|

Imputed Rent

Imputed rent is the rental price an individual would pay for an asset they own. The concept applies to any capital good, but it is most commonly used in housing markets to measure the rent homeowners would pay for a housing unit equivalent to the one they own. Imputing housing rent is necessary to measure economic activity in national accounts. Because asset owners do not pay rent, owners' imputed rent must be measured indirectly. Imputed housing rent is the economic theory of imputation applied to real estate: that the value is more a matter of what the buyer is willing to pay than the cost the seller incurs to create it. In this case, market rents are used to estimate the value to the property owner. Thus, imputed rent offers a way to compare homeowners' and tenants' economic decisions. More formally, in owner-occupancy, the landlord– tenant relationship is short-circuited. Consider a model: two people, A and B, each of whom owns property. If A lives in B's property, and B ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

National Accounts

National accounts or national account systems (NAS) are the implementation of complete and consistent accounting Scientific technique, techniques for measuring the economic activity of a nation. These include detailed underlying measures that rely on double-entry accounting. By design, such accounting makes the totals on both sides of an account equal even though they each measure different characteristics, for example production and the income from it. As a methodology, method, the subject is termed national accounting or, more generally, social accounting.Nancy D. Ruggles, 1987. "social accounting," ''The New Palgrave: A Dictionary of Economics'', v. 4, pp. 377–82. Stated otherwise, national accounts as ''systems'' may be distinguished from the economic data associated with those systems. While sharing many common principles with business accounting, national accounts are based on economic concepts. One conceptual construct for representing flows of all economic transacti ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Theory Of Imputation

The theory of imputation is based on the so-called theory of factors of production proposed by the French economist Jean-Baptiste Say and elaborated by the American economist John Bates Clark in his work ''The Distribution of Wealth'' (1899; Russian translation, 1934). The proponents of the theory of imputation see its main task as elucidating which parts of wealth may be attributed (imputed) to labor and capital, respectively. Principles In economics, the theory of imputation, first expounded by Carl Menger, maintains that factor prices are determined by output prices (i.e. the value of factors of production is the individual contribution of each in the final product, but its value is the value of the last contributed to the final product (the marginal utility before reaching the point Pareto optimal). Thus, Friedrich von Wieser identified a flaw in the theory of imputation as expounded by his teacher, Carl Menger: overvaluation may occur if one is confronted with economies where ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

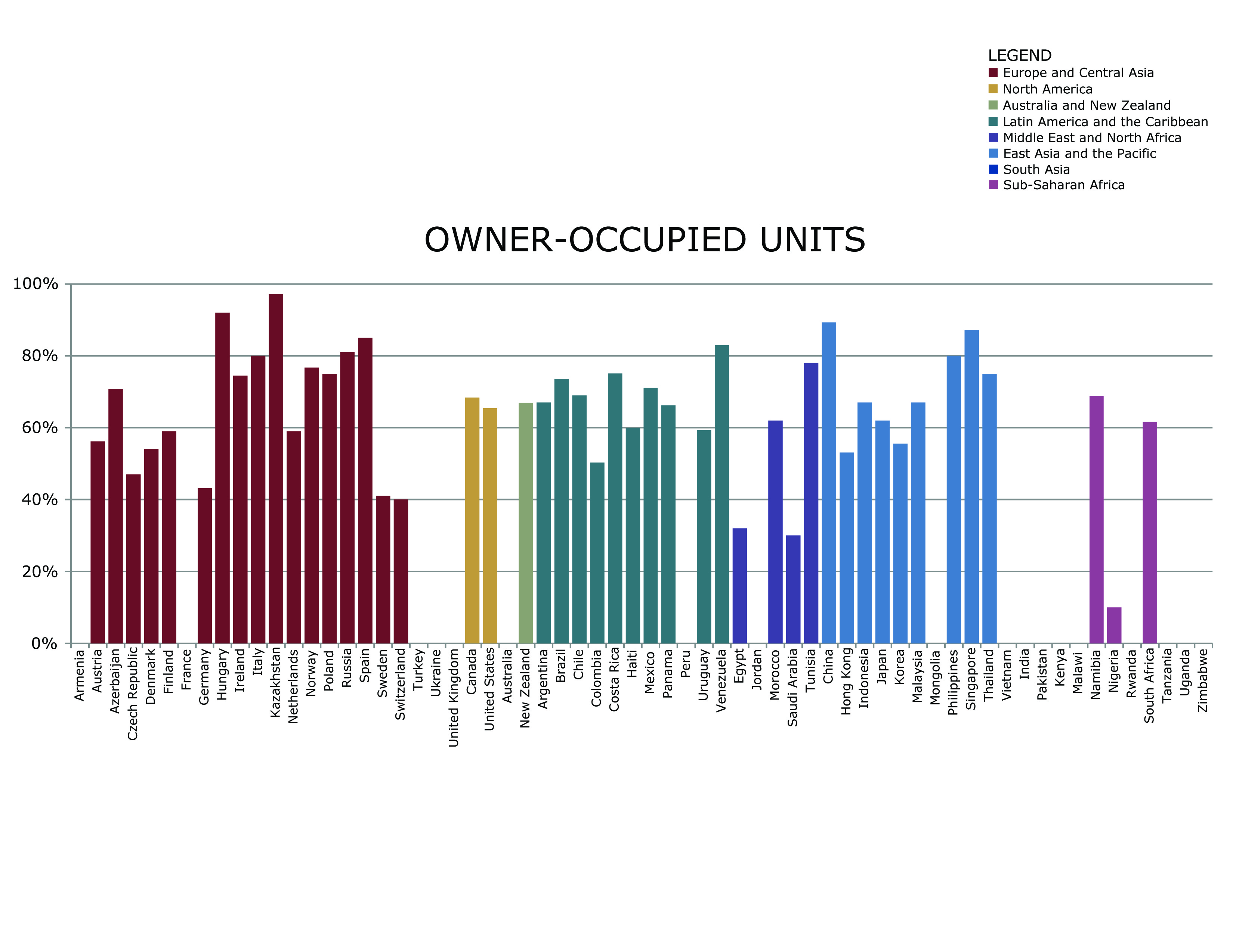

Owner-occupancy

Owner-occupancy or home-ownership is a form of housing tenure in which a person, called the owner-occupier, owner-occupant, or home owner, owns the home in which they live. The home can be a house, such as a single-family detached home, single-family house, an apartment, condominium, or a housing cooperative. In addition to providing housing, owner-occupancy also functions as a real estate investing, real estate investment. Acquisition Some homes are constructed by the owners with the intent to occupy. Many are inheritance, inherited. A large number are purchased as new homes from a real estate development, real estate developer or as an existing home from a previous landlord or owner-occupier. A house is usually the most expensive single purchase an individual or family makes and often costs several times the annual household income. Given the high cost, most individuals do not have enough saving, savings on hand to pay the entire amount outright. In developed countries, mortg ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

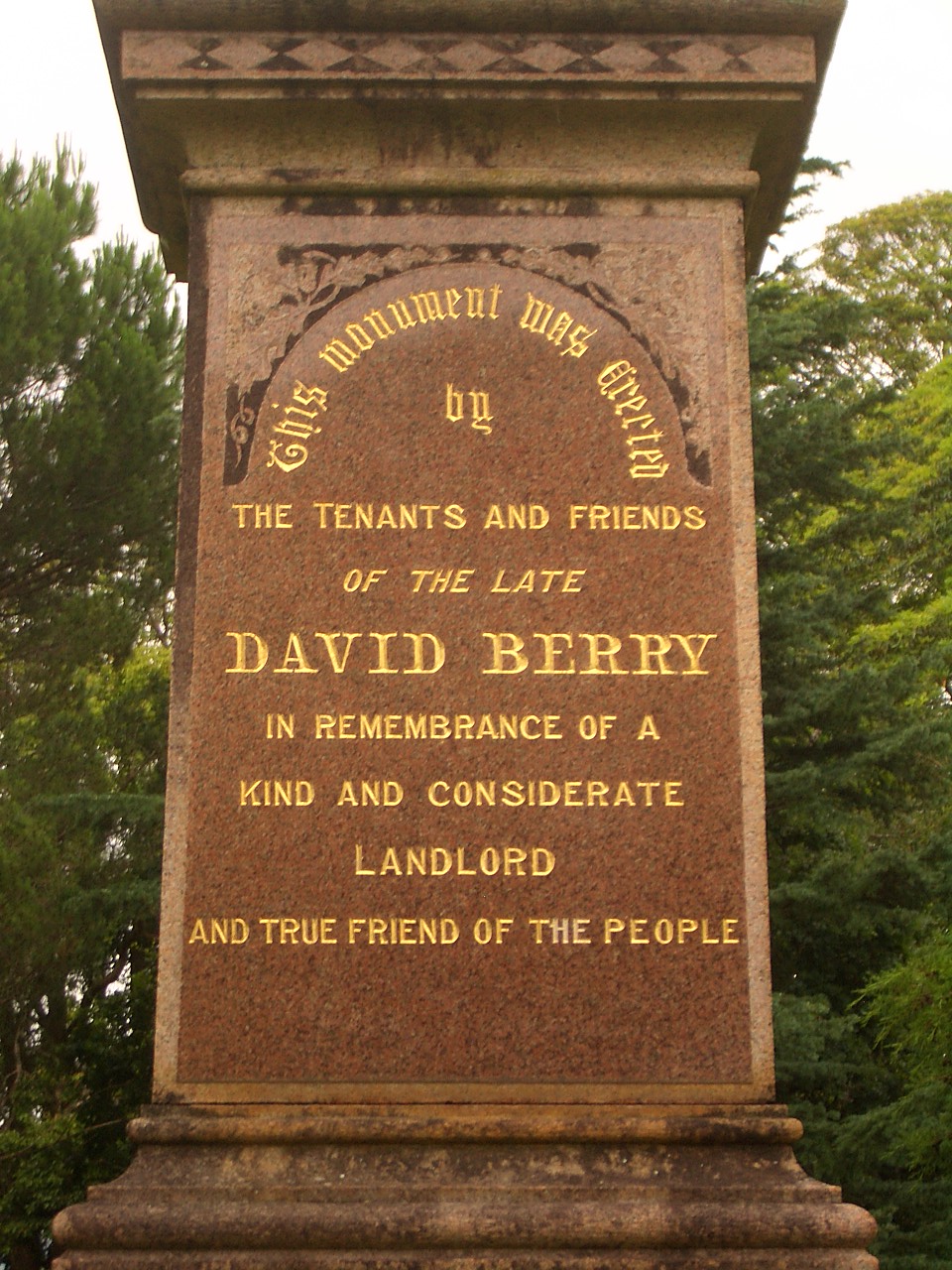

Landlord

A landlord is the owner of property such as a house, apartment, condominium, land, or real estate that is rented or leased to an individual or business, known as a tenant (also called a ''lessee'' or ''renter''). The term landlord applies when a juristic person occupies this position. Alternative terms include lessor and owner. For female property owners, the term landlady may be used. In the United Kingdom, the manager of a pub, officially a licensed victualler, is also referred to as the landlord/landlady. In political economy, landlord specifically refers to someone who owns natural resources (such as land, excluding buildings) from which they derive economic rent, a form of passive income. History The concept of a landlord can be traced to the feudal system of manoralism ( seignorialism), where landed estates were owned by Lords of the Manor ( mesne lords). These lords were typically members of the lower nobility who later formed the rank of knights during ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Leasehold Estate

A leasehold estate is an ownership of a temporary right to hold land or property in which a lessee or a tenant has rights of real property by some form of title from a lessor or landlord. Although a tenant does hold rights to real property, a leasehold estate is typically considered personal property. Leasehold is a form of land tenure or property tenure where one party buys the right to occupy land or a building for a given time. As a lease is a legal estate, leasehold estate can be bought and sold on the open market. A leasehold thus differs from a freehold or fee simple where the ownership of a property is purchased outright and after that held for an indeterminate length of time, and also differs from a tenancy where a property is let (rented) periodically such as weekly or monthly. Terminology and types of leasehold vary from country to country. Sometimes, but not always, a residential tenancy under a lease agreement is colloquially known as renting. The leaseholder can r ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Market (economics)

In economics, a market is a composition of systems, institutions, procedures, social relations or infrastructures whereby parties engage in Exchange (economics), exchange. While parties may exchange goods and services by barter, most markets rely on sellers offering their goods or services (including labour power) to buyers in exchange for money. It can be said that a market is the process by which the value of goods and services are established. Markets facilitate trade and enable the distribution and allocation of resources in a society. Markets allow any tradeable item to be evaluated and priced. A market emergence, emerges more or less spontaneous order, spontaneously or may be constructed deliberately by human interaction in order to enable the exchange of rights (cf. ownership) of services and goods. Markets generally supplant Gift economy, gift economies and are often held in place through rules and customs, such as a booth fee, competitive pricing, and source of goods for ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bureau Of Labor Statistics

The Bureau of Labor Statistics (BLS) is a unit of the United States Department of Labor. It is the principal fact-finding agency for the government of the United States, U.S. government in the broad field of labor economics, labor economics and statistics and serves as a principal agency of the Federal Statistical System of the United States, U.S. Federal Statistical System. The BLS collects, processes, analyzes, and disseminates essential statistical data to the American public, the United States Congress, U.S. Congress, other Federal agencies, State and local governments, business, and labor representatives. The BLS also serves as a statistical resource to the United States Department of Labor, and conducts research measuring the income levels families need to maintain a satisfactory quality of life. BLS data must satisfy a number of criteria, including relevance to current social and economic issues, timeliness in reflecting today's rapidly changing economic conditions, accur ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Measures Of National Income And Output

A variety of measures of national income and output are used in economics to estimate total economic activity in a country or region, including gross domestic product (GDP), Gross national income (GNI), net national income (NNI), and adjusted national income (NNI adjusted for natural resource depletion – also called as NNI at factor cost). All are specially concerned with counting the total amount of goods and services produced within the economy and by various sectors. The boundary is usually defined by geography or citizenship, and it is also defined as the total income of the nation and also restrict the goods and services that are counted. For instance, some measures count only goods & services that are exchanged for money, excluding bartered goods, while other measures may attempt to include bartered goods by ''imputing'' monetary values to them. National accounts Arriving at a figure for the total production of goods and services in a large region like a country entails a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Income Tax

An income tax is a tax imposed on individuals or entities (taxpayers) in respect of the income or profits earned by them (commonly called taxable income). Income tax generally is computed as the product of a tax rate times the taxable income. Taxation rates may vary by type or characteristics of the taxpayer and the type of income. The tax rate may increase as taxable income increases (referred to as graduated or progressive tax rates). The tax imposed on companies is usually known as corporate tax and is commonly levied at a flat rate. Individual income is often taxed at progressive rates where the tax rate applied to each additional unit of income increases (e.g., the first $10,000 of income taxed at 0%, the next $10,000 taxed at 1%, etc.). Most jurisdictions exempt local charitable organizations from tax. Income from investments may be taxed at different (generally lower) rates than other types of income. Credits of various sorts may be allowed that reduce tax. Some jurisdictio ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Cross-National Equivalent File

The 'Cross-National Equivalent File'' (CNEF) is a project that harmonizes and maintains cross nation data for researchers across the world. Current CNEF organization contains data from general population household-based panel surveys fielded in 9 countries, namely Australia, Canada, Germany, Great Britain, Japan, Korea, Russia, Switzerland and the United States. Management The project was originally started by Dr. Richard Burkhauser at Cornell University. ThCNEFis currently managed bDean Lillardat the Department of Human Sciences of Ohio State University. Data collection and processing Each of the participating countries conducts a longitudinal survey of households and their residents. Researchers from various institutions collaborate with CNEF to harmonize a subset of data from these surveys. This cross-national data collection is designed to enable researchers even with little experience in panel data analysis to access a simplified version of the panels, while also providin ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Business Insider

''Business Insider'' (stylized in all caps: BUSINESS INSIDER; known from 2021 to 2023 as INSIDER) is a New York City–based multinational financial and business news website founded in 2007. Since 2015, a majority stake in ''Business Insider''s parent company Insider Inc. has been owned by the international publishing house Axel Springer. It operates several international editions, including one in the United Kingdom. ''Insider'' publishes original reporting and aggregates material from other outlets. it maintained a liberal policy on the use of anonymous sources. It has also published native advertising and granted sponsors editorial control of its content. The outlet has been nominated for several awards, but has also been criticized for using factually incorrect clickbait headlines to attract viewership. In 2015, Axel Springer SE acquired 88 percent of the stake in Insider Inc. for $343 million (€306 million), implying a total valuation of $442 million. From ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |