|

Subsidy

A subsidy or government incentive is a form of financial aid or support extended to an economic sector (business, or individual) generally with the aim of promoting economic and social policy. Although commonly extended from the government, the term subsidy can relate to any type of support – for example from NGOs or as implicit subsidies. Subsidies come in various forms including: direct (cash grants, interest-free loans) and indirect ( tax breaks, insurance, low-interest loans, accelerated depreciation, rent rebates). Furthermore, they can be broad or narrow, legal or illegal, ethical or unethical. The most common forms of subsidies are those to the producer or the consumer. Producer/production subsidies ensure producers are better off by either supplying market price support, direct support, or payments to factors of production. Consumer/consumption subsidies commonly reduce the price of goods and services to the consumer. For example, in the US at one time it was cheaper to b ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Subsidy - Visualization 2

A subsidy or government incentive is a form of financial aid or support extended to an economic sector (business, or individual) generally with the aim of promoting economic and social policy. Although commonly extended from the government, the term subsidy can relate to any type of support – for example from NGOs or as implicit subsidies. Subsidies come in various forms including: direct (cash grants, interest-free loans) and indirect ( tax breaks, insurance, low-interest loans, accelerated depreciation, rent rebates). Furthermore, they can be broad or narrow, legal or illegal, ethical or unethical. The most common forms of subsidies are those to the producer or the consumer. Producer/production subsidies ensure producers are better off by either supplying market price support, direct support, or payments to factors of production. Consumer/consumption subsidies commonly reduce the price of goods and services to the consumer. For example, in the US at one time it was cheaper to b ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Pigovian Tax

A Pigouvian tax (also spelled Pigovian tax) is a tax on any market activity that generates negative externalities (i.e., external costs incurred by the producer that are not included in the market price). The tax is normally set by the government to correct an undesirable or inefficient market outcome (a market failure), and does so by being set equal to the external marginal cost of the negative externalities. In the presence of negative externalities, social cost includes private cost and external cost caused by negative externalities. This means the social cost of a market activity is not covered by the private cost of the activity. In such a case, the market outcome is not efficient and may lead to over-consumption of the product. Often-cited examples of negative externalities are environmental pollution and increased public healthcare costs associated with tobacco and sugary drink consumption.. In the presence of positive externalities (i.e., external public benefits gain ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Externality

In economics, an externality or external cost is an indirect cost or benefit to an uninvolved third party that arises as an effect of another party's (or parties') activity. Externalities can be considered as unpriced goods involved in either consumer or producer market transactions. Air pollution from motor vehicles is one example. The cost of air pollution to society is not paid by either the producers or users of motorized transport to the rest of society. Water pollution from mills and factories is another example. All consumers are all made worse off by pollution but are not compensated by the market for this damage. A positive externality is when an individual's consumption in a market increases the well-being of others, but the individual does not charge the third party for the benefit. The third party is essentially getting a free product. An example of this might be the apartment above a bakery receiving the benefit of enjoyment from smelling fresh pastries every morni ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Rail Subsidies

Many countries offer subsidies to their railways because of the social and economic benefits that it brings. The economic benefits can greatly assist in funding the rail network. Those countries usually also fund or subsidize road construction, and therefore effectively also subsidize road transport. Rail subsidies vary in both size and how they are distributed, with some countries funding the infrastructure and others funding trains and their operators, while others have a mixture of both. Subsidies can be used for either investment in upgrades and new lines, or to keep lines running that create economic growth. Rail subsidies are largest in China ($130 billion), Europe (€73 billion) and India ($35.8 billion), while the United States has relatively small subsidies for passenger rail with freight not subsidized. Social and economic benefits of rail Railways channel growth toward dense city agglomerations and along their arteries. These arrangements help to regenerate cities, in ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Renewable Energy Subsidies

Energy subsidies are measures that keep prices for customers below market levels, or for suppliers above market levels, or reduce costs for customers and suppliers. Energy subsidies may be direct cash transfers to suppliers, customers, or related bodies, as well as indirect support mechanisms, such as tax exemptions and rebates, price controls, trade restrictions, and limits on market access. The International Renewable Energy Agency tracked some $634 billion in energy-sector subsidies in 2020, and found that around 70% were fossil fuel subsidies. About 20% went to renewable power generation, 6% to biofuels and just over 3% to nuclear. Overview of all sources of energy If governments choose to subsidize one particular source of energy more than another, that choice can impact the environment. That distinguishing factor informs the below discussion on all energy subsidies of all sources of energy in general. Main arguments for energy subsidies are: * Security of su ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

