|

Jumbo Loan

In the United States, a jumbo mortgage is a mortgage loan that may have high credit quality, but is in an amount above conventional conforming loan limits.Lemke, Lins and Picard, ''Mortgage-Backed Securities'', Chapter 3 (Thomson West, 2013 ed.). This standard is set by the two government-sponsored enterprises (GSE), Fannie Mae and Freddie Mac, and sets the limit on the maximum value of any individual mortgage they will purchase from a lender. Fannie Mae (FNMA) and Freddie Mac (FHLMC) are large agencies that purchase the bulk of U.S. residential mortgages from banks and other lenders, allowing them to free up liquidity to lend more mortgages. When FNMA and FHLMC limits don't cover the full loan amount, the loan is referred to as a "jumbo mortgage". Traditionally, the interest rates on jumbo mortgages are higher than for conforming mortgages, however with GSE fees increasing, Jumbo loans have recently seen lower interest rates than conforming loans. History On February 13, 2008, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

United States

The United States of America (USA), also known as the United States (U.S.) or America, is a country primarily located in North America. It is a federal republic of 50 U.S. state, states and a federal capital district, Washington, D.C. The 48 contiguous states border Canada to the north and Mexico to the south, with the semi-exclave of Alaska in the northwest and the archipelago of Hawaii in the Pacific Ocean. The United States asserts sovereignty over five Territories of the United States, major island territories and United States Minor Outlying Islands, various uninhabited islands in Oceania and the Caribbean. It is a megadiverse country, with the world's List of countries and dependencies by area, third-largest land area and List of countries and dependencies by population, third-largest population, exceeding 340 million. Its three Metropolitan statistical areas by population, largest metropolitan areas are New York metropolitan area, New York, Greater Los Angeles, Los Angel ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Housing Discrimination In The United States

Housing refers to a property containing one or more shelter as a living space. Housing spaces are inhabited either by individuals or a collective group of people. Housing is also referred to as a human need and human right, playing a critical role in shaping the quality of life for individuals, families, and communities. As a result, the quality and type of housing an individual or collective inhabits plays a large role in housing organization and housing policy. Overview Housing is a physical structure indented for dwelling, lodging or shelter that homes people and provides them with a place to reside. Housing includes a wide range of sub-genres from apartments and houses to temporary shelters and emergency accommodations. Access to safe, affordable, and stable housing is essential for a person to achieve optimal health, safety, and overall well-being. Housing affects economic, social, and cultural opportunities as it is directly linked to education, employment, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

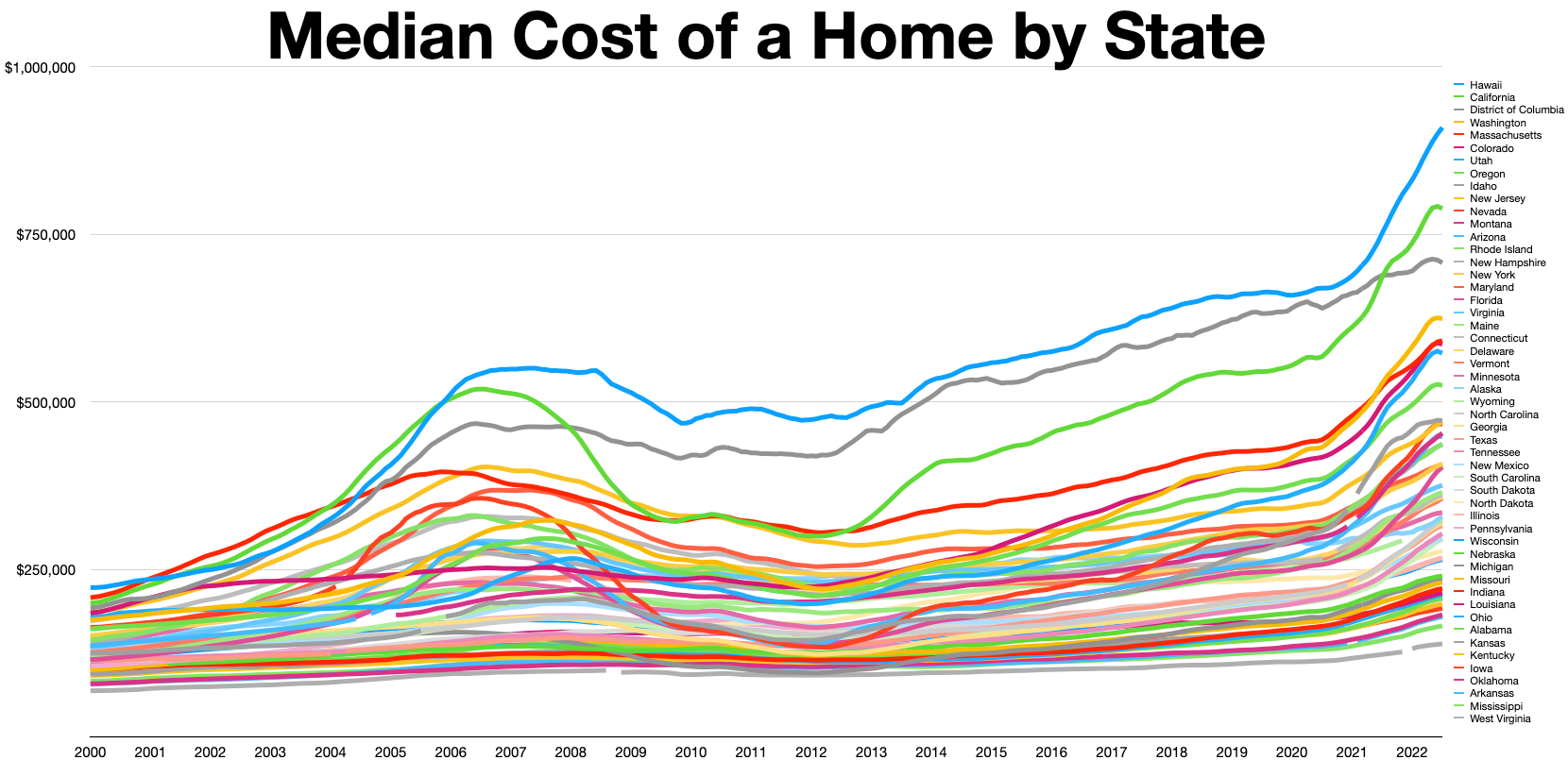

Housing Crisis

An affordable housing crisis or housing crisis is either a widespread housing shortage in places where people want to live or a financial crisis in the housing market. Housing crises can contribute to homelessness and housing insecurity. They are difficult to address, because they are a complex "web of problems and dysfunctions" with many contributing factors, but generally result from housing costs rising faster than household income. There is an ongoing decades-long increasing trend of cities around the world facing housing crises. Some notable examples of financial crises in the housing market are the American subprime mortgage crisis in 2007-2008 and the Chinese property sector crisis beginning in 2020. Global In much of the world, incomes are too low to afford basic formal housing, as housing expenses have increased faster than wages in many cities, especially since the 2008 financial crisis. In some places, this leads to informal settlement in slums or shantytowns, wh ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Affordable Housing In The United States

The term "affordable housing" refers to housing that is considered economically accessible for individuals and families whose household income falls at or below the Area Median Income (AMI), as evaluated by either national or local government authorities through an officially recognized housing affordability index. However, in the United States, the term is mostly used to refer to housing units that are deed restricted (for typically at least 30 years) to households considered Low-Income (80% of AMI), Very Low-Income (50% of AMI), and Extremely Low-Income (30% of AMI). These units are often constructed by non-profit "affordable housing developers" who use a combination of private money and government subsidies. For-profit developers, when building market-rate developments, may include some "affordable" units (often 10-30%), if required as part of a city's inclusionary zoning mandate. Housing has consistently been the largest expenditure within the average American family's financi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

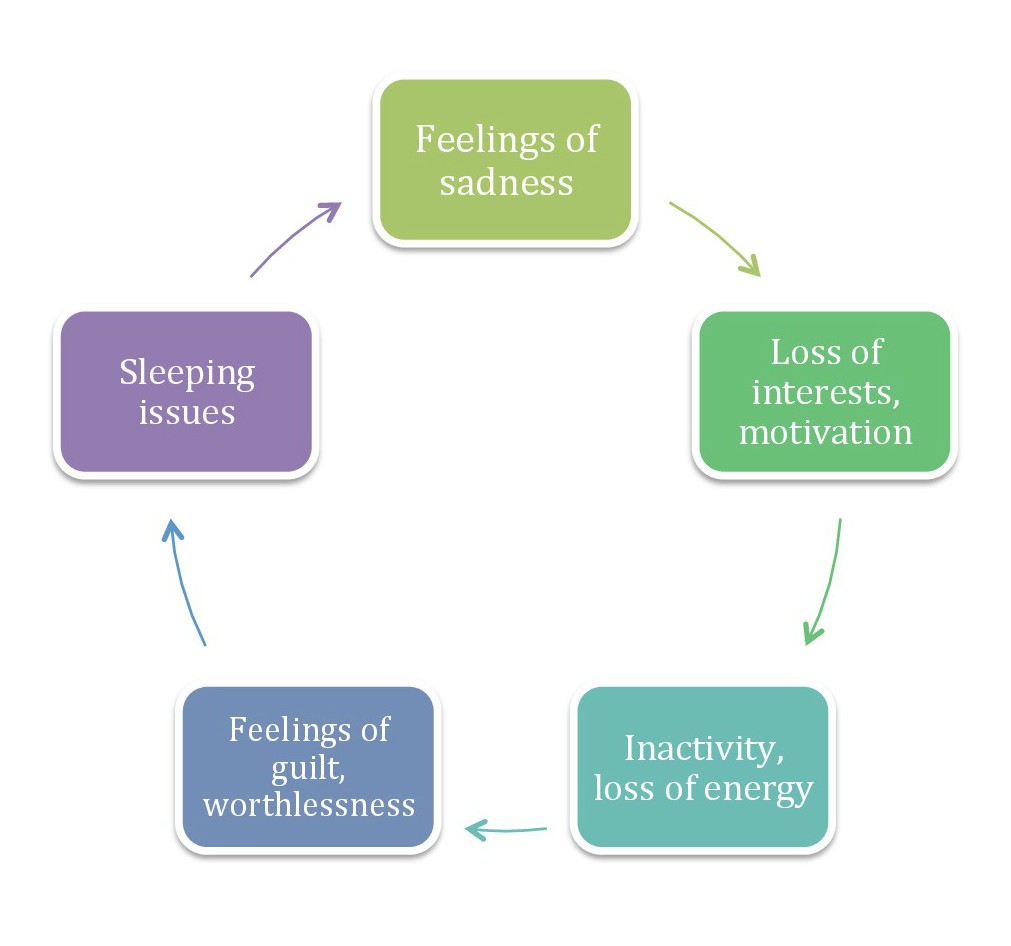

Virtuous Circle And Vicious Circle

A vicious circle (or cycle) is a complex chain of events that reinforces itself through a feedback loop, with detrimental results. It is a system with no tendency toward equilibrium (social, economic, ecological, etc.), at least in the short run. Each iteration of the cycle reinforces the previous one, in an example of positive feedback. A vicious circle will continue in the direction of its momentum until an external factor intervenes to break the cycle. A well-known example of a vicious circle in economics is hyperinflation. When the results are not detrimental but beneficial, the term virtuous cycle is used instead. Examples Subprime mortgage crisis The contemporary subprime mortgage crisis is a complex group of vicious circles, both in its genesis and in its manifold outcomes, most notably the late 2000s recession. A specific example is the circle related to housing. As housing prices decline, more homeowners go " underwater", when the market value of a home drop ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Foreclosure

Foreclosure is a legal process in which a lender attempts to recover the balance of a loan from a borrower who has Default (finance), stopped making payments to the lender by forcing the sale of the asset used as the Collateral (finance), collateral for the loan. Formally, a Mortgage law#Mortgage lender, mortgage lender (mortgagee), or other lienholder, obtains a termination of a Mortgage law#Borrower, mortgage borrower (mortgagor)'s Equity of redemption, equitable right of redemption, either by court order or by operation of law (after following a specific statutory procedure). Usually, a lender obtains a security interest from a borrower who mortgages or pledges an asset like a house to secure the loan. If the borrower default (finance), defaults and the lender tries to Repossession, repossess the property, courts of equity can grant the borrower the Equity of redemption, equitable right of redemption if the borrower repays the debt. While this equitable right exists, it is ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Subprime

In finance, subprime lending (also referred to as near-prime, subpar, non-prime, and second-chance lending) is the provision of loans to people in the United States who may have difficulty maintaining the repayment schedule. Historically, subprime borrowers were defined as having FICO scores below 600, although this threshold has varied over time. These loans are characterized by higher interest rates, poor quality collateral, and less favorable terms in order to compensate for higher credit risk. During the early to mid-2000s, many subprime loans were packaged into mortgage-backed securities (MBS) and ultimately defaulted, contributing to the 2008 financial crisis.Lemke, Lins and Picard, ''Mortgage-Backed Securities'', Chapter 3 (Thomson West, 2013 ed.). Defining subprime risk The term ''subprime'' refers to the credit quality of particular borrowers, who have weakened credit histories and a greater risk of loan default than prime borrowers. As people become economically ac ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

United States Housing Bubble

The 2000s United States housing bubble or house price boom or 2000s housing cycle was a sharp run up and subsequent collapse of house asset prices affecting over half of the U.S. states. In many regions a Real-estate bubble, real estate bubble, it was the impetus for the subprime mortgage crisis. Housing prices peaked in early 2006, started to decline in 2006 and 2007, and reached new lows in 2011. On December 30, 2008, the Case–Shiller index, Case–Shiller home price index reported the largest price drop in its history. The credit crisis resulting from the bursting of the housing bubble is an important cause of the Great Recession in the United States. Increased foreclosure rates in 2006–2007 among U.S. homeowners led to a Subprime mortgage crisis, crisis in August 2008 for the Subprime mortgage, subprime, Alt-A, collateralized debt obligation (CDO), mortgage loan, mortgage, Fixed income, credit, hedge fund, and foreign bank markets. In October 2007, Henry Paulson, the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Closing Costs

Closing may refer to: Business and law * Closing (law), a closing argument, a summation * Closing (real estate), the final step in executing a real estate transaction * Closing (sales), the process of making a sale * Closing a business, the process by which an organization ceases operations Computing * Closing (morphology), in image processing * Finalize (optical discs), the optional last step in the authoring process * CLOSING, a TCP connection state Other uses * Closing a letter or e-mail (see valediction) * "Closing", a song by Enter Shikari from the album ''Take to the Skies'' See also * Closing argument * ''Closing Bell'', CNBC television programs * Closing credits * Closing statement (other) * Closing time (other) * Close (other) * Closed (other) Closed may refer to: Mathematics * Closure (mathematics), a set, along with operations, for which applying those operations on members always results in a member of the set * Closed se ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Down Payment

In accounting, a down payment (also called a deposit in British English) is an initial up-front partial payment for the purchase of expensive goods or services such as a car or a house. It is usually paid in cash or equivalent at the time of finalizing the transaction. A loan of some sort is then required to finance the remainder of the payment. The main purposes of a down payment is to ensure that the lending institution has enough capital to create money for a loan in fractional reserve banking systems and to recover some of the balance due on the loan in the event that the borrower defaults. In real estate, the asset is used as collateral in order to secure the loan against default. If the borrower fails to repay the loan, the lender is legally entitled to sell the asset and retain enough of the proceeds to repay the remaining balance on the loan, including fees and interest added. A down payment, in this case, reduces the lender's risk to less than the value of the colla ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Mortgage Loan

A mortgage loan or simply mortgage (), in civil law (legal system), civil law jurisdictions known also as a hypothec loan, is a loan used either by purchasers of real property to raise funds to buy real estate, or by existing property owners to raise funds for any purpose while putting a lien on the property being mortgaged. The loan is "collateral (finance), secured" on the borrower's property through a process known as mortgage origination. This means that a Mortgage law, legal mechanism is put into place which allows the lender to take possession and sell the secured property ("foreclosure" or "repossession") to pay off the loan in the event the borrower defaults on the loan or otherwise fails to abide by its terms. The word ''mortgage'' is derived from a Law French term used in Legal professions in England and Wales, Britain in the Middle Ages meaning "death pledge" and refers to the pledge ending (dying) when either the obligation is fulfilled or the property is taken throu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |