|

Garnishment

Garnishment is a legal process for collecting a monetary judgment on behalf of a plaintiff from a defendant. Garnishment allows the plaintiff (the "garnishor") to take the money or property of the debtor from the person or institution that holds that property (the "garnishee"). A similar legal mechanism called execution allows the seizure of money or property held directly by the debtor. Some jurisdictions may allow for garnishment by a tax agency without the need to first obtain a judgment or other court order. Wages Wage garnishment, the most common type of garnishment, is the process of deducting money from an employee's monetary compensation (including salary), usually as a result of a court order. Wage garnishments may continue until the entire debt is paid or arrangements are made to pay off the debt. Garnishments can be taken for any type of debt but common examples of debt that result in garnishments include: * Child support * Defaulted student loans * Taxes * Unpaid cou ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Payroll

A payroll is a list of employment, employees of a company who are entitled to receive compensation as well as other work benefits, as well as the amounts that each should obtain. Along with the amounts that each employee should receive for time worked or tasks performed, payroll can also refer to a company's records of payments that were previously made to employees, including Salary, salaries and wages, Bonus payment, bonuses, and Withholding tax, withheld taxes, or the company's department that deals with Remuneration, compensation. A company may handle all aspects of the payroll process in-house or can outsource aspects to a payroll processing company. Payroll in the U.S. is subject to federal, state and local regulations including Fair Labor Standards Act of 1938, employee exemptions, Records management, record keeping, and Taxation in the United States, tax requirements. In recent years, there has been a significant shift towards cloud-based payroll solutions. These platfor ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Attachment Of Earnings

Attachment of earnings is a legal process in civil litigation by which a defendant's wages or other earnings are taken to pay for a debt. This collections process is used in the common law system, especially Britain and the United States, but in other legal regimes as well. '' Ballentine's Law Dictionary'' notes that this process is not literal, whereby a "person's property is figuratively brought into the court." United Kingdom In England, an attachment of earning order can stop money being paid to a defendant. Under English law, somebody who is self-employed, unemployed, or a member of the armed forces cannot have an attachment against them. In England, the District Council can attach earnings. United States At present four U.S. states — North Carolina, Pennsylvania, South Carolina and Texas — do not allow wage garnishment at all except for debts related to taxes, child support, federally guaranteed student loans, and court-ordered fines or restitution for a crime the d ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Tax Levies

A tax levy under United States federal law is an administrative action by the Internal Revenue Service (IRS) under statutory authority, generally without going to court, to seize property to satisfy a tax liability. The levy "includes the power of distraint and seizure by any means". The general rule is that no court permission is required for the IRS to execute a tax levy. While the government relies mainly on voluntary payment of tax, it retains the power of levy to collect involuntarily from those who persistently refuse to pay. The IRS can levy upon wages, bank accounts, social security payments, accounts receivables, insurance proceeds, real property, and, in some cases, a personal residence. Under Internal Revenue Code section 6331, the Internal Revenue Service can "levy upon all property and rights to property" of a taxpayer who owes Federal tax. The IRS can levy upon assets that are in the possession of the taxpayer, called a seizure, or it can levy upon assets in the po ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Judgment (law)

In law, a judgment is a Decision-making, decision of a court regarding the rights and liabilities of parties in a legal action or proceeding. Judgments also generally provide the court's explanation of why it has chosen to make a particular court order.''Black’s Law Dictionary'' 970 (10th ed. 2014). Speakers of British English tend to use the term at the appellate level as synonymous with judicial opinion. American English speakers prefer to maintain a clear distinction between the ''opinion'' of an appellate court (setting forth reasons for the disposition of an appeal) and the ''judgment'' of an appellate court (the pronouncement of the disposition itself). In Canadian English, the phrase "reasons for judgment" is often used interchangeably with "judgment," although the former refers to the court's justification of its judgment while the latter refers to the final court order regarding the rights and liabilities of the parties. Spelling Judgment is considered a "free var ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Tax Refund Interception

A tax refund interception, also referred to as a tax refund offset, is the act of an agency responsible for sending tax refunds using all or part of a refund to fulfill an obligation of the taxpayer rather than sending the money to the taxpayer him/herself. Some common obligations for which tax refunds are intercepted include student loans, child support, fines, restitution, and wage garnishments; however this is usually done if said debts are in considerable arrears. Debtors who have been making agreed payments on the dot are usually not subject to this as creditors often feel interception unnecessary. It can take years for an agency to initiate Tax intercept. While taxes are sometimes intercepted to pay off the balance to a government-operated collection agency, few jurisdictions allow refunds to be intercepted to pay a private collection agency. In the United States, the Internal Revenue Code allows the Internal Revenue Service (IRS) to divert overpayments of taxes to satisfy ot ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Unreported Employment

Unreported employment, also known as unlawful employment, illegal employment, working under the table or off the books is employment that is illegal and not reported to the government. The employer or the employee often does so for tax evasion or avoiding and violating other laws such as obtaining unemployment benefits while being employed. The working contract is made without social security costs and does typically not provide health insurance, paid parental leave, paid vacation or pension funds. It is a part of what has been called the underground economy, shadow economy, black market or the non-observed economy. Payments are generally in cash, and the employer often does not check the employee's background or credentials, as is sometimes required by law or otherwise expected by the industry's client base, such as a license or professional certification. While the hiring of the employee may or may not be legal in itself, it is often done when the employer or the employee int ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Child Support

Child support (or child maintenance) is an ongoing, periodic payment made by a parent for the financial benefit of a child (state or parent, caregiver, guardian) following the end of a marriage or other similar relationship. Child maintenance is paid directly or indirectly by an ''obligor'' to an ''obligee'' for the care and support of children of a relationship that has been terminated, or in some cases never existed. Often the obligor is a non-custodial parent. The obligee is typically a custodial parent, a caregiver, or a Legal guardian, guardian. Depending on the jurisdiction, a custodial parent may pay child support to a non-custodial parent. Typically one has the same duty to pay child support irrespective of sex, so a mother is required to pay support to a father just as a father must pay a mother. In some jurisdictions where there is joint custody, the child is considered to have two custodial parents and no non-custodial parents, and a custodial parent with a higher incom ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Student Loans

A student loan is a type of loan designed to help students pay for post-secondary education and the associated fees, such as tuition, books and supplies, and living expenses. It may differ from other types of loans in the fact that the interest rate may be substantially lower and the repayment schedule may be deferred while the student is still in school. It also differs in many countries in the strict laws regulating renegotiating and bankruptcy. This article highlights the differences of the student loan system in several major countries. Australia Tertiary student places in Australia are usually funded through the HECS-HELP scheme. This funding is in the form of loans that are not normal debts. They are repaid over time via a supplementary tax, using a sliding scale based on taxable income. As a consequence, loan repayments are only made when the former student has income to support the repayments. Discounts are available for early repayment. The scheme is available to cit ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Sequestration (law)

In law, sequestration is the act of removing, separating, or seizing anything from the possession of its owner under process of law for the benefit of creditors or the state. Etymology The Latin ''sequestrare'', to set aside or surrender, a late use, is derived from sequester, a depositary or trustee, one in whose hands a thing in dispute was placed until the dispute was settled; this was a term of Roman jurisprudence (cf. ''Digest L.'' 16,110). By derivation it must be connected with ''sequi'', to follow; possibly the development in meaning may be follower, attendant, intermediary, hence trustee. In English "sequestered" means merely secluded, withdrawn. England In law, the term "sequestration" has many applications; thus it is applied to the act of a belligerent power which seizes the debts due from its own subject to the enemy power; to a writ directed to persons, "sequestrators", to enter on the property of the defendant and seize the goods. Church of England There are also ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Defendant

In court proceedings, a defendant is a person or object who is the party either accused of committing a crime in criminal prosecution or against whom some type of civil relief is being sought in a civil case. Terminology varies from one jurisdiction to another. In Scots law, the terms "accused" or "panel" are used instead in criminal proceedings and "defender" in civil proceedings. Another term in use is "respondent". Criminal defendants In a criminal trial, a defendant is a person accused ( charged) of committing an offense (a crime; an act defined as punishable under criminal law). The other party to a criminal trial is usually a public prosecutor, but in some jurisdictions, private prosecutions are allowed. Criminal defendants are often taken into custody by police and brought before a court under an arrest warrant. Criminal defendants are usually obliged to post bail before being released from custody. For serious cases, such as murder, bail may be refused. Defendants ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Student Loan Default In The United States

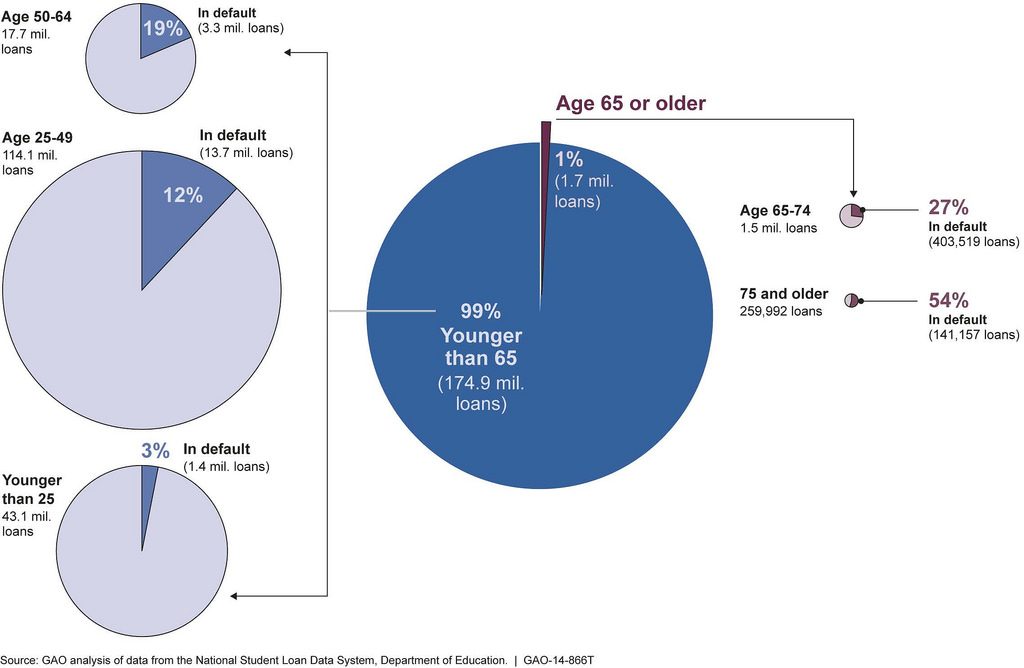

Defaulting on a loan happens when repayments are not made for a certain period of time as defined in the loan's terms of agreement, typically a promissory note. For federal student loans, default requires non-payment for a period of 270 days. For private student loans, default generally occurs after 120 days of non-payment. In 2021, outstanding student loan debt has reached a record more than $1.8 trillion. Defaulter demographics According to analysis of borrowers from the 2003-2004 academic year over a twelve-year period, defaulters generally tend to be older, lower income, and more financially independent than those who did not default. Borrowers typically owe $9,625, which is $8,500 less than the median loan balance of a non-defaulter. The majority of defaulters did not complete their bachelor's degree, but the median completed at least one year of study while maintaining grades in the C+/B- range. This shows that defaulters are able to complete college level work. Furthermore ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |