The Bank of America Corporation (Bank of America) (often abbreviated BofA or BoA) is an American multinational

investment bank

Investment is traditionally defined as the "commitment of resources into something expected to gain value over time". If an investment involves money, then it can be defined as a "commitment of money to receive more money later". From a broade ...

and

financial services

Financial services are service (economics), economic services tied to finance provided by financial institutions. Financial services encompass a broad range of tertiary sector of the economy, service sector activities, especially as concerns finan ...

holding company

A holding company is a company whose primary business is holding a controlling interest in the Security (finance), securities of other companies. A holding company usually does not produce goods or services itself. Its purpose is to own Share ...

headquartered at the

Bank of America Corporate Center

The Bank of America Corporate Center is an 871 ft (265 m) skyscraper in Charlotte center city, Uptown Charlotte, North Carolina, Charlotte, North Carolina. Designed by Argentina, Argentine architect César Pelli and HKS Architects, an ...

in

Charlotte, North Carolina

Charlotte ( ) is the List of municipalities in North Carolina, most populous city in the U.S. state of North Carolina and the county seat of Mecklenburg County, North Carolina, Mecklenburg County. The population was 874,579 at the 2020 United ...

, with

investment bank

Investment is traditionally defined as the "commitment of resources into something expected to gain value over time". If an investment involves money, then it can be defined as a "commitment of money to receive more money later". From a broade ...

ing and auxiliary headquarters in

Manhattan

Manhattan ( ) is the most densely populated and geographically smallest of the Boroughs of New York City, five boroughs of New York City. Coextensive with New York County, Manhattan is the County statistics of the United States#Smallest, larg ...

. The bank was founded by the merger of

NationsBank

NationsBank was one of the largest banking corporations in the United States, based in Charlotte, North Carolina. The company named NationsBank was formed through the merger of several other banks in 1991, and prior to that had been through mul ...

and

Bank of America

The Bank of America Corporation (Bank of America) (often abbreviated BofA or BoA) is an American multinational investment banking, investment bank and financial services holding company headquartered at the Bank of America Corporate Center in ...

in 1998. It is the

second-largest banking institution in the United States and the second-largest bank in the world by

market capitalization

Market capitalization, sometimes referred to as market cap, is the total value of a publicly traded company's outstanding common shares owned by stockholders.

Market capitalization is equal to the market price per common share multiplied by ...

, both after

JPMorgan Chase

JPMorgan Chase & Co. (stylized as JPMorganChase) is an American multinational financial services, finance corporation headquartered in New York City and incorporated in Delaware. It is List of largest banks in the United States, the largest ba ...

. Bank of America is one of the

Big Four banking institutions of the United States. and one of eight

systemically important financial institution

A systemically important financial institution (SIFI) is a bank, insurance company, or other financial institution whose failure might trigger a financial crisis. They are colloquially referred to as "too big to fail".

As the 2008 financial cri ...

s in the US. It serves about 10 percent of all American bank deposits, in direct competition with JPMorgan Chase,

Citigroup

Citigroup Inc. or Citi (Style (visual arts), stylized as citi) is an American multinational investment banking, investment bank and financial services company based in New York City. The company was formed in 1998 by the merger of Citicorp, t ...

, and

Wells Fargo

Wells Fargo & Company is an American multinational financial services company with a significant global presence. The company operates in 35 countries and serves over 70 million customers worldwide. It is a systemically important fi ...

. Its primary financial services revolve around

commercial bank

A commercial bank is a financial institution that accepts deposits from the public and gives loans for the purposes of consumption and investment to make a profit.

It can also refer to a bank or a division of a larger bank that deals with whol ...

ing,

wealth management

Wealth management (WM) or wealth management advisory (WMA) is an investment advisory service that provides financial management and wealth advisory services to a wide array of clients ranging from affluent to high-net-worth (HNW) and ultra-hi ...

, and investment banking.

Through mergers, the oldest branch of the Bank of America franchise can be traced to 1784, when

Massachusetts Bank was chartered, the first federally chartered joint-stock owned bank in the United States. Another branch of its history goes back to the U.S.-based

Bank of Italy

The Bank of Italy (Italian language, Italian: ''Banca d'Italia'', , informally referred to as ''Bankitalia'') is the National central bank (Eurosystem), national central bank for Italy within the Eurosystem. It was the Italian central bank from ...

, founded by

Amadeo Pietro Giannini in 1904, which provided various banking options to

Italian immigrants

The Italian diaspora (, ) is the large-scale emigration of Italians from Italy.

There were two major Italian diasporas in Italian history. The first diaspora began around 1880, two decades after the Unification of Italy, and ended in the 1920s ...

who

faced service discrimination.

[ The bank grew due to insurance monies provided after the 1906 Earthquake.] Headquartered in

San Francisco, California

San Francisco, officially the City and County of San Francisco, is a commercial, Financial District, San Francisco, financial, and Culture of San Francisco, cultural center of Northern California. With a population of 827,526 residents as of ...

, Giannini acquired

Banca d'America e d'Italia

Deutsche Bank S.p.A. is an Italian bank based in Milan, Lombardy. It is a subsidiary of Deutsche Bank A.G.

History

Banca dell'Italia Meridionale was found in 1917. It was acquired by Amadeo Giannini, the founder of Bank of Italy (United States) i ...

, in 1922 and eventually did business as Bank of America.

In the 1950s, passage of landmark federal banking legislation facilitated rapid growth, quickly establishing prominent shares for the present bank's predecessors. After suffering significant losses during the

1998 Russian financial crisis

The Russian financial crisis (also called the ruble crisis or the Russian flu) began in Russia on 17 August 1998. It resulted in the Russian government and the Russian Central Bank devaluing the Russian rouble, ruble and sovereign default, defau ...

, BankAmerica, as it was then known, was acquired by the Charlotte-based

NationsBank

NationsBank was one of the largest banking corporations in the United States, based in Charlotte, North Carolina. The company named NationsBank was formed through the merger of several other banks in 1991, and prior to that had been through mul ...

for $62 billion. Following what was then the

largest bank acquisition in history, the Bank of America Corporation was founded. Through a series of mergers and acquisitions, it built upon its commercial banking business by establishing

Merrill Lynch

Merrill Lynch, Pierce, Fenner & Smith Incorporated, doing business as Merrill, and previously branded Merrill Lynch, is an American investment management and wealth management division of Bank of America. Along with BofA Securities, the investm ...

for wealth management and

Bank of America Merrill Lynch

BofA Securities, Inc., previously Bank of America Merrill Lynch (BAML), is an American multinational investment banking division under the auspices of Bank of America. It is not to be confused with Merrill, the stock brokerage and trading pla ...

for investment banking in 2008 and 2009, respectively, and since renamed BofA Securities.

Both Bank of America and Merrill Lynch Wealth Management retain large market shares in their respective offerings. The

investment bank

Investment is traditionally defined as the "commitment of resources into something expected to gain value over time". If an investment involves money, then it can be defined as a "commitment of money to receive more money later". From a broade ...

is considered within the "

Bulge Bracket" as the

third largest investment bank in the world, . Its wealth management unit manages $1.08 trillion in

assets under management

In finance, assets under management (AUM), sometimes called fund under management, refers to the total market value of all financial assets that a financial institution—such as a mutual fund, venture capital firm, or depository institutio ...

(AUM) as the

second largest wealth manager in the world, after

UBS

UBS Group AG (stylized simply as UBS) is a multinational investment bank and financial services firm founded and based in Switzerland, with headquarters in both Zurich and Basel. It holds a strong foothold in all major financial centres as the ...

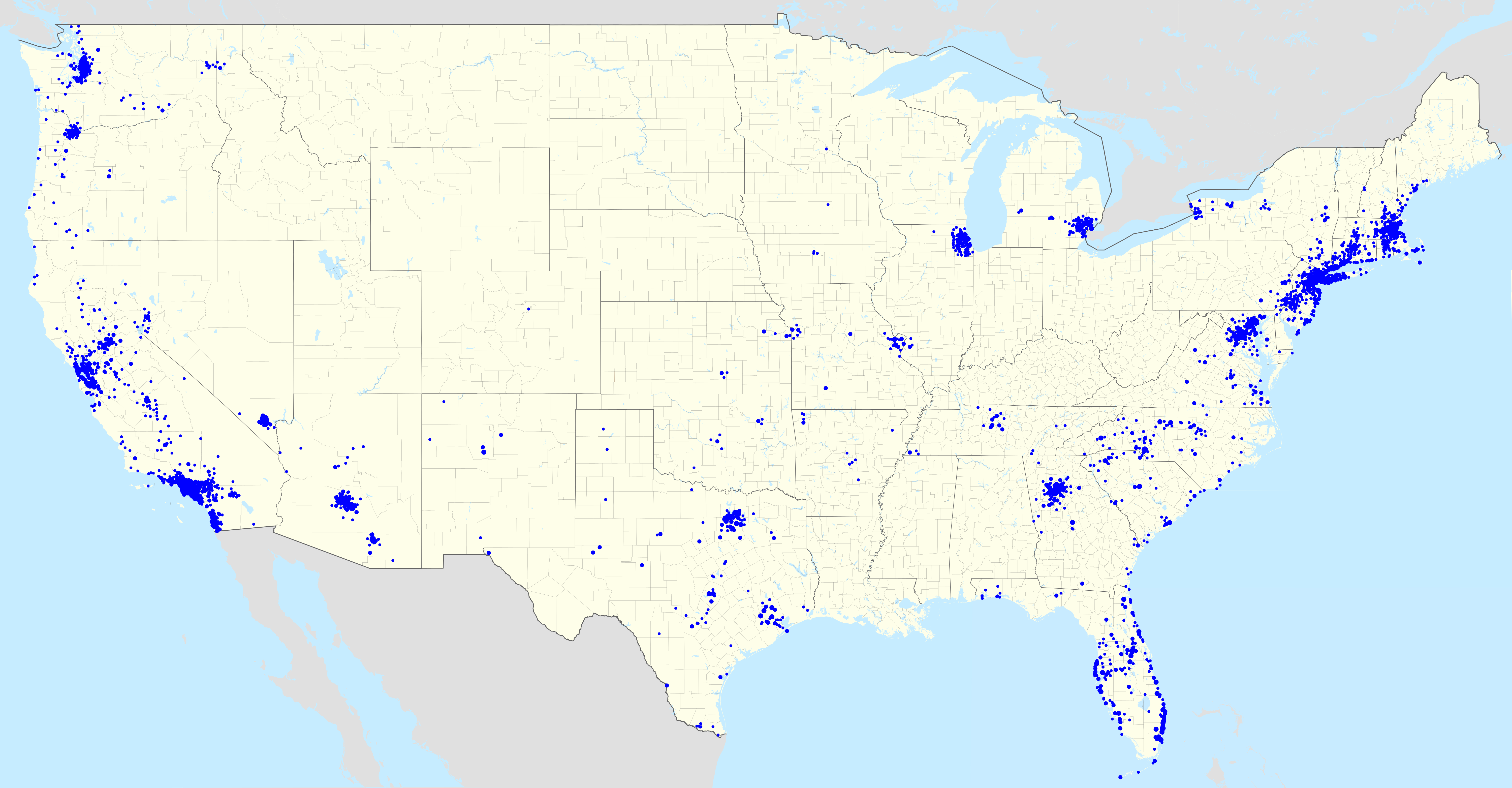

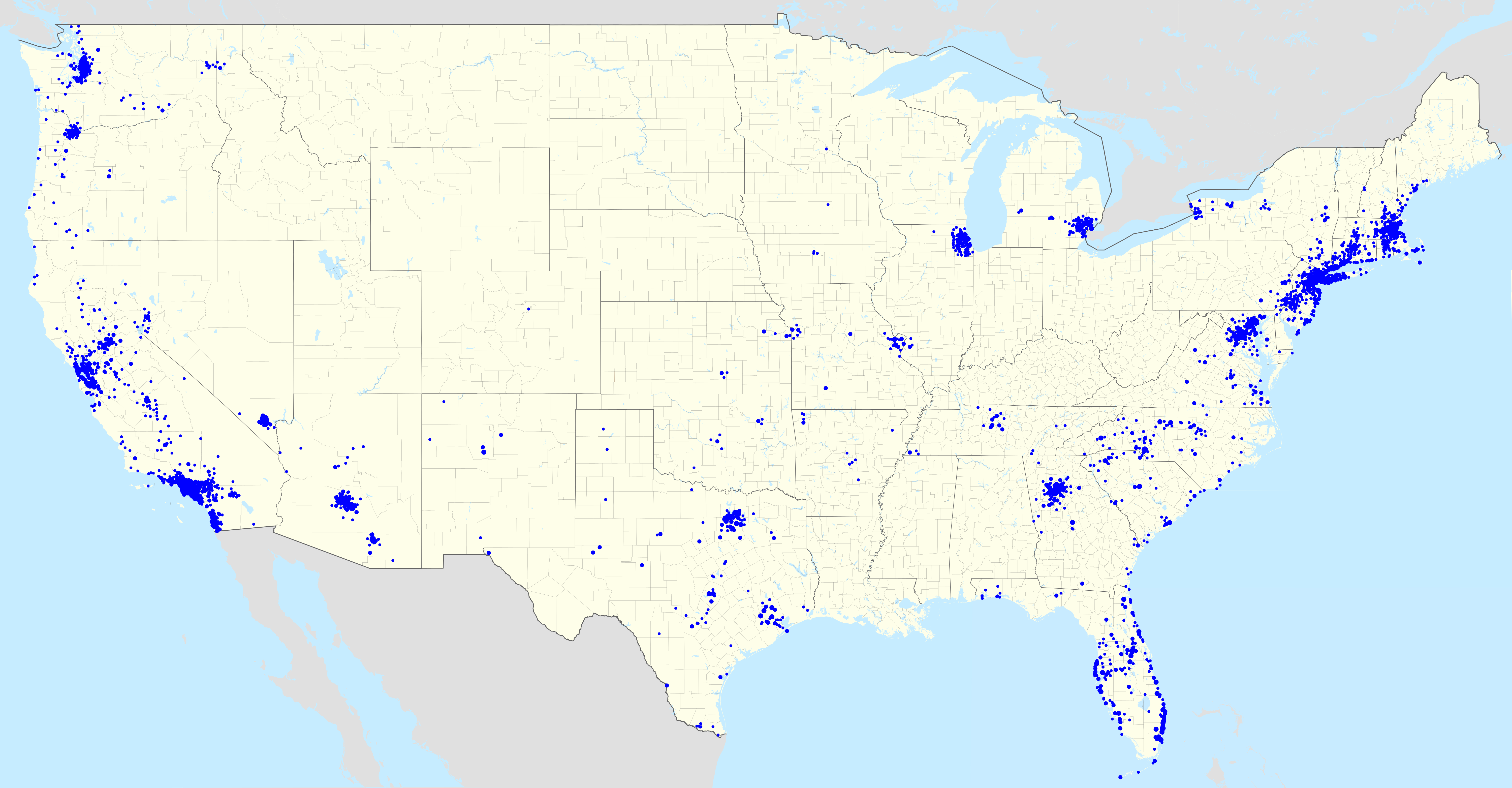

. In commercial banking, Bank of America has operations, but does not necessarily maintain retail branches in all 50 states of the United States,

Washington, D.C.

Washington, D.C., formally the District of Columbia and commonly known as Washington or D.C., is the capital city and federal district of the United States. The city is on the Potomac River, across from Virginia, and shares land borders with ...

, and over 40 other countries. Its commercial banking footprint encapsulates 46 million consumer and small business relationships at 4,600 banking centers and 16,000

automated teller machine

An automated teller machine (ATM) is an electronic telecommunications device that enables customers of financial institutions to perform financial transactions, such as cash withdrawals, deposits, funds transfers, balance inquiries or account ...

s (ATMs).

The bank's large market share, business activities, and economic impact has led to numerous lawsuits and investigations regarding both mortgages and financial disclosures dating back to the

2008 financial crisis

The 2008 financial crisis, also known as the global financial crisis (GFC), was a major worldwide financial crisis centered in the United States. The causes of the 2008 crisis included excessive speculation on housing values by both homeowners ...

. Its corporate practices of servicing the

middle class

The middle class refers to a class of people in the middle of a social hierarchy, often defined by occupation, income, education, or social status. The term has historically been associated with modernity, capitalism and political debate. C ...

and wider banking community have yielded a substantial market share since the early 20th century. , Bank of America has a $313.5 billion

market capitalization

Market capitalization, sometimes referred to as market cap, is the total value of a publicly traded company's outstanding common shares owned by stockholders.

Market capitalization is equal to the market price per common share multiplied by ...

, making it the

13th largest company in the world. As the sixth largest American public company, it garnered $102.98 billion in sales . Bank of America was ranked No. 25 on the 2020

Fortune 500

The ''Fortune'' 500 is an annual list compiled and published by ''Fortune (magazine), Fortune'' magazine that ranks 500 of the largest United States Joint-stock company#Closely held corporations and publicly traded corporations, corporations by ...

rankings of the largest US corporations by total revenue. Likewise, Bank of America was also ranked No. 6 on the 2023 Global 2000 rankings done by Forbes. Bank of America was named the "World's Best Bank" by the ''

Euromoney Institutional Investor

Delinian (formerly Euromoney Institutional Investor) is a British financial media company that has interests in business and financial publishing and event organisation.

, it was one of Europe's largest business and financial information comp ...

'' in its 2018 Awards for Excellence.

History

Bank of America, Los Angeles

The Bank of America, Los Angeles, was established in 1923 by Orra E. Monnette, emerging from a series of mergers between Los Angeles–based banks between 1909 and 1923. The formation of BoA L.A. predates the creation of the Bank of America, mer ...

was founded in California in 1923. In 1928, this entity was acquired by

Bank of Italy

The Bank of Italy (Italian language, Italian: ''Banca d'Italia'', , informally referred to as ''Bankitalia'') is the National central bank (Eurosystem), national central bank for Italy within the Eurosystem. It was the Italian central bank from ...

of San Francisco, which took the Bank of America name two years later.

The eastern portion of the Bank of America franchise can be traced to 1784, when

Massachusetts Bank was chartered, the first federally chartered joint-stock owned bank in the United States and only the second bank to receive a charter in the United States. This bank became

FleetBoston

FleetBoston Financial was a Boston, Massachusetts–based bank created in 1999 by the merger of Fleet Financial Group and BankBoston. In 2004 it merged with Bank of America; all of its banks and branches were converted to Bank of America.

Hist ...

, with which Bank of America merged in 2004. In 1874,

Commercial National Bank

Commercial National Bank was a bank formed in Charlotte, North Carolina, on 18 February 1874, which was a predecessor to the American Commercial Bank which then helped form North Carolina National Bank. NCNB changed their name to NationsBank in ...

was founded in Charlotte. That bank merged with American Trust Company in 1958 to form American Commercial Bank. Two years later it became

North Carolina National Bank

North Carolina National Bank (NCNB) was an American bank based in Charlotte, North Carolina, prior to 1960 called American Commercial Bank. It was one of America's top banking institutions between the 1960s-1990s. From 1974 to 1983, the bank was ...

when it merged with Security National Bank of Greensboro. In 1991, it merged with

C&S/

Sovran

''Sovran'' is the sixth studio album by Swedish gothic metal band Draconian, released on 30 October 2015 through Napalm Records. It's the first album with new singer Heike Langhans (:LOR3L3I:, REMINA) after the departure of Lisa Johansson in 201 ...

Corporation of

Atlanta

Atlanta ( ) is the List of capitals in the United States, capital and List of municipalities in Georgia (U.S. state), most populous city in the U.S. state of Georgia (U.S. state), Georgia. It is the county seat, seat of Fulton County, Georg ...

and

Norfolk

Norfolk ( ) is a Ceremonial counties of England, ceremonial county in England, located in East Anglia and officially part of the East of England region. It borders Lincolnshire and The Wash to the north-west, the North Sea to the north and eas ...

to form

NationsBank

NationsBank was one of the largest banking corporations in the United States, based in Charlotte, North Carolina. The company named NationsBank was formed through the merger of several other banks in 1991, and prior to that had been through mul ...

.

The central portion of the franchise dates to 1910, when Commercial National Bank and Continental National Bank of Chicago merged in 1910 to form Continental & Commercial National Bank, which evolved into

Continental Illinois National Bank & Trust

Continental may refer to:

Places

* Continental, Arizona, a small community in Pima County, Arizona, US

* Continental, Ohio, a small town in Putnam County, US

Arts and entertainment

* ''Continental'' (album), an album by Saint Etienne

* Continent ...

.

Bank of America

The history of Bank of America dates back to October 17, 1904, when

Amadeo Pietro Giannini (1870–1949) founded the

Bank of Italy

The Bank of Italy (Italian language, Italian: ''Banca d'Italia'', , informally referred to as ''Bankitalia'') is the National central bank (Eurosystem), national central bank for Italy within the Eurosystem. It was the Italian central bank from ...

, in San Francisco.

In 1922, Bank of America, Los Angeles was established with Giannini as a minority investor. The two banks merged in 1928 and consolidated with other bank holdings to create what would become the largest banking institution in the country.

In 1918, another corporation, Bancitaly Corporation, was organized by A. P. Giannini, the largest stockholder of which was Stockholders Auxiliary Corporation. This company acquired the stocks of various banks located in New York City and certain foreign countries.

In 1928, Giannini merged his bank with

Bank of America, Los Angeles

The Bank of America, Los Angeles, was established in 1923 by Orra E. Monnette, emerging from a series of mergers between Los Angeles–based banks between 1909 and 1923. The formation of BoA L.A. predates the creation of the Bank of America, mer ...

, headed by

Orra E. Monnette. Bank of Italy was renamed on November 3, 1930, to

Bank of America National Trust and Savings Association, which was the only such designated bank in the United States at that time. Giannini and Monnette headed the resulting company, serving as co-chairs.

Expansion in California

Giannini introduced branch banking shortly after 1909 legislation in California allowed for branch banking in the state, establishing the bank's first branch outside San Francisco in 1909 in San Jose. By 1929 the bank had 453 banking offices in California with aggregate resources of over US$1.4 billion. There is a replica of the 1909 Bank of Italy branch bank in

History Park

History Park at Kelley Park in San Jose, California, United States, is designed as an indoor/outdoor museum, arranged to appear as a small US town might have in the early 1900s (decade). Since its inauguration in 1971, 32 historic buildings and ot ...

in San Jose, and the 1925

Bank of Italy Building Bank of Italy is the Bank of Italy or Banca d'Italia, the central bank of Italy.

Or it may refer to:

*Bank of Italy (United States), a bank established in San Francisco, California and the forerunner of the Bank of America.

Or Bank of Italy or Ban ...

is an important

downtown

''Downtown'' is a term primarily used in American and Canadian English to refer to a city's sometimes commercial, cultural and often the historical, political, and geographic heart. It is often synonymous with its central business district ( ...

landmark. Giannini sought to build a national bank, expanding into most of the western states as well as into the

insurance industry

Insurance is a means of protection from financial loss in which, in exchange for a fee, a party agrees to compensate another party in the event of a certain loss, damage, or injury. It is a form of risk management, primarily used to protect ...

, under the aegis of his holding company,

Transamerica Corporation

Transamerica Corporation is an American holding company for various life insurance companies and investment firms operating primarily in the United States, offering life and supplemental health insurance, investments, and retirement services. The ...

.

In 1953 regulators succeeded in forcing the separation of

Transamerica Corporation

Transamerica Corporation is an American holding company for various life insurance companies and investment firms operating primarily in the United States, offering life and supplemental health insurance, investments, and retirement services. The ...

and Bank of America under the

Clayton Antitrust Act

The Clayton Antitrust Act of 1914 (, codified at , ), is a part of United States antitrust law with the goal of adding further substance to the U.S. antitrust law regime; the Clayton Act seeks to prevent anticompetitive practices in their inci ...

. The passage of the

Bank Holding Company Act of 1956

The Bank Holding Company Act of 1956 (, ''et seq.'') is a United States Act of Congress that regulates the actions of bank holding companies.

The original law (subsequently amended), specified that the Federal Reserve Board of Governors must appr ...

prohibited banks from owning

non-banking subsidiaries such as insurance companies. Bank of America and Transamerica were separated, with the latter company continuing in the insurance sector. However, federal banking regulators prohibited Bank of America's interstate banking activity, and Bank of America's domestic banks outside California were forced into a separate company that eventually became

First Interstate Bancorp

First Interstate Bancorp was a bank holding company based in the United States. Headquartered in Los Angeles, it was the nation's eighth largest banking company.

Although First Interstate Bancorp was taken over by Wells Fargo in 1996, the name ...

, later acquired by

Wells Fargo and Company

Wells Fargo & Company is an American multinational financial services company with a significant global presence. The company operates in 35 countries and serves over 70 million customers worldwide. It is a systemically important fi ...

in 1996. Only in the 1980s, with a change in federal banking legislation and regulation, could Bank of America again expand its domestic consumer banking activity outside California.

New technologies also allowed the direct linking of

credit cards with individual bank accounts. In 1958, the bank introduced the BankAmericard, which changed its name to

Visa

Visa most commonly refers to:

* Travel visa, a document that allows entry to a foreign country

* Visa Inc., a US multinational financial and payment cards company

** Visa Debit card issued by the above company

** Visa Electron, a debit card

** Vi ...

in 1977. A coalition of regional bankcard associations introduced Interbank in 1966 to compete with BankAmericard. Interbank became Master Charge in 1966 and then

Mastercard in 1979.

[ Available through SpringerLink.]

From February 1970 through September 1971, there were 66 attacks on Bank of America branches in California, including 53 bombings or fire-bombings, and 13 arson fires. There were "few injuries" and the property damage cost about $500,000, 80% of which was from the burning of the Isla Vista branch during a February 1970 riot.

Expansion outside California

Following passage of the

Bank Holding Company Act of 1956

The Bank Holding Company Act of 1956 (, ''et seq.'') is a United States Act of Congress that regulates the actions of bank holding companies.

The original law (subsequently amended), specified that the Federal Reserve Board of Governors must appr ...

by the

U.S. Congress

The United States Congress is the legislative branch of the federal government of the United States. It is a bicameral legislature, including a lower body, the U.S. House of Representatives, and an upper body, the U.S. Senate. They both ...

, BankAmerica Corporation was established for the purpose of owning and operating Bank of America and its subsidiaries.

In 1983, Bank of America expanded outside

California

California () is a U.S. state, state in the Western United States that lies on the West Coast of the United States, Pacific Coast. It borders Oregon to the north, Nevada and Arizona to the east, and shares Mexico–United States border, an ...

, through acquisition, orchestrated in part by

Stephen McLin Stephen McLin was a longtime executive in the banking industry who came to the industry from an engineering, rather than a finance background.

McLin, the oldest of six children, was the son of an Air Force doctor. He grew up moving every few years, ...

of

Seafirst Corporation in

Seattle

Seattle ( ) is the most populous city in the U.S. state of Washington and in the Pacific Northwest region of North America. With a population of 780,995 in 2024, it is the 18th-most populous city in the United States. The city is the cou ...

, and its wholly owned banking subsidiary, Seattle-First National Bank.

Seafirst was at risk of seizure by the federal government after becoming insolvent due to a series of bad loans to the

oil industry

The petroleum industry, also known as the oil industry, includes the global processes of exploration, extraction, refining, transportation (often by oil tankers and pipelines), and marketing of petroleum products. The largest volume products ...

. BankAmerica continued to operate its new subsidiary as Seafirst rather than Bank of America until the 1998 merger with NationsBank.

BankAmerica experienced huge losses in 1986 and 1987 due to the placement of a series of bad loans in the

Third World

The term Third World arose during the Cold War to define countries that remained non-aligned with either NATO or the Warsaw Pact. The United States, Canada, Taiwan, Japan, South Korea, the Southern Cone, NATO, Western European countries and oth ...

. The company fired its CEO,

Sam Armacost, in 1986. Though Armacost blamed the problems on his predecessor,

A. W. (Tom) Clausen, Clausen was appointed to replace Armacost. The losses resulted in a huge decline of BankAmerica stock, making it vulnerable to a hostile

takeover

In business, a takeover is the purchase of one company (the ''target'') by another (the ''acquirer'' or ''bidder''). In the UK, the term refers to the acquisition of a public company whose shares are publicly listed, in contrast to the acquisi ...

.

First Interstate Bancorp

First Interstate Bancorp was a bank holding company based in the United States. Headquartered in Los Angeles, it was the nation's eighth largest banking company.

Although First Interstate Bancorp was taken over by Wells Fargo in 1996, the name ...

of Los Angeles (which had originated from banks once owned by BankAmerica), launched such a bid in the fall of 1986, although BankAmerica rebuffed it, mostly by selling operations. It sold its FinanceAmerica subsidiary to

Chrysler

FCA US, LLC, Trade name, doing business as Stellantis North America and known historically as Chrysler ( ), is one of the "Big Three (automobile manufacturers), Big Three" automobile manufacturers in the United States, headquartered in Auburn H ...

and the brokerage firm

Charles Schwab and Co. back to

Mr. Schwab. It also sold

Bank of America and Italy to

Deutsche Bank

Deutsche Bank AG (, ) is a Germany, German multinational Investment banking, investment bank and financial services company headquartered in Frankfurt, Germany, and dual-listed on the Frankfurt Stock Exchange and the New York Stock Exchange.

...

. By the time of the

1987 stock-market crash, BankAmerica's share price had fallen to $8, but by 1992 it had rebounded mightily to become one of the biggest gainers of that half-decade.

BankAmerica's next big acquisition came in 1992. The company acquired Security Pacific Corporation and its subsidiary

Security Pacific National Bank

Security Pacific National Bank (SPNB) was a large U.S. bank headquartered in Los Angeles, California. It was acquired by Bank of America in 1992.

History

On September 1, 1868, Hellman, Temple and Co. opened their first bank branch in Los ...

in California and other banks in

Arizona

Arizona is a U.S. state, state in the Southwestern United States, Southwestern region of the United States, sharing the Four Corners region of the western United States with Colorado, New Mexico, and Utah. It also borders Nevada to the nort ...

,

Idaho

Idaho ( ) is a landlocked U.S. state, state in the Pacific Northwest and Mountain states, Mountain West subregions of the Western United States. It borders Montana and Wyoming to the east, Nevada and Utah to the south, and Washington (state), ...

,

Oregon

Oregon ( , ) is a U.S. state, state in the Pacific Northwest region of the United States. It is a part of the Western U.S., with the Columbia River delineating much of Oregon's northern boundary with Washington (state), Washington, while t ...

, and

Washington

Washington most commonly refers to:

* George Washington (1732–1799), the first president of the United States

* Washington (state), a state in the Pacific Northwest of the United States

* Washington, D.C., the capital of the United States

** A ...

, which Security Pacific had acquired in a series of acquisitions in the late 1980s. This represented, at the time, the largest bank acquisition in history. Federal regulators, however, forced the sale of roughly half of Security Pacific's

Washington

Washington most commonly refers to:

* George Washington (1732–1799), the first president of the United States

* Washington (state), a state in the Pacific Northwest of the United States

* Washington, D.C., the capital of the United States

** A ...

subsidiary, the former

Rainier Bank, as the combination of Seafirst and Security Pacific Washington would have given BankAmerica too large a share of the market in that state. The Washington branches were divided and sold to West One Bancorp (now

U.S. Bancorp

U.S. Bancorp (stylized as us bancorp) is an American multinational financial services firm headquartered in Minneapolis, Minnesota and incorporated in Delaware. It is the 5th-largest bank in the United States as of 2025. As the largest bank i ...

) and

KeyBank

KeyBank is an American regional bank headquartered in Cleveland, Ohio, and the 27th largest bank in the United States. Organized under the publicly traded KeyCorp, KeyBank was formed from the 1994 merger of the Cleveland-based Society Corpora ...

. Later that year, BankAmerica expanded into Nevada by acquiring Valley Bank of Nevada.

In 1994, BankAmerica acquired the

Continental Illinois National Bank and Trust Co. of Chicago. At the time, no bank possessed the resources to bail out Continental, so the federal government operated the bank for nearly a decade.

Illinois

Illinois ( ) is a U.S. state, state in the Midwestern United States, Midwestern United States. It borders on Lake Michigan to its northeast, the Mississippi River to its west, and the Wabash River, Wabash and Ohio River, Ohio rivers to its ...

then regulated branch banking extremely heavily, so Bank of America Illinois was a single-unit bank until the 21st century. BankAmerica moved its national lending department to Chicago in an effort to establish a financial beachhead in the region.

These mergers helped BankAmerica Corporation to once again become the largest U.S. bank holding company in terms of deposits, but the company fell to second place in 1997 behind North Carolina's fast-growing

NationsBank Corporation, and to third in 1998 behind

First Union

First Union Corporation was a bank holding company that provided commercial bank, commercial and retail banking services in eleven states in the Eastern United States, eastern U.S. First Union also provided various other financial services, incl ...

Corp.

On the capital markets side, the acquisition of Continental Illinois helped BankAmerica to build a leveraged finance origination- and distribution business, which allowed the firm's existing broker-dealer, BancAmerica Securities (originally named BA Securities), to become a full-service franchise. In addition, in 1997, BankAmerica acquired

Robertson Stephens

Robertson Stephens is a wealth management firm serving high net worth individuals and family offices. The firm is registered with the United States Securities and Exchange Commission as an investment advisor.

Robertson Stephens was founded as ...

, a San Francisco–based investment bank specializing in high technology for $540 million. Robertson Stephens was integrated into BancAmerica Securities, and the combined subsidiary was renamed "BancAmerica Robertson Stephens".

Merger of NationsBank and BankAmerica

In 1997, BankAmerica lent investment management firm

D. E. Shaw & Co. $1.4 billion to run various businesses for the bank. However, D.E. Shaw suffered significant loss during the

1998 Russian financial crisis

The Russian financial crisis (also called the ruble crisis or the Russian flu) began in Russia on 17 August 1998. It resulted in the Russian government and the Russian Central Bank devaluing the Russian rouble, ruble and sovereign default, defau ...

.

NationsBank

NationsBank was one of the largest banking corporations in the United States, based in Charlotte, North Carolina. The company named NationsBank was formed through the merger of several other banks in 1991, and prior to that had been through mul ...

of Charlotte acquired BankAmerica in 1998 in what was the largest bank acquisition in history at that time.

While NationsBank was the nominal survivor, the merged bank took the better-known name of Bank of America. Hence, the holding company was renamed Bank of America Corporation, while NationsBank, N.A. merged with Bank of America NT&SA to form Bank of America, N.A. as the remaining legal bank entity. The combined bank operates under Federal Charter 13044, which was granted to Giannini's Bank of Italy on March 1, 1927. However, the merged company was and still is headquartered in Charlotte, and retains NationsBank's pre-1998 stock price history. All

U.S. Securities and Exchange Commission

The United States Securities and Exchange Commission (SEC) is an independent agency of the United States federal government, created in the aftermath of the Wall Street crash of 1929. Its primary purpose is to enforce laws against market m ...

(SEC) filings before 1998 are listed under NationsBank, not Bank of America. NationsBank president, chairman, and CEO

Hugh McColl

Hugh Leon McColl Jr. (born June 18, 1935) is a former business executive who was the CEO of NationsBank and the former chairman and the first CEO of Bank of America. Active in banking since around 1960, McColl was a driving force behind conso ...

, took on the same roles with the merged company.

In 1998, Bank of America possessed combined assets of $570 billion, as well as 4,800 branches in 22 U.S. states. Despite the size of the two companies, federal regulators insisted only upon the divestiture of 13 branches in

New Mexico

New Mexico is a state in the Southwestern United States, Southwestern region of the United States. It is one of the Mountain States of the southern Rocky Mountains, sharing the Four Corners region with Utah, Colorado, and Arizona. It also ...

, in towns that would be left with only a single bank following the combination. These branches were sold to

BOK Financial Corporation

BOK Financial Corporation — pronounced as letters, "B-O-K" — is a financial services holding company headquartered in Tulsa, Oklahoma. Offering a full complement of retail and commercial banking products and services across the American Midw ...

, which operates them under the name "Bank of Albuquerque". The broker-dealer, NationsBanc Montgomery Securities, was named

Banc of America Securities

The Bank of America Corporation (Bank of America) (often abbreviated BofA or BoA) is an American multinational investment bank and financial services holding company headquartered at the Bank of America Corporate Center in Charlotte, North ...

in 1998.

Banc of America Securities

Banc of America Securities LLC (BAS), was the

investment banking

Investment banking is an advisory-based financial service for institutional investors, corporations, governments, and similar clients. Traditionally associated with corporate finance, such a bank might assist in raising financial capital by und ...

subsidiary of BoA from 1998 until BoA was merged with

Merrill Lynch

Merrill Lynch, Pierce, Fenner & Smith Incorporated, doing business as Merrill, and previously branded Merrill Lynch, is an American investment management and wealth management division of Bank of America. Along with BofA Securities, the investm ...

(2008). Headquartered in New York City, the company competed in both the domestic and international equity and investment banking markets. The company was a registered

broker-dealer

In financial services, a broker-dealer is a natural person, company or other organization that engages in the business of trading securities for its own account or on behalf of its customers. Broker-dealers are at the heart of the securities and ...

with the

United States Securities and Exchange Commission

The United States Securities and Exchange Commission (SEC) is an independent agencies of the United States government, independent agency of the United States federal government, created in the aftermath of the Wall Street crash of 1929. Its ...

(SEC) and was a member of the

New York Stock Exchange

The New York Stock Exchange (NYSE, nicknamed "The Big Board") is an American stock exchange in the Financial District, Manhattan, Financial District of Lower Manhattan in New York City. It is the List of stock exchanges, largest stock excha ...

and the

National Association of Securities Dealers

The Financial Industry Regulatory Authority (FINRA) is a private American corporation that acts as a self-regulatory organization (SRO) that regulates member brokerage firms and exchange markets. FINRA is the successor to the National Associati ...

. The use of "

Banc

"Banq" and "banc" are alternative spellings used in company names to evade legal restrictions on the use of the word 'bank' while maintaining a similar pronunciation. This practice is common in the financial services industry, particularly in the ...

" in the BAS's name was indicative of the fact that the company was not a

bank

A bank is a financial institution that accepts Deposit account, deposits from the public and creates a demand deposit while simultaneously making loans. Lending activities can be directly performed by the bank or indirectly through capital m ...

, and its deposits and other holdings were not insured by the

Federal Deposit Insurance Corporation

The Federal Deposit Insurance Corporation (FDIC) is a State-owned enterprises of the United States, United States government corporation supplying deposit insurance to depositors in American commercial banks and savings banks. The FDIC was cr ...

.

The subsidiary was founded in 1998 following a strategy pioneered by

Citigroup

Citigroup Inc. or Citi (Style (visual arts), stylized as citi) is an American multinational investment banking, investment bank and financial services company based in New York City. The company was formed in 1998 by the merger of Citicorp, t ...

that combines corporate lending with investment banking advice and services. During its years of operation its strongest investment banking groups included

high-yield debt

In finance, a high-yield bond (non-investment-grade bond, speculative-grade bond, or junk bond) is a bond that is rated below investment grade by credit rating agencies. These bonds have a higher risk of default or other adverse credit even ...

underwriting and Leveraged Finance, in addition to industry coverage groups such as Healthcare, Consumer & Retail, Global Industries, Media & Telecom, Financial Institutions, Real Estate and Gaming. BAS also did a significant amount of work for Financial Sponsors, or private equity firms, often financing leveraged transactions. On the product side, the firm employed M&A senior bankers throughout the industry coverage groups. BAS also had a stand-alone

Mergers & Acquisitions

''Mergers & Acquisitions'' is a real-time B2B community, featuring a monthly magazine, daily enewsletter, conferences and member gatherings that provide news, commentary, data, analysis and community around the burgeoning middle market, providin ...

Group, consisting of bankers that transact M&A deals across all industries, as well as a Transaction Development Group, which aimed to identify and market transaction opportunities. The unit also had sizeable fixed income, currency and commodities divisions.

During 2007–2008, BAS significantly downsized its international operations, eliminating a number of industry groups in Europe, as well as cutting numerous banking and sales and trading positions in North America and Asia prior to its merger with Merrill Lynch. On October 3, 2008, Bank of America announced that

John Thain

John Alexander Thain (born May 26, 1955) is an American financial executive and investment banker. He was president and co-COO of Goldman Sachs, and then CEO of the New York Stock Exchange. Thain then became the last chairman and CEO of Merrill ...

would lead the combined Bank of America/

Merrill Lynch

Merrill Lynch, Pierce, Fenner & Smith Incorporated, doing business as Merrill, and previously branded Merrill Lynch, is an American investment management and wealth management division of Bank of America. Along with BofA Securities, the investm ...

Global Corporate and Investment Banking enterprise. Thain was forced out by Bank of America Chairman

Kenneth D. Lewis on January 22, 2009, because of the colossal losses visited on B of A due to its acquisition of Merrill Lynch.

With Thain's departure,

Brian Moynihan

Brian Thomas Moynihan is an American lawyer and banker. He is the chairman, president, and CEO of Bank of America, having been promoted to these positions in 2010.

Moynihan is a member of the Council on Competitiveness board and Partnership for ...

became president of Global Banking and Global Wealth and Investment Management.

After the merger was closed, the SEC Registration of Banc of America Securities was terminated in January 2011.

BAS operated from a number of offices across the world, with major offices in

New York, New York

New York, often called New York City (NYC), is the List of United States cities by population, most populous city in the United States, located at the southern tip of New York State on New York Harbor, one of the world's largest natural harb ...

,

Charlotte, North Carolina

Charlotte ( ) is the List of municipalities in North Carolina, most populous city in the U.S. state of North Carolina and the county seat of Mecklenburg County, North Carolina, Mecklenburg County. The population was 874,579 at the 2020 United ...

,

Chicago, Illinois

Chicago is the List of municipalities in Illinois, most populous city in the U.S. state of Illinois and in the Midwestern United States. With a population of 2,746,388, as of the 2020 United States census, 2020 census, it is the List of Unite ...

,

San Francisco, California

San Francisco, officially the City and County of San Francisco, is a commercial, Financial District, San Francisco, financial, and Culture of San Francisco, cultural center of Northern California. With a population of 827,526 residents as of ...

,

Tokyo

Tokyo, officially the Tokyo Metropolis, is the capital of Japan, capital and List of cities in Japan, most populous city in Japan. With a population of over 14 million in the city proper in 2023, it is List of largest cities, one of the most ...

,

Frankfurt

Frankfurt am Main () is the most populous city in the States of Germany, German state of Hesse. Its 773,068 inhabitants as of 2022 make it the List of cities in Germany by population, fifth-most populous city in Germany. Located in the forela ...

,

London

London is the Capital city, capital and List of urban areas in the United Kingdom, largest city of both England and the United Kingdom, with a population of in . London metropolitan area, Its wider metropolitan area is the largest in Wester ...

, and

Mumbai

Mumbai ( ; ), also known as Bombay ( ; its official name until 1995), is the capital city of the Indian state of Maharashtra. Mumbai is the financial capital and the most populous city proper of India with an estimated population of 12 ...

. The bulk of its investment banking operations eventually moved to the

Bank of America Tower, a $1 billion, 58-story skyscraper, at

Bryant Park

Bryant Park is a , privately managed public park in the New York City borough (New York City), borough of Manhattan. It is located between Fifth Avenue and Avenue of the Americas (Sixth Avenue) and between 40th Street (Manhattan), 40th and 42 ...

in New York City that was completed in 2009. Prior to that, BAS in New York had offices in various locations due to the numerous mergers that had taken place over the previous decade, including space at 9 West 57th Street,

1 World Trade Center

One World Trade Center, also known as One WTC and as the Freedom Tower, is the main building of the rebuilt World Trade Center complex in Lower Manhattan, New York City. Designed by David Childs of Skidmore, Owings & Merrill, One World Tra ...

, 1633 Broadway, 40 East 52nd Street, 335 Madison Avenue, and 100 West 33rd Street.

2005 to 2007

In 2001, McColl stepped down as CEO and named

Ken Lewis as his successor. In 2004, Bank of America announced it would purchase Boston-based bank

FleetBoston Financial

FleetBoston Financial was a Boston, Massachusetts–based bank created in 1999 by the merger of Fleet Financial Group and BankBoston. In 2004 it merged with Bank of America; all of its banks and branches were converted to Bank of America.

Histo ...

for $47 billion in cash and stock.

By merging with Bank of America, all of its banks and branches were given the Bank of America logo. At the time of merger, FleetBoston was the seventh largest bank in United States with $197 billion in assets, over 20 million customers and revenue of $12 billion.

Hundreds of FleetBoston workers lost their jobs or were demoted, according to ''

The Boston Globe

''The Boston Globe,'' also known locally as ''the Globe'', is an American daily newspaper founded and based in Boston, Massachusetts. The newspaper has won a total of 27 Pulitzer Prizes. ''The Boston Globe'' is the oldest and largest daily new ...

''.

On June 30, 2005, Bank of America announced it would purchase credit card giant

MBNA

MBNA Corporation was a bank holding company and parent company of wholly owned subsidiary MBNA America Bank, N.A., headquartered in Wilmington, Delaware, prior to being acquired by Bank of America in 2006.

History

The former Maryland National ...

for $35 billion in cash and stock. The

Federal Reserve Board

The Board of Governors of the Federal Reserve System, commonly known as the Federal Reserve Board, is the main governing body of the Federal Reserve System. It is charged with overseeing the Federal Reserve Banks and with helping implement the mo ...

gave final approval to the merger on December 15, 2005, and the merger closed on January 1, 2006. The acquisition of MBNA provided Bank of America a leading domestic and foreign credit card issuer. The combined Bank of America Card Services organization, including the former MBNA, had more than 40 million U.S. accounts and nearly $140 billion in outstanding balances. Under Bank of America, the operation was renamed FIA Card Services.

Bank of America operated under the name BankBoston in many other Latin American countries, including Brazil. In May 2006, Bank of America and

Banco Itaú

Banco Itaú S.A. was a Brazilian bank that merged with Unibanco on November 4, 2008, to form Itaú Unibanco, Banco Itaú Unibanco.

History

Banco Itaú began in 1945 under the name ''Banco Central de Crédito'' (Central Bank of Credit) and later ...

(Investimentos Itaú S.A.) entered into an acquisition agreement, through which Itaú agreed to acquire BankBoston's operations in Brazil, and was granted an exclusive right to purchase Bank of America's operations in

Chile

Chile, officially the Republic of Chile, is a country in western South America. It is the southernmost country in the world and the closest to Antarctica, stretching along a narrow strip of land between the Andes, Andes Mountains and the Paci ...

and Uruguay, in exchange for Itaú shares. The deal was signed in August 2006.

Prior to the transaction, BankBoston's Brazilian operations included asset management, private banking, a credit card portfolio, and small, middle-market, and large corporate segments. It had 66 branches and 203,000 clients in Brazil. BankBoston in Chile had 44 branches and 58,000 clients and in Uruguay, it had 15 branches. In addition, there was a credit card company, OCA, in Uruguay, which had 23 branches. BankBoston N.A. in Uruguay, together with OCA, jointly served 372,000 clients. While the BankBoston name and trademarks were not part of the transaction, as part of the sale agreement, they cannot be used by Bank of America in Brazil, Chile or Uruguay following the transactions. Hence, the BankBoston name has disappeared from Brazil, Chile and Uruguay. The Itaú stock received by Bank of America in the transactions has allowed Bank of America's stake in Itaú to reach 11.51%. Banco de Boston de Brazil had been founded in 1947.

On November 20, 2006, Bank of America announced the purchase of The United States Trust Company for $3.3 billion, from the Charles Schwab Corporation. US Trust had about $100 billion of

assets under management

In finance, assets under management (AUM), sometimes called fund under management, refers to the total market value of all financial assets that a financial institution—such as a mutual fund, venture capital firm, or depository institutio ...

and over 150 years of experience. The deal closed July 1, 2007.

On September 14, 2007, Bank of America won approval from the Federal Reserve to acquire LaSalle Bank Corporation from ABN AMRO for $21 billion. With this purchase, Bank of America possessed $1.7 trillion in assets. A Dutch court blocked the sale until it was later approved in July. The acquisition was completed on October 1, 2007. Many of LaSalle's branches and offices had already taken over smaller regional banks within the previous decade, such as Lansing and Detroit-based Michigan National Bank. The acquisition also included the Chicago Marathon event, which ABN AMRO acquired in 1996. Bank of America took over the event starting with the 2007 race.

The deal increased Bank of America's presence in

Illinois

Illinois ( ) is a U.S. state, state in the Midwestern United States, Midwestern United States. It borders on Lake Michigan to its northeast, the Mississippi River to its west, and the Wabash River, Wabash and Ohio River, Ohio rivers to its ...

, Michigan, and Indiana by 411 branches, 17,000 commercial bank clients, 1.4 million retail customers, and 1,500 ATMs. Bank of America became the largest bank in the Chicago market with 197 offices and 14% of the deposit share, surpassing

JPMorgan Chase

JPMorgan Chase & Co. (stylized as JPMorganChase) is an American multinational financial services, finance corporation headquartered in New York City and incorporated in Delaware. It is List of largest banks in the United States, the largest ba ...

.

LaSalle Bank and LaSalle Bank Midwest branches adopted the Bank of America name on May 5, 2008.

2007–2010 (Subprime mortgage crisis)

During the subprime mortgage crisis, the bank, under

Ken Lewis, made two major acquisitions that would shape the future of the company for the next couple years coming out of the crisis. Specifically the bank was sued by many different parties and made to pay tens of billions of dollars.

Acquisition of Countrywide Financial

On August 23, 2007, the company announced a $2 billion repurchase agreement for Countrywide Financial. This purchase of preferred stock was arranged to provide a return on investment of 7.25% ''per annum'' and provided the option to purchase common stock at a price of $18 per share.

On January 11, 2008, Bank of America announced that it would buy Countrywide Financial for $4.1 billion. In March 2008, it was reported that the Federal Bureau of Investigation (FBI) was investigating Countrywide for possible fraud relating to home loans and mortgages. This news did not hinder the acquisition, which was completed in July 2008, giving the bank a substantial market share of the mortgage business, and access to Countrywide's resources for servicing mortgages. The acquisition was seen as preventing a potential bankruptcy for Countrywide. Countrywide, however, denied that it was close to bankruptcy. Countrywide provided mortgage servicing for nine million mortgages valued at $1.4 trillion as of December 31, 2007.

This purchase made Bank of America Corporation the leading mortgage originator and servicer in the U.S., controlling 20–25% of the home loan market. The deal was structured to merge Countrywide with the Red Oak Merger Corporation, which Bank of America created as an independent subsidiary. It has been suggested that the deal was structured this way to prevent a potential bankruptcy stemming from large losses in Countrywide hurting the parent organization by keeping Countrywide bankruptcy remote. Countrywide Financial has changed its name to Bank of America Home Loans.

In December 2011, the United States Department of Justice, Justice Department announced a $335 million settlement agreement, settlement with Bank of America over discriminatory lending practice at Countrywide Financial. United States Attorney General, Attorney General Eric Holder said a federal probe found mortgage discrimination, discrimination against qualified African-American and Latino borrowers from 2004 to 2008. He said that minority borrowers who qualified for prime lending rate, prime loans were steered into higher-interest-rate subprime loans.

Acquisition of Merrill Lynch

On September 14, 2008, Bank of America announced its intention to purchase Merrill Lynch, Merrill Lynch & Co., Inc. in an all-stock deal worth approximately $50 billion. Merrill Lynch was at the time within days of collapse, and the acquisition effectively saved Merrill from bankruptcy. Around the same time Bank of America was reportedly also in talks to purchase Lehman Brothers, however a lack of government guarantees caused the bank to abandon talks with Lehman. Lehman Brothers filed for bankruptcy the same day Bank of America announced its plans to acquire Merrill Lynch. This acquisition made Bank of America the largest

financial services

Financial services are service (economics), economic services tied to finance provided by financial institutions. Financial services encompass a broad range of tertiary sector of the economy, service sector activities, especially as concerns finan ...

company in the world. Temasek Holdings, the largest shareholder of Merrill Lynch & Co., Inc., briefly became one of the largest shareholders of Bank of America, with a 3% stake. However, taking a loss Reuters estimated at $3 billion, the Singapore sovereign wealth fund sold its whole stake in Bank of America in the first quarter of 2009.

Shareholders of both companies approved the acquisition on December 5, 2008, and the deal closed January 1, 2009. Bank of America had planned to retain various members of the then Merrill Lynch's CEO,

John Thain

John Alexander Thain (born May 26, 1955) is an American financial executive and investment banker. He was president and co-COO of Goldman Sachs, and then CEO of the New York Stock Exchange. Thain then became the last chairman and CEO of Merrill ...

's management team after the merger. However, after Thain was removed from his position, most of his allies left. The departure of Nelson Chai, who had been named Asia-Pacific president, left just one of Thain's hires in place: Tom Montag, head of sales and trading.

The bank, in its January 16, 2009, earnings release, revealed massive losses at Merrill Lynch in the fourth quarter, which necessitated an infusion of money that had previously been negotiated with the government as part of the government-persuaded deal for the bank to acquire Merrill. Merrill recorded an operating loss of $21.5 billion in the quarter, mainly in its sales and trading operations, led by Tom Montag. The bank also disclosed it tried to abandon the deal in December after the extent of Merrill's trading losses surfaced, but was compelled to complete the merger by the U.S. government. The bank's stock price sank to $7.18, its lowest level in 17 years, after announcing earnings and the Merrill mishap. The market capitalization of Bank of America, including Merrill Lynch, was then $45 billion, less than the $50 billion it offered for Merrill just four months earlier, and down $108 billion from the merger announcement.

Bank of America CEO Kenneth Lewis testified before Congress

that he had some misgivings about the acquisition of Merrill Lynch and that federal official pressured him to proceed with the deal or face losing his job and endangering the bank's relationship with federal regulators.

Lewis's statement is backed up by internal emails subpoenaed by Republican lawmakers on the House Oversight Committee. In one of the emails, Richmond Federal Reserve President Jeffrey M. Lacker, Jeffrey Lacker threatened that if the acquisition did not go through, and later Bank of America were forced to request federal assistance, the management of Bank of America would be "gone". Other emails, read by Congressman Dennis Kucinich during the course of Lewis' testimony, state that Mr. Lewis had foreseen the outrage from his shareholders that the purchase of Merrill would cause, and asked government regulators to issue a letter stating that the government had ordered him to complete the deal to acquire Merrill. Lewis, for his part, states he didn't recall requesting such a letter.

The acquisition made Bank of America the number one securities underwriting, underwriter of global

high-yield debt

In finance, a high-yield bond (non-investment-grade bond, speculative-grade bond, or junk bond) is a bond that is rated below investment grade by credit rating agencies. These bonds have a higher risk of default or other adverse credit even ...

, the third largest underwriter of global equity and the ninth largest adviser on global mergers and acquisitions. As the credit crisis eased, losses at Merrill Lynch subsided, and the subsidiary generated $3.7 billion of Bank of America's $4.2 billion in profit by the end of quarter one in 2009, and over 25% in quarter 3 2009.

On September 28, 2012, Bank of America settled the class-action lawsuit over the Merrill Lynch acquisition and will pay $2.43 billion. This was one of the first major securities class action lawsuits stemming from the

2008 financial crisis

The 2008 financial crisis, also known as the global financial crisis (GFC), was a major worldwide financial crisis centered in the United States. The causes of the 2008 crisis included excessive speculation on housing values by both homeowners ...

to settle. Many major financial institutions had a stake in this lawsuit, including Chicago Clearing Corporation, hedge funds, and bank trusts, due to the belief that Bank of America stock was a sure investment.

Federal Troubled Asset Relief Program

On January 16, 2009, Bank of America received $20 billion and a guarantee of $118 billion in potential losses from the U.S. government through the Troubled Asset Relief Program (TARP). This was in addition to the $25 billion given to the bank in the fall of 2008 through TARP. The additional payment was part of a deal with the U.S. government to preserve Bank of America's merger with

Merrill Lynch

Merrill Lynch, Pierce, Fenner & Smith Incorporated, doing business as Merrill, and previously branded Merrill Lynch, is an American investment management and wealth management division of Bank of America. Along with BofA Securities, the investm ...

. Since then, members of the U.S. Congress have expressed considerable concern about how this money has been spent, especially since some of the recipients have been accused of misusing the bailout money. Then CEO

Ken Lewis was quoted as claiming "We are still lending, and we are lending far more because of the TARP program." Members of the U.S. House of Representatives, however, were skeptical and quoted many anecdotes about loan applicants (particularly small business owners) being denied loans and credit card holders facing stiffer terms on the debt in their card accounts.

According to an article in ''The New York Times'' published on March 15, 2009, Bank of America received an additional $5.2 billion in government bailout money via the bailout of American International Group.

As a result of its federal bailout and management problems, ''The Wall Street Journal'' reported that the Bank of America was operating under a secret "memorandum of understanding" (MOU) from the U.S. government that requires it to "overhaul its board and address perceived problems with risk and liquidity management". With the federal action, the institution has taken several steps, including arranging for six of its #Board of directors, directors to resign and forming a Regulatory Impact Office. Bank of America faces several deadlines in July and August and if not met, could face harsher penalties by federal regulators. Bank of America did not respond to ''The Wall Street Journal'' story.

On December 2, 2009, Bank of America announced it would repay the entire $45 billion it received in TARP and exit the program, using $26.2 billion of excess liquidity along with $18.6 billion to be gained in "common equivalent securities" (Tier 1 capital). The bank announced it had completed the repayment on December 9. Bank of America's

Ken Lewis said during the announcement, "We appreciate the critical role that the U.S. government played last fall in helping to stabilize financial markets, and we are pleased to be able to fully repay the investment, with interest.... As America's largest bank, we have a responsibility to make good on the taxpayers' investment, and our record shows that we have been able to fulfill that commitment while continuing to lend."

Bonus settlement

On August 3, 2009, Bank of America agreed to pay a $33 million fine, without admission or denial of charges, to the

U.S. Securities and Exchange Commission

The United States Securities and Exchange Commission (SEC) is an independent agency of the United States federal government, created in the aftermath of the Wall Street crash of 1929. Its primary purpose is to enforce laws against market m ...

(SEC) over the non-disclosure of an agreement to pay up to $5.8 billion of bonuses at Merrill. The bank approved the bonuses before the merger but did not disclose them to its shareholders when the shareholders were considering approving the Merrill acquisition, in December 2008. The issue was originally investigated by New York Attorney General Andrew Cuomo, who commented after the suit and announced a settlement that "the timing of the bonuses, as well as the disclosures relating to them, constituted a 'surprising fit of corporate irresponsibility and "our investigation of these and other matters pursuant to New York's Martin Act will continue". Congressman Kucinich commented at the same time that "This may not be the last fine that Bank of America pays for how it handled its merger of Merrill Lynch." A federal judge, Jed Rakoff, in an unusual action, refused to approve the settlement on August 5.

A first hearing before the judge on August 10 was at times heated, and he was "sharply critic[al]" of the bonuses. David Rosenfeld represented the SEC, and Lewis J. Liman, son of Arthur L. Liman, represented the bank. The actual amount of bonuses paid was $3.6 billion, of which $850 million was "guaranteed" and the rest was shared among 39,000 workers who received average payments of $91,000; 696 people received more than $1 million in bonuses; at least one person received a more than $33 million bonus.

On September 14, the judge rejected the settlement and told the parties to prepare for trial to begin no later than February 1, 2010. The judge focused much of his criticism on the fact that the fine in the case would be paid by the bank's shareholders, who were the ones that were supposed to have been injured by the lack of disclosure. He wrote, "It is quite something else for the very management that is accused of having lied to its shareholders to determine how much of those victims' money should be used to make the case against the management go away," ... "The proposed settlement," the judge continued, "suggests a rather cynical relationship between the parties: the S.E.C. gets to claim that it is exposing wrongdoing on the part of the Bank of America in a high-profile merger; the bank's management gets to claim that they have been coerced into an onerous settlement by overzealous regulators. And all this is done at the expense, not only of the shareholders but also of the truth."

While ultimately deferring to the SEC, in February 2010, Judge Rakoff approved a revised settlement with a $150 million fine "reluctantly", calling the accord "half-baked justice at best" and "inadequate and misguided". Addressing one of the concerns he raised in September, the fine will be "distributed only to Bank of America shareholders harmed by the non-disclosures, or 'legacy shareholders, an improvement on the prior $33 million while still "paltry", according to the judge. Case: SEC v. Bank of America Corp., 09-cv-06829, United States District Court for the Southern District of New York. Investigations also were held on this issue in the United States House Committee on Oversight and Government Reform,

[Story, Louise]

"Judge Rejects Settlement Over Merrill Bonuses"

, ''The New York Times'', September 14, 2009. Retrieved September 14, 2009. under chairman Edolphus Towns (D-NY) and in its investigative United States House Oversight and Government Reform Subcommittee on Domestic Policy, Domestic Policy Subcommittee under Kucinich.

Fraud

In 2010, the U.S. government accused the bank of defrauding schools, hospitals, and dozens of state and local government organizations via misconduct and illegal activities involving the investment of proceeds from municipal bond sales. As a result, the bank agreed to pay $137.7 million, including $25 million to the Internal Revenue Service and $4.5 million to the state attorney general, to the affected organizations to settle the allegations. Former bank official Douglas Campbell pleaded guilty to antitrust, conspiracy, and wire fraud charges. , other bankers and brokers are under indictment or investigation.

On October 24, 2012, the top federal prosecutor in

Manhattan

Manhattan ( ) is the most densely populated and geographically smallest of the Boroughs of New York City, five boroughs of New York City. Coextensive with New York County, Manhattan is the County statistics of the United States#Smallest, larg ...

filed a lawsuit alleging that Bank of America fraudulently cost American taxpayers more than $1 billion when Countrywide Financial sold toxic mortgages to Fannie Mae and Freddie Mac. The scheme was called 'Hustle', or High Speed Swim Lane.

On May 23, 2016, the Second U.S. Circuit Court of Appeals ruled that the finding of fact by the jury that low quality mortgages were supplied by Countrywide to Fannie Mae and Freddie Mac in the "Hustle" case supported only "intentional breach of contract", not a fraud. The action, for civil fraud, relied on provisions of the Financial Institutions Reform, Recovery, and Enforcement Act of 1989#Use with respect to the subprime mortgage crisis, Financial Institutions Reform, Recovery and Enforcement Act. The decision turned on lack of intent to defraud at the time the contract to supply mortgages was made.

Change of CEO

Ken Lewis, who had lost the title of chairman of the board, announced that he would retire as CEO effective December 31, 2009, in part due to controversy and legal investigations concerning the purchase of Merrill Lynch.

Brian Moynihan

Brian Thomas Moynihan is an American lawyer and banker. He is the chairman, president, and CEO of Bank of America, having been promoted to these positions in 2010.

Moynihan is a member of the Council on Competitiveness board and Partnership for ...

became president and CEO effective January 1, 2010, and afterward credit card charge offs and delinquencies declined in January. Bank of America also repaid the $45 billion it had received from the Troubled Assets Relief Program.

2011 to present

Downsizing (2011 to 2014)

During 2011, Bank of America began conducting personnel reductions of an estimated 36,000 people, contributing to intended savings of $5 billion per year by 2014. In December 2011, ''Forbes'' ranked Bank of America's financial wealth 91st out of the nation's largest 100 banks and thrift institutions.

Bank of America cut around 16,000 jobs in a quicker fashion by the end of 2012 as revenue continued to decline because of new regulations and a slow economy. This put a plan one year ahead of time to eliminate 30,000 jobs under a cost-cutting program, called Project New BAC. In the first quarter of 2014, Berkshire Hathaway, Berkshire bank purchased 20 Bank of America branches in Central and eastern New York for 14.4 million dollars. The branches were from Utica/Rome region and down the Mohawk Valley east to the capital region. In April and May 2014, Bank of America sold two dozen branches in Michigan to Huntington Bancshares. The locations were converted to Huntington National Bank branches in September.

As part of its new strategy Bank of America is focused on growing its mobile banking platform. , Bank of America has 31 million active online users and 16 million mobile users. Its retail banking branches have decreased to 4,900 as a result of increased mobile banking use and a decline in customer branch visits. By 2018, the number of mobile users has increased to 25.3 million and the number of locations fell to 4,411 at the end of June.

Sale of stake in China Construction Bank

In 2005, Bank of America acquired a 9% stake in China Construction Bank, one of the Big Four (banking)#China, Big Four banks in China, for US$3 billion. It represented the company's largest foray into China's growing banking sector. Bank of America has offices in Hong Kong, Shanghai, and Guangzhou and was looking to greatly expand its Chinese business as a result of this deal. In 2008, Bank of America was awarded Project Finance Deal of the Year at the 2008 ALB Hong Kong Law Awards. In November 2011, Bank of America announced plans to divest most of its stake in the China Construction Bank.

In September 2013, Bank of America sold its remaining stake in the China Construction Bank for as much as $1.5 billion, marking the firm's full exit from the country.

$17 billion settlement with Justice Department

In August 2014, Bank of America agreed to a near–$17 billion deal to settle claims against it relating to the sale of toxic mortgage-linked securities including subprime home loans, in what was believed to be the largest settlement in U.S. corporate history. The bank agreed with the United States Department of Justice, U.S. Justice Department to pay $9.65 billion in fines, and $7 billion in relief to the victims of the faulty loans which included homeowners, borrowers, pension funds and municipalities.

Real estate economist Jed Kolko said the settlement is a "drop in the bucket" compared to the $700 billion in damages done to 11 million homeowners. Since the settlement covered such a substantial portion of the market, he said for most consumers "you're out of luck".

Much of the government's prosecution was based on information provided by three whistleblowers – Shareef Abdou (a senior vice president at the bank), Robert Madsen (a professional appraiser employed by a bank subsidiary), and Edward O'Donnell (a Fannie Mae official). The three men received $170 million in whistleblower awards.

DOD Community Bank

Bank of America has formed a partnership with the United States Department of Defense creating a newly chartered bank DOD Community Bank ("Community Bank") providing full banking services to military personnel at 68 branches and ATM locations on U.S. military installations in Guantanamo Bay Naval Base Cuba, Diego Garcia, Germany, Japan, Italy, Kwajalein Atoll, South Korea, the Netherlands, and the United Kingdom. Even though Bank of America operates Community Bank, customer services are not interchangeable between the two financial institutions, meaning that a Community Bank customer cannot go to a Bank of America branch and withdraw from their account and vice versa. Deposits made into checking and savings accounts are insured by the

Federal Deposit Insurance Corporation

The Federal Deposit Insurance Corporation (FDIC) is a State-owned enterprises of the United States, United States government corporation supplying deposit insurance to depositors in American commercial banks and savings banks. The FDIC was cr ...

up to $250,000 despite the fact that none of Community's operating branches are located within the jurisdictional borders of the United States.

Decision not to finance makers of military-style guns

In April 2018, Bank of America announced that it would stop providing financing to makers of military-style weapons such as the AR-15 style rifle, AR-15 rifle. In announcing the decision, Bank of America referenced recent mass shootings and said that it wanted to "contribute in any way we can" to reduce them.

Return to expansion (2015–present)

In 2015, Bank of America began expanding organically, opening branches in cities where it previously did not have a retail presence. They started that year in Denver, followed by Minneapolis–Saint Paul and Indianapolis, in all cases having at least one of its

Big Four competitors, with Chase Bank being available in Denver and Indianapolis, while

Wells Fargo

Wells Fargo & Company is an American multinational financial services company with a significant global presence. The company operates in 35 countries and serves over 70 million customers worldwide. It is a systemically important fi ...

is available in Denver and the Twin Cities.

The Twin Cities market is also the home market of

U.S. Bancorp

U.S. Bancorp (stylized as us bancorp) is an American multinational financial services firm headquartered in Minneapolis, Minnesota and incorporated in Delaware. It is the 5th-largest bank in the United States as of 2025. As the largest bank i ...

, the largest non-Big Four rival.

In January 2018, Bank of America announced an organic expansion of its retail footprint into Pittsburgh and surrounding areas, to supplement its existing commercial lending and investment businesses in the area. Before the expansion, Pittsburgh had been one of the largest US cities without a retail presence by any of the Big Four, with locally based PNC Financial Services (no. 6 nationally) having a commanding market share in the area;

this coincided with Chase making a similar expansion into Pittsburgh. By the end of the fiscal year 2020, Bank of America had become Pittsburgh's 16th largest bank by deposits, which considering the dominance of PNC and BNY Mellon in the market is considered relatively impressive. By 2021, Bank of America had moved up to 12th in the market.

In February 2018, Bank of America announced it would expand into Ohio across the state's three biggest cities (Cleveland, Columbus, Ohio, Columbus, and Cincinnati), which are strongholds of Chase. Columbus serves as the bank's hub in Ohio due to its central location as the state's capital, its overall size and growth, and an existing Bank of America call center for its credit card division in suburban Westerville, Ohio, Westerville. Within a year of entering Ohio, Columbus quickly saw the bank become the 5th largest in the market by deposits, behind only banks either based in Ohio (Fifth Third Bank and locally based Huntington Bancshares) or have a major presence as a result of an acquisition of an Ohio-based institution (Chase and PNC), and ahead of US Bancorp (also with a large presence due to acquiring an Ohio-based bank), Ohio-based

KeyBank

KeyBank is an American regional bank headquartered in Cleveland, Ohio, and the 27th largest bank in the United States. Organized under the publicly traded KeyCorp, KeyBank was formed from the 1994 merger of the Cleveland-based Society Corpora ...

, and several local institutions. As of 2021, Bank of America is the 9th largest bank by deposits in all of Ohio.

In January 2020, Bank of America hired new advisors whose primary functions are to assist ultra-wealthy clients.

Operations

Bank of America generates 90% of its revenues in its domestic market. The core of Bank of America's strategy is to be the number one bank in its domestic market. It has achieved this through key acquisitions.

Consumer Banking