The welfare state of the United Kingdom began to evolve in the 1900s and early 1910s, and comprises expenditures by the government of the

United Kingdom of Great Britain and Northern Ireland

The United Kingdom of Great Britain and Northern Ireland, commonly known as the United Kingdom (UK) or Britain, is a country in Northwestern Europe, off the coast of European mainland, the continental mainland. It comprises England, Scotlan ...

intended to improve health, education,

employment

Employment is a relationship between two party (law), parties Regulation, regulating the provision of paid Labour (human activity), labour services. Usually based on a employment contract, contract, one party, the employer, which might be a cor ...

and

social security

Welfare spending is a type of government support intended to ensure that members of a society can meet basic human needs such as food and shelter. Social security may either be synonymous with welfare, or refer specifically to social insurance ...

. The British system has been classified as a liberal

welfare state

A welfare state is a form of government in which the State (polity), state (or a well-established network of social institutions) protects and promotes the economic and social well-being of its citizens, based upon the principles of equal oppor ...

system.

History

Before the official establishment of the modern welfare state, clear examples of social welfare existed to help the poor and vulnerable within British society. A key date in the welfare state's history is 1563; when Queen Elizabeth I's government encouraged the wealthier members of society to give to the poor, by passing the

Poor Act 1562.

The welfare state in the modern sense was anticipated by the

Royal Commission into the Operation of the Poor Laws 1832 which found that the

Poor Relief Act 1601 (a part of the

English Poor laws

The English Poor Laws were a system of poor relief in England and Wales that developed out of the codification of late-medieval and Tudor-era laws in 1587–1598. The system continued until the modern welfare state emerged in the late 1940s.

En ...

) was subject to widespread abuse and promoted squalor, idleness and criminality in its recipients, compared to those who received private charity. Accordingly, the qualifications for receiving aid were tightened up, forcing many recipients to either turn to private charity or accept employment.

Opinions began to be changed late in the century by reports drawn up by men such as

Seebohm Rowntree and

Charles Booth into the levels of poverty in Britain. These reports indicated that in the massive industrial cities, between one-quarter and one-third of the population were living below the

poverty line

The poverty threshold, poverty limit, poverty line, or breadline is the minimum level of income deemed adequate in a particular country. The poverty line is usually calculated by estimating the total cost of one year's worth of necessities for ...

.

A 2022 study linked trade shocks during the

first globalization (1870–1914) with increased support for a welfare state and reduced support for the Conservative Party.

Liberal reforms

The late nineteenth century saw the emergence of New Liberalism within the Liberal Party, which advocated state intervention as a means of guaranteeing freedom and removing obstacles to it such as poverty and unemployment. The policies of the New Liberalism are now known as

social liberalism

Social liberalism is a political philosophy and variety of liberalism that endorses social justice, social services, a mixed economy, and the expansion of civil and political rights, as opposed to classical liberalism which favors limited g ...

.

The New Liberals included intellectuals like

L. T. Hobhouse, and

John A. Hobson. They saw individual liberty as something achievable only under favourable social and economic circumstances.

In their view, the poverty, squalor, and ignorance in which many people lived made it impossible for freedom and individuality to flourish. New Liberals believed that these conditions could be ameliorated only through collective action coordinated by a strong, welfare-oriented, and interventionist state.

After the historic 1906 victory, the

Liberal Party

The Liberal Party is any of many political parties around the world.

The meaning of ''liberal'' varies around the world, ranging from liberal conservatism on the right to social liberalism on the left. For example, while the political systems ...

launched the welfare state with a series of major welfare reforms in 1906–1914.

The reforms were greatly extended over the next forty years.

The Liberal Party introduced multiple reforms on a range of issues, including

health insurance

Health insurance or medical insurance (also known as medical aid in South Africa) is a type of insurance that covers the whole or a part of the risk of a person incurring medical expenses. As with other types of insurance, risk is shared among ma ...

,

unemployment insurance, and

pension

A pension (; ) is a fund into which amounts are paid regularly during an individual's working career, and from which periodic payments are made to support the person's retirement from work. A pension may be either a " defined benefit plan", wh ...

s for elderly workers, thereby laying the groundwork for the future British

welfare state

A welfare state is a form of government in which the State (polity), state (or a well-established network of social institutions) protects and promotes the economic and social well-being of its citizens, based upon the principles of equal oppor ...

. Some proposals failed, such as licensing fewer pubs, or rolling back Conservative educational policies. The

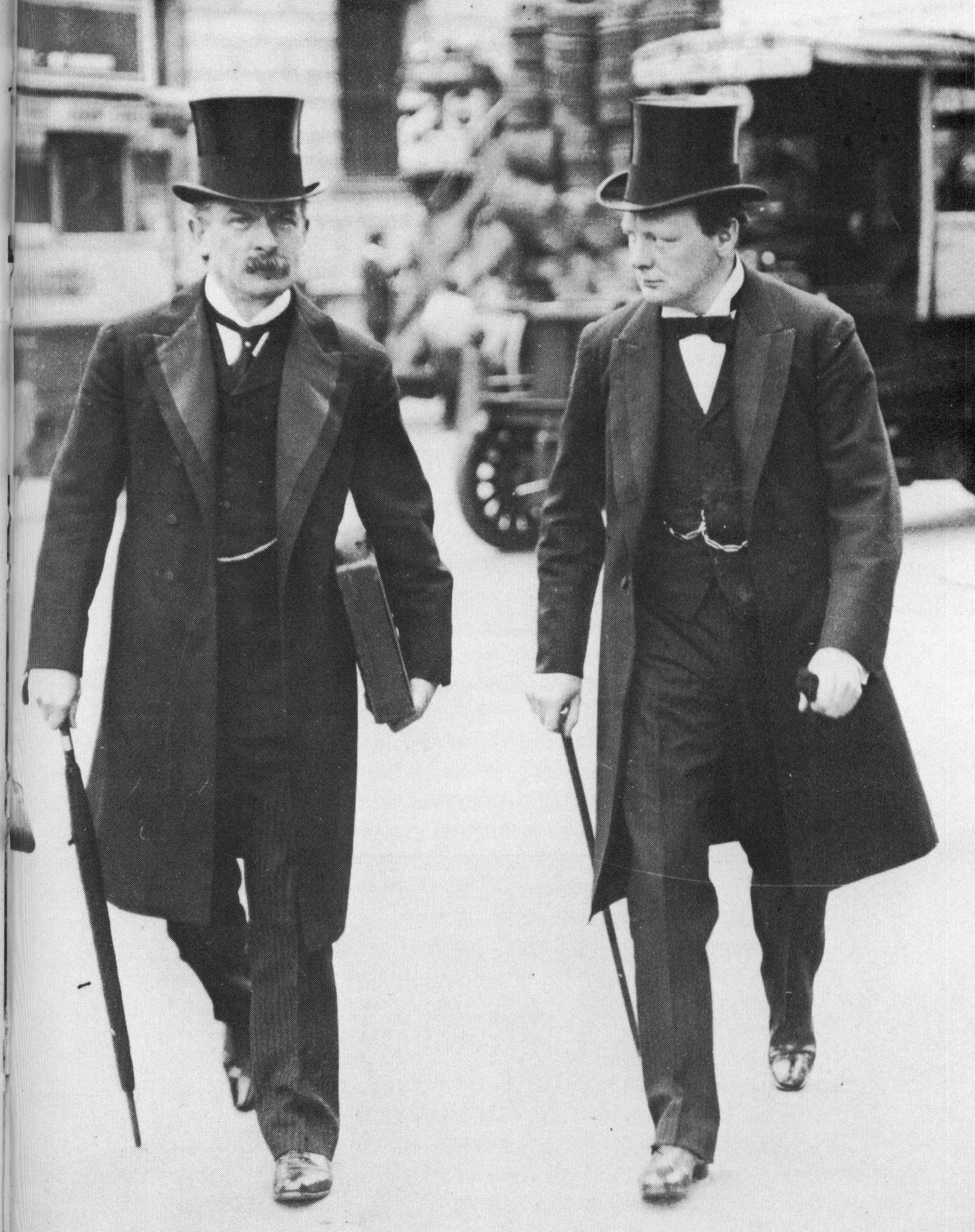

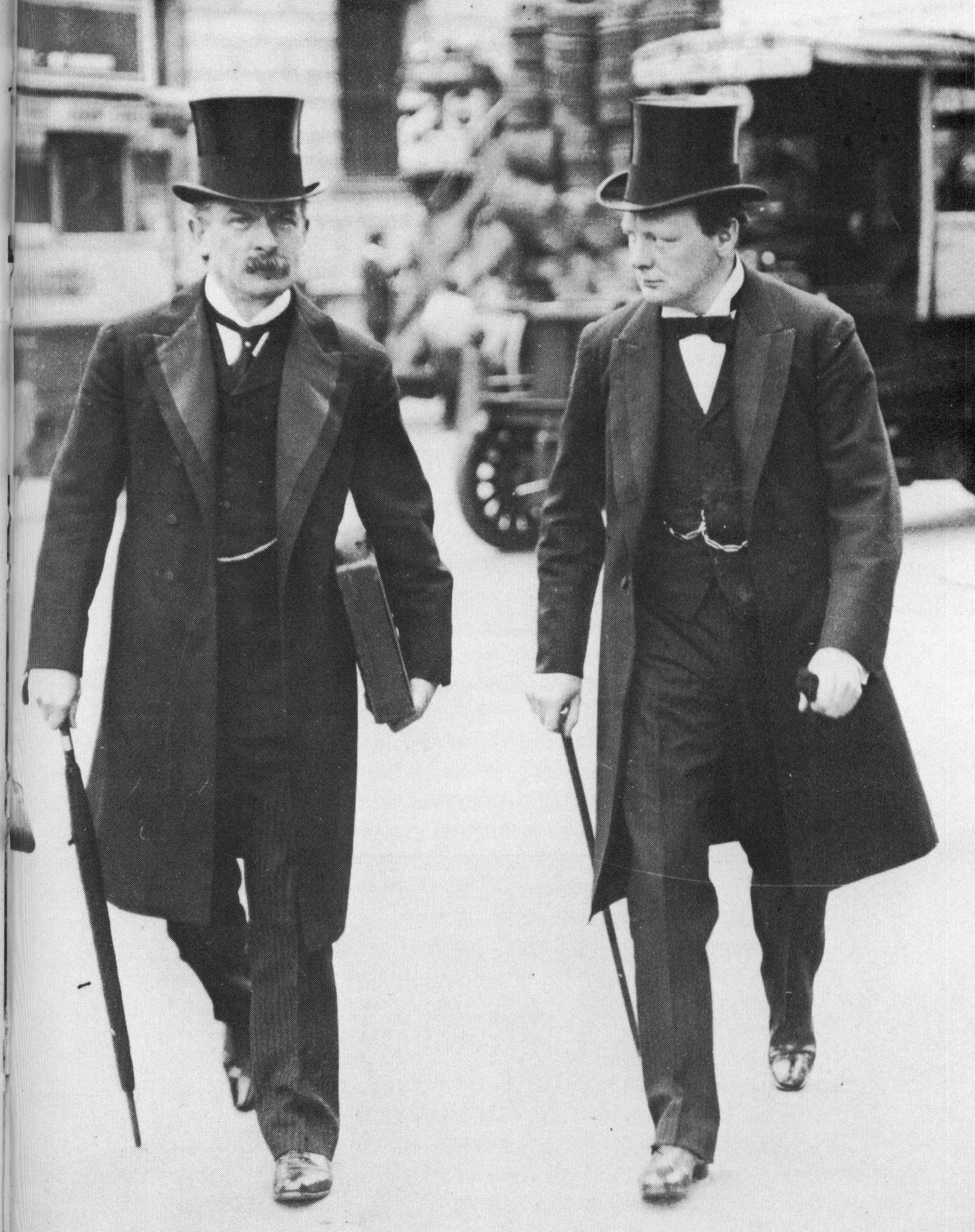

People's Budget of 1909, championed by

David Lloyd George and fellow Liberal

Winston Churchill

Sir Winston Leonard Spencer Churchill (30 November 1874 – 24 January 1965) was a British statesman, military officer, and writer who was Prime Minister of the United Kingdom from 1940 to 1945 (Winston Churchill in the Second World War, ...

, introduced unprecedented taxes on the wealthy in Britain and radical social welfare programmes to the country's policies. In the Liberal camp, as noted by one study, "the Budget was on the whole enthusiastically received." It was the first budget with the expressed intent of redistributing wealth among the public. It imposed increased taxes on luxuries, liquor, tobacco, high incomes, and land –

taxation that fell heavily on the rich. The new money was to be made available for new welfare programmes as well as new battleships. In 1911 Lloyd George succeeded in putting through Parliament his

National Insurance Act, making provision for sickness and invalidism, and this was followed by his

Unemployment Insurance Act.

The

minimum wage was introduced in Great Britain in 1909 for certain low-wage industries and expanded to numerous industries, including farm labour, by 1920. However, by the 1920s, a new perspective was offered by reformers to emphasise the usefulness of

family allowance

Child benefit or children's allowance is a social security payment which is distributed to the parents or guardians of children, teenagers and in some cases, young adult (psychology), young adults. Countries operate different versions of the benefi ...

targeted at low-income families was the alternative to relieving poverty without distorting the labour market. The

trade unions

A trade union (British English) or labor union (American English), often simply referred to as a union, is an organization of workers whose purpose is to maintain or improve the conditions of their employment, such as attaining better wages ...

and the

Labour Party adopted this view. In 1945, family allowances were introduced; minimum wages faded from view.

The experience of almost total state control during the

Second World War

World War II or the Second World War (1 September 1939 – 2 September 1945) was a World war, global conflict between two coalitions: the Allies of World War II, Allies and the Axis powers. World War II by country, Nearly all of the wo ...

had encouraged the belief that the state might be able to solve problems in wide areas of national life.

The

Liberal government of 1906–1914 implemented welfare policies concerning three main groups in society: the old, the young and working people.

Beveridge Report and Labour

The aftermath of the

First World War

World War I or the First World War (28 July 1914 – 11 November 1918), also known as the Great War, was a World war, global conflict between two coalitions: the Allies of World War I, Allies (or Entente) and the Central Powers. Fighting to ...

boosted demands for social reform, and led to a permanent increase in the role of the state in British society. The end of the war also brought

a period of unemployment and poverty, particularly in northern industrial towns, that deepened into the Great Depression by the 1930s.

During the war, the government became much more involved in people's lives via governmental organisation of the rationing of foodstuffs, clothing and fuel and extra milk and meals being given to expectant mothers and children.

