|

Pump-and-dump

Pump and dump (P&D) is a form of securities fraud that involves artificially inflating the price of an owned stock through false and misleading positive statements (pump), in order to sell the cheaply purchased stock at a higher price (dump). Once the operators of the scheme "dump" (sell) their overvalued shares, the price falls and investors lose their money. This is most common with small-cap cryptocurrencies and very small corporations/companies, i.e. " microcaps". While fraudsters in the past relied on cold calls, the Internet now offers a cheaper and easier way of reaching large numbers of potential investors through spam email, investment research websites, social media, and misinformation. Scenarios Pump-and-dump schemes do take place on the Internet using an email spam campaign, through media channels via a fake press release, or through telemarketing from " boiler room" brokerage houses (such as that dramatized in the 2000 film '' Boiler Room''). Often the stock pr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Microcap Stock Fraud

Microcap stock fraud is a form of securities fraud involving stocks of "microcap stock, microcap" companies, generally defined in the United States as those with a market capitalization of under $250 million. Its prevalence has been estimated to run into the billions of dollars a year. Many microcap stocks are penny stocks, which the U.S. Securities and Exchange Commission, SEC defines as a security that trades at less than $5 per share, is not listed on a national exchange, and fails to meet other specific criteria. Microcap stock fraud generally takes place among stocks traded on the OTC Bulletin Board and the Pink Sheets LLC, Pink Sheets Electronic Quotation Service, stocks which usually do not meet the requirements to be listed on the stock exchanges. Some fraud occurs among stocks traded on the NASDAQ Small Cap Market, now called the NASDAQ Capital Market. Microcap fraud encompasses several types of investor fraud: *Pump and dump, Pump-and-dump schemes, involve the use ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Jordan Belfort

Jordan Ross Belfort (; born July 9, 1962) is an American former stockbroker, financial criminal, and businessman who pleaded guilty to fraud and related crimes in connection with stock-market manipulation and running a boiler room as part of a penny-stock scam in 1999. Belfort spent 22 months in prison as part of an agreement under which, becoming an informant for the FBI and wearing a wire, he gave testimony against numerous partners and subordinates in his fraud scheme. He published the memoir '' The Wolf of Wall Street'' in 2007, which was adapted into Martin Scorsese's film of the same name released in 2013, in which he was played by Leonardo DiCaprio. Early life Belfort was born in 1962 in the Bronx, a borough of New York City, to Jewish parents, Maxwell "Max" Belfort and Leah (née Markowitz). They were both accountants. He has an older brother named Robert. His paternal grandfather, Jack Belfort (1904–1970), was an immigrant from Russia, while his grandmother was ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Securities Fraud

Securities fraud, also known as stock fraud and investment fraud, is a deceptive practice in the stock or commodities markets that induces investors to make purchase or sale decisions on the basis of false information."Securities Fraud Awareness & Prevention Tips faq by FBI, accessed February 11, 2013 The setups are generally made to result in monetary gain for the deceivers, and generally result in unfair monetary losses for the investors. They are generally violating securities laws. Securities fraud can also include outright theft from investors ( embezzlement by [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Stratton Oakmont

Stratton Oakmont, Inc. was an American over-the-counter brokerage house founded in 1989 by Jordan Belfort and Danny Porush. The firm defrauded many shareholders, leading to the arrest and incarceration of several executives and the closing of the firm in 1996. Section 230 of the Communications Decency Act was created in response to '' Stratton Oakmont, Inc. v. Prodigy Services Co.''. History Jordan Belfort founded Stratton Oakmont in 1989 with Danny Porush and Brian Blake. Earlier, Belfort had opened a franchise of Stratton Securities, a minor league broker-dealer, and then bought out the entire firm. Stratton Oakmont became the largest over-the-counter firm in the United States during the late 1980s and 1990s, responsible for the initial public offering of 35 companies, including Steve Madden, Ltd. The firm had no product control function to verify prices of its positions and monitor trading activity. Stratton Oakmont participated in pump-and-dump schemes, a form of micr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Cryptocurrency Exchange

A cryptocurrency exchange, or a digital currency exchange (DCE), is a business that allows customers to trade cryptocurrencies or digital currencies for other assets, such as conventional fiat money or other digital currencies. Exchanges may accept credit card payments, wire transfers or other forms of payment in exchange for digital currencies or cryptocurrencies. A cryptocurrency exchange can be a market maker that typically takes the bid–ask spreads as a transaction commission for its service or, as a matching platform, simply charges fees. Some brokerages which also focus on other assets such as stocks, let users purchase but not withdraw cryptocurrencies to cryptocurrency wallets while dedicated cryptocurrency exchanges do allow cryptocurrency withdrawals. Operation A cryptocurrency exchange can typically send cryptocurrency to a user's personal cryptocurrency wallet. Some can convert digital currency balances into anonymous prepaid cards which can be used to withdraw ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Illiquid

In business, economics or investment, market liquidity is a market's feature whereby an individual or firm can quickly purchase or sell an asset without causing a drastic change in the asset's price. Liquidity involves the trade-off between the price at which an asset can be sold, and how quickly it can be sold. In a liquid market, the trade-off is mild: one can sell quickly without having to accept a significantly lower price. In a relatively illiquid market, an asset must be discounted in order to sell quickly. A liquid asset is an asset which can be converted into cash within a relatively short period of time, or cash itself, which can be considered the most liquid asset because it can be exchanged for goods and services instantly at face value. Overview A liquid asset has some or all of the following features: it can be sold rapidly, with minimal loss of value, anytime within market hours. The essential characteristic of a liquid market is that there are always ready and wil ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

PLUS Markets Group

PLUS Markets Group was a UK electronic stock exchange based in London for small cap companies. It was a market operator under MiFID Markets in Financial Instruments Directive, and was both a regulated market and a multilateral trading facility. PLUS Market Group was the holding company for PLUS Stock Exchange (PLUS-SX), PLUS Derivatives (PLUS-DX) and Plus Technology (PLUS-TX). It provided cash trading, listing, derivatives and technology services. After the group got into financial trouble in 2012 it looked for ways to sell the business. The exchange, containing all the listed companies and the exchange license, was sold to ICAP and the technology division was sold to GMEX Group (formerly Forum Trading Solutions). PLUS Markets was acquired by ICAP in 2012 and rebranded as ICAP Securities and Derivatives Exchange (ISDX). History PLUS Markets grew out of a growth-company stock market named OFEX, which effectively collapsed in September 2004 after a failed fundraising. PLUS wa ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Alternative Investment Market

AIM (formerly the Alternative Investment Market) is a sub-market of the London Stock Exchange that was launched on 19 June 1995 as a replacement to the previous Unlisted Securities Market, Unlisted Securities Market (USM) that had been in operation since 1980. It allows Company, companies that are smaller, less-developed, or want/need a more flexible approach to governance to Initial public offering, float stock, shares with a more flexible financial regulation, regulatory system than is applicable on the main market. At launch, AIM comprised only 10 companies valued collectively at £82.2 million. As at May 2021, 821 companies comprised the sub-market, with an average market cap of £80 million per listing. AIM has also started to become an international exchange, often due to its low regulatory burden, especially in relation to the US Sarbanes–Oxley Act (though only a quarter of AIM-listed companies would qualify to be listed on a US stock exchange even prior to passage of t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

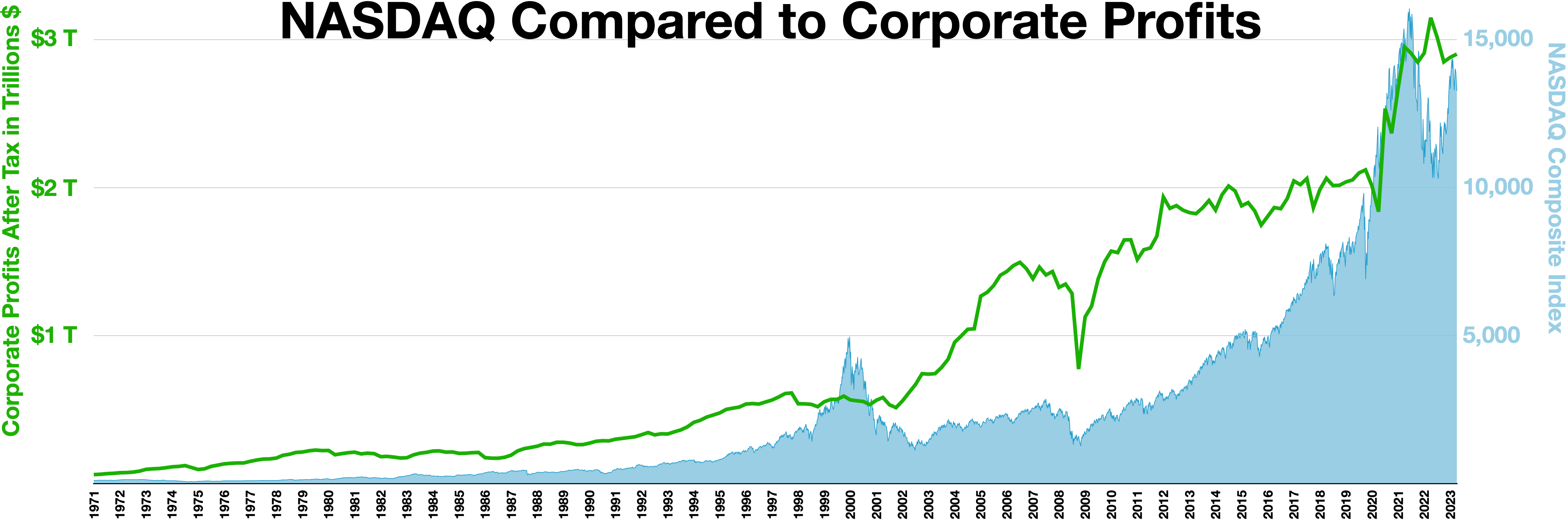

NASDAQ

The Nasdaq Stock Market (; National Association of Securities Dealers Automated Quotations) is an American stock exchange based in New York City. It is the most active stock trading venue in the U.S. by volume, and ranked second on the list of stock exchanges by market capitalization of shares traded, behind the New York Stock Exchange. The exchange platform is owned by Nasdaq, Inc. (which the exchange also lists; ticker symbol NDAQ), which also owns the Nasdaq Nordic stock market network and several U.S.-based stock and options exchanges. Although it trades stock of healthcare, financial, media, entertainment, retail, hospitality, and food businesses, it focuses more on technology stocks. The exchange is made up of both American and foreign firms, with China and Israel being the largest foreign sources. History 1972–2000 Nasdaq, Inc. was founded in 1971 by the National Association of Securities Dealers (NASD), which is now known as the Financial Industry Regulatory A ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

New York Stock Exchange

The New York Stock Exchange (NYSE, nicknamed "The Big Board") is an American stock exchange in the Financial District, Manhattan, Financial District of Lower Manhattan in New York City. It is the List of stock exchanges, largest stock exchange in the world by market capitalization, exceeding $25 trillion in July 2024. The NYSE is owned by Intercontinental Exchange, an American holding company that it also lists (ticker symbol ICE). Previously, it was part of NYSE Euronext (NYX), which was formed by the NYSE's 2007 merger with Euronext. According to a Gallup, Inc., Gallup poll conducted in 2022, approximately 58% of American adults reported having money invested in the stock market, either through individual stocks, mutual funds, or 401(k), retirement accounts. __FORCETOC__ History The earliest recorded organization of Security (finance), securities trading in New York among brokers directly dealing with each other can be traced to the Buttonwood Agreement. Previously, secu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Pink Sheets LLC

OTC Markets Group, Inc. (formerly known as National Quotation Bureau, Pink Sheets, and Pink OTC Markets) is an American financial services corporation that operates a financial market providing price and liquidity information for almost 12,400 over-the-counter (OTC) securities. The group has its headquarters in New York City. OTC-traded securities are organized into three markets to inform investors of opportunities and risks: OTCQX, OTCQB and Pink. History The company was first established in 1913 as the National Quotation Bureau (NQB). For decades, the NQB reported quotations for both stocks and bonds, publishing the quotations in the paper-based Pink Sheets and Yellow Sheets respectively. The publications were named for the color of paper on which they were printed. NQB was owned by CCH from 1963 to 1993. In September 1999, the NQB introduced the real-time Electronic Quotation Service. The National Quotation Bureau changed its name to Pink Sheets LLC in 2000 and subs ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

OTC Bulletin Board

The OTC (Over-The-Counter) Bulletin Board or OTCBB was a United States Financial quote, quotation medium operated by the Financial Industry Regulatory Authority (FINRA) for its subscribing members. FINRA closed the OTCBB on November 8, 2021. The board was used for many over-the-counter (finance), over-the-counter (OTC) Stock, equity security (finance), securities that were not listed on the NASDAQ or a national stock exchange, it had shrunk significantly as stock have migrated to the trading facilities of the OTC Markets Group. Broker-dealers who subscribed to the system, which was not electronic, were able to use the OTCBB to enter orders for OTC securities that qualified to be quoted. According to the U.S. Securities and Exchange Commission (SEC), "fraudsters often claim or imply that an OTCBB company is a Nasdaq company to mislead investors into thinking that the company is bigger than it is". FINRA, an "independent, not-for-profit organization authorized by U.S. Congress, Cong ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |