|

Trade Financing

Trade finance is a phrase used to describe different strategies that are employed to make international trade easier. It signifies financing for trade, and it concerns both domestic and international trade transactions. A trade transaction requires a seller of goods and services as well as a buyer. Various intermediaries such as banks and financial institutions can facilitate these transactions by financing the trade. Trade finance manifests itself in the form of letters of credit (LOC), guarantees, or insurance, and is usually provided by intermediaries. Description While a seller (or exporter) can require the purchaser (an importer) to prepay for goods shipped, the purchaser (importer) may wish to reduce risk by requiring the seller to document the goods that have been shipped. Banks may assist by providing various forms of support. For example, the importer's bank may provide a letter of credit to the exporter (or the exporter's bank) providing for payment upon presentatio ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bank

A bank is a financial institution that accepts Deposit account, deposits from the public and creates a demand deposit while simultaneously making loans. Lending activities can be directly performed by the bank or indirectly through capital markets. As banks play an important role in financial stability and the economy of a country, most jurisdictions exercise a high degree of Bank regulation, regulation over banks. Most countries have institutionalized a system known as fractional-reserve banking, under which banks hold liquid assets equal to only a portion of their current liabilities. In addition to other regulations intended to ensure accounting liquidity, liquidity, banks are generally subject to minimum capital requirements based on an international set of capital standards, the Basel Accords. Banking in its modern sense evolved in the fourteenth century in the prosperous cities of Renaissance Italy but, in many ways, functioned as a continuation of ideas and concepts o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Letter Of Credit

A letter of credit (LC), also known as a documentary credit or bankers commercial credit, or letter of undertaking (LoU), is a payment mechanism used in international trade to provide an economic guarantee from a creditworthy bank to an exporter of goods. Letters of credit are used extensively in the financing of international trade, when the reliability of contracting parties cannot be readily and easily determined. Its economic effect is to introduce a bank as an underwriter that assumes the counterparty risk of the buyer paying the seller for goods. Typically, after a sales contract has been negotiated, and the buyer and seller have agreed that a letter of credit will be used as the method of payment, the ''applicant'' will contact a bank to ask for a letter of credit to be issued. Once the ''issuing bank'' has assessed the buyer's credit risk, it will issue the letter of credit, meaning that it will provide a promise to pay the seller upon presentation of certain docum ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

International Trade

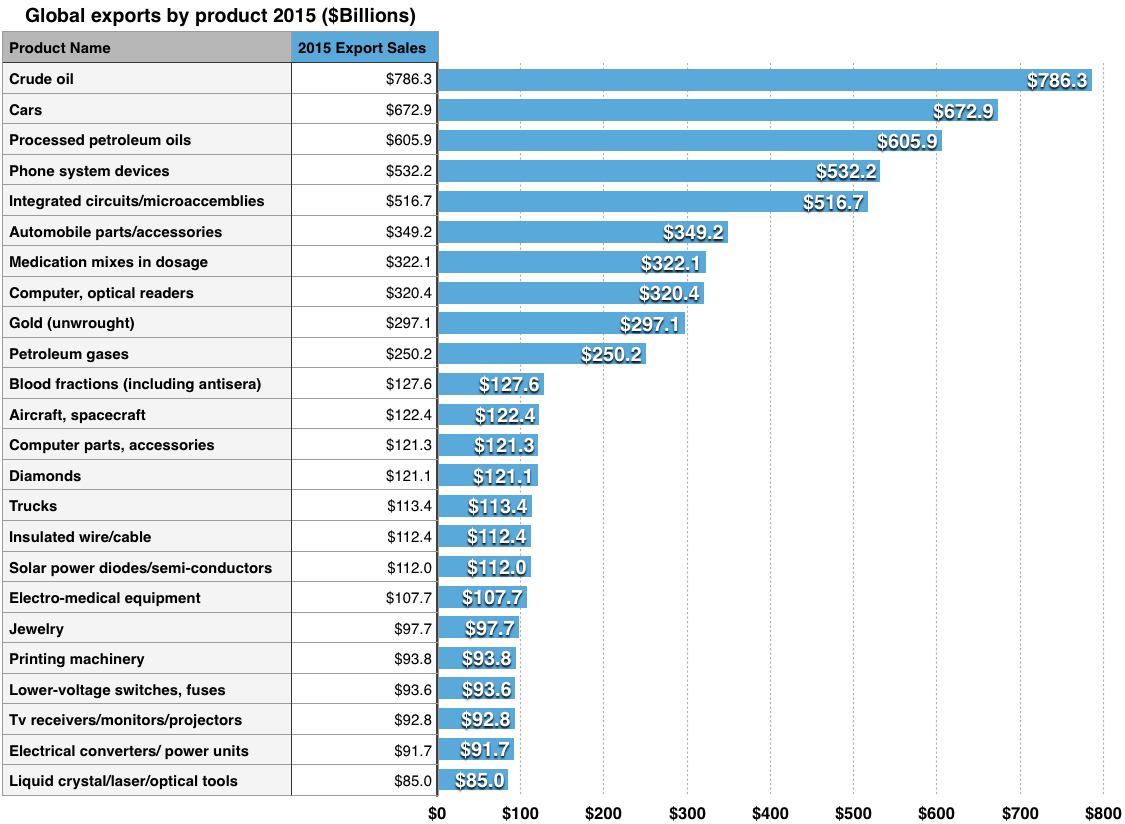

International trade is the exchange of capital, goods, and services across international borders or territories because there is a need or want of goods or services. (See: World economy.) In most countries, such trade represents a significant share of gross domestic product (GDP). While international trade has existed throughout history (for example Uttarapatha, Silk Road, Amber Road, salt roads), its economic, social, and political importance has been on the rise in recent centuries. Carrying out trade at an international level is a complex process when compared to domestic trade. When trade takes place between two or more states, factors like currency, government policies, economy, judicial system, laws, and markets influence trade. To ease and justify the process of trade between countries of different economic standing in the modern era, some international economic organizations were formed, such as the World Trade Organization. These organizations work towards the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Business Terms

Business is the practice of making one's living or making money by producing or buying and selling products (such as goods and services). It is also "any activity or enterprise entered into for profit." A business entity is not necessarily separate from the owner and the creditors can hold the owner liable for debts the business has acquired except for limited liability company. The taxation system for businesses is different from that of the corporates. A business structure does not allow for corporate tax rates. The proprietor is personally taxed on all income from the business. A distinction is made in law and public offices between the term business and a company (such as a corporation or cooperative). Colloquially, the terms are used interchangeably. Corporations are distinct from sole proprietors and partnerships. Corporations are separate and unique legal entities from their shareholders; as such they provide limited liability for their owners and members. Cor ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Supply Chain Engineering

Supply chain engineering is the engineering discipline that concerns the planning, design, and operation of supply chains. Some of its main areas include logistics, production, and pricing. It involves various areas in mathematical modelling such as operations research, machine learning, and optimization, which are usually implemented using software. Comparison with other disciplines Supply chain engineering draws heavily from, and overlaps with other engineering disciplines such as industrial engineering, manufacturing engineering, systems engineering, information engineering, and software engineering. Although supply chain engineering and supply chain management have the same goals, the former is focused on a mathematical model-based approach, whereas the latter is focused on a more traditional management and business-based one. Supply chain engineering can be seen as including supply chain optimization, although this can also be undertaken using more qualitative management ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

SWIFT

Swift or SWIFT most commonly refers to: * SWIFT, an international organization facilitating transactions between banks ** SWIFT code * Swift (programming language) * Swift (bird), a family of birds It may also refer to: Organizations * SWIFT, an international organization facilitating transactions between banks * Swift Engineering, an American engineering firm * Swift & Company, a meat processing company * Swifts (aerobatic team), a Russian aerobatic team Transportation companies * Swift Cooper, a British racing car manufacturer * Swift Leisure, a British manufacturer of caravans * Swift Motor Company, of Coventry, England * Swift Transportation, a US trucking company Places * River Swift, a river in England * Swift, Illinois, an unincorporated community in northeastern Illinois * Swift County, Minnesota, a county in west-central Minnesota * Swift, Minnesota, an unincorporated community in northern Minnesota * Swift, Missouri, a ghost town in southeastern Missou ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Correspondent Bank

A correspondent account is an account (often called a nostro or vostro account) established by a banking institution to receive deposits from, make payments on behalf of, or handle other financial transactions for another financial institution. Correspondent accounts are established through bilateral agreements between the two banks. Application Commonly, correspondent accounts are the accounts of foreign banks that require the ability to pay and receive the domestic currency. A bank will typically require correspondent accounts for holding currencies outside of jurisdictions where it has a branch or affiliate. This is because most central bank settlement systems do not register deposits or transfer funds to banks not doing business in their countries. With few exceptions, the actual funds held in any foreign currency account (whether for a bank or for its customer) are held in the bank's correspondent account in that currency's home country. Even where a bank has branches or af ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Business Partner

A business partner is a commercial entity with which another commercial entity has some form of alliance. This relationship may be a contractual, exclusive bond in which both entities commit not to ally with third parties. Alternatively, it may be a very loose arrangement designed largely to impress customers and competitors with the size of the network that the business partners belong to. Partnership formation A business partner or alliance can be crucial for businesses. However, businesses can not choose business partners, called business mating, in any way they want. In many instances, the potential partner might not be interested in forming a business relationship. It is important that both sides of the agreement complement each other and have some common ground, for example in management style, mindset, and technology. If, for example, management style would be too different between the firms, then a partnership could be problematic. Kask and Linton (2013) investigate under ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bill Of Exchange

A negotiable instrument is a document guaranteeing the payment of a specific amount of money, either on demand, or at a set time, whose payer is usually named on the document. More specifically, it is a document contemplated by or consisting of a contract, which promises the payment of money without condition, which may be paid either on demand or at a future date. The term has different meanings, depending on its use in the application of different laws and depending on countries and contexts. The word "negotiable" refers to transferability, and "Legal instrument, instrument" refers to a document giving legal effect by the virtue of the law. Concept of negotiability William Searle Holdsworth defines the concept of negotiability as follows: #Negotiable instruments are transferable under the following circumstances: they are transferable by delivery where they are made payable to the bearer, they are transferable by delivery and endorsement where they are made payable to order. #Co ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

International Trade

International trade is the exchange of capital, goods, and services across international borders or territories because there is a need or want of goods or services. (See: World economy.) In most countries, such trade represents a significant share of gross domestic product (GDP). While international trade has existed throughout history (for example Uttarapatha, Silk Road, Amber Road, salt roads), its economic, social, and political importance has been on the rise in recent centuries. Carrying out trade at an international level is a complex process when compared to domestic trade. When trade takes place between two or more states, factors like currency, government policies, economy, judicial system, laws, and markets influence trade. To ease and justify the process of trade between countries of different economic standing in the modern era, some international economic organizations were formed, such as the World Trade Organization. These organizations work towards the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Payment

A payment is the tender of something of value, such as money or its equivalent, by one party (such as a person or company) to another in exchange for goods or services provided by them, or to fulfill a legal obligation or philanthropy desire. The party making the payment is commonly called the payer, while the payee is the party receiving the payment. Whilst payments are often made voluntarily, some payments are compulsory, such as payment of a fine. Payments can be effected in a number of ways, for example: * the use of money, whether through cash, cheque, mobile payment or bank transfers. * the transfer of anything of value, such as stock, or using barter, the exchange of one good or service for another. In general, payees are at liberty to determine what method of payment they will accept; though normally laws require the payer to accept the country's legal tender up to a prescribed limit. Payment is most commonly affected in the local currency of the payee unless ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Import

An importer is the receiving country in an export from the sending country. Importation and exportation are the defining financial transactions of international trade. Import is part of the International Trade which involves buying and receiving of goods or services produced in another country. The seller of such goods and services is called an exporter, while the foreign buyer is known as an importer. In international trade, the importation and exportation of goods are limited by import quotas and mandates from the customs authority. The importing and exporting jurisdictions may impose a tariff (tax) on the goods. In addition, the importation and exportation of goods are subject to trade agreements between the importing and exporting jurisdictions. Definition Imports consist of transactions in goods and services to a resident of a jurisdiction (such as a nation) from non-residents. The exact definition of imports in national accounts includes and excludes specific "borderlin ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |