|

Optimal Capital Income Taxation

Optimal capital income taxation is a subarea of optimal tax theory which studies the design of taxes on capital income such that a given economic criterion like utility is optimized. Some have theorized that the optimal capital income tax is zero. Starting from the conceptualization of capital income as future consumption, the taxation of capital income corresponds to a differentiated consumption tax on present and future consumption. Consequently, a capital income tax results in the distortion of individuals' saving and consumption behavior as individuals substitute the more heavily taxed future consumption with current consumption. Due to these distortions, zero taxation of capital income might be optimal, a result postulated by the Atkinson–Stiglitz theorem (1976) and the Chamley–Judd zero capital income tax result (1985/1986). Subsequent work on optimal capital income taxation has elucidated the assumptions underlying the theoretical optimality of a zero capital income ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Optimal Tax

Optimal tax theory or the theory of optimal taxation is the study of designing and implementing a tax that maximises a social welfare function subject to economic constraints. The social welfare function used is typically a function of individuals' utilities, most commonly some form of utilitarian function, so the tax system is chosen to maximise the aggregate of individual utilities. Tax revenue is required to fund the provision of public goods and other government services, as well as for redistribution from rich to poor individuals. However, most taxes distort individual behavior, because the activity that is taxed becomes relatively less desirable; for instance, taxes on labour income reduce the incentive to work. The optimization problem involves minimizing the distortions caused by taxation, while achieving desired levels of redistribution and revenue. Some taxes are thought to be less distorting, such as lump-sum taxes (where individuals cannot change their behaviour to re ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

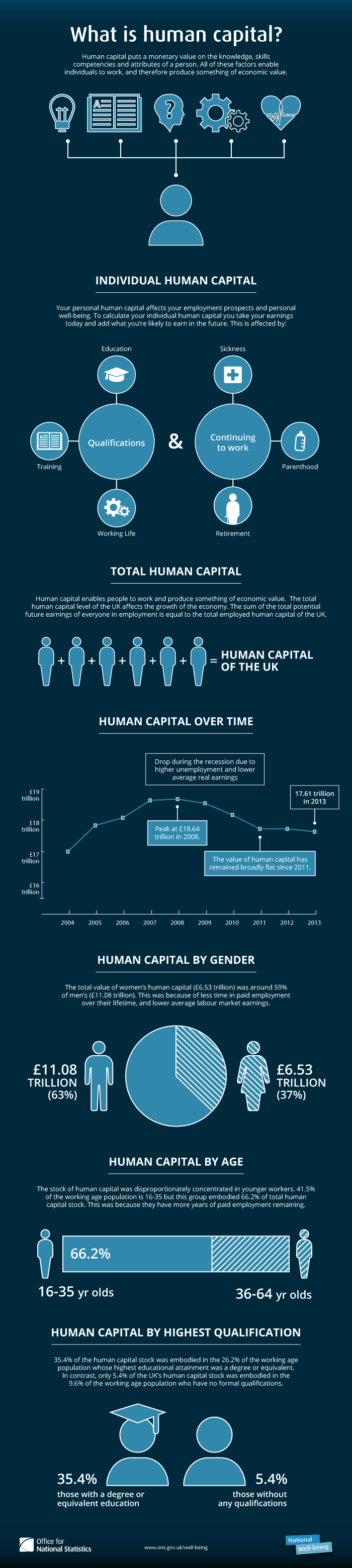

Human Capital

Human capital or human assets is a concept used by economists to designate personal attributes considered useful in the production process. It encompasses employee knowledge, skills, know-how, good health, and education. Human capital has a substantial impact on individual earnings. Research indicates that human capital investments have high economic returns throughout childhood and young adulthood. Companies can invest in human capital; for example, through education and training, improving levels of quality and production. History Adam Smith included in his definition of Capital (economics), capital "the acquired and useful abilities of all the inhabitants or members of the society". The first use of the term "human capital" may be by Irving Fisher. An early discussion with the phrase "human capital" was from Arthur Cecil Pigou: But the term only found widespread use in economics after its popularization by economists of the Chicago School of economics, Chicago School, in ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Optimal Labor Income Taxation

Optimal labour income tax is a sub-area of optimal tax theory which refers to the study of designing a tax on individual labour income such that a given economic criterion like social welfare is optimized. Efficiency-equity tradeoff The modern literature on optimal labour income taxation largely follows from James Mirrlees' "Exploration in the Theory of Optimum Income Taxation". The approach is based on asymmetric information, as the government is assumed to be unable to observe the number of hours people work or how productive they are, but can observe individuals' incomes. This imposes incentive compatibility constraints that limit the taxes which the government is able to levy, and prevents it from taxing high-productivity people at higher rates than low-productivity people. The government seeks to maximise a utilitarian social welfare function subject to these constraints. It faces a tradeoff between efficiency and equity: * Higher levels of taxation on the rich create ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Progressive Tax

A progressive tax is a tax in which the tax rate increases as the taxable amount increases. The term ''progressive'' refers to the way the tax rate progresses from low to high, with the result that a taxpayer's average tax rate is less than the person's marginal tax rate. The term can be applied to individual taxes or to a tax system as a whole. Progressive taxes are imposed in an attempt to reduce the tax incidence of people with a lower wikt:ability to pay, ability to pay, as such taxes shift the incidence increasingly to those with a higher ability-to-pay. The opposite of a progressive tax is a regressive tax, such as a sales tax, where the poor pay a larger proportion of their income compared to the rich (for example, spending on groceries and food staples varies little against income, so poor pay similar to rich even while latter has much higher income). The term is frequently applied in reference to personal income taxes, in which people with lower income pay a lower percen ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Mirrlees Review

The Mirrlees Review was a comprehensive review of the UK tax system undertaken in 2010, chaired by the Nobel laureate Sir James Mirrlees for the Institute for Fiscal Studies. The findings were launched in November 2010 and were published by Oxford University Press in two volumes. The report argued that it was possible for governments to raise the same revenues at significantly lower cost than the current system of taxation and submitted recommendations to support this notion. Panel The review panel members were: * Sir James Mirrlees * Stuart Adam * Timothy Besley * Richard Blundell * Stephen Bond * Robert Chote * Malcolm Gammie * Paul Johnson * Gareth Myles * James Poterba Key Principles The report was based on the following key principles. A tax system should: # Be designed as a whole in conjunction with a benefits system # Seek to be neutral and minimise distortion in the market # Be progressive as efficiently as possible Recommendations The report recommendations included ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Journal Of Public Economics

The ''Journal of Public Economics'' is a monthly peer-reviewed academic journal covering public economics, with particular emphasis on the application of modern economic theory and methods of quantitative analysis. It provides a forum for discussion of public policy of interest to an international readership. It was established in 1972 by Tony Atkinson and is published by Elsevier. The current editors-in-chief are John Friedman (Brown University) and Wojciech Kopczuk (Columbia University). According to the ''Journal Citation Reports'', the journal has a 2019 impact factor The impact factor (IF) or journal impact factor (JIF) of an academic journal is a type of journal ranking. Journals with higher impact factor values are considered more prestigious or important within their field. The Impact Factor of a journa ... of 2.218. References External links * Economics journals Elsevier academic journals Monthly journals Academic journals established in 1972 Public economics ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Pareto Efficiency

In welfare economics, a Pareto improvement formalizes the idea of an outcome being "better in every possible way". A change is called a Pareto improvement if it leaves at least one person in society better off without leaving anyone else worse off than they were before. A situation is called Pareto efficient or Pareto optimal if all possible Pareto improvements have already been made; in other words, there are no longer any ways left to make one person better off without making some other person worse-off. In social choice theory, the same concept is sometimes called the unanimity principle, which says that if ''everyone'' in a society (strict inequality, non-strictly) prefers A to B, society as a whole also non-strictly prefers A to B. The Pareto frontier, Pareto front consists of all Pareto-efficient situations. In addition to the context of efficiency in ''allocation'', the concept of Pareto efficiency also arises in the context of productive efficiency, ''efficiency in prod ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Second Welfare Theorem

There are two fundamental theorems of welfare economics. The first states that in economic equilibrium, a set of complete markets, with complete information, and in perfect competition, will be Pareto optimal (in the sense that no further exchange would make one person better off without making another worse off). The requirements for perfect competition are these: # There are no externalities and each actor has perfect information. # Firms and consumers take prices as given (no economic actor or group of actors has market power). The theorem is sometimes seen as an analytical confirmation of Adam Smith's "invisible hand" principle, namely that ''competitive markets ensure an efficient allocation of resources''. However, there is no guarantee that the Pareto optimal market outcome is equitative, as there are many possible Pareto efficient allocations of resources differing in their desirability (e.g. one person may own everything and everyone else nothing). The second theorem s ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Aiyagari Model

Sudhakar Rao Aiyagari (November 9, 1951 – May 20, 1997) was an Indian-born economics professor at the University of Rochester. He had previous been a leading research economist at the Minneapolis Fed, prior to which he had taught, in the 1980s, at New York University, University of Wisconsin, Madison, and Carnegie-Mellon University in Pittsburgh. Aiyagari made significant contributions to the economics literature, primarily in the areas of macroeconomics, monetary theory and intertemporal general equilibrium theory. He died of a heart attack while playing tennis aged 45. Aiyagari held a doctorate in economics (received 1981) from the University of Minnesota and master's degrees in economics and physics from Jawaharlal Nehru University in New Delhi and the Indian Institute of Technology, Delhi Indian Institute of Technology Delhi (IIT- Delhi) is a public institute of technology located in Delhi, India. It is one of the 23 Indian Institutes of Technology created to be a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Market Failure

In neoclassical economics, market failure is a situation in which the allocation of goods and services by a free market is not Pareto efficient, often leading to a net loss of economic value.Paul Krugman and Robin Wells Krugman, Robin Wells (2006). ''Economics'', New York, Worth Publishers. The first known use of the term by economists was in 1958,Francis M. Bator (1958). "The Anatomy of Market Failure," ''Quarterly Journal of Economics'', 72(3) pp351–379(press +). but the concept has been traced back to the Victorian writers John Stuart Mill and Henry Sidgwick.Steven G. Medema (2007). "The Hesitant Hand: Mill, Sidgwick, and the Evolution of the Theory of Market Failure," ''History of Political Economy'', 39(3)pp. 331��358. 200Online Working Paper. Market failures are often associated with public goods, time-inconsistent preferences, Information asymmetry, information asymmetries, Market structure, failures of competition, principal–agent problems, externalities,Jean-Jacques L ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

United States

The United States of America (USA), also known as the United States (U.S.) or America, is a country primarily located in North America. It is a federal republic of 50 U.S. state, states and a federal capital district, Washington, D.C. The 48 contiguous states border Canada to the north and Mexico to the south, with the semi-exclave of Alaska in the northwest and the archipelago of Hawaii in the Pacific Ocean. The United States asserts sovereignty over five Territories of the United States, major island territories and United States Minor Outlying Islands, various uninhabited islands in Oceania and the Caribbean. It is a megadiverse country, with the world's List of countries and dependencies by area, third-largest land area and List of countries and dependencies by population, third-largest population, exceeding 340 million. Its three Metropolitan statistical areas by population, largest metropolitan areas are New York metropolitan area, New York, Greater Los Angeles, Los Angel ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Finland

Finland, officially the Republic of Finland, is a Nordic country in Northern Europe. It borders Sweden to the northwest, Norway to the north, and Russia to the east, with the Gulf of Bothnia to the west and the Gulf of Finland to the south, opposite Estonia. Finland has a population of 5.6 million. Its capital and largest city is Helsinki. The majority of the population are Finns, ethnic Finns. The official languages are Finnish language, Finnish and Swedish language, Swedish; 84.1 percent of the population speak the first as their mother tongue and 5.1 percent the latter. Finland's climate varies from humid continental climate, humid continental in the south to boreal climate, boreal in the north. The land cover is predominantly boreal forest biome, with List of lakes of Finland, more than 180,000 recorded lakes. Finland was first settled around 9000 BC after the Last Glacial Period, last Ice Age. During the Stone Age, various cultures emerged, distinguished by differen ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |