Citizens Republic Bancorp on:

[Wikipedia]

[Google]

[Amazon]

Citizens Republic Bancorp was a bank holding company for Citizens Bank, headquartered in

Citizens Republic Bancorp was a bank holding company for Citizens Bank, headquartered in

Citizens Republic Bancorp was a bank holding company for Citizens Bank, headquartered in

Citizens Republic Bancorp was a bank holding company for Citizens Bank, headquartered in Flint

Flint, occasionally flintstone, is a sedimentary cryptocrystalline form of the mineral quartz, categorized as the variety of chert that occurs in chalk or marly limestone. Historically, flint was widely used to make stone tools and start ...

, Michigan

Michigan ( ) is a peninsular U.S. state, state in the Great Lakes region, Great Lakes region of the Upper Midwest, Upper Midwestern United States. It shares water and land boundaries with Minnesota to the northwest, Wisconsin to the west, ...

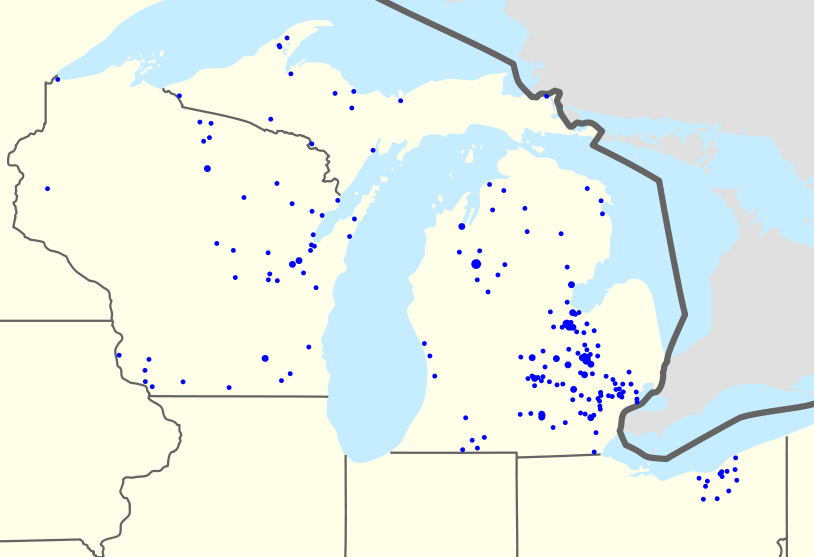

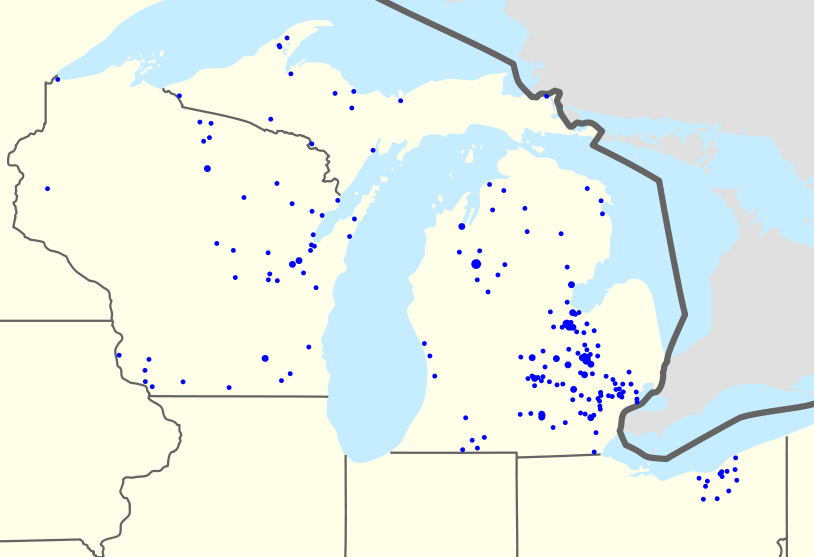

. It merged with FirstMerit Bank in June 2013. It operated 219 branches and 248 ATMs in Michigan

Michigan ( ) is a peninsular U.S. state, state in the Great Lakes region, Great Lakes region of the Upper Midwest, Upper Midwestern United States. It shares water and land boundaries with Minnesota to the northwest, Wisconsin to the west, ...

, Wisconsin

Wisconsin ( ) is a U.S. state, state in the Great Lakes region, Great Lakes region of the Upper Midwest of the United States. It borders Minnesota to the west, Iowa to the southwest, Illinois to the south, Lake Michigan to the east, Michig ...

, and Ohio

Ohio ( ) is a U.S. state, state in the Midwestern United States, Midwestern region of the United States. It borders Lake Erie to the north, Pennsylvania to the east, West Virginia to the southeast, Kentucky to the southwest, Indiana to the ...

. FirstMerit merged with Huntington Bancshares

Huntington Bancshares Incorporated is an American bank holding company headquartered in Columbus, Ohio. Its banking subsidiary, The Huntington National Bank, operates 1047 banking offices, primarily in the Midwest: 459 in Ohio, 290 in Michigan, ...

in 2016.

History

Citizens National Bank

Citizens National Bank was established in 1871 at the height of Flint's great lumber industry. Citizens National Bank played a key role in the development of the auto industry in the United States.General Motors

General Motors Company (GM) is an American Multinational corporation, multinational Automotive industry, automotive manufacturing company headquartered in Detroit, Michigan, United States. The company is most known for owning and manufacturing f ...

founder William C. Durant acknowledged that a loan he and partner J. Dallas Dort received from Citizens in 1886 enabled him to start his vehicle manufacturing company now known as General Motors

General Motors Company (GM) is an American Multinational corporation, multinational Automotive industry, automotive manufacturing company headquartered in Detroit, Michigan, United States. The company is most known for owning and manufacturing f ...

.

Citizens Commercial & Savings Bank

Citizens National Bank switched from a national to a state-chartered institution in 1890 as Citizens Commercial & Savings Bank. In 1928, the original bank building was demolished and the a new headquarters building, Citizens Bank Building, was built on the site. In 1937, the Bank began its annual Citizens' Holiday Sing. The Weather Ball on the bank headquarters was first illuminated August 30, 1956. The ball is a regular beacon in the city except from 1974 until January 1, 1978, when it was turned off during the 1970s energy crisis.Citizens Banking Corporation

Citizens Commercial & Savings Bank formed a holding company, Citizens Banking Corporation, in 1981 to acquire additional banks. Banks acquired were Grayling State Bank and State Bank of Standish in 1984. In 1985, Citizens Banking acquired Second National Corporation, owner of Second National Bank of Saginaw and Second National Bank of Bay City, for $68.3 million. In November 1986, Citizens Banking announced the acquisition of National Bank of Illinois / Commercial National Bank of Berwyn, Illinois as its first non-Michigan acquisition. David T. Dort, son of J. Dallas Dort, retired April 10, 1988, as the longest-serving director of Citizen Banking Corp. after 22 years. On April 8, 1991, Citizens Banking designated $15 million in loans for small businesses in county's poor and minority communities over three years. The bank purchased Bishop International Airport expansion bonds January 15, 1992, saving the airport $2 million on a $34 million project. On February 18, 1992, Citizens pledged $15,000 toward construction of the Robert M. Perry School of Banking building atCentral Michigan University

Central Michigan University (CMU) is a Public university, public research university in Mount Pleasant, Michigan, United States. It was established in 1892 as a private normal school and became a state institution in 1895. CMU is one of the eigh ...

.

Citizens acquired Royal Bank Group on October 1, 1993.

It acquired four Michigan locations of Banc One on February 28, 1995.

Citizens acquired CB Financial on July 1, 1997.

In the last quarter of 1999, Citizens purchased 17 branches from Bank One.

In 1999, Citizens acquired F&M Bancorporation, with banks in Wisconsin and Iowa, for $820 million.

TCF Financial Corporation sold three locations to Citizens Banking on May 12, 2000. On April 25, 2005, F&M Bank-Wisconsin changed its name to Citizens Bank as Citizens Banking Corporation had applied to consolidate the two banks.

Citizens Republic Bancorp

On December 29, 2006, the bank acquired Republic Bancorp ofAnn Arbor, Michigan

Ann Arbor is a city in Washtenaw County, Michigan, United States, and its county seat. The 2020 United States census, 2020 census recorded its population to be 123,851, making it the List of municipalities in Michigan, fifth-most populous cit ...

to become, at the time, the 45th largest U.S. bank-holding company. After this acquisition, it was renamed to Citizens Republic Bancorp. To gain Federal Reserve Bank approval for the merger with Republic Bank, Republic sold seven local branches to First Place Financial under its Franklin Bank subsidiary.

In December 2008, the bank received $300 million in funds from the Troubled Asset Relief Program

The Troubled Asset Relief Program (TARP) is a program of the United States government to purchase toxic assets and equity from financial institutions to strengthen its financial sector that was passed by Congress and signed into law by U.S. Presi ...

after it suffered losses from the downturn of the U.S. automotive industry during the 2008 financial crisis

The 2008 financial crisis, also known as the global financial crisis (GFC), was a major worldwide financial crisis centered in the United States. The causes of the 2008 crisis included excessive speculation on housing values by both homeowners ...

.

In 2010, the bank sold its F&M Bank Iowa locations for $50 million cash to Great Western Bank.

In 2011, the bank agreed to a settlement in a Redlining

Redlining is a Discrimination, discriminatory practice in which financial services are withheld from neighborhoods that have significant numbers of Race (human categorization), racial and Ethnic group, ethnic minorities. Redlining has been mos ...

case as Republic Bank's successor by the US Department of Justice triggered by a Board of Governors of the Federal Reserve System

The Federal Reserve System (often shortened to the Federal Reserve, or simply the Fed) is the central banking system of the United States. It was created on December 23, 1913, with the enactment of the Federal Reserve Act, after a series of ...

complaint which will require them to open a loan office in a Detroit

Detroit ( , ) is the List of municipalities in Michigan, most populous city in the U.S. state of Michigan. It is situated on the bank of the Detroit River across from Windsor, Ontario. It had a population of 639,111 at the 2020 United State ...

black neighborhood and $3.6 million for loans and grants in Wayne County.

In 2010, the bank reported losses of $286 million, its largest annual loss in three years of consecutive losses. It reported a net income of $17 million for 2011.

In 2011, the United States Department of the Treasury

The Department of the Treasury (USDT) is the Treasury, national treasury and finance department of the federal government of the United States. It is one of 15 current United States federal executive departments, U.S. government departments.

...

appointed two directors to the bank's board after it had failed to repay $300 million in bailout funds. For the first time since the economic downturn, the Bank reports in July 2012 five consecutive quarters of profit.

FirstMerit merger

In August 2012, Citizens Republic had not repaid its $300 million bailout loan from the US Treasury. The bank holding company considered issuing stock to pay the debt back, but instead put itself up for sale with J.P. Morgan Chase hired to find a buyer. On September 13, 2012,Akron, Ohio

Akron () is a city in Summit County, Ohio, United States, and its county seat. It is the List of municipalities in Ohio, fifth-most populous city in Ohio, with a population of 190,469 at the 2020 United States census, 2020 census. The Akron metr ...

-based FirstMerit Corporation announced it would acquire Citizens in a stock-for-stock merger transaction valued at approximately $912 million. With the stock payment worth less than the stock's tangible book value, several law firms started looking into a possible case of breached fiduciary duties by Citizens Republic's Board of Directors. On April 12, 2013, First Merit Corporation closed on its acquisition of the company. FirstMerit repaid the $300 million in TARP funds, including $45 million of interest, on behalf of Citizens.

Citizens Banking Building

The Citizens Banking Building is currently the Flint headquarters for Huntington Bank. The building is more a complex of three structures, the North, South, and West building, which are interconnected. The ground and second floors connect the North and South buildings, while the South and West buildings are connected via the second and third floors over Buckham Alley. In 1928, the South building was built with a lower level vault with a door weighing 43 tons which was then the largest vault door in the state. In the 1950s, a 4 four-story annex was added on its south side. West was built next in 1958 with four stories with 2 more added in 1965. The North Building was the final building build in 1974 as a 10-story building. On June 13, 2013, the building was given a new FirstMerit Bank sign along with revealing the new design of the Weatherball. In October 2015, the University of Michigan–Flint announced a purchase agreement for $6 million the North tower of the building to be completed by March 31. The week of April 25 2018, the "FM" letters were removed for the current owners of the bank building, Huntington Bank, which purchase First Merit.Weatherball on bank headquarters

The symbol of the bank was the weatherball atop its headquarters in downtown Flint. Currently it is lettered forHuntington Bancshares

Huntington Bancshares Incorporated is an American bank holding company headquartered in Columbus, Ohio. Its banking subsidiary, The Huntington National Bank, operates 1047 banking offices, primarily in the Midwest: 459 in Ohio, 290 in Michigan, ...

. The Weather Ball on the bank headquarters was first illuminated October 30, 1956. A poem explaining the weather meaning behind the ball's colors. In 1964, a Citizens Bank jingle was crafted by Jackie Bowles from the poem, with small alternation to the words, and set to Cumberland Mountain Bear Chase music. The ball is a regular beacon in the city except from 1974 until January 1, 1978, when it was turned off during the 1970s energy crisis. The weatherball was re-lettered for FirstMerit Bank in November 2013. The original "CB" letters were removed and were supposedly going to be put in the Sloan Museum in Flint, Michigan. Unfortunately, because of their poor condition due to their age, they had to be recycled. The "CB" initials underneath were made of neon piping for the letters with a metal, reflective backing behind the neon letters, and the letters were mounted on square porcelain plates.

The Weather Ball was operated by Citizens Republic Bancorp based on National Weather Service forecasts, and is still operated the same way. The Weather Ball’s construction materials include 800 square feet of Plexiglas and 667 feet of lighting tubing. It is designed to withstand winds of up to 120 mph.

*Weight: 2.5 tons

*Height: 15 feet

*Diameter: 15 feet

*Circumference: 47 feet.

References

{{reflist 2013 mergers and acquisitions Banks based in Michigan Defunct banks of the United States Huntington Bancshares