|

Stock Market Prediction

Stock market prediction is the act of trying to determine the future value of a company stock or other financial instrument traded on an exchange. The successful prediction of a stock's future price could yield significant profit. The efficient market hypothesis suggests that stock prices reflect all currently available information and any price changes that are not based on newly revealed information thus are inherently unpredictable. Others disagree and those with this viewpoint possess myriad methods and technologies which purportedly allow them to gain future price information. The efficient markets hypothesis and the random walk The efficient market hypothesis posits that stock prices are a function of information and rational expectations, and that newly revealed information about a company's prospects is almost immediately reflected in the current stock price. This would imply that all publicly known information about a company, which obviously includes its price history, w ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Stock

Stocks (also capital stock, or sometimes interchangeably, shares) consist of all the Share (finance), shares by which ownership of a corporation or company is divided. A single share of the stock means fractional ownership of the corporation in proportion to the total number of shares. This typically entitles the shareholder (stockholder) to that fraction of the company's earnings, proceeds from liquidation of assets (after discharge of all Seniority (financial), senior claims such as secured and unsecured debt), or Voting interest, voting power, often dividing these up in proportion to the number of like shares each stockholder owns. Not all stock is necessarily equal, as certain classes of stock may be issued, for example, without voting rights, with enhanced voting rights, or with a certain priority to receive profits or liquidation proceeds before or after other classes of Shareholder, shareholders. Stock can be bought and sold over-the-counter (finance), privately or on ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

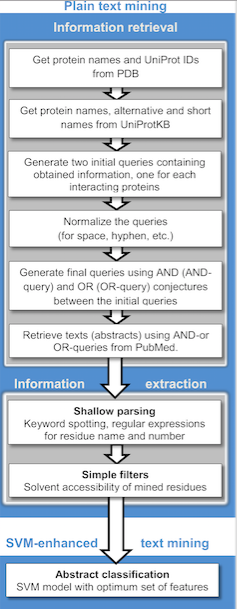

Text Mining

Text mining, text data mining (TDM) or text analytics is the process of deriving high-quality information from text. It involves "the discovery by computer of new, previously unknown information, by automatically extracting information from different written resources." Written resources may include websites, books, emails, reviews, and articles. High-quality information is typically obtained by devising patterns and trends by means such as statistical pattern learning. According to Hotho et al. (2005), there are three perspectives of text mining: information extraction, data mining, and knowledge discovery in databases (KDD). Text mining usually involves the process of structuring the input text (usually parsing, along with the addition of some derived linguistic features and the removal of others, and subsequent insertion into a database), deriving patterns within the structured data, and finally evaluation and interpretation of the output. 'High quality' in text mining usually ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Supervised Learning

In machine learning, supervised learning (SL) is a paradigm where a Statistical model, model is trained using input objects (e.g. a vector of predictor variables) and desired output values (also known as a ''supervisory signal''), which are often human-made labels. The training process builds a function that maps new data to expected output values. An optimal scenario will allow for the algorithm to accurately determine output values for unseen instances. This requires the learning algorithm to Generalization (learning), generalize from the training data to unseen situations in a reasonable way (see inductive bias). This statistical quality of an algorithm is measured via a ''generalization error''. Steps to follow To solve a given problem of supervised learning, the following steps must be performed: # Determine the type of training samples. Before doing anything else, the user should decide what kind of data is to be used as a Training, validation, and test data sets, trainin ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Random Forests

Random forests or random decision forests is an ensemble learning method for classification, regression and other tasks that works by creating a multitude of decision trees during training. For classification tasks, the output of the random forest is the class selected by most trees. For regression tasks, the output is the average of the predictions of the trees. Random forests correct for decision trees' habit of overfitting to their training set. The first algorithm for random decision forests was created in 1995 by Tin Kam Ho using the random subspace method, which, in Ho's formulation, is a way to implement the "stochastic discrimination" approach to classification proposed by Eugene Kleinberg. An extension of the algorithm was developed by Leo Breiman and Adele Cutler, who registered "Random Forests" as a trademark in 2006 (, owned by Minitab, Inc.). The extension combines Breiman's " bagging" idea and random selection of features, introduced first by Ho and later inde ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Artificial Neural Networks

In machine learning, a neural network (also artificial neural network or neural net, abbreviated ANN or NN) is a computational model inspired by the structure and functions of biological neural networks. A neural network consists of connected units or nodes called '' artificial neurons'', which loosely model the neurons in the brain. Artificial neuron models that mimic biological neurons more closely have also been recently investigated and shown to significantly improve performance. These are connected by ''edges'', which model the synapses in the brain. Each artificial neuron receives signals from connected neurons, then processes them and sends a signal to other connected neurons. The "signal" is a real number, and the output of each neuron is computed by some non-linear function of the sum of its inputs, called the '' activation function''. The strength of the signal at each connection is determined by a ''weight'', which adjusts during the learning process. Typically, neur ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Digital Computer

A computer is a machine that can be programmed to automatically carry out sequences of arithmetic or logical operations (''computation''). Modern digital electronic computers can perform generic sets of operations known as ''programs'', which enable computers to perform a wide range of tasks. The term computer system may refer to a nominally complete computer that includes the hardware, operating system, software, and peripheral equipment needed and used for full operation; or to a group of computers that are linked and function together, such as a computer network or computer cluster. A broad range of industrial and consumer products use computers as control systems, including simple special-purpose devices like microwave ovens and remote controls, and factory devices like industrial robots. Computers are at the core of general-purpose devices such as personal computers and mobile devices such as smartphones. Computers power the Internet, which links billions of compute ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Exponential Moving Average

In statistics, a moving average (rolling average or running average or moving mean or rolling mean) is a calculation to analyze data points by creating a series of averages of different selections of the full data set. Variations include: simple, cumulative, or weighted forms. Mathematically, a moving average is a type of convolution. Thus in signal processing it is viewed as a low-pass finite impulse response filter. Because the boxcar function outlines its filter coefficients, it is called a boxcar filter. It is sometimes followed by downsampling. Given a series of numbers and a fixed subset size, the first element of the moving average is obtained by taking the average of the initial fixed subset of the number series. Then the subset is modified by "shifting forward"; that is, excluding the first number of the series and including the next value in the series. A moving average is commonly used with time series data to smooth out short-term fluctuations and highlight longer- ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Head And Shoulders (chart Pattern)

On the technical analysis chart, the head and shoulders formation occurs when a market trend A market trend is a perceived tendency of the financial markets to move in a particular direction over time. Analysts classify these trends as ''secular'' for long time-frames, ''primary'' for medium time-frames, and ''secondary'' for short time ... is in the process of reversal either from a bullish or bearish trend; a characteristic pattern takes shape and is recognized as reversal formation. Head and shoulders top Head and shoulders formations consist of a left shoulder, a head, and a right shoulder and a line drawn as the neckline. The left shoulder is formed at the end of an extensive move during which volume is noticeably high. After the peak of the left shoulder is formed, there is a subsequent reaction and prices slide down somewhat, generally occurring on low volume. The prices rally up to form the head with normal or heavy volume and subsequent reaction downward is acco ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Time Series Analysis

In mathematics, a time series is a series of data points indexed (or listed or graphed) in time order. Most commonly, a time series is a sequence taken at successive equally spaced points in time. Thus it is a sequence of discrete-time data. Examples of time series are heights of ocean tides, counts of sunspots, and the daily closing value of the Dow Jones Industrial Average. A time series is very frequently plotted via a run chart (which is a temporal line chart). Time series are used in statistics, signal processing, pattern recognition, econometrics, mathematical finance, weather forecasting, earthquake prediction, electroencephalography, control engineering, astronomy, communications engineering, and largely in any domain of applied science and engineering which involves temporal measurements. Time series ''analysis'' comprises methods for analyzing time series data in order to extract meaningful statistics and other characteristics of the data. Time series ''forec ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Andrew Lo

Andrew Wen-Chuan Lo (; born 1960) is a Hong Kong-born Taiwanese-American economist and academic who is the Charles E. and Susan T. Harris Professor of Finance at the MIT Sloan School of Management. Lo is the author of many academic articles in finance and financial economics. He founded AlphaSimplex Group in 1999 and served as chairman and chief investment strategist until 2018 when he transitioned to his current role as chairman emeritus and senior advisor. Life and career Lo was born in 1960 in Hong Kong and was raised in Taiwan. He and his family lived in Taiwan before immigrating to the United States when Lo was five years old. Raised by a single mother, Lo graduated from the Bronx High School of Science in 1977. He then studied economics at Yale University, graduating in 1980 with a Bachelor of Arts. He then did doctoral study in economics at Harvard University, receiving a Master of Arts and a Ph.D. in 1984. Lo is a professor of finance at the MIT Sloan School of Manage ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bloomberg Press

John Wiley & Sons, Inc., commonly known as Wiley (), is an American multinational publishing company that focuses on academic publishing and instructional materials. The company was founded in 1807 and produces books, journals, and encyclopedias, in print and electronically, as well as online products and services, training materials, and educational materials for undergraduate, graduate, and continuing education students. History The company was established in 1807 when Charles Wiley opened a print shop in Manhattan. The company was the publisher of 19th century American literary figures like James Fenimore Cooper, Washington Irving, Herman Melville, and Edgar Allan Poe, as well as of legal, religious, and other non-fiction titles. The firm took its current name in 1865. Wiley later shifted its focus to scientific, technical, and engineering subject areas, abandoning its literary interests. Wiley's son John (born in Flatbush, New York, October 4, 1808; died in East Orang ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Efficient-market Hypothesis

The efficient-market hypothesis (EMH) is a hypothesis in financial economics that states that asset prices reflect all available information. A direct implication is that it is impossible to "beat the market" consistently on a risk-adjusted basis since market prices should only react to new information. Because the EMH is formulated in terms of risk adjustment, it only makes testable predictions when coupled with a particular model of risk. As a result, research in financial economics since at least the 1990s has focused on market anomalies, that is, deviations from specific models of risk. The idea that financial market returns are difficult to predict goes back to Bachelier, Mandelbrot, and Samuelson, but is closely associated with Eugene Fama, in part due to his influential 1970 review of the theoretical and empirical research. The EMH provides the basic logic for modern risk-based theories of asset prices, and frameworks such as consumption-based asset pricing and int ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |