|

Protectionist Tariff

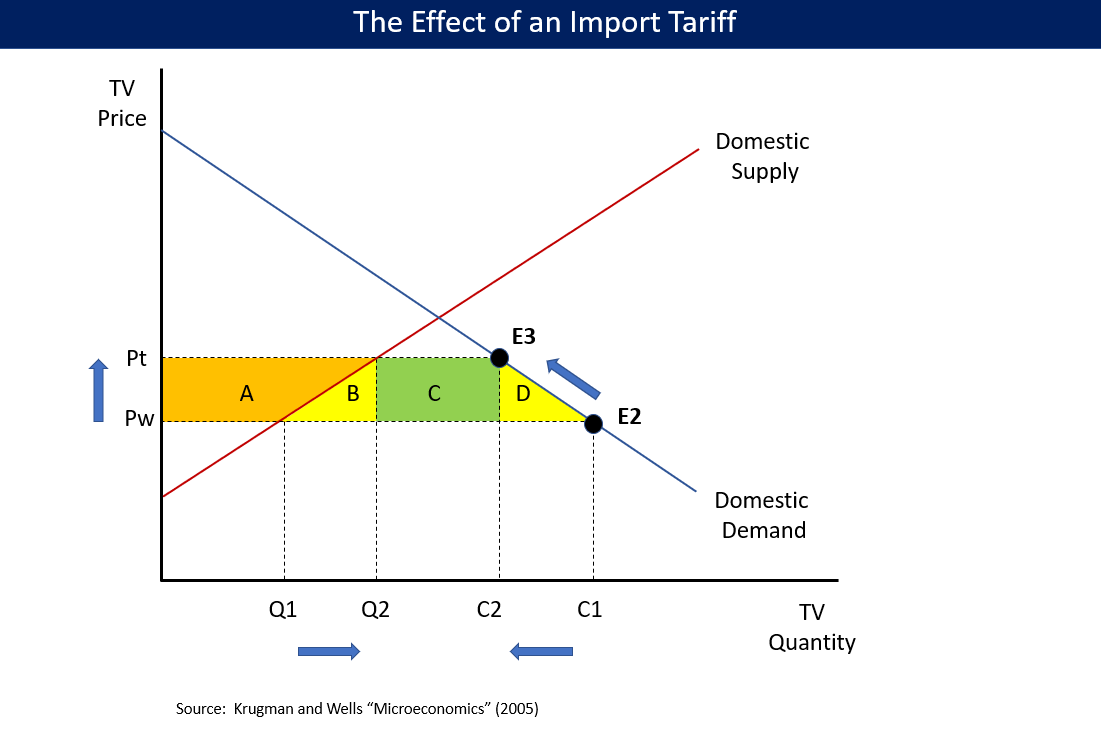

Protective tariffs are tariffs that are enacted with the aim of protecting a domestic industry. They aim to make imported goods cost more than equivalent goods produced domestically, thereby causing sales of domestically produced goods to rise, supporting local industry. Tariffs are also imposed in order to raise government revenue, or to reduce an undesirable activity (sin tax). Although a tariff can simultaneously protect domestic industry and earn government revenue, the goals of protection and revenue maximization suggest different tariff rates, entailing a tradeoff between the two aims. How tariffs work A tariff is a tax added onto goods imported into a country; protective tariffs are taxes that are intended to increase the cost of an import so it is less competitive against a roughly equivalent domestic good. For example, if similar cloth for sale in America cost $4 for a version imported from Britain (including additional shipping, etc.) and $4 for a version originating ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Tariff

A tariff or import tax is a duty (tax), duty imposed by a national Government, government, customs territory, or supranational union on imports of goods and is paid by the importer. Exceptionally, an export tax may be levied on exports of goods or raw materials and is paid by the exporter. Besides being a source of revenue, import duties can also be a form of regulation of International trade, foreign trade and policy that burden foreign products to encourage or safeguard domestic industry. Protective tariffs are among the most widely used instruments of protectionism, along with import quotas and export quotas and other non-tariff barriers to trade. Tariffs can be fixed (a constant sum per unit of imported goods or a percentage of the price) or variable (the amount varies according to the price). Tariffs on imports are designed to raise the price of imported goods to discourage consumption. The intention is for citizens to buy local products instead, which, according to support ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

United States House Of Representatives

The United States House of Representatives is a chamber of the Bicameralism, bicameral United States Congress; it is the lower house, with the U.S. Senate being the upper house. Together, the House and Senate have the authority under Article One of the United States Constitution, Article One of the Constitution of the United States, U.S. Constitution to pass or defeat federal legislation, known as Bill (United States Congress), bills. Those that are also passed by the Senate are sent to President of the United States, the president for signature or veto. The House's exclusive powers include initiating all revenue bills, Impeachment in the United States, impeaching federal officers, and Contingent election, electing the president if no candidate receives a majority of votes in the United States Electoral College, Electoral College. Members of the House serve a Fixed-term election, fixed term of two years, with each seat up for election before the start of the next Congress. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Customs Duties

A tariff or import tax is a duty (tax), duty imposed by a national Government, government, customs territory, or supranational union on imports of goods and is paid by the importer. Exceptionally, an export tax may be levied on exports of goods or raw materials and is paid by the exporter. Besides being a source of revenue, import duties can also be a form of regulation of International trade, foreign trade and policy that burden foreign products to encourage or safeguard domestic industry. Protective tariffs are among the most widely used instruments of protectionism, along with import quotas and export quotas and other non-tariff barriers to trade. Tariffs can be fixed (a constant sum per unit of imported goods or a percentage of the price) or variable (the amount varies according to the price). Tariffs on imports are designed to raise the price of imported goods to discourage consumption. The intention is for citizens to buy local products instead, which, according to support ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

World Trade Organization

The World Trade Organization (WTO) is an intergovernmental organization headquartered in Geneva, Switzerland that regulates and facilitates international trade. Governments use the organization to establish, revise, and enforce the rules that govern international trade in cooperation with the United Nations System. The WTO is the world's largest international economic organization, with 166 members representing over 98% of global trade and global GDP. The WTO facilitates trade in goods, trade in services, services and intellectual property among participating countries by providing a framework for negotiating trade agreements, which usually aim to reduce or eliminate tariffs, Import quota, quotas, and other Trade barrier, restrictions; these agreements are signed by representatives of member governments. (The document's printed folio numbers do not match the PDF page numbers.) and ratified by their legislatures. It also administers independent dispute resolution for enforcing ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Protectionism In The United States

Protectionism in the United States is protectionist economic policy that erects tariffs and other barriers on imported goods. This policy was most prevalent in the 19th century. At that time, it was mainly used to protect Northern United States, Northern industries and was opposed by Southern United States, Southern states that wanted free trade to expand cotton and other agricultural exports. Protectionist measures included tariffs and Import quota, quotas on imported goods, along with subsidies and other means, to restrain the free movement of imported goods, thus encouraging local industry. There was a general lessening of protectionist measures from the 1930s onwards, culminating in the free trade period that followed the Second World War. After the war, the United States promoted the General Agreement on Tariffs and Trade (GATT), to liberalize trade among all capitalist countries. In 1995, GATT became the World Trade Organization (WTO), and with the collapse of Communism i ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Protectionism

Protectionism, sometimes referred to as trade protectionism, is the economic policy of restricting imports from other countries through methods such as tariffs on imported goods, import quotas, and a variety of other government regulations. Proponents argue that protectionist policies shield the producers, businesses, and workers of the import-competing sector in the country from foreign competitors and raise government revenue. Opponents argue that protectionist policies reduce trade, and adversely affect consumers in general (by raising the cost of imported goods) as well as the producers and workers in export sectors, both in the country implementing protectionist policies and in the countries against which the protections are implemented. Protectionism has been advocated mainly by parties that hold economic nationalist positions, while economically liberal political parties generally support free trade. There is a consensus among economists that protectionism has a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Tariffs

A tariff or import tax is a duty imposed by a national government, customs territory, or supranational union on imports of goods and is paid by the importer. Exceptionally, an export tax may be levied on exports of goods or raw materials and is paid by the exporter. Besides being a source of revenue, import duties can also be a form of regulation of foreign trade and policy that burden foreign products to encourage or safeguard domestic industry. Protective tariffs are among the most widely used instruments of protectionism, along with import quotas and export quotas and other non-tariff barriers to trade. Tariffs can be fixed (a constant sum per unit of imported goods or a percentage of the price) or variable (the amount varies according to the price). Tariffs on imports are designed to raise the price of imported goods to discourage consumption. The intention is for citizens to buy local products instead, which, according to supporters, would stimulate their country's econom ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Donald Trump

Donald John Trump (born June 14, 1946) is an American politician, media personality, and businessman who is the 47th president of the United States. A member of the Republican Party (United States), Republican Party, he served as the 45th president from 2017 to 2021. Born into a wealthy family in the New York City borough of Queens, Trump graduated from the University of Pennsylvania in 1968 with a bachelor's degree in economics. He became the president of his family's real estate business in 1971, renamed it the Trump Organization, and began acquiring and building skyscrapers, hotels, casinos, and golf courses. He launched side ventures, many licensing the Trump name, and filed for six business bankruptcies in the 1990s and 2000s. From 2004 to 2015, he hosted the reality television show ''The Apprentice (American TV series), The Apprentice'', bolstering his fame as a billionaire. Presenting himself as a political outsider, Trump won the 2016 United States presidential e ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Great Depression In The United States

In the United States, the Great Depression began with the Wall Street Crash of October 1929 and then spread worldwide. The nadir came in 1931–1933, and recovery came in 1940. The stock market crash marked the beginning of a decade of high unemployment, famine, poverty, low profits, deflation, plunging farm incomes, and lost opportunities for economic growth as well as for personal advancement. Altogether, there was a general loss of confidence in the economic future. The usual explanations include numerous factors, especially high consumer debt, ill-regulated markets that permitted overoptimistic loans by banks and investors, and the lack of high-growth new industries. These all interacted to create a downward economic spiral of reduced spending, falling confidence and lowered production. Industries that suffered the most included construction, shipping, mining, logging, and agriculture. Also hard hit was the manufacturing of durable goods like automobiles and appliances, w ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Emergency Tariff Of 1921

The Emergency Tariff of 1921 of the United States was enacted on May 27, 1921. The Underwood Tariff, passed under the Presidency of Woodrow Wilson, had Republican leaders in the United States Congress rush to create a temporary measure to ease the plight of farmers until a better solution could be put into place. With growing unrest in the American public, President Warren G. Harding and Congress passed the tariff. Causes In the 1920s, the most disconcerting economic issue was declining farm profits. From 1900 to 1920, American farmers had prospered while European agriculture suffered serious disruption during World War I, which made prices soar. In 1919, Europeans began to close their markets by implementing tariff barriers. The period of American agricultural prosperity caused by rising demand had ended by the early 1920s. While American farms continued to grow because of previous wartime price and technological advances, the European demand for American farm products declined, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

First World War

World War I or the First World War (28 July 1914 – 11 November 1918), also known as the Great War, was a World war, global conflict between two coalitions: the Allies of World War I, Allies (or Entente) and the Central Powers. Fighting took place mainly in European theatre of World War I, Europe and the Middle Eastern theatre of World War I, Middle East, as well as in parts of African theatre of World War I, Africa and the Asian and Pacific theatre of World War I, Asia-Pacific, and in Europe was characterised by trench warfare; the widespread use of Artillery of World War I, artillery, machine guns, and Chemical weapons in World War I, chemical weapons (gas); and the introductions of Tanks in World War I, tanks and Aviation in World War I, aircraft. World War I was one of the List of wars by death toll, deadliest conflicts in history, resulting in an estimated World War I casualties, 10 million military dead and more than 20 million wounded, plus some 10 million civilian de ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Nelson W

Nelson may refer to: Arts and entertainment * ''Nelson'' (1918 film), a historical film directed by Maurice Elvey * ''Nelson'' (1926 film), a historical film directed by Walter Summers * ''Nelson'' (opera), an opera by Lennox Berkeley to a libretto by Alan Pryce-Jones * Nelson (band), an American rock band * ''Nelson'', a 2010 album by Paolo Conte People * Nelson (surname), including a list of people with the name * Nelson (given name), including a list of people with the name * Horatio Nelson, 1st Viscount Nelson (1758–1805), British admiral * Nelson Mandela, the first black South African president * Bishop of Nelson (other), a title sometimes referred to as "Nelson" Fictional characters * Alice Nelson, the housekeeper on the TV series ''The Brady Bunch'' * Dave Nelson, a main character on the TV series ''NewsRadio'' * Emma Nelson (Degrassi: The Next Generation), on the TV series ''Degrassi: The Next Generation'' * Foggy Nelson, law partner of Matt Murdoc ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |