|

Warrant (finance)

In finance, a warrant is a Security (finance), security that entitles the holder to buy or sell stock, typically the stock of the issuing company, at a fixed price called the exercise price. Warrants and option (finance), options are similar in that the two contractual financial instruments allow the holder special rights to buy securities. Both are discretionary, and have expiration dates. They differ mainly in that warrants are only issued by specific authorized institutions (typically the corporation on which the warrant is based), and in certain technical aspects of their trading and exercise. Warrants are frequently attached to Bond (finance), bonds or preferred stock as a sweetener, allowing the issuer to pay lower interest rates or dividends. They can be used to enhance the Yield (finance), yield of the bonds and make them more attractive to potential buyers. Warrants can also be used in private equity deals. Frequently, these warrants are detachable, and can be sold inde ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Finance

Finance refers to monetary resources and to the study and Academic discipline, discipline of money, currency, assets and Liability (financial accounting), liabilities. As a subject of study, is a field of Business administration, Business Administration wich study the planning, organizing, leading, and controlling of an organization's resources to achieve its goals. Based on the scope of financial activities in financial systems, the discipline can be divided into Personal finance, personal, Corporate finance, corporate, and public finance. In these financial systems, assets are bought, sold, or traded as financial instruments, such as Currency, currencies, loans, Bond (finance), bonds, Share (finance), shares, stocks, Option (finance), options, Futures contract, futures, etc. Assets can also be banked, Investment, invested, and Insurance, insured to maximize value and minimize loss. In practice, Financial risk, risks are always present in any financial action and entities. Due ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Futures Exchange

A futures exchange or futures market is a central financial exchange where people can trade standardized futures contracts defined by the exchange. Futures contracts are derivatives contracts to buy or sell specific quantities of a commodity or financial instrument at a specified price with delivery set at a specified time in the future. Futures exchanges provide physical or electronic trading venues, details of standardized contracts, market and price data, clearing houses, exchange self-regulations, margin mechanisms, settlement procedures, delivery times, delivery procedures and other services to foster trading in futures contracts. Futures exchanges can be integrated under the same brand name or organization with other types of exchanges, such as stock markets, options markets, and bond markets. Futures exchanges can be organized as non-profit member-owned organizations or as for-profit organizations. Non-profit, member-owned futures exchanges benefit their members, who ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Corporate Finance

Corporate finance is an area of finance that deals with the sources of funding, and the capital structure of businesses, the actions that managers take to increase the Value investing, value of the firm to the shareholders, and the tools and analysis used to allocate financial resources. The primary goal of corporate finance is to Shareholder value, maximize or increase valuation (finance), shareholder value.SeCorporate Finance: First Principles Aswath Damodaran, New York University's Stern School of Business Correspondingly, corporate finance comprises two main sub-disciplines. Capital budgeting is concerned with the setting of criteria about which value-adding Project#Corporate finance, projects should receive investment funding, and whether to finance that investment with ownership equity, equity or debt capital. Working capital management is the management of the company's monetary funds that deal with the short-term operating balance of current assets and Current liability, cu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Dilutive Security

Dilutive securities are financial instruments—usually stock options, warrants, convertible bonds—which increase the number of common shares if exercised; this then reduces, or "dilutes", the basic EPS (earnings per share). Thus, only where the diluted EPS is less than the basic EPS is the transaction classified as dilutive. Compare Accretion (finance). Some examples of dilutive securities are convertible debt, convertible preferred stock, options, warrants, participating securities, two-class common stocks, and contingent shares. The concept of dilutive securities is often a purely theoretical one, since these instruments will not be converted into common stock unless the price at which they can be purchased will generate a profit Profit may refer to: Business and law * Profit (accounting), the difference between the purchase price and the costs of bringing to market * Profit (economics), normal profit and economic profit * Profit (real property), a nonposse ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Contract For Difference

In finance, a contract for difference (CFD) is a financial agreement between two parties, commonly referred to as the "buyer" and the "seller." The contract stipulates that the buyer will pay the seller the difference between the current value of an asset and its value at the time the contract was initiated. If the asset's price increases from the opening to the closing of the contract, the seller compensates the buyer for the increase, which constitutes the buyer's profit. Conversely, if the asset's price decreases, the buyer compensates the seller, resulting in a profit for the seller. History Invention Developed in Britain in 1974 as a way to leverage gold, modern CFDs have been trading widely since the early 1990s. CFDs were originally developed as a type of equity swap that was traded on margin. The invention of the CFD is widely credited to Brian Keelan and Jon Wood, both of UBS Warburg, during their Trafalgar House deal in the early 1990s. Asset management and syntheti ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Price Discovery

In economics and finance, the price discovery process (also called price discovery mechanism) is the process of determining the price of an asset in the marketplace through the interactions of buyers and sellers. Overview Price discovery is different from valuation. The price discovery process involves buyers and sellers arriving at a transaction price for a specific item at a given time. It involves the following: * Buyers and seller (number, size, location, and valuation perceptions) * Market mechanism (bidding and settlement processes, liquidity) * Available information (amount, timeliness, significance and reliability) including futures and other related markets * Risk management choices. "Market" is a broad term that covers buyers, sellers and even sentiment. A single market will have one or more execution venues, which describes where trades are executed. This could be in the street for a street market, or increasingly it could be an electronic or "virtual" venue. Examples ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Stock Exchange

A stock exchange, securities exchange, or bourse is an exchange where stockbrokers and traders can buy and sell securities, such as shares of stock, bonds and other financial instruments. Stock exchanges may also provide facilities for the issue and redemption of such securities and instruments and capital events including the payment of income and dividends. Securities traded on a stock exchange include stock issued by listed companies, unit trusts, derivatives, pooled investment products and bonds. Stock exchanges often function as "continuous auction" markets with buyers and sellers consummating transactions via open outcry at a central location such as the floor of the exchange or by using an electronic system to process financial transactions. To be able to trade a security on a particular stock exchange, the security must be listed there. Usually, there is a central location for record keeping, but trade is increasingly less linked to a physical place as mod ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Covered Warrant

In finance a covered warrant (sometimes called naked warrant) is a type of warrant that has been issued without an accompanying bond or equity. Like a normal warrant, it allows the holder to buy or sell a specific amount of equities, currency, or other financial instruments from the issuer at a specified price at a predetermined date. Unlike normal warrants, they are usually issued by financial institutions instead of share-issuing companies and are listed as fully tradable securities on a number of stock exchanges. They can also have a variety of underlying instruments, not just equities, and may allow the holder to buy or sell the underlying asset. These attributes make it possible to use covered warrants as a tool to speculate on financial markets. Structure and features A covered warrant gives the holder the right, but not the obligation, to buy ("call" warrant) or to sell (" put" warrant) an underlying asset at a specified price (the "strike" or "exercise" price) by a pr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Share (finance)

In finance, financial markets, a share (sometimes referred to as stock or Equity (finance), equity) is a unit of Equity (finance), equity ownership in the Stock, capital stock of a corporation. It can refer to units of mutual funds, limited partnerships, and real estate investment trusts. Share capital refers to all of the shares of an enterprise. The owner of shares in a company is a shareholder (or stockholder) of the corporation. A share expresses the ownership relationship between the company and the shareholder. The denominated value of a share is its face value, and the total of the face value of issued shares represent the Financial capital, capital of a company, which may not reflect the market value of those shares. The income received from the ownership of shares is a dividend. There are different types of shares such as equity shares, preference shares, deferred shares, redeemable shares, bonus shares, right shares, and employee stock option plan shares. Terminology ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Covered Warrant

In finance a covered warrant (sometimes called naked warrant) is a type of warrant that has been issued without an accompanying bond or equity. Like a normal warrant, it allows the holder to buy or sell a specific amount of equities, currency, or other financial instruments from the issuer at a specified price at a predetermined date. Unlike normal warrants, they are usually issued by financial institutions instead of share-issuing companies and are listed as fully tradable securities on a number of stock exchanges. They can also have a variety of underlying instruments, not just equities, and may allow the holder to buy or sell the underlying asset. These attributes make it possible to use covered warrants as a tool to speculate on financial markets. Structure and features A covered warrant gives the holder the right, but not the obligation, to buy ("call" warrant) or to sell (" put" warrant) an underlying asset at a specified price (the "strike" or "exercise" price) by a pr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

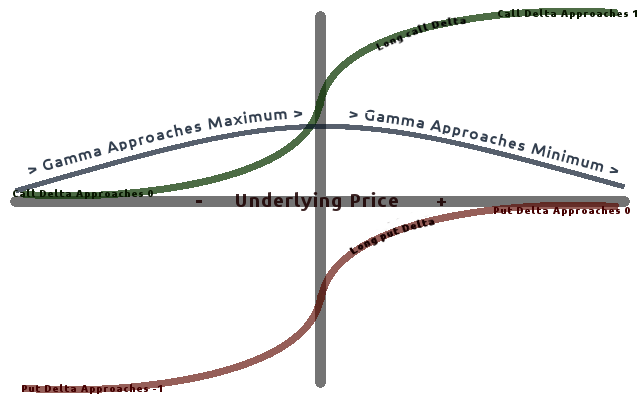

Greeks (finance)

In mathematical finance, the Greeks are the quantities (known in calculus as partial derivatives; first-order or higher) representing the sensitivity of the price of a derivative instrument such as an option to changes in one or more underlying parameters on which the value of an instrument or portfolio of financial instruments is dependent. The name is used because the most common of these sensitivities are denoted by Greek letters (as are some other finance measures). Collectively these have also been called the risk sensitivities, risk measures or hedge parameters. Use of the Greeks The Greeks are vital tools in risk management. Each Greek measures the sensitivity of the value of a portfolio to a small change in a given underlying parameter, so that component risks may be treated in isolation, and the portfolio rebalanced accordingly to achieve a desired exposure; see for example delta hedging. The Greeks in the Black–Scholes model (a relatively simple idealised mode ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Chicago Board Options Exchange

Cboe Global Markets, Inc. is an American company that owns the Chicago Board Options Exchange and the stock exchange operator BATS Global Markets. History Founded by the Chicago Board of Trade in 1973 and member-owned for several decades, the Chicago Board Options Exchange was the first exchange to list standardized, exchange-traded stock options, and began its first day of trading on April 26, 1973, in celebration of the 125th birthday of the Chicago Board of Trade. In 1969, the vice chairman of the Chicago Board of Trade, Edmund “Eddie” O’Connor, developed the idea for an options exchange. At that time, options on stocks were traded in a New York-based, over-the-counter market which required a direct link between the buyer and seller and complex terms of sale. The options exchange that O'Connor imagined would use a central clearinghouse to facilitate trades and stand behind contracts. The Chicago Board of Trade established a committee to evaluate the concept. The optio ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |