The Great Recession was a period of market decline in economies around the world that occurred from late 2007 to mid-2009.

[“US Business Cycle Expansions and Contractions”](_blank)

United States NBER, or National Bureau of Economic Research, updated March 14, 2023. This government agency dates the Great Recession as starting in December 2007 and bottoming-out in June 2009. The scale and timing of the

recession

In economics, a recession is a business cycle contraction that occurs when there is a period of broad decline in economic activity. Recessions generally occur when there is a widespread drop in spending (an adverse demand shock). This may be tr ...

varied from country to country (see map).

At the time, the

International Monetary Fund

The International Monetary Fund (IMF) is a major financial agency of the United Nations, and an international financial institution funded by 191 member countries, with headquarters in Washington, D.C. It is regarded as the global lender of las ...

(IMF) concluded that it was the most severe economic and financial meltdown since the

Great Depression

The Great Depression was a severe global economic downturn from 1929 to 1939. The period was characterized by high rates of unemployment and poverty, drastic reductions in industrial production and international trade, and widespread bank and ...

.

The causes of the Great Recession include a combination of vulnerabilities that developed in the financial system, along with a series of triggering events that began with the bursting of the United States

housing bubble

A housing bubble (or housing price bubble) is one of several types of asset price bubbles which periodically occur in the market. The basic concept of a housing bubble is the same as for other asset bubbles, consisting of two main phases. First t ...

in 2005–2012. When housing prices fell and homeowners began to abandon their mortgages, the value of

mortgage-backed securities

A mortgage-backed security (MBS) is a type of asset-backed security (an "Financial instrument, instrument") which is secured by a mortgage loan, mortgage or collection of mortgages. The mortgages are aggregated and sold to a group of individuals ( ...

held by investment banks declined in 2007–2008, causing several to collapse or be bailed out in September 2008. This 2007–2008 phase was called the

subprime mortgage crisis

The American subprime mortgage crisis was a multinational financial crisis that occurred between 2007 and 2010, contributing to the 2008 financial crisis. It led to a severe economic recession, with millions becoming unemployed and many busines ...

.

The combination of banks being unable to provide funds to businesses, and homeowners paying down debt rather than borrowing and spending, resulted in the Great Recession that began in the U.S. officially in December 2007 and lasted until June 2009, thus extending over 19 months.

[US Business Cycle Expansions and Contractions](_blank)

, NBER, accessed August 9, 2012. As with most other recessions, it appears that no known formal theoretical or empirical model was able to accurately predict the advance of this recession, except for minor signals in the sudden rise of forecast probabilities, which were still well under 50%.

The recession was not felt equally around the world; whereas most of the world's

developed economies

In economics, economic development (or economic and social development) is the process by which the economic well-being and quality of life of a nation, region, local community, or an individual are improved according to targeted goals and object ...

, particularly in North America, South America and Europe, fell into a severe, sustained recession, many more recently developing economies suffered far less impact, particularly

China

China, officially the People's Republic of China (PRC), is a country in East Asia. With population of China, a population exceeding 1.4 billion, it is the list of countries by population (United Nations), second-most populous country after ...

,

India

India, officially the Republic of India, is a country in South Asia. It is the List of countries and dependencies by area, seventh-largest country by area; the List of countries by population (United Nations), most populous country since ...

and

Indonesia

Indonesia, officially the Republic of Indonesia, is a country in Southeast Asia and Oceania, between the Indian Ocean, Indian and Pacific Ocean, Pacific oceans. Comprising over List of islands of Indonesia, 17,000 islands, including Sumatra, ...

, whose

economies grew substantially during this period. Similarly,

Oceania

Oceania ( , ) is a region, geographical region including Australasia, Melanesia, Micronesia, and Polynesia. Outside of the English-speaking world, Oceania is generally considered a continent, while Mainland Australia is regarded as its co ...

suffered

minimal impact, in part due to its proximity to Asian markets.

Terminology

Two

definitions

A definition is a statement of the meaning of a term (a word, phrase, or other set of symbols). Definitions can be classified into two large categories: intensional definitions (which try to give the sense of a term), and extensional definit ...

of the term "economic recession" exist: one sense referring generally to "a period of reduced economic activity"

and ongoing hardship; and a technical definition used in

economics

Economics () is a behavioral science that studies the Production (economics), production, distribution (economics), distribution, and Consumption (economics), consumption of goods and services.

Economics focuses on the behaviour and interac ...

, which is

defined operationally, specifically the

contraction phase of a

business cycle

Business cycles are intervals of general expansion followed by recession in economic performance. The changes in economic activity that characterize business cycles have important implications for the welfare of the general population, governmen ...

with two or more consecutive quarters of

GDP contraction (negative GDP growth rate). The latter is typically used to influence abrupt changes in monetary policy.

Under the technical definition, the recession ended in the United States in June or July 2009.

Journalist

Robert Kuttner

Robert L. Kuttner (; born April 17, 1943) is an American journalist, university professor and writer whose works present a liberal and progressive point of view. Kuttner is the co-founder and current co-editor of ''The American Prospect'', whic ...

has argued that 'The Great Recession' is a misnomer. According to Kuttner, "recessions are mild dips in the business cycle that are either self-correcting or soon cured by modest fiscal or monetary stimulus. Because of the continuing deflationary trap, it would be more accurate to call this decade's stagnant economy The Lesser Depression or The Great Deflation."

Overview

The Great Recession met the

IMF

The International Monetary Fund (IMF) is a major financial agency of the United Nations, and an international financial institution funded by 191 member countries, with headquarters in Washington, D.C. It is regarded as the global lender of la ...

criteria for being a

global recession

A global recession is a recession that affects many countries around the world—that is, a period of global economic slowdown or declining economic output.

Definitions

The International Monetary Fund defines a global recession as "a decline ...

only in the single calendar year 2009.

That IMF definition requires a ''decline in annual real

world GDP percapita''. Despite the fact that quarterly data are being used as

recession

In economics, a recession is a business cycle contraction that occurs when there is a period of broad decline in economic activity. Recessions generally occur when there is a widespread drop in spending (an adverse demand shock). This may be tr ...

definition criteria by all

G20 members, representing 85% of the

world GDP, the International Monetary Fund (IMF) has decidedin the absence of a complete data setnot to declare/measure global recessions according to quarterly GDP data. The ''seasonally adjusted

PPPweighted real GDP'' for the G20zone, however, is a good indicator for the world GDP, and it was measured to have suffered a direct

quarter on quarter

Quarter-on-quarter or quarter-over-quarter, abbreviated as QOQ is a term of art in accounting, finance and economics

Economics () is a behavioral science that studies the Production (economics), production, distribution (economics), distrib ...

decline during the three quarters from Q32008 until Q12009, which more accurately mark when the recession took place at the global level.

According to the U.S.

National Bureau of Economic Research

The National Bureau of Economic Research (NBER) is an American private nonprofit research organization "committed to undertaking and disseminating unbiased economic research among public policymakers, business professionals, and the academic co ...

(the official arbiter of U.S. recessions), the recession began in December 2007 and ended in June 2009, and thus extended over eighteen months.

The years leading up to the crisis were characterized by an exorbitant rise in asset prices and associated boom in economic demand. Further, the U.S.

shadow banking system

The shadow banking system is a term for the collection of non-bank financial intermediaries (NBFIs) that legally provide services similar to traditional commercial banks but outside normal banking regulations. S&P Global estimates that, at end-2 ...

(i.e., non-depository financial institutions such as investment banks) had grown to rival the depository system yet was not subject to the same regulatory oversight, making it vulnerable to a

bank run

A bank run or run on the bank occurs when many Client (business), clients withdraw their money from a bank, because they believe Bank failure, the bank may fail in the near future. In other words, it is when, in a fractional-reserve banking sys ...

.

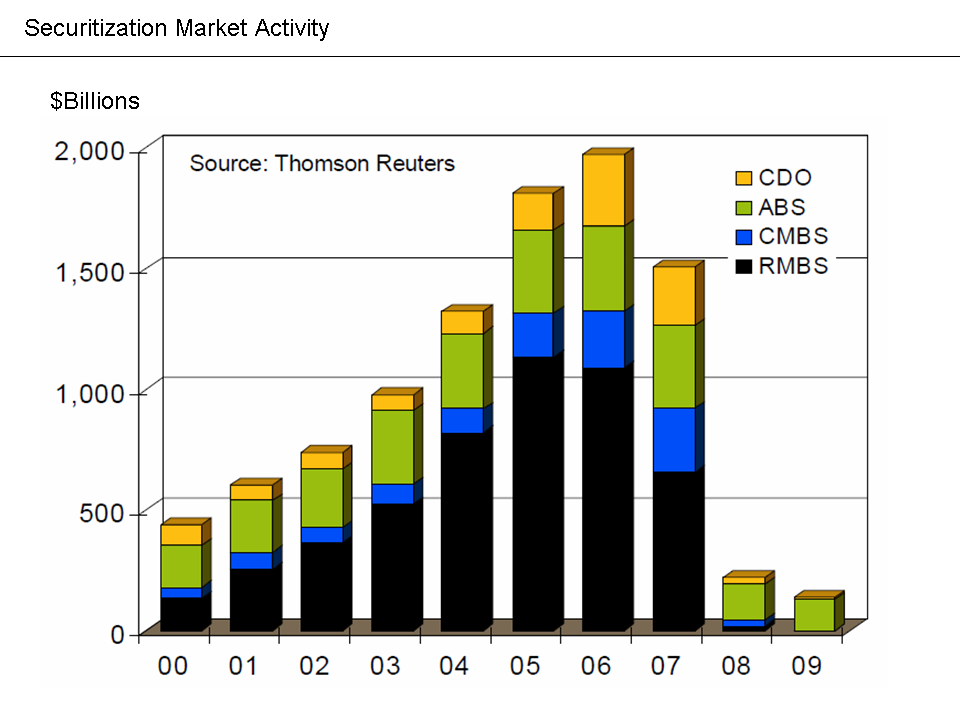

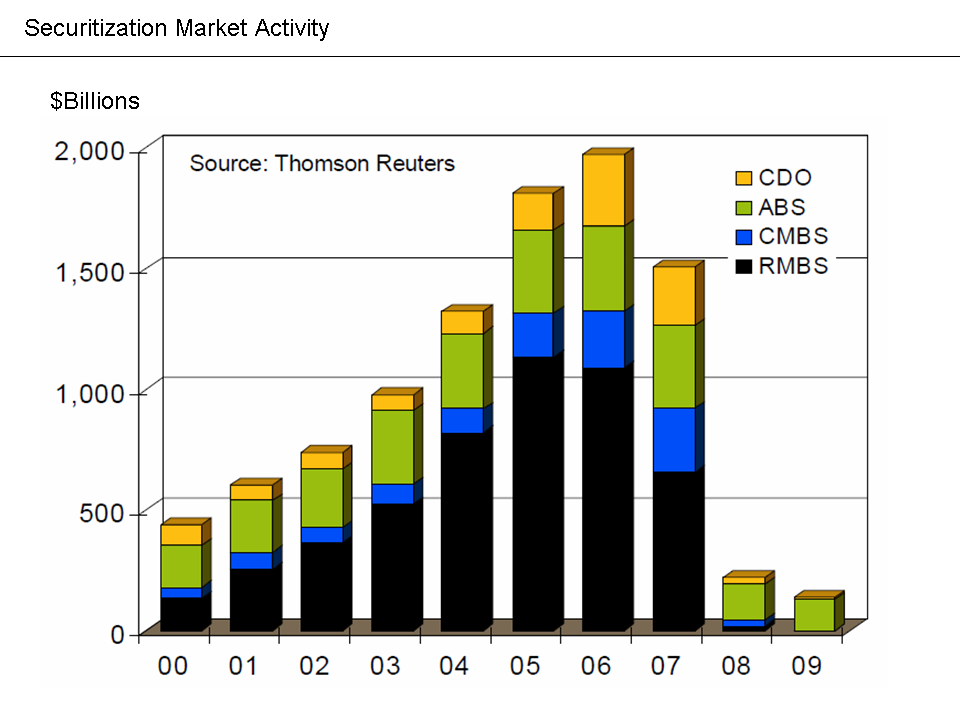

U.S.

mortgage-backed securities

A mortgage-backed security (MBS) is a type of asset-backed security (an "Financial instrument, instrument") which is secured by a mortgage loan, mortgage or collection of mortgages. The mortgages are aggregated and sold to a group of individuals ( ...

, which had risks that were hard to assess, were marketed around the world, as they offered higher yields than U.S. government bonds. Many of these securities were backed by subprime mortgages, which collapsed in value when the U.S. housing bubble burst during 2006 and homeowners began to default on their mortgage payments in large numbers starting in 2007.

The emergence of

subprime loan losses in 2007 began the crisis and exposed other risky loans and over-inflated asset prices. With loan losses mounting and the fall of

Lehman Brothers

Lehman Brothers Inc. ( ) was an American global financial services firm founded in 1850. Before filing for bankruptcy in 2008, Lehman was the fourth-largest investment bank in the United States (behind Goldman Sachs, Morgan Stanley, and Merril ...

on September 15, 2008, a major panic broke out on the inter-bank loan market. There was the equivalent of a bank run on the

shadow banking system

The shadow banking system is a term for the collection of non-bank financial intermediaries (NBFIs) that legally provide services similar to traditional commercial banks but outside normal banking regulations. S&P Global estimates that, at end-2 ...

, resulting in many large and well established

investment bank

Investment is traditionally defined as the "commitment of resources into something expected to gain value over time". If an investment involves money, then it can be defined as a "commitment of money to receive more money later". From a broade ...

s and

commercial bank

A commercial bank is a financial institution that accepts deposits from the public and gives loans for the purposes of consumption and investment to make a profit.

It can also refer to a bank or a division of a larger bank that deals with whol ...

s in the United States and

Europe

Europe is a continent located entirely in the Northern Hemisphere and mostly in the Eastern Hemisphere. It is bordered by the Arctic Ocean to the north, the Atlantic Ocean to the west, the Mediterranean Sea to the south, and Asia to the east ...

suffering huge losses and even facing bankruptcy, resulting in massive public financial assistance (government bailouts).

The global recession that followed resulted in a sharp drop in

international trade

International trade is the exchange of capital, goods, and services across international borders or territories because there is a need or want of goods or services. (See: World economy.)

In most countries, such trade represents a significan ...

, rising

unemployment

Unemployment, according to the OECD (Organisation for Economic Co-operation and Development), is the proportion of people above a specified age (usually 15) not being in paid employment or self-employment but currently available for work du ...

and slumping commodity prices. Several economists predicted that recovery might not appear until 2011 and that the recession would be the worst since the

Great Depression

The Great Depression was a severe global economic downturn from 1929 to 1939. The period was characterized by high rates of unemployment and poverty, drastic reductions in industrial production and international trade, and widespread bank and ...

of the 1930s. Economist

Paul Krugman

Paul Robin Krugman ( ; born February 28, 1953) is an American New Keynesian economics, New Keynesian economist who is the Distinguished Professor of Economics at the CUNY Graduate Center, Graduate Center of the City University of New York. He ...

once commented on this as seemingly the beginning of "a second Great Depression".

Governments and central banks responded with

fiscal policy

In economics and political science, fiscal policy is the use of government revenue collection ( taxes or tax cuts) and expenditure to influence a country's economy. The use of government revenue expenditures to influence macroeconomic variab ...

and

monetary policy

Monetary policy is the policy adopted by the monetary authority of a nation to affect monetary and other financial conditions to accomplish broader objectives like high employment and price stability (normally interpreted as a low and stable rat ...

initiatives to stimulate national economies and reduce financial system risks. The recession renewed interest in

Keynesian

Keynesian economics ( ; sometimes Keynesianism, named after British economist John Maynard Keynes) are the various macroeconomic theories and models of how aggregate demand (total spending in the economy) strongly influences economic output an ...

economic ideas on how to combat recessionary conditions. Economists advise that the stimulus measures such as quantitative easing (pumping money into the system) and holding down central bank wholesale lending interest rates should be withdrawn as soon as economies recover enough to "chart a path to

sustainable growth

Sustainable development is an approach to growth and human development that aims to meet the needs of the present without compromising the ability of future generations to meet their own needs.United Nations General Assembly (1987)''Report of th ...

".

The distribution of household incomes in the United States became more unequal during the post-2008

economic recovery.

grew from 2005 to 2012 in more than two thirds of metropolitan areas.

Median household wealth fell 35% in the U.S., from $106,591 to $68,839 between 2005 and 2011.

Causes

Panel reports

The U.S.

Financial Crisis Inquiry Commission, composed of six Democratic and four Republican appointees, reported its majority findings in January 2011. It concluded that "the crisis was avoidable and was caused by:

* Widespread failures in financial regulation, including the Federal Reserve's failure to stem the tide of toxic mortgages;

* Dramatic breakdowns in corporate governance including too many financial firms acting recklessly and taking on too much risk;

* An explosive mix of excessive borrowing and risk by households and Wall Street that put the financial system on a collision course with crisis;

* Key policy makers ill prepared for the crisis, lacking a full understanding of the financial system they oversaw; and systemic breaches in accountability and ethics at all levels."

There were two Republican dissenting FCIC reports. One of them, signed by three Republican appointees, concluded that there were multiple causes. In his separate dissent to the majority and minority opinions of the FCIC, Commissioner

Peter J. Wallison of the

American Enterprise Institute

The American Enterprise Institute for Public Policy Research, known simply as the American Enterprise Institute (AEI), is a center-right think tank based in Washington, D.C., that researches government, politics, economics, and social welfare ...

(AEI) primarily blamed U.S. housing policy, including the actions of

Fannie

Fannie is a given name. Notable people with the name include:

* Fannie Fern Andrews (1867–1950), American lecturer, teacher, social worker and writer

* Fannie Barrios, Venezuelan bodybuilder

* Fannie Birckhead (1935–2022), American communi ...

and

Freddie, for the crisis. He wrote: "When the bubble began to deflate in mid-2007, the low quality and high risk loans engendered by government policies failed in unprecedented numbers."

In its "Declaration of the Summit on Financial Markets and the World Economy," dated November 15, 2008, leaders of the

Group of 20

The G20 or Group of 20 is an intergovernmental forum comprising 19 sovereign countries, the European Union (EU), and the African Union (AU). It works to address major issues related to the global economy, such as international financial stabi ...

cited the following causes:

Federal Reserve Chair

Ben Bernanke

Ben Shalom Bernanke ( ; born December 13, 1953) is an American economist who served as the 14th chairman of the Federal Reserve from 2006 to 2014. After leaving the Federal Reserve, he was appointed a distinguished fellow at the Brookings Insti ...

testified in September 2010 before the FCIC regarding the causes of the crisis. He wrote that there were shocks or triggers (i.e., particular events that touched off the crisis) and vulnerabilities (i.e., structural weaknesses in the financial system, regulation and supervision) that amplified the shocks. Examples of triggers included: losses on subprime mortgage securities that began in 2007 and a

run on the

shadow banking system

The shadow banking system is a term for the collection of non-bank financial intermediaries (NBFIs) that legally provide services similar to traditional commercial banks but outside normal banking regulations. S&P Global estimates that, at end-2 ...

that began in the middle of 2007, which adversely affected the functioning of money markets. Examples of vulnerabilities in the ''private'' sector included: financial institution dependence on unstable sources of short-term funding such as

repurchase agreements or Repos; deficiencies in corporate risk management; excessive use of leverage (borrowing to invest); and inappropriate usage of derivatives as a tool for taking excessive risks. Examples of vulnerabilities in the ''public'' sector included: statutory gaps and conflicts between regulators; ineffective use of regulatory authority; and ineffective crisis management capabilities. Bernanke also discussed "

Too big to fail

"Too big to fail" (TBTF) is a theory in banking and finance that asserts that certain corporations, particularly financial institutions, are so large and so interconnected with an economy that their failure would be disastrous to the greater e ...

" institutions, monetary policy, and trade deficits.

Narratives

There are several "narratives" attempting to place the causes of the recession into context, with overlapping elements. Five such narratives include:

# There was the equivalent of a

bank run

A bank run or run on the bank occurs when many Client (business), clients withdraw their money from a bank, because they believe Bank failure, the bank may fail in the near future. In other words, it is when, in a fractional-reserve banking sys ...

on the

shadow banking system

The shadow banking system is a term for the collection of non-bank financial intermediaries (NBFIs) that legally provide services similar to traditional commercial banks but outside normal banking regulations. S&P Global estimates that, at end-2 ...

, which includes investment banks and other non-depository financial entities. This system had grown to rival the depository system in scale yet was not subject to the same regulatory safeguards. Its failure disrupted the flow of credit to consumers and corporations.

# The

U.S. economy was being driven by a housing bubble. When it burst, private residential investment (i.e., housing construction) fell by over four percent of GDP. Consumption enabled by bubble-generated housing wealth also slowed. This created a gap in annual demand (GDP) of nearly $1 trillion. The U.S. government was unwilling to make up for this private sector shortfall.

# Record levels of

household debt

Household debt is the combined debt of all people in a household, including consumer debt and mortgage loans. A significant rise in the level of this debt coincides historically with many severe economic crises and was a cause of the U.S. and s ...

accumulated in the decades preceding the crisis resulted in a

balance sheet recession (similar to

debt deflation

Debt deflation is a theory that recessions and depressions are due to the overall level of debt rising in real value because of deflation, causing people to default on their consumer loans and mortgages. Bank assets fall because of the defaults an ...

) once housing prices began falling in 2006. Consumers began paying off debt, which reduces their consumption, slowing down the economy for an extended period while debt levels are reduced.

# U.S. government policies encouraged home ownership even for those who could not afford it, contributing to lax lending standards, unsustainable housing price increases, and indebtedness.

# Wealthy and middle-class

house flippers with mid-to-good credit scores created a

speculative bubble

Speculative may refer to:

In arts and entertainment

*Speculative art (disambiguation)

*Speculative fiction, which includes elements created out of human imagination, such as the science fiction and fantasy genres

** Speculative Fiction Group, a Pe ...

in house prices, and then wrecked local housing markets and financial institutions after they defaulted on their debt en masse.

Underlying narratives #1–3 is a hypothesis that growing

income inequality

In economics, income distribution covers how a country's total GDP is distributed amongst its population. Economic theory and economic policy have long seen income and its distribution as a central concern. Unequal distribution of income causes ...

and

wage stagnation

Real wages are wages adjusted for inflation, or equivalently wages in terms of the amount of goods and services that can be bought. This term is used in contrast to nominal wages or unadjusted wages. Because it has been adjusted to account for ...

encouraged families to increase their

household debt

Household debt is the combined debt of all people in a household, including consumer debt and mortgage loans. A significant rise in the level of this debt coincides historically with many severe economic crises and was a cause of the U.S. and s ...

to maintain their desired living standard, fueling the bubble. Further, this greater share of income flowing to the top increased the political power of business interests, who used that power to

deregulate or limit regulation of the shadow banking system.

Narrative #5 challenges the popular claim (narrative #4) that subprime borrowers with shoddy credit caused the crisis by buying homes they couldn't afford. This narrative is supported by new research showing that the biggest growth of mortgage debt during the U.S. housing boom came from those with good credit scores in the middle and top of the credit score distributionand that these borrowers accounted for a disproportionate share of defaults.

Trade imbalances and debt bubbles

''

The Economist

''The Economist'' is a British newspaper published weekly in printed magazine format and daily on Electronic publishing, digital platforms. It publishes stories on topics that include economics, business, geopolitics, technology and culture. M ...

'' wrote in July 2012 that the inflow of investment dollars required to fund the U.S. trade deficit was a major cause of the housing bubble and financial crisis: "The trade deficit, less than 1% of GDP in the early 1990s, hit 6% in 2006. That deficit was financed by inflows of foreign savings, in particular from East Asia and the Middle East. Much of that money went into dodgy mortgages to buy overvalued houses, and the financial crisis was the result."

In May 2008, NPR explained in their

Peabody Award

The George Foster Peabody Awards (or simply Peabody Awards or the Peabodys) program, named for the American businessman and philanthropist George Foster Peabody, George Peabody, honor what are described as the most powerful, enlightening, and in ...

winning program "

The Giant Pool of Money" that a vast inflow of savings from developing nations flowed into the mortgage market, driving the U.S. housing bubble. This pool of fixed income savings increased from around $35 trillion in 2000 to about $70 trillion by 2008. NPR explained this money came from various sources, "

t the main headline is that all sorts of poor countries became kind of rich, making things like TVs and selling us oil. China, India, Abu Dhabi, Saudi Arabia made a lot of money and banked it."

Describing the crisis in Europe,

Paul Krugman

Paul Robin Krugman ( ; born February 28, 1953) is an American New Keynesian economics, New Keynesian economist who is the Distinguished Professor of Economics at the CUNY Graduate Center, Graduate Center of the City University of New York. He ...

wrote in February 2012 that: "What we're basically looking at, then, is a balance of payments problem, in which capital flooded south after the creation of the euro, leading to overvaluation in southern Europe."

Monetary policy

Another narrative about the origin has been focused on the respective parts played by public monetary policy (notably in the US) and by the practices of private financial institutions. In the U.S., mortgage funding was unusually decentralised, opaque, and competitive, and it is believed that competition between lenders for revenue and market share contributed to declining underwriting standards and risky lending.

While Alan Greenspan's role as

Chairman of the Federal Reserve

The chair of the Board of Governors of the Federal Reserve System is the head of the Federal Reserve, and is the active executive officer of the Board of Governors of the Federal Reserve System. The chairman presides at meetings of the Board.

...

has been widely discussed, the main point of controversy remains the lowering of the

Federal funds rate

In the United States, the federal funds rate is the interest rate at which depository institutions (banks and credit unions) lend reserve balances to other depository institutions overnight on an collateral (finance), uncollateralized basis ...

to 1% for more than a year, which, according to

Austrian theorists, injected huge amounts of "easy" credit-based money into the financial system and created an unsustainable economic boom. There is an argument that Greenspan's actions in the years 2002–2004 were actually motivated by the need to take the U.S. economy out of the

early 2000s recession

The early 2000s recession was a major decline in economic activity which mainly occurred in developed countries. The recession affected the European Union during 2000 and 2001 and the United States from March to November 2001. The United King ...

caused by the bursting of the

dot-com bubble

The dot-com bubble (or dot-com boom) was a stock market bubble that ballooned during the late-1990s and peaked on Friday, March 10, 2000. This period of market growth coincided with the widespread adoption of the World Wide Web and the Interne ...

: although by doing so he did not avert the crisis, but only postponed it.

High private debt levels

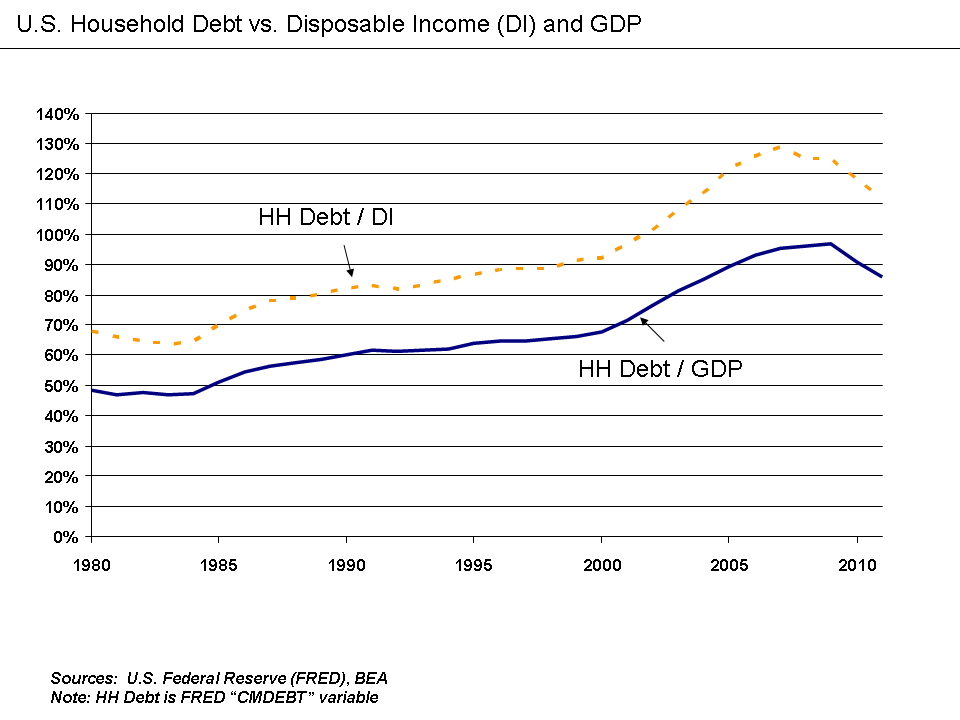

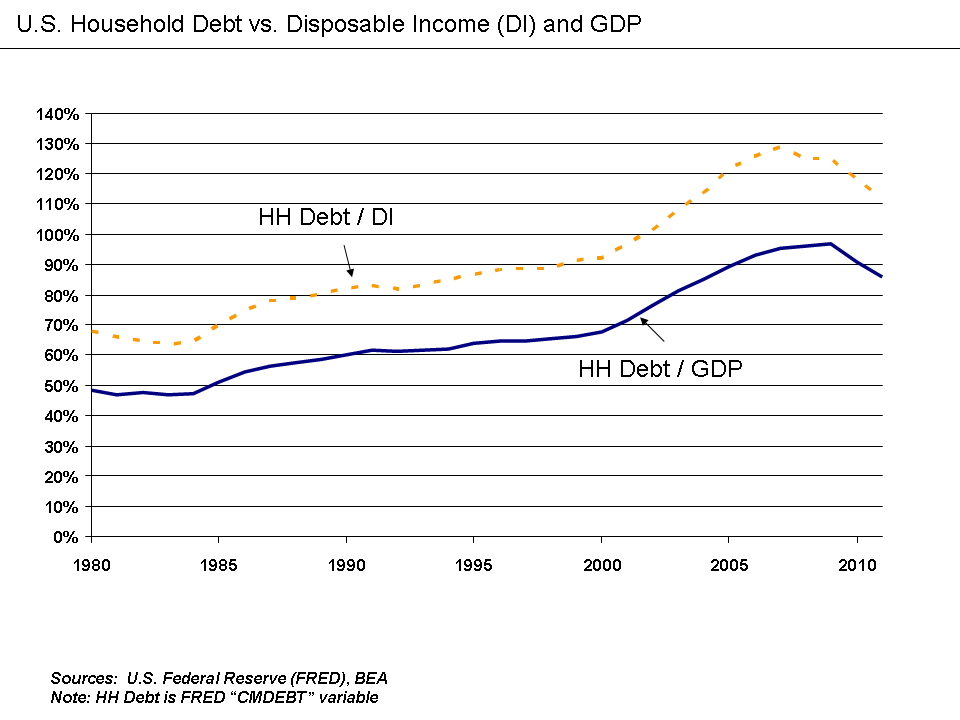

Another narrative focuses on high levels of private debt in the US economy. USA

household debt

Household debt is the combined debt of all people in a household, including consumer debt and mortgage loans. A significant rise in the level of this debt coincides historically with many severe economic crises and was a cause of the U.S. and s ...

as a percentage of annual

disposable personal income was 127% at the end of 2007, versus 77% in 1990.

Faced with increasing mortgage payments as their adjustable rate mortgage payments increased, households began to default in record numbers, rendering mortgage-backed securities worthless. High private debt levels also impact growth by making recessions deeper and the following recovery weaker.

Robert Reich

Robert Bernard Reich (; born June 24, 1946) is an American professor, author, lawyer, and political commentator. He worked in the administrations of presidents Gerald Ford and Jimmy Carter, and he served as United States Secretary of Labor, Se ...

claims the amount of debt in the US economy can be traced to

economic inequality, assuming that middle-class wages remained stagnant while wealth concentrated at the top, and households "pull equity from their homes and overload on debt to maintain living standards".

The IMF reported in April 2012: "Household debt soared in the years leading up to the downturn. In advanced economies, during the five years preceding 2007, the ratio of household debt to income rose by an average of 39 percentage points, to 138 percent. In Denmark, Iceland, Ireland, the Netherlands, and Norway, debt peaked at more than 200 percent of household income. A surge in household debt to historic highs also occurred in emerging economies such as Estonia, Hungary, Latvia, and Lithuania. The concurrent boom in both house prices and the stock market meant that household debt relative to assets held broadly stable, which masked households' growing exposure to a sharp fall in asset prices. When house prices declined, leading to the

2008 financial crisis

The 2008 financial crisis, also known as the global financial crisis (GFC), was a major worldwide financial crisis centered in the United States. The causes of the 2008 crisis included excessive speculation on housing values by both homeowners ...

, many households saw their wealth shrink relative to their debt, and, with less income and more unemployment, found it harder to meet mortgage payments. By the end of 2011, real house prices had fallen from their peak by about 41% in Ireland, 29% in Iceland, 23% in Spain and the United States, and 21% in Denmark. Household defaults, underwater mortgages (where the loan balance exceeds the house value), foreclosures, and fire sales are now endemic to a number of economies. Household

deleveraging

At the microeconomics, micro-economic level, deleveraging refers to the reduction of the leverage ratio, or the percentage of debt in the balance sheet of a single economic entity, such as a household or a firm. It is the opposite of leverage (fina ...

by paying off debts or defaulting on them has begun in some countries. It has been most pronounced in the United States, where about two-thirds of the debt reduction reflects defaults."

Pre-recession warnings

The onset of the economic crisis took most people by surprise. A 2009 paper identifies twelve economists and commentators who, between 2000 and 2006, predicted a recession based on the collapse of the then-booming housing market in the United States:

[Dirk J Bezemer: ''"No One Saw This Coming" Understanding Financial Crisis Through Accounting Models'', available via]

MPRA

, esp. p. 9 and appendix. Dean Baker,

Wynne Godley,

Fred Harrison,

Michael Hudson,

Eric Janszen,

Med Jones Steve Keen

Steve Keen (born 28 March 1953) is an Australian economist and author. He considers himself a post-Keynesian, criticising neoclassical economics as inconsistent, unscientific, and empirically unsupported.

Keen was formerly an associate profe ...

,

Jakob Brøchner Madsen, Jens Kjaer Sørensen,

Kurt Richebächer,

Nouriel Roubini,

Peter Schiff, and

Robert Shiller

Robert James Shiller (born March 29, 1946) is an American economist, academic, and author. As of 2022, he served as a Sterling Professor of Economics at Yale University and is a fellow at the Yale School of Management's International Center fo ...

.

Housing bubbles

By 2007, real estate bubbles were still under way in many parts of the world, especially in the

United States

The United States of America (USA), also known as the United States (U.S.) or America, is a country primarily located in North America. It is a federal republic of 50 U.S. state, states and a federal capital district, Washington, D.C. The 48 ...

, France, the

United Kingdom

The United Kingdom of Great Britain and Northern Ireland, commonly known as the United Kingdom (UK) or Britain, is a country in Northwestern Europe, off the coast of European mainland, the continental mainland. It comprises England, Scotlan ...

,

Spain

Spain, or the Kingdom of Spain, is a country in Southern Europe, Southern and Western Europe with territories in North Africa. Featuring the Punta de Tarifa, southernmost point of continental Europe, it is the largest country in Southern Eur ...

, the Netherlands, Australia, the United Arab Emirates,

New Zealand

New Zealand () is an island country in the southwestern Pacific Ocean. It consists of two main landmasses—the North Island () and the South Island ()—and List of islands of New Zealand, over 600 smaller islands. It is the List of isla ...

,

Ireland

Ireland (, ; ; Ulster Scots dialect, Ulster-Scots: ) is an island in the North Atlantic Ocean, in Northwestern Europe. Geopolitically, the island is divided between the Republic of Ireland (officially Names of the Irish state, named Irelan ...

,

Poland

Poland, officially the Republic of Poland, is a country in Central Europe. It extends from the Baltic Sea in the north to the Sudetes and Carpathian Mountains in the south, bordered by Lithuania and Russia to the northeast, Belarus and Ukrai ...

,

South Africa

South Africa, officially the Republic of South Africa (RSA), is the Southern Africa, southernmost country in Africa. Its Provinces of South Africa, nine provinces are bounded to the south by of coastline that stretches along the Atlantic O ...

,

Greece

Greece, officially the Hellenic Republic, is a country in Southeast Europe. Located on the southern tip of the Balkan peninsula, it shares land borders with Albania to the northwest, North Macedonia and Bulgaria to the north, and Turkey to th ...

,

Bulgaria

Bulgaria, officially the Republic of Bulgaria, is a country in Southeast Europe. It is situated on the eastern portion of the Balkans directly south of the Danube river and west of the Black Sea. Bulgaria is bordered by Greece and Turkey t ...

,

Croatia

Croatia, officially the Republic of Croatia, is a country in Central Europe, Central and Southeast Europe, on the coast of the Adriatic Sea. It borders Slovenia to the northwest, Hungary to the northeast, Serbia to the east, Bosnia and Herze ...

,

Norway

Norway, officially the Kingdom of Norway, is a Nordic countries, Nordic country located on the Scandinavian Peninsula in Northern Europe. The remote Arctic island of Jan Mayen and the archipelago of Svalbard also form part of the Kingdom of ...

,

Singapore

Singapore, officially the Republic of Singapore, is an island country and city-state in Southeast Asia. The country's territory comprises one main island, 63 satellite islands and islets, and one outlying islet. It is about one degree ...

,

South Korea

South Korea, officially the Republic of Korea (ROK), is a country in East Asia. It constitutes the southern half of the Korea, Korean Peninsula and borders North Korea along the Korean Demilitarized Zone, with the Yellow Sea to the west and t ...

,

Sweden

Sweden, formally the Kingdom of Sweden, is a Nordic countries, Nordic country located on the Scandinavian Peninsula in Northern Europe. It borders Norway to the west and north, and Finland to the east. At , Sweden is the largest Nordic count ...

,

Finland

Finland, officially the Republic of Finland, is a Nordic country in Northern Europe. It borders Sweden to the northwest, Norway to the north, and Russia to the east, with the Gulf of Bothnia to the west and the Gulf of Finland to the south, ...

,

Argentina

Argentina, officially the Argentine Republic, is a country in the southern half of South America. It covers an area of , making it the List of South American countries by area, second-largest country in South America after Brazil, the fourt ...

, the

Baltic states

The Baltic states or the Baltic countries is a geopolitical term encompassing Estonia, Latvia, and Lithuania. All three countries are members of NATO, the European Union, the Eurozone, and the OECD. The three sovereign states on the eastern co ...

,

India

India, officially the Republic of India, is a country in South Asia. It is the List of countries and dependencies by area, seventh-largest country by area; the List of countries by population (United Nations), most populous country since ...

,

Romania

Romania is a country located at the crossroads of Central Europe, Central, Eastern Europe, Eastern and Southeast Europe. It borders Ukraine to the north and east, Hungary to the west, Serbia to the southwest, Bulgaria to the south, Moldova to ...

,

Ukraine

Ukraine is a country in Eastern Europe. It is the List of European countries by area, second-largest country in Europe after Russia, which Russia–Ukraine border, borders it to the east and northeast. Ukraine also borders Belarus to the nor ...

and

China

China, officially the People's Republic of China (PRC), is a country in East Asia. With population of China, a population exceeding 1.4 billion, it is the list of countries by population (United Nations), second-most populous country after ...

. U.S. Federal Reserve Chairman

Alan Greenspan

Alan Greenspan (born March 6, 1926) is an American economist who served as the 13th chairman of the Federal Reserve from 1987 to 2006. He worked as a private adviser and provided consulting for firms through his company, Greenspan Associates L ...

said in mid-2005 that "at a minimum, there's a little 'froth'

n the U.S. housing market..it's hard not to see that there are a lot of local bubbles".

''

The Economist

''The Economist'' is a British newspaper published weekly in printed magazine format and daily on Electronic publishing, digital platforms. It publishes stories on topics that include economics, business, geopolitics, technology and culture. M ...

'', writing at the same time, went further, saying, "

e worldwide rise in house prices is the biggest bubble in history". Real estate bubbles are (by definition of the word "bubble") followed by a price decrease (also known as a ''housing price crash'') that can result in many owners holding

negative equity

Negative equity is a deficit of owner's equity, occurring when the value of an asset used to secure a loan is less than the outstanding balance on the loan. In the United States, assets (particularly real estate, whose loans are mortgages) with ...

(a

mortgage

A mortgage loan or simply mortgage (), in civil law (legal system), civil law jurisdictions known also as a hypothec loan, is a loan used either by purchasers of real property to raise funds to buy real estate, or by existing property owners t ...

debt higher than the current value of the property).

Ineffective regulation

Derivatives

Several sources have noted the failure of the US government to supervise or even require transparency of the

financial instruments

Financial instruments are monetary contracts between parties. They can be created, traded, modified and settled. They can be cash (currency), evidence of an ownership, interest in an entity or a contractual right to receive or deliver in the form ...

known as

derivatives.

[ Derivatives such as credit default swaps (CDSs) were unregulated or barely regulated. ]Michael Lewis

Michael Monroe Lewis (born October 15, 1960) Gale Biography In Context. is an American author and financial journalist. He has also been a contributing editor to '' Vanity Fair'' since 2009, writing mostly on business, finance, and economics. ...

noted CDSs enabled speculators to stack bets on the same mortgage securities. This is analogous to allowing many persons to buy insurance on the same house. Speculators that bought CDS protection were betting significant mortgage security defaults would occur, while the sellers (such as AIG

American International Group, Inc. (AIG) is an American multinational finance and insurance corporation with operations in more than 80 countries and jurisdictions. As of 2023, AIG employed 25,200 people. The company operates through three core ...

) bet they would not. An unlimited amount could be wagered on the same housing-related securities, provided buyers and sellers of the CDS could be found. When massive defaults occurred on underlying mortgage securities, companies like AIG that were selling CDS were unable to perform their side of the obligation and defaulted; U.S. taxpayers paid over $100 billion to global financial institutions to honor AIG obligations, generating considerable outrage.The Washington Post

''The Washington Post'', locally known as ''The'' ''Post'' and, informally, ''WaPo'' or ''WP'', is an American daily newspaper published in Washington, D.C., the national capital. It is the most widely circulated newspaper in the Washington m ...

'' found leading government officials at the time (Federal Reserve Board Chairman Alan Greenspan

Alan Greenspan (born March 6, 1926) is an American economist who served as the 13th chairman of the Federal Reserve from 1987 to 2006. He worked as a private adviser and provided consulting for firms through his company, Greenspan Associates L ...

, Treasury Secretary Robert Rubin

Robert Edward Rubin (born August 29, 1938) is an American retired banking executive, lawyer, and former Federal government of the United States, government official. He served as the 70th United States Secretary of the Treasury, U.S. secretary o ...

, and SEC Chairman Arthur Levitt

Arthur Levitt Jr. (born February 3, 1931) is the former chairman of the United States Securities and Exchange Commission (SEC). He served from 1993 to 2001 as the twenty-fifth and longest-serving chairman of the commission. Widely hailed as a ...

) vehemently opposed any regulation of derivatives. In 1998, Brooksley E. Born, head of the Commodity Futures Trading Commission

The Commodity Futures Trading Commission (CFTC) is an Independent agencies of the United States government, independent agency of the US government created in 1974 that regulates the U.S. derivatives markets, which includes futures contract, fut ...

, put forth a policy paper asking for feedback from regulators, lobbyists, and legislators on the question of whether derivatives should be reported, sold through a central facility, or whether capital requirements should be required of their buyers. Greenspan, Rubin, and Levitt pressured her to withdraw the paper and Greenspan persuaded Congress

A congress is a formal meeting of the representatives of different countries, constituent states, organizations, trade unions, political parties, or other groups. The term originated in Late Middle English to denote an encounter (meeting of ...

to pass a resolution preventing CFTC from regulating derivatives for another six months – when Born's term of office would expire.[ Bethany McLean and Joe Nocera, '' All the Devils Are Here: The Hidden History of the Financial Crisis'' Portfolio, Penguin, 2010, pp. 104–107] Ultimately, it was the collapse of a specific kind of derivative, the mortgage-backed security

A mortgage-backed security (MBS) is a type of asset-backed security (an "Financial instrument, instrument") which is secured by a mortgage loan, mortgage or collection of mortgages. The mortgages are aggregated and sold to a group of individuals ( ...

, that triggered the economic crisis of 2008.

Shadow banking system

Paul Krugman wrote in 2009 that the run on the

Paul Krugman wrote in 2009 that the run on the shadow banking system

The shadow banking system is a term for the collection of non-bank financial intermediaries (NBFIs) that legally provide services similar to traditional commercial banks but outside normal banking regulations. S&P Global estimates that, at end-2 ...

was the fundamental cause of the crisis. "As the shadow banking system expanded to rival or even surpass conventional banking in importance, politicians and government officials should have realised that they were re-creating the kind of financial vulnerability that made the Great Depression possible – and they should have responded by extending regulations and the financial safety net to cover these new institutions. Influential figures should have proclaimed a simple rule: anything that does what a bank does, anything that has to be rescued in crises the way banks are, should be regulated like a bank." He referred to this lack of controls as "malign neglect".Lehman Brothers

Lehman Brothers Inc. ( ) was an American global financial services firm founded in 1850. Before filing for bankruptcy in 2008, Lehman was the fourth-largest investment bank in the United States (behind Goldman Sachs, Morgan Stanley, and Merril ...

) or were sold at fire sale

A fire sale is the sale of goods at extremely discounted prices. The term originated in reference to the sale of goods at a heavy discount due to fire damage. It may or may not be defined as a closeout, the final sale of goods to zero inventor ...

prices to other banks (Bear Stearns

The Bear Stearns Companies, Inc. was an American investment bank, securities trading, and brokerage firm that failed in 2008 during the 2008 financial crisis and the Great Recession. After its closure it was subsequently sold to JPMorgan Chas ...

and Merrill Lynch

Merrill Lynch, Pierce, Fenner & Smith Incorporated, doing business as Merrill, and previously branded Merrill Lynch, is an American investment management and wealth management division of Bank of America. Along with BofA Securities, the investm ...

). The investment banks were not subject to the more stringent regulations applied to depository banks. These failures exacerbated the instability in the global financial system. The remaining two investment banks, Morgan Stanley

Morgan Stanley is an American multinational investment bank and financial services company headquartered at 1585 Broadway in Midtown Manhattan, New York City. With offices in 42 countries and more than 80,000 employees, the firm's clients in ...

and Goldman Sachs

The Goldman Sachs Group, Inc. ( ) is an American multinational investment bank and financial services company. Founded in 1869, Goldman Sachs is headquartered in Lower Manhattan in New York City, with regional headquarters in many internationa ...

, potentially facing failure, opted to become commercial banks, thereby subjecting themselves to more stringent regulation but receiving access to credit via the Federal Reserve. Further, American International Group

American International Group, Inc. (AIG) is an American multinational finance and insurance corporation with operations in more than 80 countries and jurisdictions. As of 2023, AIG employed 25,200 people. The company operates through three core ...

(AIG) had insured mortgage-backed and other securities but was not required to maintain sufficient reserves to pay its obligations when debtors defaulted on these securities. AIG was contractually required to post additional collateral with many creditors and counter-parties, touching off controversy when over $100 billion of U.S. taxpayer money was paid out to major global financial institutions on behalf of AIG. While this money was legally owed to the banks by AIG (under agreements made via credit default swaps purchased from AIG by the institutions), a number of Congressmen and media members expressed outrage that taxpayer money was used to bail out banks.Gramm–Leach–Bliley Act

The Gramm–Leach–Bliley Act (GLBA), also known as the Financial Services Modernization Act of 1999, () is an act of the 106th United States Congress (1999–2001). It repealed part of the Glass–Steagall Act of 1933, removing barriers in ...

(1999), which reduced the regulation of banks by allowing commercial and investment banks to merge, has also been blamed for the crisis, by Nobel Prize

The Nobel Prizes ( ; ; ) are awards administered by the Nobel Foundation and granted in accordance with the principle of "for the greatest benefit to humankind". The prizes were first awarded in 1901, marking the fifth anniversary of Alfred N ...

–winning economist Joseph Stiglitz

Joseph Eugene Stiglitz (; born February 9, 1943) is an American New Keynesian economist, a public policy analyst, political activist, and a professor at Columbia University. He is a recipient of the Nobel Memorial Prize in Economic Sciences (2 ...

among others.

Regulations encouraging lax lending standards

Peter Wallison and Edward Pinto of the American Enterprise Institute

The American Enterprise Institute for Public Policy Research, known simply as the American Enterprise Institute (AEI), is a center-right think tank based in Washington, D.C., that researches government, politics, economics, and social welfare ...

, which advocates for private enterprise and limited government, have asserted that private lenders were encouraged to relax lending standards by government affordable housing policies. They cite The Housing and Community Development Act of 1992, which initially required that 30 percent or more of Fannie's and Freddie's loan purchases be related to affordable housing. The legislation gave HUD the power to set future requirements. These rose to 42 percent in 1995 and 50 percent in 2000, and by 2008 a 56 percent minimum was established.Paul Krugman

Paul Robin Krugman ( ; born February 28, 1953) is an American New Keynesian economics, New Keynesian economist who is the Distinguished Professor of Economics at the CUNY Graduate Center, Graduate Center of the City University of New York. He ...

referring to it as "imaginary history".

One of the other challenges with blaming government regulations for essentially forcing banks to make risky loans is the timing. Subprime lending increased from around 10% of mortgage origination historically to about 20% only from 2004 to 2006, with housing prices peaking in 2006. Blaming affordable housing regulations established in the 1990s for a sudden spike in subprime origination is problematic at best.

Systemic crisis

The 2008 financial crisis

The 2008 financial crisis, also known as the global financial crisis (GFC), was a major worldwide financial crisis centered in the United States. The causes of the 2008 crisis included excessive speculation on housing values by both homeowners ...

and the Great Recession

The Great Recession was a period of market decline in economies around the world that occurred from late 2007 to mid-2009. were described as a symptom of another, deeper crisis by a number of economists. For example, Ravi Batra argues that growing inequality of financial capitalism produces speculative bubbles that burst and result in depression and major political changes. Feminist economists Ailsa McKay and Margunn Bjørnholt

Margunn Bjørnholt (born 9 October 1958 in Bø, Telemark) is a Norwegian sociologist and economics, economist. She is a Academic ranks in Norway#Research professor, research professor at the Norwegian Centre for Violence and Traumatic Stress Stud ...

argue that the 2008 financial crisis

The 2008 financial crisis, also known as the global financial crisis (GFC), was a major worldwide financial crisis centered in the United States. The causes of the 2008 crisis included excessive speculation on housing values by both homeowners ...

and the response to it revealed a crisis of ideas in mainstream economics and within the economics profession, and call for a reshaping of both the economy, economic theory and the economics profession. They argue that such a reshaping should include new advances within feminist economics

Feminist economics is the critical study of economics and economies, with a focus on gender-aware and inclusive economic inquiry and policy analysis. Feminist economic researchers include academics, activists, policy theorists, and practitio ...

and ecological economics

Ecological economics, bioeconomics, ecolonomy, eco-economics, or ecol-econ is both a transdisciplinary and an interdisciplinary field of academic research addressing the interdependence and coevolution of human economy, economies and natural ec ...

that take as their starting point the socially responsible, sensible and accountable subject in creating an economy and economic theories that fully acknowledge care for each other as well as the planet.

Effects

Effects on the United States

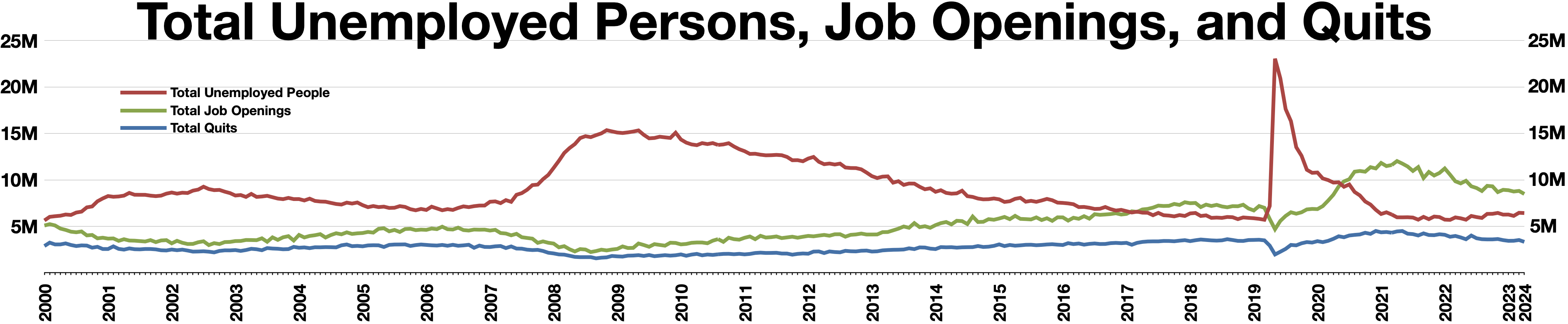

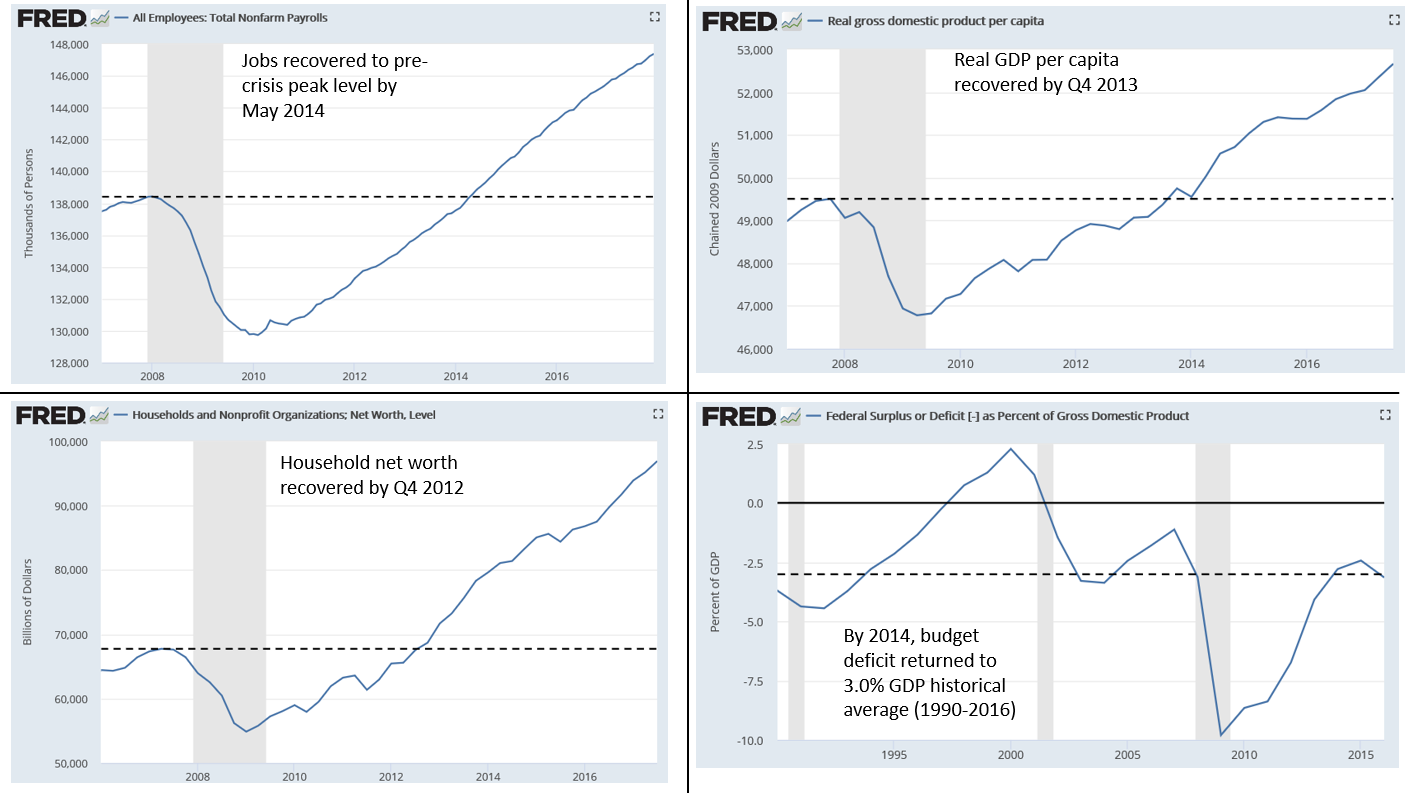

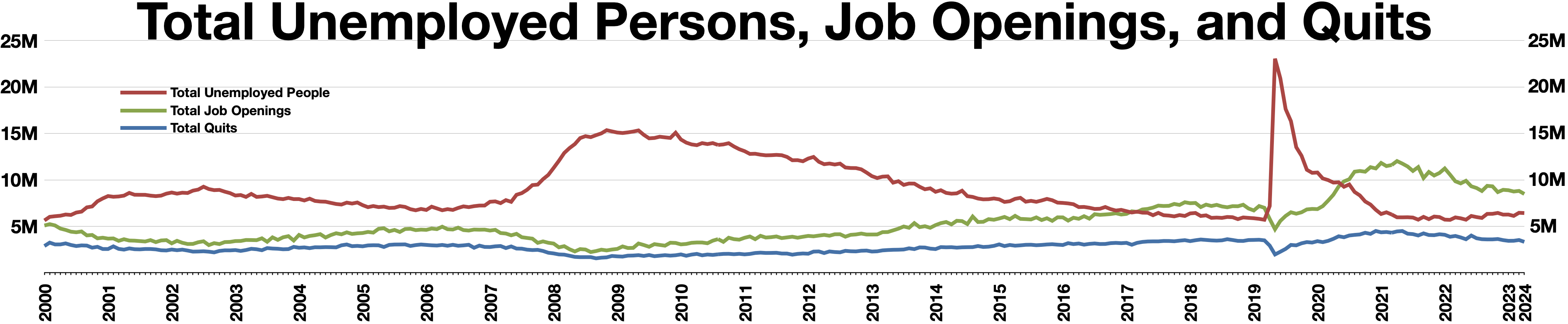

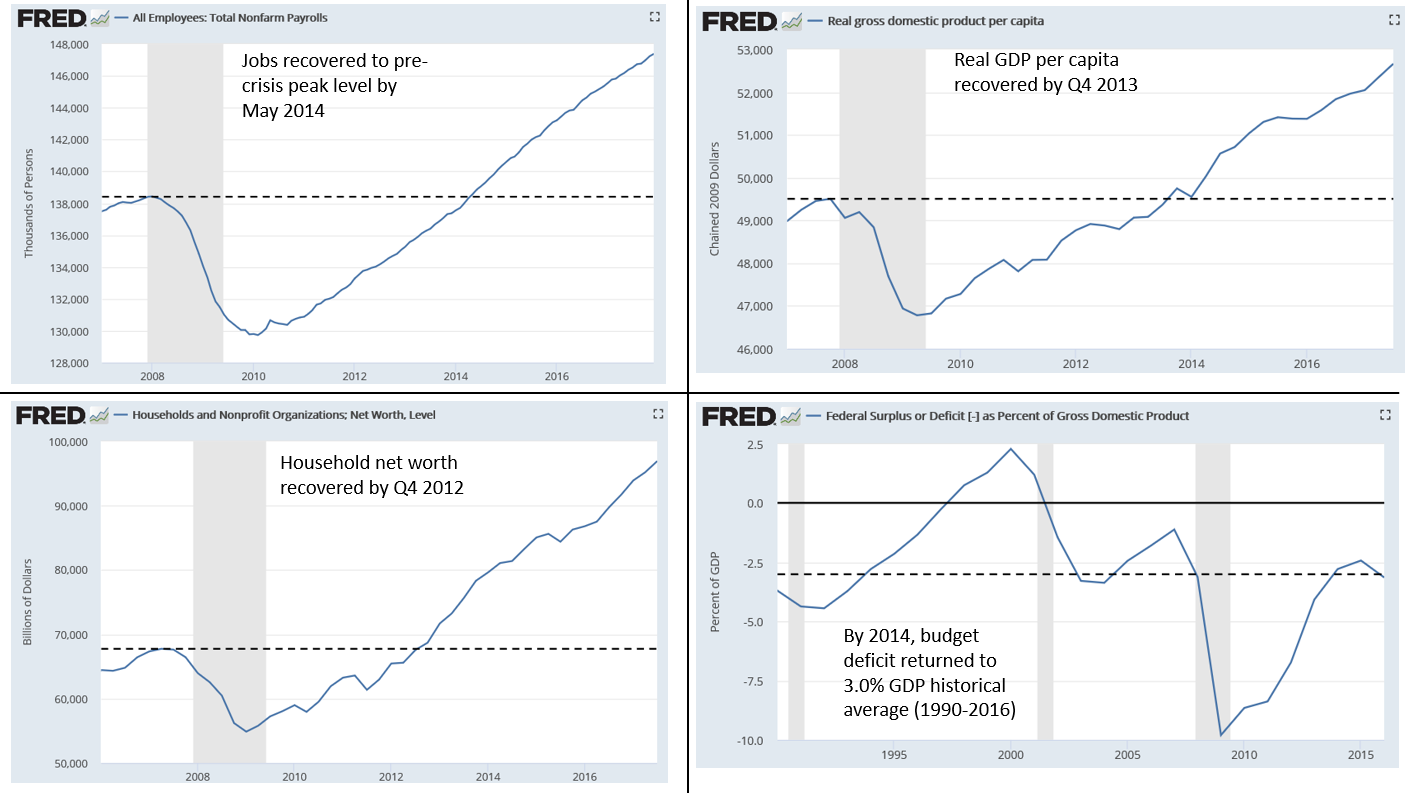

Though no one knew they were in it at the time, the Great Recession had a significant economic and political impact on the United States. While the recession technically lasted from December 2007June 2009 (the nominal GDP trough), many important economic variables did not regain pre-recession (November or Q4 2007) levels until 2011–2016. For example, real GDP fell $650 billion (4.3%) and did not recover its $15 trillion pre-recession level until Q3 2011. Household net worth, which reflects the value of both stock markets and housing prices, fell $11.5 trillion (17.3%) and did not regain its pre-recession level of $66.4 trillion until Q3 2012. The number of persons with jobs (total non-farm payrolls) fell 8.6 million (6.2%) and did not regain the pre-recession level of 138.3 million until May 2014. The unemployment rate peaked at 10.0% in October 2009 and did not return to its pre-recession level of 4.7% until May 2016.

A key dynamic slowing the recovery was that both individuals and businesses paid down debts for several years, as opposed to borrowing and spending or investing as had historically been the case. This shift to a private sector surplus drove a sizable government deficit.

Though no one knew they were in it at the time, the Great Recession had a significant economic and political impact on the United States. While the recession technically lasted from December 2007June 2009 (the nominal GDP trough), many important economic variables did not regain pre-recession (November or Q4 2007) levels until 2011–2016. For example, real GDP fell $650 billion (4.3%) and did not recover its $15 trillion pre-recession level until Q3 2011. Household net worth, which reflects the value of both stock markets and housing prices, fell $11.5 trillion (17.3%) and did not regain its pre-recession level of $66.4 trillion until Q3 2012. The number of persons with jobs (total non-farm payrolls) fell 8.6 million (6.2%) and did not regain the pre-recession level of 138.3 million until May 2014. The unemployment rate peaked at 10.0% in October 2009 and did not return to its pre-recession level of 4.7% until May 2016.

A key dynamic slowing the recovery was that both individuals and businesses paid down debts for several years, as opposed to borrowing and spending or investing as had historically been the case. This shift to a private sector surplus drove a sizable government deficit.austerity

In economic policy, austerity is a set of Political economy, political-economic policies that aim to reduce government budget deficits through Government spending, spending cuts, tax increases, or a combination of both. There are three prim ...

. Then-Fed Chair Ben Bernanke

Ben Shalom Bernanke ( ; born December 13, 1953) is an American economist who served as the 14th chairman of the Federal Reserve from 2006 to 2014. After leaving the Federal Reserve, he was appointed a distinguished fellow at the Brookings Insti ...

explained during November 2012 several of the economic headwinds that slowed the recovery:

*The housing sector did not rebound, as was the case in prior recession recoveries, as the sector was severely damaged during the crisis. Millions of foreclosures had created a large surplus of properties and consumers were paying down their debts rather than purchasing homes.

*Credit for borrowing and spending by individuals (or investing by corporations) was not readily available as banks paid down their debts.

*Restrained government spending following initial stimulus efforts (i.e., austerity) was not sufficient to offset private sector weaknesses.George W. Bush

George Walker Bush (born July 6, 1946) is an American politician and businessman who was the 43rd president of the United States from 2001 to 2009. A member of the Bush family and the Republican Party (United States), Republican Party, he i ...

and continued or expanded by President Obama) with few consequences for banking leadership, were a factor in driving the country politically rightward starting in 2010. The Troubled Asset Relief Program (TARP) was the largest of the bailouts. In 2008, TARP allocated $426.4 billion to various major financial institutions. However, the US collected $441.7 billion in return from these loans in 2010, recording a profit of $15.3 billion. Nonetheless, there was a political shift from the Democratic party. Examples include the rise of the Tea Party and the loss of Democratic majorities in subsequent elections. President Obama declared the bailout measures started under the Bush administration and continued during his administration as completed and mostly profitable . , bailout funds had been fully recovered by the government, when interest on loans is taken into consideration. A total of $626B was invested, loaned, or granted due to various bailout measures, while $390B had been returned to the Treasury. The Treasury had earned another $323B in interest on bailout loans, resulting in an $87B profit. Economic and political commentators have argued the Great Recession was also an important factor in the rise of populist sentiment that resulted in the election of right-wing populist President Trump

Donald John Trump (born June 14, 1946) is an American politician, media personality, and businessman who is the 47th president of the United States. A member of the Republican Party, he served as the 45th president from 2017 to 2021.

...

in 2016, and left-wing populist Bernie Sanders

Bernard Sanders (born September8, 1941) is an American politician and activist who is the Seniority in the United States Senate, senior United States Senate, United States senator from the state of Vermont. He is the longest-serving independ ...

' candidacy for the Democratic nomination.

Effects on Europe

The crisis in Europe generally progressed from banking system crises to sovereign debt crises, as many countries elected to bail out their banking systems using taxpayer money. Greece was different in that it faced large public debts rather than problems within its banking system. Several countries received bailout packages from the troika (European Commission, European Central Bank, International Monetary Fund), which also implemented a series of emergency measures.

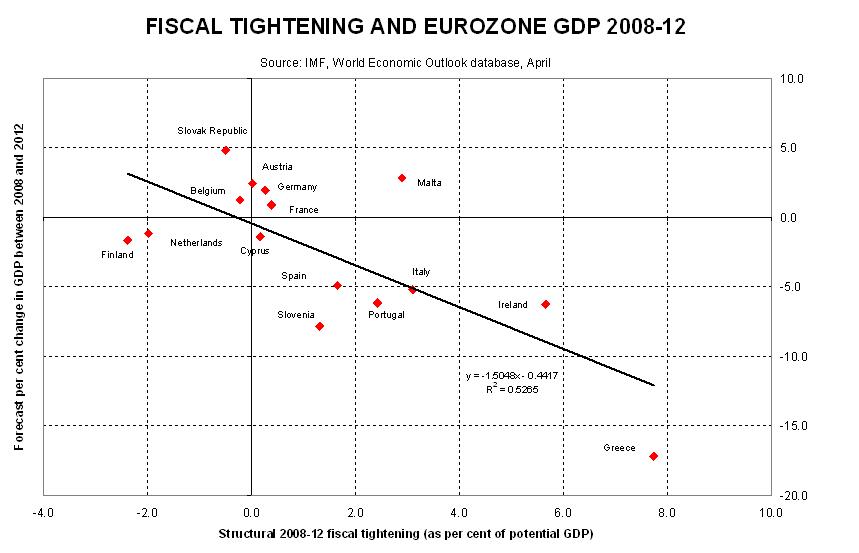

Many European countries embarked on austerity programs, reducing their budget deficits relative to GDP from 2010 to 2011. For example, according to the ''

The crisis in Europe generally progressed from banking system crises to sovereign debt crises, as many countries elected to bail out their banking systems using taxpayer money. Greece was different in that it faced large public debts rather than problems within its banking system. Several countries received bailout packages from the troika (European Commission, European Central Bank, International Monetary Fund), which also implemented a series of emergency measures.

Many European countries embarked on austerity programs, reducing their budget deficits relative to GDP from 2010 to 2011. For example, according to the ''CIA World Factbook

''The World Factbook'', also known as the ''CIA World Factbook'', is a reference resource produced by the United States' Central Intelligence Agency (CIA) with almanac-style information about the countries of the world. The official print ve ...

'' Greece improved its budget deficit from 10.4% GDP in 2010 to 9.6% in 2011. Iceland, Italy, Ireland, Portugal, France, and Spain also improved their budget deficits from 2010 to 2011 relative to GDP.Eurostat

Eurostat ("European Statistical Office"; also DG ESTAT) is a department of the European Commission ( Directorate-General), located in the Kirchberg quarter of Luxembourg City, Luxembourg. Eurostat's main responsibilities are to provide statist ...

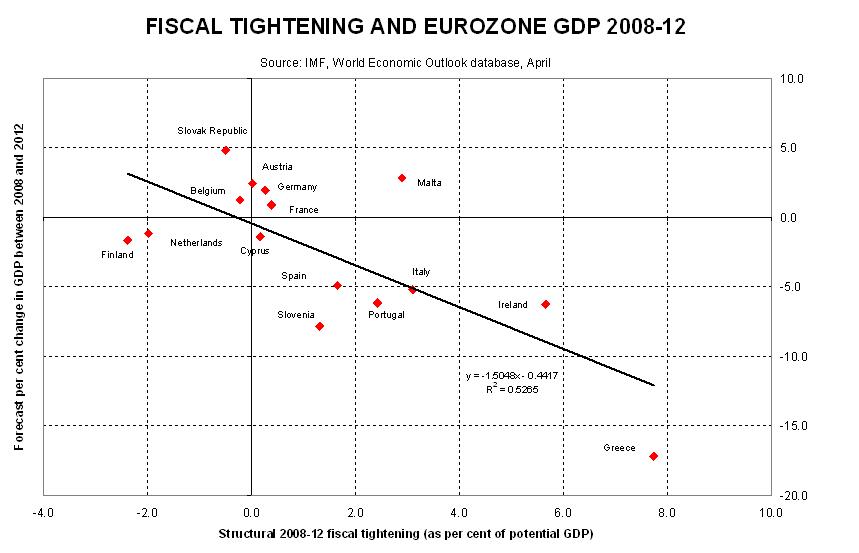

reported that the debt to GDP ratio for the 17 Euro area countries together was 70.1% in 2008, 79.9% in 2009, 85.3% in 2010, and 87.2% in 2011. Economist

Economist Martin Wolf

Martin Harry Wolf (born 16 August 1946 in London) is a British journalist who focuses on economics. He is the chief economics commentator at the ''Financial Times''. He also writes a weekly column for the French newspaper ''Le Monde''.

Earl ...

analysed the relationship between cumulative GDP growth from 2008 to 2012 and total reduction in budget deficits due to austerity policies (see chart) in several European countries during April 2012. He concluded that: "In all, there is no evidence here that large fiscal contractions udget deficit reductionsbring benefits to confidence and growth that offset the direct effects of the contractions. They bring exactly what one would expect: small contractions bring recessions and big contractions bring depressions." Changes in budget balances (deficits or surpluses) explained approximately 53% of the change in GDP, according to the equation derived from the IMF data used in his analysis.Paul Krugman

Paul Robin Krugman ( ; born February 28, 1953) is an American New Keynesian economics, New Keynesian economist who is the Distinguished Professor of Economics at the CUNY Graduate Center, Graduate Center of the City University of New York. He ...

analysed the relationship between GDP and reduction in budget deficits for several European countries in April 2012 and concluded that austerity was slowing growth, similar to Martin Wolf. He also wrote: "... this also implies that 1 euro of austerity yields only about 0.4 euros of reduced deficit, even in the short run. No wonder, then, that the whole austerity enterprise is spiraling into disaster."

Britain's decision to leave the European Union in 2016 has been partly attributed to the after-effects of the Great Recession on the country.

Effects on democracy

During the Great Recession and in the immediate aftermath, Bangladesh

Bangladesh, officially the People's Republic of Bangladesh, is a country in South Asia. It is the List of countries and dependencies by population, eighth-most populous country in the world and among the List of countries and dependencies by ...

, Ukraine

Ukraine is a country in Eastern Europe. It is the List of European countries by area, second-largest country in Europe after Russia, which Russia–Ukraine border, borders it to the east and northeast. Ukraine also borders Belarus to the nor ...

, Honduras

Honduras, officially the Republic of Honduras, is a country in Central America. It is bordered to the west by Guatemala, to the southwest by El Salvador, to the southeast by Nicaragua, to the south by the Pacific Ocean at the Gulf of Fonseca, ...

, Guatemala

Guatemala, officially the Republic of Guatemala, is a country in Central America. It is bordered to the north and west by Mexico, to the northeast by Belize, to the east by Honduras, and to the southeast by El Salvador. It is hydrologically b ...

, Palestine

Palestine, officially the State of Palestine, is a country in West Asia. Recognized by International recognition of Palestine, 147 of the UN's 193 member states, it encompasses the Israeli-occupied West Bank, including East Jerusalem, and th ...

, and Hong Kong

Hong Kong)., Legally Hong Kong, China in international treaties and organizations. is a special administrative region of China. With 7.5 million residents in a territory, Hong Kong is the fourth most densely populated region in the wor ...

went from democracies to a mix of democracy and authoritarianism and Madagascar

Madagascar, officially the Republic of Madagascar, is an island country that includes the island of Madagascar and numerous smaller peripheral islands. Lying off the southeastern coast of Africa, it is the world's List of islands by area, f ...

, the Gambia

The Gambia, officially the Republic of The Gambia, is a country in West Africa. Geographically, The Gambia is the List of African countries by area, smallest country in continental Africa; it is surrounded by Senegal on all sides except for ...

, Ethiopia

Ethiopia, officially the Federal Democratic Republic of Ethiopia, is a landlocked country located in the Horn of Africa region of East Africa. It shares borders with Eritrea to the north, Djibouti to the northeast, Somalia to the east, Ken ...

, Russia

Russia, or the Russian Federation, is a country spanning Eastern Europe and North Asia. It is the list of countries and dependencies by area, largest country in the world, and extends across Time in Russia, eleven time zones, sharing Borders ...

, and Fiji

Fiji, officially the Republic of Fiji, is an island country in Melanesia, part of Oceania in the South Pacific Ocean. It lies about north-northeast of New Zealand. Fiji consists of an archipelago of more than 330 islands—of which about ...

went from mixed regimes to authoritarian ones. While each country had democratic backsliding for different reasons, economic calamity has long been known to contribute to instability that can cause authoritarian forces to take hold.

Countries that avoided recession

Poland

Poland, officially the Republic of Poland, is a country in Central Europe. It extends from the Baltic Sea in the north to the Sudetes and Carpathian Mountains in the south, bordered by Lithuania and Russia to the northeast, Belarus and Ukrai ...

was the only member of the European Union

The European Union (EU) is a supranational union, supranational political union, political and economic union of Member state of the European Union, member states that are Geography of the European Union, located primarily in Europe. The u ...

to avoid a GDP recession during the Great Recession. As of December 2009, the Polish economy had not entered recession nor even contracted, while its IMF 2010 GDP growth forecast of 1.9 percent was expected to be upgraded. Analysts identified several causes for the positive economic development in Poland: Extremely low levels of bank lending and a relatively small mortgage market; the relatively recent dismantling of EU trade barriers and the resulting surge in demand for Polish goods since 2004; Poland being the recipient of direct EU funding since 2004; lack of over-dependence on a single export sector; a tradition of government fiscal responsibility; a relatively large internal market; the free-floating Polish zloty

Polish may refer to:

* Anything from or related to Poland, a country in Europe

* Polish language

* Polish people, people from Poland or of Polish descent

* Polish chicken

* Polish brothers (Mark Polish and Michael Polish, born 1970), American twin ...

; low labour costs attracting continued foreign direct investment; economic difficulties at the start of the decade, which prompted austerity measures in advance of the world crisis.

While India

India, officially the Republic of India, is a country in South Asia. It is the List of countries and dependencies by area, seventh-largest country by area; the List of countries by population (United Nations), most populous country since ...

, Uzbekistan

, image_flag = Flag of Uzbekistan.svg

, image_coat = Emblem of Uzbekistan.svg

, symbol_type = Emblem of Uzbekistan, Emblem

, national_anthem = "State Anthem of Uzbekistan, State Anthem of the Republ ...

, China

China, officially the People's Republic of China (PRC), is a country in East Asia. With population of China, a population exceeding 1.4 billion, it is the list of countries by population (United Nations), second-most populous country after ...

, and Iran

Iran, officially the Islamic Republic of Iran (IRI) and also known as Persia, is a country in West Asia. It borders Iraq to the west, Turkey, Azerbaijan, and Armenia to the northwest, the Caspian Sea to the north, Turkmenistan to the nort ...

experienced slowing growth, they did not enter recessions.

South Korea

South Korea, officially the Republic of Korea (ROK), is a country in East Asia. It constitutes the southern half of the Korea, Korean Peninsula and borders North Korea along the Korean Demilitarized Zone, with the Yellow Sea to the west and t ...

narrowly avoided technical recession in the first quarter of 2009. The International Energy Agency

The International Energy Agency (IEA) is a Paris-based autonomous intergovernmental organization, established in 1974, that provides policy recommendations, analysis and data on the global energy sector. The 31 member countries and 13 associatio ...

stated in mid September that South Korea could be the only OECD

The Organisation for Economic Co-operation and Development (OECD; , OCDE) is an international organization, intergovernmental organization with 38 member countries, founded in 1961 to stimulate economic progress and international trade, wor ...

country to avoid recession for the whole of 2009.

Australia

Australia, officially the Commonwealth of Australia, is a country comprising mainland Australia, the mainland of the Australia (continent), Australian continent, the island of Tasmania and list of islands of Australia, numerous smaller isl ...

avoided a technical recession after experiencing only one quarter of negative growth in the fourth quarter of 2008, with GDP returning to positive in the first quarter of 2009.

The 2008 financial crisis

The 2008 financial crisis, also known as the global financial crisis (GFC), was a major worldwide financial crisis centered in the United States. The causes of the 2008 crisis included excessive speculation on housing values by both homeowners ...

did not affect developing countries to a great extent. Experts see several reasons: Africa was not affected because it is not fully integrated in the world market. Latin America and Asia seemed better prepared, since they have experienced crises before. In Latin America, for example, banking laws and regulations are very stringent. Bruno Wenn of the German DEG suggests that Western countries could learn from these countries when it comes to regulations of financial markets.

Timeline of effects

The few recessions appearing early in 2006–07 are commonly never associated to be part of the Great Recession, which is illustrated by the fact that only two countries (Iceland and Jamaica) were in recession in Q4 2007.

One year before the maximum, in Q1 2008, only six countries were in recession (Iceland, Sweden, Finland, Ireland, Portugal and New Zealand). The number of countries in recession was 25 in Q2 2008, 39 in Q3 2008 and 53 in Q4 2008. At the steepest part of the Great Recession in Q1 2009, a total of 59 out of 71 countries were simultaneously in recession. The number of countries in recession was 37 in Q2 2009, 13 in Q3 2009 and 11 in Q4 2009. One year after the maximum, in Q1 2010, only seven countries were in recession (Greece, Croatia, Romania, Iceland, Jamaica, Venezuela and Belize).

The recession data for the overall G20 zone (representing 85% of all GWP), depict that the Great Recession existed as a global recession

A global recession is a recession that affects many countries around the world—that is, a period of global economic slowdown or declining economic output.

Definitions

The International Monetary Fund defines a global recession as "a decline ...

throughout Q3 2008 until Q1 2009.

Subsequent follow-up recessions in 2010–2013 were confined to Belize, El Salvador, Paraguay, Jamaica, Japan, Taiwan, New Zealand and 24 out of 50 European countries (including Greece). As of October 2014, only five out of the 71 countries with available quarterly data (Cyprus, Italy, Croatia, Belize and El Salvador), were still in ongoing recessions.European debt crisis

The euro area crisis, often also referred to as the eurozone crisis, European debt crisis, or European sovereign debt crisis, was a multi-year debt crisis and financial crisis in the European Union (EU) from 2009 until, in Greece, 2018. The e ...

.

Country specific details about recession timelines

Iceland fell into an economic depression in 2008 following the collapse of its banking system (''see 2008–2011 Icelandic financial crisis

The Icelandic financial crisis was a major financial crisis, economic and political event in Iceland between 2008 and 2010. It involved the default (finance), default of all three of the country's major privately owned commercial banks in late 2 ...

''). By mid-2012 Iceland is regarded as one of Europe's recovery success stories largely as a result of a currency devaluation that has effectively reduced wages by 50%--making exports more competitive.

The following countries had a recession starting in the fourth quarter of 2007: United States.Spain

Spain, or the Kingdom of Spain, is a country in Southern Europe, Southern and Western Europe with territories in North Africa. Featuring the Punta de Tarifa, southernmost point of continental Europe, it is the largest country in Southern Eur ...

, and Taiwan.

The following countries/territories had a recession starting in the fourth quarter of 2008: Switzerland.

South Korea avoided recession with GDP returning positive at a 0.1% expansion in the first quarter of 2009.

Of the seven largest economies in the world by GDP, only China avoided a recession in 2008. In the year to the third quarter of 2008 China grew by 9%. Until recently Chinese officials considered 8% GDP growth to be required simply to create enough jobs for rural people moving to urban centres. This figure may more accurately be considered to be 5–7% now that the main growth in working population is receding.

Ukraine went into technical depression in January 2009 with a GDP growth of −20%, when comparing on a monthly basis with the GDP level in January 2008. Overall the Ukrainian real GDP fell 14.8% when comparing the entire part of 2009 with 2008. When measured quarter-on-quarter by changes of seasonally adjusted real GDP, Ukraine was more precisely in recession/depression throughout the four quarters from Q2-2008 until Q1-2009 (with respective qoq-changes of: -0.1%, -0.5%, -9.3%, -10.3%), and the two quarters from Q3-2012 until Q4-2012 (with respective qoq-changes of: -1.5% and -0.8%).

Japan was in recovery in the middle of the decade 2000s but slipped back into recession and deflation in 2008. The recession in Japan intensified in the fourth quarter of 2008 with a GDP growth of −12.7%, and deepened further in the first quarter of 2009 with a GDP growth of −15.2%.

Political instability related to the economic crisis

On February 26, 2009, an Economic Intelligence Briefing was added to the daily intelligence briefings prepared for the

On February 26, 2009, an Economic Intelligence Briefing was added to the daily intelligence briefings prepared for the President of the United States

The president of the United States (POTUS) is the head of state and head of government of the United States. The president directs the Federal government of the United States#Executive branch, executive branch of the Federal government of t ...

. This addition reflects the assessment of U.S. intelligence agencies that the 2008 financial crisis

The 2008 financial crisis, also known as the global financial crisis (GFC), was a major worldwide financial crisis centered in the United States. The causes of the 2008 crisis included excessive speculation on housing values by both homeowners ...

presented a serious threat to international stability.