The wartime coalition, and the introduction of family allowances.

Many people welcomed this government intervention and wanted it to go further.

The

Beveridge Report

The Beveridge Report, officially entitled ''Social Insurance and Allied Services'' ( Cmd. 6404), is a government report, published in November 1942, influential in the founding of the welfare state in the United Kingdom. It was drafted by the Lib ...

of 1942, (which identified five "Giant Evils" in society: squalor, ignorance, want, idleness and disease) essentially recommended a national, compulsory,

flat rate insurance

Insurance is a means of protection from financial loss in which, in exchange for a fee, a party agrees to compensate another party in the event of a certain loss, damage, or injury. It is a form of risk management, primarily used to protect ...

scheme which would combine unemployment, widows benefit, child benefit and retirement benefits into one central government support scheme. In regards to healthcare Beveridge preferred the contemporary healthcare system of voluntary and private hospitals "more than that of a taxpayer funded healthcare"

[ ] believing more people would access healthcare when they need it if they were voluntarily involved in their own healthcare. But it is key to note Beveridge still emphasised that healthcare should be accessible for everyone in the United Kingdom and that people should give what they can according to their means when receiving healthcare in voluntary hospitals. Beveridge himself was careful to emphasise that unemployment benefits should be held to a subsistence level, and after six months would be conditional on work or training, so as not to encourage abuse of the system.

That was however predicated on the concept of the "maintenance of employment" which meant 'it should be possible to make unemployment of any individual for more than 26 weeks continuously a rare thing in normal times'

and recognised that the imposition of a training condition would be impractical if the unemployed were numbered by the million.

After its victory in the

1945 general election, the Labour Party pledged to eradicate the Giant Evils, and undertook policy measures to provide for the people of the United Kingdom "from the cradle to the grave." While the original intention of the report was to abolish these Giant Evils, the implementation of these suggested policies aimed to reduce income, health, and educational inequalities.

[Crafts, N., 2023. ''The welfare state and inequality: were the UK reforms of the 1940s a success?,'' s.l.: IFS Deaton Review of Inequalities.] However, the lack of real follow-through on Beveridge's recommended strategies meant that the Labour government ultimately failed to abolish poverty with their welfare reforms.

Included among the laws passed were the

National Assistance Act 1948 (

11 & 12 Geo. 6. c. 29),

National Insurance Act 1946

The National Insurance Act 1946 ( 9 & 10 Geo. 6. c. 67) was a British act of Parliament passed during the Attlee ministry which established a comprehensive system of social security throughout the United Kingdom.

The act meant that all who we ...

, and

National Insurance (Industrial Injuries) Act 1946.

Impact

This policy resulted in increased expenditure and a widening of what was considered to be the

state's responsibility. In addition to the central services of education, health, unemployment and sickness allowances, the welfare state also included the idea of increasing redistributive taxation, and increasing regulation of industry, food, and housing (better safety regulations,

weights and measures

A unit of measurement, or unit of measure, is a definite magnitude (mathematics), magnitude of a quantity, defined and adopted by convention or by law, that is used as a standard for measurement of the same kind of quantity. Any other qua ...

controls, etc.)

The foundation of the

National Health Service

The National Health Service (NHS) is the term for the publicly funded health care, publicly funded healthcare systems of the United Kingdom: the National Health Service (England), NHS Scotland, NHS Wales, and Health and Social Care (Northern ...

(NHS) did not involve building new hospitals, but

nationalisation of existing municipal provision and charitable foundations. The aim was not to substantially increase provision but to standardise care across the country; indeed

William Beveridge

William Henry Beveridge, 1st Baron Beveridge, (5 March 1879 – 16 March 1963) was a British economist and Liberal Party (UK), Liberal politician who was a Progressivism, progressive, social reformer, and eugenicist who played a central role ...

believed that the overall cost of medical care would decrease, as people became healthier and so needed less treatment.

However, instead of falling, the cost of the NHS has risen by 4% annually on average due to an ageing population, leading to a reduction in provision. Charges for dentures, and spectacles were introduced in 1951 by the same

Labour government that had founded the NHS three years earlier, and prescription charges by the successive

Conservative Government were introduced in 1952. In 1988, free eye tests for all were abolished, although they are now free for the over-60s.

After 1979, Margaret Thatcher had laid the post-war Keynesian consensus to rest, in favour of an Individualist and

Monetarist Welfare policy, guided by the economy. This Thatcherite consensus was characterised by policies such as Privatisation, driven by her belief in Individualism and Competition. Therefore, her main focus was to attempt to control public spending, privatisation, targeting and rising inequality, so much of the 1980s was focused on cutting public spending in the UK.

Policies differ in different regions of the United Kingdom, but the provision of a welfare state is still a basic principle of government policy in the United Kingdom today. The principle of health care "free at the point of use" became a central idea of the welfare state, which later

Conservative

Conservatism is a cultural, social, and political philosophy and ideology that seeks to promote and preserve traditional institutions, customs, and values. The central tenets of conservatism may vary in relation to the culture and civiliza ...

governments, although critical of some aspects of the welfare state, did not reverse.

Welfare spending on poor people dropped by 25% under the

United Kingdom government austerity programme of 2010 - 2019, cuts to

benefits that disabled people receive were significant,

Personal Independence Payments and

Employment and Support Allowance have both dropped by 10%. Over half of families living below the breadline have at least one relative with a disability. Cuts include, tax credits (£4.6bn), universal credit (£3.6bn), child benefit (£3.4bn), disability benefits (£2.8bn),

Employment and Support Allowance and

Incapacity Benefit (£2bn) and housing benefit (£2.3bn).

Frank Field said, "A £37bn attack has been mounted on the living standards of many of our fellow citizens to such an extent that possibly millions struggle to keep on top of their rent, pay the bills and buy adequate food. Likewise, an unknown number are unable to clothe their children properly before sending them to school where all too many of these children not only rely on

free school dinners as a cornerstone of their diet, but on breakfast and supper clubs as well."

[Welfare spending for UK's poorest shrinks by £37bn](_blank)

''The Guardian

''The Guardian'' is a British daily newspaper. It was founded in Manchester in 1821 as ''The Manchester Guardian'' and changed its name in 1959, followed by a move to London. Along with its sister paper, ''The Guardian Weekly'', ''The Guardi ...

''

Expenditure

In the financial year 2014/15, state pensions were overwhelmingly the largest governmental welfare expense, costing £86,500,000,000 followed by

housing benefit

Housing Benefit is a means-tested social security benefit in the United Kingdom that is intended to help meet housing costs for rented accommodation. It is the second biggest item in the Department for Work and Pensions' budget after the state ...

, which accounted for over £20,000,000,000

Expenditure in 2015–16 on benefits included: £2,300,000,000 paid to unemployed people and £27,100,000,000 to people on low incomes, and £27,600,000,000 for personal tax credits.

In 2023/24, it is expected that government health spending, which is the biggest element of public spending, will reach £176,200,000,000.

[Office for Budget Responsibility, 2023. ''A brief guide to the public finances,'' s.l.: Office for Budget Responsibility. https://obr.uk/docs/dlm_uploads/BriefGuide-M23.pdf] Other welfare expenses include education, which is predicted to reached £81,400,000,000, and state pensions, for which expenditure will be £124,300,000,000.

Criticisms

Conservative thinkers have debated the structural incompatibility between liberal principles and welfare state principles. Certain sectors of society have argued that the welfare state creates a disincentive for working and investment. Also suggesting that the welfare state at times does not eliminate the causes of individual contingencies and needs. Economically, the net losers of the welfare state are often more against its values and role within society.

In 2010, the

Conservative-Lib Dem coalition government led by

David Cameron

David William Donald Cameron, Baron Cameron of Chipping Norton (born 9 October 1966) is a British politician who served as Prime Minister of the United Kingdom from 2010 to 2016. Until 2015, he led the first coalition government in the UK s ...

argued for a reduction of welfare spending in the United Kingdom as part of their

programme of austerity.

Government ministers have argued that a growing culture of

welfare dependency is perpetuating welfare spending, and claim that a cultural change is required to reduce the welfare bill.

Public opinion in the UK appears to support a reduction in welfare spending, however commentators have suggested that negative public perceptions are founded on exaggerated assumptions about the proportion of spending on

unemployment benefit

Unemployment, according to the OECD (Organisation for Economic Co-operation and Development), is the proportion of people above a specified age (usually 15) not being in paid employment or self-employment but currently available for Work (hu ...

and the level of

benefit fraud.

Figures from the

Department for Work and Pensions

The Department for Work and Pensions (DWP) is a Departments of the Government of the United Kingdom, ministerial department of the Government of the United Kingdom. It is responsible for welfare spending, welfare, pensions and child maintenance ...

show that benefit fraud is thought to have cost taxpayers £1.2 billion during 2012–13, up 9% on the year before. This was lower than the £1.5 billion of benefit underpayment due to error.

In some cases, relatives who bring up a child when the parents cannot bring up the child face sanctions and financial penalties, they can be left poor and homeless. There are also widespread complaints from church groups and others that the UK welfare state does insufficient work to prevent

poverty

Poverty is a state or condition in which an individual lacks the financial resources and essentials for a basic standard of living. Poverty can have diverse Biophysical environmen ...

, deprivation and even

hunger

In politics, humanitarian aid, and the social sciences, hunger is defined as a condition in which a person does not have the physical or financial capability to eat sufficient food to meet basic nutritional needs for a sustained period. In t ...

. In 2018,

food bank

A food bank or food pantry is a non-profit, charitable organization that distributes food to those who have difficulty purchasing enough to avoid hunger, usually through intermediaries like food pantries and soup kitchens. Some food banks distrib ...

usage in the UK reached its highest point on record, with the UK's main food bank provider,

The Trussell Trust, stating that welfare benefits do not cover basic living costs. The Trussell Trust's figures showed that 1,332,952 three-day emergency food supplies were delivered to people from March 2017 to March 2018. This represented a 13% increase from the previous year.