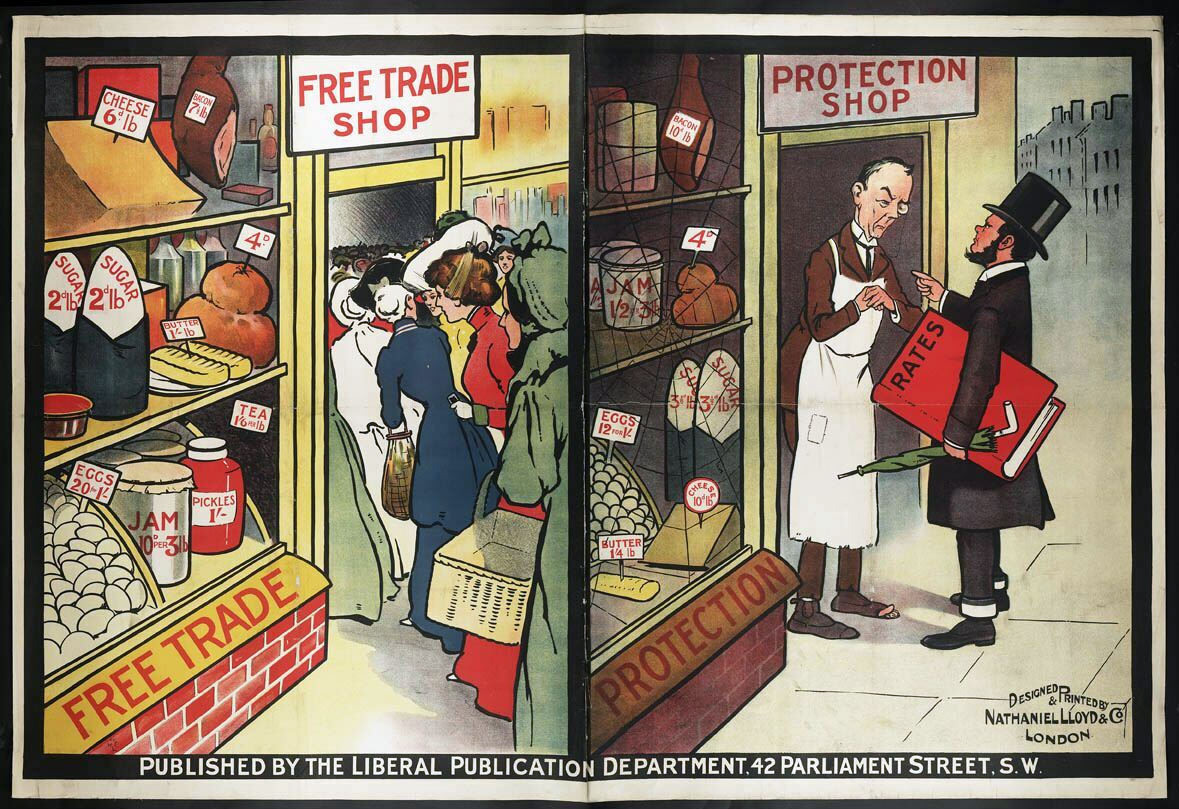

Protectionism

Protectionism, sometimes referred to as trade protectionism, is the economic policy of restricting imports from other countries through methods such as tariffs on imported goods, import quotas, and a variety of other government regulations. Proponents argue that protectionist policies shield the producers, businesses, and workers of the import-competing sector in the country from foreign competitors. Opponents argue that protectionist policies reduce trade and adversely affect consumers in general (by raising the cost of imported goods) as well as the producers and workers in export sectors, both in the country implementing protectionist policies and in the countries protected against. Protectionism is advocated mainly by parties that hold economic nationalist or left-wing positions, while economically right-wing political parties generally support free trade. There is a consensus among economists that protectionism has a negative effect on economic growth and economi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

World Trade Organization

The World Trade Organization (WTO) is an intergovernmental organization that regulates and facilitates international trade. With effective cooperation in the United Nations System, governments use the organization to establish, revise, and enforce the rules that govern international trade. It officially commenced operations on 1 January 1995, pursuant to the 1994 Marrakesh Agreement, thus replacing the General Agreement on Tariffs and Trade (GATT) that had been established in 1948. The WTO is the world's largest international economic organization, with 164 member states representing over 98% of global trade and global GDP. The WTO facilitates trade in goods, services and intellectual property among participating countries by providing a framework for negotiating trade agreements, which usually aim to reduce or eliminate tariffs, quotas, and other restrictions; these agreements are signed by representatives of member governmentsUnderstanding the WTO' Handbook at WTO offi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Expenditures

Tax expenditures are government revenue losses from tax exclusions, exemptions, deductions, credits, deferrals, and preferential tax rates. They are a counterpart to direct expenditures, in that they both are forms of government spending. Tax expenditures function as subsidies for certain activities and alter the horizontal and vertical equity of the basic tax system by giving preferential treatment to those activities. For instance, two people who have the same income can have different effective tax rates if one of the tax payers qualifies for certain tax expenditures by owning a home, having children, or receiving employer-provided health care and pension insurance. Definition The Congressional Budget and Impoundment Control Act of 1974 (CBA) defines tax expenditures as "those revenue losses attributable to provisions of the Federal tax laws which allow a special credit, a preferential rate of tax, or a deferral of tax liability". The term was coined in 1967 by Sta ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Perverse Incentive

A perverse incentive is an incentive that has an unintended and undesirable result that is contrary to the intentions of its designers. The cobra effect is the most direct kind of perverse incentive, typically because the incentive unintentionally rewards people for making the issue worse. The term is used to illustrate how incorrect stimulation in economics and politics can cause unintended consequences. Examples of perverse incentives The original cobra effect The term ''cobra effect'' was coined by economist Horst Siebert based on an anecdote of an occurrence in India during British rule. The British government, concerned about the number of venomous cobras in Delhi, offered a bounty for every dead cobra. Initially, this was a successful strategy; large numbers of snakes were killed for the reward. Eventually, however, enterprising people began to breed cobras for the income. When the government became aware of this, the reward program was scrapped. When cobra breede ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Usha Haley

Usha C. V. Haley is an American author and academic, currently W. Frank Barton Distinguished Chair of International Business and Professor of Management at the W. Frank Barton School of Business at Wichita State University in the U.S. state of Kansas. She is also Director of the Center for International Business Advancement at Wichita State University and elected Chair of the independent World Trade Council of Wichita. Prior to this, she was at other universities including West Virginia University, Massey University in New Zealand and at Harvard Kennedy School, Harvard University. Haley is credited with providing the intellectual foundations on understanding subsidies to Chinese industry with her book of the same name and testimonies, used as a basis for the current trade wars. See http://ushahaley.academia.edu. Born in Mumbai, India, she received a bachelor's degree in Politics at Elphinstone College, Mumbai and then went on to get graduate degrees from various American univer ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Audit Management

Audit management is responsible for ensuring that board-approved audit directives are implemented. Audit management helps simplify and well-organise the workflow and collaboration process of compiling audits. Most audit teams heavily rely on email and shared drive for sharing information with each other. Typically task such as submitting client request, sender reminder and following up on findings are all done from using broad tools. Investing in the right software could help save time, reduce errors and save on resources. Audit management oversees the internal/external audit staff, establishes audit programs, and hires and trains the appropriate audit personnel. The staff should have the necessary skills and expertise to identify inherent risks In simple terms, risk is the possibility of something bad happening. Risk involves uncertainty about the effects/implications of an activity with respect to something that humans value (such as health, well-being, wealth, property or th ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

OECD

The Organisation for Economic Co-operation and Development (OECD; french: Organisation de coopération et de développement économiques, ''OCDE'') is an intergovernmental organisation with 38 member countries, founded in 1961 to stimulate economic progress and world trade. It is a forum whose member countries describe themselves as committed to democracy and the market economy, providing a platform to compare policy experiences, seek answers to common problems, identify good practices, and coordinate domestic and international policies of its members. The majority of OECD members are high-income economies with a very high Human Development Index (HDI), and are regarded as developed countries. Their collective population is 1.38 billion. , the OECD member countries collectively comprised 62.2% of global nominal GDP (US$49.6 trillion) and 42.8% of global GDP ( Int$54.2 trillion) at purchasing power parity. The OECD is an official United Nations observer. In April 194 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |