|

Winner-take-all Market

In economics, a winner-take-all market is a market in which a product or service that is favored over the competitors, even if only slightly, receives a disproportionately large share of the revenues for that class of products or services. It occurs when the top producer of a product earns a lot more than their competitors. Examples of winner-take-all markets include the sports and entertainment markets. The distribution of rewards for different amounts of work determines the degree to which a market is considered winner-take-all. For example, most lottery games are 100% winner-take-all systems because one person takes the entire reward and the rest receive nothing. On the other hand, most manual work, such as picking apples, is the opposite of a winner-take-all system. In this apple-picking example, the reward is proportional to the amount picked — a person who picks only one box of apples still gets rewarded proportionally. There are also intermediate cases. For example, in Oly ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Economics

Economics () is a behavioral science that studies the Production (economics), production, distribution (economics), distribution, and Consumption (economics), consumption of goods and services. Economics focuses on the behaviour and interactions of Agent (economics), economic agents and how economy, economies work. Microeconomics analyses what is viewed as basic elements within economy, economies, including individual agents and market (economics), markets, their interactions, and the outcomes of interactions. Individual agents may include, for example, households, firms, buyers, and sellers. Macroeconomics analyses economies as systems where production, distribution, consumption, savings, and Expenditure, investment expenditure interact; and the factors of production affecting them, such as: Labour (human activity), labour, Capital (economics), capital, Land (economics), land, and Entrepreneurship, enterprise, inflation, economic growth, and public policies that impact gloss ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

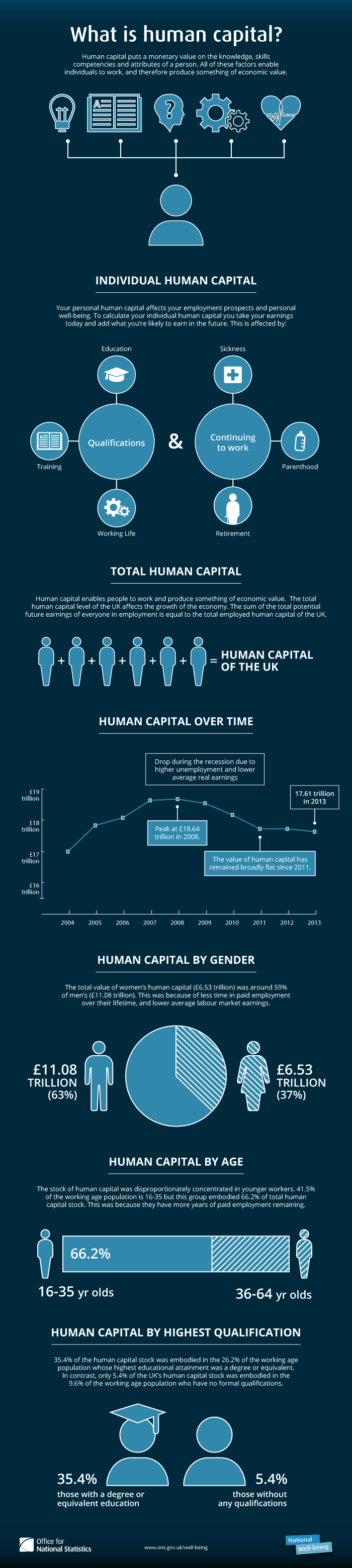

Human Capital

Human capital or human assets is a concept used by economists to designate personal attributes considered useful in the production process. It encompasses employee knowledge, skills, know-how, good health, and education. Human capital has a substantial impact on individual earnings. Research indicates that human capital investments have high economic returns throughout childhood and young adulthood. Companies can invest in human capital; for example, through education and training, improving levels of quality and production. History Adam Smith included in his definition of Capital (economics), capital "the acquired and useful abilities of all the inhabitants or members of the society". The first use of the term "human capital" may be by Irving Fisher. An early discussion with the phrase "human capital" was from Arthur Cecil Pigou: But the term only found widespread use in economics after its popularization by economists of the Chicago School of economics, Chicago School, in ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Two Sector Private Equilibrium Vs Social Optimimum Allocation For A Winner-take-all Market

2 (two) is a number, numeral and digit. It is the natural number following 1 and preceding 3. It is the smallest and the only even prime number. Because it forms the basis of a duality, it has religious and spiritual significance in many cultures. Mathematics The number 2 is the second natural number after 1. Each natural number, including 2, is constructed by succession, that is, by adding 1 to the previous natural number. 2 is the smallest and the only even prime number, and the first Ramanujan prime. It is also the first superior highly composite number, and the first colossally abundant number. An integer is determined to be even if it is divisible by two. When written in base 10, all multiples of 2 will end in 0, 2, 4, 6, or 8; more generally, in any even base, even numbers will end with an even digit. A digon is a polygon with two sides (or edges) and two vertices. Two distinct points in a plane are always sufficient to define a unique line in a nont ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Developing Country

A developing country is a sovereign state with a less-developed industrial base and a lower Human Development Index (HDI) relative to developed countries. However, this definition is not universally agreed upon. There is also no clear agreement on which countries fit this category. The terms low-and middle-income country (LMIC) and newly emerging economy (NEE) are often used interchangeably but they refer only to the economy of the countries. The World Bank classifies the world's economies into four groups, based on gross national income per capita: high-, upper-middle-, lower-middle-, and low-income countries. Least developed countries, landlocked developing countries, and small island developing states are all sub-groupings of developing countries. Countries on the other end of the spectrum are usually referred to as high-income countries or developed countries. There are controversies over the terms' use, as some feel that it perpetuates an outdated concept of "us" and ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Dual Labour Market

The dual labour market (also referred to as the segmented labour market) theory aims at introducing a broader range of factors into economic research, such as institutional aspects, race and gender. It divides the economy into two parts, called the "primary" and "secondary" sectors. The distinction may also be drawn between formal/informal sectors or sectors with high/low value-added. A broader concept is that of labour market segmentation. While the word "dual" implies a division into two parallel markets, segmentation in its broadest sense may involve several distinct labour markets. In a dual labour market, a secondary sector is characterized by short-term employment relationships, little or no prospect of internal promotion, and the determination of wages primarily by market forces. In terms of occupations, it consists primarily of low or unskilled jobs, whether they are blue-collar (manual labour), white-collar (e.g. filing clerks), or service industry (e.g. waiters). These ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Cumulative Prospect Theory

In behavioral economics, cumulative prospect theory (CPT) is a model for descriptive decisions under risk and uncertainty which was introduced by Amos Tversky and Daniel Kahneman in 1992 (Tversky, Kahneman, 1992). It is a further development and variant of prospect theory. The difference between this version and the original version of prospect theory is that weighting is applied to the cumulative probability distribution function, as in rank-dependent expected utility theory but not applied to the probabilities of individual outcomes. In 2002, Daniel Kahneman received the Nobel Memorial Prize in Economic Sciences for his contributions to behavioral economics, in particular the development of CPT. Outline of the model The main observation of CPT (and its predecessor prospect theory) is that people tend to think of possible outcomes usually relative to a certain reference point (often the status quo) rather than to the final status, a phenomenon which is called framin ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Expected Utility Hypothesis

The expected utility hypothesis is a foundational assumption in mathematical economics concerning decision making under uncertainty. It postulates that rational agents maximize utility, meaning the subjective desirability of their actions. Rational choice theory, a cornerstone of microeconomics, builds this postulate to model aggregate social behaviour. The expected utility hypothesis states an agent chooses between risky prospects by comparing expected utility values (i.e., the weighted sum of adding the respective utility values of payoffs multiplied by their probabilities). The summarised formula for expected utility is U(p)=\sum u(x_k)p_k where p_k is the probability that outcome indexed by k with payoff x_k is realized, and function ''u'' expresses the utility of each respective payoff. Graphically the curvature of the u function captures the agent's risk attitude. For example, imagine you’re offered a choice between receiving $50 for sure, or flipping a coin to win $100 i ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Nash Equilibrium

In game theory, the Nash equilibrium is the most commonly used solution concept for non-cooperative games. A Nash equilibrium is a situation where no player could gain by changing their own strategy (holding all other players' strategies fixed). The idea of Nash equilibrium dates back to the time of Cournot, who in 1838 applied it to his model of competition in an oligopoly. If each player has chosen a strategy an action plan based on what has happened so far in the game and no one can increase one's own expected payoff by changing one's strategy while the other players keep theirs unchanged, then the current set of strategy choices constitutes a Nash equilibrium. If two players Alice and Bob choose strategies A and B, (A, B) is a Nash equilibrium if Alice has no other strategy available that does better than A at maximizing her payoff in response to Bob choosing B, and Bob has no other strategy available that does better than B at maximizing his payoff in response to Alice c ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Philip J

Philip, also Phillip, is a male name derived from the Greek (''Philippos'', lit. "horse-loving" or "fond of horses"), from a compound of (''philos'', "dear", "loved", "loving") and (''hippos'', "horse"). Prominent Philips who popularized the name include kings of Macedonia and one of the apostles of early Christianity. ''Philip'' has many alternative spellings. One derivation often used as a surname is Phillips. The original Greek spelling includes two Ps as seen in Philippides and Philippos, which is possible due to the Greek endings following the two Ps. To end a word with such a double consonant—in Greek or in English—would, however, be incorrect. It has many diminutive (or even hypocoristic) forms including Phil, Philly, Phillie, Lip, and Pip. There are also feminine forms such as Philippine and Philippa. Philip in other languages * Afrikaans: Filip * Albanian: Filip * Amharic: ፊሊጶስ (Filip'os) * Arabic: فيلبس (Fīlibus), فيليبوس ( ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Lottery

A lottery (or lotto) is a form of gambling that involves the drawing of numbers at random for a prize. Some governments outlaw lotteries, while others endorse it to the extent of organizing a national or state lottery. It is common to find some degree of regulation of lottery by governments. The most common regulations are prohibition of sale to minors and licensing of ticket vendors. Although lotteries were common in the United States and some other countries during the 19th century, by the beginning of the 20th century, most forms of gambling, including lotteries and sweepstakes, were illegal in the U.S. and most of Europe as well as many other countries. This remained so until well after World War II. In the 1960s, casinos and lotteries began to re-appear throughout the world as a means for governments to raise revenue without raising taxes. Lotteries come in many formats. For example, the prize can be a fixed amount of cash or goods. In this format, there is risk to the org ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Robert H

The name Robert is an ancient Germanic given name, from Proto-Germanic "fame" and "bright" (''Hrōþiberhtaz''). Compare Old Dutch ''Robrecht'' and Old High German ''Hrodebert'' (a compound of ''Hrōþ, Hruod'' () "fame, glory, honour, praise, renown, godlike" and ''berht'' "bright, light, shining"). It is the second most frequently used given name of ancient Germanic origin.Reaney & Wilson, 1997. ''Dictionary of English Surnames''. Oxford University Press. It is also in use Robert (surname), as a surname. Another commonly used form of the name is Rupert (name), Rupert. After becoming widely used in Continental Europe, the name entered England in its Old French form ''Robert'', where an Old English cognate form (''Hrēodbēorht'', ''Hrodberht'', ''Hrēodbēorð'', ''Hrœdbœrð'', ''Hrœdberð'', ''Hrōðberχtŕ'') had existed before the Norman Conquest. The feminine version is Roberta (given name), Roberta. The Italian, Portuguese, and Spanish form is Roberto (given name), ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

The Rich Get Richer And The Poor Get Poorer

"The rich get richer and the poor get poorer" is an aphorism attributed to Percy Bysshe Shelley. In '' A Defence of Poetry'' (1821, not published until 1840) Shelley remarked that the promoters of utility had exemplified the saying, "To him that hath, more shall be given; and from him that hath not, the little that he hath shall be taken away. The rich have become richer, and the poor have become poorer; and the vessel of the State is driven between the Scylla and Charybdis of anarchy and despotism." It describes a positive feedback loop (a corresponding negative feedback loop would be e.g. progressive tax). "To him that hath" etc. is a reference to Matthew 25:29 (the parable of the talents, see also Matthew effect). The aphorism is commonly evoked, with variations in wording, as a synopsis of the effect of free market capitalism producing excessive inequality. Predecessors Andrew Jackson, the seventh President of the U.S. (1829–1837), in his 1832 bank veto, said that "wh ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |