|

Welfare Cost Of Business Cycles

In macroeconomics, the cost of business cycles is the decrease in social welfare, if any, caused by business cycle fluctuations. Nobel Prize in Economics, Nobel economist Robert Lucas, Jr., Robert Lucas proposed measuring the cost of business cycles as the percentage increase in Consumption (economics), consumption that would be necessary to make a representative agent, representative consumer Preference#Economics, indifferent between a smooth, non-fluctuating, consumption trend and one that is subject to business cycles. Under the assumptions that business cycles represent random shocks around a trend growth path, Robert Lucas, Jr., Robert Lucas argued that the cost of business cycles is extremely small, and as a result the focus of both academic economists and policy makers on economic stabilization policy rather than on long term economic growth, growth has been misplaced. Lucas himself, after calculating this cost back in 1987, reoriented his own macroeconomic research program ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Macroeconomics

Macroeconomics is a branch of economics that deals with the performance, structure, behavior, and decision-making of an economy as a whole. This includes regional, national, and global economies. Macroeconomists study topics such as output (economics), output/Gross domestic product, GDP (gross domestic product) and national income, unemployment (including Unemployment#Measurement, unemployment rates), price index, price indices and inflation, Consumption (economics), consumption, saving, investment (macroeconomics), investment, Energy economics, energy, international trade, and international finance. Macroeconomics and microeconomics are the two most general fields in economics. The focus of macroeconomics is often on a country (or larger entities like the whole world) and how its markets interact to produce large-scale phenomena that economists refer to as aggregate variables. In microeconomics the focus of analysis is often a single market, such as whether changes in supply or ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Review Of Economics And Statistics

''The Review of Economics and Statistics'' is a peer-reviewed academic journal that covers applied economics, with specific relevance to the scope of econometrics. The editors-in-chief are Will Dobbie (Harvard University) and Raymond Fisman (Boston University). The journal is over 100 hundred years old. History The journal, founded initially as ''The Review of Economic Statistics'' at Harvard University in 1917, published its official “inaugural volume” in 1919. The journal obtained its current title in 1948. As the first editor-in-chief, Charles J. Bullock remarked in his ''Prefatory Statement'' to the first issue that "the purpose of the Review is to promote the collection, criticism, and interpretation of economic statistics, with a view to making them more accurate and valuable than they are at present for business and scientific purposes." Editors-in-chief The following persons are or have been editors-in-chief An editor-in-chief (EIC), also known as lead editor or chi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

United States

The United States of America (USA), also known as the United States (U.S.) or America, is a country primarily located in North America. It is a federal republic of 50 U.S. state, states and a federal capital district, Washington, D.C. The 48 contiguous states border Canada to the north and Mexico to the south, with the semi-exclave of Alaska in the northwest and the archipelago of Hawaii in the Pacific Ocean. The United States asserts sovereignty over five Territories of the United States, major island territories and United States Minor Outlying Islands, various uninhabited islands in Oceania and the Caribbean. It is a megadiverse country, with the world's List of countries and dependencies by area, third-largest land area and List of countries and dependencies by population, third-largest population, exceeding 340 million. Its three Metropolitan statistical areas by population, largest metropolitan areas are New York metropolitan area, New York, Greater Los Angeles, Los Angel ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Relative Risk Aversion

In economics and finance, risk aversion is the tendency of people to prefer outcomes with low uncertainty to those outcomes with high uncertainty, even if the average outcome of the latter is equal to or higher in monetary value than the more certain outcome. Risk aversion explains the inclination to agree to a situation with a lower average payoff that is more predictable rather than another situation with a less predictable payoff that is higher on average. For example, a risk-averse investor might choose to put their money into a bank account with a low but guaranteed interest rate, rather than into a stock that may have high expected returns, but also involves a chance of losing value. Example A person is given the choice between two scenarios: one with a guaranteed payoff, and one with a risky payoff with same average value. In the former scenario, the person receives $50. In the uncertain scenario, a coin is flipped to decide whether the person receives $100 or nothing. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Natural Log

The natural logarithm of a number is its logarithm to the base of the mathematical constant , which is an irrational and transcendental number approximately equal to . The natural logarithm of is generally written as , , or sometimes, if the base is implicit, simply . Parentheses are sometimes added for clarity, giving , , or . This is done particularly when the argument to the logarithm is not a single symbol, so as to prevent ambiguity. The natural logarithm of is the power to which would have to be raised to equal . For example, is , because . The natural logarithm of itself, , is , because , while the natural logarithm of is , since . The natural logarithm can be defined for any positive real number as the area under the curve from to (with the area being negative when ). The simplicity of this definition, which is matched in many other formulas involving the natural logarithm, leads to the term "natural". The definition of the natural logarithm can then ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Standard Deviation

In statistics, the standard deviation is a measure of the amount of variation of the values of a variable about its Expected value, mean. A low standard Deviation (statistics), deviation indicates that the values tend to be close to the mean (also called the expected value) of the set, while a high standard deviation indicates that the values are spread out over a wider range. The standard deviation is commonly used in the determination of what constitutes an outlier and what does not. Standard deviation may be abbreviated SD or std dev, and is most commonly represented in mathematical texts and equations by the lowercase Greek alphabet, Greek letter Sigma, σ (sigma), for the population standard deviation, or the Latin script, Latin letter ''s'', for the sample standard deviation. The standard deviation of a random variable, Sample (statistics), sample, statistical population, data set, or probability distribution is the square root of its variance. (For a finite population, v ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

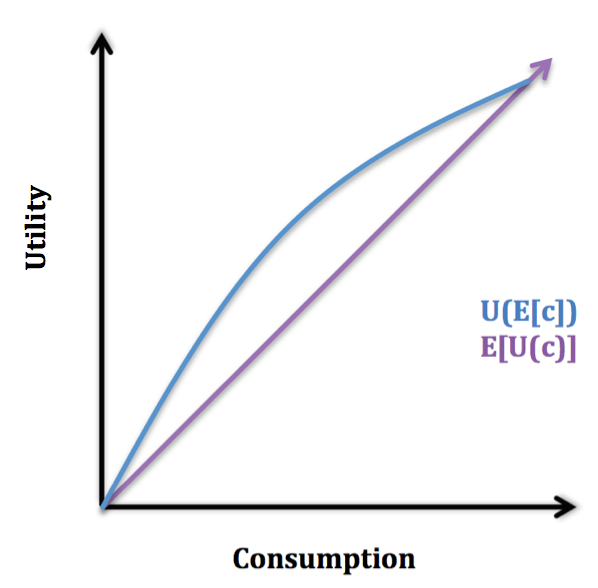

Consumption Smoothing

Consumption smoothing is an economic concept for the practice of optimizing a person's standard of living through an appropriate balance between savings and consumption over time. An optimal consumption rate should be relatively similar at each stage of a person's life rather than fluctuate wildly. Luxurious consumption at an old age does not compensate for an impoverished existence at other stages in one's life. Since income tends to be hump-shaped across an individual's life, economic theory suggests that individuals should on average have low or negative savings rate at early stages in their life, high in middle age, and negative during retirement. Although many popular books on personal finance advocate that individuals should at all stages of their careers set aside money in savings, economist James Choi states that this deviates from the advice of economists. Expected utility model The graph below illustrates the expected utility model, in which U(c) is increasing in and ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Willingness To Pay

In behavioral economics, willingness to pay (WTP) is the maximum price at or below which a consumer will definitely buy one unit of a product. This corresponds to the standard economic view of a consumer reservation price. Some researchers, however, conceptualize WTP as a range. According to the constructed preference view, consumer willingness to pay is a context-sensitive construct; that is, a consumer's WTP for a product depends on the concrete decision context. For example, consumers tend to be willing to pay more for a soft drink in a luxury hotel resort in comparison to a beach bar or a local retail store. Experimental context In laboratory experiments auctions are conducted, a premise of the experiment is often that "bid = WTP". See also * Cost-benefit analysis * Welfare economics Welfare economics is a field of economics that applies microeconomic techniques to evaluate the overall well-being (welfare) of a society. The principles of welfare economics are ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Social Welfare Function

In welfare economics and social choice theory, a social welfare function—also called a social ordering, ranking, utility, or choice function—is a function that ranks a set of social states by their desirability. Each person's preferences are combined in some way to determine which outcome is considered better by society as a whole. It can be seen as mathematically formalizing Rousseau's idea of a general will. Social choice functions are studied by economists as a way to identify socially-optimal decisions, giving a procedure to rigorously define which of two outcomes should be considered better for society as a whole (e.g. to compare two different possible income distributions). They are also used by democratic governments to choose between several options in elections, based on the preferences of voters; in this context, a social choice function is typically referred to as an electoral system. The notion of social utility is analogous to the notion of a utility fu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Economic Surplus

In mainstream economics, economic surplus, also known as total welfare or total social welfare or Marshallian surplus (after Alfred Marshall), is either of two related quantities: * Consumer surplus, or consumers' surplus, is the monetary gain obtained by consumers because they are able to purchase a product for a price that is less than the highest price that they would be willing to pay. * Producer surplus, or producers' surplus, is the amount that producers benefit by selling at a market price that is higher than the least that they would be willing to sell for; this is roughly equal to profit (since producers are not normally willing to sell at a loss and are normally indifferent to selling at a break-even price). The sum of consumer and producer surplus is sometimes known as social surplus or total surplus; a decrease in that total from inefficiencies is called deadweight loss. Overview In the mid-19th century, engineer Jules Dupuit first propounded the concept of e ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Risk Aversion

In economics and finance, risk aversion is the tendency of people to prefer outcomes with low uncertainty to those outcomes with high uncertainty, even if the average outcome of the latter is equal to or higher in monetary value than the more certain outcome. Risk aversion explains the inclination to agree to a situation with a lower average payoff that is more predictable rather than another situation with a less predictable payoff that is higher on average. For example, a risk-averse investor might choose to put their money into a bank account with a low but guaranteed interest rate, rather than into a stock that may have high expected returns, but also involves a chance of losing value. Example A person is given the choice between two scenarios: one with a guaranteed payoff, and one with a risky payoff with same average value. In the former scenario, the person receives $50. In the uncertain scenario, a coin is flipped to decide whether the person receives $100 or nothing. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Variance

In probability theory and statistics, variance is the expected value of the squared deviation from the mean of a random variable. The standard deviation (SD) is obtained as the square root of the variance. Variance is a measure of dispersion, meaning it is a measure of how far a set of numbers is spread out from their average value. It is the second central moment of a distribution, and the covariance of the random variable with itself, and it is often represented by \sigma^2, s^2, \operatorname(X), V(X), or \mathbb(X). An advantage of variance as a measure of dispersion is that it is more amenable to algebraic manipulation than other measures of dispersion such as the expected absolute deviation; for example, the variance of a sum of uncorrelated random variables is equal to the sum of their variances. A disadvantage of the variance for practical applications is that, unlike the standard deviation, its units differ from the random variable, which is why the standard devi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |