|

Commuter Tax

A commuter tax is a tax (generally on either income or wages) levied upon persons who work, but do not live, in a particular jurisdiction. The argument for a commuter tax is that it pays for public services, such as police, fire, and sanitation, received by and beneficial to people who work within the jurisdiction levying the commuter tax. Arguments against such a tax are that it acts as an incentive for businesses to relocate outside of the jurisdiction, along with their residents. In some cases, individual cities may be barred from enacting a commuter tax even though the state governments may impose a non-resident income tax. States may choose to enter "reciprocal tax agreements" to exempt non-residents from some local taxes. Until 1999, New York City had a commuter tax, and there are periodic calls for its reinstatement. A commuter tax in New York City would need to have support from the State Legislature in order for reinstatement, and since the majority of state legislators rep ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

New York City

New York, often called New York City (NYC), is the most populous city in the United States, located at the southern tip of New York State on one of the world's largest natural harbors. The city comprises five boroughs, each coextensive with a respective county. The city is the geographical and demographic center of both the Northeast megalopolis and the New York metropolitan area, the largest metropolitan area in the United States by both population and urban area. New York is a global center of finance and commerce, culture, technology, entertainment and media, academics, and scientific output, the arts and fashion, and, as home to the headquarters of the United Nations, international diplomacy. With an estimated population in 2024 of 8,478,072 distributed over , the city is the most densely populated major city in the United States. New York City has more than double the population of Los Angeles, the nation's second-most populous city. [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

The New York Times

''The New York Times'' (''NYT'') is an American daily newspaper based in New York City. ''The New York Times'' covers domestic, national, and international news, and publishes opinion pieces, investigative reports, and reviews. As one of the longest-running newspapers in the United States, the ''Times'' serves as one of the country's Newspaper of record, newspapers of record. , ''The New York Times'' had 9.13 million total and 8.83 million online subscribers, both by significant margins the List of newspapers in the United States, highest numbers for any newspaper in the United States; the total also included 296,330 print subscribers, making the ''Times'' the second-largest newspaper by print circulation in the United States, following ''The Wall Street Journal'', also based in New York City. ''The New York Times'' is published by the New York Times Company; since 1896, the company has been chaired by the Ochs-Sulzberger family, whose current chairman and the paper's publ ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Metropolitan Transportation Authority

The Metropolitan Transportation Authority (MTA) is a New York state public benefit corporations, public benefit corporation in New York (state), New York State responsible for public transportation in the New York metropolitan area, New York City metropolitan area. The MTA is the largest public transit authority in North America, serving 12 counties in Downstate New York, along with two counties in southwestern Connecticut under contract to the Connecticut Department of Transportation, carrying over 11 million passengers on an average weekday systemwide, and over 850,000 vehicles on its MTA Bridges and Tunnels, seven toll bridges and two tunnels per weekday. History Founding In February 1965, New York governor Nelson Rockefeller suggested that the New York State Legislature create an authority to purchase, operate, and modernize the Long Island Rail Road (LIRR). The LIRR, then a subsidiary of the Pennsylvania Railroad (PRR), had been operating under bankruptcy protection since 1 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Philadelphia

Philadelphia ( ), colloquially referred to as Philly, is the List of municipalities in Pennsylvania, most populous city in the U.S. state of Pennsylvania and the List of United States cities by population, sixth-most populous city in the United States, with a population of 1,603,797 in the 2020 United States census, 2020 census. The city is the urban core of the Philadelphia metropolitan area (sometimes called the Delaware Valley), the nation's Metropolitan statistical area, seventh-largest metropolitan area and ninth-largest combined statistical area with 6.245 million residents and 7.379 million residents, respectively. Philadelphia was founded in 1682 by William Penn, an English Americans, English Quakers, Quaker and advocate of Freedom of religion, religious freedom, and served as the capital of the Colonial history of the United States, colonial era Province of Pennsylvania. It then played a historic and vital role during the American Revolution and American Revolutionary ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Maryland

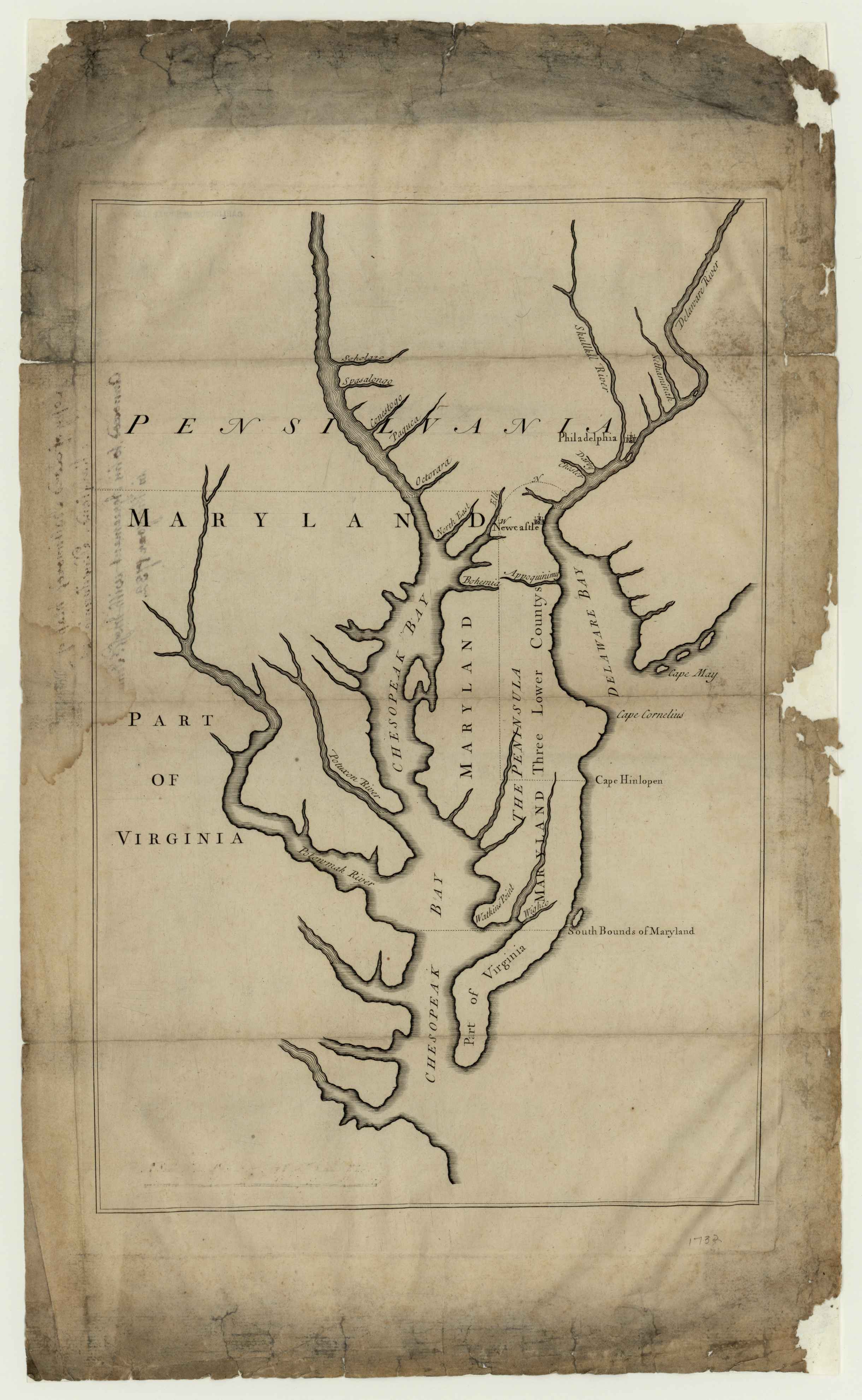

Maryland ( ) is a U.S. state, state in the Mid-Atlantic (United States), Mid-Atlantic region of the United States. It borders the states of Virginia to its south, West Virginia to its west, Pennsylvania to its north, and Delaware to its east, as well as with the Atlantic Ocean to its east, and the national capital and federal district of Washington, D.C. to the southwest. With a total area of , Maryland is the List of U.S. states and territories by area, ninth-smallest state by land area, and its population of 6,177,224 ranks it the List of U.S. states and territories by population, 18th-most populous state and the List of states and territories of the United States by population density, fifth-most densely populated. Maryland's capital city is Annapolis, Maryland, Annapolis, and the state's most populous city is Baltimore. Maryland's coastline was first explored by Europeans in the 16th century. Prior to that, it was inhabited by several Native Americans in the United States ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Virginia

Virginia, officially the Commonwealth of Virginia, is a U.S. state, state in the Southeastern United States, Southeastern and Mid-Atlantic (United States), Mid-Atlantic regions of the United States between the East Coast of the United States, Atlantic Coast and the Appalachian Mountains. The state's List of capitals in the United States, capital is Richmond, Virginia, Richmond and its most populous city is Virginia Beach, Virginia, Virginia Beach. Its most populous subdivision is Fairfax County, Virginia, Fairfax County, part of Northern Virginia, where slightly over a third of Virginia's population of more than 8.8million live. Eastern Virginia is part of the Atlantic Plain, and the Middle Peninsula forms the mouth of the Chesapeake Bay. Central Virginia lies predominantly in the Piedmont (United States), Piedmont, the foothill region of the Blue Ridge Mountains, which cross the western and southwestern parts of the state. The fertile Shenandoah Valley fosters the state's mo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

District Of Columbia Home Rule Act

The District of Columbia Home Rule Act is a United States federal law passed on December 24, 1973, which devolved certain congressional powers of the District of Columbia to local government, furthering District of Columbia home rule. In particular, it includes the District Charter (also called the Home Rule Charter), which provides for an elected mayor and the Council of the District of Columbia The Council of the District of Columbia (or simply D.C. Council) is the legislative branch of the government of the District of Columbia. As permitted in the United States Constitution, the district is not part of any U.S. state and is overseen .... The council is composed of a chair elected at large and twelve members, four of whom are elected at large, and one from each of the District's eight wards. Council members are elected to four-year terms. Under the "Home Rule" government, Congress reviews all legislation passed by the council before it can become law and retains a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

The Washington Post

''The Washington Post'', locally known as ''The'' ''Post'' and, informally, ''WaPo'' or ''WP'', is an American daily newspaper published in Washington, D.C., the national capital. It is the most widely circulated newspaper in the Washington metropolitan area and has a national audience. As of 2023, the ''Post'' had 130,000 print subscribers and 2.5 million digital subscribers, both of which were the List of newspapers in the United States, third-largest among U.S. newspapers after ''The New York Times'' and ''The Wall Street Journal''. The ''Post'' was founded in 1877. In its early years, it went through several owners and struggled both financially and editorially. In 1933, financier Eugene Meyer (financier), Eugene Meyer purchased it out of bankruptcy and revived its health and reputation; this work was continued by his successors Katharine Graham, Katharine and Phil Graham, Meyer's daughter and son-in-law, respectively, who bought out several rival publications. The ''Post ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Employer Transportation Benefits In The United States

An employer in the United States may provide transportation benefits to their employees that are tax free up to a certain limit. Under the U.S. Internal Revenue Code section 132(a), the qualified transportation benefits are one of the eight types of statutory employee benefits (also known as fringe benefits) that are excluded from gross income in calculating federal income tax. The qualified transportation benefits are transit passes, vanpooling, bicycling, and parking associated with these things. Commuting expenses in general are not excluded from taxable compensation in US tax law (for example, the cost of fuel to drive to the regular work place cannot be deducted). The goal of making the specific benefits described above nontaxable is to encourage forms of commuting that reduce road congestion and pollution. Overview Tax-free commuter benefits, also known as qualified transportation fringes, are employer provided voluntary benefit programs that allow employees to reduce the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Income Tax

An income tax is a tax imposed on individuals or entities (taxpayers) in respect of the income or profits earned by them (commonly called taxable income). Income tax generally is computed as the product of a tax rate times the taxable income. Taxation rates may vary by type or characteristics of the taxpayer and the type of income. The tax rate may increase as taxable income increases (referred to as graduated or progressive tax rates). The tax imposed on companies is usually known as corporate tax and is commonly levied at a flat rate. Individual income is often taxed at progressive rates where the tax rate applied to each additional unit of income increases (e.g., the first $10,000 of income taxed at 0%, the next $10,000 taxed at 1%, etc.). Most jurisdictions exempt local charitable organizations from tax. Income from investments may be taxed at different (generally lower) rates than other types of income. Credits of various sorts may be allowed that reduce tax. Some jurisdictio ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Payroll Tax

Payroll taxes are taxes imposed on employers or employees. They are usually calculated as a percentage of the salaries that employers pay their employees. By law, some payroll taxes are the responsibility of the employee and others fall on the employer, but almost all economists agree that the true economic incidence of a payroll tax is unaffected by this distinction, and falls largely or entirely on workers in the form of lower wages. Because payroll taxes fall exclusively on wages and not on returns to financial or physical investments, payroll taxes may contribute to underinvestment in human capital, such as higher education. National payroll tax systems Australia The Australian federal government ( ATO) requires withholding tax on employment income (payroll taxes of the first type), under a system known as pay-as-you-go (PAYG). The individual states impose payroll taxes of the second type. Bermuda In Bermuda, payroll tax accounts for over a third of the annual nation ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |