|

Conscientious Objection To Military Taxation

Conscientious objection to military taxation (COMT) is a legal theory that attempts to extend into the realm of taxation the concessions to conscientious objectors that many governments allow in the case of conscription, thereby allowing conscientious objectors to insist that their tax payments not be spent for military purposes. Some tax resisters advocate legal recognition of a right to COMT, while others conscientiously resist taxes without concern for whether their stand has legal approval. This article addresses the former subgroup. Theory COMT is thought by its proponents to be a logical extension to conscientious objection to military service. A person with a religious or ethical scruple against taking part in killing people during war is likely to feel no less scruple about paying somebody else to do the killing or about purchasing the mechanism of killing. If a government can respect the right of a person not to participate directly in making war, can it also respect th ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Conscientious Objectors

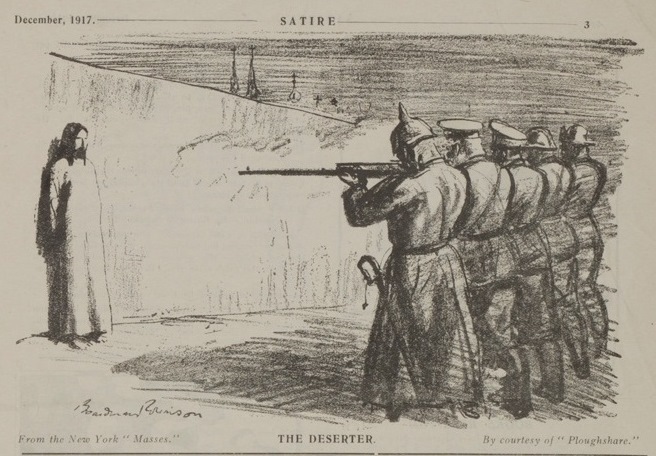

A conscientious objector is an "individual who has claimed the right to refuse to perform military service" on the grounds of freedom of conscience or freedom of religion, religion. The term has also been extended to objecting to working for the military–industrial complex due to a crisis of conscience. In some countries, conscientious objectors are assigned to an alternative civilian service as a substitute for conscription or military service. A number of organizations around the world celebrate the principle on May 15 as International Conscientious Objection Day. On March 8, 1995, the United Nations Commission on Human Rights resolution 1995/83 stated that "persons performing military service should not be excluded from the right to have conscientious objections to military service". This was re-affirmed on April 22, 1998, when resolution 1998/77 recognized that "persons [already] performing military service may ''develop'' conscientious objections". History Many cons ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bill Siksay

William Livingstone Siksay (born March 11, 1955) is a Canadian politician. He was the Member of Parliament (MP) who represented the British Columbia riding of Burnaby—Douglas for the New Democratic Party from 2004 to 2011. Early life Siksay was born in Oshawa, Ontario, to parents Patricia and William Siksay. Receiving his high school diploma from McLaughlin Collegiate and Vocational Institute in Oshawa, Ontario, Siksay attended Victoria College at the University of Toronto, graduating with a BA in 1978. He then enrolled in the MDiv programme at the Vancouver School of Theology at the University of British Columbia, studying as a candidate to be a congregational minister in the United Church of Canada. He was one of the first people to come out as gay or lesbian in the process of his ordination and helped start the debate in the church on the ordination and commissioning of openly gay or lesbian candidates. He did not complete the programme and was not ordained. Politica ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Military Economics

A military, also known collectively as armed forces, is a heavily armed, highly organized force primarily intended for warfare. Militaries are typically authorized and maintained by a sovereign state, with their members identifiable by a distinct military uniform. They may consist of one or more military branches such as an army, navy, air force, space force, marines, or coast guard. The main task of a military is usually defined as defence of their state and its interests against external armed threats. In broad usage, the terms "armed forces" and "military" are often synonymous, although in technical usage a distinction is sometimes made in which a country's armed forces may include other paramilitary forces such as armed police. Beyond warfare, the military may be employed in additional sanctioned and non-sanctioned functions within the state, including internal security threats, crowd control, promotion of political agendas, emergency services and reconstruction ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Resistance

Tax resistance is the refusal to pay tax because of opposition to the government that is imposing the tax, or to government policy, or as opposition to taxation in itself. Tax resistance is a form of direct action and, if in violation of the tax regulations, also a form of civil disobedience. Tax resisters are distinct from " tax protesters", who deny that the legal obligation to pay taxes exists or applies to them. Tax resisters may accept that some law commands them to pay taxes but they still choose to resist taxation. Examples of tax resistance campaigns include those advocating home rule, such as the Salt March led by Mahatma Gandhi, and those promoting women's suffrage, such as the Women's Tax Resistance League. War tax resistance is the refusal to pay some or all taxes that pay for war and may be practiced by conscientious objectors, pacifists, or those protesting against a particular war. History The earliest and most widespread forms of taxation were the corvée a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Human Right

Human rights are universally recognized moral principles or norms that establish standards of human behavior and are often protected by both national and international laws. These rights are considered inherent and inalienable, meaning they belong to every individual simply by virtue of being human, regardless of characteristics like nationality, ethnicity, religion, or socio-economic status. They encompass a broad range of civil, political, economic, social, and cultural rights, such as the right to life, freedom of expression, protection against enslavement, and right to education. The modern concept of human rights gained significant prominence after World War II, particularly in response to the atrocities of the Holocaust, leading to the adoption of the Universal Declaration of Human Rights (UDHR) by the United Nations General Assembly in 1948. This document outlined a comprehensive framework of rights that countries are encouraged to protect, setting a global s ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

United Kingdom

The United Kingdom of Great Britain and Northern Ireland, commonly known as the United Kingdom (UK) or Britain, is a country in Northwestern Europe, off the coast of European mainland, the continental mainland. It comprises England, Scotland, Wales and Northern Ireland. The UK includes the island of Great Britain, the north-eastern part of the island of Ireland, and most of List of islands of the United Kingdom, the smaller islands within the British Isles, covering . Northern Ireland shares Republic of Ireland–United Kingdom border, a land border with the Republic of Ireland; otherwise, the UK is surrounded by the Atlantic Ocean, the North Sea, the English Channel, the Celtic Sea and the Irish Sea. It maintains sovereignty over the British Overseas Territories, which are located across various oceans and seas globally. The UK had an estimated population of over 68.2 million people in 2023. The capital and largest city of both England and the UK is London. The cities o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Taxes For Peace Not War

A tax is a mandatory financial charge or levy imposed on an individual or legal entity by a governmental organization to support government spending and public expenditures collectively or to regulate and reduce negative externalities. Tax compliance refers to policy actions and individual behavior aimed at ensuring that taxpayers are paying the right amount of tax at the right time and securing the correct tax allowances and tax relief. The first known taxation occurred in Ancient Egypt around 3000–2800 BC. Taxes consist of direct or indirect taxes and may be paid in money or as labor equivalent. All countries have a tax system in place to pay for public, common societal, or agreed national needs and for the functions of government. Some countries levy a flat percentage rate of taxation on personal annual income, but most scale taxes are progressive based on brackets of yearly income amounts. Most countries charge a tax on an individual's income and corporate income. Countr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

On The Duty Of Civil Disobedience

"Resistance to Civil Government", also called "On the Duty of Civil Disobedience" or "Civil Disobedience", is an essay by American Transcendentalism, transcendentalist Henry David Thoreau, first published in 1849. In it, Thoreau argues that individuals should prioritize their conscience over compliance with Rule according to higher law, unjust laws, asserting that Acquiescence, passive submission to government authority enables injustice. Thoreau was motivated by his opposition to slavery and the Mexican–American War (1846–1848), which he viewed as morally and politically objectionable. The essay has had a significant impact on political thought and activism, influencing figures such as Mahatma Gandhi, who adopted its principles in the struggle for Indian independence movement, Indian independence, and Martin Luther King Jr., who cited it as a key influence during the Civil rights movement, American civil rights movement. Its themes of Moral responsibility, individual respo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

War Resisters League

The War Resisters League (WRL) is the oldest secular pacifist organization in the United States, having been founded in 1923. History Founded in 1923 by men and women who had opposed World War I, it is a section of the London-based War Resisters' International. It continues to be one of the leading radical voices in the anti-war movement. Many of the organization's founders had been jailed during World War I for refusing conscription in the United States, military service. From the Fellowship of Reconciliation many Jews, suffragists, socialists, and anarchists separated to form this more secular organization. Although the WRL was opposed to US participation in World War II, it did not protest against it; the WRL complied with the Espionage Act of 1917, Espionage Act, ceased public protests, and did not solicit new members during this period. During World War II, many members were labeled conscientious objectors. In the 1950s, WRL members worked in the civil rights movement and or ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Resistance In The United States

Tax resistance in the United States has been practiced at least since colonial times, and has played important parts in American history. Tax resistance is the refusal to pay a tax, usually by means that bypass established legal norms, as a means of protest, nonviolent resistance, or conscientious objection. It was a core tactic of the American Revolution and has played a role in many struggles in America from colonial times to the present day. In addition, the philosophy of tax resistance, from the " no taxation without representation" axiom that served as a foundation of the Revolution to the assertion of individual conscience in Henry David Thoreau's '' Civil Disobedience'', has been an important plank of American political philosophy. Theory The theory that there should be "no taxation without representation", while it did not originate in America, is often associated with the American Revolution, in which that slogan did strong duty. It continues to be a rallying cry ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

National War Tax Resistance Coordinating Committee

The National War Tax Resistance Coordinating Committee (NWTRCC — usually pronounced "new-trick") is an American activist coalition that promotes tax resistance as a way to protest against and/or disassociate from war and militarism. In 1982, the War Resisters League and the Center on Law and Pacifism organized a "National Action Conference" to discuss war tax resistance. NWTRCC was founded on September 18, 1982, by Ed Hedemann and other activists. It filled an organizational gap that had been left since the group War Tax Resistance (founded in 1969) dissolved in 1975. Members of that group, of Conscience and Military Tax Campaign, and of Center on Law and Pacifism, among others, recognized a need to coordinate war tax resistance activities undertaken by a variety of groups in the United States. They published a legal and practical guide for war tax resistance counselors, created a list of nationwide counselors, and organized national gatherings of a diverse variety of war tax r ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

National Campaign For A Peace Tax Fund

The National Campaign for a Peace Tax Fund (NCPTF) is a non-profit organization located in Washington, D.C. It was founded in 1971 to address conscientious objection to military taxation. History and purpose The campaign exists solely to pass Peace Tax legislation in the United States. Such legislation would provide a way for some conscientious objectors to participate in the tax system without violating their beliefs. The proposed legislation, ''Religious Freedom Peace Tax Fund Act'', would amend the Internal Revenue Code to allow a conscientious objector to have his or her income, estate, and gift tax payments spent for non-military purposes only. The campaign advocates and educates on behalf of citizens who are petitioning the government for the right to pay 100% of their taxes without violating their religious or ethical teachings. Voluntary contributions from some 2,000 individuals and from organizations support the campaign. The annual budget is $140,000. Forty seven natio ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |