|

Foreign Corporation

Foreign corporation is a term used in the United States to describe an existing corporation (or other type of corporate entity, such as a limited liability company or LLC) that conducts business in a state or jurisdiction other than where it was originally incorporated. The term applies both to domestic corporations that are incorporated in another state and to corporations that are incorporated in a nation other than the United States (known as "alien corporations"). All states require that foreign corporations register with the state before conducting business in the state. For U.S. federal tax purposes, where " foreign corporation" means a corporation that is not created or organized in the United States. For tax purposes, the Internal Revenue Service (IRS) treats all domestic companies in the same manner for tax purposes, without regard to where they were originally formed or organized within the United States, but applies different rules to companies that are formed or org ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

United States

The United States of America (USA), also known as the United States (U.S.) or America, is a country primarily located in North America. It is a federal republic of 50 U.S. state, states and a federal capital district, Washington, D.C. The 48 contiguous states border Canada to the north and Mexico to the south, with the semi-exclave of Alaska in the northwest and the archipelago of Hawaii in the Pacific Ocean. The United States asserts sovereignty over five Territories of the United States, major island territories and United States Minor Outlying Islands, various uninhabited islands in Oceania and the Caribbean. It is a megadiverse country, with the world's List of countries and dependencies by area, third-largest land area and List of countries and dependencies by population, third-largest population, exceeding 340 million. Its three Metropolitan statistical areas by population, largest metropolitan areas are New York metropolitan area, New York, Greater Los Angeles, Los Angel ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

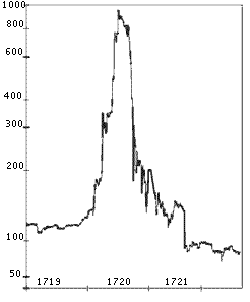

Bank

A bank is a financial institution that accepts Deposit account, deposits from the public and creates a demand deposit while simultaneously making loans. Lending activities can be directly performed by the bank or indirectly through capital markets. As banks play an important role in financial stability and the economy of a country, most jurisdictions exercise a high degree of Bank regulation, regulation over banks. Most countries have institutionalized a system known as fractional-reserve banking, under which banks hold liquid assets equal to only a portion of their current liabilities. In addition to other regulations intended to ensure accounting liquidity, liquidity, banks are generally subject to minimum capital requirements based on an international set of capital standards, the Basel Accords. Banking in its modern sense evolved in the fourteenth century in the prosperous cities of Renaissance Italy but, in many ways, functioned as a continuation of ideas and concepts o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Flag Of Convenience (business)

In business and commerce, the term flag of convenience is the use of a place, jurisdiction, state or country as a nominal (in name only) "home base" for one's operations or charter, even though either no or virtually no operations or business are conducted there. It is also used where the organization operates in one place even though nearly all of its customers are from elsewhere. It is a type of jurisdiction shopping. There are several reasons for doing this. Corporation requirements The most common use of a flag of convenience is a U.S. corporation being chartered as a domestic corporation in Nevada or Delaware because of favorable corporate governance rules. The reason for this sort of a choice is that, in general, in the United States, a corporation which operates in more than one state (or country) has a particular state where it is incorporated, to which it is a domestic corporation. In all other states where it operates and has filed papers to be allowed to operate, i ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Company Law

Corporate law (also known as company law or enterprise law) is the body of law governing the rights, relations, and conduct of persons, companies, organizations and businesses. The term refers to the legal practice of law relating to corporations, or to the theory of corporations. Corporate law often describes the law relating to matters which derive directly from the life-cycle of a corporation.John Armour, Henry Hansmann, Reinier Kraakman, Mariana Pargendler "What is Corporate Law?" in ''The Anatomy of Corporate Law: A Comparative and Functional Approach''(Eds Reinier Kraakman, John Armour, Paul Davies, Luca Enriques, Henry Hansmann, Gerard Hertig, Klaus Hopt, Hideki Kanda, Mariana Pargendler, Wolf-Georg Ringe, and Edward Rock, Oxford University Press 2017)1.1 It thus encompasses the formation, funding, governance, and death of a corporation. While the minute nature of corporate governance as personified by share ownership, capital market, and business culture rules d ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bermuda

Bermuda is a British Overseas Territories, British Overseas Territory in the Atlantic Ocean, North Atlantic Ocean. The closest land outside the territory is in the American state of North Carolina, about to the west-northwest. Bermuda is an archipelago consisting of List of islands of Bermuda, 181 islands, although the most significant islands are connected by bridges and appear to form one landmass. It has a land area of . Bermuda has a tropical climate, with warm winters and hot summers. Its climate also exhibits Oceanic climate, oceanic features similar to other coastal areas in the Northern Hemisphere with warm, moist air from the ocean ensuring relatively high humidity and stabilising temperatures. Bermuda is prone to severe weather from Westerlies#Interaction with tropical cyclones, recurving tropical cyclones; however, it receives some protection from a coral reef and its position north of the Main Development Region, which limits the direction and severity of approach ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

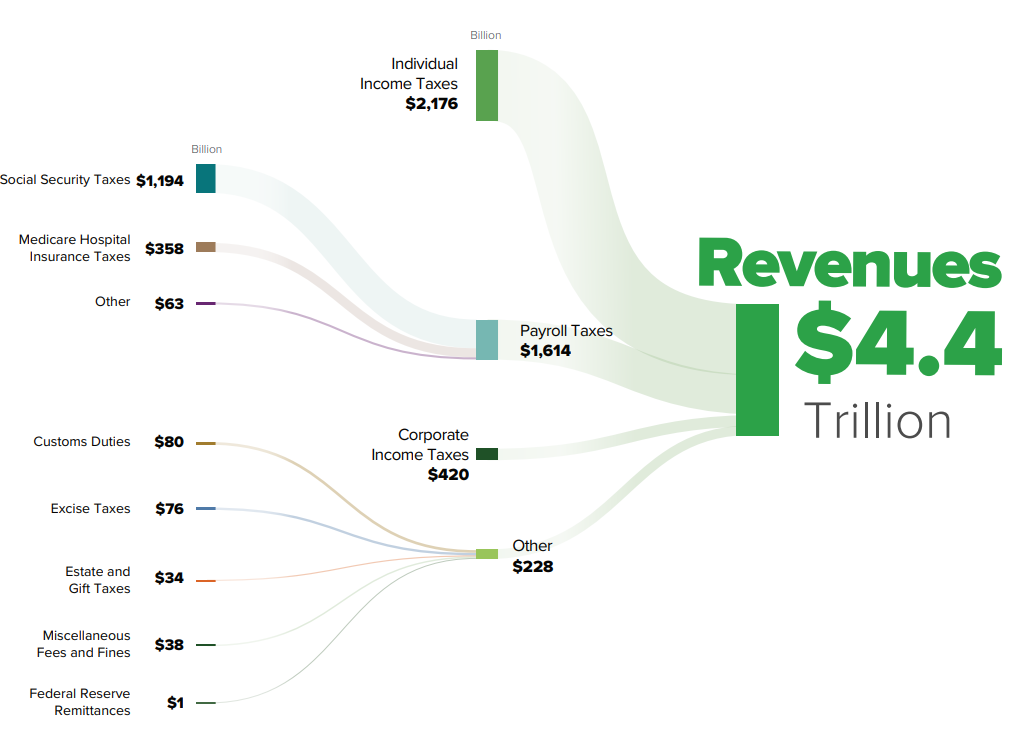

Taxation In The United States

The United States has separate federal, state, and local governments with taxes imposed at each of these levels. Taxes are levied on income, payroll, property, sales, capital gains, dividends, imports, estates and gifts, as well as various fees. In 2020, taxes collected by federal, state, and local governments amounted to 25.5% of GDP, below the OECD average of 33.5% of GDP. U.S. tax and transfer policies are progressive and therefore reduce effective income inequality, as rates of tax generally increase as taxable income increases. As a group, the lowest earning workers, especially those with dependents, pay no income taxes and may actually receive a small subsidy from the federal government (from child credits and the Earned Income Tax Credit). Taxes fall much more heavily on labor income than on capital income. Divergent taxes and subsidies for different forms of income and spending can also constitute a form of indirect taxation of some activities over others. Taxes ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

C Corporation

A C corporation, under United States federal income tax law, is any corporation that is taxed separately from its owners. A C corporation is distinguished from an S corporation, which generally is not taxed separately. Many companies, including most major corporations, are treated as C corporations for U.S. federal income tax purposes. C corporations and S corporations both enjoy limited liability, but only C corporations are subject to corporate income taxation. Versus S corporations Generally, all for-profit corporations are automatically classified as a C corporation unless the corporation elects the option to treat the corporation as a flow-through entity known as an S corporation. An S corporation is not subject to income tax; rather, its shareholders are subject to tax on their ''pro rata'' shares of income based on their shareholdings. To qualify to make the S corporation election, the corporation's shares must be held by residents, citizens or certain qualifying trusts. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Flow-through Entity

A flow-through entity (FTE) is a legal entity where income "flows through" to investors or owners; that is, the income of the entity is treated as the income of the investors or owners. Flow-through entities are also known as pass-through entities or fiscally-transparent entities. Common types of FTEs are general partnerships, limited partnerships and limited liability partnerships. In the United States, additional types of FTE include S corporations, income trusts and limited liability companies. Most countries require an FTE (or its owners) to file an annual return reporting the shares of income allocated to owners, and to provide each owner with a statement of allocated income to enable owners to report their shares of income on their own tax returns. In the United States, the statement of allocated income is known as a K-1 (or Schedule K-1). Depending on the local tax regulations, this structure can avoid dividend tax and double taxation because only owners or investors are ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Nevada Corporation

A Nevada corporation is a corporation incorporated under Chapter 78 of the '' Nevada Revised Statutes'' of the U.S. state of Nevada. It is significant in United States corporate law. Nevada, like Delaware (see Delaware General Corporation Law), is well known as a state that offers a corporate haven. Many major corporations are incorporated in Nevada, particularly corporations whose headquarters are located in California and other Western states. Piercing the veil Nevada law provides extremely strong protection against piercing the corporate veil, where a corporation's owners can be held responsible for the actions of a corporation. For instance, from 1987 to 2007, there was only one case that successfully pierced the corporate veil of a Nevada corporation, and in this case the veil was pierced due to fraud on the part of the corporation's owners. Because the provisions on "piercing the corporate veil" are corporate governance matters, if a corporation chartered in Californi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Delaware General Corporation Law

The Delaware General Corporation Law (sometimes abbreviated DGCL), officially the General Corporation Law of the State of Delaware (Title 8, Chapter 1 of the Delaware Code), is the statute of the Delaware Code that governs corporate law in the U.S. state of Delaware. The statute was adopted in 1899. Since the 1913 anti-corporation reforms in New Jersey under the governorship of Woodrow Wilson, Delaware has become the most prevalent jurisdiction in United States corporate law and has been described as the ''de facto'' corporate capital of the United States. Delaware is considered a corporate haven because of its business-friendly/anti-consumer corporate laws compared to most other U.S. states. 66% of the ''Fortune'' 500, including Walmart and Amazon (two of the world's largest companies by revenue) are incorporated (and therefore have their domiciles for service of process purposes) in the state. Over half of all publicly traded corporations listed in the New York Stock Exc ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Corporation

A corporation or body corporate is an individual or a group of people, such as an association or company, that has been authorized by the State (polity), state to act as a single entity (a legal entity recognized by private and public law as "born out of statute"; a legal person in a legal context) and recognized as such in Corporate law, law for certain purposes. Early incorporated entities were established by charter (i.e., by an ''ad hoc'' act granted by a monarch or passed by a parliament or legislature). Most jurisdictions now allow the creation of new corporations through List of company registers, registration. Corporations come in many different types but are usually divided by the law of the jurisdiction where they are chartered based on two aspects: whether they can issue share capital, stock, or whether they are formed to make a profit (accounting), profit. Depending on the number of owners, a corporation can be classified as ''aggregate'' (the subject of this articl ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |