|

Tracking Error

In finance, tracking error or active risk is a measure of the risk in an investment portfolio that is due to active management decisions made by the portfolio manager; it indicates how closely a portfolio follows the index to which it is benchmarked. The best measure is the standard deviation of the difference between the portfolio and index returns. Many portfolios are managed to a benchmark, typically an index. Some portfolios, notably index funds, are expected to replicate, before trading and other costs, the returns of an index exactly, while others ' actively manage' the portfolio by deviating from the index in order to generate active returns. Tracking error measures the deviation from the benchmark: an index fund has a near-zero tracking error, while an actively managed portfolio would normally have a higher tracking error. Thus the tracking error does not include any risk (return) that is merely a function of the market's movement. In addition to risk (return) from specif ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Finance

Finance refers to monetary resources and to the study and Academic discipline, discipline of money, currency, assets and Liability (financial accounting), liabilities. As a subject of study, is a field of Business administration, Business Administration wich study the planning, organizing, leading, and controlling of an organization's resources to achieve its goals. Based on the scope of financial activities in financial systems, the discipline can be divided into Personal finance, personal, Corporate finance, corporate, and public finance. In these financial systems, assets are bought, sold, or traded as financial instruments, such as Currency, currencies, loans, Bond (finance), bonds, Share (finance), shares, stocks, Option (finance), options, Futures contract, futures, etc. Assets can also be banked, Investment, invested, and Insurance, insured to maximize value and minimize loss. In practice, Financial risk, risks are always present in any financial action and entities. Due ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Factor Analysis

Factor analysis is a statistical method used to describe variability among observed, correlated variables in terms of a potentially lower number of unobserved variables called factors. For example, it is possible that variations in six observed variables mainly reflect the variations in two unobserved (underlying) variables. Factor analysis searches for such joint variations in response to unobserved latent variables. The observed variables are modelled as linear combinations of the potential factors plus "error" terms, hence factor analysis can be thought of as a special case of errors-in-variables models. Simply put, the factor loading of a variable quantifies the extent to which the variable is related to a given factor. A common rationale behind factor analytic methods is that the information gained about the interdependencies between observed variables can be used later to reduce the set of variables in a dataset. Factor analysis is commonly used in psychometrics, pers ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Risk Management

Financial risk management is the practice of protecting Value (economics), economic value in a business, firm by managing exposure to financial risk - principally credit risk and market risk, with more specific variants as listed aside - as well as some aspects of operational risk. As for risk management more generally, financial risk management requires identifying the sources of risk, measuring these, and crafting plans to mitigation, mitigate them. See for an overview. Financial risk management as a "science" can be said to have been bornW. Kenton (2021)"Harry Markowitz" investopedia.com with modern portfolio theory, particularly as initiated by Professor Harry Markowitz in 1952 with his article, "Portfolio Selection"; see . The discipline can be qualitative and quantitative; as a specialization of risk management, however, financial risk management focuses more on when and how to Hedge (finance), hedge, often using financial instruments to manage costly exposures to risk. * ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

YouTube

YouTube is an American social media and online video sharing platform owned by Google. YouTube was founded on February 14, 2005, by Steve Chen, Chad Hurley, and Jawed Karim who were three former employees of PayPal. Headquartered in San Bruno, California, it is the second-most-visited website in the world, after Google Search. In January 2024, YouTube had more than 2.7billion monthly active users, who collectively watched more than one billion hours of videos every day. , videos were being uploaded to the platform at a rate of more than 500 hours of content per minute, and , there were approximately 14.8billion videos in total. On November 13, 2006, YouTube was purchased by Google for $1.65 billion (equivalent to $ billion in ). Google expanded YouTube's business model of generating revenue from advertisements alone, to offering paid content such as movies and exclusive content produced by and for YouTube. It also offers YouTube Premium, a paid subs ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Quadratic Programming

Quadratic programming (QP) is the process of solving certain mathematical optimization problems involving quadratic functions. Specifically, one seeks to optimize (minimize or maximize) a multivariate quadratic function subject to linear constraints on the variables. Quadratic programming is a type of nonlinear programming. "Programming" in this context refers to a formal procedure for solving mathematical problems. This usage dates to the 1940s and is not specifically tied to the more recent notion of "computer programming." To avoid confusion, some practitioners prefer the term "optimization" — e.g., "quadratic optimization." Problem formulation The quadratic programming problem with variables and constraints can be formulated as follows. Given: * a real-valued, -dimensional vector , * an -dimensional real symmetric matrix , * an -dimensional real matrix , and * an -dimensional real vector , the objective of quadratic programming is to find an -dimensional vector , that ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Covariance Matrix

In probability theory and statistics, a covariance matrix (also known as auto-covariance matrix, dispersion matrix, variance matrix, or variance–covariance matrix) is a square matrix giving the covariance between each pair of elements of a given random vector. Intuitively, the covariance matrix generalizes the notion of variance to multiple dimensions. As an example, the variation in a collection of random points in two-dimensional space cannot be characterized fully by a single number, nor would the variances in the x and y directions contain all of the necessary information; a 2 \times 2 matrix would be necessary to fully characterize the two-dimensional variation. Any covariance matrix is symmetric and positive semi-definite and its main diagonal contains variances (i.e., the covariance of each element with itself). The covariance matrix of a random vector \mathbf is typically denoted by \operatorname_, \Sigma or S. Definition Throughout this article, boldfaced u ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Performance Attribution

Performance attribution, or investment performance attribution is a set of techniques that performance analysts use to explain why a portfolio's performance differed from the benchmark. This difference between the portfolio return and the benchmark return is known as the active return. The active return is the component of a portfolio's performance that arises from the fact that the portfolio is actively managed. Different kinds of performance attribution provide different ways of explaining the active return. Attribution analysis attempts to distinguish which of the various different factors affecting portfolio performance is the source of the portfolio's overall performance. Specifically, this method compares the total return of the manager's actual investment holdings with the return for a predetermined benchmark portfolio and decomposes the difference into a ''selection effect'' and an ''allocation effect''. Simple example Consider a portfolio whose benchmark consists o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Index (economics)

In economics, statistics, and finance, an index is a number that measures how a group of related data points—like prices, company performance, productivity, or employment—changes over time to track different aspects of economic health from various sources. Consumer-focused indices include the Consumer Price Index (CPI), which shows how retail prices for goods and services shift in a fixed area, aiding adjustments to salaries, Bond (finance), bond interest rates, and tax thresholds for inflation. The cost-of-living index (COLI) compares living expenses over time or across places.Turvey, Ralph. (2004) Consumer Price Index Manual: Theory And Practice.' Page 11. Publisher: International Labour Organization. . ''The Economist''’s Big Mac Index uses a Big Mac’s cost to explore currency values and purchasing power. Market performance indices track trends like company value or employment. Stock market index, Stock market indices include the Dow Jones Industrial Average and S&P 500, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Inverse Exchange-traded Fund

An inverse exchange-traded fund is an exchange-traded fund (ETF), traded on a public stock market, which is designed to perform as the ''inverse'' of whatever index or benchmark it is designed to track. These funds work by using short selling, trading derivatives such as futures contracts, and other leveraged investment techniques. By providing over short investing horizons and excluding the impact of fees and other costs, performance opposite to their benchmark, inverse ETFs give a result similar to short selling the stocks in the index. An inverse S&P 500 ETF, for example, seeks a daily percentage movement opposite that of the S&P. If the S&P 500 rises by 1%, the inverse ETF is designed to fall by 1%; and if the S&P falls by 1%, the inverse ETF should rise by 1%. Because their value rises in a declining market environment, they are popular investments in bear markets. Short sales have the potential to expose an investor to unlimited losses, whether or not the sale involves a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Second-order Cone Programming

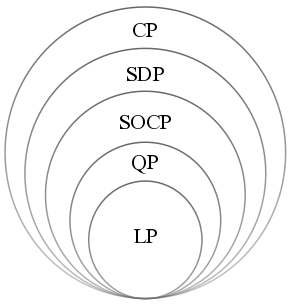

A second-order cone program (SOCP) is a convex optimization problem of the form :minimize \ f^T x \ :subject to ::\lVert A_i x + b_i \rVert_2 \leq c_i^T x + d_i,\quad i = 1,\dots,m ::Fx = g \ where the problem parameters are f \in \mathbb^n, \ A_i \in \mathbb^, \ b_i \in \mathbb^, \ c_i \in \mathbb^n, \ d_i \in \mathbb, \ F \in \mathbb^, and g \in \mathbb^p. x\in\mathbb^n is the optimization variable. \lVert x \rVert_2 is the Euclidean norm and ^T indicates transpose In linear algebra, the transpose of a Matrix (mathematics), matrix is an operator which flips a matrix over its diagonal; that is, it switches the row and column indices of the matrix by producing another matrix, often denoted by (among other .... The "second-order cone" in SOCP arises from the constraints, which are equivalent to requiring the affine function (A x + b, c^T x + d) to lie in the second-order cone in \mathbb^. SOCPs can be solved by interior point methods and in general, can be solved ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Mathematical Optimization

Mathematical optimization (alternatively spelled ''optimisation'') or mathematical programming is the selection of a best element, with regard to some criteria, from some set of available alternatives. It is generally divided into two subfields: discrete optimization and continuous optimization. Optimization problems arise in all quantitative disciplines from computer science and engineering to operations research and economics, and the development of solution methods has been of interest in mathematics for centuries. In the more general approach, an optimization problem consists of maxima and minima, maximizing or minimizing a Function of a real variable, real function by systematically choosing Argument of a function, input values from within an allowed set and computing the Value (mathematics), value of the function. The generalization of optimization theory and techniques to other formulations constitutes a large area of applied mathematics. Optimization problems Opti ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Beta (finance)

In finance, the beta ( or market beta or beta coefficient) is a statistic that measures the expected increase or decrease of an individual stock price in proportion to movements of the stock market as a whole. Beta can be used to indicate the contribution of an individual asset to the market risk of a portfolio when it is added in small quantity. It refers to an asset's non-diversifiable risk, systematic risk, or market risk. Beta is not a measure of idiosyncratic risk. Beta is the hedge ratio of an investment with respect to the stock market. For example, to hedge out the market-risk of a stock with a market beta of 2.0, an investor would short $2,000 in the stock market for every $1,000 invested in the stock. Thus insured, movements of the overall stock market no longer influence the combined position on average. Beta measures the contribution of an individual investment to the risk of the market portfolio that was not reduced by diversification. It does not measure the r ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |