|

Forensic Accountant

Forensic accountants are experienced auditors, accountants, and investigators of legal and financial documents that are hired to look into possible suspicions of fraudulent activity within a company; or are hired by a company who may just want to prevent fraudulent activities from occurring. They also provide services in areas such as accounting, antitrust, damages, analysis, valuation, and general consulting. Forensic accountants have also been used in divorces, bankruptcy, insurance claims, personal injury claims, fraudulent claims, construction, royalty audits, and tracking terrorism by investigating financial records. Many forensic accountants work closely with law enforcement personnel and lawyers during investigations and often appear as expert witnesses during trials. Tasks performed Forensic accounting or forensic accountancy has been used since the time of the ancient Egyptians when Pharaoh had scribes account for his gold and other assets. These scribes worked in Pharaoh' ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Auditor

An auditor is a person or a firm appointed by a company to execute an audit.Practical Auditing, Kul Narsingh Shrestha, 2012, Nabin Prakashan, Nepal To act as an auditor, a person should be certified by the regulatory authority of accounting and auditing or possess certain specified qualifications. Generally, to act as an external auditor of the company, a person should have a certificate of practice from the regulatory authority. Types of auditors * External auditor/ Statutory auditor is an independent firm engaged by the client subject to the audit, to express an opinion on whether the company's financial statements are free of material misstatements, whether due to fraud or error. For publicly traded companies, external auditors may also be required to express an opinion over the effectiveness of internal controls over financial reporting. External auditors may also be engaged to perform other agreed-upon procedures, related or unrelated to financial statements. Mo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

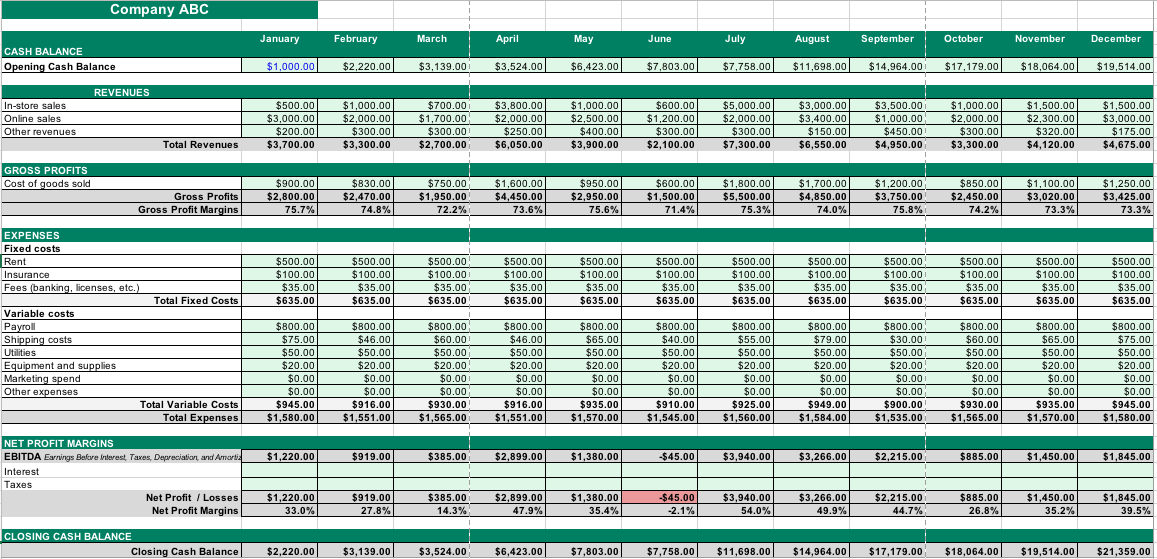

Financial Model

Financial modeling is the task of building an abstract representation (a model) of a real world financial situation. This is a mathematical model designed to represent (a simplified version of) the performance of a financial asset or portfolio of a business, project, or any other investment. Typically, then, financial modeling is understood to mean an exercise in either asset pricing or corporate finance, of a quantitative nature. It is about translating a set of hypotheses about the behavior of markets or agents into numerical predictions. At the same time, "financial modeling" is a general term that means different things to different users; the reference usually relates either to accounting and corporate finance applications or to quantitative finance applications. Accounting In corporate finance and the accounting profession, ''financial modeling'' typically entails financial statement forecasting; usually the preparation of detailed company-specific models used for deci ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Certified Fraud Examiner

The Certified Fraud Examiner (CFE) is a credential awarded by the '' Association of Certified Fraud Examiners'' (ACFE) since 1989. The ACFE association is a provider of anti-fraud training and education. Founded in 1988 by Dr. Joseph T Wells. The ACFE established and administers the Certified Fraud Examiner (CFE) credential. To become a Certified Fraud Examiner (CFE), one must meet the following requirements: * Be an Associate Member of the ACFE in good standing * Meet minimum academic and professional requirements (undergraduate degree and professional experience (Note: a combination of graduate or post-graduate education and experience can be used to increase eligibility, however most importantly a candidate must score 40 points or above based on eligibility criteria). * Be of high moral character * Agree to abide by the Bylaws and Code of Professional Ethics of the Association of Certified Fraud Examiners * Pass the CFE Examination Academic requirements Generally, applicants ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Chartered Professional Accountant

Chartered Professional Accountant (CPA; ) is the professional certification, professional designation which united the three Canadian accounting designations that previously existed: :* Canadian Institute of Chartered Accountants, Chartered Accountant (Chartered accountant, CA), :* Certified General Accountants Association of Canada, Certified General Accountant (Certified general accountant, CGA) :* Certified Management Accountants of Canada, Certified Management Accountant (Certified Management Accountant, CMA). CPA Canada is the national organization that represents the profession, and the CPA designation has been in use by members of all constituent accounting bodies in the provinces, territories and Bermuda since 2014. The legislative process for implementing the new designation began in Quebec in May 2012, and was completed in the Northwest Territories and Nunavut in January 2019. CPA Competency Map The CPA Competency Map lays the foundation for the CPA certification pro ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Certified Management Accountant

Certified Management Accountant (CMA) is a professional certification credential in the management accounting and financial management fields. The certification signifies that the person possesses knowledge in the areas of financial planning, analysis, control, decision support, and professional ethics. There are many professional bodies globally that have management accounting professional qualifications. The main bodies that offer the CMA certification are: # Institute of Management Accountants, Institute of Management Accountants USA; # Institute of Certified Management Accountants, Institute of Certified Management Accountants (Australia); # Certified Management Accountants of Canada. Since the Canadian body merged with the CPA Canada in September 2015, there are only 2 global bodies that offer the CMA certification, IMA (USA) and ICMA (Australia). However, the certification pathways for the two bodies – in terms of entry requirements, study syllabi and experience requirem ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Certified Public Accountant

Certified Public Accountant (CPA) is the title of qualified accountants in numerous countries in the English-speaking world. It is generally equivalent to the title of chartered accountant in other English-speaking countries. In the United States, the CPA is a license to provide accounting services to the public. It is awarded by each of the 50 states for practice in that state. Additionally, all states except Hawaii have passed mobility laws to allow CPAs from other states to practice in their state. State licensing requirements vary, but the minimum standard requirements include passing the Uniform Certified Public Accountant Examination, 150 semester units of college education, and one year of accounting-related experience. Continuing professional education (CPE) is also required to maintain licensure. Individuals who have been awarded the CPA but have lapsed in the fulfillment of the required CPE or who have requested conversion to inactive status are in many states permitte ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Certified Forensic Investigation Professional

Certification is part of testing, inspection and certification and the provision by an independent body of written assurance (a certificate) that the product, service or system in question meets specific requirements. It is the formal attestation or confirmation of certain characteristics of an object, person, or organization. This confirmation is often, but not always, provided by some form of external review, education, assessment, or audit. Accreditation is a specific organization's process of certification. According to the U.S. National Council on Measurement in Education, a certification test is a credentialing test used to determine whether individuals are knowledgeable enough in a given occupational area to be labeled "competent to practice" in that area. As a rule, certificates must be renewed and periodically reviewed by a certifying regulatory body responsible for the validity of the certificate's assessment methods. The certifying body can be either a state authority ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Bachelor's Degree

A bachelor's degree (from Medieval Latin ''baccalaureus'') or baccalaureate (from Modern Latin ''baccalaureatus'') is an undergraduate degree awarded by colleges and universities upon completion of a course of study lasting three to six years (depending on the institution and academic discipline). The two most common bachelor's degrees are the Bachelor of Arts (BA) and the Bachelor of Science (BS or BSc). In some institutions and educational systems, certain bachelor's degrees can only be taken as graduate or postgraduate educations after a first degree has been completed, although more commonly the successful completion of a bachelor's degree is a prerequisite for further courses such as a master's or a doctorate. In countries with qualifications frameworks, bachelor's degrees are normally one of the major levels in the framework (sometimes two levels where non-honours and honours bachelor's degrees are considered separately). However, some qualifications titled bachelor's ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Satyam Scandal

The Satyam Computer Services scandal was India's largest corporate fraud until 2010. The founder and directors of India-based outsourcing company Satyam Computer Services, falsified the accounts, inflated the share price, and stole large sums from the company. Much of this was invested in property. The swindle was discovered in late 2008 when the Hyderabad property market collapsed, leaving a trail back to Satyam. The scandal was brought to light in 2009 when chairman Byrraju Ramalinga Raju confessed that the company's accounts had been falsified. History For many years Satyam accounts showed profits that had never existed, cash at the bank that did not exist, which inflated the share price. Raju and friends then sold shares. The accounts also showed $3m of "salary payments" to people who did not exist. These in fact went to board members. The falsified accounts were used to obtain cheap loans in the USA which were stolen by Raju and never entered into the accounts. M ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Edward I

Edward I (17/18 June 1239 – 7 July 1307), also known as Edward Longshanks and the Hammer of the Scots (Latin: Malleus Scotorum), was King of England from 1272 to 1307. Concurrently, he was Lord of Ireland, and from 1254 to 1306 ruled Gascony as Duke of Aquitaine in his capacity as a vassal of the French king. Before his accession to the throne, he was commonly referred to as the Lord Edward. The eldest son of Henry III, Edward was involved from an early age in the political intrigues of his father's reign. In 1259, he briefly sided with a baronial reform movement, supporting the Provisions of Oxford. After reconciling with his father, he remained loyal throughout the subsequent armed conflict, known as the Second Barons' War. After the Battle of Lewes, Edward was held hostage by the rebellious barons, but escaped after a few months and defeated the baronial leader Simon de Montfort at the Battle of Evesham in 1265. Within two years, the rebe ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Altman Z-score

Example of an Excel spreadsheet that uses Altman Z-score to predict the bankruptcy.html" ;"title="probability that a firm will go into bankruptcy">probability that a firm will go into bankruptcy within two years The Z-score formula for predicting bankruptcy was published in 1968 by Edward I. Altman, who was, at the time, an Assistant Professor of Finance at New York University. The formula may be used to determine the probability that a firm will go into bankruptcy within two years. Z-scores are used to predict corporate defaults and an easy-to-calculate control measure for the financial distress status of companies in academic studies. The Z-score uses multiple corporate income and balance sheet values to measure the financial health of a company. The formula The Z-score is a linear combination of four or five common business ratios, weighted by coefficients. The coefficients were estimated by identifying a set of firms which had declared bankruptcy and then collecting a mat ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |