Devise And Bequeath on:

[Wikipedia]

[Google]

[Amazon]

A devise is the act of giving

A devise is the act of giving

Law Dictionary: all the estate I own A ''conditional bequest'' is a bequest that will be granted only if a particular event has occurred by the time of its operation. For example, a

merriam-webster.com

{{Authority control Wills and trusts

A devise is the act of giving

A devise is the act of giving real property

In English common law, real property, real estate, immovable property or, solely in the US and Canada, realty, refers to parcels of land and any associated structures which are the property of a person. For a structure (also called an Land i ...

by will

Will may refer to:

Common meanings

* Will and testament, instructions for the disposition of one's property after death

* Will (philosophy), or willpower

* Will (sociology)

* Will, volition (psychology)

* Will, a modal verb - see Shall and will

...

, traditionally referring to real property

In English common law, real property, real estate, immovable property or, solely in the US and Canada, realty, refers to parcels of land and any associated structures which are the property of a person. For a structure (also called an Land i ...

. A bequest is the act of giving property by will, usually referring to personal property

Personal property is property that is movable. In common law systems, personal property may also be called chattels or personalty. In civil law (legal system), civil law systems, personal property is often called movable property or movables—a ...

. Today, the two words are often used interchangeably due to their combination in many wills as ''devise and bequeath'', a legal doublet

A legal doublet is a standardized phrase used frequently in English legal language consisting of two or more words that are irreversible binomials and frequently synonyms, usually connected by ''and'', such as ''cease and desist''. The order of th ...

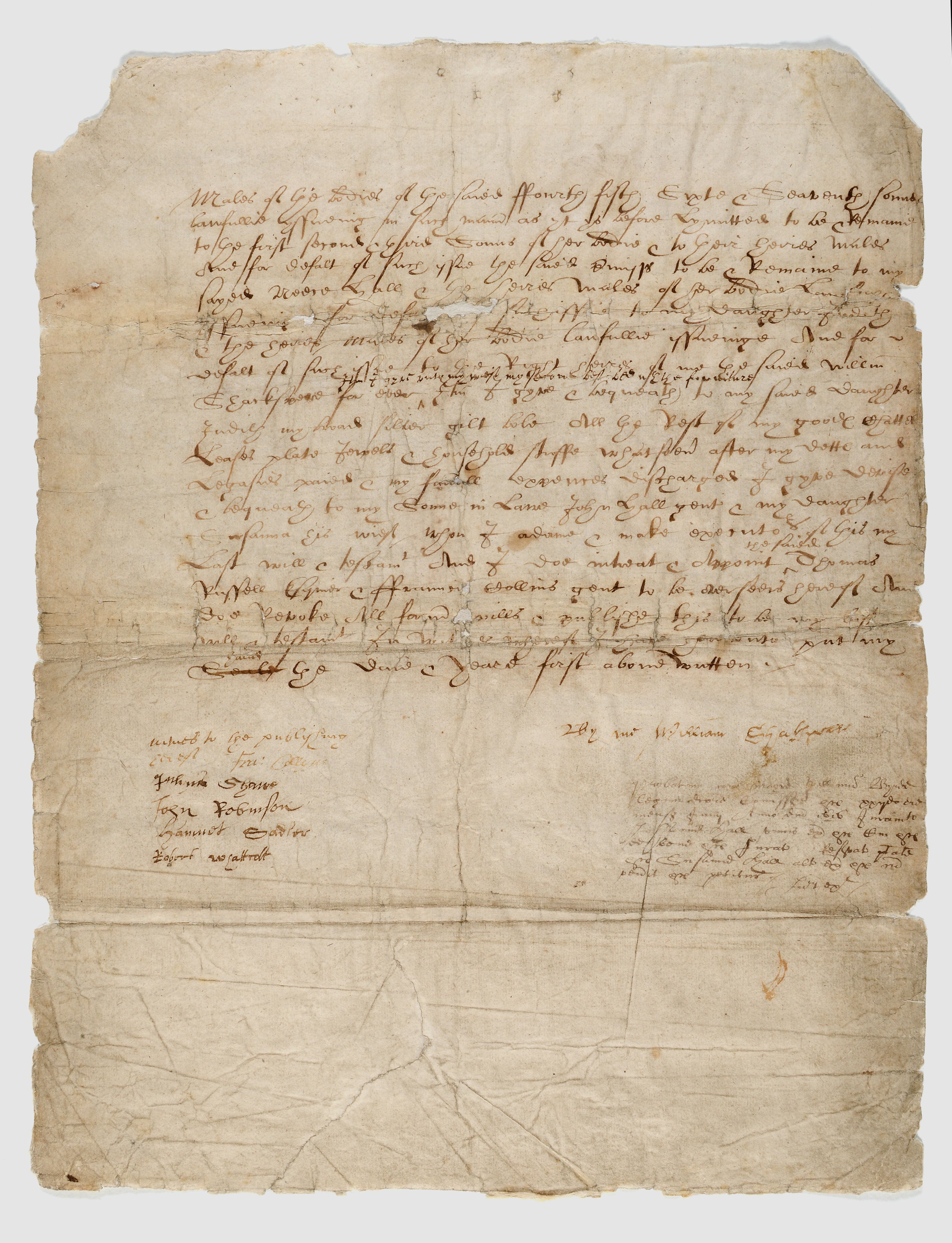

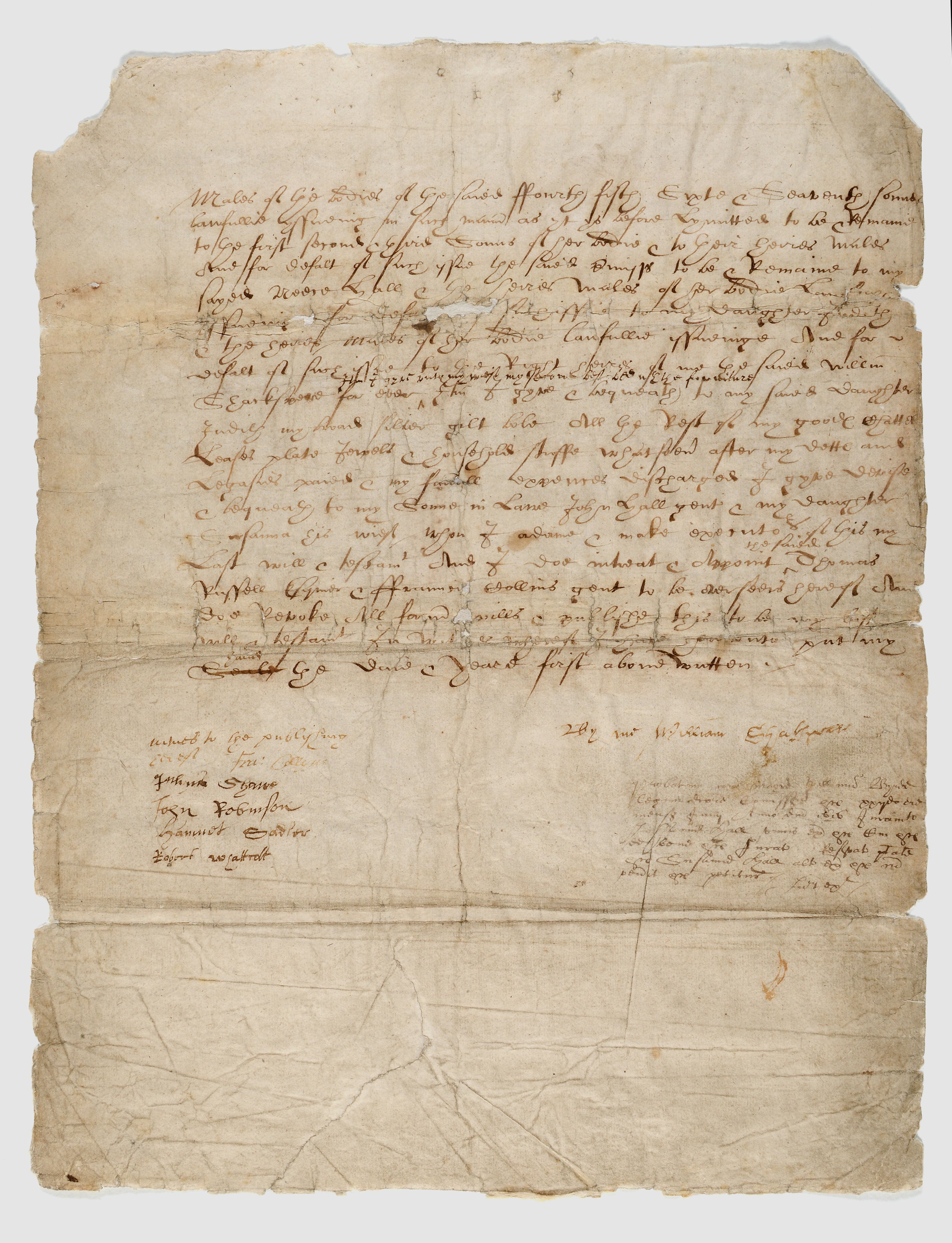

. The phrase ''give, devise, and bequeath'', a legal triplet, has been used for centuries, including the will of William Shakespeare

William Shakespeare ( 23 April 1564 – 23 April 1616) was an English playwright, poet and actor. He is widely regarded as the greatest writer in the English language and the world's pre-eminent dramatist. He is often called England's nation ...

.

The word ''bequeath'' is a verb form for the act of making a ''bequest''.

Etymology

Bequest comes fromOld English

Old English ( or , or ), or Anglo-Saxon, is the earliest recorded form of the English language, spoken in England and southern and eastern Scotland in the Early Middle Ages. It developed from the languages brought to Great Britain by Anglo-S ...

, "to declare or express in words"—cf. "quoth".

Interpretations

Part of the process ofprobate

In common law jurisdictions, probate is the judicial process whereby a will is "proved" in a court of law and accepted as a valid public document that is the true last testament of the deceased; or whereby, in the absence of a legal will, the e ...

involves interpreting the instructions in a will. Some wordings that define the scope of a bequest have specific interpretations. "All the estate I own" would involve all of the decedent's possessions at the moment of death.Law.comLaw Dictionary: all the estate I own A ''conditional bequest'' is a bequest that will be granted only if a particular event has occurred by the time of its operation. For example, a

testator

A testator () is a person who has written and executed a last will and testament that is in effect at the time of their death. It is any "person who makes a will."Gordon Brown, ''Administration of Wills, Trusts, and Estates'', 3d ed. (2003), p. ...

might write in the will that "Mary will receive the house held in trust if she is married" or "if she has children," etc.

An ''executory bequest'' is a bequest that will be granted only if a particular event occurs in the future. For example, a testator might write in the will that "Mary will receive the house held in a trust set when she marries" or "when she has children".

In some jurisdictions a bequest can also be a deferred payment, as held in '' Wolder v. Commissioner'', which will impact its tax status.

Explanations

Inmicroeconomics

Microeconomics is a branch of economics that studies the behavior of individuals and Theory of the firm, firms in making decisions regarding the allocation of scarcity, scarce resources and the interactions among these individuals and firms. M ...

, theorists have engaged the issue of bequest from the perspective of consumption theory, in which they seek to explain the phenomenon in terms of a bequest motive

...

.

Oudh Bequest

The Oudh Bequest is a ''waqf

A (; , plural ), also called a (, plural or ), or ''mortmain'' property, is an Alienation (property law), inalienable charitable financial endowment, endowment under Sharia, Islamic law. It typically involves donating a building, plot ...

'' which led to the gradual transfer of more than six million rupee

Rupee (, ) is the common name for the currency, currencies of

Indian rupee, India, Mauritian rupee, Mauritius, Nepalese rupee, Nepal, Pakistani rupee, Pakistan, Seychellois rupee, Seychelles, and Sri Lankan rupee, Sri Lanka, and of former cu ...

s from the Indian kingdom of Oudh

The Kingdom of Awadh (, , also Oudh State, Kingdom of Oudh, Awadh Subah, or Awadh State) was a Mughal subah, then an independent kingdom, and lastly a British protectorate in the Awadh region of North India until its annexation by the Br ...

(Awadh) to the Shia

Shia Islam is the second-largest branch of Islam. It holds that Muhammad designated Ali ibn Abi Talib () as both his political successor (caliph) and as the spiritual leader of the Muslim community (imam). However, his right is understood ...

holy cities of Najaf

Najaf is the capital city of the Najaf Governorate in central Iraq, about 160 km (99 mi) south of Baghdad. Its estimated population in 2024 is about 1.41 million people. It is widely considered amongst the holiest cities of Shia Islam an ...

and Karbala

Karbala is a major city in central Iraq. It is the capital of Karbala Governorate. With an estimated population of 691,100 people in 2024, Karbala is the second largest city in central Iraq, after Baghdad. The city is located about southwest ...

between 1850 and 1903. The bequest first reached the cities in 1850. It was distributed by two ''mujtahid

''Ijtihad'' ( ; ' , ) is an Islamic legal term referring to independent reasoning by an expert in Islamic law, or the thorough exertion of a jurist's mental faculty in finding a solution to a legal question. It is contrasted with '' taqlid'' (i ...

s'', one from each city. The British later gradually took over the bequest and its distribution; according to scholars, they intended to use it as a "power lever" to influence Iranian ''ulama'' and Shia.

American tax law

Recipients

In order to calculate a taxpayer's income tax obligation, the gross income of the taxpayer must be determined. Under Section 61 of the U.S.Internal Revenue Code

The Internal Revenue Code of 1986 (IRC), is the domestic portion of federal statutory tax law in the United States. It is codified in statute as Title 26 of the United States Code. The IRC is organized topically into subtitles and sections, co ...

gross income is "all income from whatever source derived". On its face, the receipt of a bequest would seemingly fall within gross income and thus be subject to tax. However, in other sections of the code, exceptions are made for a variety of things that do not need to be included in gross income. Section 102(a) of the Code makes an exception for bequests stating that "Gross income does not include the value of property acquired by gift, bequest, or inheritance." In general this means that the value or amount of the bequest does not need to be included in a taxpayer's gross income. This rule is not exclusive, however, and there are some exceptions under Section 102(b) of the code where the amount of value must be included. There is great debate about whether or not bequests should be included in gross income and subject to income taxes; however, there has been some type of exclusion for bequests in every Federal Income Tax Act.Samuel A. Donaldson (2007). Federal Income Taxation of Individuals: Cases, Problems and Materials, 2nd Edition, St. Paul: Thomson/West, 93

Donors

One reason that the recipient of a bequest is usually not taxed on the bequest is because the donor may be taxed on it. Donors of bequests may be taxed through other mechanisms such as federal wealth transfer taxes. Wealth Transfer taxes, however, are usually imposed against only the very wealthy.References

External links

merriam-webster.com

{{Authority control Wills and trusts