In 2018 support for raising taxes to finance more provision on health, education and social benefits was the highest it had been since 2002 according to

NatCen Social Research. Two-thirds of Labour supporters favoured tax rises and 53% of Conservatives also favoured that.

In 2018 the

House of Commons

The House of Commons is the name for the elected lower house of the Bicameralism, bicameral parliaments of the United Kingdom and Canada. In both of these countries, the Commons holds much more legislative power than the nominally upper house of ...

library estimated that by 2021, £37bn less would be spent on working-age social security than in 2010. Cuts to

disability benefits,

Personal Independence Payments (PIP) and

employment and support allowance (ESA) are noteworthy, they will have fallen by 10%, since 2010. Over half of families with income below the breadline include at least one person with a disability. There are also cuts to

tax credit

A tax credit is a tax incentive which allows certain taxpayers to subtract the amount of the credit they have accrued from the total they owe the state. It may also be a credit granted in recognition of taxes already paid or a form of state "dis ...

s

Universal Credit

Universal Credit is a United Kingdom based Welfare state in the United Kingdom, social security payment. It is Means test, means-tested and is replacing and combining six benefits, for working-age households with a low income: income-related Emp ...

child benefit

Child benefit or children's allowance is a social security payment which is distributed to the parents or guardians of children, teenagers and in some cases, young adult (psychology), young adults. Countries operate different versions of the benefi ...

disability benefits ESA and

incapacity benefit and

housing benefit

Housing Benefit is a means-tested social security benefit in the United Kingdom that is intended to help meet housing costs for rented accommodation. It is the second biggest item in the Department for Work and Pensions' budget after the state ...

. Alison Garnham of the

Child Poverty Action Group said, "Cuts and freezes have taken family budgets to the bone as costs rise and there is more pain to come as the two-child limit for tax credits and universal credit, the bedroom tax, the benefit cap and the rollout of universal credit push families deeper into poverty."

Social security payments in 2019 were the lowest they had been since the welfare state was started and

food bank

A food bank or food pantry is a non-profit, charitable organization that distributes food to those who have difficulty purchasing enough to avoid hunger, usually through intermediaries like food pantries and soup kitchens. Some food banks distrib ...

use had increased. The

Institute for Public Policy Research

The Institute for Public Policy Research (IPPR) is a Progressivism, progressive think tank based in London. It was founded in 1988 by Clive Hollick, Baron Hollick, Lord Hollick and John Eatwell, Baron Eatwell, Lord Eatwell, and is an independen ...

(IPPR) found £73 per week, (which is standard for

Universal Credit

Universal Credit is a United Kingdom based Welfare state in the United Kingdom, social security payment. It is Means test, means-tested and is replacing and combining six benefits, for working-age households with a low income: income-related Emp ...

that 2.3 million people claim) amounted to 12.5% of median earnings. When

unemployment benefit

Unemployment, according to the OECD (Organisation for Economic Co-operation and Development), is the proportion of people above a specified age (usually 15) not being in paid employment or self-employment but currently available for Work (hu ...

was introduced in 1948 it amounted to 20%. Millions of people in 2019 were "excluded from mainstream society, with the basic goods and amenities needed to survive let alone thrive increasingly out of their grip". The IPPR urged all parties to add an emergency £8.4bn into the welfare system, which has become harder than previous systems because debt deductions are made from payments, there is increasing underpayment and strict sanctions are applied. One in three universal credit claimants are working.

Numerous negative consequences have been attributed to benefit sanctions imposed by the

Department for Work and Pensions

The Department for Work and Pensions (DWP) is a Departments of the Government of the United Kingdom, ministerial department of the Government of the United Kingdom. It is responsible for welfare spending, welfare, pensions and child maintenance ...

(DWP), the

UK Government department that runs the welfare state in the UK. These include "increased debt and rent arrears, food poverty, crime and worsening physical and

mental health

Mental health is often mistakenly equated with the absence of mental illness. However, mental health refers to a person's overall emotional, psychological, and social well-being. It influences how individuals think, feel, and behave, and how t ...

. Statistics indicate that in the period of 2011 to 2015 benefit sanctions on people with mental health problems increased by 668%. 19,259 people with mental health problems had benefits stopped in the period of 2014 to 2015, compared to 2,507 people in the period of 2011 to 2012. In 2020, the UK Government admitted that it had made no assessment of the impact that benefit sanctions made on mental health. At the same point in time the Government also refused to assess the impact benefit sanctions have on people's mental health, which came after repeated warnings on the long-term damage they can cause to people that use the welfare state and to these people's families. Also in 2020, it was reported that at least 69 suicides were linked to the DWP's handling of benefit claims. The National Audit Office (NAO) said the actual number of deaths linked to claims could be much higher than this. It was also reported that the DWP were not looking into information from coroners or families, nor investigating all the reports of suicide made aware to it. In the same year the DWP were accused of a "cover-up" due to destroying approximately 50 reports connected to benefits being stopped. Officials blamed data protection laws for the actions, though the data watchdog denied there was any requirement to destroy the documents by any date. In March 2022, an academic study into whether benefit sanctions are linked to claimant ill-health, including mental illness and suicide was stopped after the DWP and Government ministers refused to release their recorded data on sanctions.

From a contemporary perspective, in practice, social welfare in the United Kingdom is very different from the ideal version of the welfare state that people may carry. Coverage is extensive, but benefits and services are delivered at a low level. The social protection provided is patchy, and services are tightly rationed." This opinion appears to be growing in popularity amongst the general population of the UK. This argument does stand when you compare certain statistics with some of Europe's biggest nations. The UK has a tax revenue, as a share of GDP percentage of 12.55%... this is in this is simply incomparable when matched with France's (57%), Germany's (66.66%), and Italy's (75%). It was also found, in a 2021 study by The Health Foundation, that Britain spends the 6th most money on health care amongst "developed countries." This figure sits below the EU average and explains why some believe the welfare state is not so successful. It is also a fact that "The UK dedicates roughly one-fifth of its GDP to social spending. That places us 17th – roughly in the middle – of OECD countries" (Whiteford, 2022).

Over the course of the

COVID-19 pandemic

The COVID-19 pandemic (also known as the coronavirus pandemic and COVID pandemic), caused by severe acute respiratory syndrome coronavirus 2 (SARS-CoV-2), began with an disease outbreak, outbreak of COVID-19 in Wuhan, China, in December ...

, it became clear that there was a distinct shortage of provisions available to support public health, including a lack of beds in the NHS and a lack of

personal protective equipment

Personal protective equipment (PPE) is protective clothing, helmets, goggles, or other garments or equipment designed to protect the wearer's body from injury or infection. The hazards addressed by protective equipment include physical, elect ...

(PPE). In the closing statement of the British Medical Association (BMA) in July 2023, it was noted that this lack of pandemic preparedness manifested in four key areas; failure to protect healthcare workers, lack of capacity and resources, failings of the test and trace system, and failings in government structures and processes.

The statement also claimed that the "UK was bottom of the table on numbers of doctors, nurses, beds, intensive care units, respirators and ventilators",

and that funding of healthcare has been inadequate since 2010,

suggesting that the state the NHS found itself in at the outbreak of the pandemic had not been an overnight shift, but rather the effect of the past decade's funding issues.

The UK has seen a drastic increase in the usage of foodbanks nationwide: 2.17m food bank users in 2021/22 in comparison to the 41,000 in 2009/10.

During the COVID-19 crisis, food insecurity impacted 16% of the population, and some critics argue that government food aid was instigated too late for the elderly and vulnerable. There have also been criticisms of the food parcels given, as reports stated that the parcels lacked nutritional food and instead contained an abundance of processed foods.

Historical statistics on welfare trends

Benefit rates as a percentage of industrial earnings

Note on source, as quoted in the text: "based on statistics of weekly earnings, ''Employment and Productivity Gazette''."

Changes in National Assistance/Supplementary Benefit

; Notes

* (a) As quoted in the text: "the scale is calculated using the average discretionary addition (adjusted to spread winter fuel costs throughout the year) for retirement pensioners. It does not include any allowance for rent. The price index used for the single pensioner is that in the ''Employment and Productivity Gazette''."

* (b) As quoted in the text: "it is assumed that the children are aged four, six, and eleven."

Increases in National Insurance benefits

; Notes:

* (a) As quoted by text: "Based on average earnings for adult male manual workers in manufacturing, allowing for income tax and national insurance contributions."

* (b) As quoted by text: "Calculated on the special price index for single pensioner households published by the ''

Employment and Productivity Gazette'' adjusted for housing expenditure using the housing component of the retail price index. Since a disproportionate number of pensioners have controlled tenancies, this may overstate the increase in prices."

* (c) This column is deflated by use of the

Retail Price Index

In the United Kingdom, the Retail Prices Index or Retail Price Index (RPI) is a measure of inflation published monthly by the Office for National Statistics. It measures the change in the cost of a representative sample of retail goods and servi ...

Social security benefits as a percentage of average earnings

* a,b Man plus dependent wife.

* c Man plus dependent wife on his insurance.

* d Married couple.

* e For one child.

Social policy benefits and earnings under the Labour Government 1964–1969

Supplementary benefits rates as a proportion of income

Households dependent on Supplementary Benefit

Changes in real terms in social security benefits

; Notes:

* (a) Refers to married couple.

* (b) Refers to man plus dependent wife.

* (c) Refers to man plus wife on his insurance. After 1971 refers to recipients under 80 years old.

* (d) Includes family allowance and tax allowance combined for second child up to 1977, when these were unified into the child benefit.

Percentage change in social security benefits, prices and earnings

* (a) Single person.

* (b) Single pensioner under age 80.

* (c) General index of retail prices.

* (d) Average gross weekly earnings of full-time adult male manual workers. For November 1978, October 1977 to October 1978 increase used.

Unemployment and sickness benefits as a percentage of income

* (a) After allowing for income tax and national insurance contributions.

* (b) Average earnings of adult male manual workers.

* (c) Earnings Related Supplement calculated using average earnings in October of the relevant tax year.

The real value of social security benefits, 1948–1975

See also

*

Social welfare

Welfare spending is a type of government support intended to ensure that members of a society can meet basic human needs such as food and shelter. Social security may either be synonymous with welfare, or refer specifically to social insurance p ...

*

Universal basic income in the United Kingdom

*

Welfare reform

*

Workfare

Workfare is a governmental plan under which welfare recipients are required to accept public-service jobs or to participate in job training. Many countries around the world have adopted workfare (sometimes implemented as "work-first" policies) t ...

*

Workfare in the United Kingdom

Housing

*

Public housing

Public housing, also known as social housing, refers to Subsidized housing, subsidized or affordable housing provided in buildings that are usually owned and managed by local government, central government, nonprofit organizations or a ...

*

Housing estate

A housing estate (or sometimes housing complex, housing development, subdivision (land), subdivision or community) is a group of homes and other buildings built together as a single development. The exact form may vary from country to count ...

*

Council house

A council house, corporation house or council flat is a form of British Public housing in the United Kingdom, public housing built by Local government in the United Kingdom, local authorities. A council estate is a building complex containing ...

References

Bibliography

* Béland, Daniel, and Alex Waddan. "Conservatives, partisan dynamics and the politics of universality: reforming universal social programmes in the UK and Canada." ''Journal of Poverty and Social Justice'' 22#2 (2014): 83–97.

* Bruce, Maurice. ''The Coming of the Welfare State'' (1966

online

* Calder, Gideon, and Jeremy Gass. ''Changing Directions of the British Welfare State'' (University of Wales Press, 2012).

* Esping-Andersen, Gosta; ''The Three Worlds of Welfare Capitalism'', (Princeton University Press (1990).

* Ferragina, Emanuele and Seeleib-Kaiser, Martin. "Welfare Regime Debate: Past, Present, Futures?" ''Policy & Politics'' 39#4 pp. 583–611 (2011)

online* Forder, Anthony, ed. ''Penelope Hall's Social Services of England and Wales'' (Routledge, 2013).

* Fraser, Derek. ''The evolution of the British welfare state: a history of social policy since the Industrial Revolution'' (2nd ed. 1984).

* Häusermann, Silja, Georg Picot, and Dominik Geering. "Review article: Rethinking party politics and the welfare state–recent advances in the literature." British Journal of Political Science 43.01 (2013): 221–40

online* Heclo, Hugh. ''Modern Social Politics in Britain and Sweden. From Relief to Income Maintenance'' (Yale UP, 1974

online* Hill, Michael J. ''The welfare state in Britain : a political history since 1945'' (1993

online* Jones, Margaret, and Rodney Lowe, eds. ''From Beveridge to Blair: the first fifty years of Britain's welfare state 1948–98'' (Manchester UP, 2002)

online* Laybourn Keith. ''The Evolution of British Social Policy and the Welfare State, c. 1800–1993'' (Keele University Press. 1995)

online* Slater, Tom. "The myth of "Broken Britain": welfare reform and the production of ignorance." ''Antipode'' 46.4 (2014): 948–69

online* Sullivan, Michael. ''The development of the British welfare state'' (1996)

* Welshman John. ''Underclass: A History of the Excluded, 1880–2000'' (2006

excerpt

External links

Text of the Beveridge ReportThe Welfare State – Never Ending Reform

Brief history of the Welfare State by Frank Field (BBC website)

The UK Economy at the Crossroads

research paper from the Center for Economic and Policy Research

{{Policies of the United Kingdom

Taxation in the United Kingdom

Social security in the United Kingdom

Child welfare in the United Kingdom

ku:Hukmeta jînfirehiyê

The New Liberals included intellectuals like L. T. Hobhouse, and John A. Hobson. They saw individual liberty as something achievable only under favourable social and economic circumstances. In their view, the poverty, squalor, and ignorance in which many people lived made it impossible for freedom and individuality to flourish. New Liberals believed that these conditions could be ameliorated only through collective action coordinated by a strong, welfare-oriented, and interventionist state.

After the historic 1906 victory, the

The New Liberals included intellectuals like L. T. Hobhouse, and John A. Hobson. They saw individual liberty as something achievable only under favourable social and economic circumstances. In their view, the poverty, squalor, and ignorance in which many people lived made it impossible for freedom and individuality to flourish. New Liberals believed that these conditions could be ameliorated only through collective action coordinated by a strong, welfare-oriented, and interventionist state.

After the historic 1906 victory, the