|

Grantor Retained Annuity Trust

A grantor-retained annuity trust (commonly referred to by the acronym GRAT) is a financial instrument commonly used in the United States to make large financial gifts to family members without paying a U.S. gift tax. Basic mechanism A grantor transfers property into an irrevocable trust in exchange for the right to receive fixed payments at least annually, based on original fair market value of the property transferred. At the end of a specified time, any remaining value in the trust is passed on to a beneficiary of the trust as a gift. Beneficiaries are generally close family members of the grantor, such as children or grandchildren, who are prohibited from being named beneficiaries of another estate freeze technique, the grantor-retained income trust. If a grantor dies before the trust period ends, the assets in the GRAT are included in the grantor's estate by operation of I.R.C. § 2036, eliminating any potential gift tax benefit; this is the GRAT's main weakness as a tax avoi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Acronym

An acronym is a type of abbreviation consisting of a phrase whose only pronounced elements are the initial letters or initial sounds of words inside that phrase. Acronyms are often spelled with the initial Letter (alphabet), letter of each word in all caps with no punctuation. For some, an initialism or alphabetism connotes this general meaning, and an ''acronym'' is a subset with a narrower definition; an acronym is pronounced as a word rather than as a sequence of letters. In this sense, ''NASA'' () is an acronym, but ''United States, USA'' () is not. The broader sense of ''acronym'', ignoring pronunciation, is its original meaning and in common use. . Dictionary and style-guide editors dispute whether the term ''acronym'' can be legitimately applied to abbreviations which are not pronounced as words, and they do not agree on acronym space (punctuation), spacing, letter case, casing, and punctuation. The phrase that the acronym stands for is called its . The of an acron ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

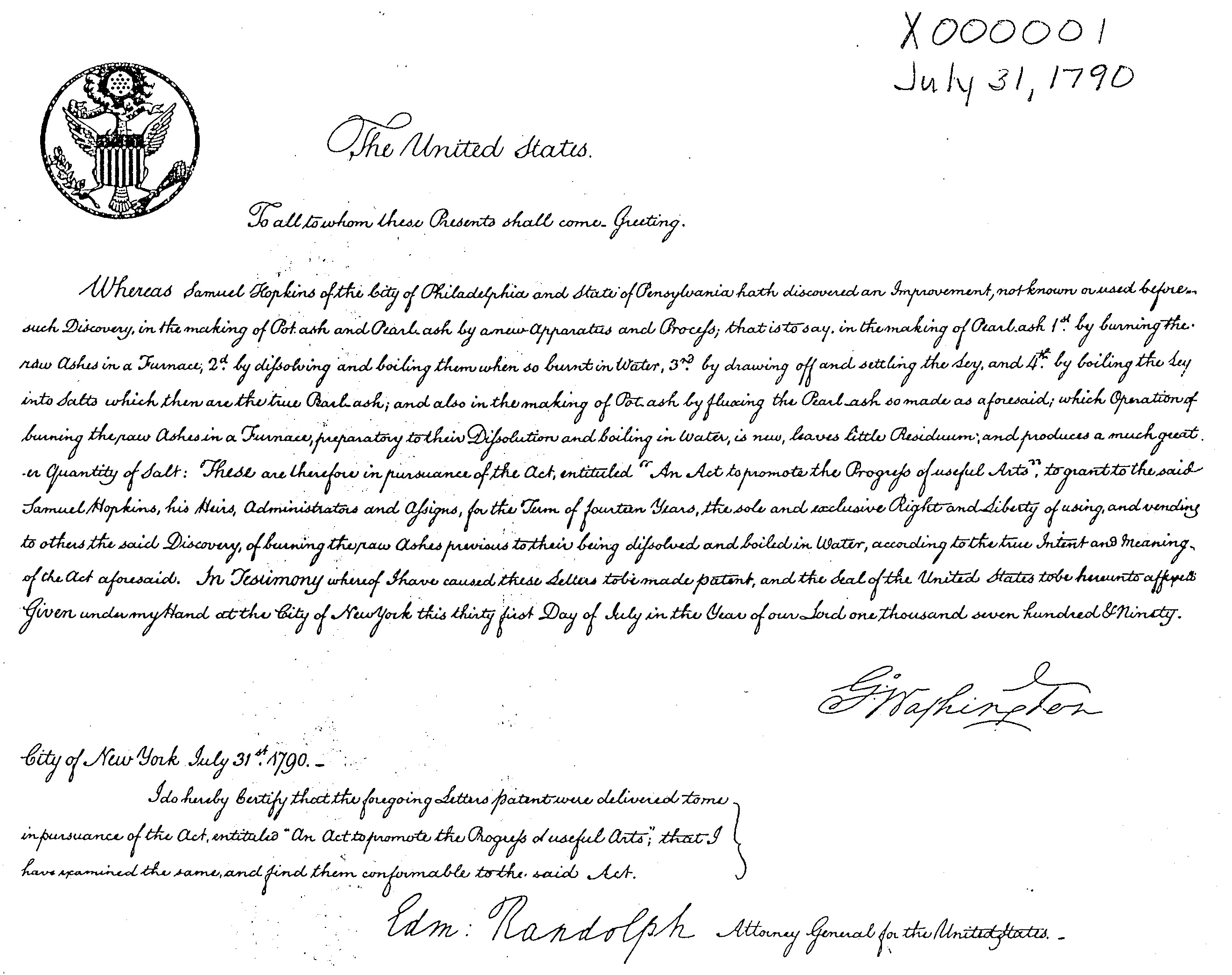

USPTO

The United States Patent and Trademark Office (USPTO) is an agency in the U.S. Department of Commerce that serves as the national patent office and trademark registration authority for the United States. The USPTO's headquarters are in Alexandria, Virginia, after a 2005 move from the Crystal City area of neighboring Arlington, Virginia. The USPTO is "unique among federal agencies because it operates solely on fees collected by its users, and not on taxpayer dollars". Its "operating structure is like a business in that it receives requests for services—applications for patents and trademark registrations—and charges fees projected to cover the cost of performing the services tprovide . The office is headed by the under secretary of commerce for intellectual property and director of the United States Patent and Trademark Office. , Coke Morgan Stewart is acting undersecretary and director, having been appointed to the position by President Trump on January 20. The U ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Taxation In The United States

The United States has separate Federal government of the United States, federal, U.S. state, state, and Local government in the United States, local governments with taxes imposed at each of these levels. Taxes are levied on income, payroll, property, sales, Capital gains tax in the United States, capital gains, dividends, imports, estates and gifts, as well as various fees. In 2020, taxes collected by federal, state, and local governments amounted to 25.5% of GDP, below the OECD average of 33.5% of GDP. Income tax in the United States, U.S. tax and transfer policies are Progressive tax, progressive and therefore reduce effective income inequality in the United States, income inequality, as rates of tax generally increase as taxable income increases. As a group, the lowest earning workers, especially those with dependents, pay no income taxes and may actually receive a small subsidy from the federal government (from child credits and the Earned Income Tax Credit). Taxes fall m ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Personal Taxes

Personal may refer to: Aspects of persons' respective individualities * Privacy * Personality * Personal, personal advertisement, variety of classified advertisement used to find romance or friendship Companies * Personal, Inc., a Washington, D.C.–based tech startup * The Personal, a Canadian-based group car insurance and home insurance company * Telecom Personal, a mobile phone company in Argentina and Paraguay Music * ''Personal'' (Men of Vizion album), 1996 * Personal (George Howard album), 1990 * Personal (Florrie album), 2023 * ''Personal'', an album by Quique González, or the title song * "Message"/"Personal", a 2003 song by Aya Ueto * "Personal" (Hrvy song), a song from ''Talk to Ya'' * "Personal" (The Vamps song), a song from ''Night & Day'' *"Personal", a song by Kehlani from ''SweetSexySavage'' *"Personal", a song by Olly Murs from his 2012 album '' Right Place Right Time'' *"Personal", a song by Against the Current from their 2018 album '' Past Lives'' Bo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Inheritance

Inheritance is the practice of receiving private property, titles, debts, entitlements, privileges, rights, and obligations upon the death of an individual. The rules of inheritance differ among societies and have changed over time. Officially bequeathing private property and/or debts can be performed by a testator via will, as attested by a notary or by other lawful means. Terminology In law, an "heir" ( heiress) is a person who is entitled to receive a share of property from a decedent (a person who died), subject to the rules of inheritance in the jurisdiction where the decedent was a citizen, or where the decedent died or owned property at the time of death. The inheritance may be either under the terms of a will or by intestate laws if the deceased had no will. However, the will must comply with the laws of the jurisdiction at the time it was created or it will be declared invalid (for example, some states do not recognise handwritten wills as valid, or only in ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Wills And Trusts

Wills may refer to: * Will (law), a legal document Places Australia * Wills, Queensland, a locality in the Shire of Boulia * Division of Wills, an Australian electoral division in Victoria United States * Wills Township, LaPorte County, Indiana * Wills Township, Guernsey County, Ohio * Wills, Wisconsin, an unincorporated community * Wills Creek (Ohio), a tributary of the Muskingum River * Wills Creek (North Branch Potomac River), in Pennsylvania and Maryland People * Wills (surname), a surname * William, Prince of Wales William, Prince of Wales (William Arthur Philip Louis; born 21 June 1982), is the heir apparent to the British throne. He is the elder son of King Charles III and Diana, Princess of Wales. William was born during the reign of his pat ... (born 1982), nicknamed "Wills" Other uses * Wills baronets, of Northmoor, a former title in the Peerage of the United Kingdom - see Baron Dulverton * Wills Hall, a student residence of the University of ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Trust Law

A trust is a legal relationship in which the owner of property, or any transferable right, gives it to another to manage and use solely for the benefit of a designated person. In the English common law, the party who entrusts the property is known as the "settlor", the party to whom it is entrusted is known as the "trustee", the party for whose benefit the property is entrusted is known as the "beneficiary", and the entrusted property is known as the "corpus" or "trust property". A ''testamentary trust'' is an irrevocable trust established and funded pursuant to the terms of a deceased person's will. An inter vivos trust is a trust created during the settlor's life. The trustee is the legal owner of the assets held in trust on behalf of the trust and its beneficiaries. The beneficiaries are equitable owners of the trust property. Trustees have a fiduciary duty to manage the trust for the benefit of the equitable owners. Trustees must provide regular accountings of trust income ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Dechert LLP

Dechert LLP (; ) is a multinational American law firm of more than 900 lawyers with practices in corporate and securities, complex litigation, finance and real estate, financial services, asset management, and private equity. In 2021, the firm raised revenues by 25%, with a total of $1.3 billion. On Law.com's 2022 Global 200 survey, Dechert ranked as the 41st highest grossing law firm in the world. History The firm's first predecessor, MacVeagh & Bispham, was formed in 1875 by Wayne MacVeagh and George Tucker Bispham. MacVeagh previously served as ambassadors of the United States to Turkey, and Bispham authored the treatise "Principles of Equity", which was considered the definitive work on the subject at the time. MacVeagh went on to become United States attorney general under president James Garfield, and then ambassadors of the United States to Italy in 1893. Bispham went on to become a professor at the University of Pennsylvania Law School in 1884. Over the next few decades ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Jeffrey Epstein

Jeffrey Edward Epstein ( , ; January 20, 1953August 10, 2019) was an American financier and child sex offender. Born and raised in New York City, Epstein began his professional career as a teacher at the Dalton School, despite lacking a college degree. After his dismissal from the school in 1976, he entered the banking and finance sector, working at Bear Stearns in various roles before starting his own firm. Epstein cultivated an elite social circle and procured many women and children whom he and his associates sexually abused. In 2005, police in Palm Beach, Florida, began investigating Epstein after a parent reported that he had sexually abused her 14-year-old daughter. Federal officials identified 36 girls, some as young as 14 years old, whom Epstein had sexually abused. Epstein pleaded guilty and was convicted in 2008 by a Florida state court of procuring a child for prostitution and of soliciting a prostitute. He was convicted of only these two crimes as part of a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

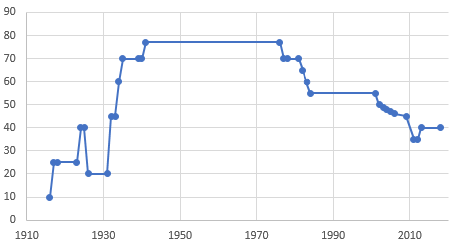

Estate Tax In The United States

In the United States, the estate tax is a federal tax on the transfer of the estate of a person who dies. The tax applies to property that is transferred by will or, if the person has no will, according to state laws of intestacy. Other transfers that are subject to the tax can include those made through a trust and the payment of certain life insurance benefits or financial accounts. The estate tax is part of the federal unified gift and estate tax in the United States. The other part of the system, the gift tax, applies to transfers of property during a person's life. In addition to the federal government, 12 states tax the estate of the deceased. Six states have " inheritance taxes" levied on the person who receives money or property from the estate of the deceased. The estate tax is periodically the subject of political debate. Some opponents have called it the "death tax" [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Reexamination

In United States patent law, a reexamination is a process whereby anyone—third party or inventor—can have a U.S. patent reexamined by a patent examiner to verify that the subject matter it claims is patentable. To have a patent reexamined, an interested party must submit prior art, in the form of patents or printed publications, that raises a "substantial new question of patentability". The Leahy-Smith America Invents Act makes substantial changes to the U.S. patent system, including new mechanisms for challenging patents at the U.S. Patent and Trademark Office. One of the new mechanisms is a post-grant review proceeding, which will provide patent challengers expanded bases on which to attack patents. Process A request for a reexamination can be filed by anyone at any time during the period of enforceability of a patent. To request a reexamination, one must submit a "request for reexamination" which includes (1) a statement pointing out each "substantial new question of pa ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Stock Options

In finance, an option is a contract which conveys to its owner, the ''holder'', the right, but not the obligation, to buy or sell a specific quantity of an underlying asset or instrument at a specified strike price on or before a specified date, depending on the style of the option. Options are typically acquired by purchase, as a form of compensation, or as part of a complex financial transaction. Thus, they are also a form of asset (or contingent liability) and have a valuation that may depend on a complex relationship between underlying asset price, time until expiration, market volatility, the risk-free rate of interest, and the strike price of the option. Options may be traded between private parties in ''over-the-counter'' (OTC) transactions, or they may be exchange-traded in live, public markets in the form of standardized contracts. Definition and application An option is a contract that allows the holder the right to buy or sell an underlying asset or financial i ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |