|

Forward Rate Agreement

In finance, a forward rate agreement (FRA) is an interest rate derivative (IRD). In particular, it is a linear IRD with strong associations with interest rate swaps (IRSs). General description A forward rate agreement's (FRA's) effective description is a cash for difference derivative contract, between two parties, benchmarked against an interest rate index. That index is commonly an interbank offered rate (-IBOR) of specific tenor in different currencies, for example LIBOR in USD, GBP, EURIBOR in EUR or STIBOR in SEK. An FRA between two counterparties requires a fixed rate, notional amount, chosen interest rate index tenor and date to be completely specified.Pricing and Trading Interest Rate Derivatives: A Practical Guide to Swaps J H M Darbyshire, 2017, Extended descrip ...

|

Finance

Finance refers to monetary resources and to the study and Academic discipline, discipline of money, currency, assets and Liability (financial accounting), liabilities. As a subject of study, is a field of Business administration, Business Administration wich study the planning, organizing, leading, and controlling of an organization's resources to achieve its goals. Based on the scope of financial activities in financial systems, the discipline can be divided into Personal finance, personal, Corporate finance, corporate, and public finance. In these financial systems, assets are bought, sold, or traded as financial instruments, such as Currency, currencies, loans, Bond (finance), bonds, Share (finance), shares, stocks, Option (finance), options, Futures contract, futures, etc. Assets can also be banked, Investment, invested, and Insurance, insured to maximize value and minimize loss. In practice, Financial risk, risks are always present in any financial action and entities. Due ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Interest Rate Derivative

In finance, an interest rate derivative (IRD) is a derivative whose payments are determined through calculation techniques where the underlying benchmark product is an interest rate, or set of different interest rates. There are a multitude of different interest rate indices that can be used in this definition. IRDs are popular with all financial market participants given the need for almost any area of finance to either hedge or speculate on the movement of interest rates. Modeling of interest rate derivatives is usually done on a time-dependent multi-dimensional lattice ("tree") or using specialized simulation models. Both are calibrated to the underlying risk drivers, usually domestic or foreign short rates and foreign exchange market rates, and incorporate delivery- and day count conventions. The Heath–Jarrow–Morton framework is often used instead of short rates. Types The most basic subclassification of interest rate derivatives (IRDs) is to define linear and n ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Interest Rate Swap

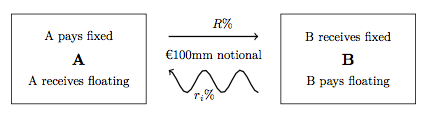

In finance, an interest rate swap (IRS) is an interest rate derivative (IRD). It involves exchange of interest rates between two parties. In particular it is a "linear" IRD and one of the most liquid, benchmark products. It has associations with forward rate agreements (FRAs), and with zero coupon swaps (ZCSs). In its December 2014 statistics release, the Bank for International Settlements reported that interest rate swaps were the largest component of the global OTC derivative market, representing 60%, with the notional amount outstanding in OTC interest rate swaps of $381 trillion, and the gross market value of $14 trillion. Interest rate swaps can be traded as an index through the FTSE MTIRS Index. Interest rate swaps General description An interest rate swap's (IRS's) effective description is a derivative contract, agreed between two counterparties, which specifies the nature of an exchange of payments benchmarked against an interest rate index. The most common IRS ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bid–ask Spread

The bid–ask spread (also bid–offer or bid/ask and buy/sell in the case of a market maker) is the difference between the prices quoted (either by a single market maker or in a Order book (trading), limit order book) for an immediate sale (Ask price, ask) and an immediate purchase (Bid price, bid) for Shares, stocks, futures contracts, Option (finance), options, or currency pairs in some auction scenario. The size of the bid–ask spread in a security is one measure of the liquidity of the market and of the size of the transaction cost. If the spread is 0 then it is a frictionless market, frictionless asset. Liquidity The trader initiating the transaction is said to demand market liquidity, liquidity, and the other party (counterparty) to the transaction supplies liquidity. Liquidity demanders place market orders and liquidity suppliers place limit orders. For a round trip (a purchase and sale together) the liquidity demander pays the spread and the liquidity supplier earns the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Derivative (finance)

In finance, a derivative is a contract between a buyer and a seller. The derivative can take various forms, depending on the transaction, but every derivative has the following four elements: # an item (the "underlier") that can or must be bought or sold, # a future act which must occur (such as a sale or purchase of the underlier), # a price at which the future transaction must take place, and # a future date by which the act (such as a purchase or sale) must take place. A derivative's value depends on the performance of the underlier, which can be a commodity (for example, corn or oil), a financial instrument (e.g. a stock or a bond), price index, a price index, a currency, or an interest rate. Derivatives can be used to insure against price movements (Hedge (finance)#Etymology, hedging), increase exposure to price movements for speculation, or get access to otherwise hard-to-trade assets or markets. Most derivatives are price guarantees. But some are based on an event or p ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Forward Rate

The forward rate is the future yield on a bond. It is calculated using the yield curve. For example, the yield on a three-month Treasury bill six months from now is a ''forward rate''.. Forward rate calculation To extract the forward rate, we need the zero-coupon yield curve. We are trying to find the future interest rate r_ for time period (t_1, t_2), t_1 and t_2 expressed in years, given the rate r_1 for time period (0, t_1) and rate r_2 for time period (0, t_2). To do this, we use the property that the proceeds from investing at rate r_1 for time period (0, t_1) and then reinvesting those proceeds at rate r_ for time period (t_1, t_2) is equal to the proceeds from investing at rate r_2 for time period (0, t_2). r_ depends on the rate calculation mode (simple, yearly compounded or continuously compounded), which yields three different results. Mathematically it reads as follows: Simple rate : (1+r_1t_1)(1+ r_(t_2-t_1)) = 1+r_2t_2 Solving for r_ yields: Thus r_ = ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Forward-forward Agreement

In business and contract law, a forward-forward agreement (FFA) is a form of forward rate agreement in which party ''A'' agrees to lend party ''B'' the ''m1'' amount of money, at future time ''t1''. In return, ''B'' will pay to ''A'' a larger monetary amount ''m2'' at time ''t2 > t1''. The name "forward-forward agreement" derives from the fact that both issuing and repayment of the loan take place in the future. A regular forward rate agreement lends the money at once. A quoted forward rate is associated with every forward-forward agreement. This can be thought of as the interest rate earned by party ''A'' for lending the money to ''B''. See also *Futures contract *Forward contract *Arbitrage Arbitrage (, ) is the practice of taking advantage of a difference in prices in two or more marketsstriking a combination of matching deals to capitalize on the difference, the profit being the difference between the market prices at which th ... References {{reflist Stock market t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

List Of Finance Topics

A list is a set of discrete items of information collected and set forth in some format for utility, entertainment, or other purposes. A list may be memorialized in any number of ways, including existing only in the mind of the list-maker, but lists are frequently written down on paper, or maintained electronically. Lists are "most frequently a tool", and "one does not ''read'' but only ''uses'' a list: one looks up the relevant information in it, but usually does not need to deal with it as a whole". Lucie Doležalová,The Potential and Limitations of Studying Lists, in Lucie Doležalová, ed., ''The Charm of a List: From the Sumerians to Computerised Data Processing'' (2009). Purpose It has been observed that, with a few exceptions, "the scholarship on lists remains fragmented". David Wallechinsky, a co-author of '' The Book of Lists'', described the attraction of lists as being "because we live in an era of overstimulation, especially in terms of information, and lists help ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Derivatives (finance)

The derivative of a function is the rate of change of the function's output relative to its input value. Derivative may also refer to: In mathematics and economics * Brzozowski derivative in the theory of formal languages *Covariant derivative, a way of specifying a derivative along tangent vectors of a manifold with a connection. * Exterior derivative, an extension of the concept of the differential of a function to differential forms of higher degree. *Formal derivative, an operation on elements of a polynomial ring which mimics the form of the derivative from calculus * Fréchet derivative, a derivative defined on normed spaces. * Gateaux derivative, a generalization of the concept of directional derivative in differential calculus. * Lie derivative, the change of a tensor field (including scalar functions, vector fields and one-forms), along the flow defined by another vector field. * Radon–Nikodym derivative in measure theory * Derivative (set theory), a concept app ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |