|

Exchange Economy

Exchange economy is technical term used in microeconomics research to describe interaction between several agents. In the market, the agent is the subject of exchange and the good is the object of exchange. Each agent brings his/her own endowment, and they can exchange products among them based on a price system. Two types of exchange economy are studied: * In a pure exchange economy, all agents are consumers; there is no production and all agents can do is exchange their initial endowments. In daily research, to avoid research difficulties caused by a large number of consumers and goods, the simple trading conditions of two consumers and two goods are usually assumed. * In contrast, in an exchange economy with production, some or all agents are firms that may also produce new goods. A major interesting question regarding an exchange economy is if and when the economy attains a competitive equilibrium. Exchange and distribution efficiency are concerned. Pure exchange economy * A ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Microeconomics

Microeconomics is a branch of economics that studies the behavior of individuals and Theory of the firm, firms in making decisions regarding the allocation of scarcity, scarce resources and the interactions among these individuals and firms. Microeconomics focuses on the study of individual markets, sectors, or industries as opposed to the economy as a whole, which is studied in macroeconomics. One goal of microeconomics is to analyze the market mechanisms that establish relative prices among goods and services and allocate limited resources among alternative uses. Microeconomics shows conditions under which free markets lead to desirable allocations. It also analyzes market failure, where markets fail to produce Economic efficiency, efficient results. While microeconomics focuses on firms and individuals, macroeconomics focuses on the total of economic activity, dealing with the issues of Economic growth, growth, inflation, and unemployment—and with national policies relati ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Budget Constraint

In economics, a budget constraint represents all the combinations of goods and services that a consumer may purchase given current prices within their given income. Consumer theory uses the concepts of a budget constraint and a preference map as tools to examine the parameters of consumer choices . Both concepts have a ready graphical representation in the two-good case. The consumer can only purchase as much as their income will allow, hence they are constrained by their budget. The equation of a budget constraint is P_x x+P_y y=m where P_x is the price of good , and P_y is the price of good , and is income. Soft budget constraint The concept of soft budget constraint is commonly applied to centrally planned economies, later economies in transition. This theory was originally proposed by János Kornai in 1979. It was used to explain the "economic behavior in socialist economies marked by shortage”. In the socialist transition economy there are soft budget constraint o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Price System

In economics, a price system is a system through which the valuations of any forms of property (tangible or intangible) are determined. All societies use price systems in the allocation and exchange of resources as a consequence of scarcity. Even in a barter system with no money, price systems are still utilized in the determination of exchange ratios (relative valuations) between the properties being exchanged. A price system may be either a regulated price system (such as a fixed price system) where prices are administered by an authority, or it may be a free price system (such as a market system) where prices are left to float "freely" as determined by supply and demand without the intervention of an authority. A mixed price system involves a combination of both regulated and free price systems. History Price systems have been around as long as there has been economic exchanges. The price system has transformed into the system of global capitalism that is present in t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Competitive Equilibrium

Competitive equilibrium (also called: Walrasian equilibrium) is a concept of economic equilibrium, introduced by Kenneth Arrow and Gérard Debreu in 1951, appropriate for the analysis of commodity markets with flexible prices and many traders, and serving as the benchmark of efficiency in economic analysis. It relies crucially on the assumption of a competitive environment where each trader decides upon a quantity that is so small compared to the total quantity traded in the market that their individual transactions have no influence on the prices. Competitive markets are an ideal standard by which other market structures are evaluated. Definitions A competitive equilibrium (CE) consists of two elements: * A price function P. It takes as argument a vector representing a bundle of commodities, and returns a positive real number that represents its price. Usually the price function is linear - it is represented as a vector of prices, a price for each commodity type. * An allocation ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Market Economy

A market economy is an economic system in which the decisions regarding investment, production, and distribution to the consumers are guided by the price signals created by the forces of supply and demand. The major characteristic of a market economy is the existence of factor markets that play a dominant role in the allocation of capital and the factors of production. Market economies range from minimally regulated free market and '' laissez-faire'' systems where state activity is restricted to providing public goods and services and safeguarding private ownership, to interventionist forms where the government plays an active role in correcting market failures and promoting social welfare. State-directed or dirigist economies are those where the state plays a directive role in guiding the overall development of the market through industrial policies or indicative planning—which guides yet does not substitute the market for economic planning—a form sometimes r ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

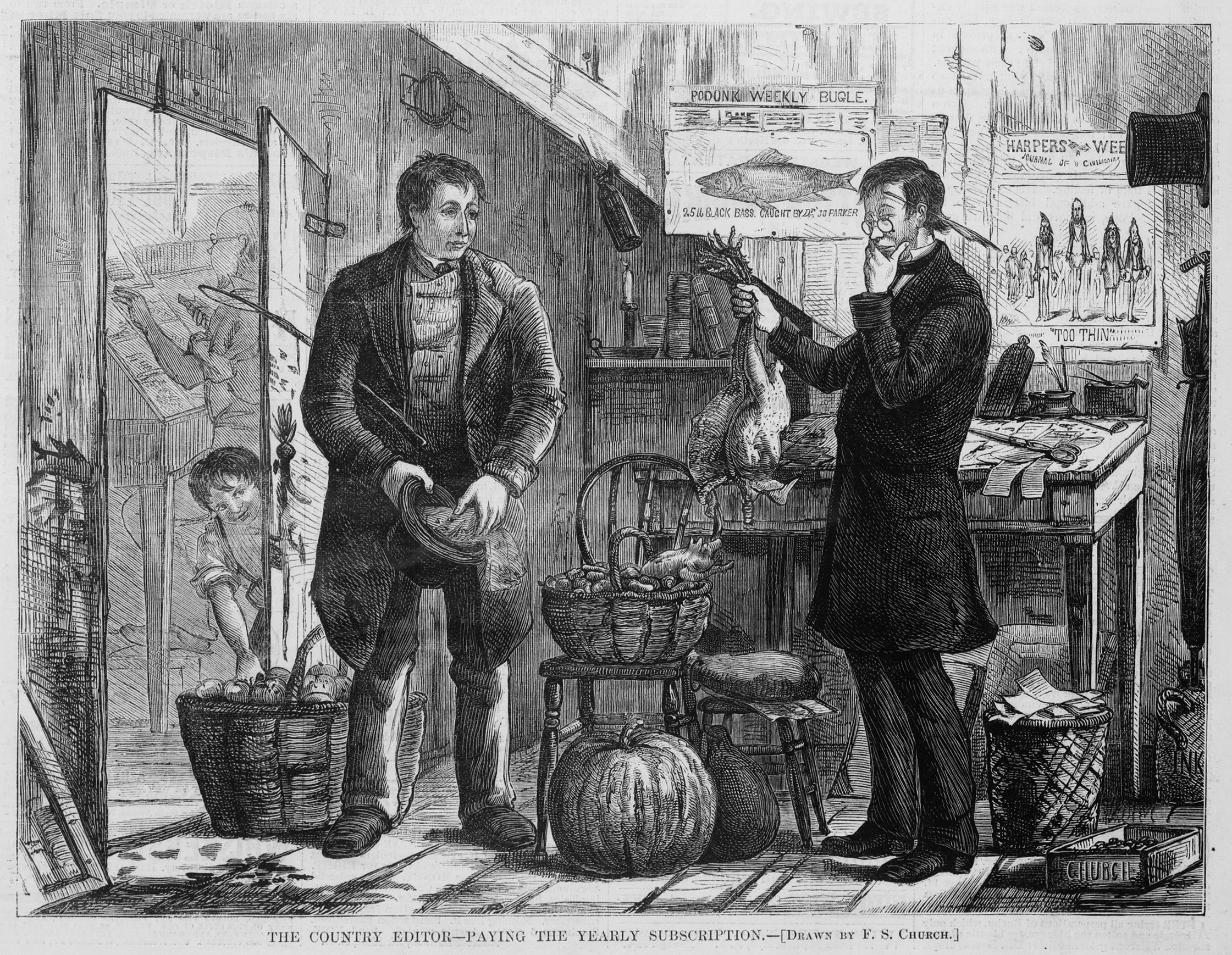

Barter

In trade, barter (derived from ''bareter'') is a system of exchange (economics), exchange in which participants in a financial transaction, transaction directly exchange good (economics), goods or service (economics), services for other goods or services without using a medium of exchange, such as money. Economists usually distinguish barter from gift economy, gift economies in many ways; barter, for example, features immediate reciprocity (cultural anthropology), reciprocal exchange, not one delayed in time. Barter usually takes place on a bilateral trade, bilateral basis, but may be multilateral exchange, multilateral (if it is mediated through a trade exchange). In most developed countries, barter usually exists parallel to monetary systems only to a very limited extent. Market actors use barter as a replacement for money as the method of exchange in times of monetary crisis, such as when currency becomes unstable (such as hyperinflation or a Deflation#Deflationary spiral, de ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Pareto Optimality

In welfare economics, a Pareto improvement formalizes the idea of an outcome being "better in every possible way". A change is called a Pareto improvement if it leaves at least one person in society better off without leaving anyone else worse off than they were before. A situation is called Pareto efficient or Pareto optimal if all possible Pareto improvements have already been made; in other words, there are no longer any ways left to make one person better off without making some other person worse-off. In social choice theory, the same concept is sometimes called the unanimity principle, which says that if ''everyone'' in a society ( non-strictly) prefers A to B, society as a whole also non-strictly prefers A to B. The Pareto front consists of all Pareto-efficient situations. In addition to the context of efficiency in ''allocation'', the concept of Pareto efficiency also arises in the context of ''efficiency in production'' vs. '' x-inefficiency'': a set of outputs of go ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Edgeworth Box

In economics, an Edgeworth box, sometimes referred to as an Edgeworth-Bowley box, is a graphical representation of a market with just two commodities, ''X'' and ''Y'', and two consumers. The dimensions of the box are the total quantities Ω''x'' and Ω''y'' of the two goods. Let the consumers be Octavio and Abby. The top right-hand corner of the box represents the allocation in which Octavio holds all the goods, while the bottom left corresponds to complete ownership by Abby. Points within the box represent ways of allocating the goods between the two consumers. Market behaviour will be determined by the consumers' indifference curve, indifference curves. The blue curves in the diagram represent indifference curves for Octavio, and are shown as convex from his viewpoint (i.e. seen from the bottom left). The orange curves apply to Abby, and are convex as seen from the top right. Moving up and to the right increases Octavio's allocation and puts him onto a more desirable indifference ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Walrasian Equilibrium

Competitive equilibrium (also called: Walrasian equilibrium) is a concept of economic equilibrium, introduced by Kenneth Arrow and Gérard Debreu in 1951, appropriate for the analysis of commodity markets with flexible prices and many traders, and serving as the benchmark of efficiency in economic analysis. It relies crucially on the assumption of a perfect competition, competitive environment where each trader decides upon a quantity that is so small compared to the total quantity traded in the market that their individual transactions have no influence on the prices. Competitive markets are an ideal standard by which other market structures are evaluated. Definitions A competitive equilibrium (CE) consists of two elements: * A price function P. It takes as argument a vector representing a bundle of commodities, and returns a positive real number that represents its price. Usually the price function is linear - it is represented as a vector of prices, a price for each commodity t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Welfare Economics

Welfare economics is a field of economics that applies microeconomic techniques to evaluate the overall well-being (welfare) of a society. The principles of welfare economics are often used to inform public economics, which focuses on the ways in which government intervention can improve social welfare. Additionally, welfare economics serves as the theoretical foundation for several instruments of public economics, such as cost–benefit analysis. The intersection of welfare economics and behavioral economics has given rise to the subfield of behavioral welfare economics. Two fundamental theorems are associated with welfare economics. The first states that competitive markets, under certain assumptions, lead to Pareto efficient outcomes. This idea is sometimes referred to as Adam Smith's invisible hand. The second theorem states that with further restrictions, any Pareto efficient outcome can be achieved through a competitive market equilibrium, provided that a social ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |