|

Incorporated In Delaware

The Delaware General Corporation Law (sometimes abbreviated DGCL), officially the General Corporation Law of the State of Delaware (Title 8, Chapter 1 of the Delaware Code), is the statute of the Delaware Code that governs corporate law in the U.S. state of Delaware. The statute was adopted in 1899. Since the 1913 anti-corporation reforms in New Jersey under the governorship of Woodrow Wilson, Delaware has become the most prevalent jurisdiction in United States corporate law and has been described as the ''de facto'' corporate capital of the United States. Delaware is considered a corporate haven because of its business-friendly/anti-consumer corporate laws compared to most other U.S. states. 66% of the ''Fortune'' 500, including Walmart and Amazon (two of the world's largest companies by revenue) are incorporated (and therefore have their domiciles for service of process purposes) in the state. Over half of all publicly traded corporations listed in the New York Stock Exchan ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Statute

A statute is a law or formal written enactment of a legislature. Statutes typically declare, command or prohibit something. Statutes are distinguished from court law and unwritten law (also known as common law) in that they are the expressed will of a legislative body, whether that be on the behalf of a country, state or province, county, municipality, or so on. Depending on the legal system, a statute may also be referred to as an "act." Etymology The word appears in use in English as early as the 14th century. "Statute" and earlier English spellings were derived from the Old French words ''statut'', ''estatut'', ''estatu,'' meaning "(royal) promulgation, (legal) statute." These terms were in turn derived from the Late Latin ''statutum,'' meaning "a law, decree." Publication and organization In virtually all countries, newly enacted statutes are published and distributed so that everyone can look up the statutory law. This can be done in the form of a government gazette, whi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Dodging

Tax avoidance is the legal usage of the tax regime in a single territory to one's own advantage to reduce the amount of tax that is payable. A tax shelter is one type of tax avoidance, and tax havens are jurisdictions that facilitate reduced taxes. Tax avoidance should not be confused with tax evasion, which is illegal. Forms of tax avoidance that use legal tax laws in ways not necessarily intended by the government are often criticized in the court of public opinion and by journalists. Many businesses pay little or no tax, and some experience a backlash when their tax avoidance becomes known to the public. Conversely, benefiting from tax laws in ways that were intended by governments is sometimes referred to as tax planning. The World Bank's World Development Report 2019 on the future of work supports increased government efforts to curb tax avoidance as part of a new social contract focused on human capital investments and expanded social protection. "Tax mitigation", "tax a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Franchise Tax

A franchise tax is a government levy (tax) charged by some US states to certain business organizations such as corporations and partnerships with a nexus in the state. A franchise tax is not based on income. Rather, the typical franchise tax calculation is based on the net worth of capital held by the entity. The franchise tax effectively charges corporations for the privilege of doing business in the state. Nexus Whether or not a business must pay a franchise tax to the state in which it does business can cause some confusion. Some states report using both the economic and physical presence tests, and in some states, there are no written, public interpretations of their test at all.QX Accounting Services, Tax return preparation outsourcing services to boost profitability by up to 50%. https://qxaccounting.com/usa/tax-preparation-outsourcing-services/ Physical presence test The physical presence test is based on Quill Corp. v. North Dakota, ( 504 U.S. 298 (1992)), a United St ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Lost, Mislaid, And Abandoned Property

In property law, lost, mislaid, and abandoned property are categories of the common law of property which deals with personal property or chattel which has left the possession of its rightful owner without having directly entered the possession of another person. Property can be considered lost, mislaid, or abandoned depending on the circumstances under which it is found by the next party who obtains its possession. An old saying is that "possession is nine-tenths of the law", dating back centuries. This means that in most cases, the possessor of a piece of property is its rightful owner without evidence to the contrary. More colloquially, these may be called finders, keepers. The contradiction to this principle is theft by finding, which may occur if conversion occurs after finding someone else's property. The rights of a finder of such property are determined in part by the status in which it is found. Because these classifications have developed under the common law of ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Income Tax

An income tax is a tax imposed on individuals or entities (taxpayers) in respect of the income or profits earned by them (commonly called taxable income). Income tax generally is computed as the product of a tax rate times the taxable income. Taxation rates may vary by type or characteristics of the taxpayer and the type of income. The tax rate may increase as taxable income increases (referred to as graduated or progressive tax rates). The tax imposed on companies is usually known as corporate tax and is commonly levied at a flat rate. Individual income is often taxed at progressive rates where the tax rate applied to each additional unit of income increases (e.g., the first $10,000 of income taxed at 0%, the next $10,000 taxed at 1%, etc.). Most jurisdictions exempt local charitable organizations from tax. Income from investments may be taxed at different (generally lower) rates than other types of income. Credits of various sorts may be allowed that reduce tax. Some jurisdictio ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Internal Affairs Doctrine

The internal affairs doctrine is a choice of law rule in corporate law. Simply stated, it provides that the "internal affairs" of a corporation (e.g. conflicts between shareholders and management figures such as the board of directors and corporate officers) will be governed by the corporate statutes and case law of the state in which the corporation is incorporated,VantagePoint Venture Partners 1996 v. Examen, Inc.'' 871 A.2d 1108, 1112-1113 (2005). sometimes referred to as the ''lex incorporationis''. Practical effects of the doctrine The internal affairs doctrine ensures that such issues as voting rights of shareholders, distributions of dividends and corporate property, and the fiduciary obligations of management are all determined in accordance with the law of the state in which the company is incorporated. On the other hand, the "external affairs" of a corporation, such as labor and employment issues and tax liability, are typically governed by the law of the state in wh ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Office Of The Comptroller Of The Currency

The Office of the Comptroller of the Currency (OCC) is an independent bureau within the United States Department of the Treasury that was established by the National Currency Act of 1863 and serves to corporate charter, charter, bank regulation in the United States, regulate, and supervise all National bank (United States), national banks and Federal savings association, federal thrift institutions and the federally licensed branches and agencies of foreign banks in the United States. The acting comptroller of the currency is Rodney E. Hood, who took office on February 10, 2025. Duties and functions Headquartered in Washington, D.C., it has four district offices located in New York City, Chicago, Dallas and Denver. It has an additional 92 operating locations throughout the United States. It is an independent Government agency, bureau of the United States Department of the Treasury and is headed by the comptroller of the currency, appointed to a five-year term by the president w ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

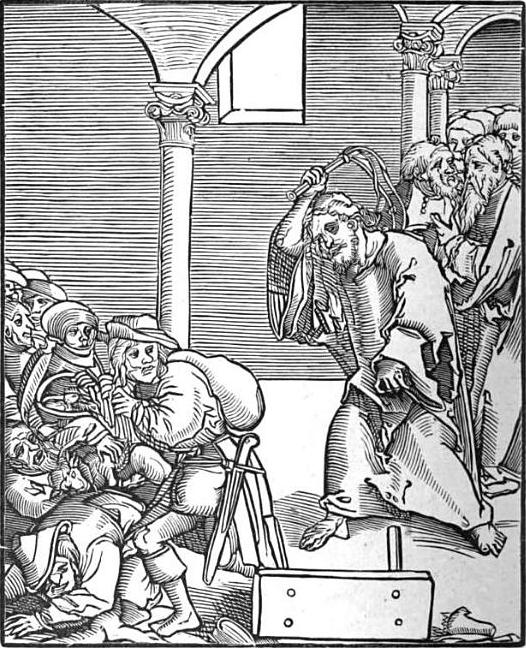

Usury

Usury () is the practice of making loans that are seen as unfairly enriching the lender. The term may be used in a moral sense—condemning taking advantage of others' misfortunes—or in a legal sense, where an interest rate is charged in excess of the maximum rate that is allowed by law. A loan may be considered usurious because of excessive or abusive interest rates or other factors defined by the laws of a state. Someone who practices usury can be called a ''usurer'', but in modern colloquial English may be called a ''loan shark''. In many historical societies including ancient Christian, Jewish, and Islamic societies, usury meant the charging of interest of any kind, and was considered wrong, or was made illegal. During the Sutra period in India (7th to 2nd centuries BC) there were laws prohibiting the highest castes from practicing usury. Similar condemnations are found in religious texts from Buddhism, Judaism ('' ribbit'' in Hebrew), Christianity, and Islam (''rib ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Interest

In finance and economics, interest is payment from a debtor or deposit-taking financial institution to a lender or depositor of an amount above repayment of the principal sum (that is, the amount borrowed), at a particular rate. It is distinct from a fee which the borrower may pay to the lender or some third party. It is also distinct from dividend which is paid by a company to its shareholders (owners) from its profit (economics), profit or Reserve (accounting), reserve, but not at a particular rate decided beforehand, rather on a pro rata basis as a share in the reward gained by risk taking entrepreneurs when the revenue earned exceeds the total costs. For example, a customer would usually pay interest to debt, borrow from a bank, so they pay the bank an amount which is more than the amount they borrowed; or a customer may earn interest on their savings, and so they may withdraw more than they originally deposited. In the case of savings, the customer is the lender, and the ban ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Delaware Supreme Court

The Delaware Supreme Court is the sole appellate court in the United States state of Delaware. Because Delaware is a popular haven for corporations, the Court has developed a worldwide reputation as a respected source of corporate law decisions, particularly in the area of mergers and acquisitions.Thomas Lee Hazen and Jerry W. Markham, ''Corporations and Other Business Enterprises'' (2003) Jurisdiction The Supreme Court has appellate jurisdiction over direct appeals from the Superior Court, Family Court, and Court of Chancery. Because it is the only appellate court in the state, its jurisdiction over appeals from final orders is mandatory. However, it has discretionary jurisdiction over appeals from interlocutory orders. The Court has original jurisdiction over writs of mandamus, prohibition, and certiorari. In addition, the Court regulates and has exclusive jurisdiction over matters concerning the admission and discipline of lawyers, the Lawyers' Fund for Client Protection, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

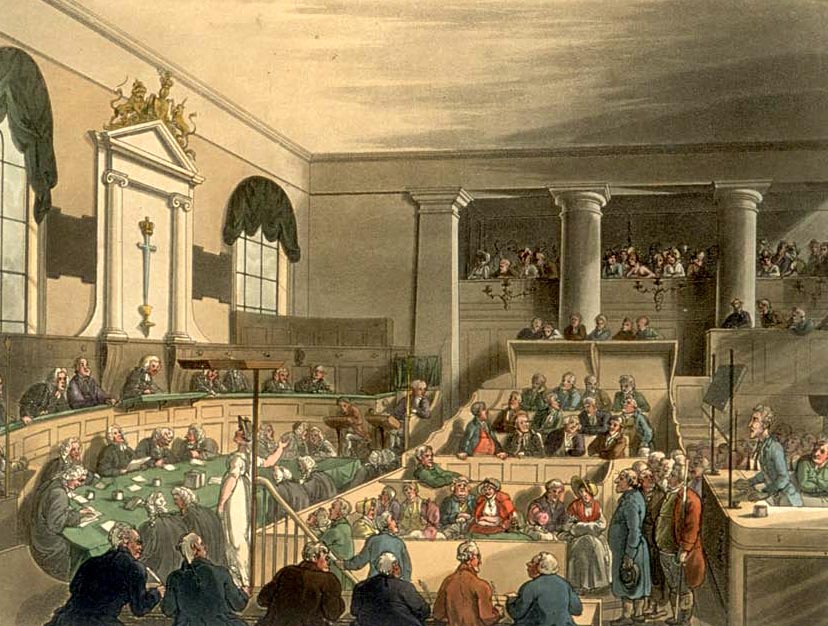

Court Of Law

A court is an institution, often a government entity, with the authority to adjudicate legal disputes between Party (law), parties and Administration of justice, administer justice in Civil law (common law), civil, Criminal law, criminal, and Administrative law, administrative matters in accordance with the rule of law. Courts generally consist of Judge, judges or other judicial officers, and are usually established and dissolved through legislation enacted by a legislature. Courts may also be established by constitution or an equivalent constituting instrument. The practical authority given to the court is known as its jurisdiction, which describes the court's power to decide certain kinds of questions, or Petition, petitions put to it. There are various kinds of courts, including trial courts, appellate courts, administrative courts, international courts, and tribunals. Description A court is any person or institution, often as a government institution, with the authori ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Court Of Equity

A court of equity, also known as an equity court or chancery court, is a court authorized to apply principles of Equity (law), equity rather than principles of law to cases brought before it. These courts originated from petitions to the Lord Chancellor, Lord Chancellor of England and primarily heard claims for relief other than damages, such as specific performance and Prerogative writ, extraordinary writs. Over time, most equity courts merged with courts of law, and the adoption of various Acts granted courts combined jurisdiction to administer common law and equity concurrently. Courts of equity are now recognized for complementing the common law by addressing its shortcomings and promoting justice. In the early years of the United States, some states followed the English law, English tradition of maintaining separate courts for law and equity. Others combined both types of jurisdiction in their courts, as the United States Congress, US Congress did for Federal judiciary of the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |