|

Progressive Beer Duty

Progressive beer duty is a beer duty system that allows smaller breweries to pay less tax on their products. The idea originates from Bavaria in Germany, where such a system has underpinned the brewing industry and helped support local production. This idea encourages competition in quality and variety and supports diversity in local economies. It also encourages consumer interest and product pride which in turn helps promote cultural links. This concept was adopted by the European Union in 2002 using EU Directive 92/83/EEC as a derogated power so not all countries implemented the idea. The structure and its parameters provided by EU law allowed the creation of systems which suited the needs of individual states. There is, as some journalists have suggested, no "European system" as such. EU law allows for a maximum discount of 50% of beer tax on production levels up to 20 million litres with the provision for a stepped structure. Each country can choose the percentage and le ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Breweries

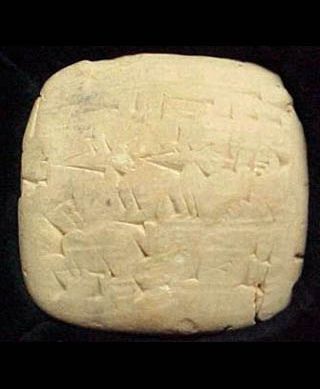

A brewery or brewing company is a business that makes and sells beer. The place at which beer is commercially made is either called a brewery or a beerhouse, where distinct sets of brewing equipment are called plant. The commercial brewing of beer has taken place since at least 2500 BC; in ancient Mesopotamia, brewers derived social sanction and divine protection from the goddess Ninkasi. Brewing was initially a Cottage Industry, cottage industry, with production taking place at home; by the ninth century, monasteries and farms would produce beer on a larger scale, selling the excess; and by the eleventh and twelfth centuries larger, dedicated breweries with eight to ten workers were being built. The diversity of size in breweries is matched by the diversity of processes, degrees of automation, and kinds of beer produced in breweries. A brewery is typically divided into distinct sections, with each section reserved for one part of the brewing process. History Beer may have ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bavaria

Bavaria, officially the Free State of Bavaria, is a States of Germany, state in the southeast of Germany. With an area of , it is the list of German states by area, largest German state by land area, comprising approximately 1/5 of the total land area of Germany, and with over 13.08 million inhabitants, it is the list of German states by population, second most populous German state, behind only North Rhine-Westphalia; however, due to its large land area, its population density is list of German states by population density, below the German average. Major cities include Munich (its capital and List of cities in Bavaria by population, largest city, which is also the list of cities in Germany by population, third largest city in Germany), Nuremberg, and Augsburg. The history of Bavaria includes its earliest settlement by Iron Age Celts, Celtic tribes, followed by the conquests of the Roman Empire in the 1st century BC, when the territory was incorporated into the provinces of Ra ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Local Purchasing

Local purchasing is a preference to buy locally produced goods and services rather than those produced farther away. It is very often abbreviated as a positive goal, "buy local" or "buy locally', that parallels the phrase " think globally, act locally", common in green politics. On the national level, the equivalent of local purchasing is import substitution, the deliberate industrial policy or agricultural policy of replacing goods or services produced on the far side of a national border with those produced on the near side, i.e., in the same country or trade bloc. Before industrialization and globalization became widespread, there were so many incentives to buy locally that no one had to make any kind of point to do so, but with current market conditions, it is often cheaper to buy distantly-produced goods, despite any added costs in terms of packaging, transport, inspection, wholesale/retail facilities, etc. As such, one must now often take explicit action if one wants ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

European Union

The European Union (EU) is a supranational union, supranational political union, political and economic union of Member state of the European Union, member states that are Geography of the European Union, located primarily in Europe. The union has a total area of and an estimated population of over 449million as of 2024. The EU is often described as a ''sui generis'' political entity combining characteristics of both a federation and a confederation. Containing 5.5% of the world population in 2023, EU member states generated a nominal gross domestic product (GDP) of around €17.935 trillion in 2024, accounting for approximately one sixth of global economic output. Its cornerstone, the European Union Customs Union, Customs Union, paved the way to establishing European Single Market, an internal single market based on standardised European Union law, legal framework and legislation that applies in all member states in those matters, and only those matters, where the states ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Derogation

Derogation is a legal term of art, which allows for part or all of a provision in a legal measure to be applied differently, or not at all, in certain cases. European Foundation for the Improvement of Living and Working ConditionsDerogation published 11 March 2007, accessed 14 December 2023 The term is also used in Catholic canon law,Manual of Canon Law, pg. 69 and in this context differs from dispensation in that it applies to the law, whereas dispensation applies to specific people affected by the law. Definitions Black's Law Dictionary defines derogation as "the partial repeal or abolishing of a law, as by a subsequent act which limits its scope or impairs its utility and force". It is sometimes used, loosely, to mean abrogation, as in the legal maxim ''lex posterior derogat priori'' ("a subsequent law derogates the previous one"). According to ''West's Encyclopedia of American Law'', derogation "implies the taking away of only some part of a law", or it is a "partial repea ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

EU Law

European Union law is a system of Supranational union, supranational Law, laws operating within the 27 member states of the European Union (EU). It has grown over time since the 1952 founding of the European Coal and Steel Community, to promote peace, social justice, a social market economy with full employment, and environmental protection. The Treaties of the European Union agreed to by member states form its constitutional structure. EU law is interpreted by, and EU case law is created by, the judicial branch, known collectively as the Court of Justice of the European Union. Legal Act of the European Union, Legal Acts of the EU are created by a variety of European Union legislative procedure, EU legislative procedures involving the popularly elected European Parliament, the Council of the European Union (which represents member governments), the European Commission (a cabinet which is elected jointly by the Council and Parliament) and sometimes the European Council (composed o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Society Of Independent Brewers

The Society of Independent Brewers and Associates (formerly the Small Independent Brewers Association, or SIBA) is an organisation representing the interests of independent breweries in the UK. Founded in 1980, it was intended to fight the pub-tie system, under which large brewers owned 80% of the UK's pubs. It changed its name in 1995 to reflect the changing aspirations of its members, but retained its original acronym. History Peter Austin was the prime mover in establishing SIBA, and was the group's first chairman. Under his leadership, SIBA campaigned for 21 years for a progressive beer duty system, where smaller breweries would pay less tax on their products, to be introduced in the UK. Such a system was eventually adopted in 2002 by then-Chancellor Gordon Brown. Current status With growing credibility and campaigning success, SIBA has come to represent the broad spectrum of the UK independent brewing sector. There is no longer a ceiling on membership and SIBA. In 201 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Peter Austin (brewer)

Peter Austin, (18 July 1921 – 1 January 2014) was a British brewer. He founded Ringwood Brewery and was a co-founder and first chairman of the Society of Independent Brewers (SIBA). He built some 140 new breweries in the UK and 16 other countries. Early life and education Peter Austin was born in Edmonton, London on 18 July 1921. He went to Highgate School, followed by the British merchant navy training ship HMS ''Conway''. His father worked for the brewing equipment supplier Pontifex, and his great-uncle had run a brewery in Christchurch. Career Austin founded Ringwood Brewery in 1978. In 1979, David Bruce started his first Firkin Brewery brewpub in Elephant and Castle, London; Austin oversaw his choice of equipment and the design for its small basement brewery. Austin was the prime mover in establishing the Society of Independent Brewers (SIBA) in 1980, and its first chairman. Under his leadership, SIBA campaigned for 20 years, without the support of any other body ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Gordon Brown

James Gordon Brown (born 20 February 1951) is a British politician who served as Prime Minister of the United Kingdom and Leader of the Labour Party (UK), Leader of the Labour Party from 2007 to 2010. Previously, he was Chancellor of the Exchequer from 1997 to 2007 under Tony Blair. Brown was Member of Parliament (United Kingdom), Member of Parliament (MP) for Dunfermline East (UK Parliament constituency), Dunfermline East from 1983 to 2005 and for Kirkcaldy and Cowdenbeath from 2005 to 2015. He has served as Special Envoy of the Secretary-General, United Nations Special Envoy for Global Education since 2012, and he was appointed as WHO Goodwill Ambassador, World Health Organization Ambassador for Global Health Financing in 2021. A Doctor of Philosophy, doctoral graduate, Brown studied history at the University of Edinburgh. He spent his early career as a lecturer at a further education college and as a television journalist. Brown was elected to the House of Commons of the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Microbreweries

Craft beer is beer manufactured by craft breweries, which typically produce smaller amounts of beer than larger "macro" breweries and are often independently owned. Such breweries are generally perceived and marketed as emphasising enthusiasm, new flavours, and varied brewing techniques. The microbrewery movement began in both the United States and United Kingdom in the 1970s, although traditional artisanal brewing existed in Europe for centuries and subsequently spread to other countries. As the movement grew, and some breweries expanded their production and distribution, the more encompassing concept of craft brewing emerged. A brewpub is a pub that brews its own beer for sale on the premises. Producer definitions Microbrewery Although the term "microbrewery" was originally used in relation to the size of breweries, it gradually came to reflect an alternative attitude and approach to brewing flexibility, adaptability, experimentation and customer service. The term and t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Flat Tax

A flat tax (short for flat-rate tax) is a tax with a single rate on the taxable amount, after accounting for any deductions or exemptions from the tax base. It is not necessarily a fully proportional tax. Implementations are often progressive due to exemptions, or regressive in case of a maximum taxable amount. There are various tax systems that are labeled "flat tax" even though they are significantly different. The defining characteristic is the existence of only one tax rate other than zero, as opposed to multiple non-zero rates that vary depending on the amount subject to taxation. A flat tax system is usually discussed in the context of an income tax, where progressivity is common, but it may also apply to taxes on consumption, property or transfers. Major categories Flat tax proposals differ in how the subject of the tax is defined. True flat-rate income tax A true flat-rate tax is a system of taxation where one tax rate is applied to all personal income with ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |