|

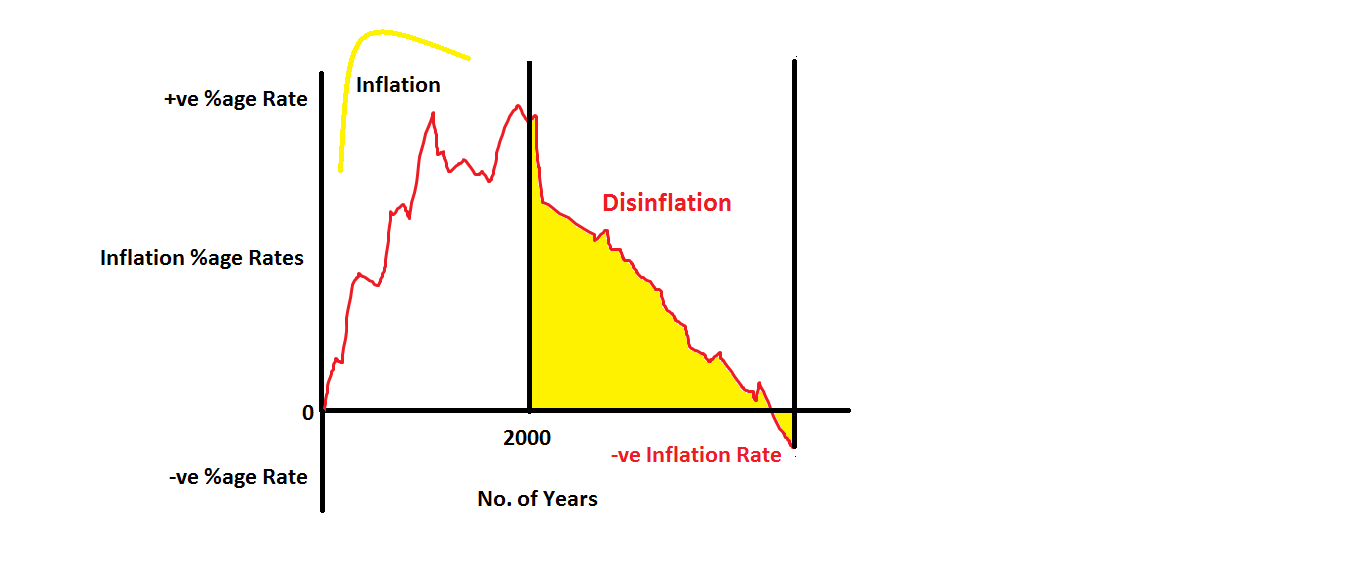

Disinflation

Disinflation is a decrease in the rate of inflation – a slowdown in the rate of increase of the general price level of goods and services in a nation's gross domestic product over time. It is the opposite of reflation. If the inflation rate is not very high to start with, disinflation can lead to deflation – decreases in the general price level of goods and services. For example if the annual inflation rate one month is 5% and it is 4% the following month, prices disinflated by 1% but are still increasing at a 4% annual rate. If the current rate is 1% and it is the -2% the following month, prices disinflated by 3% and are decreasing at a 2% annual rate. See also *Hyperinflation * Stagflation * Devaluation * Chronic inflation *Deflation In economics, deflation is a decrease in the general price level of goods and services. Deflation occurs when the inflation rate falls below 0% and becomes negative. While inflation reduces the value of currency over time, deflati ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Disinflation Graph

Disinflation is a decrease in the rate of inflation – a slowdown in the rate of increase of the general price level of goods and services in a nation's gross domestic product over time. It is the opposite of reflation. If the inflation rate is not very high to start with, disinflation can lead to deflation – decreases in the general price level of goods and services. For example if the annual inflation rate one month is 5% and it is 4% the following month, prices disinflated by 1% but are still increasing at a 4% annual rate. If the current rate is 1% and it is the -2% the following month, prices disinflated by 3% and are decreasing at a 2% annual rate. See also *Hyperinflation *Stagflation *Devaluation * Chronic inflation *Deflation References Further reading * * * * * External links Globalization and Global Disinflationby Kenneth Rogoff Kenneth Saul Rogoff (born March 22, 1953) is an American economist and chess Grandmaster. He is the Maurits C. Boas Chair of ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

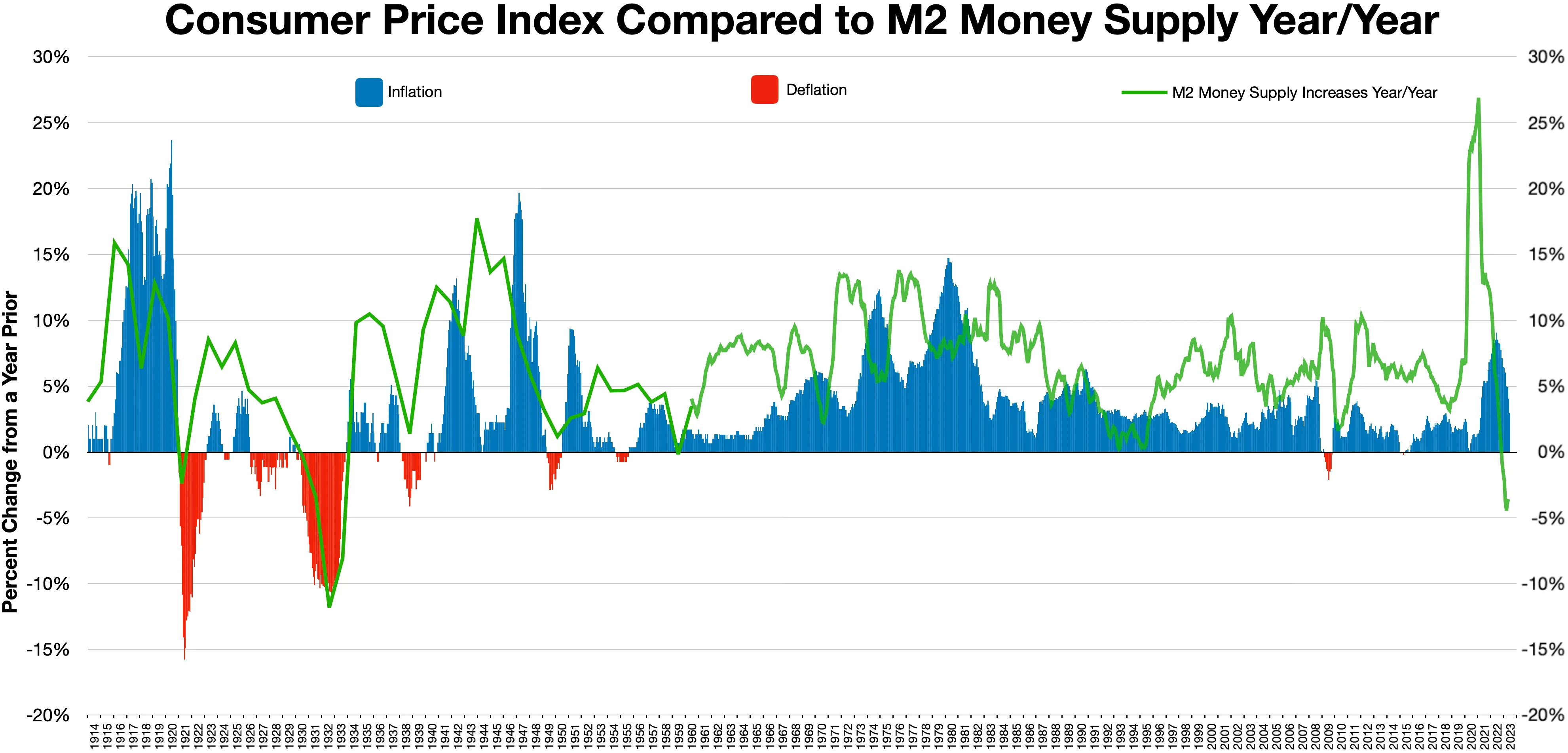

Inflation

In economics, inflation is an increase in the average price of goods and services in terms of money. This increase is measured using a price index, typically a consumer price index (CPI). When the general price level rises, each unit of currency buys fewer goods and services; consequently, inflation corresponds to a reduction in the purchasing power of money. The opposite of CPI inflation is deflation, a decrease in the general price level of goods and services. The common measure of inflation is the inflation rate, the annualized percentage change in a general price index. Changes in inflation are widely attributed to fluctuations in Real versus nominal value (economics), real demand for goods and services (also known as demand shocks, including changes in fiscal policy, fiscal or monetary policy), changes in available supplies such as during energy crisis, energy crises (also known as supply shocks), or changes in inflation expectations, which may be self-fulfilling. Moderat ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

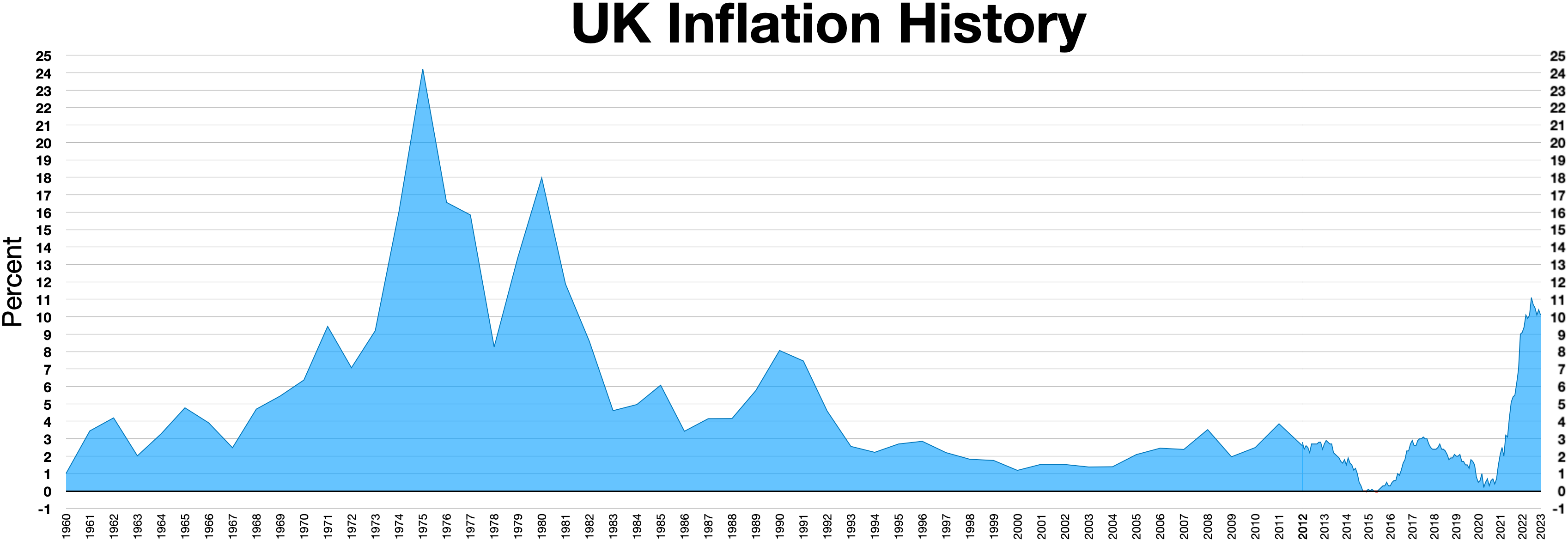

Stagflation

Stagflation is the combination of high inflation, stagnant economic growth, and elevated unemployment. The term ''stagflation'', a portmanteau of "stagnation" and "inflation," was popularized, and probably coined, by British politician Iain Macleod in the 1960s, during a period of economic distress in the United Kingdom. It gained broader recognition in the 1970s after a series of global economic shocks, particularly the 1973 oil crisis, which disrupted supply chains and led to rising prices and slowing growth. Stagflation challenges traditional economic theories, which suggest that inflation and unemployment are inversely related, as depicted by the Phillips Curve. Stagflation presents a policy dilemma, as measures to curb inflation—such as tightening monetary policy—can exacerbate unemployment, while policies aimed at reducing unemployment may fuel inflation. In economic theory, there are two main explanations for stagflation: supply shocks, such as a sharp increa ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Reflation

Reflation is used to describe a return of prices to a previous rate of inflation. One usage describes an act of stimulating the economy by increasing the money supply or by reducing taxes, seeking to bring the economy (specifically the price level) back ''up'' to the long-term trend, following a dip in the business cycle. It is the opposite of disinflation, which seeks to return the economy back ''down'' to the long-term trend. Overview In this perspective, reflation, is contrasted with inflation (narrowly speaking) ''above'' the some long-term trend line, while reflation is a recovery of the price level when it has fallen ''below'' the trend line. For example, if inflation had been running at a 3% rate, but for one year it falls to 0%, the following year would need 6% inflation (actually 6.09% due to compounding) to catch back up to the long-term trend. This higher than normal inflation is considered reflation, since it is a return to trend, not exceeding the long-term trend. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Deflation

In economics, deflation is a decrease in the general price level of goods and services. Deflation occurs when the inflation rate falls below 0% and becomes negative. While inflation reduces the value of currency over time, deflation increases it. This allows more goods and services to be bought than before with the same amount of currency. Deflation is distinct from '' disinflation'', a slowdown in the inflation rate; i.e., when inflation declines to a lower rate but is still positive. Economists generally believe that a sudden deflationary shock is a problem in a modern economy because it increases the real value of debt, especially if the deflation is unexpected. Deflation may also aggravate recessions and lead to a deflationary spiral . Some economists argue that prolonged deflationary periods are related to the underlying technological progress in an economy, because as productivity increases ( TFP), the cost of goods decreases. Deflation usually happens when supply is hi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Price Index

A price index (''plural'': "price indices" or "price indexes") is a normalized average (typically a weighted average) of price relatives for a given class of goods or services in a specific region over a defined time period. It is a statistic designed to measure how these price relatives, as a whole, differ between time periods or geographical locations, often expressed relative to a base period set at 100. Price indices serve multiple purposes. Broad indices, like the Consumer price index, reflect the economy’s general price level or cost of living, while narrower ones, such as the Producer price index, assist producers with pricing and business planning. They can also guide investment decisions by tracking price trends. Types of price indices Some widely recognized price indices include: * Consumer price index – Measures retail price changes for consumer goods and services. * Producer price index – Tracks wholesale price changes for producers. * Wholesal ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Gross Domestic Product

Gross domestic product (GDP) is a monetary measure of the total market value of all the final goods and services produced and rendered in a specific time period by a country or countries. GDP is often used to measure the economic performance of a country or region. Several national and international economic organizations maintain definitions of GDP, such as the OECD and the International Monetary Fund. GDP is often used as a metric for international comparisons as well as a broad measure of economic progress. It is often considered to be the world's most powerful statistical indicator of national development and progress. The GDP can be divided by the total population to obtain the average GDP per capita. Total GDP can also be broken down into the contribution of each industry or sector of the economy. Nominal GDP is useful when comparing national economies on the international market according to the exchange rate. To compare economies over time inflation can be adjus ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Hyperinflation

In economics, hyperinflation is a very high and typically accelerating inflation. It quickly erodes the real versus nominal value (economics), real value of the local currency, as the prices of all goods increase. This causes people to minimize their holdings in that currency as they usually switch to more stable foreign currencies. Effective capital controls and currency substitution ("dollarization") are the orthodox solutions to ending short-term hyperinflation; however, there are significant social and economic costs to these policies. Ineffective implementations of these solutions often exacerbate the situation. Many governments choose to attempt to solve structural issues without resorting to those solutions, with the goal of bringing inflation down slowly while minimizing social costs of further economic shocks; however, this can lead to a prolonged period of high inflation. Unlike low inflation, where the process of rising prices is protracted and not generally noticeab ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Devaluation

In macroeconomics and modern monetary policy, a devaluation is an official lowering of the value of a country's currency within a fixed exchange-rate system, in which a monetary authority formally sets a lower exchange rate of the national currency in relation to a foreign reference currency or currency basket. The opposite of devaluation, a change in the exchange rate making the domestic currency more expensive, is called a '' revaluation''. A monetary authority (e.g., a central bank) maintains a fixed value of its currency by being ready to buy or sell foreign currency with the domestic currency at a stated rate; a devaluation is an indication that the monetary authority will buy and sell foreign currency at a lower rate. However, under a floating exchange rate system (in which exchange rates are determined by market forces acting on the foreign exchange market, and not by government or central bank policy actions), a decrease in a currency's value relative to other major cur ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Chronic Inflation

Chronic inflation is an economic phenomenon occurring when a country experiences high inflation for a prolonged period (several years or decades) due to continual increases in the money supply among other things. In countries with chronic inflation, inflation expectations become 'built-in', and it becomes extremely difficult to reduce the inflation rate because the process of reducing inflation by, for example, slowing down the growth rate of the money supply, will often lead to high unemployment until inflationary expectations have adjusted to the new situation. Chronic inflation is distinct from hyperinflation. Occurrence Even more so than hyperinflation, chronic inflation is a 20th-century phenomenon, being first observed by Felipe Pazos in 1972. High inflation can only be sustained with unbacked paper currencies over long periods, and before World War II unbacked paper currencies were rare except in countries affected by war – which often produced extremely high inflat ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |