|

Silver Exchange-traded Fund

Silver exchange-traded products are exchange-traded funds (ETFs), exchange-traded notes (ETNs) and closed-end funds (CEFs) that aim to track the price of silver. Silver exchange-traded products are traded on the major stock exchanges including the London and New York Stock Exchanges. The U.S Geological Survey cites the emergence of silver ETFs as a significant factor in the 2007-2011 price rise of silver. As of September 2011, the largest of these funds holds the equivalent of over one third of the world's total annual silver production. Products Physically backed funds * Central Fund of Canada and Silver Bullion Trust are closed-end funds created by the same Canadian founders and mandated to keep the bulk of their net assets in precious metals, with a small percentage of cash. The Central Fund of Canada holds a mix of gold and silver, while the Silver Bullion Trust holds only silver. The Central Fund of Canada and Silver Bullion Trust initial public offerings were completed in 1 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Exchange-traded Fund

An exchange-traded fund (ETF) is a type of investment fund that is also an exchange-traded product, i.e., it is traded on stock exchanges. ETFs own financial assets such as stocks, bonds, currencies, debts, futures contracts, and/or commodities such as gold bars. Many ETFs provide some level of diversification compared to owning an individual stock. An ETF divides ownership of itself into shares that are held by shareholders. Depending on the country, the legal structure of an ETF can be a corporation, trust, open-end management investment company, or unit investment trust. Shareholders indirectly own the assets of the fund and are entitled to a share of the profits, such as interest or dividends, and would be entitled to any residual value if the fund undergoes liquidation. They also receive annual reports. An ETF generally operates with an arbitrage mechanism designed to keep it trading close to its net asset value, although deviations can occur. The larges ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

IShares

iShares is a collection of exchange-traded funds (ETFs) and index mutual funds managed by BlackRock, which acquired the brand and business from Barclays in 2009. The first iShares ETFs were known as World Equity Benchmark Shares (WEBS) but have since been rebranded. Most iShares funds track a bond or stock market index, although some are actively managed. Stock exchanges listing iShares funds include the London Stock Exchange, American Stock Exchange, New York Stock Exchange, BATS Exchange, Hong Kong Stock Exchange, Mexican Stock Exchange, Toronto Stock Exchange, Australian Securities Exchange, B3 (stock exchange), and a number of European and Asian stock exchanges. iShares is the largest issuer of ETFs in the US and globally, and also manages index mutual funds. History In 1993, State Street, in cooperation with American Stock Exchange, launched Standard & Poor's Depositary Receipts () (now the 'SPDR S&P 500'), which was traded in real time and tracked the S&P 500 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Platinum As An Investment

Investment in platinum is often compared in financial history to gold and silver, which were both known to be used as money in ancient civilizations. Experts posit that platinum is about 15–20 times scarcer than gold and approximately 60–100 times scarcer than silver, on the basis of annual mine production. Since 2014, platinum prices have traded at a discount to gold. A significant portion of global platinum is mined in South Africa. Overview Platinum is extremely Scarcity, scarce even when compared to other precious metals. New Mining, mine production totals approximately less than each year. In contrast, gold mine production runs approximately annually, and silver mine production is approximately annually. Platinum is traded on the New York Mercantile Exchange (NYMEX) and the London Platinum and Palladium Market. To be saleable on most international markets, platinum ingots must be metallurgical assay, assayed and hallmarked. Platinum is traded in the spot market wi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Gold Exchange-traded Product

Gold exchange-traded products are exchange-traded funds (ETFs), closed-end funds (CEFs) and exchange-traded notes (ETNs) that are used to own gold as an investment. Gold exchange-traded products are traded on the major stock exchanges including the SIX Swiss Exchange, the Bombay Stock Exchange, the London Stock Exchange, the Paris Bourse, and the New York Stock Exchange. Each gold ETF, ETN, and CEF has a different structure outlined in its prospectus. Some such instruments do not necessarily hold physical gold. For example, gold ETNs generally track the price of gold using derivatives. The funds pay their annual expenses such as storage, insurance, and management fees to the sponsor by selling a small amount of gold; therefore, the amount of gold in each share will gradually decline over time. The annual fee charged by State Street Corporation as sponsor of SPDR Gold Shares, the largest gold-backed fund in the world, is 0.40% of the assets in the fund. In some countries, gold ETF ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

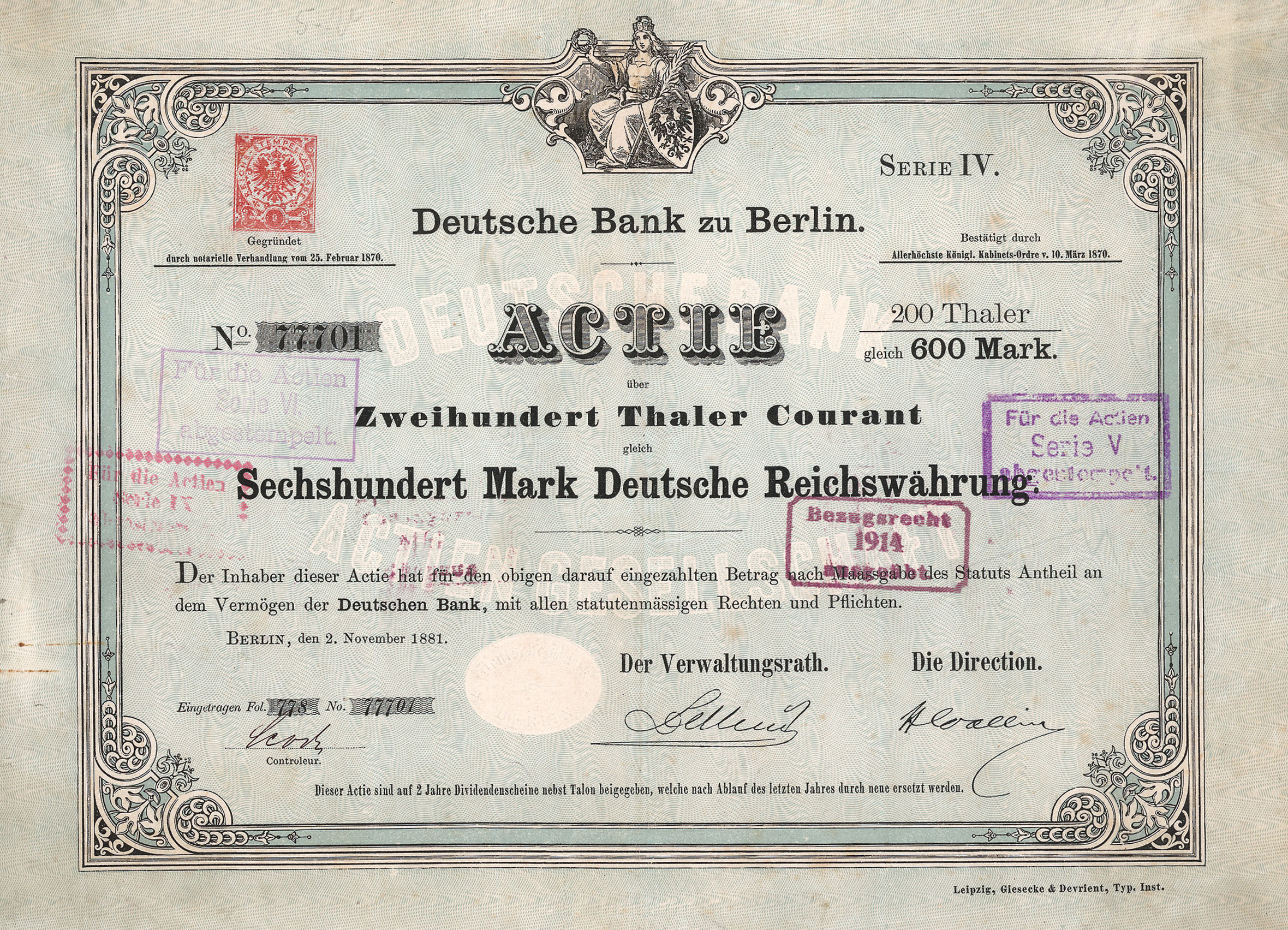

Deutsche Bank

Deutsche Bank AG (, ) is a Germany, German multinational Investment banking, investment bank and financial services company headquartered in Frankfurt, Germany, and dual-listed on the Frankfurt Stock Exchange and the New York Stock Exchange. Deutsche Bank was founded in 1870 in Berlin. From 1929 to 1937, following its merger with Disconto-Gesellschaft, it was known as ''Deutsche Bank und Disconto-Gesellschaft'' or DeDi-Bank. Other transformative acquisitions have included those of Mendelssohn & Co. in 1938, Morgan, Grenfell & Company, Morgan Grenfell in 1990, Bankers Trust in 1998, and Deutsche Postbank in 2010. As of 2018, the bank's network spanned 58 countries with a large presence in Europe, the Americas, and Asia. It is a component of the DAX stock market index and is often referred to as the List of banks in Germany, largest German banking institution, with Deutsche Bank holding the majority stake in DWS Group for combined assets of 2.2 trillion euros, rivaling even Spa ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

HSBC Bank USA

HSBC Bank USA, National Association, an American subsidiary of the British banking group HSBC, is a bank with its operational head office in New York City and its nominal head office in Tysons, Virginia (as designated on its charter). HSBC Bank USA, N.A. is a national bank chartered under the National Bank Act, and thus is regulated by the Office of the Comptroller of the Currency (OCC), a part of the U.S. Department of the Treasury. Although this company was established in 1850 as Marine Midland Bank, its presence dates to 1865 when HSBC entered into the American market by opening an office in San Francisco before becoming a branch in 1875. Through multiple expansions nationwide and the full acquisition of Marine Midland in 1987, the company adopted its current HSBC USA name in 1999. The company has 22 branch locations, down from the previous 148 before divesting its retail banking business to Citizens Financial Group, Cathay Bank and KeyBank in 2021. History Beginning ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

LBMA

The London Bullion Market Association (now known simply as LBMA), established in 1987, is the international trade association representing the global Over The Counter (OTC) bullion market, and defines itself as "the global authority on precious metals". It has a membership of approximately 150 firms globally, including traders, refiners, producers, miners, fabricators, as well as those providing storage and secure carrier services. Functions LBMA's mission “is to add value to the global precious metals industry, by setting standards and developing market services, thereby ensuring the highest levels of integrity, transparency and trust.” LBMA drives governance and continuous improvement of the market, ensuring all market participants can operate with confidence. LBMA is the standard-setting organisation that defines how precious metals are refined as well as traded, demonstrating this through its management of the globally acknowledged London Good Delivery Lists and Respon ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

ETF Securities

ETF Securities is an asset management firm that issues exchange-traded funds (ETFs) primarily in Australia. History The company was founded by Australian businessman and philanthropist Graham Tuckwell. The company worked with the World Gold Council on the development of the first gold ETF in 2003 and collaborated on the listing of Gold Bullion Securities on the London Stock Exchange in March 2004. In 2003, the company listed the first physically-backed gold exchange-traded commodity (ETC) on the Australian Stock Exchange. In 2005, the company created Europe's first petroleum ETF and in 2006 established the world's first commodities ETF platform, making 19 commodities and 10 commodity indices available on the London Stock Exchange and other European exchanges. In 2008, the company listed the first carbon ETF on the London Stock Exchange. In September 2008, the company launched ETF Exchange, a trading platform in Europe. The company launched an exchange-traded currencies so ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Initial Public Offering

An initial public offering (IPO) or stock launch is a public offering in which shares of a company are sold to institutional investors and usually also to retail (individual) investors. An IPO is typically underwritten by one or more investment banks, who also arrange for the shares to be listed on one or more stock exchanges. Through this process, colloquially known as ''floating'', or ''going public'', a privately held company is transformed into a public company. Initial public offerings can be used to raise new equity capital for companies, to monetize the investments of private shareholders such as company founders or private equity investors, and to enable easy trading of existing holdings or future capital raising by becoming publicly traded. After the IPO, shares are traded freely in the open market at what is known as the free float. Stock exchanges stipulate a minimum free float both in absolute terms (the total value as determined by the share price multiplied ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Exchange-traded Note

An exchange-traded note (ETN) is a senior, unsecured, unsubordinated debt security issued by an underwriting bank or by a special-purpose entity. Similar to other debt securities, ETNs may have a maturity date and are backed by the credit of the issuer, though some ETNs may have a portfolio of assets given as a collateral. ETNs are designed to provide investors access to the returns of various market benchmarks. The returns of ETNs are usually linked to the performance of a market benchmark, a so-called ''market-linked note'', or to the performance of an active investment strategy, in this case being called an ''actively managed certificate'' or ''performance-linked bond''. In all cases, the returns are net of expenses and management fees. When an investor buys an ETN, the issuer promises to pay the amount reflected in the index net of expenses and fees upon maturity (though in some cases the ETN may be perpetual, and the investor will get their investment back by selling it ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

United States Geological Survey

The United States Geological Survey (USGS), founded as the Geological Survey, is an agency of the U.S. Department of the Interior whose work spans the disciplines of biology, geography, geology, and hydrology. The agency was founded on March 3, 1879, to study the landscape of the United States, its natural resources, and the natural hazards that threaten it. The agency also makes maps of planets and moons, based on data from U.S. space probes. The sole scientific agency of the U.S. Department of the Interior, USGS is a fact-finding research organization with no regulatory responsibility. It is headquartered in Reston, Virginia, with major offices near Lakewood, Colorado; at the Denver Federal Center; and in NASA Research Park in California. In 2009, it employed about 8,670 people. The current motto of the USGS, in use since August 1997, is "science for a changing world". The agency's previous slogan, adopted on its hundredth anniversary, was "Earth Science in the Pub ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

New York Stock Exchange

The New York Stock Exchange (NYSE, nicknamed "The Big Board") is an American stock exchange in the Financial District, Manhattan, Financial District of Lower Manhattan in New York City. It is the List of stock exchanges, largest stock exchange in the world by market capitalization, exceeding $25 trillion in July 2024. The NYSE is owned by Intercontinental Exchange, an American holding company that it also lists (ticker symbol ICE). Previously, it was part of NYSE Euronext (NYX), which was formed by the NYSE's 2007 merger with Euronext. According to a Gallup, Inc., Gallup poll conducted in 2022, approximately 58% of American adults reported having money invested in the stock market, either through individual stocks, mutual funds, or 401(k), retirement accounts. __FORCETOC__ History The earliest recorded organization of Security (finance), securities trading in New York among brokers directly dealing with each other can be traced to the Buttonwood Agreement. Previously, secu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |