|

Tax Burden

In economics, tax incidence or tax burden is the effect of a particular tax on the distribution of economic welfare. Economists distinguish between the entities who ultimately bear the tax burden and those on whom the tax is initially imposed. The tax burden measures the true economic effect of the tax, measured by the difference between real incomes or utilities before and after imposing the tax, and taking into account how the tax causes prices to change. For example, if a 10% tax is imposed on sellers of butter, but the market price rises 8% as a result, most of the tax burden is on buyers, not sellers. The concept of tax incidence was initially brought to economists' attention by the French Physiocrats, in particular François Quesnay, who argued that the incidence of all taxation falls ultimately on landowners and is at the expense of land rent. Tax incidence is said to "fall" upon the group that ultimately bears the burden of, or ultimately suffers a loss from, the tax. The ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Economics

Economics () is a behavioral science that studies the Production (economics), production, distribution (economics), distribution, and Consumption (economics), consumption of goods and services. Economics focuses on the behaviour and interactions of Agent (economics), economic agents and how economy, economies work. Microeconomics analyses what is viewed as basic elements within economy, economies, including individual agents and market (economics), markets, their interactions, and the outcomes of interactions. Individual agents may include, for example, households, firms, buyers, and sellers. Macroeconomics analyses economies as systems where production, distribution, consumption, savings, and Expenditure, investment expenditure interact; and the factors of production affecting them, such as: Labour (human activity), labour, Capital (economics), capital, Land (economics), land, and Entrepreneurship, enterprise, inflation, economic growth, and public policies that impact gloss ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Monopolistic Competition

Monopolistic competition is a type of imperfect competition such that there are many producers competing against each other but selling products that are differentiated from one another (e.g., branding, quality) and hence not perfect substitutes. For monopolistic competition, a company takes the prices charged by its rivals as given and ignores the effect of its own prices on the prices of other companies. If this happens in the presence of a coercive government, monopolistic competition make evolve into government-granted monopoly. Unlike perfect competition, the company may maintain spare capacity. Models of monopolistic competition are often used to model industries. Textbook examples of industries with market structures similar to monopolistic competition include restaurants, cereals, clothing, shoes, and service industries in large cities. The earliest developer of the theory of monopolistic competition is Edward Hastings Chamberlin, who wrote a pioneering book on t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Oligopoly

An oligopoly () is a market in which pricing control lies in the hands of a few sellers. As a result of their significant market power, firms in oligopolistic markets can influence prices through manipulating the supply function. Firms in an oligopoly are mutually interdependent, as any action by one firm is expected to affect other firms in the market and evoke a reaction or consequential action. As a result, firms in oligopolistic markets often resort to collusion as means of maximising profits. Nonetheless, in the presence of fierce competition among market participants, oligopolies may develop without collusion. This is a situation similar to perfect competition, where oligopolists have their own market structure. In this situation, each company in the oligopoly has a large share in the industry and plays a pivotal, unique role. Many jurisdictions deem collusion to be illegal as it violates competition laws and is regarded as anti-competition behaviour. The EU com ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Monopoly

A monopoly (from Greek language, Greek and ) is a market in which one person or company is the only supplier of a particular good or service. A monopoly is characterized by a lack of economic Competition (economics), competition to produce a particular thing, a lack of viable substitute goods, and the possibility of a high monopoly price well above the seller's marginal cost that leads to a high monopoly profit. The verb ''monopolise'' or ''monopolize'' refers to the ''process'' by which a company gains the ability to raise prices or exclude competitors. In economics, a monopoly is a single seller. In law, a monopoly is a business entity that has significant market power, that is, the power to charge Monopoly price, overly high prices, which is associated with unfair price raises. Although monopolies may be big businesses, size is not a characteristic of a monopoly. A small business may still have the power to raise prices in a small industry (or market). A monopoly may als ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Backward Bending Supply Curve Of Labour

In economics, a backward-bending supply curve of labour, or backward-bending labour supply curve, is a graphical device showing a situation in which as real (inflation-corrected) wages increase beyond a certain level, people will substitute time previously devoted for paid work for leisure (non-paid time) and so higher wages lead to a decrease in the labour supply and so less labour-time being offered for sale. The "labour-leisure" tradeoff is the tradeoff faced by wage-earning human beings between the amount of time spent engaged in wage-paying work (assumed to be unpleasant) and satisfaction-generating unpaid time, which allows participation in "leisure" activities and the use of time to do necessary self-maintenance, such as sleep. The key to the tradeoff is a comparison between the wage received from each hour of working and the amount of satisfaction generated by the use of unpaid time. Labour supply is the total number of hours that workers to work at a given wage rate. Su ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Factors Of Production

In economics, factors of production, resources, or inputs are what is used in the production process to produce output—that is, goods and services. The utilised amounts of the various inputs determine the quantity of output according to the relationship called the production function. There are four ''basic'' resources or factors of production: land, labour, capital and entrepreneur (or enterprise). The factors are also frequently labeled "producer goods or services" to distinguish them from the goods or services purchased by consumers, which are frequently labeled "consumer goods". There are two types of factors: ''primary'' and ''secondary''. The previously mentioned primary factors are land, labour and capital. Materials and energy are considered secondary factors in classical economics because they are obtained from land, labour, and capital. The primary factors facilitate production but neither become part of the product (as with raw materials) nor become significantly tran ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

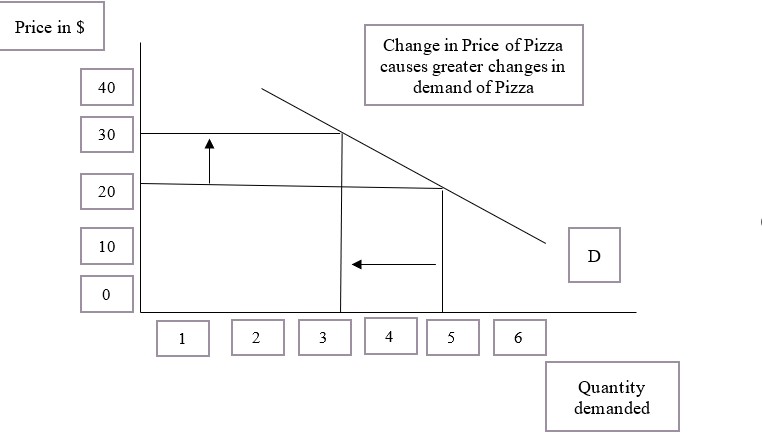

Elasticity (economics)

In economics, elasticity measures the responsiveness of one economic variable to a change in another. For example, if the price elasticity of the demand of a good is −2, then a 10% increase in price will cause the quantity demanded to fall by 20%. Elasticity in economics provides an understanding of changes in the behavior of the buyers and sellers with price changes. There are two types of elasticity for demand and supply, one is inelastic demand and supply and the other one is elastic demand and supply. Introduction The concept of price elasticity was first cited in an informal form in the book ''Principles of Economics (Marshall book), Principles of Economics'' published by the author Alfred Marshall in 1890. Subsequently, a major study of the price elasticity of supply and the price elasticity of demand for US products was undertaken by Joshua Levy and Trevor Pollock in the late 1960s. Elasticity is an important concept in neoclassical economic theory, and enables in ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Factors Of Production

In economics, factors of production, resources, or inputs are what is used in the production process to produce output—that is, goods and services. The utilised amounts of the various inputs determine the quantity of output according to the relationship called the production function. There are four ''basic'' resources or factors of production: land, labour, capital and entrepreneur (or enterprise). The factors are also frequently labeled "producer goods or services" to distinguish them from the goods or services purchased by consumers, which are frequently labeled "consumer goods". There are two types of factors: ''primary'' and ''secondary''. The previously mentioned primary factors are land, labour and capital. Materials and energy are considered secondary factors in classical economics because they are obtained from land, labour, and capital. The primary factors facilitate production but neither become part of the product (as with raw materials) nor become significantly tran ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Specific Tax

A per unit tax, or specific tax, is a tax A tax is a mandatory financial charge or levy imposed on an individual or legal entity by a governmental organization to support government spending and public expenditures collectively or to regulate and reduce negative externalities. Tax co ... that is defined as a fixed amount for each unit of a good or service sold, such as cents per kilogram. It is thus proportional to the particular quantity of a product sold, regardless of its price. Excise taxes, for instance, fall into this tax category. By contrast, an ad valorem tax is a charge based on a fixed percentage of the product value. Per unit taxes have administrative advantages when it is easy to measure quantities of the product or service being sold. Effect on supply curve Any tax will raise cost of production hence shift the supply curve to the left. In the case of specific tax, the shift will be purely parallel because the amount of tax is the same at all prices. That am ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Ad Valorem Tax

An ''ad valorem'' tax (Latin for "according to value") is a tax whose amount is based on the value of a transaction or of a property. It is typically imposed at the time of a transaction, as in the case of a sales tax or value-added tax (VAT). An ''ad valorem'' tax may also be imposed annually, as in the case of a real or personal property tax, or in connection with another significant event (e.g. inheritance tax, expatriation tax, or tariff). In some countries, a stamp duty is imposed as an ''ad valorem'' tax. Operation All ad valorem taxes are collected according to the determined value of the taxed item. In the most common application of ad valorem taxes, namely municipal property taxes, public tax assessors regularly assess the property owner's real estate in order to determine its current value. The determined value of the property is used to calculate the annual tax collected by the municipality or any other government entity upon the property owner. Ad valorem ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Demand Curve

A demand curve is a graph depicting the inverse demand function, a relationship between the price of a certain commodity (the ''y''-axis) and the quantity of that commodity that is demanded at that price (the ''x''-axis). Demand curves can be used either for the price-quantity relationship for an individual consumer (an individual demand curve), or for all consumers in a particular market (a market demand curve). It is generally assumed that demand curves slope down, as shown in the adjacent image. This is because of the law of demand: for most goods, the quantity demanded falls if the price rises. Certain unusual situations do not follow this law. These include Veblen goods, Giffen goods, and speculative bubbles where buyers are attracted to a commodity if its price rises. Demand curves are used to estimate behaviour in competitive markets and are often combined with supply curves to find the equilibrium price (the price at which sellers together are willing to sell the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |