|

Georgism

Georgism, in modern times also called Geoism, and known historically as the single tax movement, is an economic ideology holding that people should own the value that they produce themselves, while the economic rent derived from land—including from all natural resources, the commons, and urban locations—should belong equally to all members of society. Developed from the writings of American economist and social reformer Henry George, the Georgist paradigm seeks solutions to social and ecological problems based on principles of land rights and public finance that attempt to integrate economic efficiency with social justice. Georgism is concerned with the distribution of economic rent caused by land ownership, natural monopolies, pollution rights, and control of the commons, including title of ownership for natural resources and other contrived Privilege (legal ethics), privileges (e.g., intellectual property). Any natural resource that is inherently limited in Supply (econ ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Henry George

Henry George (September 2, 1839 – October 29, 1897) was an American political economist, Social philosophy, social philosopher and journalist. His writing was immensely popular in 19th-century America and sparked several reform movements of the Progressive Era. He inspired the economic philosophy known as Georgism, the belief that people should own the value they produce themselves, but that the economic value of land (economics), land (including natural resources) should belong equally to all members of society. George famously argued that a single tax on land values would create a more productive and just society. His most famous work, ''Progress and Poverty'' (1879), sold millions of copies worldwide. The treatise investigates the paradox of increasing inequality and poverty amid economic and technological progress, the business cycle with its cyclic nature of industrialized economies, and the use of rent capture such as land value taxation and other anti-monopoly reforms ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Land Value Tax

A land value tax (LVT) is a levy on the value of land (economics), land without regard to buildings, personal property and other land improvement, improvements upon it. Some economists favor LVT, arguing it does not cause economic efficiency, economic inefficiency, and helps reduce economic inequality. A land value tax is a progressive tax, in that the tax burden falls on land owners, because land ownership is correlated with wealth and income. The land value tax has been referred to as "the perfect tax" and the economic efficiency of a land value tax has been accepted since the eighteenth century. Economists since Adam Smith and David Ricardo have advocated this tax because it does not hurt economic activity, and encourages development without subsidies. LVT is associated with Henry George, whose ideology became known as Georgism. George argued that taxing the land value is the most logical source of public revenue because the supply of land is fixed and because public infrastru ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Progress And Poverty

''Progress and Poverty: An Inquiry into the Cause of Industrial Depressions and of Increase of Want with Increase of Wealth: The Remedy'' is an 1879 book by social theorist and economist Henry George. It is a treatise on the questions of why poverty accompanies economic and technological progress and why economies exhibit a tendency toward cyclical boom and bust. George uses history and deductive logic to argue for a radical solution focusing on the capture of economic rent from natural resource and land titles. ''Progress and Poverty'', George's first book, sold several million copies, becoming one of the highest selling books of the late 1800s. It helped spark the Progressive Era and a worldwide social reform movement around an ideology now known as Georgism. Jacob Riis, for example, explicitly marks the beginning of the Progressive Era awakening as 1879 because of the date of this publication. The Princeton historian Eric F. Goldman wrote this about the influence of '' ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Land (economics)

In economics, land comprises all naturally occurring resources as well as geographic land. Examples include particular geographical locations, mineral deposits, forests, fish stocks, atmospheric quality, geostationary orbits, and portions of the electromagnetic spectrum. Supply of these resources is fixed. Factor of production Land is considered one of the three factors of production (also sometimes called the three producer goods) along with capital, and labor. Natural resources are fundamental to the production of all goods, including capital goods. While the particular role of land in the economy was extensively debated in classical economics it played a minor role in the neoclassical economics dominant in the 20th century. Income derived from ownership or control of natural resources is referred to as rent. Ownership Because no man created the land, it does not have a definite original proprietor, owner or user. Consequently, conflicting claims on geographic ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Citizen's Dividend

Citizen's dividend is a proposed policy based upon the Georgist principle that the natural world is the Commons, common property of all people. It is proposed that all citizens receive regular payments (dividends) from revenue raised by leasing or taxing the monopoly of valuable land (economics), land and other natural resources. History A concept akin to a citizen's dividend was known in Classical Athens. In 483 BC, a massive new seam of silver was found in the Athenian silver mines at Laurium.PlutarchThemistocles 4/ref> The dispersal of this provoked great debate. The statesman Aristides proposed the profit from this should be distributed among the Athenian citizens.Holland, pp. 219–222 However he was opposed by Themistocles, who proposed the money be spent building warships for the Athenian navy. In the end, Themistocles' policy was the one adopted. In the United Kingdom and United States, the idea can be traced back to Thomas Paine's essay, ''Agrarian Justice' ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Economic Rent

In economics, economic rent is any payment to the owner of a factor of production in excess of the costs needed to bring that factor into production. In classical economics, economic rent is any payment made (including imputed value) or benefit received for non-produced inputs such as location (land) and for assets formed by creating official privilege over natural opportunities (e.g., patents). In the moral economy of neoclassical economics, assuming the market is natural, and does not come about by state and social contrivance, economic rent includes income gained by labor or state beneficiaries or other "contrived" exclusivity, such as labor guilds and unofficial corruption. Overview In the moral economy of the economics tradition broadly, economic rent is distinct from producer surplus, or normal profit, both of which are theorized to involve productive human action. Economic rent is also independent of opportunity cost, unlike economic profit, where opportunity c ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Basic Income

Universal basic income (UBI) is a social welfare proposal in which all citizens of a given population regularly receive a minimum income in the form of an unconditional transfer payment, i.e., without a means test or need to perform Work (human activity), work. In contrast, a ''guaranteed minimum income'' is paid only to those who do not already receive an income that is enough to live on. A UBI would be received independently of any other income. If the level is sufficient to meet a person's basic needs (i.e., at or above the poverty line), it is considered a ''full basic income''; if it is less than that amount, it is called a ''partial basic income''. As of 2025, no country has implemented a full UBI system, but two countries—Mongolia and Iran—have had a partial UBI in the past. There have been Universal basic income pilots, numerous pilot projects, and the idea Universal basic income around the world, is discussed in many countries. Some have labelled UBI as utopian du ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Ground Rent

As a legal term, ground rent specifically refers to regular payments made by a holder of a leasehold property to the freeholder or a superior leaseholder, as required under a lease. In this sense, a ground rent is created when a freehold piece of land is sold on a long lease or leases.seDepartment for Communities and Local Government/ref> The ground rent provides an income for the landowner. In economics, ground rent is a form of economic rent meaning all value accruing to titleholders as a result of the exclusive ownership of title privilege to location. History In Roman law, ground rent (''solarium'') was an annual rent payable by the lessee of a ''superficies'' (a piece of land), or perpetual lease of building land. In early Norman England, tenants could lease their title to land so that the land-owning lords did not have any power over the sub-tenant to collect taxes. In 1290 King Edward I passed the Statute of ''Quia Emptores'' that prevented tenants from leasing their l ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Equity (economics)

Economic equity is the construct, concept or idea of ''fairness'' in economics and ''justice'' in the distribution of wealth, resources, and taxation within a society. Equity is closely tied to taxation policies, welfare economics, and the discussions of public finance, influencing how resources are allocated among different segments of the population. Overview According to Peter Corning, there are three distinct categories of substantive fairness (equality, equity, and reciprocity) that must be combined and balanced in order to achieve a truly fair society. But while most of middle-income countries increased inequality in recent years, it is important to note that middle classes and—to a lesser extent—poorer-income groups seem to be getting an increasing share of income in recent years. To some, this advance is still vulnerable and needs to be quickly accelerated in the 21st century Definitions of equity Equity in economics refers to a condition of fairness where the econo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

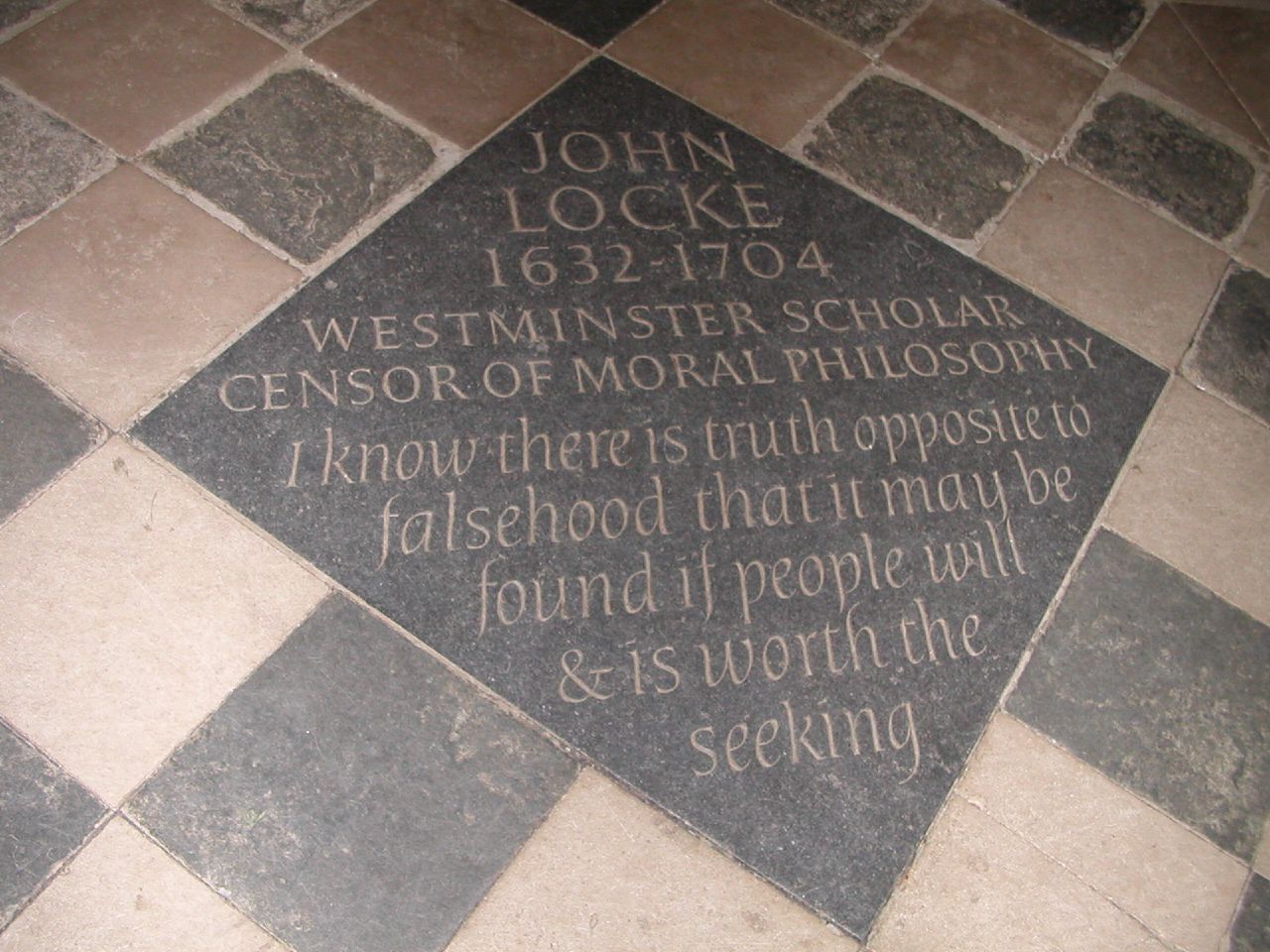

John Locke

John Locke (; 29 August 1632 (Old Style and New Style dates, O.S.) – 28 October 1704 (Old Style and New Style dates, O.S.)) was an English philosopher and physician, widely regarded as one of the most influential of the Enlightenment thinkers and commonly known as the "father of liberalism". Considered one of the first of the British empiricists, following the tradition of Francis Bacon, Locke is equally important to social contract theory. His work greatly affected the development of epistemology and political philosophy. His writings influenced Voltaire and Jean-Jacques Rousseau, and many Scottish Enlightenment thinkers, as well as the American Revolutionaries. His contributions to classical republicanism and liberal theory are reflected in the United States Declaration of Independence. Internationally, Locke's political-legal principles continue to have a profound influence on the theory and practice of limited representative government and the protection of basic right ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Thomas Paine

Thomas Paine (born Thomas Pain; – In the contemporary record as noted by Conway, Paine's birth date is given as January 29, 1736–37. Common practice was to use a dash or a slash to separate the old-style year from the new-style year. In the old calendar, the new year began on March 25, not January 1. Paine's birth date, therefore, would have been before New Year, 1737. In the new style, his birth date advances by eleven days and his year increases by one to February 9, 1737. The Old Style and New Style dates, O.S. link gives more detail if needed. – June 8, 1809) was an English-born American Founding Fathers of the United States, Founding Father, French Revolutionary, inventor, and political philosophy, political philosopher. He authored ''Common Sense'' (1776) and ''The American Crisis'' (1776–1783), two of the most influential pamphlets at the start of the American Revolution, and he helped to inspire the Colonial history of the United States, colonial era Patriot ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Adam Smith

Adam Smith (baptised 1723 – 17 July 1790) was a Scottish economist and philosopher who was a pioneer in the field of political economy and key figure during the Scottish Enlightenment. Seen by some as the "father of economics"——— or the "father of capitalism".———— He is known for two classic works: ''The Theory of Moral Sentiments'' (1759) and ''The Wealth of Nations, An Inquiry into the Nature and Causes of the Wealth of Nations'' (1776). The latter, often abbreviated as ''The Wealth of Nations'', is regarded as his ''magnum opus'', marking the inception of modern economic scholarship as a comprehensive system and an academic discipline. Smith refuses to explain the distribution of wealth and power in terms of divine will and instead appeals to natural, political, social, economic, legal, environmental and technological factors, as well as the interactions among them. The work is notable for its contribution to economic theory, particularly in its exposition o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |