|

Tax Credits

A tax credit is a tax incentive which allows certain taxpayers to subtract the amount of the credit they have accrued from the total they owe the state. It may also be a credit granted in recognition of taxes already paid or a form of state "discount" applied in certain cases. Another way to think of a tax credit is as a rebate. Refundable vs. non-refundable A refundable tax credit is one which, if the credit exceeds the taxes due, the government pays back to the taxpayer the difference. In other words, it makes possible a negative tax liability. For example, if a taxpayer has an initial tax liability of $100 and applies a $300 tax credit, then the taxpayer ends with a liability of –$200 and the government refunds to the taxpayer that $200. With a non-refundable tax credit, if the credit exceeds the taxes due then the taxpayer pays nothing but does not receive the difference. In this case, the taxpayer from the example would end with a tax liability of $0 (i.e. they could mak ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Working Tax Credit

Working Tax Credit (WTC) was a state benefit in the United Kingdom made to people who worked and received a low income. It was introduced in April 2003 and was a means-tested benefit. Despite the name, the payment was not a tax credit linked to a person's tax bill, but a payment used to top-up low wages. The amount of WTC received could exceed the amount of tax paid. Unlike most other benefits, WTC was paid by HM Revenue and Customs (HMRC). WTC could be claimed by working individuals, childless couples and working families with dependent children. In addition, some other people were also entitled to Child Tax Credit (CTC) if they were responsible for any children. WTC and CTC were assessed jointly and families remained eligible for CTC even if no adult was working or they had too much income to receive WTC. In 2010, the coalition government announced that the Working Tax Credit would, by 2017, be integrated into and replaced by Universal Credit. However, implementation of t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Incentive

A tax incentive is an aspect of a government's taxation policy designed to incentive, incentivize or encourage a particular economic activity by reducing tax payments. Tax incentives can have both positive and negative impacts on an economy. Among the positive benefits, if implemented and designed properly, tax incentives can attract investment to a country. Other benefits of tax incentives include increased employment, higher number of capital transfers, research and technology development, and also improvement to less developed areas. Though it is difficult to estimate the effects of tax incentives, they can, if done properly, raise the overall economic welfare through increasing economic growth and government tax revenue (after the expiration of the tax holiday/incentive period). However, tax incentives can cause negative effects on a government's financial condition, among other negative effects, if they are not properly designed and implemented. According to a 2020 study of ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

New Statesman

''The New Statesman'' (known from 1931 to 1964 as the ''New Statesman and Nation'') is a British political and cultural news magazine published in London. Founded as a weekly review of politics and literature on 12 April 1913, it was at first connected with Sidney Webb, Sidney and Beatrice Webb and other leading members of the socialist Fabian Society, such as George Bernard Shaw, who was a founding director. The longest-serving editor was Kingsley Martin (1930–1960), and the most recent editor was Jason Cowley (journalist), Jason Cowley, who assumed the post in 2008 and left in 2024. Today, the magazine is a print–digital hybrid. According to its present self-description, it has a modern Liberalism in the United Kingdom, liberal and Independent progressive, progressive political position. Jason Cowley (journalist), Jason Cowley, the magazine's editor, has described the ''New Statesman'' as a publication "of the left, for the left" but also as "a political and literary magaz ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

403(b)

In the United States, a 403(b) plan is a U.S. tax-advantaged retirement savings plan available for public education organizations, some non-profit employers (only Internal Revenue Code 501(c)(3) organizations), cooperative hospital service organizations, and self-employed ministers in the United States. It has tax treatment similar to a 401(k) plan, especially after the Economic Growth and Tax Relief Reconciliation Act of 2001. Both plans also require that distributions start at age 72 (according to the rules updated in 2020), known as Required Minimum Distributions (RMDs). Distributions are typically taxed as ordinary income. Employee salary deferrals into a 403(b) plan are made before income tax is paid and allowed to grow tax-deferred until the money is taxed as income when withdrawn from the plan. 403(b) plans are also referred to as a tax-sheltered annuity (TSA) although since 1974 they no longer are restricted to an annuity form and participants can also invest in mutual ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

401(k)

In the United States, a 401(k) plan is an employer-sponsored, defined-contribution, personal pension (savings) account, as defined in subsection 401(k) of the U.S. Internal Revenue Code. Periodic employee contributions come directly out of their paychecks, and may be matched by the employer. This pre-tax option is what makes 401(k) plans attractive to employees, and many employers offer this option to their (full-time) workers. 401(k) payable is a general ledger account that contains the amount of 401(k) plan pension payments that an employer has an obligation to remit to a pension plan administrator. This account is classified as a payroll liability, since the amount owed should be paid within one year. There are two types: traditional and Roth 401(k). For Roth accounts, contributions and withdrawals have no impact on income tax. For traditional accounts, contributions may be deducted from taxable income and withdrawals are added to taxable income. There are limits to contribut ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

SIMPLE IRA

A Savings Incentive Match Plan for Employees Individual Retirement Account, commonly known by the abbreviation "SIMPLE IRA", is a type of tax-deferred employer-provided retirement plan in the United States that allows employees to set aside money and invest it to grow for retirement. Specifically, it is a type of Individual Retirement Account (IRA) that is set up as an employer-provided plan. It is an employer sponsored plan, like better-known plans such as the 401(k) and 403(b) (Tax Sheltered Annuity plans), but offers simpler and less costly administration rules, as it is subject to ERISA and its associated regulations. Like a 401(k) plan, the SIMPLE IRA can be funded with pre-tax salary contributions, but those contributions are still subject to Social Security, Medicare, and Federal Unemployment Tax Act taxes. Contribution limits for SIMPLE plans are lower than for most other types of employer-provided retirement plans as compared to conventional defined contribution plans ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

SEP IRA

A Simplified Employee Pension Individual Retirement Arrangement (SEP-IRA) is a variation of the Individual Retirement Account used in the United States. SEP-IRAs are adopted by business owners to provide retirement benefits for themselves and their employees. There are no significant administration costs for a self-employed person with no employees. If the self-employed person does have employees, all employees must receive the same benefits under a SEP plan. Since SEP-IRAs are a type of IRA, funds can be invested the same way as most other IRAs. The deadline for establishing the plan and making contributions is the filing deadline for the employer's tax return, including extensions. The strictest conditions employers may place on employee eligibility are as follows. The employee must be included if they have: # attained age 21 # worked for the employer in three of the previous five years # received at least $650 in compensation for tax year 2021 ($600 for 2019 and for 2020) Emp ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Roth IRA

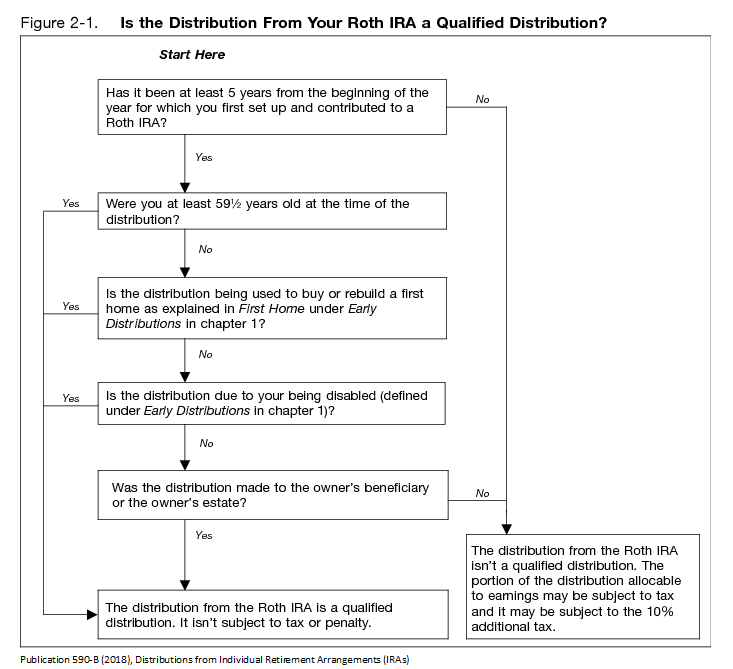

A Roth IRA is an individual retirement account (IRA) under United States law that is generally not Taxation in the United States, taxed upon distribution, provided certain conditions are met. The principal difference between Roth IRAs and most other tax-advantaged retirement plans is that rather than granting an income tax reduction for contributions to the retirement plan, qualified withdrawals from the Roth IRA plan are tax-free, and growth in the account is tax-free. The Roth IRA was introduced as part of the Taxpayer Relief Act of 1997 and is named for Senator William Roth. Overview A Roth IRA can be an individual retirement account containing investments in securities, usually common stock, common stocks and bond (finance), bonds, often through mutual fund, mutual funds (although other investments, including derivatives, notes, Certificate of deposit, certificates of deposit, and real estate are possible). A Roth IRA can also be an individual retirement Annuity (US financial p ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Individual Retirement Account

An individual retirement account (IRA) in the United States is a form of pension provided by many financial institutions that provides tax advantages for retirement savings. It is a trust that holds investment assets purchased with a taxpayer's earned income for the taxpayer's eventual benefit in old age. An individual retirement account is a type of individual retirement arrangement as described in IRS Publication 590, ''Individual Retirement Arrangements (IRAs)''. Other arrangements include individual retirement annuities and employer-established benefit trusts. Types There are several types of IRAs: * Traditional IRA – Contributions are mostly tax-deductible (often simplified as "money is deposited before tax" or "contributions are made with pre-tax assets"), no transactions within the IRA are taxed, and withdrawals in retirement are taxed as income (except for those portions of the withdrawal corresponding to contributions that were not deducted). Depending upon the nature ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Earned Income Credit

The United States federal earned income tax credit or earned income credit (EITC or EIC) is a refundable tax credit for low- to moderate-income working individuals and couples, particularly those with children. The amount of EITC benefit depends on a recipient's income and number of children. Low-income adults with no children are eligible. For a person or couple to claim one or more persons as their qualifying child, requirements such as relationship, age, and shared residency must be met.Tax Year 2020 1040 and 1040-SR Instructions, including the instructions for Schedules 1 through 3 Rules for EIC begin on page 40 for 2020 Tax Year. The earned income tax credit has been part of political debates in the United States over ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

The Independent

''The Independent'' is a British online newspaper. It was established in 1986 as a national morning printed paper. Nicknamed the ''Indy'', it began as a broadsheet and changed to tabloid format in 2003. The last printed edition was published on Saturday 26 March 2016, leaving only the online edition. The daily edition was named National Newspaper of the Year at the 2004 British Press Awards. ''The Independent'' won the Brand of the Year Award in The Drum Awards for Online Media 2023. History 1980s Launched in 1986, the first issue of ''The Independent'' was published on 7 October in broadsheet format.Dennis Griffiths (ed.) ''The Encyclopedia of the British Press, 1422–1992'', London & Basingstoke: Macmillan, 1992, p. 330. It was produced by Newspaper Publishing plc and created by Andreas Whittam Smith, Stephen Glover and Matthew Symonds. All three partners were former journalists at ''The Daily Telegraph'' who had left the paper towards the end of Lord Hartwell' ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Institute Of Chartered Accountants In England And Wales

The Institute of Chartered Accountants in England and Wales (ICAEW) is a professional membership organisation that promotes, develops and supports chartered accountants and students around the world. As of December 2024, it has over 210,000 members and students in 150 countries. ICAEW was established by Royal Charter in 1880. Overview The institute is a member of the Consultative Committee of Accountancy Bodies (CCAB), formed in 1974 by the major accountancy professional bodies in the UK and Ireland. The fragmented nature of the accountancy profession in the UK is in part due to the absence of any legal requirement for an accountant to be a member of one of the many Institutes, as the term ''accountant'' does not have legal protection. However, a person must belong to ICAEW, ICAS or CAI to hold themselves out as a '' chartered accountant'' in the UK (although there are other chartered bodies of British qualified accountants whose members are likewise authorised to conduct re ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |