|

Not-for-profit Corporation

A nonprofit corporation is any legal entity which has been incorporated under the law of its jurisdiction for purposes other than making profits for its owners or shareholders. Depending on the laws of the jurisdiction, a nonprofit corporation may seek official recognition as such, and may be taxed differently from for-profit corporations, and treated differently in other ways. Public-benefit nonprofit corporations A public-benefit nonprofit corporation is a type of nonprofit corporation chartered by a state government, and organized primarily or exclusively for social, educational, recreational or charitable purposes by like-minded citizens. Public-benefit nonprofit corporations are distinct in the law from mutual-benefit nonprofit corporations in that they are organized for the general public benefit, rather than for the interest of its members. They are also distinct in the law from religious corporations. Religious corporation A religious corporation is a non ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Legal Person

In law, a legal person is any person or legal entity that can do the things a human person is usually able to do in law – such as enter into contracts, lawsuit, sue and be sued, ownership, own property, and so on. The reason for the term "''legal'' person" is that some legal persons are not human persons: Company, companies and corporations (i.e., business entities) are ''persons'', legally speaking (they can legally do most of the things an ordinary person can do), but they are not, in a literal sense, human beings. Legal personhood is a prerequisite to capacity (law), legal capacity (the ability of any legal person to amend – i.e. enter into, transfer, etc. – rights and Law of obligations, obligations): it is a prerequisite for an international organization being able to sign treaty, international treaties in its own legal name, name. History The concept of legal personhood for organizations of people is at least as old as Ancient Rome: a variety of Coll ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

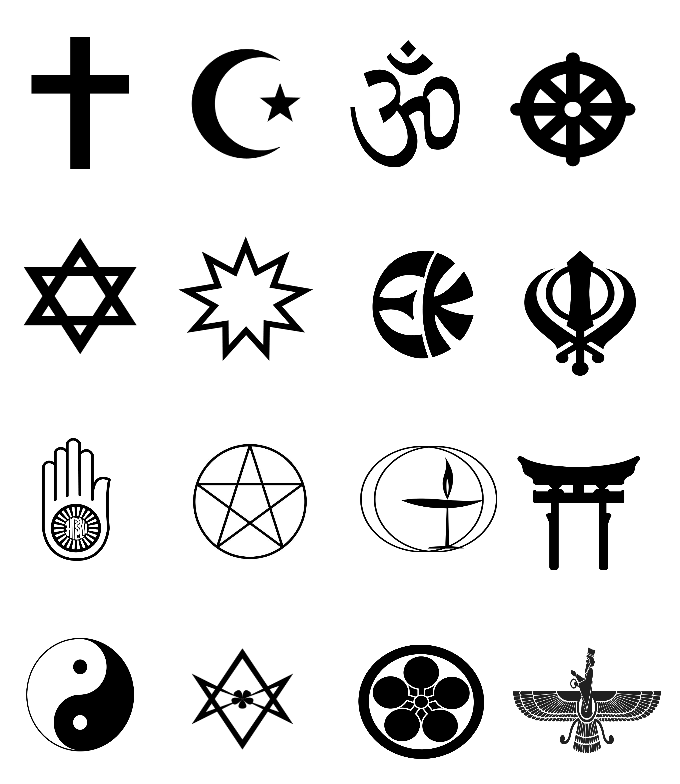

Religion

Religion is a range of social system, social-cultural systems, including designated religious behaviour, behaviors and practices, morals, beliefs, worldviews, religious text, texts, sanctified places, prophecies, ethics in religion, ethics, or religious organization, organizations, that generally relate humanity to supernatural, transcendence (religion), transcendental, and spirituality, spiritual elements—although there is no scholarly consensus over what precisely constitutes a religion. It is an essentially contested concept. Different religions may or may not contain various elements ranging from the divine, sacredness, faith,Tillich, P. (1957) ''Dynamics of faith''. Harper Perennial; (p. 1). and a supernatural being or beings. The origin of religious belief is an open question, with possible explanations including awareness of individual death, a sense of community, and dreams. Religions have sacred histories, narratives, and mythologies, preserved in oral traditions, sac ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Civic Society

In the United Kingdom, a civic society is a voluntary body or society which aims to represent the needs of a local community. Some also take the role of an amenity society. A civic society may campaign for high standards of planning of new buildings or traffic schemes, conservation of historic buildings, and may present awards for good standards. They may organise litter collections or "best kept village" cleanups. Some societies run premises and local museums. Civic Voice Civic Voice is the national membership body for civic societies in England, and replaced the former Civic Trust. The Scottish Civic Trust performs a similar role in Scotland. See also * Civic engagement * Civic virtue Civic virtue refers to the set of habits, Value (ethics), values, and Attitude (psychology), attitudes that promote the general welfare and the effective functioning of a society. Closely linked to the concept of citizenship, civic virtue () repr ... References {{reflist See also * Co ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Utility Cooperative

A utility cooperative is a type of cooperative that is tasked with the delivery of a public utility such as electricity, water or telecommunications to its members. Profits are either reinvested for infrastructure or distributed to members in the form of "patronage" or "capital credits", which are dividends paid on a member's investment in the cooperative. Each customer is a member and owner of the business. This means that all members have equal individual authority, unlike investor-owned utilities where the extent of individual authority is governed by the number of shares held. Like cooperatives operating in other sectors, many utility cooperatives conduct their affairs according to a set of ideals based on the Rochdale Principles. Some utility cooperatives respect the seventh principle, ''Concern for community'', through ''Operation Roundup'' schemes, whereby members can voluntarily have their bill rounded to the next currency unit (e.g. $55.37 becomes $56), with the diffe ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Charitable Organization

A charitable organization or charity is an organization whose primary objectives are philanthropy and social well-being (e.g. educational, Religion, religious or other activities serving the public interest or common good). The legal definition of a charitable organization (and of charity) varies between countries and in some instances regions of the country. The Charity regulators, regulation, the tax treatment, and the way in which charity law affects charitable organizations also vary. Charitable organizations may not use any of their funds to profit individual persons or entities. However, some charitable organizations have come under scrutiny for spending a disproportionate amount of their income to pay the salaries of their leadership. Financial figures (e.g. tax refunds, revenue from fundraising, revenue from the sale of goods and services or revenue from investment, and funds held in reserve) are indicators to assess the financial sustainability of a charity, especiall ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

501(c)(3)

A 501(c)(3) organization is a United States corporation, Trust (business), trust, unincorporated association or other type of organization exempt from federal income tax under section 501(c)(3) of Title 26 of the United States Code. It is one of the 29 types of 501(c) organization, 501(c) nonprofit organizations in the US. 501(c)(3) tax-exemptions apply to entities that are organized and operated exclusively for religion, religious, Charitable organization, charitable, science, scientific, literature, literary or educational purposes, for Public security#Organizations, testing for public safety, to foster national or international amateur sports competition, or for the prevention of Child abuse, cruelty to children or Cruelty to animals, animals. 501(c)(3) exemption applies also for any non-incorporated Community Chest (organization), community chest, fund, Cooperating Associations, cooperating association or foundation organized and operated exclusively for those purposes. [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Internal Revenue Service

The Internal Revenue Service (IRS) is the revenue service for the Federal government of the United States, United States federal government, which is responsible for collecting Taxation in the United States, U.S. federal taxes and administering the Internal Revenue Code, the main body of the federal statutory tax law. It is an agency of the United States Department of the Treasury, Department of the Treasury and led by the Commissioner of Internal Revenue, who is appointed to a five-year term by the President of the United States. The duties of the IRS include providing tax assistance to taxpayers; pursuing and resolving instances of erroneous or fraudulent tax filings; and overseeing various benefits programs, including the Affordable Care Act. The IRS originates from the Commissioner of Internal Revenue, a federal office created in 1862 to assess the nation's first income tax to fund the American Civil War. The temporary measure funded over a fifth of the Union's war expens ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Nonprofit

A nonprofit organization (NPO), also known as a nonbusiness entity, nonprofit institution, not-for-profit organization, or simply a nonprofit, is a non-governmental (private) legal entity organized and operated for a collective, public, or social benefit, as opposed to an entity that operates as a business aiming to generate a Profit (accounting), profit for its owners. A nonprofit organization is subject to the non-distribution constraint: any revenues that exceed expenses must be committed to the organization's purpose, not taken by private parties. Depending on the local laws, charities are regularly organized as non-profits. A host of organizations may be non-profit, including some political organizations, schools, hospitals, business associations, churches, foundations, social clubs, and consumer cooperatives. Nonprofit entities may seek approval from governments to be Tax exemption, tax-exempt, and some may also qualify to receive tax-deductible contributions, but an enti ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Corporation Sole

A corporation sole is a legal entity consisting of a single ("sole") incorporated office, occupied by a single ("sole") natural person.Technical Manual Insolvencydirect.bis.gov.uk This structure allows corporations (often religious corporations or Commonwealth governments) to pass without interruption from one officeholder to the next, giving positions legal continuity with subsequent officeholders having identical powers and possessions to their predecessors. A corporation sole is one of two types of |

Public Benefit Nonprofit Corporation

A public-benefit nonprofit corporationnonprofit corporation chartered by a state governments of the United States, U.S. state government and organized primarily or exclusively for Institution, social, educational institution, educational, Recreation, recreational or Charitable organization, charitable purposes by like-minded citizens. Public-benefit nonprofit corporations are distinct in the law from mutual-benefit nonprofit corporations in that they are organized for the general public benefit rather than for the interest of its members. They are also distinct in the law from religious corporations. See also * Civic society * New York state public-benefit corporations New York state public-benefit corporations and authorities operate like quasi-private corporations, with boards of directors appointed by elected officials, overseeing both publicly operated and privately operated systems. Public-benefit nonprofi ... References External links Non-profit corporations">* ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Mutual Benefit Nonprofit Corporation

A mutual-benefit nonprofit corporation or membership corporation is a type of nonprofit corporation in the US, similar to other mutual benefit organizations found in some of common law nations, chartered by government with a mandate to serve the mutual benefit of its members. A mutual-benefit corporation can be non-profit or not-for-profit in the United States, but it cannot obtain IRS 501(c)(3) non-profit status as a charitable organization. It is distinct in U.S. law from public-benefit nonprofit corporations, and religious corporations. Mutual benefit corporations must still file tax returns and pay income tax because they are not formed for a purpose that is meant to benefit the general public (unlike public-benefit nonprofit corporations) but rather to provide an association of people with a common benefit. Due to its private purpose, a mutual benefit corporation pays the same taxes as a regular for-profit corporation (C corporation tax rates). However, the IRS still allows for ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |