|

Complete Contract

A complete contract is an important concept from contract theory. If the parties to an agreement could specify their respective rights and duties for every possible future state of the world, their contract would be complete. There would be no gaps in the terms of the contract. However, because it would be prohibitively expensive to write a complete contract, contracts in the real world are usually incomplete. When a dispute arises and the case falls into a gap in the contract, either the parties must engage in bargaining or the courts must step in and fill in the gap. The idea of a complete contract is closely related to the notion of default rules, e.g. legal rules that will fill the gap in a contract in the absence of an agreed upon provision. In economics, the field of contract theory can be subdivided into the theory of complete contracts and the theory of incomplete contracts. Complete contracting theory is also called agency theory (or principal-agent theory) and closely re ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Contract Theory

From a legal point of view, a contract is an institutional arrangement for the way in which resources flow, which defines the various relationships between the parties to a transaction or limits the rights and obligations of the parties. From an economic perspective, contract theory studies how economic actors can and do construct contractual arrangements, generally in the presence of information asymmetry. Because of its connections with both agency and incentive In general, incentives are anything that persuade a person or organization to alter their behavior to produce the desired outcome. The laws of economists and of behavior state that higher incentives amount to greater levels of effort and therefo ...s, contract theory is often categorized within a field known as law and economics. One prominent application of it is the design of optimal schemes of managerial compensation. In the field of economics, the first formal treatment of this topic was given by Kenneth Arrow ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bargaining

In the social sciences, bargaining or haggling is a type of negotiation in which the buyer and seller of a Goods and services, good or service debate the price or nature of a Financial transaction, transaction. If the bargaining produces agreement on terms, the transaction takes place. It is often commonplace in poorer countries, or poorer localities within any specific country. Haggling can mostly be seen within street markets worldwide, wherein there remains no guarantee of the origin and authenticity of available products. Many people attribute it as a skill, but there remains no guarantee that the price put forth by the buyer would be acknowledged by the seller, resulting in losses of Profit (economics), profit and even Inventory turnover, turnover in some cases. A growth in the country's Per capita income, GDP Per Capita Income is bound to reduce both the ill-effects of bargaining and the unscrupulous practices undertaken by vendors at street markets. Although the most app ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Default Rule

{{not to be confused with, Default (law) In legal theory, a default rule is a rule of law that can be overridden by a contract, trust, will, or other legally effective agreement. Contract law, for example, can be divided into two kinds of rules: ''default rules'' and ''mandatory rules.'' Whereas the ''default rules'' can be modified by agreement of the parties, ''mandatory rules'' will be enforced, even if the parties to a contract attempt to override or modify them. One of the most important debates in contract theory concerns the proper role or purpose of default rules. The idea of a default rule in contract law is sometimes connected to the notion of a complete contract. In contract theory, a complete contract fully specifies the rights and duties of the parties to the contract for all possible future states of the world. An incomplete contract, therefore, contains gaps. Most contract theorists find that default rules fill in the gaps in what would otherwise be incomplete ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Incomplete Contracts

In contract law, an incomplete contract is one that is defective or uncertain in a material respect. In economic theory, an incomplete contract (as opposed to a complete contract) is one that provides for the rights, obligations and remedies of the parties in every possible state of the world. Since the human mind is a scarce resource and the mind cannot collect, process, and understand an infinite amount of information, economic actors are limited in their rationality (the limitations of the human mind in understanding and solving complex problems) and one cannot anticipate all possible contingencies. Or perhaps because it is too expensive to write a complete contract, the parties will opt for a "sufficiently complete" contract. In short, in practice, every contract is incomplete for a variety of reasons and limitations. The incompleteness of a contract also means that the protection it provides may be inadequate. Even if a contract is incomplete, the legal validity of the contra ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Mechanism Design

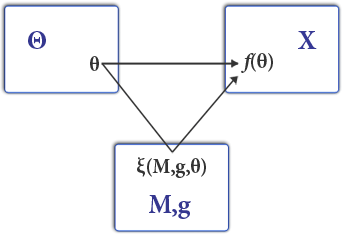

Mechanism design (sometimes implementation theory or institution design) is a branch of economics and game theory. It studies how to construct rules—called Game form, mechanisms or institutions—that produce good outcomes according to Social welfare function, some predefined metric, even when the designer does not know the players' true preferences or what information they have. Mechanism design thus focuses on the study of solution concepts for a class of private-information games. Mechanism design has broad applications, including traditional domains of economics such as market design, but also political science (through voting theory). It is a foundational component in the operation of the internet, being used in networked systems (such as inter-domain routing), e-commerce, and Sponsored search auction, advertisement auctions by Facebook and Google. Because it starts with the end of the game (a particular result), then works backwards to find a game that implements it, it ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Implementation Theory

Implementation theory is an area of research in game theory concerned with whether a class of mechanisms (or institutions) can be designed whose equilibrium outcomes implement a given set of normative goals or welfare criteria.Palfrey, Thomas R. "Chapter 61 Implementation Theory." Handbook of Game Theory with Economic Applications, 2002. . There are two general types of implementation problems: the economic problem of producing and allocating public and private goods and choosing over a finite set of alternatives.Maskin, Eric and Sjöström, Tomas. "Implementation Theory." Handbook of Social Choice and Welfare, 2002. . In the case of producing and allocating public/private goods, solution concepts are focused on finding dominant strategies. In his paper "Counterspeculation, Auctions, and Competitive Sealed Tenders", William Vickrey showed that if preferences are restricted to the case of quasi-linear utility functions then the mechanism dominant strategy is dominant-strategy imp ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Adverse Selection

In economics, insurance, and risk management, adverse selection is a market situation where Information asymmetry, asymmetric information results in a party taking advantage of undisclosed information to benefit more from a contract or trade. In an ideal world, buyers should pay a price which reflects their willingness to pay and the value to them of the product or service, and sellers should sell at a price which reflects the quality of their goods and services. However, when one party holds information that the other party does not have, they have the opportunity to damage the other party by maximizing self-utility, concealing relevant information, and perhaps even lying. This opportunity has secondary effects: the party without the information may take steps to avoid entering into an unfair contract, perhaps by withdrawing from the interaction; a party may ask for higher or lower prices, diminishing the volume of trade in the market; or parties may be deterred from participatin ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Moral Hazard

In economics, a moral hazard is a situation where an economic actor has an incentive to increase its exposure to risk because it does not bear the full costs associated with that risk, should things go wrong. For example, when a corporation is insured, it may take on higher risk knowing that its insurance will pay the associated costs. A moral hazard may occur where the actions of the risk-taking party change to the detriment of the cost-bearing party after a financial transaction has taken place. Moral hazard can occur under a type of information asymmetry where the risk-taking party to a transaction knows more about its intentions than the party paying the consequences of the risk and has a tendency or incentive to take on too much risk from the perspective of the party with less information. One example is a principal–agent approach (also called agency theory), where one party, called an agent, acts on behalf of another party, called the principal. However, a principa ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Revelation Principle

The revelation principle is a fundamental result in mechanism design, social choice theory, and game theory which shows it is always possible to design a strategy-resistant implementation of a Social welfare function, social decision-making mechanism (such as an electoral system or Market (economics), market).Gibbard, A. 1973. Manipulation of voting schemes: a general result. Econometrica 41, 587–601. It can be seen as a kind of mirror image to Gibbard's theorem. The revelation principle says that if a social choice function can be implemented with some non-honest Mechanism design, mechanism—one where players have an incentive to lie—the same function can be implemented by an Incentive compatibility, incentive-compatible (honesty-promoting) mechanism with the same equilibrium outcome (payoffs). The revelation principle shows that, while Gibbard's theorem proves it is impossible to design a system that will always be fully invulnerable to strategy (if we do not know how playe ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Incomplete Contracts

In contract law, an incomplete contract is one that is defective or uncertain in a material respect. In economic theory, an incomplete contract (as opposed to a complete contract) is one that provides for the rights, obligations and remedies of the parties in every possible state of the world. Since the human mind is a scarce resource and the mind cannot collect, process, and understand an infinite amount of information, economic actors are limited in their rationality (the limitations of the human mind in understanding and solving complex problems) and one cannot anticipate all possible contingencies. Or perhaps because it is too expensive to write a complete contract, the parties will opt for a "sufficiently complete" contract. In short, in practice, every contract is incomplete for a variety of reasons and limitations. The incompleteness of a contract also means that the protection it provides may be inadequate. Even if a contract is incomplete, the legal validity of the contra ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Theory Of The Firm

The theory of the firm consists of a number of economic theories that explain and predict the nature of the firm, company, or corporation, including its existence, behaviour, structure, and relationship to the market. Firms are key drivers in economics, providing goods and services in return for monetary payments and rewards. Organisational structure, incentives, employee productivity, and information all influence the successful operation of a firm in the economy and within itself. As such major economic theories such as transaction cost theory, managerial economics and behavioural theory of the firm will allow for an in-depth analysis on various firm and management types. Overview In simplified terms, the theory of the firm aims to answer these questions: # Existence. Why do firms emerge? Why are not all transactions in the economy mediated over the market? # Boundaries. Why is the boundary between firms and the market located exactly there in relation to size and output varie ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |