|

Tax Return

A tax return is a form on which a person or organization presents an account of income and circumstances, used by the tax authorities to determine liability for tax. Tax returns are usually processed by each country's tax authority, known as a revenue service, such as the Internal Revenue Service in the United States, the State Taxation Administration in China, and HM Revenue and Customs in the United Kingdom. Preparing the tax return A tax return reports income, expenses, tax payments made during the year and other relevant information to the taxing authority. It helps to determine whether a tax refund is due. This will depend on whether a person has overpaid on taxes, or was late in paying tax for previous years. A person or organization may not be required to file a tax return depending on circumstances, which are different in each country. Generally, a tax return does not need to be filed if income is less than a certain amount, but other factors such as the type of in ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Information Reporting

Tax information reporting in the United States is a requirement for organizations to report wage and non-wage payments made in the course of their trade or business to the Internal Revenue Service (IRS). This area of government reporting and corporate responsibility is continuously growing, carrying with it a large number of regulatory requirements established by the federal government and the states. There are currently more than 30 types of tax information returns required by the federal government, and they provide the primary cross-checking measure the IRS has to verify accuracy of tax returns filed by individual taxpayers. Information returns The tax information return most familiar to the greatest number of people is the Form W-2, which reports wages and other forms of compensation paid to employees. There are also many forms used to report non-wage income, and to report transactions that may entitle a taxpayer to take a credit on an individual tax return. These non-wage for ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Income Tax In Singapore

Income tax in Singapore involves both individual income tax and corporate income tax. Income earned both inside and outside the country for individuals and corporate entities is taxed Individual income tax Individual income tax in Singapore is payable on an annual basis, it is currently based on the progressive tax system (for local residents and tax residents), with taxes ranging from 0% to 22% since Year of Assessment 2017. The Year of Assessment (YA) is based on the calendar year commencing 1 January to 31 December, and is payable on a preceding year basis, whereby taxes payable per year of assessment is based on income earned in the preceding calendar year. Taxation is based on the source principle, in which only income earned at source, in this case in Singapore, or those derived from overseas but received in Singapore, are taxable. Any income arising from sources outside Singapore and received in Singapore on or after 1 January 2004 by an individual (other than partners of a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Income Tax In Scotland

Income tax in Scotland is a tax of personal income gained through employment. This is a tax controlled by the Scottish Parliament, and collected by the UK government agency HM Revenue & Customs. Since 2017, the Scottish Parliament has had the ability to set income tax rates and bands, apart from the personal allowance. Since this point, differences have developed between income tax rates in Scotland and those elsewhere in the UK. History When the devolved Scottish Parliament The Scottish Parliament ( ; ) is the Devolution in the United Kingdom, devolved, unicameral legislature of Scotland. It is located in the Holyrood, Edinburgh, Holyrood area of Edinburgh, and is frequently referred to by the metonym 'Holyrood'. ... was set up in 1999, the Scottish Parliament had the power to vary the rate of income tax by 3% (in either direction) from the rates applied in the rest of the UK. This power was specifically authorised by the second question of the 1997 devolution referend ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Income Tax In China

The Individual Income Tax in China (commonly abbreviated IIT) is administered on a progressive tax system with tax rates from 3 percent to 45 percent. As of 2019, China taxes individuals who reside in the country for more than 183 days on worldwide earned income. The system is separate from the income tax system of Hong Kong and Macau, which are administered independently. The taxpayers of individual income tax include both resident taxpayers and non-resident taxpayers. A resident taxpayer who has the obligation to pay taxes in full must pay individual income tax on all income derived from sources within or outside China. The non-resident taxpayer shall pay individual income tax only on the income derived or sourced from China. Individual income tax is a kind of income tax levied by the state on the income of citizens and individuals living in the country and the income derived from the country by individuals outside the country. In some countries, individual income tax is the ma ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Taxation In The United Kingdom

In the United Kingdom, taxation may involve payments to at least three different levels of government: Government of the United Kingdom, central government (HM Revenue and Customs), Devolution in the United Kingdom, devolved governments and Local government in the United Kingdom, local government. Central government revenues come primarily from income tax, National Insurance contributions, value added tax, United Kingdom corporation tax, corporation tax and Hydrocarbon oil duty, fuel duty. Local government revenues come primarily from grants from central government funds, business rates in England, Council Tax and increasingly from fees and charges such as those for decriminalised parking enforcement, on-street parking. In the fiscal year 2023–24, total government revenue was forecast to be £1,139.1 billion, or 40.9 per cent of Gross domestic product, GDP, with income taxes and National Insurance contributions standing at around £470 billion. History A uniform Land Tax (Eng ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Taxation In Spain

Taxes in Spain are levied by national (central), regional and local governments. Tax revenue in Spain stood at 36.3% of GDP in 2013. A wide range of taxes are levied on different sources, the most important ones being income tax, social security contributions, corporate tax, value added tax; some of them are applied at national level and others at national and regional levels. Most national and regional taxes are collected by the Agencia Estatal de Administración Tributaria which is the bureau responsible for collecting taxes at the national level. Other minor taxes like property transfer tax (regional), real estate property tax (local), road tax (local) are collected directly by regional or local administrations. Four historical territories or foral provinces ( Araba/Álava, Bizkaia, Gipuzkoa and Navarre) collect all national and regional taxes themselves and subsequently transfer the portion due to the central Government after two negotiations called Concierto (in which the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Taxation In Peru

Taxation represents the biggest source of revenues for the Peruvian government (up to 76%). For 2016, the projected amount of taxation revenues was S/.94.6 billion ($29 billion). There are four taxes that make up approximately 90 percent of the taxation revenues: * the income tax (both corporate and personal), * the value-added tax (VAT), * the import tax, * the excise tax. All these four types of taxes are imposed at the national level. There are also municipal taxes based on an individual's or household's residence as well as a municipal property tax and a municipal vehicle tax. Income tax Peruvian income taxes may be divided into 2 large groups: ''Corporate income tax'' The general income tax annual rate for resident entities is 29.5%. In addition to this, resident entities are obliged to make advance payments on a monthly basis by applying a coefficient over the accrued taxable income of the month. Advance payments are to be offset against the annual income tax obliga ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Taxation In Iran

Taxation in Iran is levied and collected by the Iranian National Tax Administration under the Ministry of Finance and Economic Affairs of the Government of Iran. In 2008, about 55% of the government's budget came from oil and natural gas revenues, the rest from taxes and fees. An estimated 50% of Iran's GDP was exempt from taxes in FY 2004. There are virtually millions of people who do not pay taxes in Iran and hence operate outside the formal economy. The fiscal year begins on March 21 and ends on March 20 of the next year. As part of the Iranian Economic Reform Plan, the government has proposed income tax increases on traders in gold, steel, fabrics and other sectors, prompting several work stoppages by merchants. In 2011, the government announced that during the second phase of the economic reform plan, it aims to increase tax revenues, simplify tax calculation method, introduce double taxation, mechanize tax system, regulate tax exemptions and prevent tax evasion. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Taxation In Greece

Taxation in Greece is based on the direct and indirect systems. The total tax revenue in 2017 was €47.56 billion from which €20.62 billion came from direct taxes and €26.94 billion from indirect taxes. The total tax revenue represented 39.4% of GDP in 2017. Taxes in Greece are collected by the Independent Authority for Public Revenue (Ανεξάρτητη Αρχή Δημοσίων Εσόδων). Income tax Income taxation in Greece is progressive. Income tax is payable by all individuals earning income in Greece, regardless of citizenship or place of permanent residence. Permanent residents are taxed on their worldwide income in Greece. An individual in Greece is liable for tax on their income as an employee and on income as a self-employed person. In the case of an individual who is a ''permanent resident'' of Greece, their tax owed is calculated on their income earned in Greece and overseas. An individual whose income is only from a wage is not obligated to file an annual ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

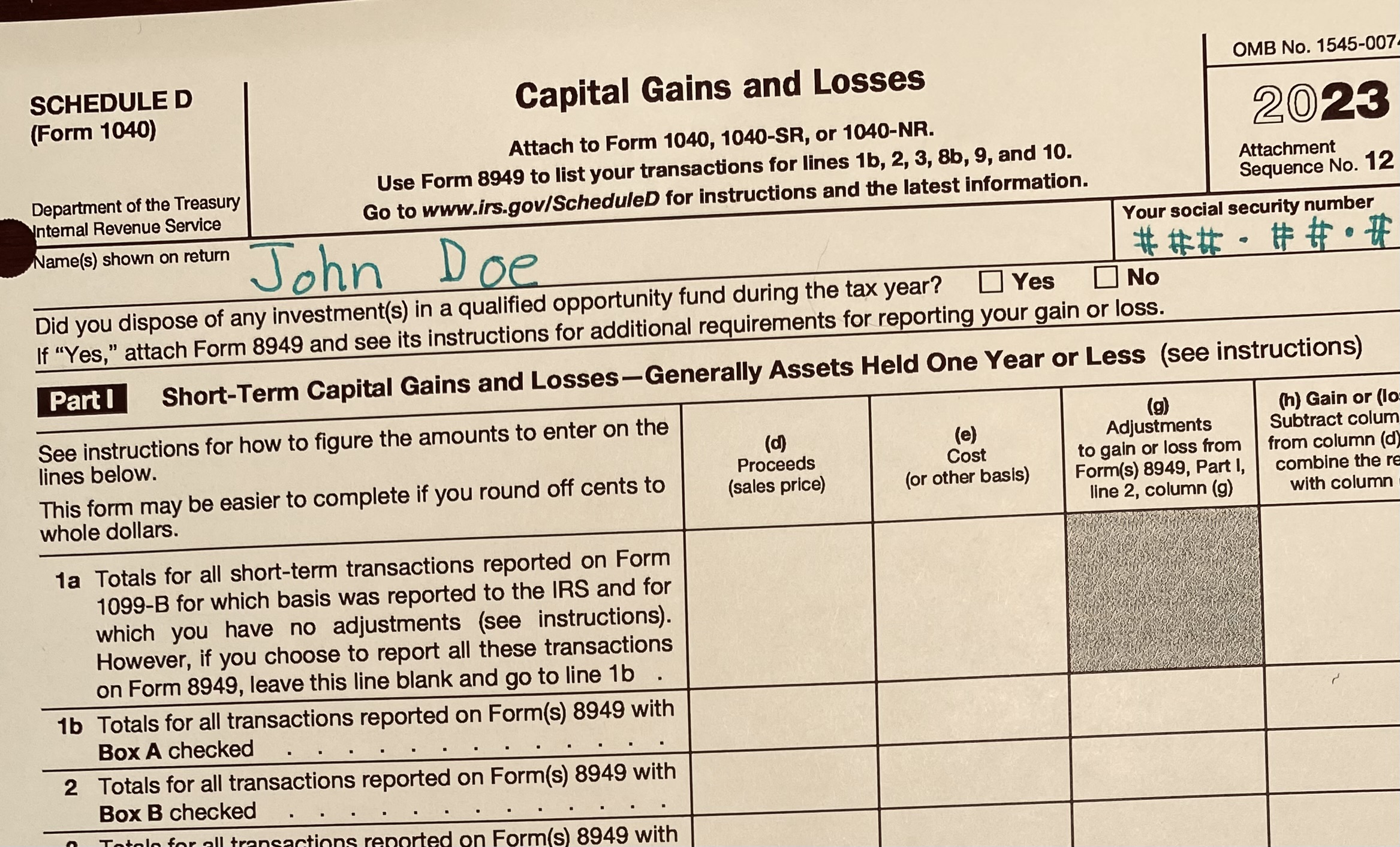

Tax Returns In The United States

Tax returns in the United States are reports filed with the Internal Revenue Service (IRS) or with the state or local tax collection agency (California Franchise Tax Board, for example) containing information used to calculate income tax or other taxes. Tax returns are generally prepared using forms prescribed by the IRS or other applicable taxing authority. Federal returns Under the Internal Revenue Code returns can be classified as either ''tax returns'' or ''information returns'', although the term "tax return" is sometimes used to describe both kinds of returns in a broad sense. Tax returns, in the more narrow sense, are reports of tax liabilities and payments, often including financial information used to compute the tax. A very common federal tax form is IRS Form 1040. A tax return provides information so that the taxation authority can check on the taxpayer's calculations, or can determine the amount of tax owed if the taxpayer is not required to calculate that amount.Vi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Returns In The United Kingdom

In the United Kingdom, a tax return is a document that must be filed with HM Revenue & Customs declaring liability for taxation. Different bodies must file different returns with respect to various forms of taxation. The main returns currently in use are: *SA100 for individuals paying income tax *SA800 for partnerships *SA900 for trusts and estates of deceased persons *CT600 for companies paying corporation tax *VAT100 for value added tax Income tax self-assessment Most employees paying tax under the PAYE system are not required to file a tax return, because the PAYE system operates to withhold the correct amount of tax from their wages or salaries. However, some taxpayers, including employees, may have income that has not been taxed at source and needs to be declared to HMRC, usually by submitting a self assessment tax return. Legally, a tax payer is obliged to submit a tax return when HMRC request one by sending a notice to file a tax return, either because the tax payer ha ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |