|

Convertibility

Convertibility is the quality that allows money or other financial instruments to be converted into other liquid stores of value. Convertibility is an important factor in international trade, where instruments valued in different currencies must be exchanged. Currency trading Freely convertible currencies have immediate value on the different international markets, and few restrictions on the manner and amount that can be traded for another currency. Free convertibility is a major feature of a hard currency. Some countries pass laws restricting the legal exchange rates of their currencies or requiring permits to exchange more than a certain amount. Some currencies, such as the North Korean won, the Transnistrian ruble, and the Cuban national peso, are officially nonconvertible and can only be exchanged on the black market. If an official exchange rate is set, its value on the black market is often lower. Convertibility controls may be introduced as part of an overall monetary ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Gold Standard

A gold standard is a backed currency, monetary system in which the standard economics, economic unit of account is based on a fixed quantity of gold. The gold standard was the basis for the international monetary system from the 1870s to the early 1920s, and from the late 1920s to 1932 as well as from 1944 until 1971 when the United States unilaterally terminated convertibility of the US dollar to gold, effectively ending the Bretton Woods system. Many states nonetheless hold substantial gold reserves. Historically, the silver standard and bimetallism have been more common than the gold standard. The shift to an international monetary system based on a gold standard reflected accident, network externalities, and path dependence. Great Britain accidentally adopted a ''de facto'' gold standard in 1717 when Isaac Newton, then-master of the Royal Mint, set the exchange rate of silver to gold too low, thus causing silver coins to go out of circulation. As Great Britain became the w ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bretton Woods System

The Bretton Woods system of monetary management established the rules for commercial relations among 44 countries, including the United States, Canada, Western European countries, and Australia, after the 1944 Bretton Woods Agreement until the Jamaica Accords in 1976. The Bretton Woods system was the first example of a fully negotiated monetary order intended to govern monetary relations among independent states. The Bretton Woods system required countries to guarantee convertibility of their currencies into U.S. dollars to within 1% of fixed parity rates, with the dollar convertible to gold bullion for foreign governments and central banks at US$35 per troy ounce of fine gold (or 0.88867 gram fine gold per dollar). It also envisioned greater cooperation among countries in order to prevent future competitive devaluations, and thus established the International Monetary Fund (IMF) to monitor exchange rates and lend reserve currencies to countries with balance of payments de ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bretton Woods Institutions

The Bretton Woods system of Monetary system, monetary management established the rules for commercial relations among 44 countries, including the United States, Canada, Western European countries, and Australia, after the 1944 Bretton Woods Agreement until the Jamaica Accords in 1976. The Bretton Woods system was the first example of a fully Representative money, negotiated monetary order intended to govern monetary relations among independent states. The Bretton Woods system required countries to guarantee convertibility of their currencies into U.S. dollars to within 1% of fixed parity rates, with the dollar gold standard, convertible to gold bullion for foreign governments and central banks at US$35 per troy ounce of fine gold (or 0.88867 gram fine gold per dollar). It also envisioned greater cooperation among countries in order to prevent future competitive devaluations, and thus established the International Monetary Fund (IMF) to monitor exchange rates and lend reserve curr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Currency

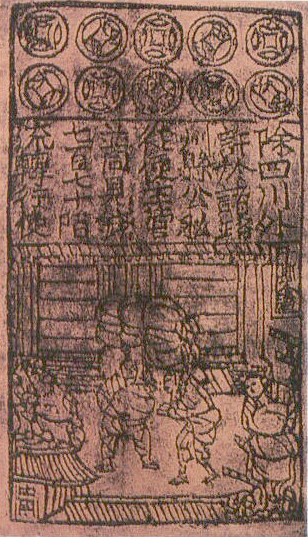

A currency is a standardization of money in any form, in use or circulation as a medium of exchange, for example banknotes and coins. A more general definition is that a currency is a ''system of money'' in common use within a specific environment over time, especially for people in a nation state. Under this definition, the British Pound sterling (£), euros (€), Japanese yen (¥), and U.S. dollars (US$) are examples of (government-issued) fiat currencies. Currencies may act as stores of value and be traded between nations in foreign exchange markets, which determine the relative values of the different currencies. Currencies in this sense are either chosen by users or decreed by governments, and each type has limited boundaries of acceptance; i.e., legal tender laws may require a particular unit of account for payments to government agencies. Other definitions of the term ''currency'' appear in the respective synonymous articles: banknote, coin, and money. Th ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Fiat Money

Fiat money is a type of government-issued currency that is not backed by a precious metal, such as gold or silver, nor by any other tangible asset or commodity. Fiat currency is typically designated by the issuing government to be legal tender, and is authorized by government regulation. Since the end of the Bretton Woods system in 1976 by the Jamaica Accords, the major currencies in the world are fiat money. Fiat money generally does not have intrinsic value and does not have use value. It has value only because the individuals who use it as a unit of account or, in the case of currency, a medium of exchange agree on its value. They trust that it will be accepted by merchants and other people as a means of payment for liabilities. Fiat money is an alternative to commodity money, which is a currency that has intrinsic value because it contains, for example, a precious metal such as gold or silver which is embedded in the coin. Fiat also differs from representative mone ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Monetary Policy

Monetary policy is the policy adopted by the monetary authority of a nation to affect monetary and other financial conditions to accomplish broader objectives like high employment and price stability (normally interpreted as a low and stable rate of inflation). Further purposes of a monetary policy may be to contribute to economic stability or to maintain predictable exchange rates with other currencies. Today most central banks in developed countries conduct their monetary policy within an inflation targeting framework, whereas the monetary policies of most developing countries' central banks target some kind of a fixed exchange rate system. A third monetary policy strategy, targeting the money supply, was widely followed during the 1980s, but has diminished in popularity since then, though it is still the official strategy in a number of emerging economies. The tools of monetary policy vary from central bank to central bank, depending on the country's stage of development, inst ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

1998–2002 Argentine Great Depression

The 1998–2002 Argentine great depression was an economic depression in Argentina, which began in the third quarter of 1998 and lasted until the second quarter of 2002. It followed fifteen years of Economic history of Argentina#Stagnation (1975–1990), stagnation and a brief period of Economic history of Argentina#Free-market reforms (1990–1995), free-market reforms. The depression, which began after the 1998 Russian financial crisis, Russian and Samba effect, Brazilian financial crises, caused widespread unemployment, December 2001 riots in Argentina, riots, the fall of the government, a Sovereign default, default on the country's foreign debt, the rise of alternative currencies and the end of the Argentine peso, peso's fixed exchange rate to the United States dollar, US dollar. The economy shrank by 28 per cent from 1998 to 2002. In terms of income, over 50 per cent of Argentines lived below the official poverty line and 25 per cent were indigent (their basic needs were unm ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Hard Currency

In macroeconomics, hard currency, safe-haven currency, or strong currency is any globally traded currency that serves as a reliable and stable store of value. Factors contributing to a currency's ''hard'' status might include the stability and reliability of the respective state's legal and bureaucratic institutions, level of corruption, long-term stability of its purchasing power, the associated country's political and fiscal condition and outlook, and the policy posture of the issuing central bank. Safe haven currency is defined as a currency which behaves like a hedge for a reference portfolio of risky assets conditional on movements in global risk aversion. Conversely, a weak or soft currency is one which is expected to fluctuate erratically or depreciate against other currencies. Softness is typically the result of weak legal institutions and/or political or fiscal instability. Junk currency is even less trusted than soft currency, and has a very low currency value. Soft ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

North Korean Won

The Korean People's won, more commonly known as the North Korean won (currency symbol, symbol: ₩; ISO 4217, code: KPW; ) and sometimes known as the Democratic People's Republic of Korea won (), is the official currency of North Korea. It is subdivided into 100 ''chon''. The currency is issued by the Central Bank of the Democratic People's Republic of Korea, based in the North Korean capital city of Pyongyang. Etymology ''Won'', like Japanese yen, is borrowed from Chinese yuan, written Hanja (), which means "round shape". The won is subdivided into 100 chon (). History 1947–2009 After the division of Korea, North Korea continued using the Korean yen for two years, until the Central Bank of the Democratic People's Republic of Korea was established on 6 December 1947 and the first North Korean won was issued. In February 1959, the second North Korean won was introduced, equal to 100 old won. From 1978 on, the Government of North Korea, North Korean government ma ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Market Liquidity

In business, economics or investment, market liquidity is a market's feature whereby an individual or firm can quickly purchase or sell an asset without causing a drastic change in the asset's price. Liquidity involves the trade-off between the price at which an asset can be sold, and how quickly it can be sold. In a liquid market, the trade-off is mild: one can sell quickly without having to accept a significantly lower price. In a relatively illiquid market, an asset must be discounted in order to sell quickly. A liquid asset is an asset which can be converted into cash within a relatively short period of time, or cash itself, which can be considered the most liquid asset because it can be exchanged for goods and services instantly at face value. Overview A liquid asset has some or all of the following features: it can be sold rapidly, with minimal loss of value, anytime within market hours. The essential characteristic of a liquid market is that there are always ready and wil ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Coin

A coin is a small object, usually round and flat, used primarily as a medium of exchange or legal tender. They are standardized in weight, and produced in large quantities at a mint in order to facilitate trade. They are most often issued by a government. Coins often have images, numerals, or text on them. The faces of coins or medals are sometimes called the ''obverse'' and the ''reverse'', referring to the front and back sides, respectively. The obverse of a coin is commonly called ''heads'', because it often depicts the head of a prominent person, and the reverse is known as ''tails''. The first metal coins – invented in the ancient Greek world and disseminated during the Hellenistic period – were precious metal–based, and were invented in order to simplify and regularize the task of measuring and weighing bullion (bulk metal) carried around for the purpose of transactions. They carried their value within the coins themselves, but the stampings also induced manip ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Exchange Rate Regime

An exchange rate regime is a way a monetary authority of a country or currency union manages the currency about other currencies and the foreign exchange market. It is closely related to monetary policy and the two are generally dependent on many of the same factors, such as economic scale and openness, inflation rate, the elasticity of the labor market, financial market development, and capital mobility. There are two major regime types: * Floating exchange rate, ''Floating (or flexible) exchange rate'' regimes exist where exchange rates are determined solely by market forces, and often manipulated by open-market operations. Countries do have the ability to influence their floating currency from activities such as buying/selling currency reserves, changing interest rates, and through foreign trade agreements. * Fixed exchange rate system, ''Fixed (or pegged) exchange rate'' regimes exist when a country sets the value of its home currency directly proportional to the value of an ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |