquire the most optimal product (i.e. the one that would grant them the most utility), but would find one that is "good enough". This heuristic may be problematic if the aspiration level is set at such a level that no products exist that could meet the requirements.

Directed cognition

Directed cognition is a search heuristic in which a person treats each opportunity to research information as their last. Rather than a contingent plan that indicates what will be done based on the results of each search, directed cognition considers only if one more search should be conducted and what alternative should be researched.

Elimination by aspects

Whereas satisficing and directed cognition compare choices, elimination by aspects compares certain qualities. A person using the elimination by aspects heuristic first chooses the quality that they value most in what they are searching for and sets an aspiration level. This may be repeated to refine the search. i.e. identify the second most valued quality and set an aspiration level. Using this heuristic, options will be eliminated as they fail to meet the minimum requirements of the chosen qualities.

Heuristics and cognitive effects

Outside of searching, behavioral economists and psychologists have identified a number of other heuristics and other cognitive effects that affect people's decision making. Some of these include:

Mental accounting

Mental accounting refers to the propensity to allocate resources for specific purposes. Mental accounting is a behavioral bias that causes one to separate money into different categories known as mental accounts either based on the source or the intention of the money.

Anchoring

Anchoring

An anchor is a device, normally made of metal , used to secure a vessel to the bed of a body of water to prevent the craft from drifting due to wind or current. The word derives from Latin ''ancora'', which itself comes from the Greek ἄγ ...

describes when people have a mental reference point with which they compare results to. For example, a person who anticipates that the weather on a particular day would be raining, but finds that on the day it is actually clear blue skies, would gain more utility from the pleasant weather because they anticipated that it would be bad.

Herd behavior

This is a relatively simple bias that reflects the tendency of people to mimic what everyone else is doing and follow the general consensus. It represents the concept of "wisdom of the crowd".

Framing effects

The framing effect is when individuals are presented with the same set of choices, but the choices are framed in a different manner, and this leads to different choices. In other words, individuals choose differently depending on the way questions are presented to them. People tend to have little control over their susceptibility to the framing effect as often, their choice-making process is based on intuition.

Biases and fallacies

While heuristics are tactics or mental shortcuts to aid in the decision-making process, people are also affected by a number of biases and fallacies. Behavioral economics identifies a number of these biases that negatively affect decision making such as:

Present bias

Present bias

Present bias is the tendency to rather settle for a smaller present reward than to wait for a larger future reward, in a trade-off situation. It describes the trend of overvaluing immediate rewards, while putting less worth in long-term consequence ...

reflects the human tendency to want rewards sooner. It describes people who are more likely to forego a greater payoff in the future in favour of receiving a smaller benefit sooner. An example of this is a smoker who is trying to quit. Although they know that in the future they will suffer health consequences, the immediate gain from the nicotine hit is more favourable to a person affected by present bias. Present bias is commonly split into people who are aware of their present bias (sophisticated) and those who are not (naive).

Gambler's fallacy

The gambler's fallacy stems from law of small numbers. It is when an individual believes that an event that has occurred frequently in the past is less likely to occur in the future, despite the probability remaining constant. For example, if a coin had been flipped three times and turned up heads every single time, a person influenced by the gambler's fallacy would predict that the next one ought to be tails because of the abnormal number of heads flipped in the past, even though the probability of a heads occurring is still 50%.

Hot hand fallacy

The hot hand fallacy is the opposite of the gambler's fallacy. It is when an individual believes that an event that has occurred frequently in the past is more likely to occur again in the future such that the streak will continue. This fallacy is particularly common within sport. For example, if a football team has consistently won the last few games they have participated in, then it is often said that they are 'on form' and thus, it is expected that the football team will maintain their winning streak.Confirmation bias

Confirmation bias is the tendency to search for, interpret, favor, and recall information in a way that confirms or supports one's prior beliefs or values. People display this bias when they select information that supports their views, ignoring ...

reflects the tendency to positively favour information this is consistent with one's beliefs, and to negatively favour evidence that is inconsistent with one's beliefs.

Familiarity bias

Familiarity bias simply describes the tendency of people to return to what they know and are comfortable with. Familiarity bias discourages affected people from exploring new options and may limit their ability to find an optimal solution.

Status quo bias

Status quo bias

Status quo bias is an emotional bias; a preference for the maintenance of one's current or previous state of affairs, or a preference to not undertake any action to change this current or previous state. The current baseline (or status quo) is take ...

describes the tendency of people to keep things the way they are. It is a particular aversion to change in favor of remaining comfortable with what is known.

Behavioral finance

Behavioral finance is the study of the influence of psychology on the behavior of investors or financial analysts

A financial analyst is a professional, undertaking financial analysis for external or internal clients as a core feature of the job.

The role may specifically be titled securities analyst, research analyst, equity analyst, investment analyst, ...

. It assumes that investors are not always rational, have limits to their self-control and are influenced by their own biases.systematic errors

Observational error (or measurement error) is the difference between a measured value of a quantity and its true value.Dodge, Y. (2003) ''The Oxford Dictionary of Statistical Terms'', OUP. In statistics, an error is not necessarily a " mistake ...

contrary to assumption of rational market participants.

Traditional finance

The accepted theories of finance are referred to as traditional finance. The foundation of traditional finance is associated with the modern portfolio theory (MPT) and the efficient-market hypothesis (EMH). Modern portfolio theory is a stock or portfolio's expected return, standard deviation, and its correlation with the other stocks or mutual funds held within the portfolio. With these three concepts, an efficient portfolio can be created for any group of stocks or bonds. An efficient portfolio is a group of stocks that has the maximum (highest) expected return given the amount of risk assumed, contains the lowest possible risk for a given expected return. The efficient-market hypothesis states that all information has already been reflected in a security's price or market value, and that the current price of the stock or bond always trades at its fair value. The proponents of the traditional theories believe that "investors should just own the entire market rather than attempting to outperform the market". Behavioral finance has emerged as an alternative to these theories of traditional finance and the behavioral aspects of psychology and sociology are integral catalysts within this field of study.

Evolution

The foundations of behavioral finance can be traced back over 150 years. Several original books written in the 1800s and early 1900s marked the beginning of the behavioral finance school. Originally published in 1841, MacKay's '' Extraordinary Popular Delusions and the Madness of Crowds'' presents a chronological timeline of the various panics and schemes throughout history. This work shows how group behavior applies to the financial markets of today. Le Bon's important work, '' The Crowd: A Study of the Popular Mind'', discusses the role of "crowds" (also known as crowd psychology

Crowd psychology, also known as mob psychology, is a branch of social psychology. Social psychologists have developed several theories for explaining the ways in which the psychology of a crowd differs from and interacts with that of the individ ...

) and group behavior as they apply to the fields of behavioral finance, social psychology, sociology, and history. Selden's 1912 book ''Psychology of The Stock Market'' was one of the first to apply the field of psychology directly to the stock market. This classic discusses the emotional and psychological forces at work on investors and traders in the financial markets. These three works along with several others form the foundation of applying psychology and sociology to the field of finance. The foundation of behavioral finance is an area based on an interdisciplinary approach including scholars from the social sciences and business schools. From the liberal arts perspective, this includes the fields of psychology, sociology, anthropology, economics and behavioral economics. On the business administration side, this covers areas such as management, marketing, finance, technology and accounting.

Critics contend that behavioral finance is more a collection of anomalies than a true branch of finance

Finance is the study and discipline of money, currency and capital assets. It is related to, but not synonymous with economics, the study of production, distribution, and consumption of money, assets, goods and services (the discipline of fina ...

and that these anomalies are either quickly priced out of the market or explained by appealing to market microstructure arguments. However, individual cognitive bias

A cognitive bias is a systematic pattern of deviation from norm or rationality in judgment. Individuals create their own "subjective reality" from their perception of the input. An individual's construction of reality, not the objective input, m ...

es are distinct from social biases; the former can be averaged out by the market, while the other can create positive feedback loops that drive the market further and further from a " fair price" equilibrium. It is observed that, the problem with the general area of behavioral finance is that it only serves as a complement to general economics. Similarly, for an anomaly to violate market efficiency, an investor must be able to trade against it and earn abnormal profits; this is not the case for many anomalies. A specific example of this criticism appears in some explanations of the equity premium puzzle. It is argued that the cause is entry barriers (both practical and psychological) and that the equity premium should reduce as electronic resources open up the stock market to more traders. In response, others contend that most personal investment funds are managed through superannuation funds, minimizing the effect of these putative entry barriers. In addition, professional investors and fund managers seem to hold more bonds than one would expect given return differentials.

Quantitative behavioral finance

Quantitative behavioral finance Quantitative behavioral finance is a new discipline that uses mathematical and statistical methodology to understand behavioral biases in conjunction with valuation.

The research can be grouped into the following areas:

# Empirical studies that d ...

uses mathematical and statistical methodology to understand behavioral bias

A cognitive bias is a systematic pattern of deviation from norm or rationality in judgment. Individuals create their own "subjective reality" from their perception of the input. An individual's construction of reality, not the objective input, m ...

es.

Financial models

Some financial models used in money management and asset valuation incorporate behavioral finance parameters. Examples:

* Thaler's model of price reactions to information, with three phases (underreaction, adjustment, and overreaction), creating a price trend.

:* One characteristic of overreaction is that average returns following announcements of good news is lower than following bad news. In other words, overreaction occurs if the market reacts too strongly or for too long to news, thus requiring an adjustment in the opposite direction. As a result, outperforming assets in one period is likely to underperform in the following period. This also applies to customers' irrational purchasing habits.

:* The stock image

Stock photography is the supply of photographs which are often licensed for specific uses. The stock photo industry, which began to gain hold in the 1920s, has established models including traditional macrostock photography, midstock photography ...

coefficient.

Economic reasoning in animals

A handful of comparative psychologists have attempted to demonstrate quasi-economic reasoning in non-human animals. Early attempts along these lines focus on the behavior of rats and pigeons. These studies draw on the tenets of comparative psychology, where the main goal is to discover analogs to human behavior in experimentally-tractable non-human animals. They are also methodologically similar to the work of Ferster and Skinner.behaviorism

Behaviorism is a systematic approach to understanding the behavior of humans and animals. It assumes that behavior is either a reflex evoked by the pairing of certain antecedent (behavioral psychology), antecedent stimuli in the environment, o ...

in their terminology. Although such studies are set up primarily in an operant conditioning chamber using food rewards for pecking/bar-pressing behavior, the researchers describe pecking and bar-pressing not in terms of reinforcement and stimulus-response relationships but instead in terms of work, demand, budget

A budget is a calculation play, usually but not always financial, for a defined period, often one year or a month. A budget may include anticipated sales volumes and revenues, resource quantities including time, costs and expenses, environmenta ...

, and labor. Recent studies have adopted a slightly different approach, taking a more evolutionary perspective, comparing economic behavior of humans to a species of non-human primate, the capuchin monkey.

Animal studies

Many early studies of non-human economic reasoning were performed on rats and pigeons in an operant conditioning chamber. These studies looked at things like peck rate (in the case of the pigeon) and bar-pressing rate (in the case of the rat) given certain conditions of reward. Early researchers claim, for example, that response pattern (pecking/bar-pressing rate) is an appropriate analogy to human labor supply.

Labor supply

The typical laboratory environment to study labor supply in pigeons is set up as follows. Pigeons are first deprived of food. Since the animals become hungry, food becomes highly desired. The pigeons are then placed in an operant conditioning chamber and through orienting and exploring the environment of the chamber they discover that by pecking a small disk located on one side of the chamber, food is delivered to them. In effect, pecking behavior becomes reinforced, as it is associated with food. Before long, the pigeon pecks at the disk (or stimulus) regularly.

In this circumstance, the pigeon is said to "work" for the food by pecking. The food, then, is thought of as the currency. The value of the currency can be adjusted in several ways, including the amount of food delivered, the rate of food delivery and the type of food delivered (some foods are more desirable than others).

Economic behavior similar to that observed in humans is discovered when the hungry pigeons stop working/work less when the reward is reduced. Researchers argue that this is similar to labor supply behavior in humans. That is, like humans (who, even in need, will only work so much for a given wage), the pigeons demonstrate decreases in pecking (work) when the reward (value) is reduced.

Demand

In human economics, a typical demand curve

In economics, a demand curve is a graph depicting the relationship between the price of a certain commodity (the ''y''-axis) and the quantity of that commodity that is demanded at that price (the ''x''-axis). Demand curves can be used either for ...

has negative slope. This means that as the price of a certain good increase, the amount that consumers are willing and able to purchase decreases. Researchers studying the demand curves of non-human animals, such as rats, also find downward slopes.

Researchers have studied demand in rats in a manner distinct from studying labor supply in pigeons. Specifically, in an operant conditioning chamber containing rats as experimental subjects, we require them to press a bar, instead of pecking a small disk, to receive a reward. The reward can be food (reward pellets), water, or a commodity drink such as cherry cola. Unlike in previous pigeon studies, where the work analog was pecking and the monetary analog was a reward, the work analog in this experiment is bar-pressing. Under these circumstances, the researchers claim that changing the number of bar presses required to obtain a commodity item is analogous to changing the price of a commodity item in human economics.

Applied issues

Intertemporal choice

Behavioral economics has been applied to intertemporal choice, which is defined as making a decision and having the effects of such decision happening in a different time. Intertemporal choice behavior is largely inconsistent, as exemplified by George Ainslie's hyperbolic discounting—one of the prominently studied observations—and further developed by David Laibson, Ted O'Donoghue and

Behavioral economics has been applied to intertemporal choice, which is defined as making a decision and having the effects of such decision happening in a different time. Intertemporal choice behavior is largely inconsistent, as exemplified by George Ainslie's hyperbolic discounting—one of the prominently studied observations—and further developed by David Laibson, Ted O'Donoghue and Matthew Rabin

Matthew Joel Rabin (born December 27, 1963) is the Pershing Square Professor of Behavioral Economics in the Harvard Economics Department and Harvard Business School. Rabin's research focuses primarily on incorporating psychologically more realist ...

. Hyperbolic discounting describes the tendency to discount outcomes in the near future more than outcomes in the far future. This pattern of discounting is dynamically inconsistent (or time-inconsistent), and therefore inconsistent with basic models of rational choice, since the rate of discount between time ''t'' and ''t+1'' will be low at time ''t-1'' when ''t'' is the near future, but high at time ''t'' when ''t'' is the present and time ''t+1'' is the near future.

This pattern can also be explained through models of sub-additive discounting that distinguish the delay and interval of discounting: people are less patient (per-time-unit) over shorter intervals regardless of when they occur.

Behavioral game theory

Behavioral game theory, invented by Colin Camerer, analyzes interactive strategic

Strategy (from Greek στρατηγία ''stratēgia'', "art of troop leader; office of general, command, generalship") is a general plan to achieve one or more long-term or overall goals under conditions of uncertainty. In the sense of the "art ...

decisions and behavior using the methods of game theory

Game theory is the study of mathematical models of strategic interactions among rational agents. Myerson, Roger B. (1991). ''Game Theory: Analysis of Conflict,'' Harvard University Press, p.&nbs1 Chapter-preview links, ppvii–xi It has appli ...

, experimental economics, and experimental psychology

Experimental psychology refers to work done by those who apply experimental methods to psychological study and the underlying processes. Experimental psychologists employ human participants and animal subjects to study a great many topics, in ...

. Experiments include testing deviations from typical simplifications of economic theory such as the independence axiom

The independence of irrelevant alternatives (IIA), also known as binary independence or the independence axiom, is an axiom of decision theory and various social sciences. The term is used in different connotation in several contexts. Although it ...

and neglect of altruism

Altruism is the principle and moral practice of concern for the welfare and/or happiness of other human beings or animals, resulting in a quality of life both material and spiritual. It is a traditional virtue in many cultures and a core as ...

, fairness, and framing effects. On the positive side, the method has been applied to interactive learning and social preferences. As a research program, the subject is a development of the last three decades.

Artificial intelligence

Much of the decisions are more and more made either by human beings with the assistance of artificial intelligent machines or wholly made by these machines. Tshilidzi Marwala and Evan Hurwitz in their book,game theory

Game theory is the study of mathematical models of strategic interactions among rational agents. Myerson, Roger B. (1991). ''Game Theory: Analysis of Conflict,'' Harvard University Press, p.&nbs1 Chapter-preview links, ppvii–xi It has appli ...

, Lewis turning point, portfolio optimization and counterfactual thinking.

Other areas of research

Other branches of behavioral economics enrich the model of the utility function without implying inconsistency in preferences. Ernst Fehr, Armin Falk

Armin Falk (born 18 January 1968) is a German economist. He has held a chair at the University of Bonn since 2003.

Biography

Education and career

Falk studied economics as well as philosophy and history at the University of Cologne. In 1998 ...

, and Rabin studied fairness, inequity aversion and reciprocal altruism, weakening the neoclassical assumption of perfect selfishness. This work is particularly applicable to wage setting. The work on "intrinsic motivation by Uri Gneezy and Aldo Rustichini and "identity" by George Akerlof and Rachel Kranton assumes that agents derive utility from adopting personal and social norms in addition to conditional expected utility. According to Aggarwal, in addition to behavioral deviations from rational equilibrium, markets are also likely to suffer from lagged responses, search costs, externalities of the commons, and other frictions making it difficult to disentangle behavioral effects in market behavior.

"Conditional expected utility" is a form of reasoning where the individual has an illusion of control, and calculates the probabilities of external events and hence their utility as a function of their own action, even when they have no causal ability to affect those external events.

Behavioral economics caught on among the general public with the success of books such as Dan Ariely's '' Predictably Irrational.'' Practitioners of the discipline have studied quasi-public policy topics such as broadband mapping.AGM postulates Belief revision is the process of changing beliefs to take into account a new piece of information. The logical formalization of belief revision is researched in philosophy, in databases, and in artificial intelligence for the design of rational ...

proposed by Alchourrón, Gärdenfors, and Makinson—the formalization of the concepts of beliefs and change for rational entities—in a symbolic logic

Mathematical logic is the study of formal logic within mathematics. Major subareas include model theory, proof theory, set theory, and recursion theory. Research in mathematical logic commonly addresses the mathematical properties of formal ...

to create a "machine learning and deduction engine that uses the latest data science

Data science is an interdisciplinary field that uses scientific methods, processes, algorithms and systems to extract or extrapolate knowledge and insights from noisy, structured and unstructured data, and apply knowledge from data across a br ...

and big data

Though used sometimes loosely partly because of a lack of formal definition, the interpretation that seems to best describe Big data is the one associated with large body of information that we could not comprehend when used only in smaller am ...

algorithms in order to generate the content and conditional rules (counterfactuals) that capture customer's behaviors and beliefs."

The University of Pennsylvania's Center for Health Incentives & Behavioral Economics (CHIBE) looks at how behavioral economics can improve health outcomes. CHIBE researchers have found evidence that many behavioral economics principles (incentives, patient and clinician nudges, gamification, loss aversion, and more) can be helpful to encourage vaccine uptake, smoking cessation, medication adherence, and physical activity, for example.

Applications of behavioral economics also exist in other disciplines, for example in the area of supply chain management.

Natural experiments

From a biological point of view, human behaviors are essentially the same during crises accompanied by stock market crashes and during bubble growth when share prices exceed historic highs. During those periods, most market participants see something new for themselves, and this inevitably induces a stress response in them with accompanying changes in their endocrine profiles and motivations. The result is quantitative and qualitative changes in behavior. This is one example where behavior affecting economics and finance can be observed and variably-contrasted using behavioral economics.

Behavioral economics' usefulness applies beyond environments similar to stock exchanges. Selfish-reasoning, 'adult behaviors', and similar, can be identified within criminal-concealment(s), and legal-deficiencies and neglect of different types can be observed and discovered. Awareness of indirect consequence (or lack of), at least in potential with different experimental models and methods, can be used as well—behavioral economics' potential uses are broad, but its reliability needs scrutiny. Underestimation of the role of novelty as a stressor is the primary shortcoming of current approaches for market research. It is necessary to account for the biologically determined diphasisms of human behavior in everyday low-stress conditions and in response to stressors.

Honors and Awards

Nobel Prize

1978 - Herbert Simon

In 1978 Herbert Simon was awarded the Nobel Memorial Prize in Economic Sciences "for his pioneering research into the decision-making process within economic organizations". Simon earned his Bachelor of Arts and his Ph.D. in Political Science from the University of Chicago before going on to teach at Carnegie Tech. Herbert was praised for his work on bounded rationality

Bounded rationality is the idea that rationality is limited when individuals make decisions, and under these limitations, rational individuals will select a decision that is satisfactory rather than optimal.

Limitations include the difficulty of ...

, a challenge to the assumption that humans are rational actors.

2001 - George Akerlof, Michael Spence, and Joseph Stiglitz

The Royal Swedish Academy of Sciences stated George Akerlof, Michael Spence and Joseph Stiglitz received the Nobel Memorial Prize in Economic Sciences in 2001 "for their analyses of markets with asymmetric information."

2002 - Daniel Kahneman and Vernon L. Smith

In 2002, psychologist Daniel Kahneman

Daniel Kahneman (; he, דניאל כהנמן; born March 5, 1934) is an Israeli-American psychologist and economist notable for his work on the psychology of judgment and decision-making, as well as behavioral economics, for which he was award ...

and economist Vernon L. Smith

Vernon Lomax Smith (born January 1, 1927) is an American economist and professor of business economics and law at Chapman University. He was formerly a professor of economics at the University of Arizona, professor of economics and law at Georg ...

were awarded the Nobel Memorial Prize in Economic Sciences. Kahneman was awarded the prize "for having integrated insights from psychological research into economic science, especially concerning human judgment and decision-making under uncertainty", while Smith was awarded the prize "for having established laboratory experiments as a tool in empirical economic analysis, especially in the study of alternative market mechanisms."

2013 - Robert J. Shiller

In 2013, economist Robert J. Shiller received the Nobel Memorial Prize in Economic Sciences along with Eugene Fama and Lars Peter "for their empirical analysis of asset prices" within the field of behavioral finance, as according to the press release from the Royal Swedish Academy of Sciences.

2017 - Richard Thaler

In 2017, economist Richard Thaler was awarded the Nobel Memorial Prize in Economic Sciences for "his contributions to behavioral economics and his pioneering work in establishing that people are predictably irrational in ways that defy economic theory." Thaler was especially recognized for presenting inconsistencies in standard Economic theory and for his formulation of mental accounting and liberal paternalism.

Other Awards

1999 - Andrei Shleifer

The work of Andrei Shleifer

Andrei Shleifer ( ; born February 20, 1961) is a Russian-American economist and Professor of Economics at Harvard University, where he has taught since 1991. Shleifer was awarded the biennial John Bates Clark Medal in 1999 for his seminal works in ...

focused on behavioral finance and made observations on the limits of the efficient market hypothesis.American Economic Association

The American Economic Association (AEA) is a learned society in the field of economics. It publishes several peer-reviewed journals acknowledged in business and academia. There are some 23,000 members.

History and Constitution

The AEA was esta ...

for his work.

2001 - Matthew Rabin

Matthew Rabin

Matthew Joel Rabin (born December 27, 1963) is the Pershing Square Professor of Behavioral Economics in the Harvard Economics Department and Harvard Business School. Rabin's research focuses primarily on incorporating psychologically more realist ...

received the "genius" award from the MarArthur Foundation in 2000.present bias

Present bias is the tendency to rather settle for a smaller present reward than to wait for a larger future reward, in a trade-off situation. It describes the trend of overvaluing immediate rewards, while putting less worth in long-term consequence ...

.

2003 - Sendhil Mullainathan

Sendhil Mullainathan was the youngest of the chosen MacArthur Fellows in 2002, receiving a fellowship grant of $500,000 in 2003.

Criticism

Experimental psychological work by Kahneman and Tversky published in Armen Alchian's 1950 paper "Uncertainty, Evolution, and Economic Theory

''Uncertainty, Evolution, and Economic Theory'' is an article published in 1950 which was written by economist Armen Alchian.

In this article, Alchian delineates an evolutionary approach to describe firms’ behavior. His theory embodies principl ...

" and Gary Becker's 1962 paper "Irrational Behavior and Economic Theory", both of which were published in the ''Journal of Political Economy

The ''Journal of Political Economy'' is a monthly peer-reviewed academic journal published by the University of Chicago Press. Established by James Laurence Laughlin in 1892, it covers both theoretical and empirical economics. In the past, the ...

'',[Alchian, A. (1950). 'Uncertainty, Evolution, and Economic Theory', ''Journal of Political Economy'', 58(1), 211-221. Available at: https://www.jstor.org/stable/1827159?seq=1 (Accessed: June 9, 2021).][Becker, G. (1962). 'Irrational Behavior and Economic Theory', ''Journal of Political Economy'', 70(1), 1–13. Available at: https://www.jstor.org/stable/1827018?seq=1 (Accessed: June 9, 2021).] provide a justification for standard neoclassical economic analysis. Alchian's 1950 paper uses the logic of natural selection, stochastic processes, probability theory, and several other lines of reasoning to justify many of the results derived from standard supply analysis assuming firms which maximizing their profits, are certain about the future, and have accurate foresight without having to assume any of those things. Becker's 1962 paper shows that downward sloping market demand curves do not actually require an assumption that the consumers in that market are rational, as is claimed by behavioral economists and they also follow from a wide variety of irrational behavior as well. The two papers laid the groundwork for Richard Thaler's work.

Critics of behavioral economics typically stress the rationality

Rationality is the quality of being guided by or based on reasons. In this regard, a person acts rationally if they have a good reason for what they do or a belief is rational if it is based on strong evidence. This quality can apply to an abil ...

of economic agents. A fundamental critique is provided by Maialeh (2019) who argues that no behavioral research can establish an economic theory. Examples provided on this account include pillars of behavioral economics such as satisficing behavior or prospect theory, which are confronted from the neoclassical perspective of utility maximization and expected utility theory respectively. The author shows that behavioral findings are hardly generalizable and that they do not disprove typical mainstream axioms related to rational behavior.

Others, such as the essayist and former trader Nassim Taleb note that cognitive theories, such as prospect theory, are models of decision-making

In psychology, decision-making (also spelled decision making and decisionmaking) is regarded as the Cognition, cognitive process resulting in the selection of a belief or a course of action among several possible alternative options. It could be ...

, not generalized economic behavior, and are only applicable to the sort of once-off decision problems presented to experiment participants or survey respondents. Others argue that decision-making models, such as the endowment effect theory, that have been widely accepted by behavioral economists may be erroneously established as a consequence of poor experimental design practices that do not adequately control subject misconceptions.revealed preference

Revealed preference theory, pioneered by economist Paul Anthony Samuelson in 1938, is a method of analyzing choices made by individuals, mostly used for comparing the influence of policies on consumer behavior. Revealed preference models assume t ...

s over stated preferences (from surveys) in the determination of economic value. Experiments and surveys are at risk of systemic biases, strategic behavior and lack of incentive compatibility. Some researchers point out that participants of experiments conducted by behavioral economists are not representative enough and drawing broad conclusions on the basis of such experiments is not possible. An acronym WEIRD has been coined in order to describe the studies participants—as those who come from Western, Educated, Industrialized, Rich, and Democratic societies.

Responses

Matthew Rabin

Matthew Joel Rabin (born December 27, 1963) is the Pershing Square Professor of Behavioral Economics in the Harvard Economics Department and Harvard Business School. Rabin's research focuses primarily on incorporating psychologically more realist ...

dismisses these criticisms, countering that consistent results typically are obtained in multiple situations and geographies and can produce good theoretical insight. Behavioral economists, however, responded to these criticisms by focusing on field studies rather than lab experiments. Some economists see a fundamental schism between experimental economics and behavioral economics, but prominent behavioral and experimental economists tend to share techniques and approaches in answering common questions. For example, behavioral economists are investigating neuroeconomics, which is entirely experimental and has not been verified in the field.

The epistemological, ontological, and methodological components of behavioral economics are increasingly debated, in particular by historians of economics and economic methodologists.

According to some researchers,

Related Fields

Experimental economics

Experimental economics is the application of experimental methods, including statistical

Statistics (from German: ''Statistik'', "description of a state, a country") is the discipline that concerns the collection, organization, analysis, interpretation, and presentation of data. In applying statistics to a scientific, industria ...

, econometric, and computational, to study economic questions. Data collected in experiments are used to estimate effect size, test the validity of economic theories, and illuminate market mechanisms. Economic experiments usually use cash to motivate subjects, in order to mimic real-world incentives. Experiments are used to help understand how and why markets and other exchange systems function as they do. Experimental economics have also expanded to understand institutions and the law (experimental law and economics).

A fundamental aspect of the subject is design of experiments. Experiments may be conducted in the field or in laboratory settings, whether of individual

An individual is that which exists as a distinct entity. Individuality (or self-hood) is the state or quality of being an individual; particularly (in the case of humans) of being a person unique from other people and possessing one's own Maslow ...

or group behavior.

Variants of the subject outside such formal confines include natural and quasi-natural experiments.

Neuroeconomics

Neuroeconomics is an interdisciplinary

Interdisciplinarity or interdisciplinary studies involves the combination of multiple academic disciplines into one activity (e.g., a research project). It draws knowledge from several other fields like sociology, anthropology, psychology, ec ...

field that seeks to explain human decision making

In psychology, decision-making (also spelled decision making and decisionmaking) is regarded as the cognitive process resulting in the selection of a belief or a course of action among several possible alternative options. It could be either rati ...

, the ability to process multiple alternatives and to follow a course of action. It studies how economic behavior can shape our understanding of the brain, and how neuroscientific discoveries can constrain and guide models of economics.cognitive

Cognition refers to "the mental action or process of acquiring knowledge and understanding through thought, experience, and the senses". It encompasses all aspects of intellectual functions and processes such as: perception, attention, thought, ...

and social psychology.mathematics

Mathematics is an area of knowledge that includes the topics of numbers, formulas and related structures, shapes and the spaces in which they are contained, and quantities and their changes. These topics are represented in modern mathematics ...

.

Neuroeconomics studies decision making by using a combination of tools from these fields so as to avoid the shortcomings that arise from a single-perspective approach. In mainstream economics

Mainstream economics is the body of knowledge, theories, and models of economics, as taught by universities worldwide, that are generally accepted by economists as a basis for discussion. Also known as orthodox economics, it can be contrasted to h ...

, expected utility (EU) and the concept of rational agents are still being used. Many economic behaviors are not fully explained by these models, such as heuristics and framing.

Evolutionary psychology

An evolutionary psychology perspective states that many of the perceived limitations in rational choice can be explained as being rational in the context of maximizing biological fitness in the ancestral environment, but not necessarily in the current one. Thus, when living at subsistence level where a reduction of resources may result in death, it may have been rational to place a greater value on preventing losses than on obtaining gains. It may also explain behavioral differences between groups, such as males being less risk-averse than females since males have more variable reproductive success than females. While unsuccessful risk-seeking may limit reproductive success for both sexes, males may potentially increase their reproductive success from successful risk-seeking much more than females can.[Paul H. Rubin and C. Monica Capra. The evolutionary psychology of economics. In ]

Notable people

Economics

* George Akerlof

* Werner De Bondt

Werner F.M. De Bondt is one of the founders in the field of behavioral finance. He is also the founding director of Richard H. Driehaus Center for Behavioral Finance at DePaul University in Chicago. Previously, he was the Frank Graner Professor o ...

* Paul De Grauwe

* Linda C. Babcock

Linda C. Babcock is an American academic. She is the James M. Walton Professor of Economics and former dean at Carnegie Mellon University's Heinz College, and is the former head of the Social and Decision Sciences department. She is also the founde ...

* Douglas Bernheim

* Colin Camerer

* Armin Falk

Armin Falk (born 18 January 1968) is a German economist. He has held a chair at the University of Bonn since 2003.

Biography

Education and career

Falk studied economics as well as philosophy and history at the University of Cologne. In 1998 ...

* Urs Fischbacher

* Tshilidzi Marwala

* Susan E. Mayer

* Ernst Fehr

* Simon Gächter

Simon Gächter (born 8 March 1965 in Nenzing, Vorarlberg) is an Austrian economist. He currently is professor of the psychology of economic decision making at the University of Nottingham.

Gächter attended the University of Vienna, where he rec ...

* Uri Gneezy

* David Laibson

* Louis Lévy-Garboua

* John A. List

* George Loewenstein

* Sendhil Mullainathan

* John Quiggin

* Matthew Rabin

Matthew Joel Rabin (born December 27, 1963) is the Pershing Square Professor of Behavioral Economics in the Harvard Economics Department and Harvard Business School. Rabin's research focuses primarily on incorporating psychologically more realist ...

* Reinhard Selten

* Herbert A. Simon

* Vernon L. Smith

Vernon Lomax Smith (born January 1, 1927) is an American economist and professor of business economics and law at Chapman University. He was formerly a professor of economics at the University of Arizona, professor of economics and law at Georg ...

* Robert Sugden

* Larry Summers

* Richard Thaler

* Abhijit Banerjee

* Esther Duflo

* Kevin Volpp

Kevin G. Volpp is an American behavioral economist and Mark V. Pauly President's Distinguished Professor at the University of Pennsylvania’s Perelman School of Medicine and the Wharton School. He is the Director of the Penn Center for Health Inc ...

*Katy Milkman

Katherine L. Milkman is an American economist who is the James G. Dinan Professor at The Wharton School of the University of Pennsylvania. She is the President of the Society for Judgment and Decision Making.

Early life and education

Milkman ...

Finance

* Malcolm Baker

Malcolm P. Baker (born c. 1970) is a professor of finance, and a former Olympic rower.

Scholar athlete

Baker graduated from St. Albans School and began rowing at Brown University. As a Freshman he was on a National Championship team and he b ...

* Nicholas Barberis

* Gunduz Caginalp

* David Hirshleifer

* Andrew Lo

* Michael Mauboussin

* Terrance Odean

Terrance Odean (born c. 1950) is the Rudd Family Foundation Professor and Chair of the Finance Group at the Haas School of Business, University of California, Berkeley. He is known for his work on behavioral finance.

After dropping out of Carle ...

* Richard L. Peterson

Richard L. Peterson is an American behavioral economist and psychiatrist.

He has developed behavioral finance-based quantitative models, imaged the brains of test subjects while play-trading, and is a writer and consultant in the psychology of fin ...

* Charles Plott

Charles Raymond Plott (born July 8, 1938) is an American economist. He currently is Edward S. Harkness Professor of Economics and Political Science at the California Institute of Technology, Director, Laboratory for Experimental Economics and Polit ...

* Robert Prechter

* Hersh Shefrin

* Robert Shiller

* Andrei Shleifer

Andrei Shleifer ( ; born February 20, 1961) is a Russian-American economist and Professor of Economics at Harvard University, where he has taught since 1991. Shleifer was awarded the biennial John Bates Clark Medal in 1999 for his seminal works in ...

* Robert Vishny

Robert Ward Vishny (born c. 1959) is an American economist and is the Myron S. Scholes Distinguished Service Professor of Finance at the University of Chicago Booth School of Business. He was the Eric J. Gleacher Distinguished Service Professor o ...

Psychology

* George Ainslie

* Dan Ariely

* Ed Diener

* Ward Edwards

* Laszlo Garai

* Gerd Gigerenzer

* Daniel Kahneman

Daniel Kahneman (; he, דניאל כהנמן; born March 5, 1934) is an Israeli-American psychologist and economist notable for his work on the psychology of judgment and decision-making, as well as behavioral economics, for which he was award ...

* Ariel Kalil

* George Katona

* Walter Mischel

* Drazen Prelec

Drazen Prelec (born 1955 in Yugoslavia) is a professor of management science and economics in the MIT Sloan School of Management, and holds appointments in the Department of Economics and in the Department of Brain and Cognitive Sciences at MIT ...

* Eldar Shafir

Eldar Shafir (Hebrew: אלדר שפיר) is an American behavioral scientist, and the co-author of '' Scarcity: Why Having Too Little Means So Much'' (with Sendhil Mullainathan). He is the Class of 1987 Professor in Behavioral Science and Public P ...

* Paul Slovic

* John StaddonAmos Tversky

Amos Nathan Tversky ( he, עמוס טברסקי; March 16, 1937 – June 2, 1996) was an Israeli cognitive and mathematical psychologist and a key figure in the discovery of systematic human cognitive bias and handling of risk.

Much of his ...

* Moran Cerf

Moran Cerf is am American-French-Israeli neuroscientist, professor of business (at the Kellogg School of Management at Northwestern University), investor and former white hat hacker.

He is the founder of Think-Alike and B-Cube and the host and ...

See also

* Adaptive market hypothesis

* Animal Spirits (Keynes)

Animal spirits is a term used by John Maynard Keynes in his 1936 book ''The General Theory of Employment, Interest and Money'' to describe the instincts, proclivities and emotions that ostensibly influence and guide human behavior, and which can ...

* Behavioralism

* Behavioral operations research

* Behavioral Strategy

* Big Five personality traits

* Confirmation bias

Confirmation bias is the tendency to search for, interpret, favor, and recall information in a way that confirms or supports one's prior beliefs or values. People display this bias when they select information that supports their views, ignoring ...

* Cultural economics

* Culture change

* Economic sociology

* Emotional bias

* Fuzzy-trace theory

* Hindsight bias

* '' Homo reciprocans''

* Important publications in behavioral economics

* List of cognitive biases

Cognitive biases are systematic patterns of deviation from norm and/or rationality in judgment. They are often studied in psychology, sociology and behavioral economics.

Although the reality of most of these biases is confirmed by reproducible ...

* Methodological individualism

* Nudge theory

* Observational techniques

* Praxeology

* Priority heuristic

* Regret theory

* Repugnancy costs

* Socioeconomics

* Socionomics

References

Citations

Sources

*

*

*

*

*

*

*

*

**

**

**

**

*

*

*

*

*

*

*

*

*

*

Description

*

* Chapter-previe

links

*

*

*

Description

*

*

*

*

*

*

The Behavioral Economics GuideOverview of Behavioral FinanceThe Institute of Behavioral FinanceStirling Behavioural Science Blog

of the Stirling Behavioural Science Centre at University of Stirling

Society for the Advancement of Behavioural EconomicsBehavioral Economics: Past, Present, Future

– Colin F. Camerer and George Loewenstein

A History of Behavioural Finance / Economics in Published Research: 1944–1988MSc Behavioural Economics

MSc in Behavioural Economics at the University of Essex

{{Authority control

Behavioral finance

Financial economics

Market trends

Microeconomics

Prospect theory

Behavioral economics studies the effects of

Behavioral economics studies the effects of  Early Neoclassical economists included psychological reasoning in much of their writing, though psychology at the time was not a recognized field of study. In '' The Theory of Moral Sentiments,'' Adam Smith wrote on concepts later popularized by modern Behavioral Economic theory, such as loss aversion. Jeremy Benthham, another Neoclassical economist in the 1700s conceptualized utility as a product of psychology. Other Neoclassical economists who incorporated psychological explanations in their works included Francis Edgeworth, Vilfredo Pareto and

Early Neoclassical economists included psychological reasoning in much of their writing, though psychology at the time was not a recognized field of study. In '' The Theory of Moral Sentiments,'' Adam Smith wrote on concepts later popularized by modern Behavioral Economic theory, such as loss aversion. Jeremy Benthham, another Neoclassical economist in the 1700s conceptualized utility as a product of psychology. Other Neoclassical economists who incorporated psychological explanations in their works included Francis Edgeworth, Vilfredo Pareto and

In 1979, Kahneman and Tversky published '' Prospect Theory: An Analysis of Decision Under Risk'', that used cognitive psychology to explain various divergences of economic decision making from neo-classical theory. Kahneman and Tversky utilising prospect theory determined three generalisations; gains are treated differently than losses, outcomes received with certainty are overweighed relative to uncertain outcomes and the structure of the problem may affect choices. These arguments were proven in part by altering a survey question so that it was no longer a case of achieving gains but averting losses and the majority of respondents altered their answers accordingly. In essence proving that emotions such as fear of loss, or greed can alter decisions, indicating the presence of an irrational decision-making process. Prospect theory has two stages: an editing stage and an evaluation stage. In the editing stage, risky situations are simplified using various heuristics. In the evaluation phase, risky alternatives are evaluated using various psychological principles that include:

* Reference dependence: When evaluating outcomes, the decision maker considers a "reference level". Outcomes are then compared to the reference point and classified as "gains" if greater than the reference point and "losses" if less than the reference point.

* Loss aversion: Losses are avoided more than equivalent gains are sought. In their 1992 paper, Kahneman and Tversky found the median coefficient of loss aversion to be about 2.25, i.e., losses hurt about 2.25 times more than equivalent gains reward.Abstract.

In 1979, Kahneman and Tversky published '' Prospect Theory: An Analysis of Decision Under Risk'', that used cognitive psychology to explain various divergences of economic decision making from neo-classical theory. Kahneman and Tversky utilising prospect theory determined three generalisations; gains are treated differently than losses, outcomes received with certainty are overweighed relative to uncertain outcomes and the structure of the problem may affect choices. These arguments were proven in part by altering a survey question so that it was no longer a case of achieving gains but averting losses and the majority of respondents altered their answers accordingly. In essence proving that emotions such as fear of loss, or greed can alter decisions, indicating the presence of an irrational decision-making process. Prospect theory has two stages: an editing stage and an evaluation stage. In the editing stage, risky situations are simplified using various heuristics. In the evaluation phase, risky alternatives are evaluated using various psychological principles that include:

* Reference dependence: When evaluating outcomes, the decision maker considers a "reference level". Outcomes are then compared to the reference point and classified as "gains" if greater than the reference point and "losses" if less than the reference point.

* Loss aversion: Losses are avoided more than equivalent gains are sought. In their 1992 paper, Kahneman and Tversky found the median coefficient of loss aversion to be about 2.25, i.e., losses hurt about 2.25 times more than equivalent gains reward.Abstract. Behavioral economics has been applied to intertemporal choice, which is defined as making a decision and having the effects of such decision happening in a different time. Intertemporal choice behavior is largely inconsistent, as exemplified by George Ainslie's hyperbolic discounting—one of the prominently studied observations—and further developed by David Laibson, Ted O'Donoghue and