|

Managed Futures Account

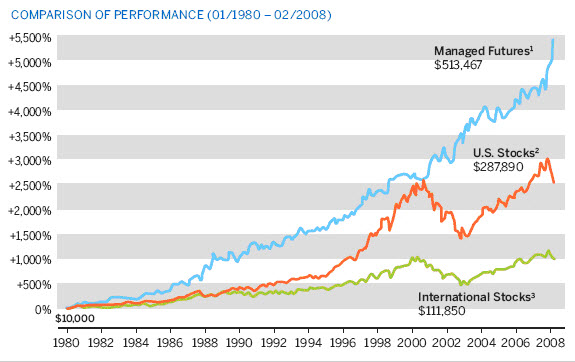

A managed futures account (MFA) or managed futures fund (MFF) is a type of alternative investment in the US in which trading in the Futures exchange, futures markets is managed by another person or entity, rather than the fund's owner. Managed futures accounts include, but are not limited to, commodity pools. These funds are operated by commodity trading advisors (CTAs) or Commodity Pool Operator, commodity pool operators (CPOs), who are generally regulated in the United States by the Commodity Futures Trading Commission and the National Futures Association. , the assets under management held by managed futures accounts totaled $340 billion. Characteristics Managed futures accounts are operated on behalf of an individual by professional money managers such as Commodity trading advisor, CTAs or Commodity Pool Operator, CPOs, trading in Futures contract, futures or other derivative securities. The funds can take both Long (finance), long and Short (finance), short positions in future ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Alternative Investment

An alternative investment, also known as an alternative asset or alternative investment fund (AIF), is an investment in any Asset classes, asset class excluding capital stocks, Bond (finance), bonds, and cash. The term is a relatively loose one and includes tangible investment, tangible assets such as Gold as an investment, precious metals, collectibles (art, Investment wine, wine, antiques, vintage cars, Coin collecting, coins, watches, musical instruments, or Stamp collecting, stamps) and some financial assets such as real estate, commodities, private equity, distressed securities, hedge funds, exchange funds, carbon credits, venture capital, film production, Derivative (finance), financial derivatives, Cryptocurrency, cryptocurrencies, Non-fungible token, non-fungible tokens, and Tax Receivable Agreements. Investments in real estate, forestry and Shipping investments, shipping are also often termed "alternative" despite the ancient use of such real assets to enhance and pre ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Investment Company Institute

The Investment Company Institute (ICI) is a global association of regulated funds, including mutual funds, exchange-traded funds, closed-end funds, and unit investment trusts in the United States, and similar funds offered to investors in jurisdictions worldwide. ICI encourages adherence to ethical standards, promotes public financial literacy about funds and investing, and advances the interests of investment funds and their shareholders, directors, and advisers. History Following the stock market crash of 1929 that presaged the Great Depression, Congress passed a series of acts related to securities and financial regulation. One of these, the Investment Company Act of 1940, clearly defined the responsibilities of investment companies. This same year, what would become ICI was established in New York as the National Committee of Investment Companies, an organization to aid in the administration of the act. It became the National Association of Investment Companies (NAIC) in 19 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

United States Chamber Of Commerce

The United States Chamber of Commerce (USCC) is a business association advocacy group and is the largest lobbying group in the United States. The group was founded in April 1912 out of local chambers of commerce at the urging of President William Howard Taft and his Secretary of Commerce and Labor Charles Nagel. President Taft's belief was that the "government needed to deal with a group that could speak with authority for the interests of business." The U.S. Chamber of Commerce claims to represent three million small business owners, but this claim is disputed because the organization is funded primarily by the largest corporations in the United States. The current president and CEO of the Chamber is Suzanne Clark. She worked for the group from 1997 to 2007 and returned in 2014, holding multiple executive roles before being named its first female CEO in February 2021. History The U.S. Chamber of Commerce was founded at a meeting of delegates on April 22, 1912. An importan ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Swap (finance)

In finance, a swap is an agreement between two counterparty, counterparties to trade, exchange financial instruments, cashflows, or payments for a certain time. The instruments can be almost anything but most swaps involve cash based on a notional principal amount.Financial Industry Business Ontology Version 2 , Annex D: Derivatives, EDM Council, Inc., Object Management Group, Inc., 2019 The general swap can also be seen as a series of forward contracts through which two parties exchange financial instruments, resulting in a common series of exchange dates and two streams of instruments, the ''legs'' of the swap. The legs can be almost anything but usually one leg involves cash flows based on a notional principal amount that both parties agree to. This principal usu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Commodity Futures Trading Commission Act Of 1974

Commodity Futures Trading Commission (CFTC) Act of 1974 (P.L. 93-463) created the Commodity Futures Trading Commission, to replace the U.S. Department of Agriculture's Commodity Exchange Authority, as the independent federal agency responsible for regulating the futures trading industry. The Act made extensive changes in the basic authority of Commodity Exchange Act of 1936, which itself had made extensive changes in the original Grain Futures Act of 1922. (7 U.S.C. 1 et seq.). The H.R. 13113 legislation was passed by the 93rd U.S. Congressional session and signed into law by the 38th President of the United States Gerald Ford on October 23, 1974. References United States federal agriculture legislation United States federal commodity and futures legislation 1974 in law 93rd United States Congress {{US-fed-statute-stub ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Commodity Exchange Act

Commodity Exchange Act (ch. 545, , enacted June 15, 1936) is a federal act enacted in 1936 by the U.S. Government, with some of its provisions amending the Grain Futures Act of 1922. The Act provides federal regulation of all commodities and futures trading activities and requires all futures and commodity options to be traded on organized exchanges. In 1974, the Commodity Futures Trading Commission (CFTC) was created as a result of the Commodity Exchange Act, and in 1982 the National Futures Association (NFA) was created by CFTC. See also * Grain Futures Act * National Futures Association *Commodity Futures Trading Commission *Futures exchange *Futures contract In finance, a futures contract (sometimes called futures) is a standardized legal contract to buy or sell something at a predetermined price for delivery at a specified time in the future, between parties not yet known to each other. The item tr ... * Commodity Futures Modernization Act of 2000 External links 7 U.S ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Grain Futures Act

The Grain Futures Act (ch. 369, , ) is a United States federal law enacted September 21, 1922 involving the regulation of trading in certain commodity futures, and causing the establishment of the Grain Futures Administration, a predecessor organization to the Commodity Futures Trading Commission. The bill that became the Grain Futures Act was introduced in the United States Congress two weeks after the US Supreme Court declared the Futures Trading Act of 1921 unconstitutional in Hill v. Wallace 259 U.S. 44 (1922).Markham, Jerry The history of Commodity futures Trading and its Regulation, 13 The Grain Futures Act was held to be constitutional by the US Supreme Court in Board of Trade of City of Chicago v. Olsen 262 US 1 (1923). In 1936 it was revised into the Commodity Exchange Act (CEA). The act was further superseded in 1974 by establishing the Commodity Futures Trading Commission. In 1982 the Commodity Futures Trading Commission created the National Futures Associati ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Futures Trading

In finance, a futures contract (sometimes called futures) is a standardized legal contract to buy or sell something at a predetermined price for delivery at a specified time in the future, between parties not yet known to each other. The item transacted is usually a commodity or financial instrument. The predetermined price of the contract is known as the ''forward price'' or ''delivery price''. The specified time in the future when delivery and payment occur is known as the ''delivery date''. Because it derives its value from the value of the underlying asset, a futures contract is a derivative. Contracts are traded at futures exchanges, which act as a marketplace between buyers and sellers. The buyer of a contract is said to be the long position holder and the selling party is said to be the short position holder. As both parties risk their counter-party reneging if the price goes against them, the contract may involve both parties lodging as security a margin of the value of ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

S&P 500

The Standard and Poor's 500, or simply the S&P 500, is a stock market index tracking the stock performance of 500 leading companies listed on stock exchanges in the United States. It is one of the most commonly followed equity indices and includes approximately 80% of the total market capitalization of U.S. public companies, with an aggregate market cap of more than $49.8 trillion as of March 31, 2025. The S&P 500 index is a Free-float weighted/ capitalization-weighted index. As of April 2025, the ten largest companies on the list of S&P 500 companies accounted for approximately 35% of the market capitalization of the index and were, in order of highest to lowest weighting: Apple (6.4%), Microsoft (6.2%), Nvidia (6.0%), Amazon.com (3.8%), Alphabet (3.6%, including both class A & C shares), Meta Platforms (2.7%), Berkshire Hathaway (2.0%), Broadcom (1.8%), Tesla (1.6%), and JPMorgan Chase (1.4%). The components that have increased their dividends in 25 consecutive ye ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Volatility (finance)

In finance, volatility (usually denoted by "sigma, σ") is the Variability (statistics), degree of variation of a trading price series over time, usually measured by the standard deviation of logarithmic returns. Historic volatility measures a time series of past market prices. Implied volatility looks forward in time, being derived from the market price of a market-traded derivative (in particular, an option). Volatility terminology Volatility as described here refers to the actual volatility, more specifically: * actual current volatility of a financial instrument for a specified period (for example 30 days or 90 days), based on historical prices over the specified period with the last observation the most recent price. * actual historical volatility which refers to the volatility of a financial instrument over a specified period but with the last observation on a date in the past **near synonymous is realized volatility, the square root of the realized variance, in turn c ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |