|

Nominal Value

In economics, nominal value refers to value measured in terms of absolute money amounts, whereas real value is considered and measured against the actual goods or services for which it can be exchanged at a given time. Real value takes into account inflation and the value of an asset in relation to its purchasing power. In macroeconomics, the real gross domestic product compensates for inflation so economists can exclude inflation from growth figures, and see how much an economy actually grows. Nominal GDP would include inflation, and thus be higher. Commodity bundles, price indices and inflation A commodity bundle is a sample of goods, which is used to represent the sum total of goods across the economy to which the goods belong, for the purpose of comparison across different times (or locations). At a single point of time, a commodity bundle consists of a list of goods, and each good in the list has a market price and a quantity. The market value of the good is the market p ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Economics

Economics () is a behavioral science that studies the Production (economics), production, distribution (economics), distribution, and Consumption (economics), consumption of goods and services. Economics focuses on the behaviour and interactions of Agent (economics), economic agents and how economy, economies work. Microeconomics analyses what is viewed as basic elements within economy, economies, including individual agents and market (economics), markets, their interactions, and the outcomes of interactions. Individual agents may include, for example, households, firms, buyers, and sellers. Macroeconomics analyses economies as systems where production, distribution, consumption, savings, and Expenditure, investment expenditure interact; and the factors of production affecting them, such as: Labour (human activity), labour, Capital (economics), capital, Land (economics), land, and Entrepreneurship, enterprise, inflation, economic growth, and public policies that impact gloss ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Real Interest Rate

The real interest rate is the rate of interest an investor, saver or lender receives (or expects to receive) after allowing for inflation. It can be described more formally by the Fisher equation, which states that the real interest rate is approximately the nominal interest rate minus the inflation rate. If, for example, an investor were able to lock in a 5% interest rate for the coming year and anticipated a 2% rise in prices, they would expect to earn a real interest rate of 3%. The expected real interest rate is not a single number, as different investors have different expectations of future inflation. Since the inflation rate over the course of a loan is not known initially, volatility in inflation represents a risk to both the lender and the borrower. In the case of contracts stated in terms of the nominal interest rate, the real interest rate is known only at the end of the period of the loan, based on the realized inflation rate; this is called the ex-post real int ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Inflation

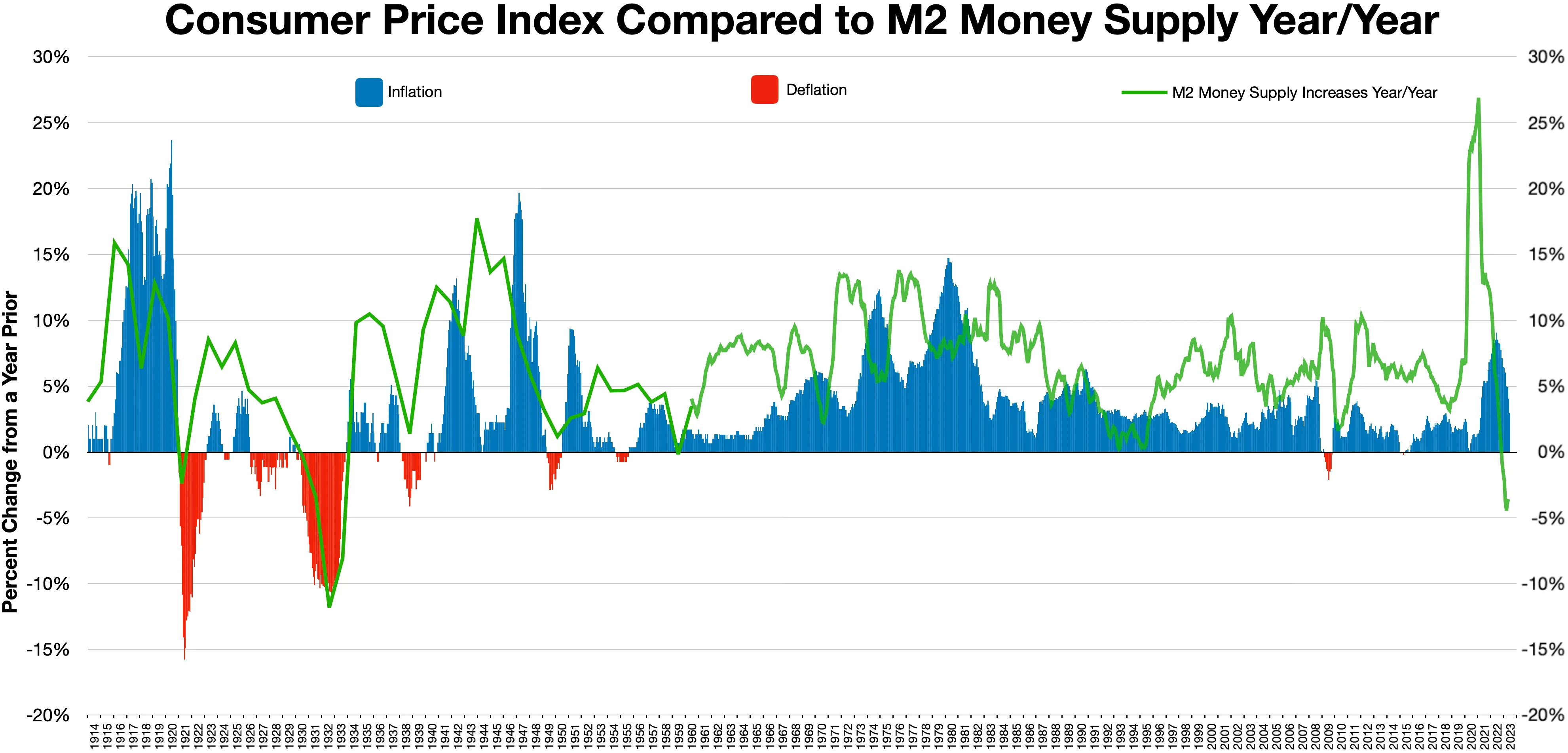

In economics, inflation is an increase in the average price of goods and services in terms of money. This increase is measured using a price index, typically a consumer price index (CPI). When the general price level rises, each unit of currency buys fewer goods and services; consequently, inflation corresponds to a reduction in the purchasing power of money. The opposite of CPI inflation is deflation, a decrease in the general price level of goods and services. The common measure of inflation is the inflation rate, the annualized percentage change in a general price index. Changes in inflation are widely attributed to fluctuations in Real versus nominal value (economics), real demand for goods and services (also known as demand shocks, including changes in fiscal policy, fiscal or monetary policy), changes in available supplies such as during energy crisis, energy crises (also known as supply shocks), or changes in inflation expectations, which may be self-fulfilling. Moderat ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Index (economics)

In economics, statistics, and finance, an index is a number that measures how a group of related data points—like prices, company performance, productivity, or employment—changes over time to track different aspects of economic health from various sources. Consumer-focused indices include the Consumer Price Index (CPI), which shows how retail prices for goods and services shift in a fixed area, aiding adjustments to salaries, Bond (finance), bond interest rates, and tax thresholds for inflation. The cost-of-living index (COLI) compares living expenses over time or across places.Turvey, Ralph. (2004) Consumer Price Index Manual: Theory And Practice.' Page 11. Publisher: International Labour Organization. . ''The Economist''’s Big Mac Index uses a Big Mac’s cost to explore currency values and purchasing power. Market performance indices track trends like company value or employment. Stock market index, Stock market indices include the Dow Jones Industrial Average and S&P 500, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Repression

Financial repression comprises "policies that result in savers earning returns below the rate of inflation" to allow banks to "provide cheap loans to companies and governments, reducing the burden of repayments." It can be particularly effective at liquidating government debt denominated in domestic currency. It can also lead to large expansions in debt "to levels evoking comparisons with the excesses that generated Japan’s lost decade and the 1997 Asian financial crisis." The term was introduced in 1973 by Stanford economists Edward S. Shaw and Ronald I. McKinnon to "disparage growth-inhibiting policies in emerging markets." Mechanism Financial repression may consist of any of the following, alone or in combination.: #Explicit or indirect capping of interest rates, such as on government debt and deposit rates (e.g., Regulation Q). #Government ownership or control of domestic banks and financial institutions with barriers that limit other institutions from entering the m ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Deflation

In economics, deflation is a decrease in the general price level of goods and services. Deflation occurs when the inflation rate falls below 0% and becomes negative. While inflation reduces the value of currency over time, deflation increases it. This allows more goods and services to be bought than before with the same amount of currency. Deflation is distinct from '' disinflation'', a slowdown in the inflation rate; i.e., when inflation declines to a lower rate but is still positive. Economists generally believe that a sudden deflationary shock is a problem in a modern economy because it increases the real value of debt, especially if the deflation is unexpected. Deflation may also aggravate recessions and lead to a deflationary spiral . Some economists argue that prolonged deflationary periods are related to the underlying technological progress in an economy, because as productivity increases ( TFP), the cost of goods decreases. Deflation usually happens when supply is hi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Cost-of-living Index

A cost-of-living index is a theoretical price index that measures relative cost of living over time or regions. It is an index that measures differences in the price of goods and services, and allows for substitutions with other items as prices vary. There are many different methods that have been developed to approximate the cost of living index. A Konüs index is a type of cost-of-living index that uses an expenditure function such as one used in assessing expected compensating variation. The expected indirect utility is equated in both periods. Application to price index theory The United States Consumer Price Index (CPI) is a price index that is based on the idea of a cost-of-living index. The U.S. Department of Labor's Bureau of Labor Statistics (BLS) explains the differences: The CPI frequently is called a cost-of-living index, but it differs in important ways from a complete cost-of-living measure. BLS has for some time used a cost-of-living framework in making prac ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Constant Item Purchasing Power Accounting

Constant purchasing power accounting (CPPA) is an accounting model that is an alternative to model historical cost accounting under high inflation and hyper-inflationary environments. It has been approved for use by the International Accounting Standards Board ( IASB) and the US Financial Accounting Standards Board ( FASB). Under this IFRS and US GAAP authorized system, financial capital maintenance is always measured in units of constant purchasing power (CPP) in terms of a Daily CPI (consumer price index) during low inflation, high inflation, hyperinflation and deflation; i.e., during all possible economic environments. During all economic environments it can also be measured in a monetized daily indexed unit of account (e.g. the Unidad de Fomento in Chile) or in terms of a daily relatively stable foreign currency parallel rate, particularly during hyperinflation when a government refuses to publish CPI data. Authorized by the IASB during low inflation In the IASB's original F ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Classical Dichotomy

In macroeconomics, the classical dichotomy is the idea, attributed to classical and pre-Keynesian economics, that real and nominal variables can be analyzed separately. To be precise, an economy exhibits the classical dichotomy if real variables such as output and real interest rates can be completely analyzed without considering what is happening to their nominal counterparts, the money value of output and the interest rate. In particular, this means that real GDP and other real variables can be determined without knowing the level of the nominal money supply or the rate of inflation. An economy exhibits the classical dichotomy if money is neutral, affecting only the price level, not real variables. As such, if the classical dichotomy holds, money only affects absolute rather than the relative prices between goods. The classical dichotomy was integral to the thinking of some pre-Keynesian economists (" money as a veil") as a long-run proposition and is found today in new clas ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Aggregation Problem

In economics, an ''aggregate'' is a summary measure. It replaces a vector that is composed of many real numbers by a single real number, or a scalar. Consequently, there occur various problems that are inherent in the formulations that use aggregated variables.Franklin M. Fisher (1987). "aggregation problem," '' The New Palgrave: A Dictionary of Economics'', v. 1, pp.53-55 The aggregation problem is the problem of finding a valid way to treat an empirical or theoretical aggregate as if it reacted like a less-aggregated measure, say, about behavior of an individual agent as described in general microeconomic theory (see representative agent and heterogeneity in economics). The second meaning of "aggregation problem" is the theoretical difficulty in using and treating laws and theorems that include aggregate variables. A typical example is the aggregate production function. Another famous problem is Sonnenschein-Mantel-Debreu theorem. Most of macroeconomic statements comp ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Cross-sectional Data

In statistics and econometrics, cross-sectional data is a type of data collected by observing many subjects (such as individuals, firms, countries, or regions) at a single point or period of time. Analysis of cross-sectional data usually consists of comparing the differences among selected subjects, typically with no regard to differences in time. For example, if we want to measure current obesity levels in a population, we could draw a sample of 1,000 people randomly from that population (also known as a cross section of that population), measure their weight and height, and calculate what percentage of that sample is categorized as obese. This cross-sectional sample provides us with a snapshot of that population, at that one point in time. Note that we do not know based on one cross-sectional sample if obesity is increasing or decreasing; we can only describe the current proportion. Cross-sectional data differs from ''time series'' data, in which the same small-scale or aggreg ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Time-series

In mathematics, a time series is a series of data points indexed (or listed or graphed) in time order. Most commonly, a time series is a sequence taken at successive equally spaced points in time. Thus it is a sequence of discrete-time data. Examples of time series are heights of ocean tides, counts of sunspots, and the daily closing value of the Dow Jones Industrial Average. A time series is very frequently plotted via a run chart (which is a temporal line chart). Time series are used in statistics, signal processing, pattern recognition, econometrics, mathematical finance, weather forecasting, earthquake prediction, electroencephalography, control engineering, astronomy, communications engineering, and largely in any domain of applied science and engineering which involves temporal measurements. Time series ''analysis'' comprises methods for analyzing time series data in order to extract meaningful statistics and other characteristics of the data. Time series ''forecastin ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |